Spend Management vs Expense Management: What’s the Difference?

At first glance, spend management and expense management might seem synonymous.

After all, isn’t all spend expenses, and aren’t all expenses spend?

While that’s technically true, effectively managing a company’s financial resources requires understanding the distinct roles these two concepts play.

Recognizing this distinction is crucial for finance and procurement professionals looking to enhance cost control, streamline processes, and align spending with broader business goals.

So, join us as we explore the key differences between spend and expense management, and how they work together to improve your organization’s bottom line.

On the surface, spend management is self-explanatory: it is the way a company manages its expenditure, right?

However, when you consider what it actually takes to effectively manage spend, things get more complex.

So, the first thing to remember is that spend management is an umbrella term that refers to implementing a comprehensive set of processes, methodologies, and tools.

For what purpose?

To ensure that spending decisions a company makes contribute—ideally—to both its bottom line and operational efficiency.

This is reflected in the definition provided by Gartner, a prominent research and consulting firm:

Illustration: Veridion / Data: Gartner

This definition firmly places all procurement and sourcing processes under the purview of spend management.

The continuation of the above definition makes this even clearer:

“Spend management is about maximizing value from company spend while decreasing costs, mitigating financial risk, and improving supplier relationships.”

Given all the above, it’s clear that the key components of spend management span far beyond basic expense tracking.

More precisely, here’s what spend management typically covers.

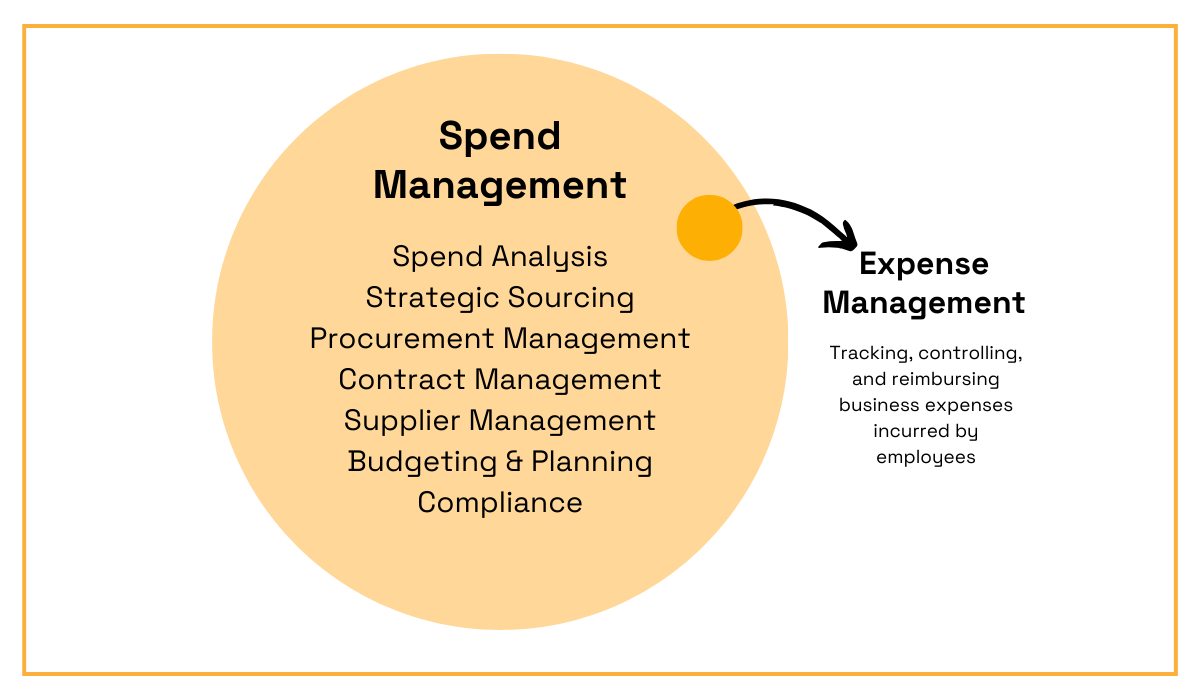

Source: Veridion

Keep in mind that all these processes are interconnected.

