Supplier Sourcing vs. Discovery: Our Guide

Key Takeaways:

Supplier sourcing and discovery are two essential procurement processes, but they’re often confused.

Which one should you prioritize—and when?

And how do they impact supplier selection and cost efficiency?

In this guide, we’ll break down the differences between supplier sourcing and discovery, compare their key factors, and help you decide when to use each—or both.

Supplier sourcing is the structured process of identifying, evaluating, selecting, and onboarding new suppliers.

Clearly, “identifying” actually refers to finding or discovering.

That’s why the sourcing process always includes some form of supplier discovery—either as a current step or one that was done earlier.

What do we mean by that?

Well, let’s say you’re looking for a new supplier that will provide a product, component, raw material, or service your company needs.

Even if you’re sourcing them from a list of pre-vetted and approved suppliers, that list had to be built through discovery at some point in time.

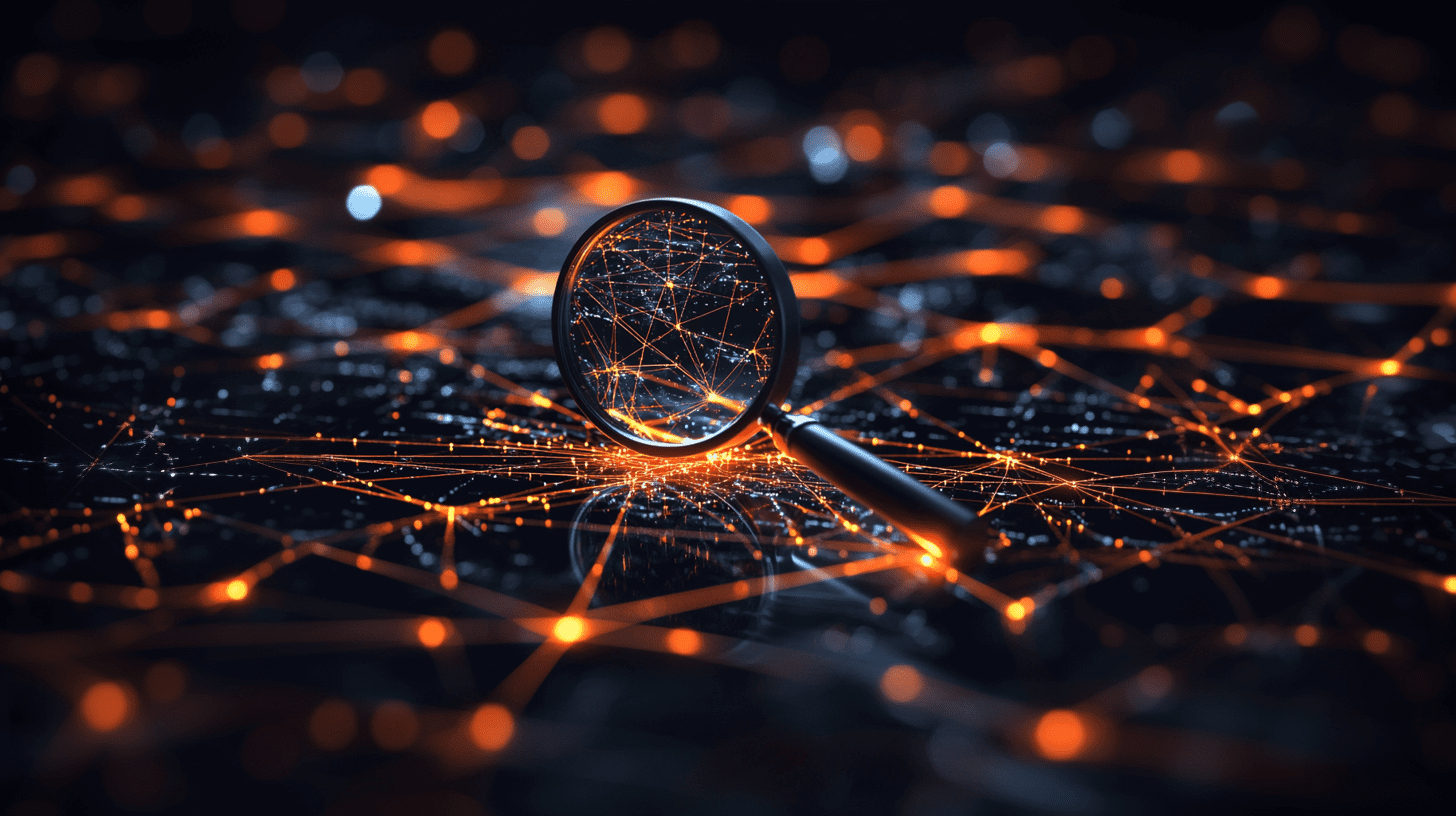

To give you a clearer picture, here’s a breakdown of the typical sourcing steps after your company identified a procurement need:

Source: Veridion

Now that we’ve outlined the sourcing framework—with discovery covered separately later—let’s dive into the remaining three key steps of the process.

