6 Methods for Effective Supplier Evaluation

Supplier evaluation is a vital process for identifying partners who can reliably meet your company’s needs and expectations.

By systematically assessing supplier capabilities and performance, you can ensure consistent product quality and delivery, control costs, and identify potential risks early.

But which evaluation methods are the most effective?

In this article, we’ll explore six proven methods for supplier evaluation and share practical tips for implementing them.

Supplier scorecards are used to assess and compare suppliers based on quality, cost, delivery, and service metrics.

They provide an objective framework for evaluating and ranking suppliers, ensuring your decisions are data-driven and aligned with business priorities.

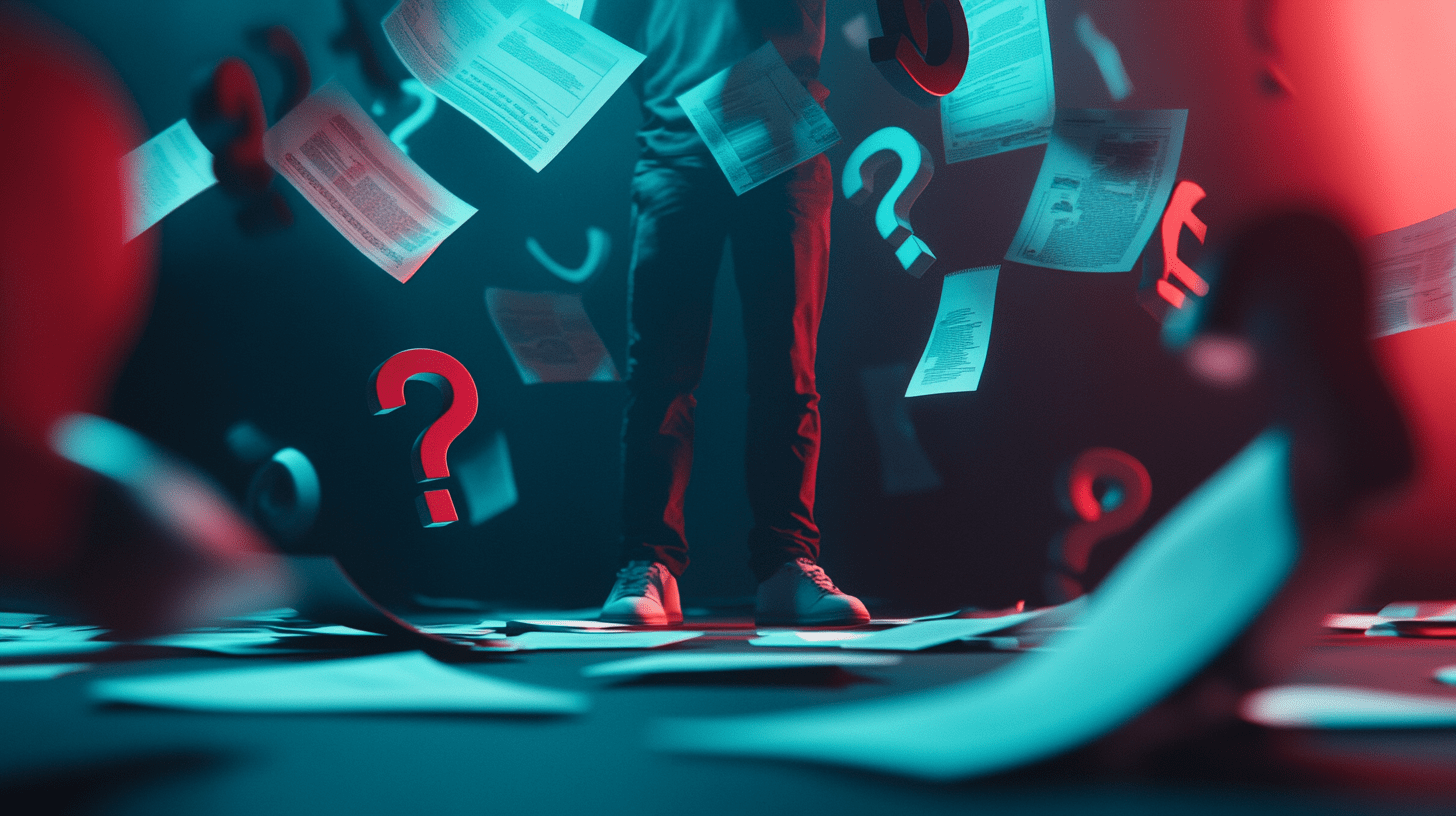

Scorecards serve a dual purpose: they can be used for selecting prospective suppliers or monitoring existing suppliers’ performance.

Despite this difference in use, a typical scorecard includes basic supplier information and a set of key performance indicators (KPIs).

While some KPIs are more relevant for supplier selection and others for performance monitoring, there is a significant overlap between the two.

Source: Veridion

When creating a supplier scorecard, start with shared KPIs, such as quality and cost, as your baseline metrics.

