10 ESG Statistics You Need to Know

Regulations, consumers, and investors are pushing companies to prioritize ESG like never before.

Procurement professionals are at the center of this shift, ensuring supply chains meet sustainability and compliance standards.

The numbers don’t lie—falling behind on ESG could mean losing a competitive advantage.

Let’s break down the most critical ESG statistics and what they mean for procurement.

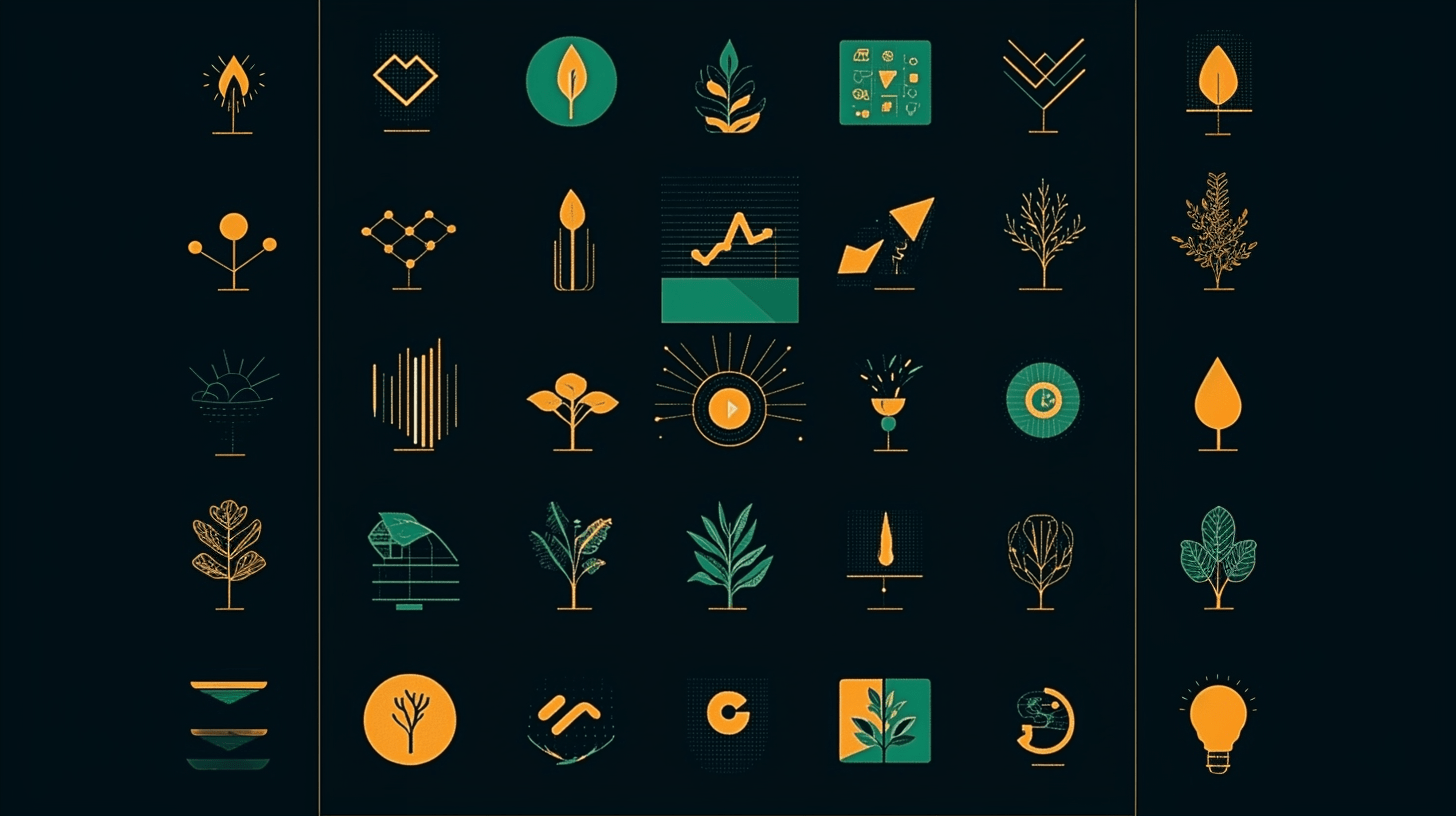

Staying ahead of ESG compliance is becoming increasingly complex.

According to ESG Book, global ESG regulations have grown by 155% in the last ten years.

To put that into perspective, there were 1,255 ESG regulations introduced worldwide since 2011, compared to just 493 between 2001 and 2010.

Illustration: Veridion / Data: Edie

That’s a 647% increase in ESG-related rules since the turn of the millennium.

What does this mean for procurement?