Remember, we’re at the stage where you’ve defined what you’re looking for, completed the initial supplier discovery, and now have a list of potential suppliers.

As shown above, the first step after discovery is supplier evaluation.

Supplier evaluation involves assessing the qualifications, capabilities, performance, cost, risks, and more for each potential supplier.

This stage is essential because it ensures that the supplier(s) you ultimately select can meet your expectations both in the short and long term.

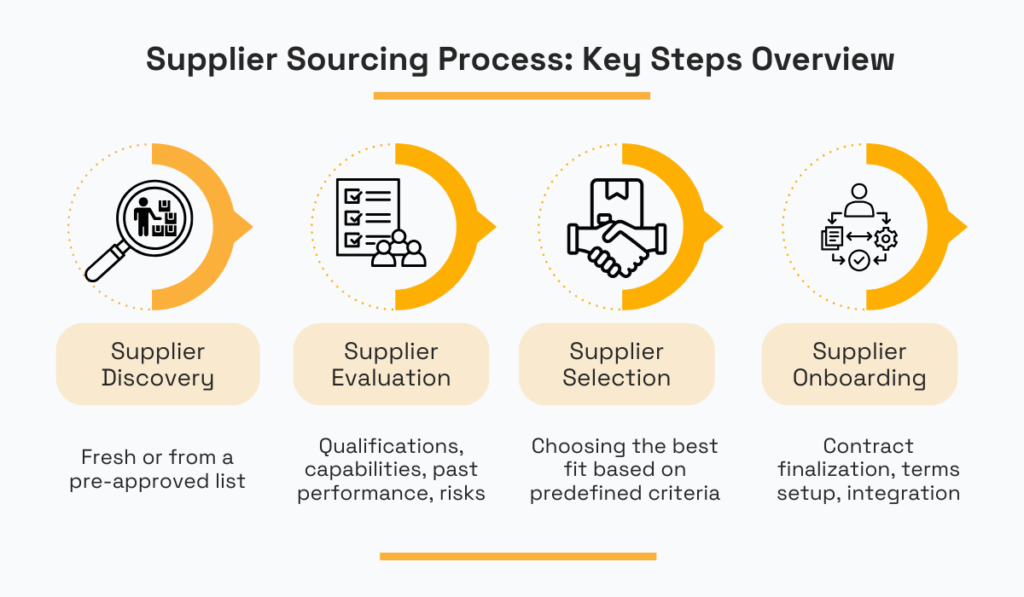

Various evaluation criteria can be applied here, as depicted below in no particular order.

Source: Veridion

Along with many criteria, there are also many activities involved in the evaluation phase.

Supplier outreach is a key part of this process, where candidates are contacted to gather more information about their capabilities, compliance, and suitability.

This step often involves sending questionnaires, Requests for Information (RFIs), or Requests for Proposal (RFPs) to assess qualifications in detail.

Source: Elsmar

For shortlisted candidates, additional steps such as interviews, site visits, and product sample requests help verify quality, reliability, and overall fit.

