8 ESG Data Providers You Need to Know About

Remember Boohoo’s 2020 scandal?

When it came to light that its suppliers paid workers just £3.50 an hour, Boohoo claimed ignorance, but its reputation and stock price inevitably tanked.

Cases like these show why companies need ESG data to catch risks before they result in hefty fines and public outcry.

Want reliable insights? Here’s a breakdown of the eight top-rated ESG data providers to help you uncover vulnerabilities and build a competitive advantage.

Veridion leverages AI and machine learning to provide comprehensive ESG insights on over 120 million companies across 250 geographies, including private equity firms, suppliers, and SMEs.

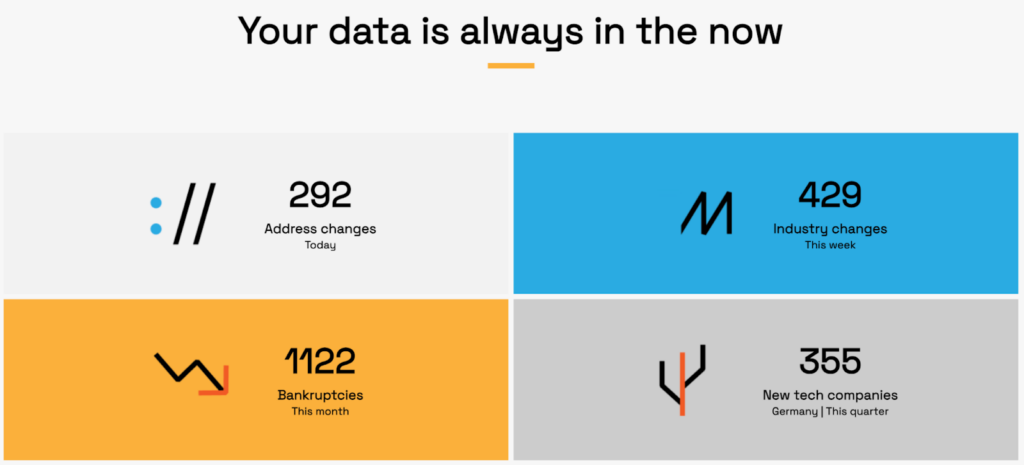

The key lies in analyzing each company’s digital footprint and continuously updating Veridion’s database with real-time insights.

Unlike some ESG data providers that rely heavily on static reports and periodic regulatory filings, Veridion’s AI-powered bots constantly scan the entire internet.

This includes suppliers’ websites, news outlets, sustainability reports, and various third-party sources, with the database updated weekly to ensure accurate, transparent, and up-to-date ESG profiles.

Source: Veridion

You can choose between batch CSV file deliveries or API integration for effortless access to key data, but no matter the method, you gain a complete view of companies’ ESG performance down to product-level details.

Veridion’s detailed ESG risk profiles cover critical factors from carbon footprint and water usage to labor standards and inclusivity—you can see the complete ESG taxonomy below.

Source: Veridion

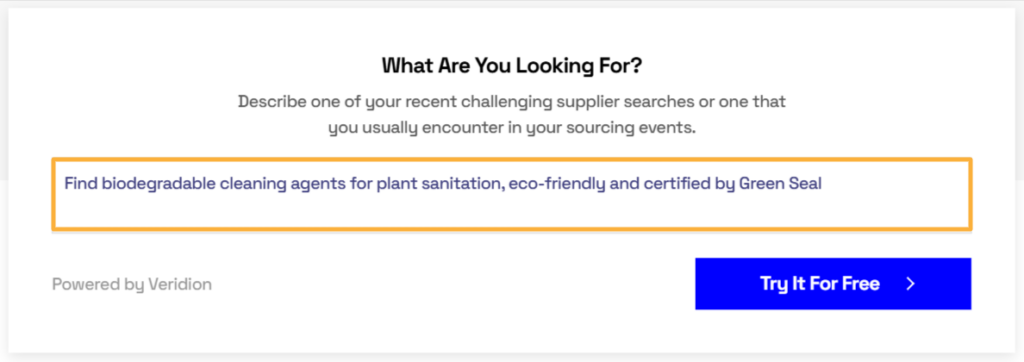

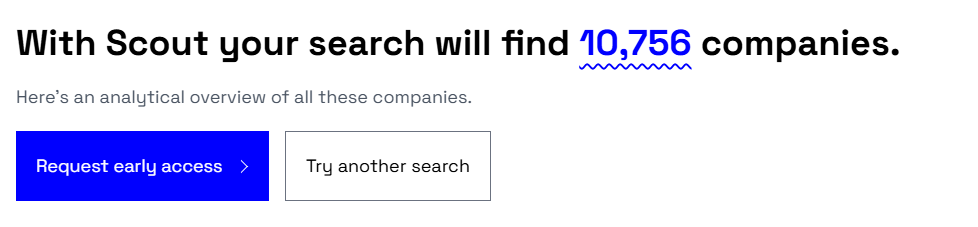

One of the benefits of AI-curated ESG data is that it helps streamline sourcing through detailed sustainability and compliance filters.