Whether you’re sourcing materials or selecting suppliers, ESG compliance is now a key factor in decision-making.

Companies sourcing from regions with different regulatory standards must navigate evolving laws, ensuring suppliers align with ESG frameworks like CSRD, SFDR, or SEC climate disclosures.

Failing to adapt could lead to legal risks, fines, or reputational damage.

However, all these regulations also burden companies, as ESG Book’s former CEO, Dr. Daniel Klier, notes:

Illustration: Veridion / Quote: Edie

While this is a valid concern, it’s clear that ignoring ESG isn’t an option, especially considering increasing demand from consumers and investors.

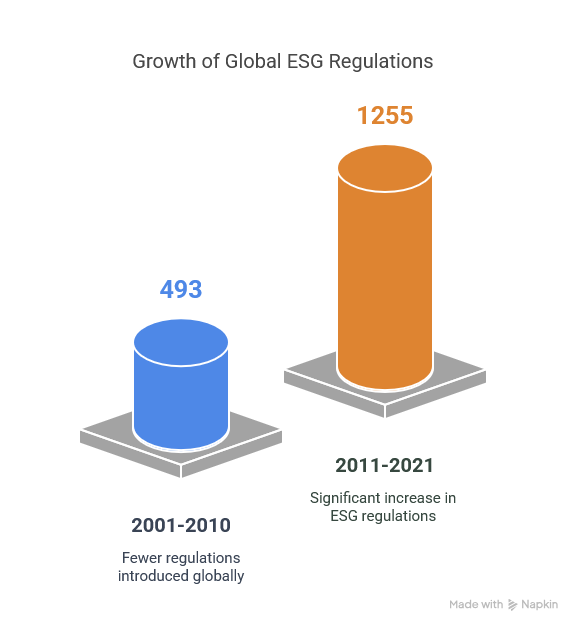

Consumer expectations are changing, and they’re holding businesses accountable like never before.

In a 2021 PwC Consumer Intelligence Series survey, three out of four consumers said they would walk away from brands that don’t treat workers fairly or harm the environment.

Illustration: Veridion / Data: PwC

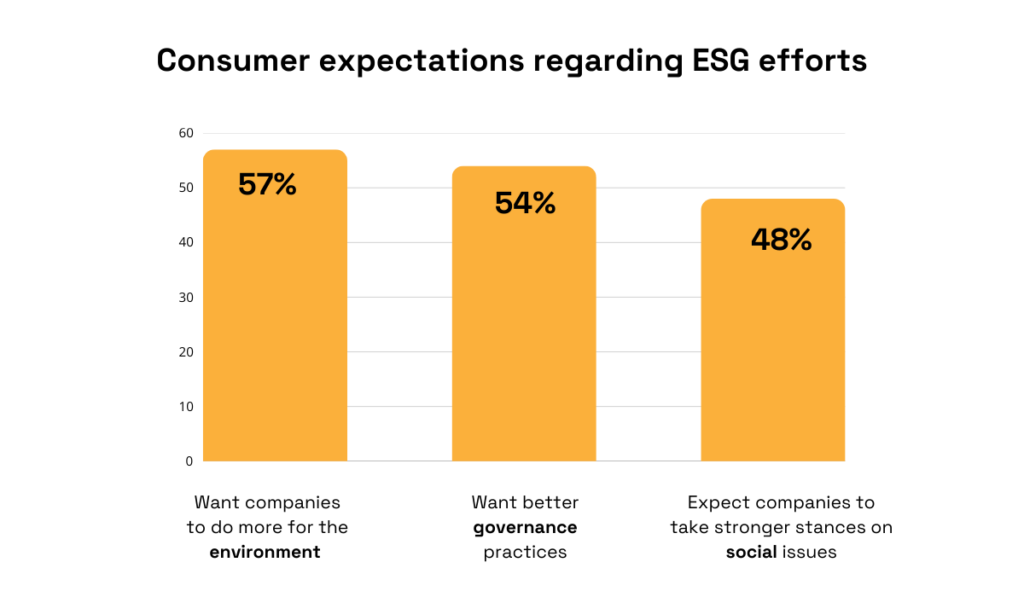

The survey also shed light on specific consumer expectations regarding ESG efforts.

Here are the results:

Illustration: Veridion / Data: PwC

As shown, consumers are focused on all aspects of ESG.

And much of it also relies on who you choose to work with.

In other words, if your suppliers engage in unethical labor practices or environmentally harmful operations, your brand reputation could suffer.

Today’s consumers have access to more information than ever, and they’re making purchasing decisions accordingly.

As such, procurement managers must carefully select suppliers who align with these values to ensure customer loyalty and stay competitive in a more sustainable marketplace.

