Best Planck Alternatives Providing Data for Insurance

Planck is a leading AI-enhanced commercial insurance data platform, helping insurers underwrite any business more effectively.

However, it’s not the only such solution available on the market.

So, if you’re searching for a Planck alternative—whether due to pricing concerns or the need for specific features—you’ve come to the right place.

This article will introduce you to five powerful insurance data providers, each with its own unique strengths.

By the time you finish reading, you’ll be well on your way to finding the perfect match for your needs.

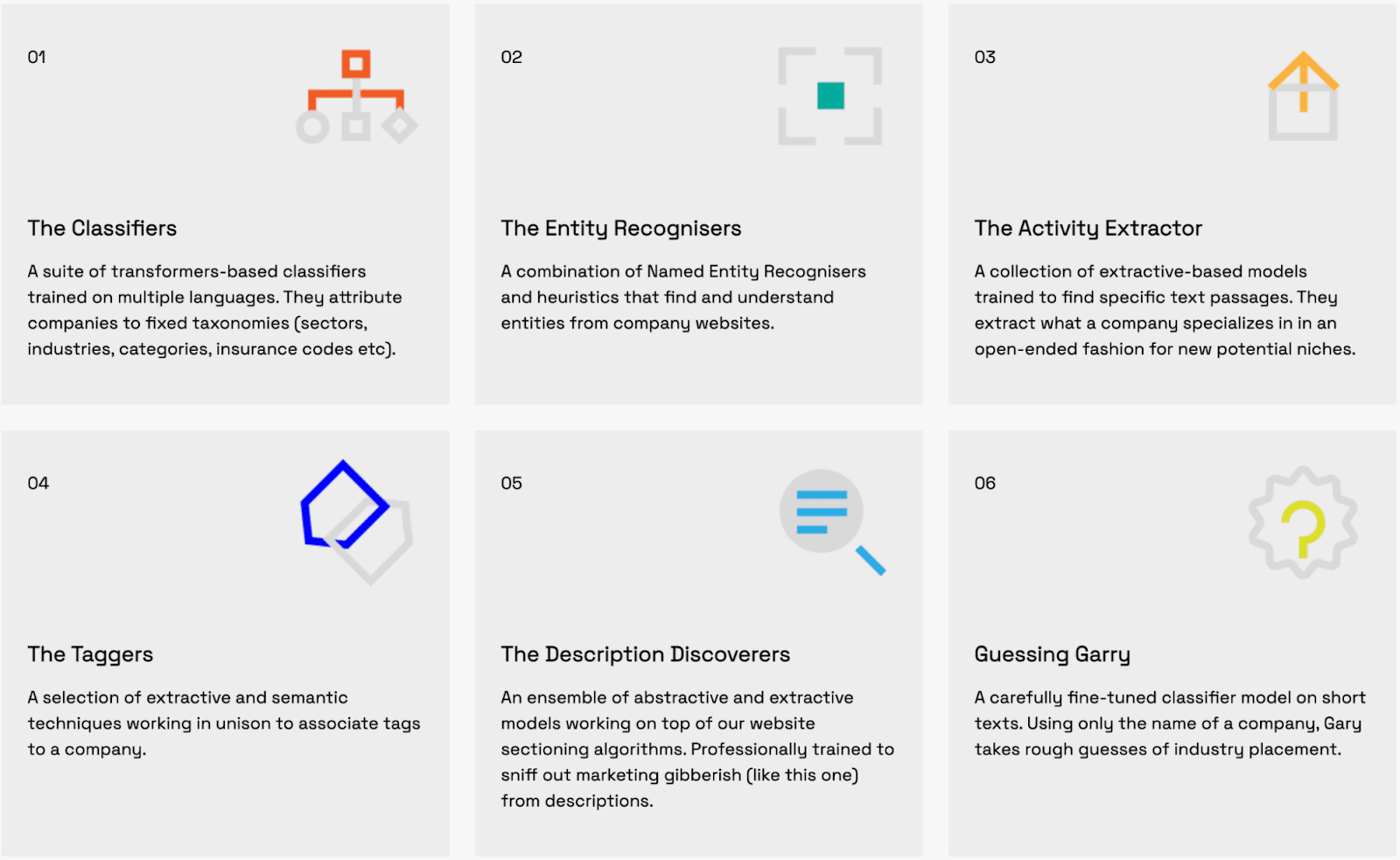

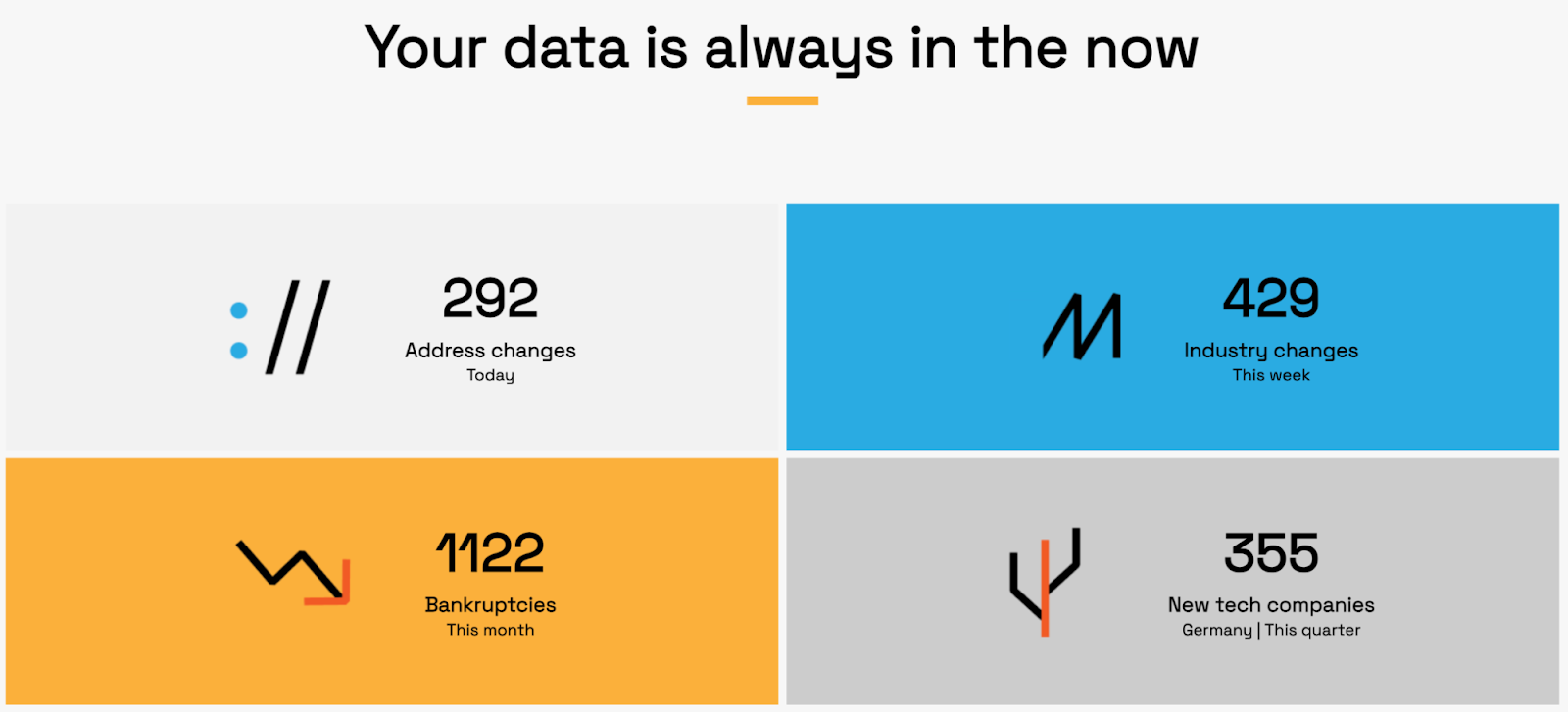

Veridion is an AI-powered business data enrichment platform, offering the most comprehensive, up-to-date, global database of company information.

Our data is a trifecta of reliability: it’s accurate, fresh, and—featuring over 100 million companies, 200 million business locations, and 70 attributes—has amazing coverage.

Here are the tools that help us gather it.

Source: Veridion

These insights can be accessed either through natural language search or by connecting your systems with our data via APIs.

You can enjoy two different services: searching for data or enriching it.

For example, insurance professionals love our search capabilities because they help them discover high-quality leads using a number of criteria like ESG materiality, NAICS codes, underwriting risks, and more.

Next, the Match & Enrich option can generate complete business profiles from just a name and address, streamlining various processes, such as insurance quote validation.