Among them, spend analysis stands out as the core component that underpins all others.

Why? Because it involves collecting, categorizing, and analyzing historical and current spend data to identify opportunities for:

As such, spend analysis informs decision-making in all other components of spend management.

For instance, by analyzing spend data, a company may determine exactly how much indirect spend it has.

Heidi Banks, Senior Director of Global Procurement at Jabil, a large multinational company, explains what detailed spend analysis has revealed for them:

Illustration: Veridion / Quote: Coupa

Armed with such insights into indirect spend, a company could optimize various key components of spend management.

For instance, if the analysis revealed that indirect suppliers are too fragmented, the company could employ strategic sourcing measures, i.e., move toward consolidating suppliers or identifying new, more cost-effective ones.

From there, the company could also refine its procurement management processes.

This could be achieved by setting stricter guidelines for purchasing decisions and ensuring that only approved suppliers are used for indirect purchases.

Upon doing so, companies can expect a range of benefits, including:

In short, spend management is a holistic approach that leverages a range of processes, methodologies, and tools to help organizations not only control costs but also create long-term value for the company.

Having covered the comprehensive nature of spend management, let’s now turn to the more focused expense management.

Although expense management is a subcomponent of spend management, its focus is much narrower.

Specifically, expense management revolves around tracking, processing, approving, and reimbursing business expenses incurred by employees.

These are expenses that employees pay out of their pocket, submit receipts for, and then get reimbursed by the company.

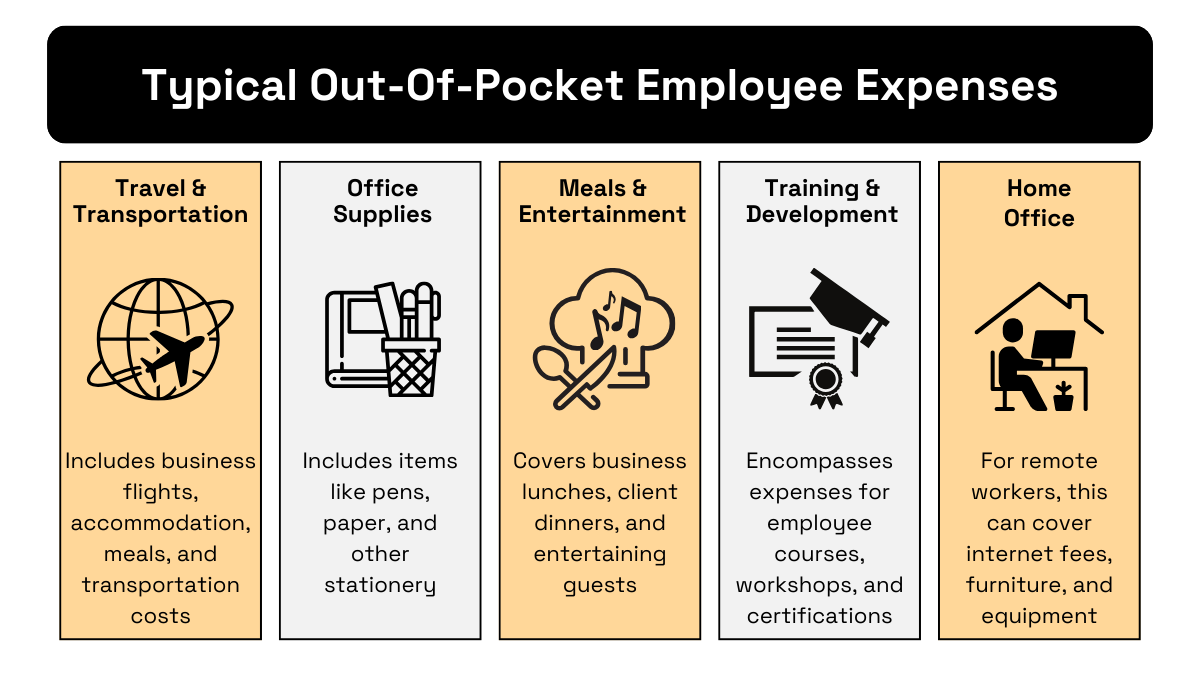

Such expenses can vary widely, depending on the nature of the business and the employee’s role.