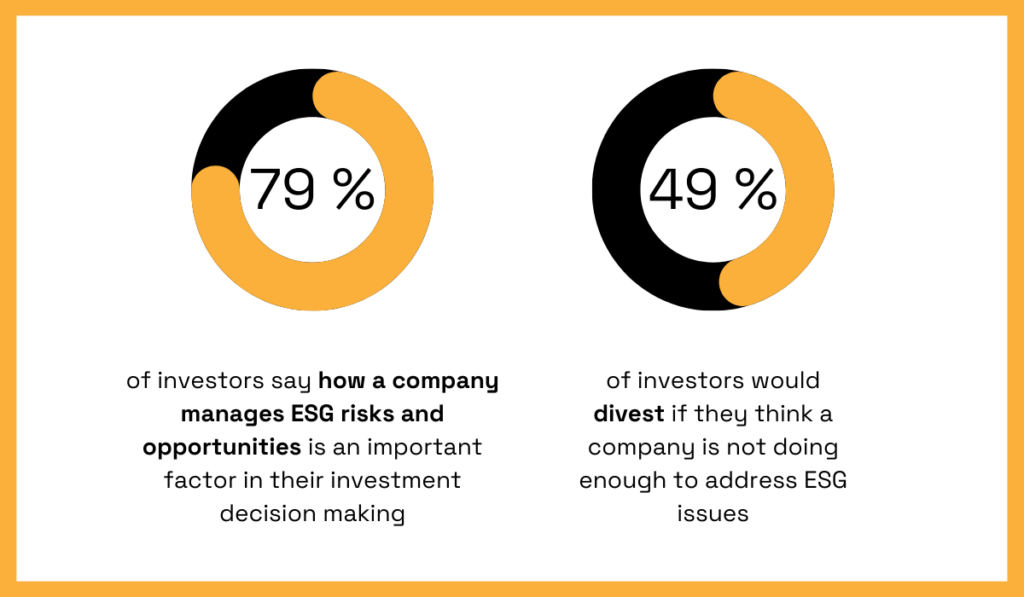

It’s not just consumers pushing for ESG—investors are just as concerned.

According to PwC’s 2021 Global Investor Survey, 79% of investors say they factor ESG risks and opportunities into their investment decisions.

Even more importantly, almost half of investors are willing to divest from companies that fail to take ESG seriously.

Illustration: Veridion / Data: PwC

James Chalmers, Director of Methodology & Innovation at PwC UK, put it bluntly:

“If investors don’t see that commitment, they won’t hesitate to take action and that can include divesting their position in a company and taking their clients’ money elsewhere.”

This means companies that neglect ESG could face financial consequences, from declining stock prices to lost funding opportunities.

Investors expect transparency and action on ESG issues, and that starts with your supply chain.

The ability to track and manage ESG risks in your procurement strategy is necessary to attract and retain investment.

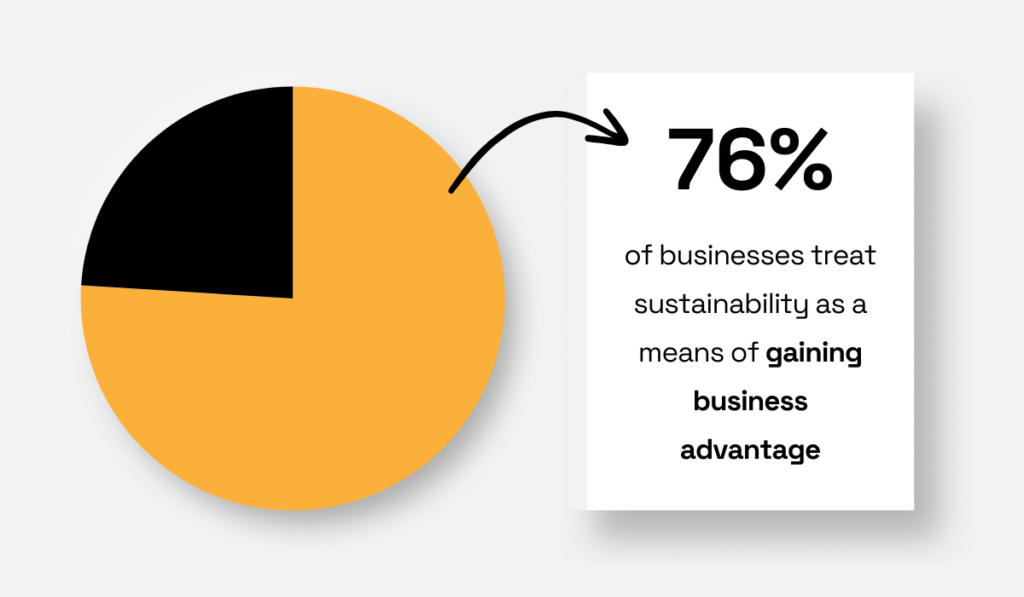

Fortunately, most companies already understand how important ESG and sustainability are.