Once evaluation is complete, the next step is supplier selection.

At this stage, your team chooses the supplier that best aligns with your company’s goals, needs, and standards.

This is where a supplier’s competitive advantages—in areas such as quality, cost, delivery, sustainability, and more—truly come into play.

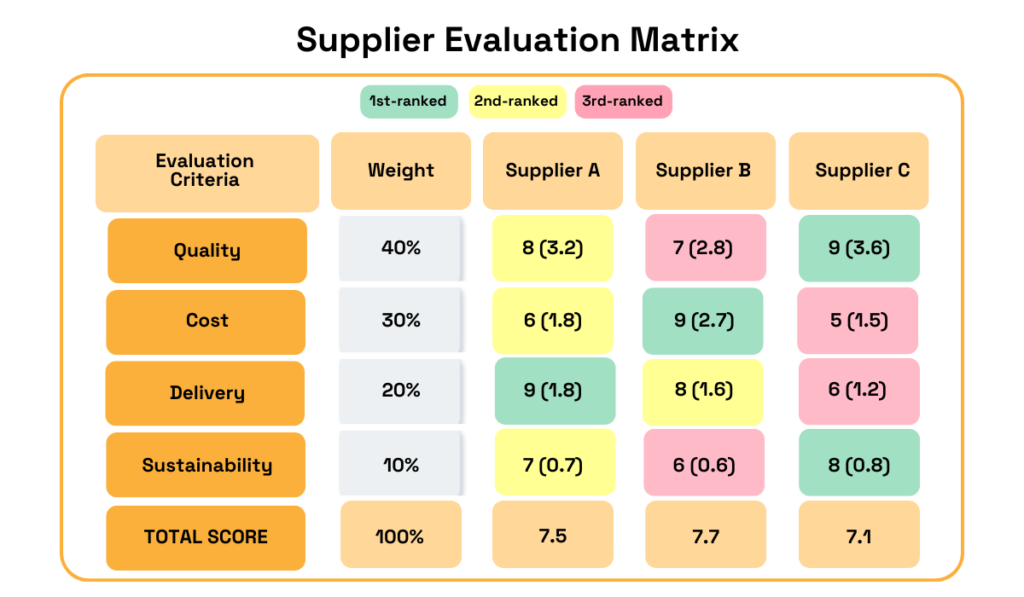

To ensure an objective decision, many organizations use structured scoring methods, such as a supplier evaluation matrix, where candidates are ranked based on weighted criteria.

Source: Veridion

Once the supplier is selected, you’ve reached the onboarding phase.

This includes finalizing contract terms, setting up logistics, and integrating the supplier into your systems and workflows.

After onboarding, the supplier officially becomes part of your supply base.

For some, this marks the end of supplier sourcing.

Others view sourcing as extending into Supplier Lifecycle Management (SLM)—a broader process that ensures suppliers continue to meet your needs over time.

Regardless of where you draw the line, SLM has a critical role, covering activities like:

Now, let’s explore supplier discovery, where the sourcing process actually begins.

Supplier discovery is a subset of the broader sourcing process, specifically focused on identifying potential suppliers.

At this stage, the goal is to research, gather information, and explore options to compile a list of potential suppliers that meet your basic criteria.

In essence, you’re starting from a blank slate.

You’re looking for the right supplier, and at this moment they can be anywhere in the world.

Source: Veridion

This vast global pool of options presents exciting opportunities—but also significant complexity.

To navigate it, companies use different discovery methods.

Some rely on manual approaches, such as attending trade shows, leveraging industry networks, or conducting direct outreach.

Others turn to digital solutions, including supplier databases, procurement platforms, and AI-powered search engines that aggregate supplier data from multiple sources.

Often, businesses combine both methods or choose to outsource supplier discovery (and sourcing) entirely to fee-based, specialized third-party providers.

For instance, Germany-based Zignify offers end-to-end global sourcing services.

Source: Zignify

Outsourcing supplier discovery can be an efficient choice for companies looking to save time, access specialized expertise, or expand into unfamiliar markets.