Veridion’s supplier discovery tool, Scout, features a clean interface and natural language search, allowing you to quickly filter suppliers based on specific ESG criteria.

Source: Veridion

In this case, a query about biodegradable, Green Seal-certified plant sanitation cleaning agents yielded over 10,000 companies in just a few seconds.

Source: Veridion

Next, the Match & Enrich feature powers supplier ESG assessment processes, enabling you to pinpoint suppliers with strong sustainability practices and uncover compliance issues.

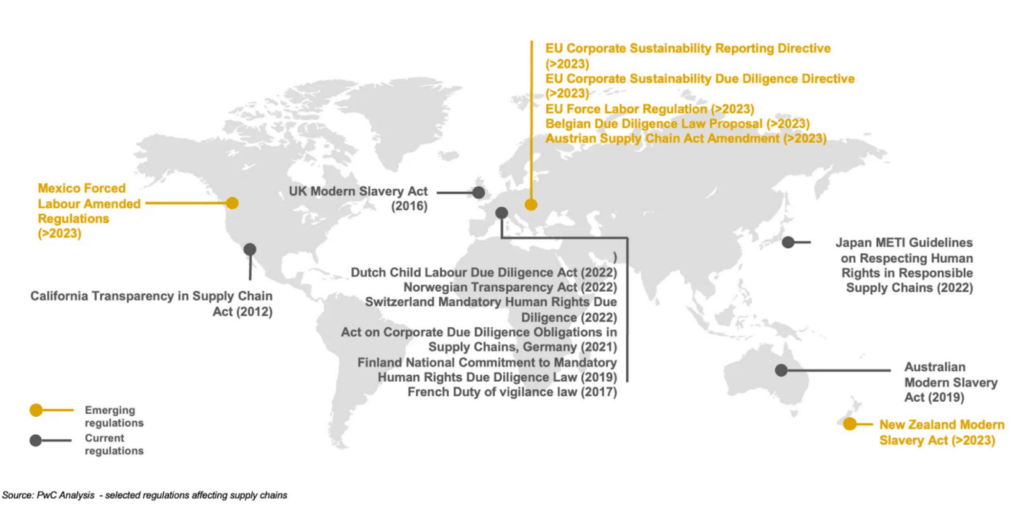

For instance, companies relying on Veridion benefit from detailed data on the

geographical distribution of key suppliers, helping them map out their whole supply chain and navigate relevant regulations.

Source: Veridion

This includes the Uyghur Forced Labor Prevention Act (UFLPA), which has forced companies to increase scrutiny and exclude suppliers from Xinjiang and other high-risk areas.

Not sure if our ESG data is worth the investment?

Veridion’s smart pricing policies encourage usage and experimentation, but you can also download a data sample or try out our free data explorer.

Finally, don’t hesitate to schedule a data consultation and learn more about how our data can help grow your business.

Sustainalytics is a subsidiary of Morningstar, a financial industry ratings firm that supplies ESG data and ratings to institutional investors and companies.

Covering over 16,000 companies, Sustainalytics provides one of the broadest analyst-based ESG Risk Ratings coverages.

Their ESG Risk Ratings identify five levels of risk while differentiating between manageable and unmanageable risks for each industry, as explained in the video.

Source: Morningstar Sustainalytics on YouTube

Similar to most other ESG data providers, Sustainalytics compiles data from regulatory filings, company reports, as well as industry associations, and public and media documents.