Research by Sweep and Capgemini Invent, which surveyed 500 sustainability leaders across the US, UK, Germany, and France, found that 76% of businesses see sustainability as a way to grow, attract customers, and improve efficiency.

Illustration: Veridion / Data: Sweep

But that also means that many of your competitors are already leveraging ESG to gain a competitive edge.

They’re choosing suppliers with strong sustainability practices, improving efficiency in their supply chains, and winning over customers who prioritize ESG.

If they’re using ESG to drive success, you should definitely be doing the same.

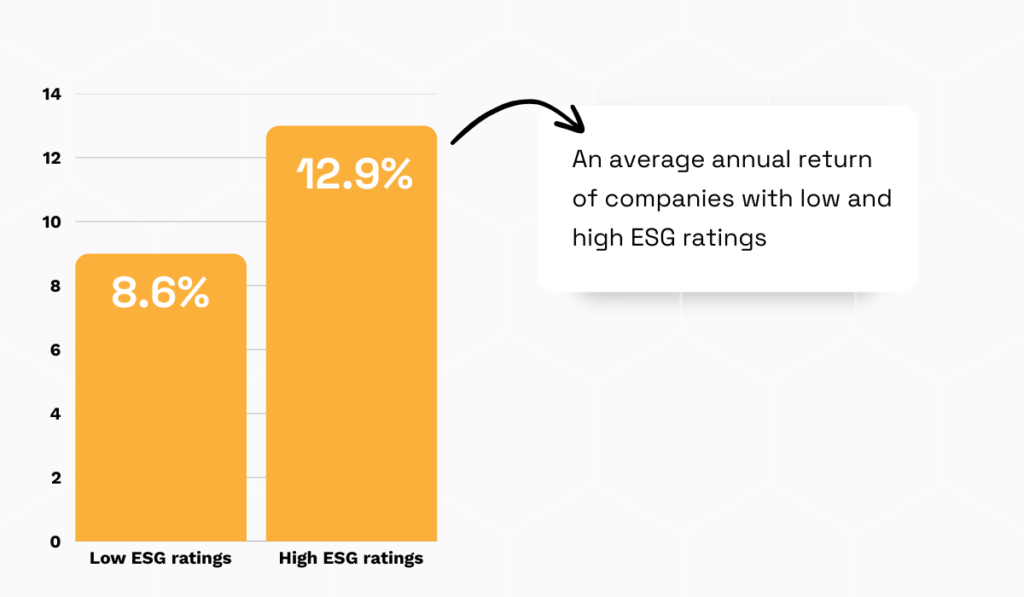

Companies leading in ESG are proving that sustainability and profitability go hand in hand.

Kroll, a financial and risk advisory firm, analyzed data from over 13,000 companies worldwide and found that businesses with better ESG ratings consistently outperformed their peers.

To put that into perspective, companies with strong ESG performance saw an average annual return of 12.9%, while those with lower ESG ratings earned just 8.6%.

Illustration: Veridion / Data: Kroll

Let’s break this down further: imagine your company spends $10 million annually on suppliers.

If you prioritize ESG-focused suppliers—who are typically more efficient, resilient, and compliant—you could see returns that mirror those of the ESG leaders.

A 12.9% return on improved efficiency, lower operational risks, and stronger supplier relationships could translate into an additional $1.29 million in value.

In contrast, sticking with lower-performing suppliers might only yield an $860,000 return, creating a difference of $430,000 per year.

This demonstrates a clear financial incentive for prioritizing ESG.

Sustainability efforts are not just good for the planet—they’re good for your bottom line.