However, these services come at a cost, which is why many organizations handle supplier discovery in-house.

But in doing so, they often face significant challenges, including:

These hurdles make the process more complex and also slow it down.

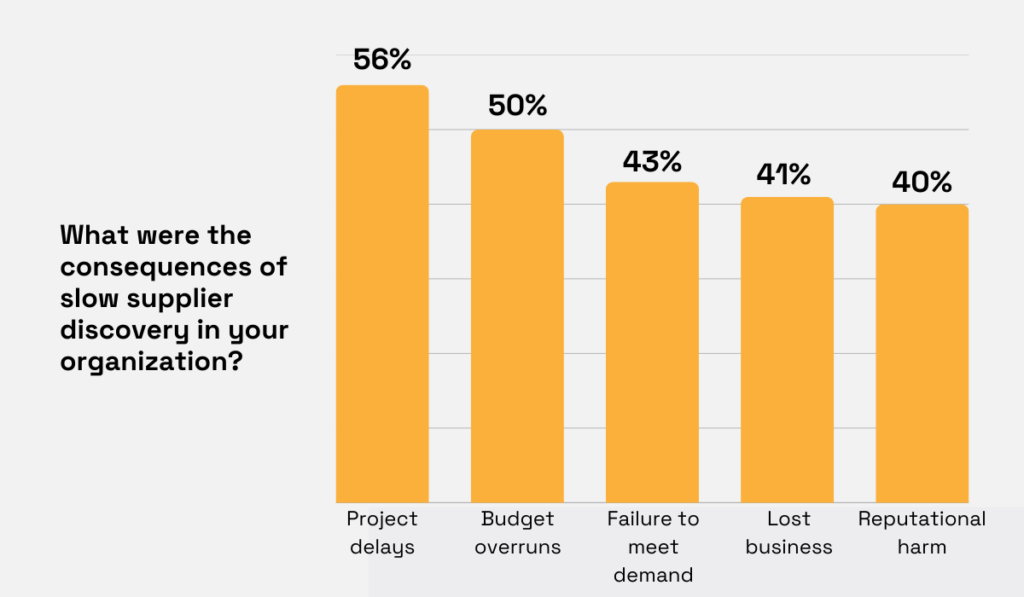

A 2021 TealBook survey of 200 procurement executives found that every single respondent reported negative consequences from prolonged supplier discovery.

Here’s how slow discovery impacted their organizations:

Illustration: Veridion / Data: TealBook

To avoid these consequences, companies need a structured discovery process supported by reliable data and technology.

As we’ll see later, supplier intelligence platforms with AI-driven search tools can significantly reduce discovery time while improving accuracy.

Ultimately, effective supplier discovery lays the groundwork for successful sourcing.

The faster and more accurately your company identifies viable suppliers, the better positioned it is to select the best ones.

While supplier sourcing and discovery are closely related, they differ in several key ways.

Let’s compare them through three critical factors—efficiency, reliance on technology, and cost implications—to highlight their unique challenges and benefits.

When it comes to efficiency, both sourcing and discovery can be complex, time-consuming, and resource-intensive, depending on your needs and the tools used.

However, supplier sourcing is typically more structured and targeted, focusing on pre-vetted suppliers that meet specific requirements.

With an approved supplier pipeline and a defined process, sourcing can be relatively straightforward.

You simply select relevant suppliers from a pre-approved list, send them an RFP, and evaluate their responses to make the final choice.

Many companies maintain such supplier lists within their procurement databases or use supplier sourcing platforms that prequalify and verify the suppliers in advance.