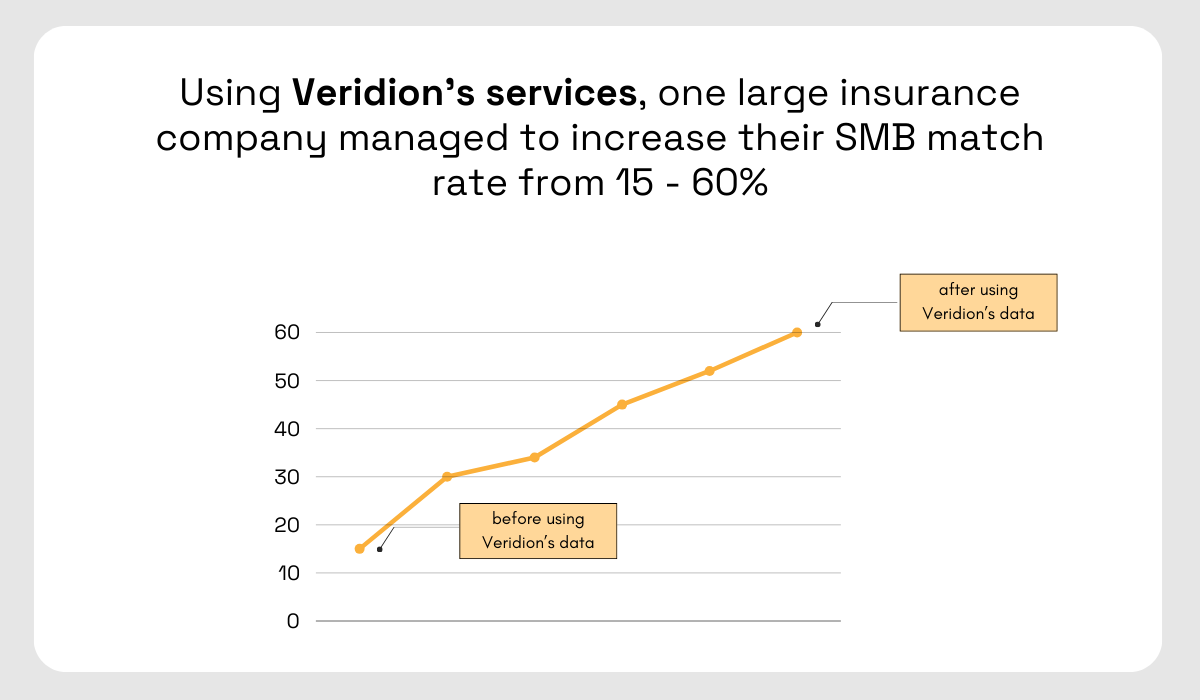

And that’s precisely how one of the top 10 North American insurance companies used our data.

Matching data (name and address) to a valid business record in real-time, they have unlocked detailed insights, including main business activities, rich text descriptions of companies, and relevant insurance codes.

Source: Veridion

Ultimately, they improved their SMB match rate from 15% to 60%, finally being able to map out small businesses to the closest insurance codes, with minimal human error.

But beyond finding leads and speeding up quote validation procedures, insurance professionals also choose Veridion to:

Now, even though Veridion’s database is massive and refreshed weekly, it’s still incredibly easy to use.

Thanks to our APIs, our data integrates with your current workflows so you can quickly access and analyze it

Plus, you can work with our team of experts to tailor the solution to your own unique needs and circumstances.

In short, Veridion is your one-stop shop for accurate, up-to-date insurance data—no need to work with multiple data vendors.

Source: Veridion

Therefore, if you’re looking for data you won’t find anywhere else, browse other pages on our website.

You can try our free data explorer or schedule a consultation to learn more about the platform.

Carpe Data is a company specializing in data science and AI solutions for the insurance industry, particularly for claims, underwriting, and book assessment.

They offer two main product suites, each designed for specific needs: ClaimsX Ultra and Minerva.

Source: Carpe Data

ClaimsX Ultra automates the entire claims lifecycle.

This is an improved version of their previous ClaimsX product, now with additional features, like:

Another product they offer is Minerva, a tool focused on improving the classification and evaluation of commercial businesses.

It leverages publicly available information about small businesses in the U.S. and uses AI to extract unique, predictive insights for more accurate loss prediction.

Similar to Veridion, Minerva delivers these insights via an API and is further divided into two product categories:

| Category | Tool | Description |

|---|---|---|

| Classify and Describe | ClassificationProfiles | Provides accurate and consistent data for more precise classification |

| BusinessCharacteristics | Identifies current business characteristics to better analyze risk | |

| Measure and Predict | GeneralBusinessesIndexes | Assesses and predicts various impacts on business performance |

As you can see, Carpe Data offers a truly wide range of products, guaranteed to fit anyone’s needs.