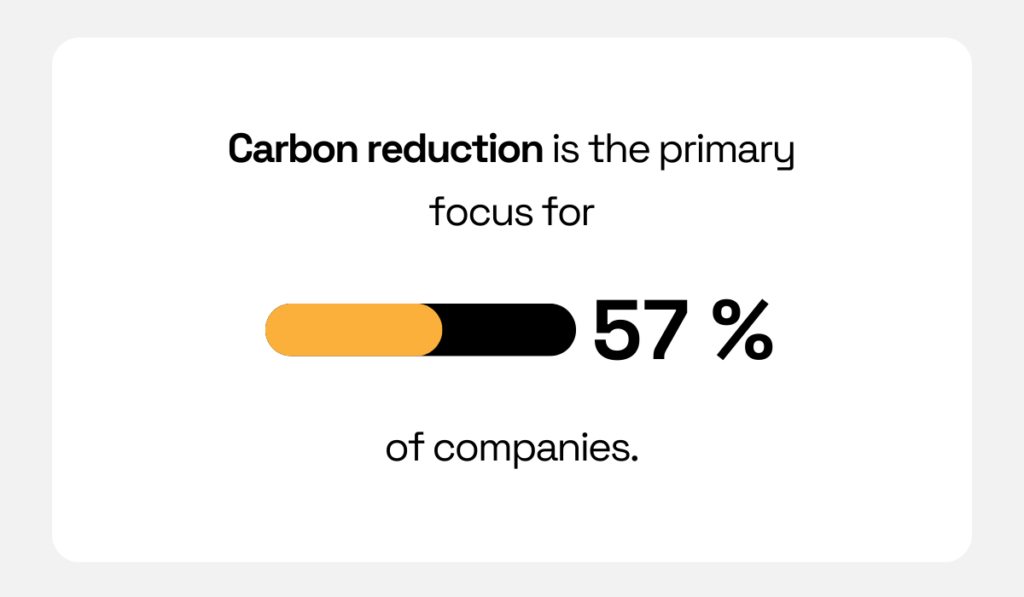

When it comes to ESG priorities, carbon reduction is leading the way.

According to the above-cited research from Sweep and Capgemini, 57% of companies say cutting emissions is their top ESG goal.

Illustration: Veridion / Data: Sweep

This makes sense, as reducing carbon emissions is essential to mitigating climate change and aligning with sustainability expectations from consumers, investors, and regulatory bodies.

To reduce their carbon footprint, businesses need to address emissions across three categories:

For most companies, Scope 3 emissions often account for the largest portion of their carbon footprint.

This is why carbon reduction efforts must extend beyond internal operations and include suppliers, and why the next statistic is very concerning.

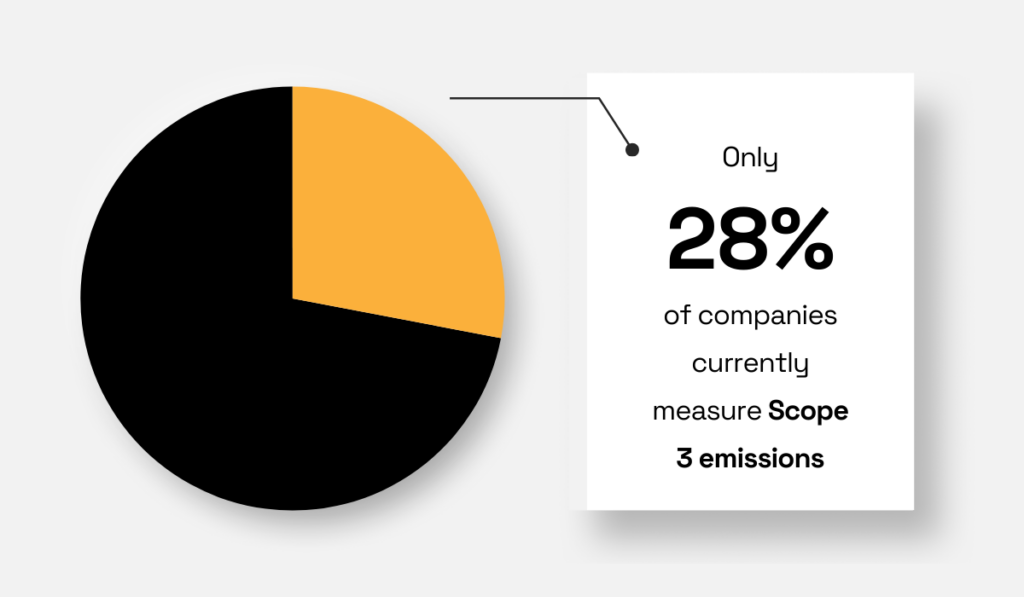

Measuring carbon emissions within your own operations is one thing—but what about the emissions generated by your supply chain?

According to the same research, only 28% of companies track their Scope 3 emissions, which are the emissions from suppliers and the broader value chain.

Illustration: Veridion / Data: Sweep

This is a significant gap, as Scope 3 emissions typically represent the bulk of a company’s total carbon footprint.

The low percentage suggests that many companies are overlooking a critical part of their environmental impact.

For procurement teams, this highlights a key challenge: while Scope 3 emissions are crucial to understanding a company’s full carbon footprint, only a small fraction of companies are able to measure them effectively.

The issue often lies in the lack of accurate data from suppliers, which makes it difficult to assess and manage emissions across the supply chain.