Additionally, companies may use corporate cards or other direct payment methods that don’t involve employees paying out-of-pocket.

With these caveats in mind, below are some common examples of employee-incurred expenses:

Source: Veridion

Keep in mind, though, that a company may cover some of the expenses outlined above through other payment methods, thereby eliminating the need for employee reimbursement.

Such expenses are then typically processed by the accounts payable team and the procurement department—when those indirect spend categories fall under its control.

Expense management, on the other hand, specifically focuses on controlling and reimbursing the business expenses described above when incurred by employees.

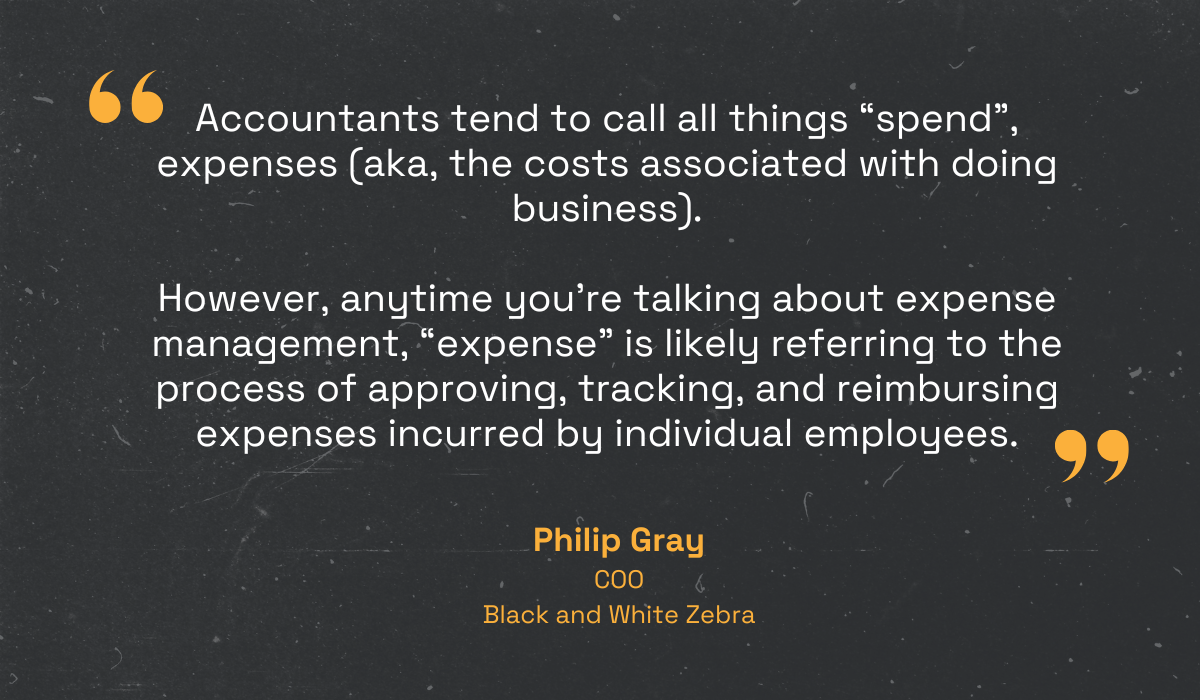

Keeping this distinction in mind can clarify any potentially confusing terminology between spend and expense management.

