2025 Best Practices for Procurement

By: Cristina Iani02 February 2024

We love our data, and now that you're here, you're one step closer to loving it too.

A wide sample of data, so you can explore what is possible with our data

Choose ->

built with procurement in mind. Focused on manufacturers, products and more

Choose ->

built with insurance in mind. Focused on classifications, business activity tags and more

Choose ->

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

Choose ->

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Choose ->

A wide sample of data, so you can explore what is possible with our data

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

A wide sample of data, so you can explore what is possible with our data

built with procurement in mind. Focused on manufacturers, products and more

built with insurance in mind. Focused on classifications, business activity tags and more

built with sustainability in mind. Focused on sustainability commitments, and environmental and social governance insights.

built with strategic insights in mind. Focused on market trends, competitor analysis, and industry-specific data

Keep up to date with our technology, what our clients are doing and get interesting monthly market insights.

Subscribe now and take the first step towards reducing churn and enhancing customer experience in Commercial Insurance at Renewal time.

is a critical time for both insurers and business customers, where accurate and up-to-date data is essential to ensure appropriate coverage and risk management. The goal of this report is to highlight the huge importance of decision-grade data to elevate operational efficiency, streamline decision-making, and enhance customer satisfaction during renewals.

can affect the efficiency and effectiveness of renewal strategies for insurers and create a time-intensive burden for business customers.

Our research indicates that an average of 45% of insurers’ commercial customers have data inaccuracies in critical areas, such as business activities and addresses.

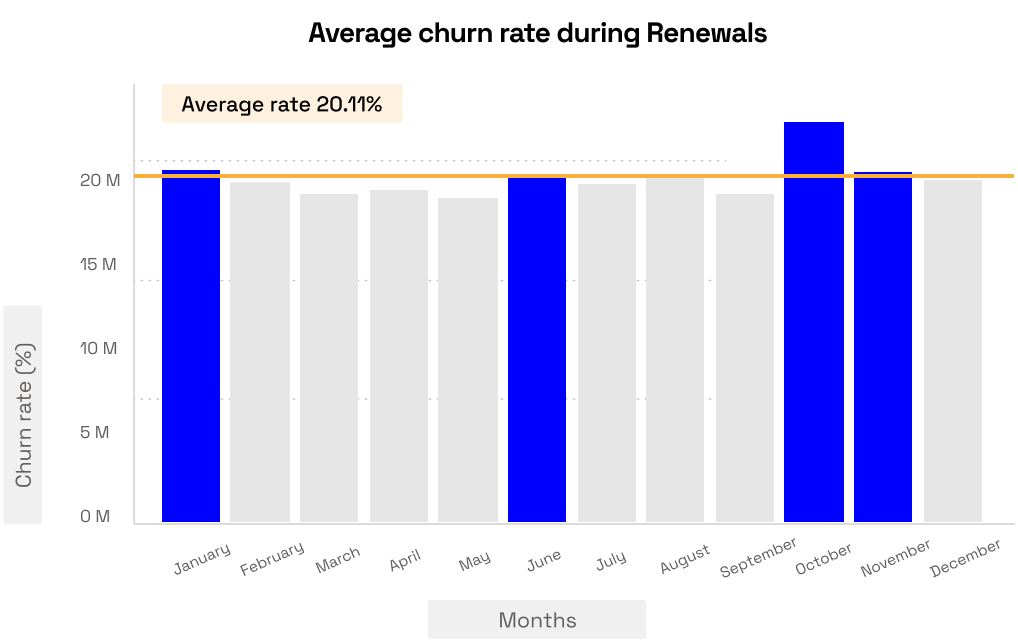

However, these data challenges are not only impacting the insurers’ strategies but are also correlated with heightened churn rates.

can be attributed to the compounded pressures of managing high volumes of renewals, coupled with the inherent inefficiencies of current data management practices.

Typical commercial insurance renewals happen in January or in June to July and the process typically starts 3 months before the renewal date. This is why March, April, and October are the busiest months and they coincide with significant fluctuations in renewals and churn rates. During these months, the volume of renewals consumes substantial resources, which during peak periods leads to a heightened risk of data-related errors and inefficiencies.

The renewal of commercial insurance policies is a complex process that requires precise data regarding a business’s operations, location, assets, and risks. Failure to update or accurately capture this information can lead to mispriced policies, inadequate coverage, and significant financial and legal repercussions.

Understand what are the data challenges faced by insurers and how can they impact the commercial renewal process.

Learn more about the risk of innacurate data in comercial renewal and the key business data that can change during a year in a company.

Expand your knowledge on how Veridion’s decision-grade data enhances risk assessment and underwriting in commercial insurance.

Explore the Key Uses Cases of Veridion decision-grade data in Commercial Insurance.

Explore the data-related obstacles that substantially affect customer retention, resulting in inefficiencies, a heightened probability of mistakes, and an absence of tailored service, all of which contribute to elevated churn rates.

Deep dive into the critical data sets insurers must evaluate and how overlooking or misinterpreting this data can lead to making wrong decisions in risk assessment and premium calculations.

Learn more about how integrating advanced data management practices and external data sources, including third-party APIs, can provide a comprehensive and up-to-date view of a business’s risk profile.

Explore Veridion’s decision-grade data, which enhances the insurance renewal process by providing up-to-date data for precise risk assessments and policy customization. Learn how API integration allows real-time updates, ensuring policy relevance and accuracy in pricing, while Veridion’s AI capabilities streamline the entire process from quote to bind, improving efficiency and reducing churn rates.

Our report will provide comprehensive insights and actionable strategies to fully leverage the power of decision-grade data in commercial renewals.