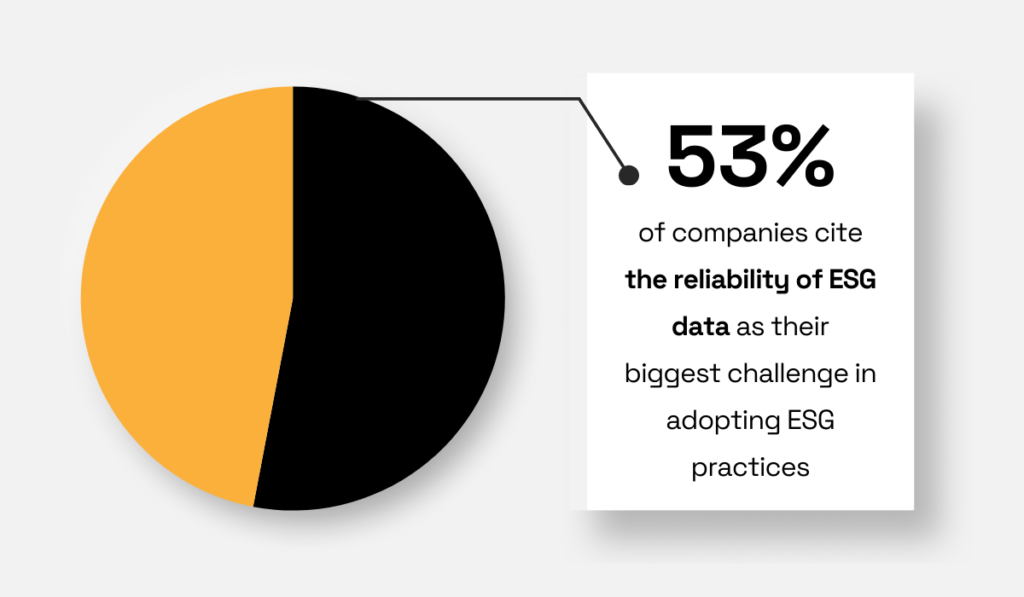

Despite improvements in ESG data and analytics, 53% of companies in a Capital Group survey cite the reliability of ESG data as their biggest challenge in adopting ESG practices.

Illustration: Veridion / Data: Capital Group

As one UK portfolio manager points out:

Illustration: Veridion / Quote: Capital Group

This lack of comparability and standardization in ESG data makes it difficult for procurement professionals to confidently evaluate potential suppliers.

The issue is particularly pronounced in the “S” (social) aspect of ESG, where quantification and comparability are still lacking.

A significant part of the challenge also lies in the lack of transparency on social issues in supply chains.

Without accurate data on factors like labor standards or working conditions, it becomes nearly impossible to make informed decisions that align with a company’s sustainability goals.

This is where solutions like Veridion step in.

Veridion is an advanced big data engine that collects and analyzes ESG data from over 123 million companies globally across 250 geographies.

Source: Veridion

What sets Veridion apart is its extensive validation process, which ensures that the ESG data you receive is accurate and reliable.

With Veridion, you gain access to critical ESG data on factors such as carbon footprints, atmospheric contamination, illegal deforestation, water usage, and labor standards.

Source: Veridion

By leveraging AI and machine learning, Veridion tracks changes in ESG data on a weekly basis, providing you with up-to-date insights that can significantly improve your supplier risk assessments and procurement decisions.

With Veridion, you no longer need to worry about unreliable ESG data.