Then, build on these by adding specific KPIs tailored to your use case.

Don’t overwhelm your evaluation team and suppliers with too many KPIs, however.

Focusing your scorecard on the most critical metrics ensures a streamlined evaluation process and makes it easier to compare suppliers.

Once you’ve established the KPIs, the next step is to develop a weighted scoring system to prioritize them.

To do so, involve key stakeholders, including senior management, operations, finance, and quality assurance.

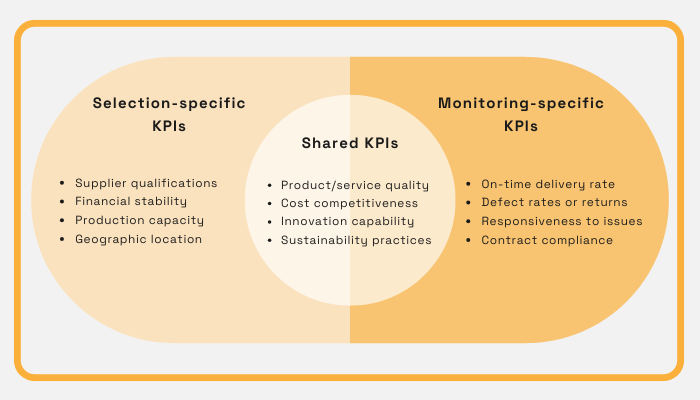

Suman Sarkar, partner and supply chain expert at 3S Consulting, agrees:

Illustration: Veridion / Data: Smartsheet

When establishing the scoring system, consider using a mix of qualitative and quantitative metrics to capture objective data and subjective assessments.

Quantitative KPIs can be easily rated using numerical scales (e.g., 1 to 5), while qualitative KPIs may require a more nuanced approach to account for their subjective nature.

Regardless, including both types of metrics ensures a comprehensive supplier evaluation.

Overall, supplier scorecards provide a balanced framework that enables you to assess suppliers from multiple angles, helping to make more informed and strategic sourcing decisions.

