Indirect Spend Management Examples: 8 Companies That Nailed It

From office supplies and IT services to travel and facility management, indirect spend covers what many call non-revenue-generating expenses.

These diverse expenditures support your organization’s day-to-day operations without being directly tied to the products or services sold to customers.

If left unmanaged, indirect spend costs can accumulate rapidly, ultimately hurting your business’s bottom line.

However, some companies have mastered indirect spend management, driving savings and efficiencies across their organizations.

Today, we’ll explore eight examples of companies that nailed it, so you can use their strategies as inspiration to streamline your own indirect spend and unlock hidden opportunities for growth.

Known for its global consumer goods operations, Unilever effectively manages its indirect spend through a centralized procurement approach and strategic partnerships.

Unilever’s procurement spend exceeds $36 billion annually across a diverse range of commodities, covering both direct and indirect categories.

Before 2000, Unilever’s purchasing activities were fragmented across separate product groups, with each group responsible for procuring its own materials and supplies through individual procurement systems.

This fragmentation caused Unilever to miss opportunities for supplier consolidation and volume discounts across various spend categories.

To address these inefficiencies, Unilever created a high-level team of procurement managers tasked with analyzing even the smallest expenses, from paper clips to pressed olives.

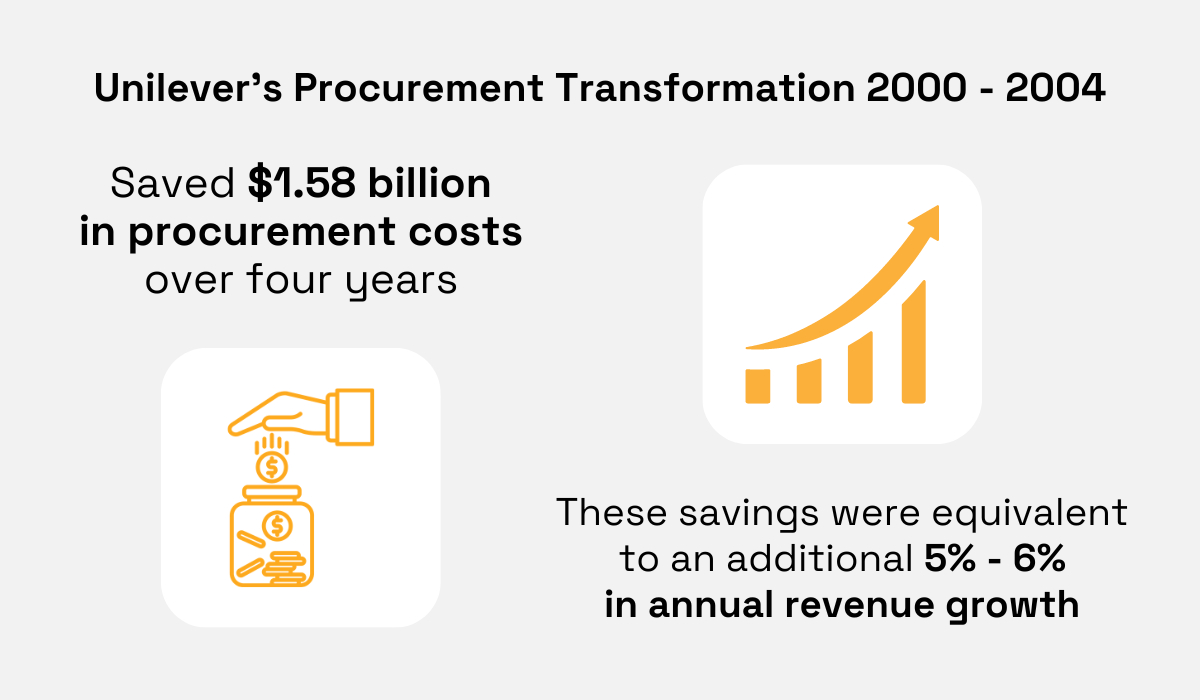

As a result of these efforts, Unilever saved $1.58 billion in procurement costs in just four years.

Illustration: Veridion / Data: Global Performance Group

As shown above, if these savings were viewed as revenue, they would equate to an annual growth rate of 5% to 6%.

So, let’s see how they achieved this.

For starters, they were among the forerunners in establishing cross-departmental teams that leveraged the expertise of both procurement and non-procurement staff.

This approach enabled Unilever’s procurement team to better understand what specific products and services internal departments need.