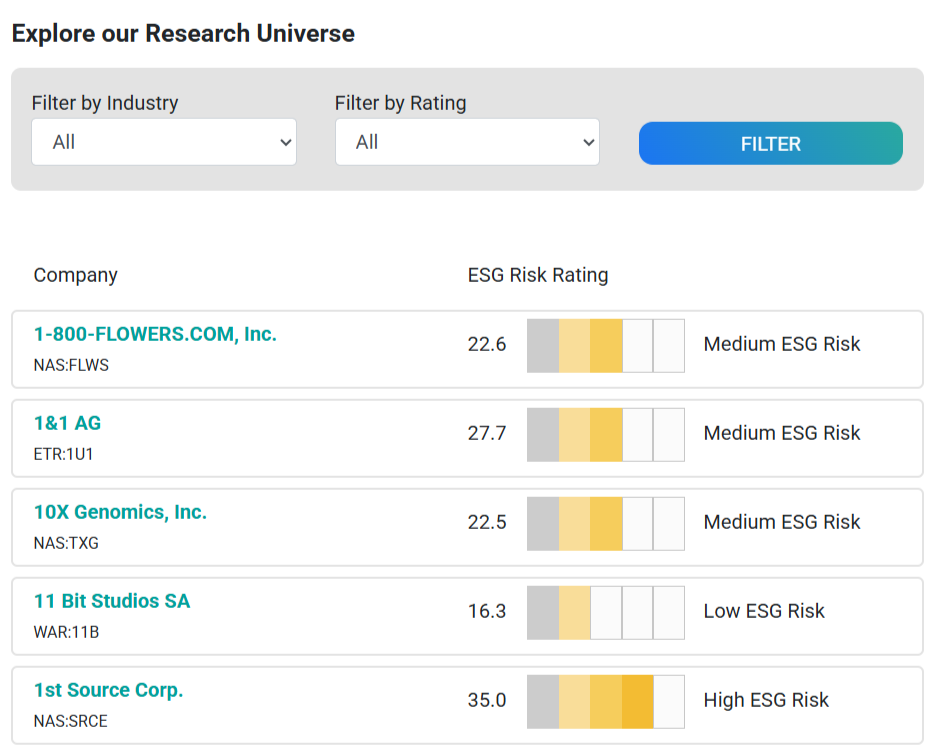

Together, these sources make up a comprehensive research universe that’s easy to sift through.

Source: Sustainalytics

The risk ratings themselves are under constant revision, with last year’s enhancements to corporate governance methodology bringing more transparency and better insight into material ESG risk measures (MEIs) at the security and portfolio level.

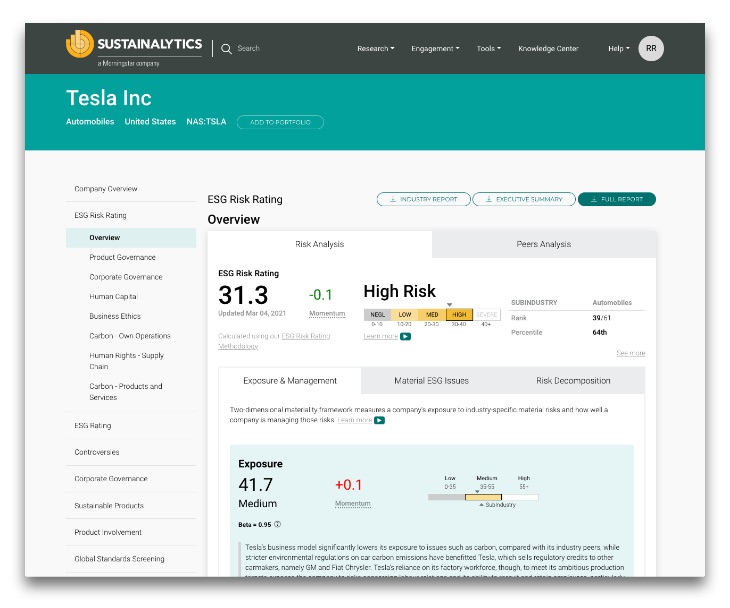

Core research and industry-leading ESG Risk Ratings are accessible through Sustainalytics’ Global Access platform, which also features an alerts functionality for easier monitoring.

Source: Sustainalytics

While ESG controversies are monitored and updated in real-time as events occur, most of the key indicators are updated less regularly, affecting the overall data relevance and reliability.

Some independent sources also point out that Sustainalytics’ methodology lacks insight into companies’ lobbying efforts, creating an incomplete picture of a company’s overall ESG risk.

Nevertheless, Morningstar’s Sustainalytics remains a top ESG data provider, so reach out directly if you’re interested in how you can best make use of their data.

Bavest is a B2B German fintech that provides access to real-time financial and ESG data.

This investment research platform is geared toward private investors, offering in-depth portfolio risk insights for data-driven, sustainable investing.

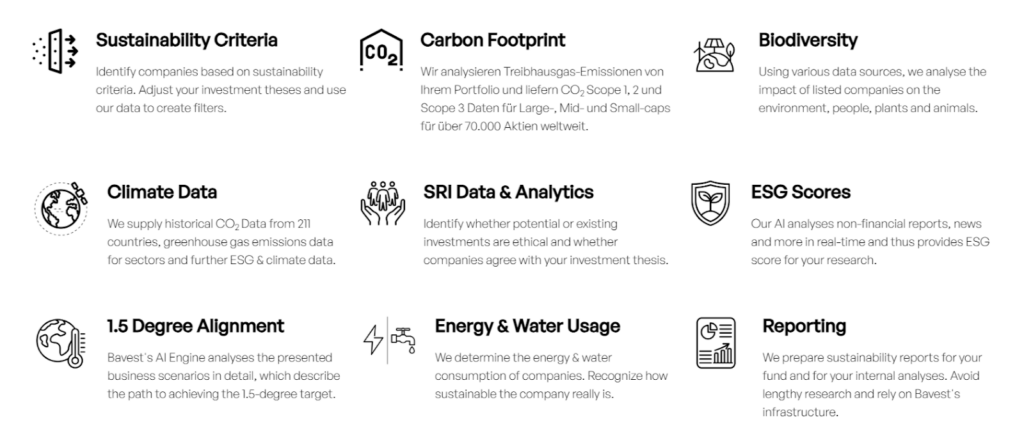

Bavest’s AI Engine incorporates core ESG criteria while analyzing various sources to generate ESG scores in real-time.