And, judging from different online articles, they also seem to be very committed to improving their offerings, adding new features, and staying ahead of the curve.

However, no details about pricing are available on their website, so it isn’t clear how the cost structure works.

Do customers need to pay for each product separately?

That way, the costs can easily add up.

If you’re interested and want to learn more about Carpe Data, use the contact form on their website.

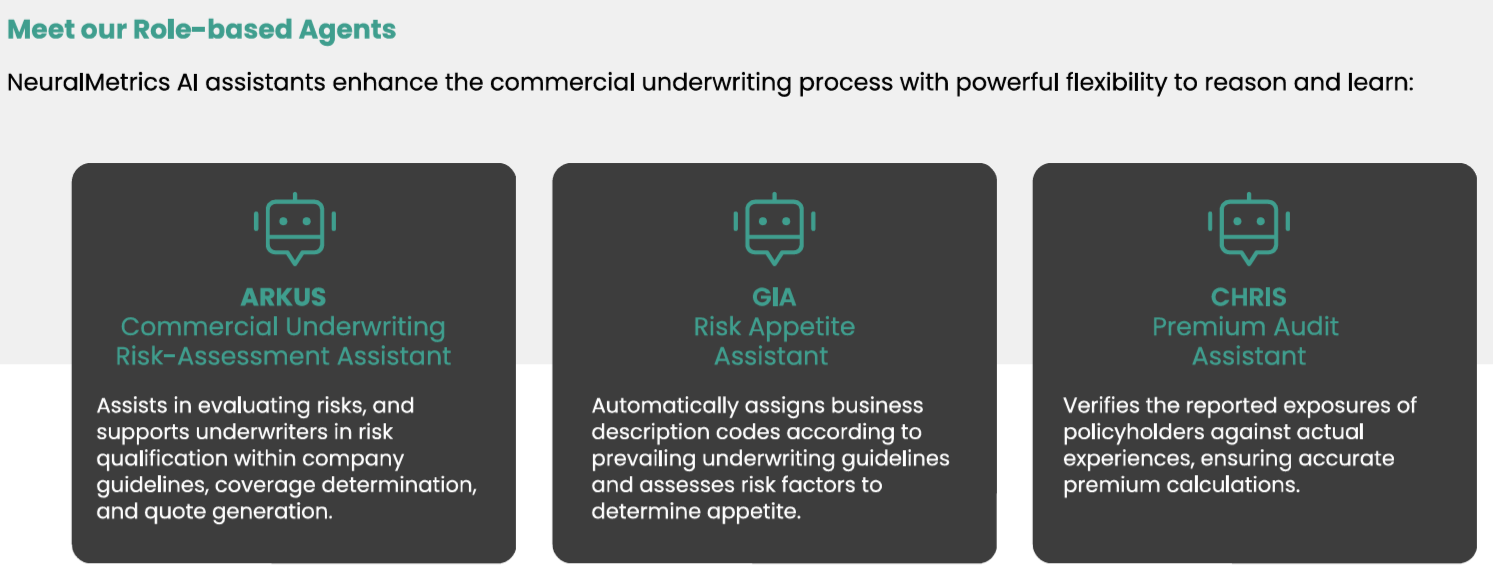

NeuralMetrics specializes in generative AI data solutions for commercial insurance underwriting, serving insurers, MGAs, and agents/brokers.

Their platform relies on different advanced technologies, like AI assistants, machine learning, and large language models, to improve the underwriting process and extract industry-compliant risk assessment intelligence from public information sources.

NeuralMetrics’ solutions can be used in several ways.

You could input information directly into their platform to receive immediate output, or you could integrate their data engines with your existing systems through an API.

That way, you get real-time results displayed within your preferred interface.

Additionally, they allow their clients to perform bulk uploads to process many insureds, which is ideal for tasks like book rolls or acquisitions.

One standout feature of this solution is the Smart Adaptive Multifunctional Agent (SAMA) platform.

SAMA provides role-based AI assistants (shown below) that handle various underwriting activities, speeding up the whole process and ensuring greater accuracy.

Source: NeuralMetrics

They’re quite powerful mechanisms, learning, adapting, and self-correcting.

