A Quick Guide to Supplier ESG Questionnaires

Key Takeaways:

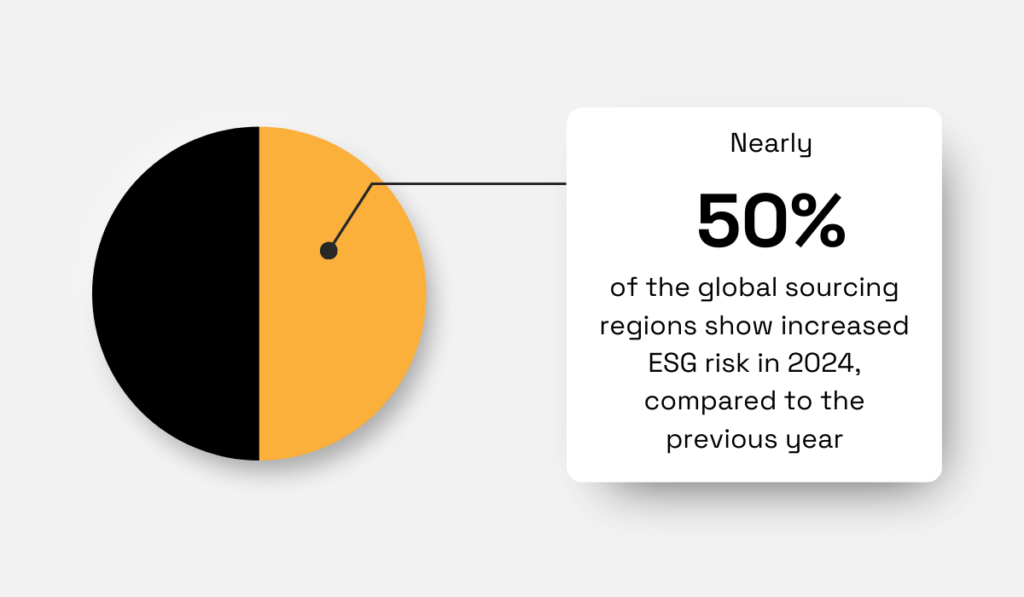

Did you know that nearly half of global sourcing regions experienced a surge in ESG-related risks in 2024?

When suppliers cut corners on environmental, social, or governance (ESG) practices, it doesn’t just affect them—it harms you as well.

From lawsuits to supply chain disruptions, ESG failures can hit where it hurts most: your bottom line and your brand reputation.

That’s where supplier ESG questionnaires come in.

Today, they are one of the essential tools for evaluating vendors’ long-term reliability and potential.

In this post, we’ll break down why ESG questionnaires are so important, what to include in them, and how to overcome some of their downsides.

First, let’s see how your company can benefit from well-made and thorough questionnaires.

An effective ESG questionnaire ensures that all suppliers are assessed using the same criteria, creating a consistent and fair evaluation process.

Essentially, by asking all vendors the same questions, you can compare apples to apples, clearly seeing how each measures up on key issues like carbon footprint, labor rights, etc.

This allows you to base supplier assessments on data that’s as objective and actionable as possible.

Anthony Payne, Chief Marketing Officer at OneStock, a distributed order management platform, puts it this way:

Illustration: Veridion / Quote: CPO Strategy

He maintains that only with a high level of transparency can leaders make informed, environmentally responsible decisions.

ESG questionnaires, thanks to their standardized format, are a great tool to achieve just that.

That said, standardization doesn’t mean sending the exact same survey to every single supplier.

While that might be easier for you and your team, it can burden vendors with irrelevant questions, leading to frustration rather than useful responses.

Payne advises:

Illustration: Veridion / Quote: CPO Strategy

In other words, treat your suppliers like partners, not just data sources. That way, they’ll be far more likely to provide accurate, meaningful responses.

Take Safran, the world’s second-largest aircraft equipment manufacturer, as an example.

Their ESG evaluations are standardized but still customized slightly based on certain supplier characteristics.

Emmanuel Potier, their CSR Director for Group Purchasing, explains:

Illustration: Veridion / Quote: Safran

So, the core questions stay consistent, but there’s room for nuance.