As Philip Gray, COO of the digital publishing and tech company Black and White Zebra points out:

Illustration: Veridion / Quote: The CFO Club

Now that we have a clear understanding of the employee-centric focus of expense management, let’s explore its key components.

It all begins with a company establishing clear guidelines on what constitutes reimbursable expenses and ensuring compliance with these policies.

For instance, management may set limits on meal costs or define specific categories eligible for reimbursement, which helps prevent fraud and overspending.

This policy and budgeting component is supported by expense reporting.

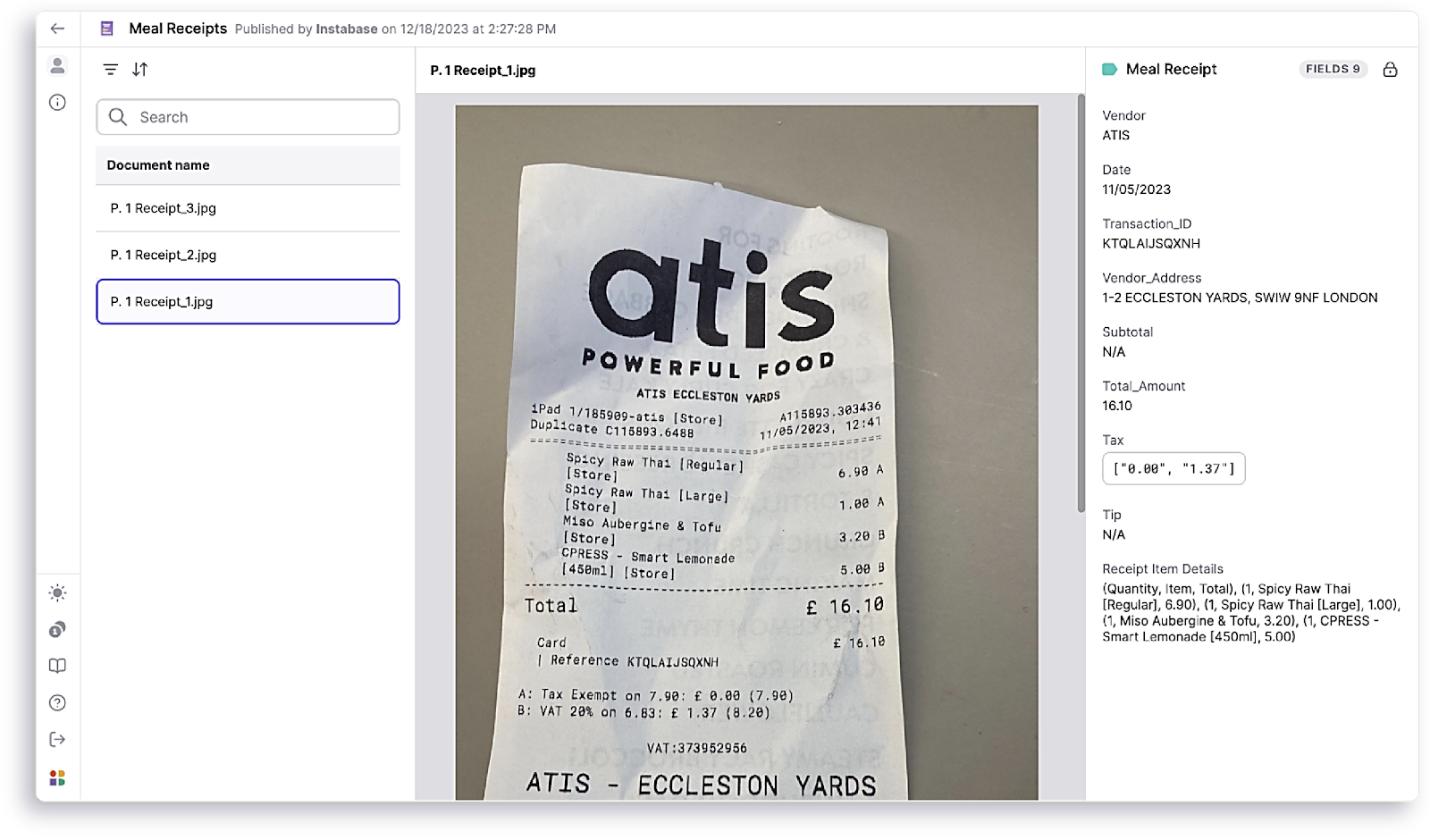

In this step, employees report their expenses through a structured process, often facilitated by software tools.