Additionally, they shifted their supplier relationships from oppositional to collaborative, which led to strengthened partnerships and enabled the sharing of new business ideas and innovations.

Source: Unilever

While Unilever’s data doesn’t specify exactly how much of the cost savings came from indirect spend categories, here are a few key actions they took in that area.

First, they introduced a company-wide software application for purchasing indirect items, such as office supplies.

They also implemented a corporate platform for reverse online auctions, where suppliers bid by lowering their prices to meet buyer requirements.

Additionally, despite having over 1,300 procurement employees, Unilever outsourced some procurement functions to Accenture to optimize their strategy and better manage their extensive indirect spend.

Ultimately, this combination of centralizing and standardizing procurement through technology, along with building strategic partnerships with suppliers and outsourcing partners, continues to help Unilever efficiently manage its indirect spend.

Jabil is a textbook example of how the visibility gained through a centralized spend management platform can be used to establish appropriate controls and manage indirect spend more effectively.

This global company employs over 260,000 people across more than 100 locations in 30 countries, providing their clients with custom manufacturing solutions.

The transformation of Jabil’s indirect spend management started with its procurement leaders analyzing where over $6 billion of their annual spend was going.

As Heidi Banks, Senior Director of Global Procurement, points out, they lacked insights into how much of their total procurement spend was actually indirect.

She explains what their thorough spend analysis revealed:

Illustration: Veridion / Data: Coupa

Jabil’s procurement leaders realized that these billions in indirect spend were not sufficiently managed and started looking for a solution.

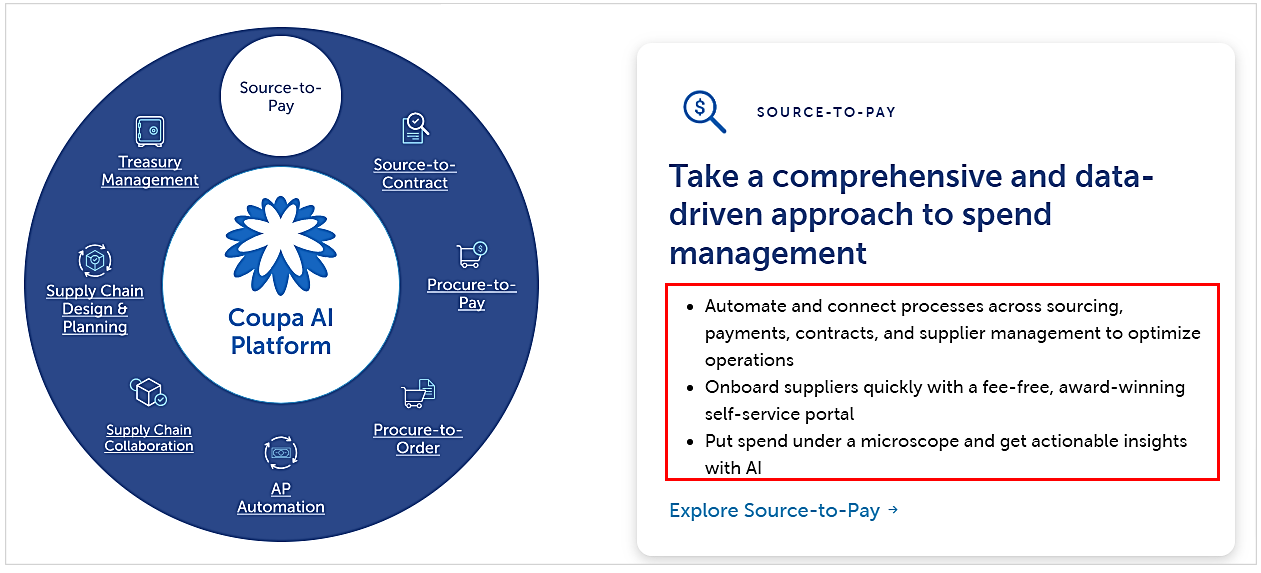

They needed a platform that could:

After evaluating multiple options, Jabil chose Coupa, a cloud-based procurement management platform, for its cost-effectiveness, user experience, and integration capabilities.

Source: Coupa

Jabil started rolling out Coupa in June 2017, first focusing on its sites in China with the highest spend concentration.

Within 18 months, electronic invoicing in those sites increased from 5% to over 50%.

Ultimately, Jabil successfully implemented Coupa across 125 sites, leading to 90% of spend being processed through the platform.