Ultimately, this enables the company to properly score each supplier and offer them detailed, tailored feedback, along with recommendations for corrective actions.

Such a structured yet adaptable approach keeps Safran’s partners not only sustainable but constantly improving in this area, too.

As a buyer, you’re not only accountable for your own actions but also for those of your suppliers.

This means that if they cut corners on ESG practices, you could be the one exposed to legal, financial, and reputational damage.

Fortunately, ESG questionnaires offer a proactive way to identify red flags early, implement corrective actions, and ultimately build a more resilient supply chain.

According to LRQA’s 2024 research, ESG risk is on the rise.

The report shows that nearly half of the global sourcing regions show increased ESG supply chain risk compared to the previous year.

Illustration: Veridion / Data: LRQA

Perhaps even more concerning, over 70 regions saw a drop in transparency scores, suggesting the real risk might be even higher than reported.

Therefore, with global risks escalating, vigilance in vendor selection and monitoring is more important than ever.

By keeping your suppliers in check through ESG questionnaires, you can uncover potential issues before they intensify, protecting your business from serious consequences.

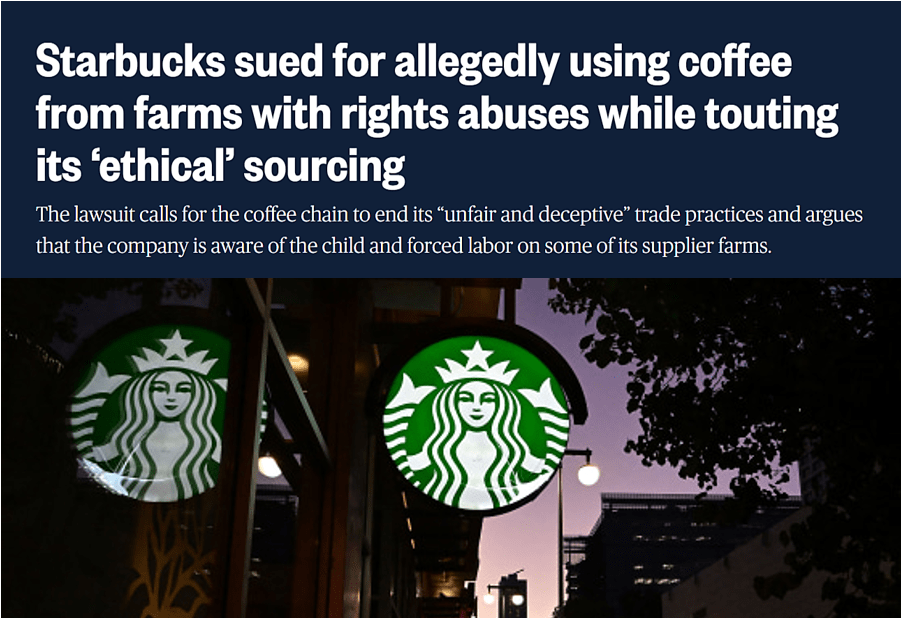

Starbucks, for instance, experienced the negative impact of its supplier’s noncompliance firsthand.

In 2024, a consumer advocacy group sued the company for false advertising, claiming it sourced coffee and tea from farms with known human rights and labor abuses.

Source: NBC News

The lawsuit, filed in Washington, D.C., argues that Starbucks misled consumers by marketing its ethical claims while knowingly working with problematic vendors.

Starbucks, however, claimed they didn’t know about the issue.

Now, even if things don’t escalate to a lawsuit, like in this example, supplier noncompliance can still hurt you.

You might face:

That’s why ESG questionnaires shouldn’t be limited to initial supplier screening—they should be part of regular reviews throughout the entire supplier relationship.

It’s one of the most reliable ways to stay ahead of potential risks and protect your company from avoidable disruptions and long-term harm.

More than ever, people expect the brands they support to operate sustainably, ethically, and transparently.

Therefore, by vetting suppliers through thorough ESG questionnaires, you can demonstrate a strong commitment to responsible sourcing and stand out as a brand that values accountability.

The data from these questionnaires can be used in marketing, PR, and CSR campaigns, helping shape the narrative of a responsible, forward-thinking brand.

This can be a major competitive differentiator.

And numerous surveys and reports back this up.