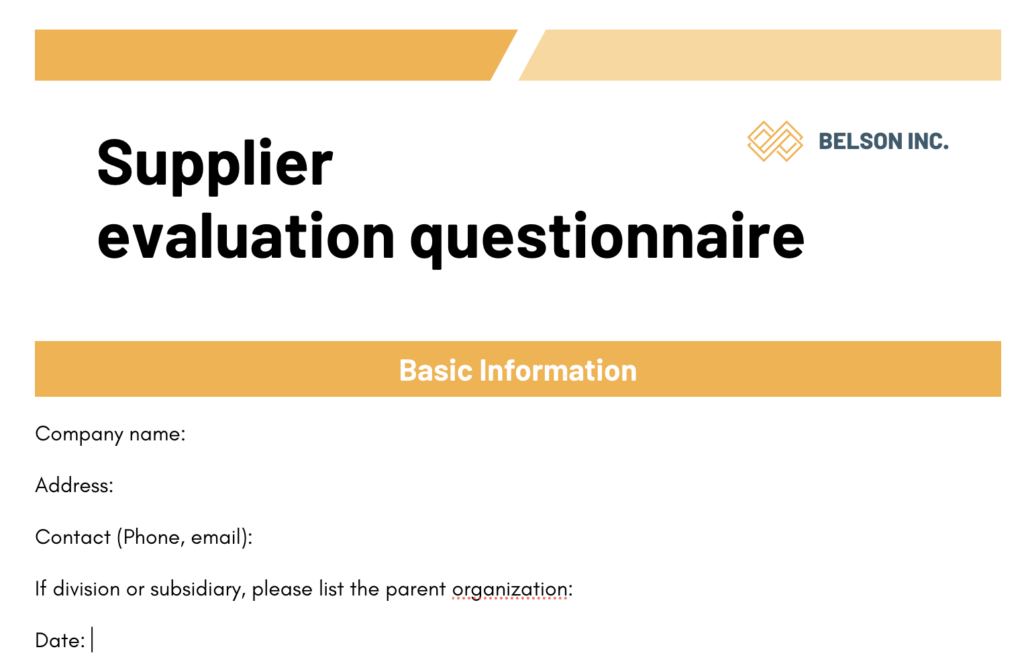

Surveys are structured questionnaires sent to suppliers to gather detailed information about their capabilities, policies, and practices.

Like scorecards, they can be used for supplier selection and performance monitoring.

When selecting new suppliers, surveys collect self-reported data that helps your team assess whether a supplier fits your company’s needs and standards.

For existing suppliers, periodic surveys can gather updates on compliance, process changes, or challenges they may be facing, ensuring your evaluation remains up-to-date.

In any case, surveys standardize the evaluation process and compare suppliers based on consistent criteria.

And they typically begin with basic supplier information.

Source: Veridion

From there, surveys usually expand into specific areas such as production capacity, quality management systems, logistics, and sustainability.

At this stage, the critical KPIs identified for the scorecard are translated into targeted survey questions designed to collect measurable responses from suppliers.

For instance, the KPI “On-Time Delivery” can be addressed with questions such as:

Similarly, the KPI “Sustainability” can be broken down into detailed questions about the supplier’s environmental, social, and governance (ESG) practices.

Here’s an example:

Source: Veridion

Questionnaires should be comprehensive yet focused, targeting information directly relevant to supplier evaluation.

Overloading potential or existing suppliers with excessive questions can result in lower-quality or incomplete responses.

After suppliers submit their responses, your team can analyze the data and use the weighted scoring system to identify the most viable candidates.

Validating responses is essential, however, and should involve cross-referencing with trustworthy external data sources.

This brings us to the next method.

To complement surveys, it’s essential to gather supplier data from other sources.

Why? Because relying solely on self-reported information can be risky, as prospective suppliers may intentionally or unintentionally omit critical issues.

This could happen either because they fear disclosure might hurt their chances of being selected, or they simply fail to recognize certain risks, such as geopolitical or market changes.

So, how can you efficiently collect supplier data from diverse external sources?

The answer is technology.