This has enabled Jabil to better manage its indirect spend while driving cost leadership and operational excellence.

Delta Airlines, a global airline leader, is another company that successfully implemented a source-to-pay (S2P) software solution and data analytics to generate indirect spend savings.

With annual revenue of over $57 billion, more than 4,000 daily flights, and 75,000 employees, Delta’s procurement processes were fraught with inefficiencies.

Before Delta’s procurement transformation, each of the company’s locations was responsible for purchasing indirect products and services needed for their everyday operations.

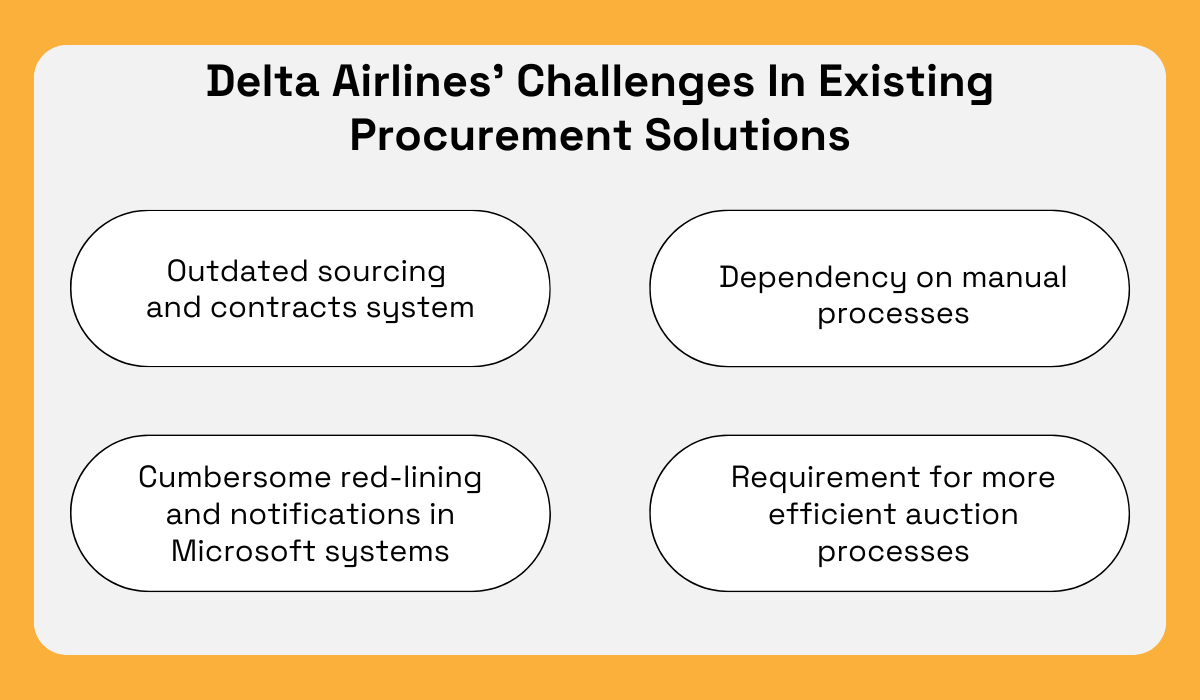

Additionally, their legacy procurement solutions presented some key challenges, outlined in the image below.

Illustration: Veridion / Data: Zycus

To address the said procurement fragmentation and the above challenges, in 2018, Delta initiated its transformation project EPIC—Enterprise Procurement Insights & Collaboration.

The project’s goal was to deliver “One way to procure at Delta.”

After careful deliberation, they opted for Zycus S2P solution whose functionalities met Delta’s requirements in three core areas:

The latter point included automating e-sourcing and RFx processes along with the supplier portal and B2B catalogs.

Ultimately, implementing the Zycus software package enabled Delta to centralize its spend data, reveal inefficiencies, and leverage its purchasing power to drive savings.

For example, Delta consolidated its hotel providers, which resulted in savings of $11 million on hotel rooms in just three months.

Today, this approach continues to help Delta optimize its indirect spend management, driving significant cost savings and operational improvements across the organization.

The Bayer Corporation, one of the largest pharmaceutical and biomedical companies in the world, is a good example of how a company can improve its indirect spend management within a decentralized system.

Just like Delta and many other companies, Bayer’s procurement functioned in a way that each production plant or business unit managed its indirect purchases.

This decentralized approach resulted in fragmented indirect spend and cost inefficiencies.