Besides the SAMA platform, NeuralMetrics provides a couple of other products, like:

| Industry Classification Module | Provides industry classification using just a business name and address, email, or website. Available via a web application or API integrated with quoting or policy systems |

| Risk Intelligence Module | Provides and answers risk evaluation questions tailored to users’ underwriting guidelines, offering 450 out-of-the-box risk insights supported by over 700 models |

| Market Data Module | Integrates large amounts of verified market data with users’ existing workflows, enabling direct prospect targeting, market filtering, and insights into competitors’ past and current positions |

In addition to all these capabilities, NeuralMetrics’ tools can be further customized according to users’ needs.

More specifically, they can tailor predefined risk qualification questions for specific business segments they offer to align with the client’s risk appetite and unique insurer requirements.

To learn more, visit their website and get in touch.

In 2020, Advisen was acquired by Zywave, a leading insurance tech provider, and together, they now deliver data, media, and technology solutions for the commercial property and casualty insurance market.

Advisen stands out as a solution that offers a truly wide range of data necessary for building strong corporate risk profiles, like:

The data serves insurers, bankers, various risk professionals, and more.

As for insurers themselves, Advisen provides a suite of products designed to improve a multitude of processes, from underwriting, pricing, or rate-making to product development and distribution:

| Underwriting Framework | Offers different tools that provide in-depth insights and improve efficiency in daily underwriting tasks |

| Loss Insight | Delivers information about significant accidents, lawsuits, regulatory actions, and other events, along with trend analyses to support risk evaluation, pricing, and program structuring |

| Cyber OverVue™ | Leverages historical loss data to create loss profiles and benchmark analyses, enabling real-time decision-making regarding cyber risks and forecasting potential scenarios that could impact clients or prospects |

All in all, if you’re in need of a reliable specialty risk data provider, Advisen is definitely worth considering.

You can visit their website to learn more or head over to the Zywave website to request a free demo of some of the products we mentioned, like Cyber OverVue or Loss Insight.

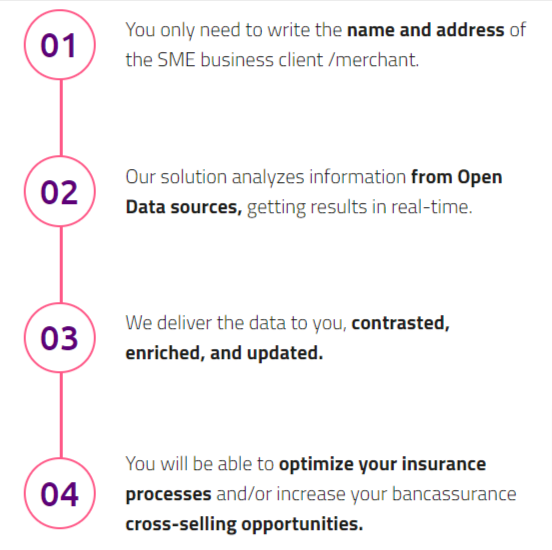

Wenalyze is an AI-driven data platform developed for commercial insurance companies, banks, and financial investors.

The platform itself consists of two flagship solutions, one of which is SME Activity Classification.

Source: Wenalyze

This is a commercial insurance solution that enriches SME data by accurately categorizing activities, SIC or NAICS codes, and the location of business clients.

Insurers use this tool to identify changes in risk before policy renewal and adjust client coverage or premiums as needed.

Another product they offer is Payments Data Aggregation.

Source: Wenalyze

This solution identifies merchants’ activity information about card payments, boosting insurance cross-selling, Know Your Customer processes and PSD2 compliance.

For example, by analyzing payment information from a customer who made a couple of travel-related purchases, such as airline tickets, the bank can offer tailored travel insurance that meets the client’s specific needs and financial situation.

Wenalyze is an open data analytics platform that doesn’t rely on traditional databases.

Instead, it gathers insights from sources like business websites, social media channels, and online reviews using proprietary technology.

Here’s how it works:

Source: Wenalyze

You can see the platform in action.

Wenalyze offers a free demo where they analyze 200 SMEs from your portfolio.

But they don’t just provide the required data: they also show where the original data was off, explain why, and reveal the sources of their corrections.

Besides, they also give you an estimate of how much you could gain by repricing and extending coverage for companies with previously inaccurate data.

This is a really great way to gauge, not only how the system works, but also how exactly you can benefit from it.

So, there you have it!

These solutions are all strong contenders when it comes to insurance data, but the best choice for you will depend on your specific needs.

Be sure to dig deeper into each tool, explore any available demos or data samples, and ask the sales teams any and all questions you might have.

Taking the time to do thorough research now will pay off in the long run as it’ll help you choose a solution that delivers accurate, timely, and reliable data, every single time.