Source: Bavest

But that’s not what sets Bavest apart.

In addition to raw ESG data, the company positions itself as a key strategic enabler for asset managers and fintechs with AI-powered analytics, predictive modeling, and automation tools.

Their AI-powered service makes it easier to incorporate findings on environmental impact or social governance to conduct a more thorough investment portfolio analysis.

Source: Bavest

Moreover, you can use Bavest’s existing infrastructure to build your own ESG tools using APIs, dashboards, and workflows for seamless access and streamlined research.

If you want to keep everything in one place, Bavest API provides a single source of real-time quotes, financial, and alternative data.

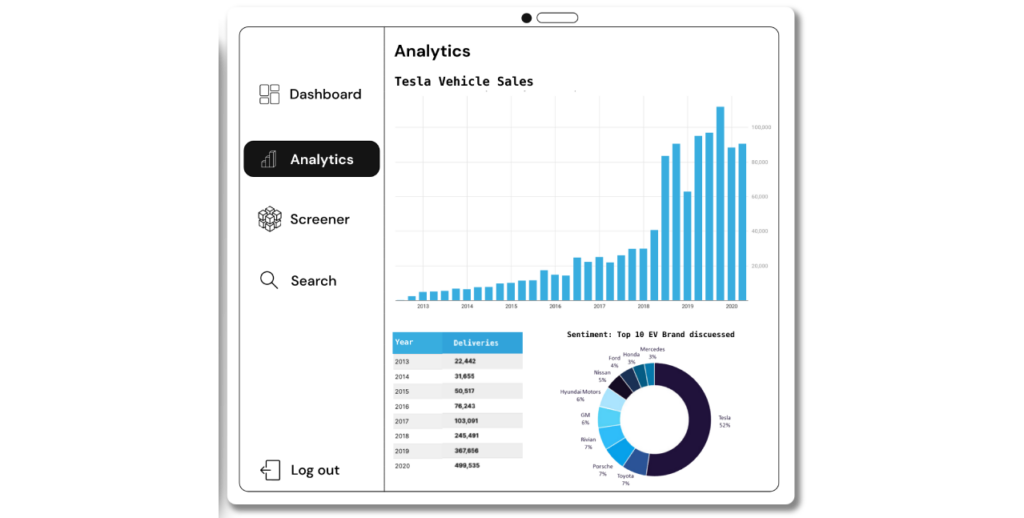

Source: Bavest Technologies on YouTube

However, one key concern is the lack of detailed documentation on Bavest’s ESG scoring methodology and coverage.

Unlike Sustainalytics, which has a well-documented and widely trusted approach, Bavest provides limited transparency into how its assessments are conducted.

While this doesn’t necessarily mean the data is unreliable, the absence of a free trial may deter potential users who want to evaluate its accuracy and reach firsthand.

Bavest’s pricing is quote-based, and you can book a demo call to explore how its offerings fit your needs.

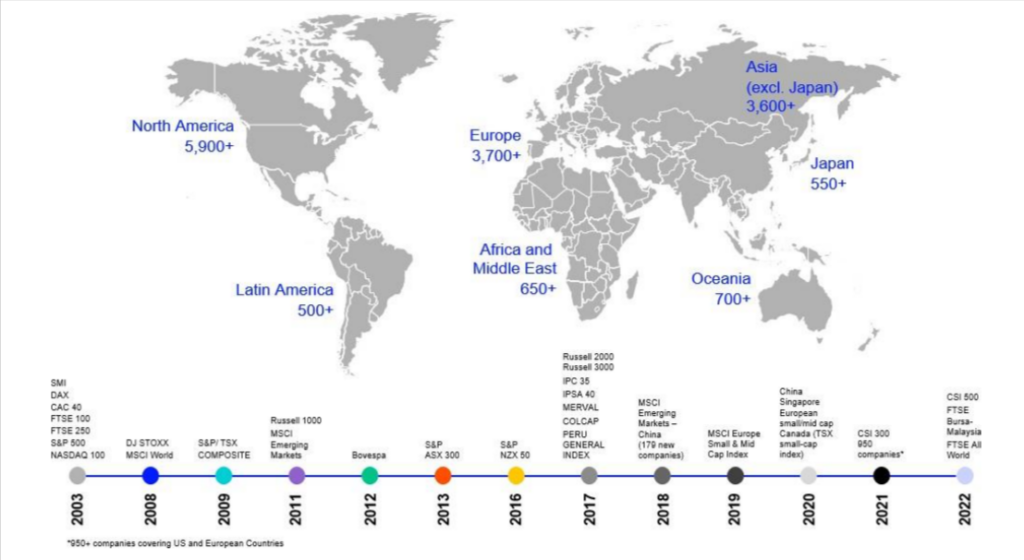

LSEG Data and Analytics, formerly known as Refinitiv, is one of the world’s largest providers of financial markets data and infrastructure, offering detailed profiles on 16,000+ companies.