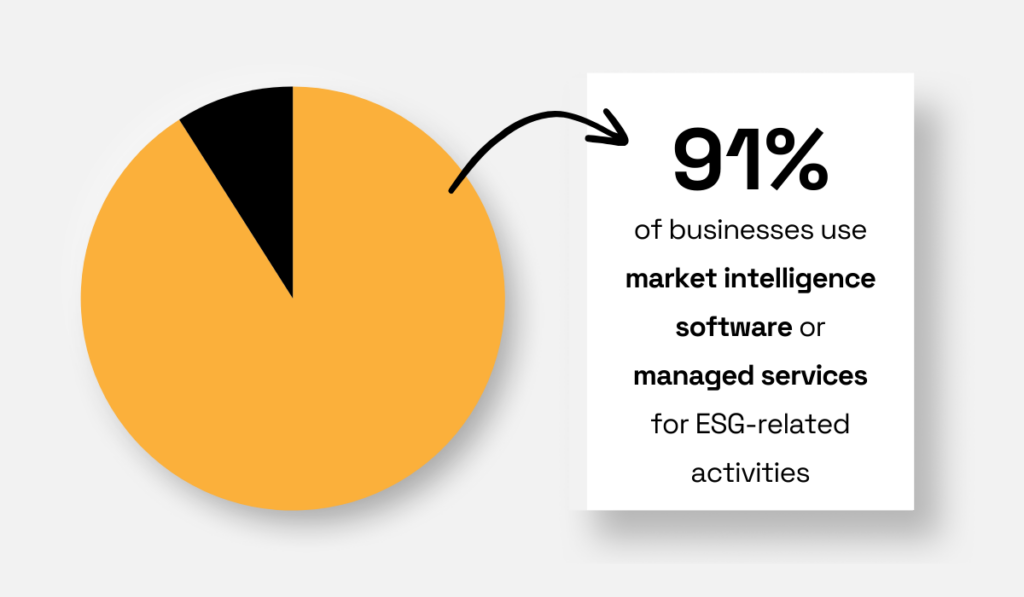

With ESG regulations tightening, most companies now rely on third-party solutions to stay compliant and manage risks.

A Thomson Reuters report found that 91% of businesses use market intelligence software or managed services for ESG-related activities.

Illustration: Veridion / Data: Thomson Reuters

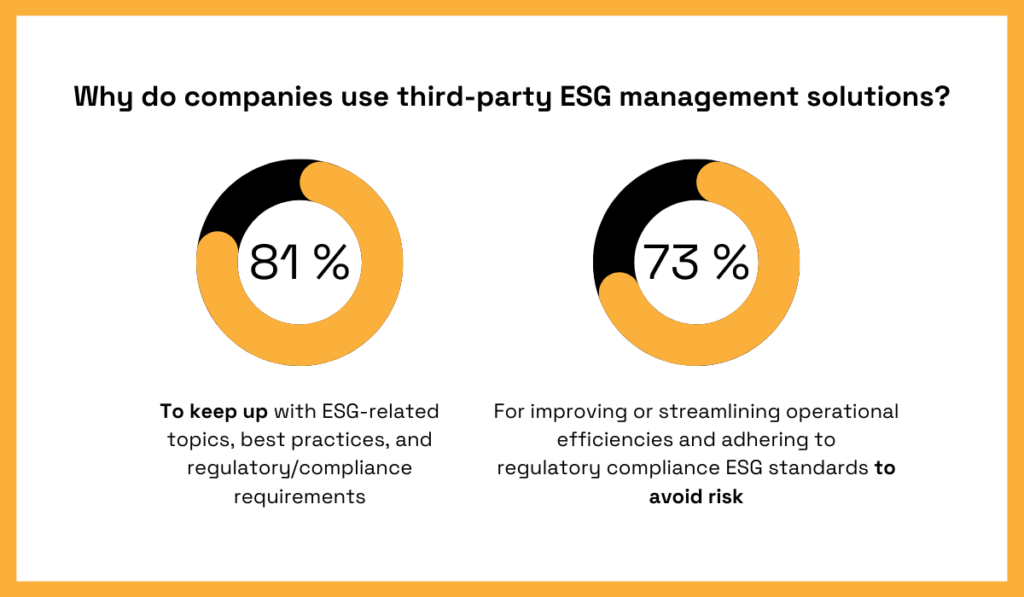

These third-party tools help businesses track regulatory updates, improve operational efficiency, conduct supplier due diligence, and ensure compliance with ESG standards.

The highest adoption—81% of companies—focuses on staying updated on evolving ESG regulations and best practices, which is crucial in a rapidly changing regulatory landscape.

Additionally, 73% of companies use these tools to streamline operational efficiencies and comply with ESG standards, reducing the risk of non-compliance and reputational damage.

Illustration: Veridion / Data: Thomson Reuters

As ESG laws tighten, tools that help you track supplier performance, verify ESG claims, and mitigate risk will become even more critical.