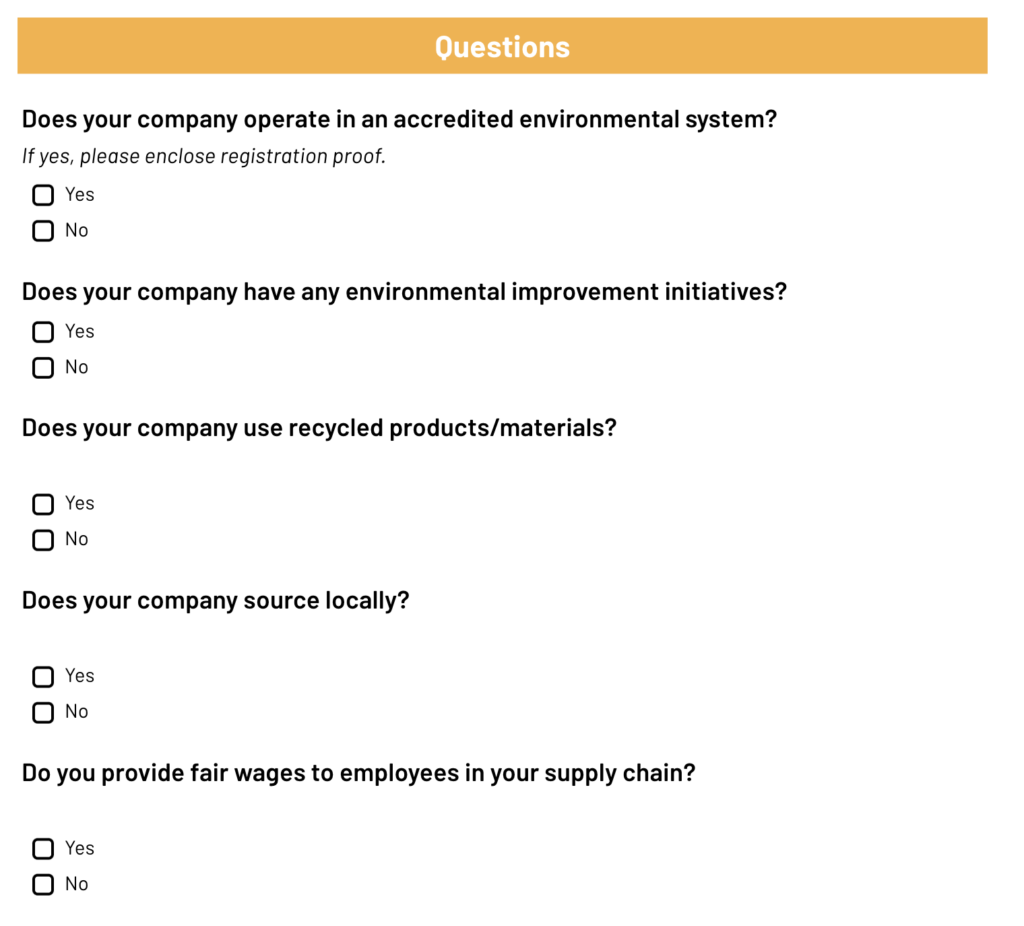

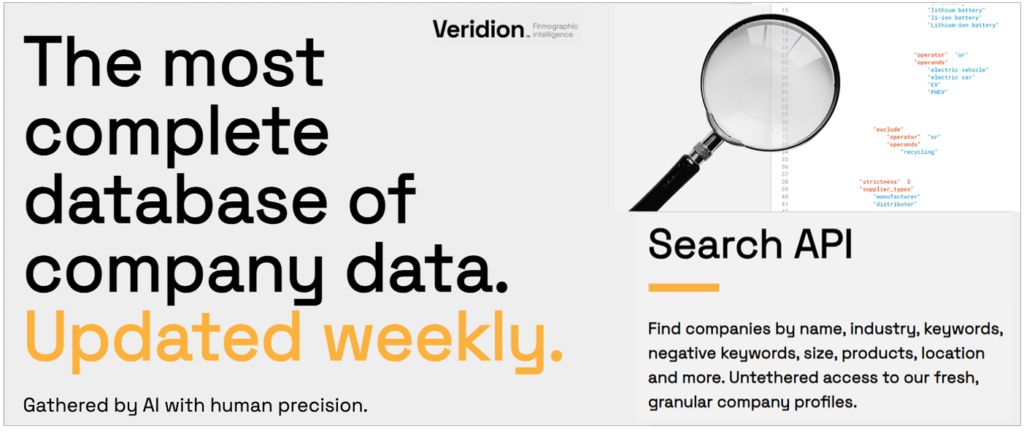

For instance, our own Veridion is a platform that leverages AI-powered bots to collect and analyze data on all suppliers with an active digital presence.

Source: Veridion

Veridion gives you access to a worldwide, weekly updated database of suppliers along with advanced search functions.

At the moment, this database covers over 120 million companies across more than 240 countries.

Using natural language, you can enter any search criteria, such as precise product specifications, supplier location, certifications, ESG practices, and more.