Their dataset provides an extensive track record from 2002 onward, with the number of ESG data points and coverage steadily increasing over time.

Source: LSEG

AI-driven advancements have helped LSEG expand its ESG data coverage, providing more comprehensive and timely insights into companies’ sustainability performance worldwide.

For example, its collaboration with MarketPsych enables real-time analysis of news articles and social media posts, offering up-to-date assessments of ESG initiatives and public sentiment.

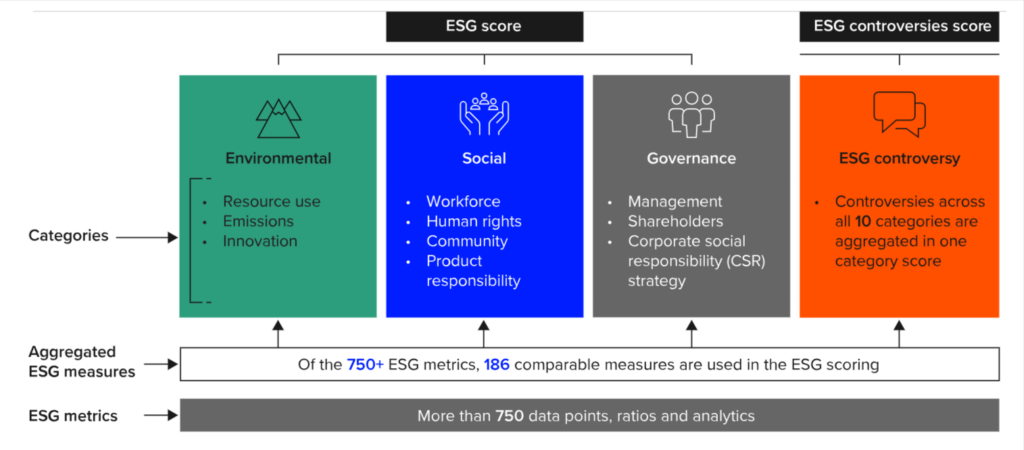

Like Sustainalytics and Bloomberg, LSEG’s ESG framework is built around a scoring system, incorporating over 750 ESG metrics.

Source: LSEG

Moreover, 186 standardized indicators allow for direct comparisons across companies, making it easier to benchmark performance.

As with other providers on the list, LSEG offers different options for accessing its data, from a dedicated account to APIs.

Source: LSEG

All in all, seamless access to data and AI-powered analytics tools make LSEG an excellent choice for institutional investors.

However, there are notable downsides as well.

With ESG metrics available for only 1,300 private companies globally, LSEG is a less-than-ideal choice for supply chain risk assessment or private equity investors.

Moreover, AI tools are likely to drive up the price, making the data less accessible to smaller firms.

Still, it’s best to contact LSEG directly if you believe they’ll be a good fit for you.

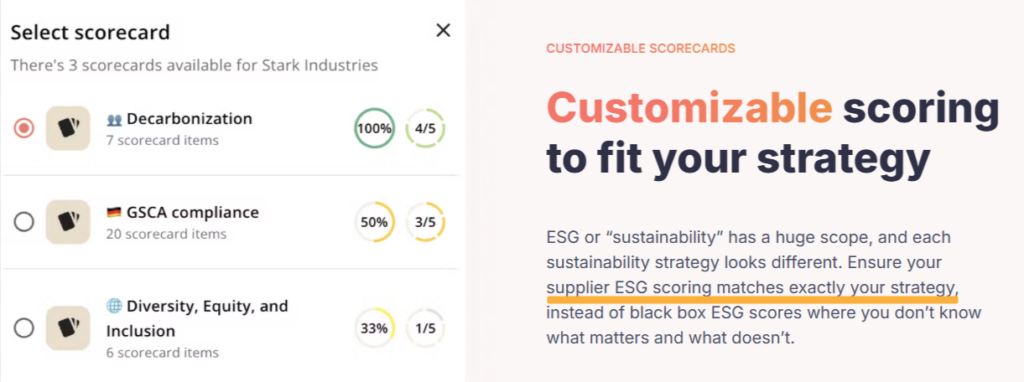

Responsibly automates supplier due diligence by consolidating a wide range of supplier sustainability data into a single platform powered by AI.

Since sustainable procurement has different requirements than traditional investment-focused ESG scoring, Responsibly’s customizable scorecards allow for tailored assessments based on specific sustainability criteria.

Source: Responsibly

To simplify compliance tracking, you can choose between a variety of data sources and standards, narrowing your scope to relevant ESG metrics as needed.