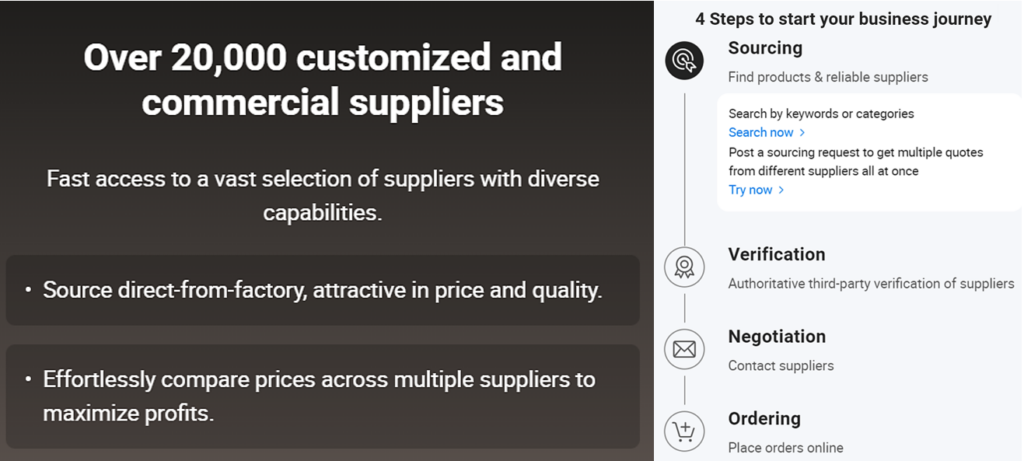

For example, Made-in-China is a B2B platform that connects buyers with over 20,000 pre-vetted Chinese suppliers.

Source: Made-in-China

Although having access to pre-vetted suppliers is convenient, it limits the number of available suppliers and still requires additional verification before a final decision.

However, it certainly simplifies the sourcing process.

In contrast, supplier discovery is a more expansive and exploratory process.

Instead of working within an established network of known suppliers, it involves searching for new or unfamiliar ones.

This process is less efficient, requiring extensive research, verification, and due diligence before proceeding.

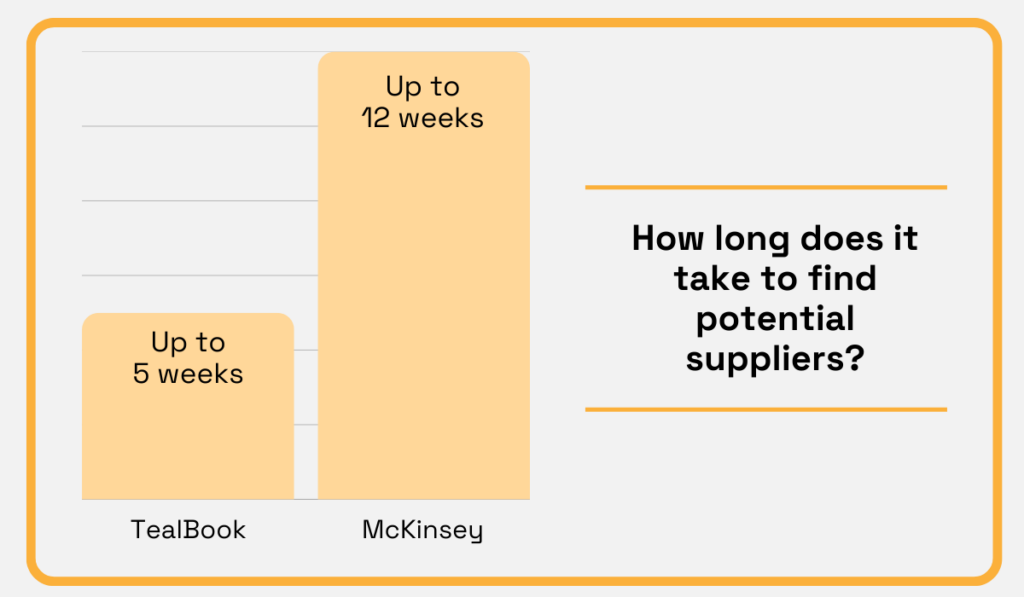

Estimates of how long supplier discovery takes range from five weeks to three months, depending on various sources.

Illustration: Veridion / Data: TealBook & McKinsey

In light of this data, it’s clear that a well-organized supplier sourcing process can be more efficient due to its structured approach and reliance on pre-vetted suppliers.