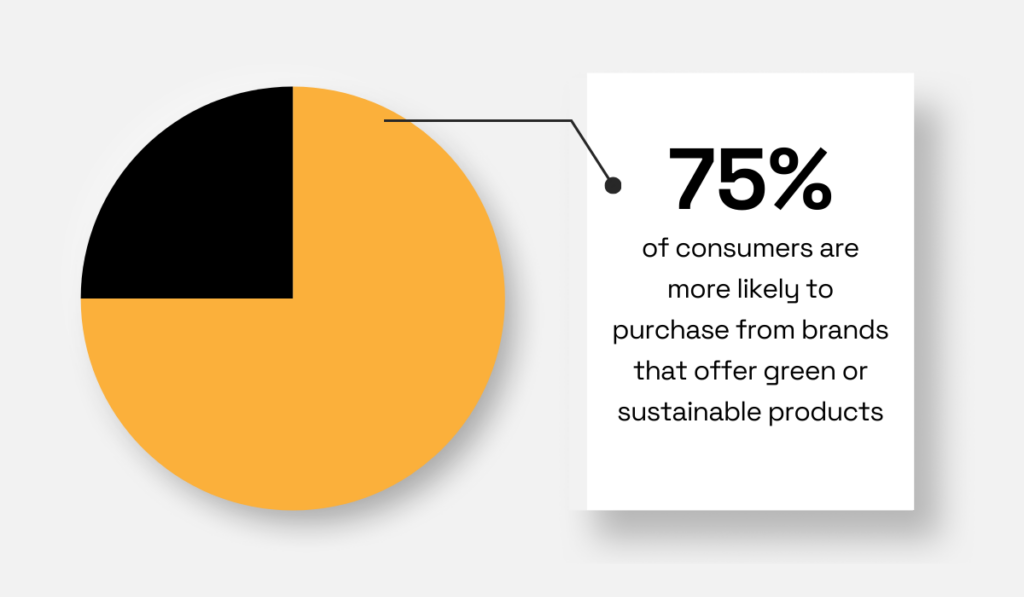

For example, one Deloitte survey found that 75% of consumers are more likely to buy from brands offering green or sustainable products.

Illustration: Veridion / Data: Deloitte

So when you highlight partnerships with suppliers who meet these expectations, you can actually attract new, value-driven customers.

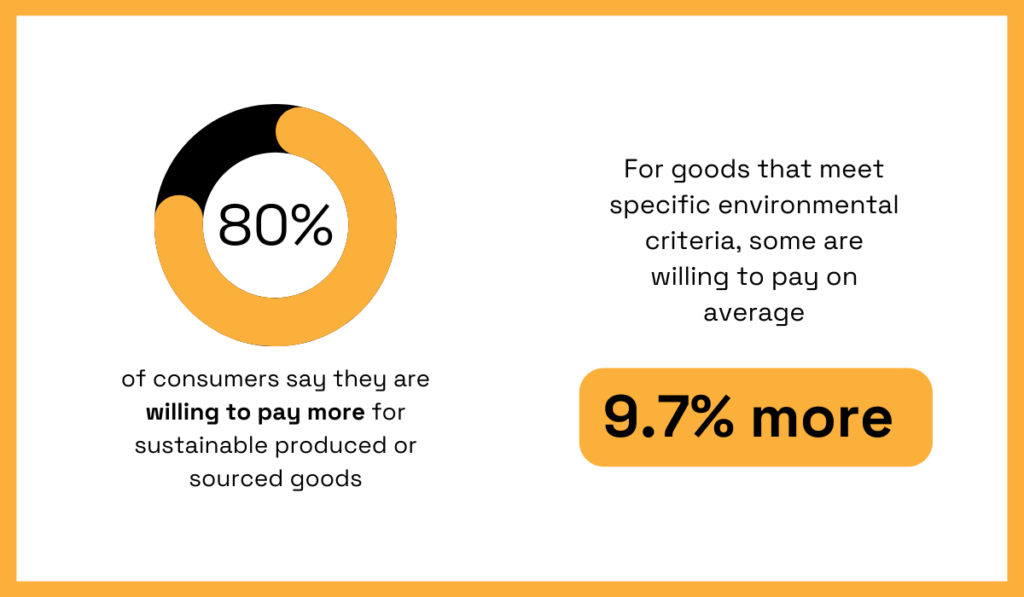

Here’s where it gets even more interesting: people aren’t just more likely to buy from sustainable brands—they’re willing to pay more for their products.