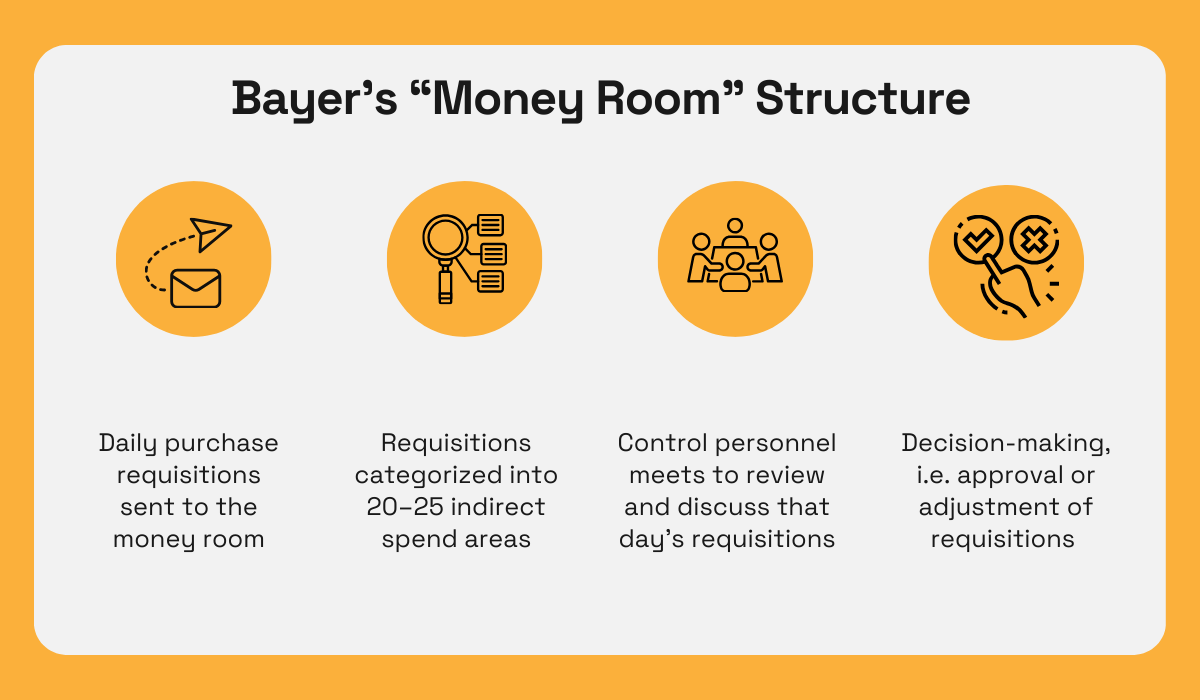

To tackle this issue, the company established “money rooms” in each production facility and administrative unit.

These rooms acted as control centers for the central purchasing department and followed the below-illustrated requisitions approval process.

Illustration: Veridion / Data: Procurement Academy

If the purchase requisitions met that day’s target spend (set beforehand) and no savings could be made, they were approved, and purchase orders were generated.

However, if the daily target spend was exceeded, the control staff were responsible for coming up with solutions to reduce it.

They could do that by consolidating several purchase categories to increase their buying leverage, delaying the approval of requisitions, or in other ways.

The chief controller of each money room was also expected to cut costs by 20% compared to the historical figures.

Bayer reported that, at one site, this program saved 46% on indirect purchases.

To recap, Bayer’s “Money Room” program demonstrates how organizational strategies in a decentralized system can streamline indirect spend management and drive cost savings.

Wolverine Worldwide (WW) is an American footwear and apparel manufacturer known for promoting absolute autonomy among its brands.

This means that, while WW’s brands share HR, supply chain, and IT operations, other functions—such as marketing, product development, and sales—are managed independently by each brand.

Although this contributed to WW’s success, it also concealed potential savings opportunities, particularly in indirect materials and services.

To address this problem, WW decided to establish a company-wide indirect procurement program.

This task was entrusted to GEP, which provides consulting and system setup services.

Roger Hockstra, Director of Indirect Procurement, explains the reasons behind this decision:

Illustration: Veridion / Data: GEP

As a pilot project, GEP chose WW’s Air Freight category.

The indirect procurement program for this category involved:

This resulted in over 14% savings on air freight spend within just three months.

Delighted by the results, WW enlisted GEP as its long-term procurement partner to help it establish a larger-scale procurement transformation project.