Responsibly can be integrated with your existing systems, with its sleek dashboard offering a comprehensive overview of all potential ESG risks, as showcased here.

Source: Responsibly on YouTube

Rooted in risk management and analysis, you can seamlessly zoom in on specific acts, metrics, or supplier regions and visually track alignment between yours and your suppliers’ goals.

Source: Responsibly

Since Responsibly primarily focuses on collecting and delivering ESG insights for onboarded suppliers, it includes a supplier engagement module to help accelerate corrective actions.

Nevertheless, Responsibly lacks supplier discovery features, which also raises questions about database size—similarly to Bavest, the company hasn’t disclosed how many suppliers it covers.

Additionally, while the platform provides automated screenings for industrial risks, third-party scores, and similar sources, it has yet to introduce media monitoring or real-time flagging of ongoing lawsuits.

On the plus side, Responsibly offers a free version and a free trial.

Pricing details are not readily available, but several sources suggest a dynamic pricing model based on the number of monthly active suppliers.

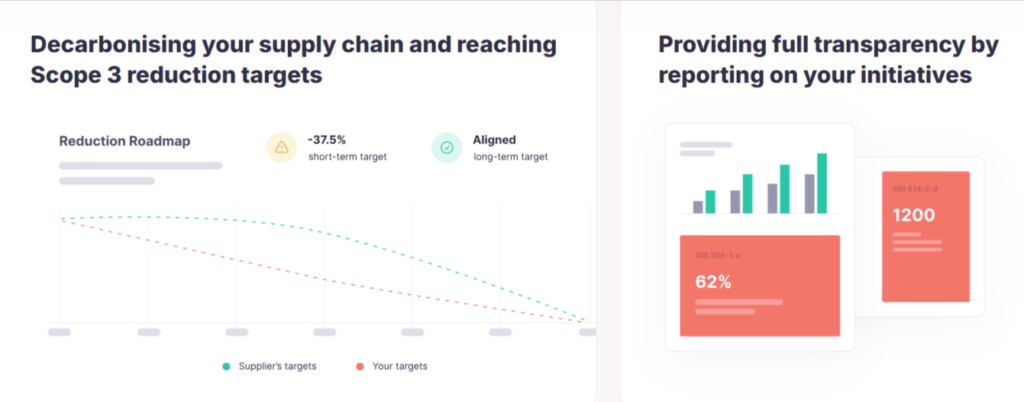

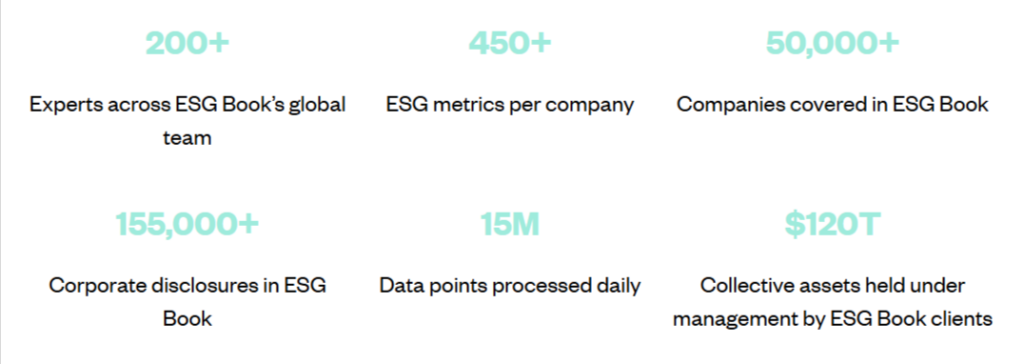

ESG Book is another data provider geared toward investors, marketers, and corporate executives in need of ESG insights.

Combining analyst research with artificial intelligence, ESG Book offers a broad repository of ESG information on over 50,000 companies worldwide.

Source: ESG Book

These metrics are mapped against leading frameworks, providing easy access to both compiled reports and the underlying raw data—reinforcing ESG Book’s commitment to transparency.