Source: Veridion on YouTube

With search results displayed in seconds, you can quickly and easily find new suppliers that match your specific criteria.

That way, your team gets real-time, data-driven insights into supplier capabilities, financial health, regulatory compliance, market position, and more.

All this streamlines supplier evaluation processes and enhances decision-making.

Of course, this applies to your existing suppliers as well.

Veridion enables you to enrich your supplier profiles with the latest data and ensures you have the correct information.

Additionally, Veridion’s risk monitoring feature allows you to automate certain aspects of supplier risk management.

You can set specific risk factors, such as a supplier’s financial instability or regulatory issues, and receive real-time alerts when such risks are detected.

Source: Veridion

This approach helps identify potential supplier issues early, allowing you to address them proactively.

To recap, tools like Veridion are the easiest way to gather accurate, up-to-date data on both prospective and existing suppliers.

This information streamlines supplier evaluation, helping you verify supplier credibility and reliability.

Reaching out to a supplier’s previous or current clients to verify their reliability, performance, and reputation is a crucial part of the evaluation process.

This step offers real-world insights that go beyond a potential supplier’s marketing claims or sales pitches.

By gathering feedback from these references, you can reduce the risk of partnering with an underperforming or unreliable supplier.

To conduct reference checks, start by requesting a list of references from the supplier and contacting them directly.

As Liz Long, founder of Maker U and a Forbes contributor, cautions, this process requires a thoughtful approach to ensure you receive genuine feedback:

Illustration: Veridion / Data: Forbes

Additionally, you should assure references that their feedback will remain confidential to encourage honest responses.

For even more candid insights into the supplier’s strengths and weaknesses, consider seeking additional contacts beyond those provided by the supplier.

When contacting references for an interview, make sure to maintain a professional tone and respect their time.

As for the interview format, face-to-face meetings and phone calls are preferable to emails or online surveys.

Source: Veridion

This is because face-to-face meetings allow you to pick up on both verbal and non-verbal cues that written responses might miss.

Phone calls, though limited to verbal cues, still offer valuable insights by capturing nuances like hesitation or sarcasm.

For interviews, prepare a list of targeted questions but also be ready to ask follow-up questions based on responses.

Remember, the goal of reference checks is to move beyond data collection and gain actionable insights into what partnering with the supplier would be like in practice.

Trial or sample orders provide a low-risk opportunity to test a supplier’s capabilities before committing to a long-term partnership.

By placing a smaller, controlled order, your team can assess whether the supplier meets critical expectations in areas like quality, delivery timelines, and responsiveness.

For example, you can validate their adherence to agreed-upon product specifications, evaluate packaging quality, and assess communication during order fulfillment.

It should be noted that some supplier sourcing providers indicate whether a supplier accepts small orders, making it easier to identify candidates for trial evaluations.

Here’s an example.

Source: Global Source on YouTube

If the supplier does not accept small orders, request an explanation, as there may be legitimate reasons for their refusal.

These could include high production costs for small quantities, minimum order requirements due to economies of scale, or logistical constraints.

However, if no agreement can be reached—despite offering to cover additional costs or adjust the trial order scope—explore other, more accommodating suppliers.

Trial orders should replicate key aspects of real procurement scenarios.

Although scaled down, the processes and requirements should reflect those of larger orders to provide a meaningful evaluation.

Ultimately, trial orders act as a critical final checkpoint, enabling you to make informed sourcing decisions and build confidence in your future supplier partnerships.

On-site audits involve visiting a supplier’s facility to evaluate their production processes, equipment, workforce, and adherence to quality, safety, and environmental standards.

These visits often uncover issues that might not be apparent through documentation or virtual audits.

As Steven Kirz, managing director at Pace Harmon, notes:

“The quality of the supplier’s resources and application of tools are typically the key differentiators for supplier selection, and the site visit is critical for revealing these elements.”

To ensure a productive on-site audit, schedule the visit and prepare a detailed checklist so you don’t forget to check something.

This checklist should cover critical areas such as production workflows, quality control measures, logistics, workplace conditions, and environmental compliance.