For example, after a business trip, an employee may scan and upload their receipts into the designated software, categorizing expenses for easy tracking.

Here’s an example of what that can look like:

Source: Instabase

The next component—expense review and approval—involves reviewing reported expenses to ensure they align with established company policies before approving them.

This process may require an employee’s expense report to be approved by both their manager and the finance team before another key component can take place—employee reimbursement.

The reimbursement process focuses on ensuring that employees receive timely and accurate payment for their approved expenses.

Employees are usually reimbursed by direct deposits into their bank accounts or, less and less frequently, through company-issued checks.

The final component—reimbursable expense analysis—entails regularly reviewing expense reports and processes to identify inefficiencies and ensure adherence to company policies.

This is where expense management connects to broader spend management practices.

For example, a company might analyze reimbursed travel expenses to determine which providers are used most frequently.

This data can help them negotiate better rates with hotels or airlines based on consistent usage.

When all these components are in place, you can expect to reap the benefits such as:

Now that we’ve covered what expense management entails, including its key components and benefits, we’re now ready to highlight the key differences between spend and expense management.

The definitions, key components, and benefits of spend and expense management we shared so far alone should give a pretty clear picture of the differences involved.

However, in this section, we’ll explore these primary distinctions in more detail, across four critical areas: scope, stakeholders involved, technologies used, and impact on business strategy.

As discussed, spend management is a comprehensive system of processes guided by company policies and supported by automation tools.

As such, it focuses on controlling and optimizing all external spending across the organization, including supplier purchases, contract negotiations, and procurement processes.

Compared to this, the scope of expense management is miniature.

Source: Veridion

As illustrated, expense management specifically focuses on tracking, controlling, and processing only expenses that need to be reimbursed to employees.

However, its narrow scope provides crucial support for a larger spend management strategy.

How?

By ensuring control over smaller, recurring expenditures and upholding compliance with policies.

More specifically, it enables finance and procurement teams to track overall spending patterns, prevent maverick purchases, and curb excessive spending.

Therefore, despite these differences in scope, both systems work together to ensure cost control and align spending with broader company goals.

The distinctive scopes of spend and expense management naturally lead to different stakeholders being involved, though there is some overlap.

As spend management covers organization-wide spending and supplier relationships, it typically involves:

Depending on the complexity of supplier contracts, legal teams may also be involved in drafting and negotiations.

For example, senior leadership approves high-level budgets and strategic spend decisions, including procurement guidelines.

Then, the procurement team makes strategic procurement decisions in line with those guidelines when sourcing suppliers and managing contracts.

Meanwhile, the finance department oversees the financial impact and ensures the proper allocation of resources.