However, supplier discovery offers a broader range of possibilities, though it traditionally requires more time and effort.

But this can be easily overcome with the right technology.

Technology has an important role in both supplier sourcing and discovery.

For supplier sourcing, teams use procurement platforms, supplier databases, and automation tools to evaluate and select suppliers more effectively.

The solutions range from specialized tools designed for specific tasks to comprehensive, all-in-one sourcing platforms.

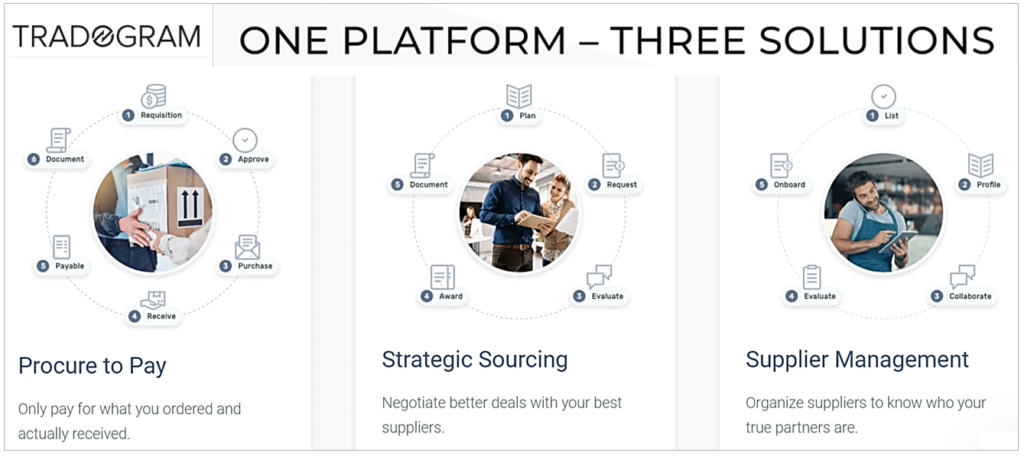

Many of these solutions integrate multiple functions into a single interface, offering end-to-end automation of sourcing activities.

Well-known examples include SAP Ariba, Coupa, Jaggaer, Tradogram, and more.

Source: Tradogram

These technologies reduce manual effort, automate various aspects of supplier sourcing, and ultimately support more data-driven decision-making.

Beyond sourcing, technology plays an even greater role in supplier discovery by helping you quickly identify reliable new suppliers.

For instance, AI-driven supplier data platforms can reduce the time required to identify potential suppliers by 90% or even more.

This efficiency comes from AI-powered bots that collect, verify, and organize supplier data much faster than humans.

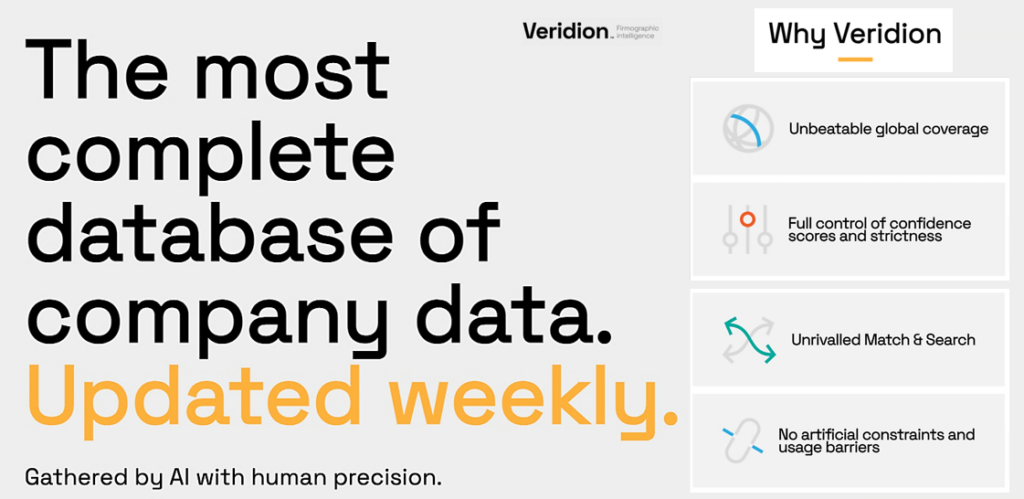

One such platform is our Veridion.