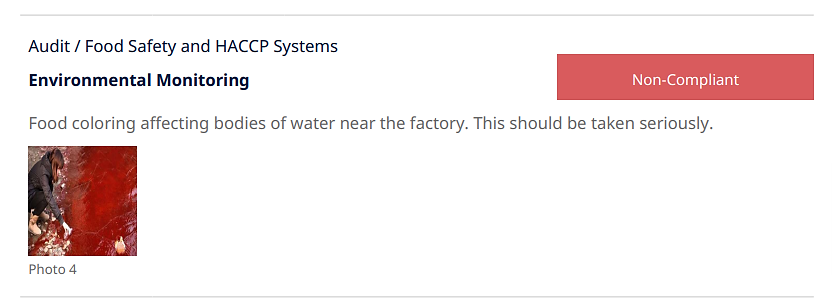

For example, the factory in this audit revealed significant shortcomings in its environmental monitoring practices, raising serious concerns about its impact on nearby ecosystems.

Source: Safety Culture

This example underscores the importance of thoroughly inspecting not only the supplier’s facility but—when relevant—its surroundings as well.

Just observing personnel in action offers valuable insights into their adherence to operational and safety practices.

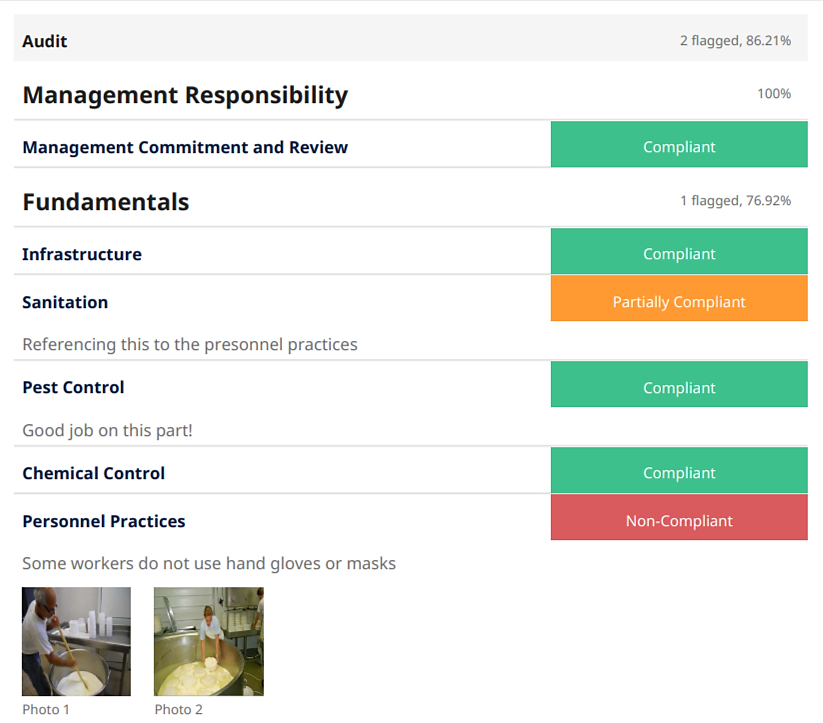

During the visit, document your findings systematically, noting strengths, weaknesses, and areas requiring improvement, as shown below.

Source: Safety Culture

A comprehensive on-site audit helps identify potential risks and provides a foundation for informed decision-making regarding potential partnerships.

Discuss any discovered non-conformances with the supplier to understand the root causes and assess their commitment to addressing them.

This applies to your existing suppliers too.

Overall, on-site audits are invaluable for reducing supplier risks, ensuring compliance, and fostering trust and confidence in your supply chain partnerships.

Combining these effective evaluation methods gives your procurement team an in-depth view of supplier capabilities and performance.

Whether it’s supplier scorecards, surveys, data gathering, or on-site audits, each method offers unique insights into potential and current suppliers.

Leverage these methods, use the right tools, and you’ll mitigate risks and foster strong, reliable supplier partnerships.