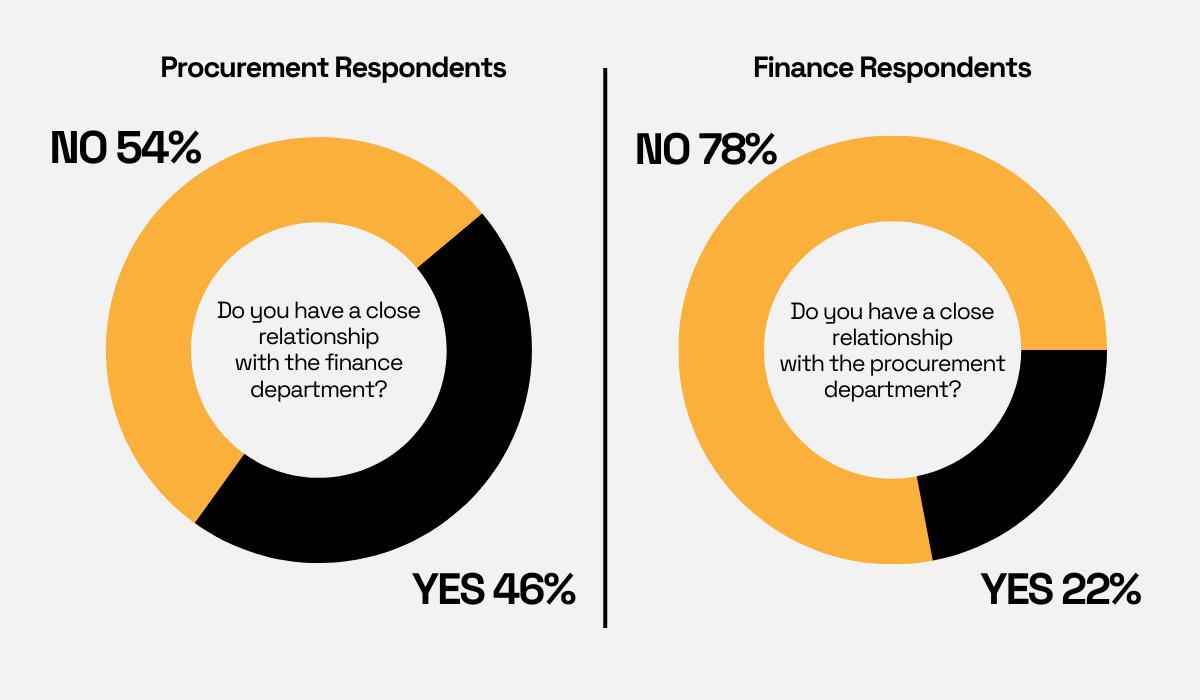

Given that these stakeholders play a central role in effective spend management, there’s no doubt that their close collaboration and open communication are crucial.

Despite this, a CPO Viewpoint study revealed that, for many procurement and finance teams, there is still a lot of room for improvement when it comes to relationship building.

Illustration: Veridion / Data: Medius

As for expense management, it focuses on ensuring that individual employee expense reports and reimbursements are processed efficiently.

Therefore, the primary stakeholders involved in this process are:

Employees submit their expense reports, department managers review and approve them, and the finance team processes the reimbursements.

This process also often involves HR managers or designated employees handling, for instance, reimbursements for employee perks like gym or wellness memberships.

Although fewer stakeholders are involved compared to spend management, their collaboration is critical for effective expense management.

Again, the huge difference between the scopes of spend and expense management dictates the types and number of technologies used to streamline these processes.

An effective spend management system typically comprises a range of comprehensive and specialized software tools.

These tools automate and streamline the processes involved in all the key components of spend management.

On top of that, integrating spend-related data from these tools and business systems like ERP into a centralized location is essential for effective spend management, as it enables comprehensive spend analysis.

To analyze spend data, a standalone spend analytics solution—or an all-in-one spend management platform with analytics features like Coupa—can be used.

Source: Coupa

It should be noted that leading solutions like Coupa, GEP, SAP, Procurify, and Jaggaer offer comprehensive solutions that go beyond spend analytics.

More precisely, they include digitization and automation of essentially all other spend management processes, such as:

As we’ll see, they also cover expense management.

However, despite their comprehensiveness, such platforms often lack a crucial element for strategic financial and procurement decision-making.