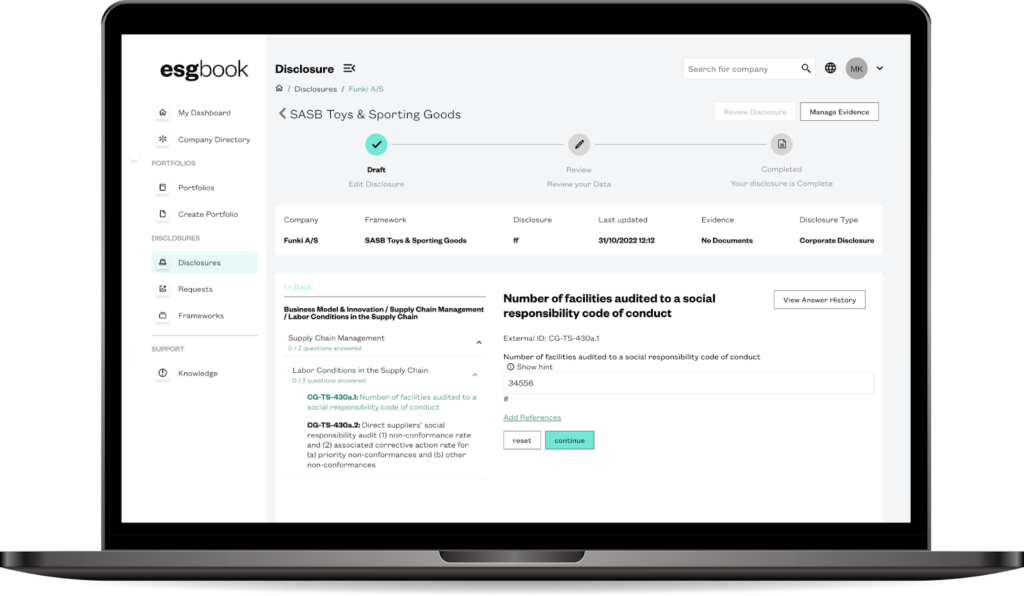

One thing that sets ESG Book apart is that, beyond portfolio screening, it offers dedicated tools for both internal ESG management and external reporting.

From a company standpoint, ESG Book’s Corporate ESG Solutions combine data, analytics, and disclosure features to enhance your ESG performance management.

The corporate dashboard, showcased below, centralizes actionable ESG insights while making it easier to benchmark your performance against peers and report to stakeholders.

Source: ESG Book on Vimeo

Automated disclosure workflows allow companies to maintain control over whether they’ll disclose their ESG data publicly or privately.

On the other hand, this functionality enables stakeholders to request ESG information from issuers directly.

Source: ESG Book

So, what are the limitations?

While ESG Book covers data on 50,000 companies, its ESG Performance Scores—which provide in-depth sustainability analytics—are available for only about 7,000 companies.

This is because ESG Book’s scoring system is based on minimum disclosure requirements, meaning companies must provide sufficient ESG data to be evaluated.

In contrast, competitors like LSEG and Bloomberg use broader methodologies that assess ESG risks even when disclosure is limited.

The good news? Companies can use ESG Book to disclose and manage ESG data for free, which is sure to help expand its scoring coverage over time.

For pricing details on specific features, you’ll need to contact ESG Book directly.

Bloomberg delivers a comprehensive suite of ESG data, research, analytics, and climate & regulatory solutions centered on sustainable finance.

Bloomberg’s enterprise-grade datasets cover over 15,500 companies in over 100 countries, providing more than 6,400 ESG fields to assess corporate sustainability across environmental, social, and governance factors.

Source: Bloomberg

Bloomberg’s award-winning DL+ ESG Manager connects multi-vendor ESG data, enhancing both the depth and accuracy of the information for a more complete view of corporate sustainability.

To access these insights, Bloomberg offers two options:

The Bloomberg Terminal is the go-to tool among finance professionals and investment analysts in need of real-time data and analytics on global markets, companies, and economies.

Source: Bloomberg on YouTube

Bloomberg Terminal is considered a premium service for a reason, with a separate billing structure, but it still has its drawbacks.

The solution’s robust features come with a steep learning curve and limited customization options—you can’t narrow down the ESG scope in a way you can with solutions like Responsibly.

Additionally, if you’re looking for diverse and accessible ESG data, you need to keep in mind that Bloomberg provides limited coverage of small and medium-sized businesses.

In terms of pricing, no details are available on the website, but for financial analysts and those without significant budget constraints, Bloomberg is sure to provide extensive, high-quality data.

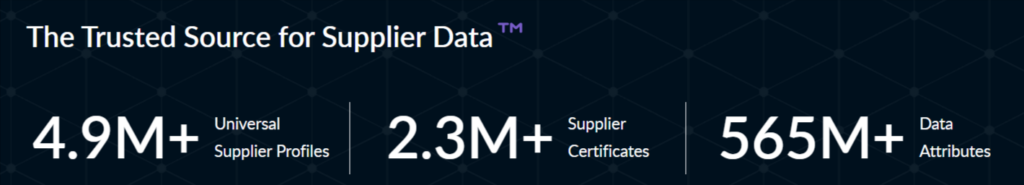

Last but not least, TealBook is a widely used Supplier Data Platform (SDP) that integrates ESG metrics and data reporting to support sourcing and procurement decisions.

While it’s unclear how many of these are ESG-related, TealBook draws from 565 million data attributes to deliver comprehensive supplier intelligence.

Source: TealBook

Its cloud-based data layer seamlessly integrates with your existing procurement systems while AI-based dynamic aggregation ensures that supplier data continues to improve over time.

