2025 Best Practices for Procurement

By: Cristina Iani16 January 2024

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

Subscribe now and take the first step towards a more efficient, profitable future in underwriting.

90% of the data points mentioned above are available through the Veridion Match & Enrich API in approximately 1.5 seconds, starting from simple inputs like a business name, address, or website link.

deep dive into the key benefits of using Veridion Match&Enrich API.

get rapid access to data in the underwriting process.

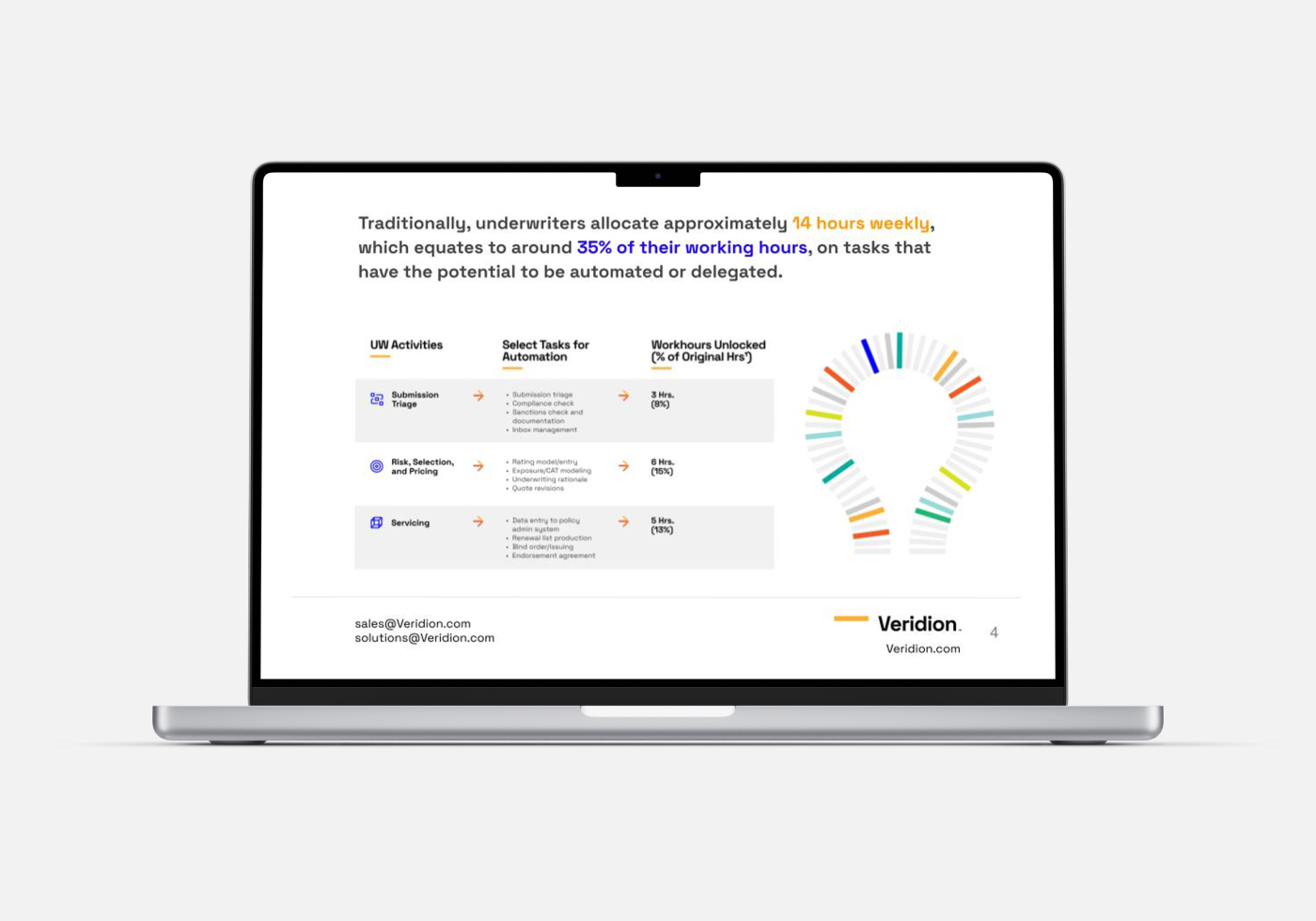

Learn how much time underwriters typically spend on their tasks and discover strategies to optimize this time for efficiency and accuracy.

Get acquainted with the crucial data sets that underwriters must know to make informed decisions.

You will find more than just an article—it’s a roadmap to success, offering in-depth analysis and practical solutions for harnessing the full potential of rapid data access in underwriting.