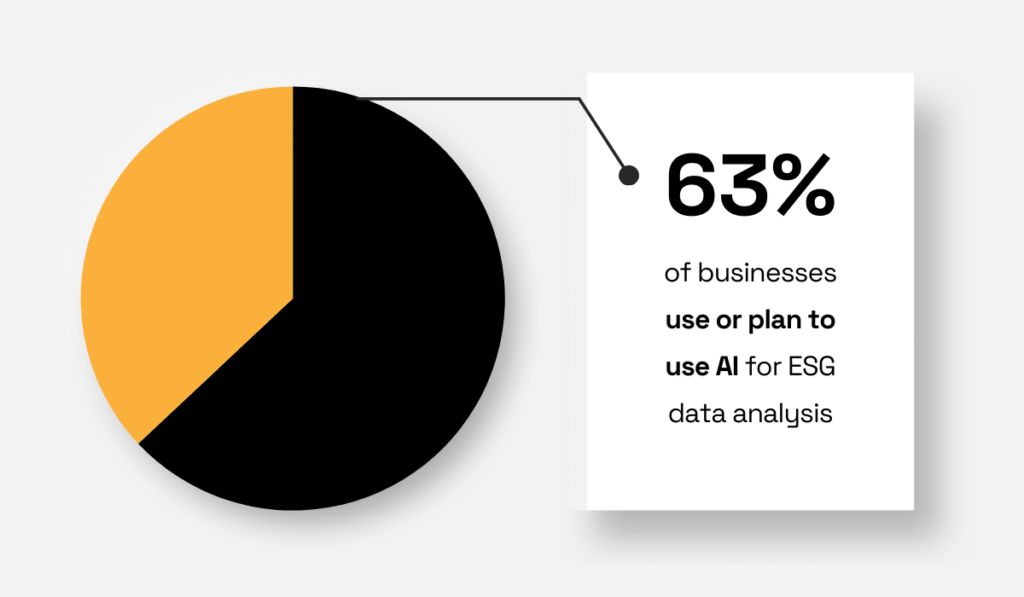

ESG reporting is complex, but AI is helping companies make sense of it.

The above-mentioned Capital Group survey found that 63% of businesses already use or plan to use AI for ESG data analysis.

Illustration: Veridion / Data: Capital Group

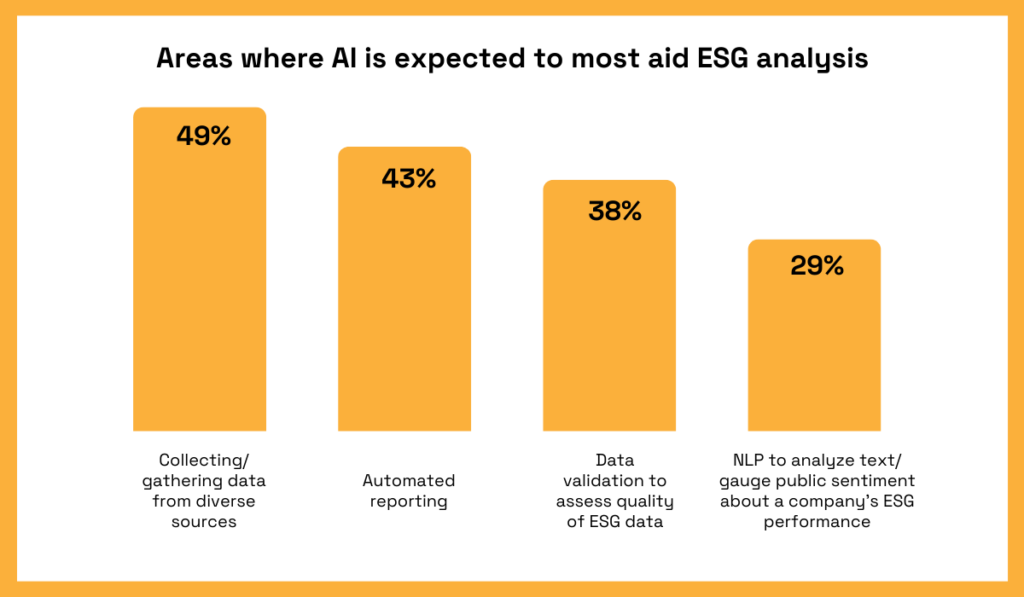

The survey also identified key areas where AI provides the most value, as shown below:

Illustration: Veridion / Data: Capital Group

For procurement teams, AI is particularly valuable in making ESG data more actionable.

Collecting supplier ESG data from multiple sources is time-consuming, and verifying its accuracy is even harder.

AI automates these processes, significantly reducing manual workload. It can validate supplier claims, flag inconsistencies, and ensure compliance with evolving ESG regulations.

Additionally, AI-powered tools can detect ESG risks early—whether it’s identifying greenwashing in supplier reports or uncovering hidden reputational risks through sentiment analysis.

With real-time insights, procurement teams can make faster, more informed decisions about which suppliers align with their company’s sustainability goals.

As ESG expectations grow, companies that adopt AI will not only improve their ESG practices but also gain a competitive edge in managing compliance and risk within their supply chains.

Naturally, this will attract both investors and consumers, further strengthening their market position.

The numbers show that ESG is no longer a niche concern but very much a defining factor in business resilience and growth.

Companies that integrate ESG into their procurement strategies are strengthening supplier relationships, securing investment opportunities, and maintaining consumer trust.

Meanwhile, those that lag behind risk regulatory penalties, reputational damage, and lost business.

Navigating complex regulations, ensuring data reliability, and tracking supplier sustainability isn’t easy.

But with the right tools and a proactive approach, businesses can turn ESG from an obligation into an opportunity.

The companies that take action today will lead the way in a more sustainable, responsible, and profitable future.