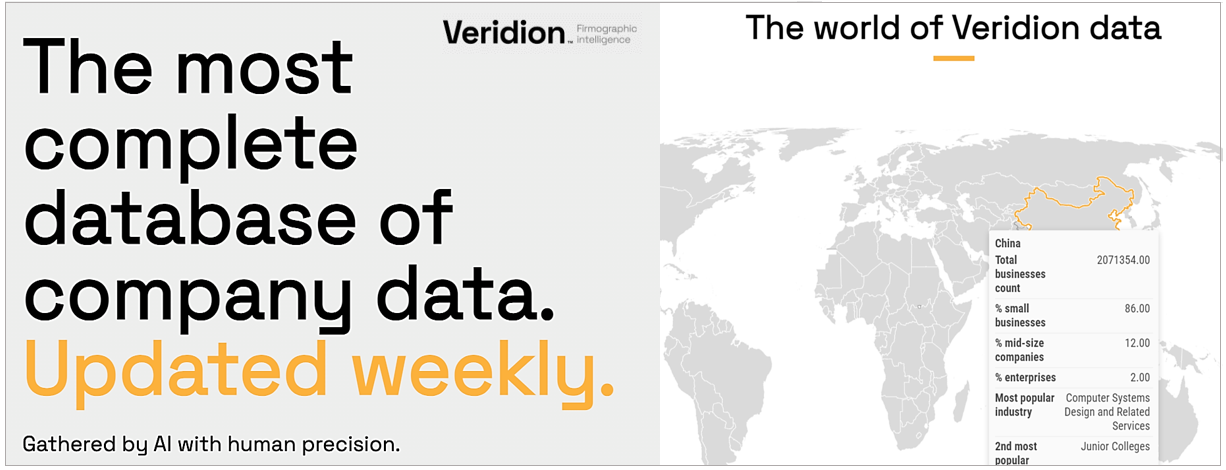

Of course, we’re talking about having accurate and up-to-date supplier data and market insights.

They are necessary for effective supplier discovery, performance monitoring, benchmarking, and risk management.

For this purpose, companies can leverage Veridion’s global database of suppliers with over 100 million companies.

Source: Veridion

Veridion’s AI-powered algorithms scour the internet to update the supplier database on a weekly basis, thereby ensuring that you always have access to the freshest information.

And, since Veridion’s data service has advanced search and notification functions easily integrated with your other software solutions, this allows your team to:

In a nutshell, Veridion provides accurate real-world data on suppliers and market trends, resulting in better-informed spend management, procurement, and sourcing decisions.

Compared to a variety of tools for spend management, expense management can be handled by a single specialized tool or—expectedly—a feature of a more comprehensive solution like Procurify.

Source: Procurify

Such solutions focus on automating the submission, approval, and reimbursement of employee expenses.

And, as you can see above, they allow users to capture their receipts and report expenses with ease.

Concurrently, managers and finance teams can quickly verify and approve expenses, enabling fast employee reimbursements.

With a clearer understanding of the technologies used to streamline spend and expense management, let’s briefly explore their impact on a company’s business strategy.

There’s no doubt that spend management—with all the processes, methodologies, and tools involved—has an immeasurably bigger role in shaping a company’s long-term business strategy.

As we explored, effective spend management practices, including spend analytics, ultimately allow companies to:

As a result, good spend management can directly contribute to your company’s profitability, operational efficiency, and competitive advantage.

In contrast, expense management is laser-focused on controlling the reporting, approval, and reimbursement of employees’ out-of-pocket expenses.

This facilitates day-to-day operational efficiency, ensures proper control of employee expenses, and enables timely reimbursements.

However, the influence of expense management on wider business strategy is limited compared to the comprehensive financial insights gained from spend management.

While both spend and expense management are essential for maintaining financial control and operational efficiency, that’s where their similarities end.

Spend management plays a crucial role in shaping your company’s long-term business strategy by driving cost savings and improving supplier relationships.

On the other hand, expense management focuses on streamlining employee reimbursements to support daily operations.

Together, these processes—supported by the right tools—help your company achieve better cost control and align spending practices with strategic business goals.

This makes both of them indispensable for ensuring financial discipline, enhancing operational efficiency, and fostering sustainable business growth.