Source: Veridion

Veridion provides access to a truly global supplier database, updated weekly through AI-driven algorithms that continuously scan the internet for new information.

At present, this database includes over 123 million companies across more than 212 million locations, and offers approximately 700 million products.

To discover new suppliers with Veridion, all you need to do is enter your search criteria in natural language.

You can see how Scout, our supplier discovery search engine, works in this short video.

Source: Veridion on YouTube

Within seconds, you’ll have results to kick-start your discovery efforts.

From there, you can refine the list of potential suppliers by adding more criteria and risk factors.

Additionally, Veridion’s market intelligence allows you to benchmark suppliers against other similar market players.

Ultimately, platforms like Veridion supercharge supplier discovery, making it faster, more accurate, and more efficient.

As we’ve seen, technology plays a crucial role in both supplier sourcing and discovery—reducing manual effort, improving data accuracy, and streamlining the entire process.

Now, let’s explore the cost implications of each approach.

When costs are concerned, supplier sourcing is often more cost-effective in the short term.

Why?

Because sourcing relies on already adopted solutions, pre-established processes, and known suppliers, reducing search and vetting costs.

In contrast, supplier discovery may involve higher costs due to the time and resources required to find, evaluate, and onboard new suppliers.

At least that was the case before the advent of AI-powered discovery solutions.

Chin Tee Teo, a former global supply chain manager at Phillips, points that out:

Illustration: Veridion / Source: LinkedIn

He continues to say that technology now does the heavy lifting, providing teams with vast amounts of curated, accurate supplier data.

By automating supplier discovery, AI-driven platforms significantly reduce the cost and effort traditionally required to find new suppliers.

At the same time, these solutions help uncover cost-saving opportunities through competitive pricing, innovation, and improved supply chain resilience.

Now that we’ve covered supplier sourcing and discovery, let’s see when you should use each approach—or a mix of both.

If speed is a priority, sourcing is the most efficient option since it relies on a prequalified list of approved suppliers.

So, instead of gathering supplier data from scratch, you should simply update existing supplier information, which can also be automated.

With Veridion’s Match & Enrich API, for example.

This video demonstrates how Veridion simplifies business data enrichment, making it easy to keep your supplier profiles updated:

Source: Veridion on YouTube

When you know supplier information is up to date, you can quickly shortlist eligible suppliers, contact them, and initiate the selection or bidding process.

This approach is especially beneficial for industries with stable and predictable supply needs, such as manufacturing and healthcare.

On the other hand, supplier discovery is ideal when you need to diversify your supplier base, identify emerging technologies and innovative solutions, or source sustainable vendors.

Source: Veridion

As illustrated, AI-driven discovery helps identify suppliers that better align with your ESG objectives.

The same applies to other key criteria, such as supplier capacity, financial stability, and climate or geopolitical risks in their region.

In essence, discovery expands your sourcing options, which can be leveraged to:

This makes supplier discovery valuable across industries, especially for those with highly specific or rapidly evolving demands, such as technology and retail.

Unsurprisingly, most organizations use both sourcing and discovery, as they complement rather than compete with each other.

Ultimately, when and how each is used depends on your procurement objectives, industry, and business size.

Now, when somebody says, “We’ve discovered potential suppliers, but we haven’t sourced any of them yet”, there will be no confusion.

Discovery expands supplier options, while sourcing ensures those options undergo a structured evaluation and selection process.

Leveraging technology in both sourcing and discovery enhances efficiency, accuracy, and cost-effectiveness.

In the end, a balanced approach that combines both discovery and sourcing helps you remain agile, mitigate risks, and secure the most reliable suppliers to meet your evolving business needs.