Today, over 80% of WW’s total indirect spend is sourced through the GEP platform, helping Wolverine achieve savings worth millions of dollars.

Amazon, the world’s leading e-commerce and cloud computing provider, needs no special introduction.

While Amazon’s own indirect spend management is undoubtedly excellent, we’ll focus on what their service—Amazon Business—can do to improve your organization’s indirect purchases.

Amazon Business was launched in 2015 to assist organizations in making bulk and spot purchases.

Soon after its launch, it became clear that Amazon Business can also help businesses control their indirect spend.

As Ken Brennan, Head of Category Adoption, explains:

Illustration: Veridion / Data: Procurement Magazine

This is where Amazon Business recognized an opportunity to help organizations by creating the world’s largest selection of business products in a single online store.

While retaining Amazon’s user-friendly shopping interface and reliable shipping, Amazon Business enabled companies to set up one account for multiple users.

With this account, organizations can set user permissions, giving their buyers access to an extensive collection of products, many of which offer business-only, discounted prices.

Another feature of Amazon Business is Request for Quote (RFQ), which enables buyers to ask suppliers for bulk discounts when purchasing larger quantities.

This feature works similarly to reverse auctions, where sellers compete by underbidding each other, driving prices down.

In summary, Amazon not only excels in its own indirect spend management but also helps other businesses improve theirs through Amazon Business.

Starbucks, a well-known multinational chain of coffeehouses, has over the years implemented several three-year procurement transformation projects aimed at optimizing its indirect spend.

Starbucks initiated the first project in 2008 with the goal of transforming its supply chain to address rising operational costs and inefficiencies.

Their spend analysis revealed that the main culprit was outsourced services.

More precisely, Starbucks was allocating 65% to 70% of its operating costs to outsourcing agreements for transportation, logistics, and contract manufacturing.

In the words of Peter D. Gibbons, their former executive VP of global supply chain operations:

Illustration: Veridion / Data: Supply Chain Exchange

To reduce the costs in these indirect spend categories, a detailed analysis of contracts and shipping costs was conducted.

This enabled Starbucks to negotiate better prices through effective “should-cost” models.

Ultimately, the company created a unified logistics system that integrated all incoming and outgoing goods, which further optimized transportation costs.

Another Starbucks’ three-year procurement transformation project was completed in 2020.

This transformation involved standardizing sourcing processes across various partners in Europe, the Middle East, and Africa (EMEA) to ensure consistent operational execution.

In addition to technology adoption, the project also focused on improvements in non-product spend categories.

To quote Eelco van der Zande, Strategic Sourcing Director for EMEA who lead the project:

Illustration: Veridion / Data: Supply Chain Digital

In summary, both of these transformation projects—reducing outsourcing costs and streamlining non-product categories—highlight Starbucks’ strategic focus on optimizing indirect spend.

Dole Sunshine, a major player in the food and beverage industry, has a rich history dating back to 1899.

Until 2020, the company had a traditional approach to indirect procurement with a decentralized structure and limited spend visibility due to the lack of digital systems.

That’s when Dole initiated a program meant to overhaul their indirect sourcing practices.

The program aims to centralize, standardize, and digitize Dole’s procurement processes to improve visibility and take control of indirect spend categories that were previously managed locally.

As Naissa von Pein, their Global Director for Indirect Categories and Procurement Excellence, explains:

Illustration: Veridion / Data: Supply Chain Digital

One of the early adopted tools in Dole’s procurement transformation was Ivalua.

This solution is now being scaled, along with efforts to train employees to use the tool to its full capacity.

In addition to process automation, the program focused on continuous engagement with local stakeholders and demonstrating the benefits of procurement’s involvement.

These factors were crucial for bringing indirect categories under procurement’s control.

In the first year, Dole consolidated spending across various indirect categories such as logistics, office supplies, PPE, MRO, and professional services on regional and global levels.

Overall, Dole’s newfound visibility and strategic approach to indirect spend management have already yielded significant savings and will continue to do so in the years to come.

To wrap up these examples of successful indirect spend management, here are a few key takeaways.

There’s no doubt that effectively managing indirect spend requires thorough spend analysis, data centralization, and continuous tracking in order to generate actionable insights.

But to achieve that, you need to leverage digital tools.

They are essential for streamlining these processes and ensuring long-term success in indirect procurement.

By adopting some of the strategies described throughout this article, your organization can also unlock significant savings in its indirect spend and drive procurement excellence.