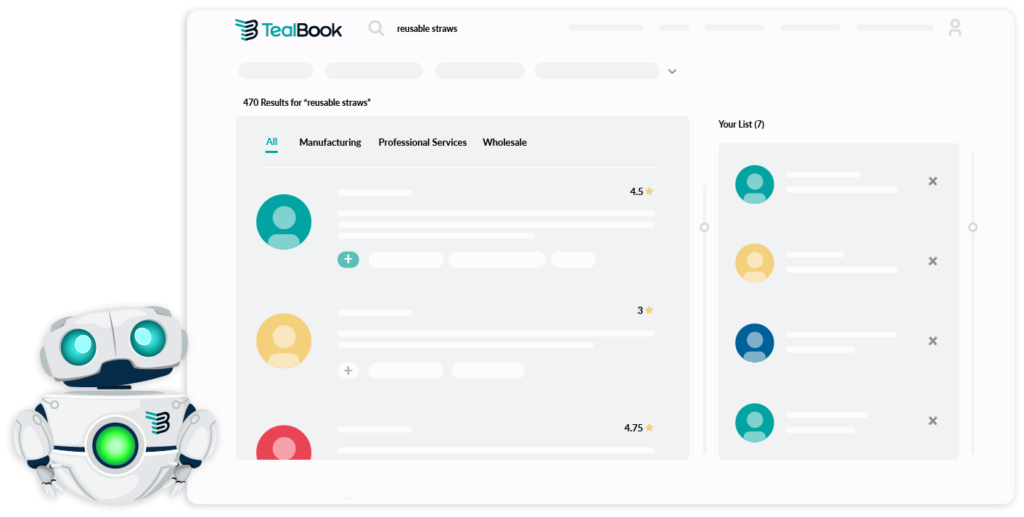

Similar to Veridion, TealBook offers both supplier discovery and data enrichment, though as the query below shows, it operates at a smaller scale and offers fewer advanced filtering options.

Source: TealBook

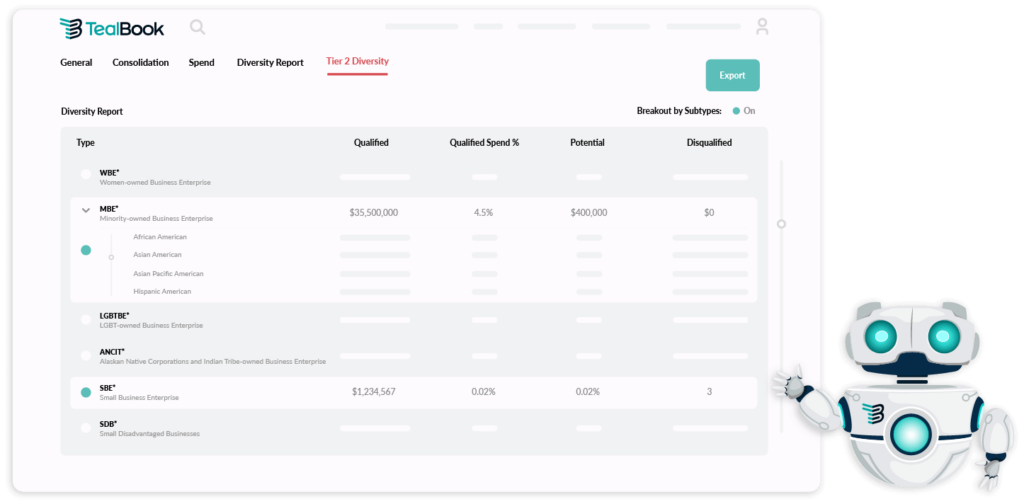

However, TealBook undoubtedly increases visibility across your supply chain, which is particularly useful for companies that are yet to establish specific ESG goals.

For instance, you can leverage AI and ML capabilities to uncover new ESG spend opportunities and see at a glance what categories could be making more use of sustainable vendors.

Alternatively, users can easily pinpoint specific suppliers—if a supplier has diversity, sustainability, or industry-specific certifications, you will find them listed alongside security or patent information.

Source: TealBook

You can then use these reporting capabilities to develop a supplier diversity program.

However, keep in mind that TealBook’s data is limited to around 13 million suppliers and specializes in specific industries such as retail, financial services, technology, and higher education.

While impressive, this narrower scope may not meet the needs of those looking for broader coverage, especially given that there is no free version or trial.

Nevertheless, TealBook is a leading supplier data management solution for a reason—for more information on pricing and offerings, you can reach out to them directly.

Partnering with the right data provider(s) ensures a steady flow of reliable ESG data tailored to your needs.

From AI-driven analytics to comprehensive scoring frameworks, the data providers on our list offer powerful tools to uncover risks and opportunities, facilitate ESG reporting, improve supplier management, and more.

But as you can see, there’s no one-size-fits-all solution—explore, compare, and take advantage of free trials and data samples to ensure you’re getting the best value.

Remember: The key to effective ESG sourcing, risk management, and regulatory compliance is ensuring your ESG data is accurate, comprehensive, and consistently updated.