A 2024 PwC research found that 80% of consumers would spend extra for sustainably produced goods.

On average, they’ll pay up to 9.7% more for products that meet environmental criteria, such as being locally sourced, made from eco-friendly materials, or produced with a lower carbon footprint.

Illustration: Veridion / Data: PwC

These are precisely the areas ESG questionnaires evaluate.

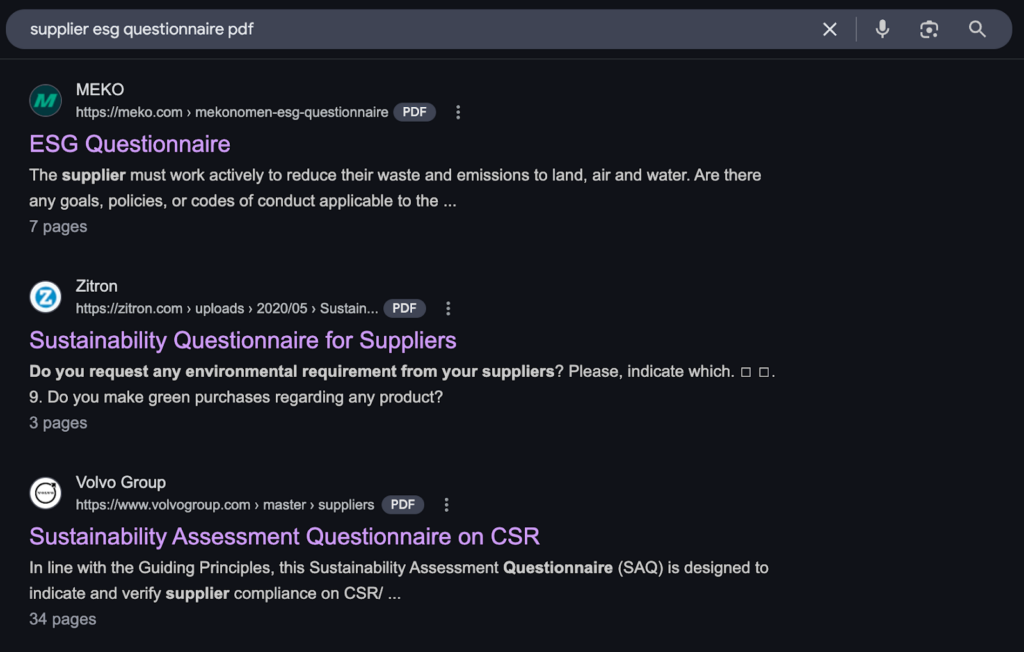

This might explain why many companies are choosing to publicly share their supplier ESG questionnaires.

Many of them make questionnaires easily accessible online, allowing both suppliers and consumers to understand their approach to sustainability and due diligence:

Source: Google

It’s a clear message to everybody: they take ESG seriously.

Ultimately, that kind of transparency builds trust, accountability, and a stronger connection with everyone from consumers to investors, improving brand reputation across the board.

Typically, supplier ESG questionnaires are structured around three core pillars: Environmental, Social, and Governance.

Here’s a quick breakdown:

| Environmental | These questions assess a company’s impact on the environment, including carbon emissions, energy usage, water consumption and pollution, waste management, biodiversity impact, and climate risk exposure. |

| Social | This pillar focuses on a company’s impact on people—employees, customers, and communities. It includes topics such as workforce diversity and inclusion, employee well-being, labor practices, and human rights policies. |

| Governance | Governance-related questions address corporate leadership, ethics, and transparency. Common areas include board composition, business ethics, anti-corruption policies, tax transparency, and regulatory compliance. |

However, there’s a lot of nuance in how these questions are framed and grouped.

Many ESG questionnaires often contain different types of questions and explore various dimensions of ESG performance, such as policies, certifications, and more.

All of these are essential components of a well-rounded ESG assessment.

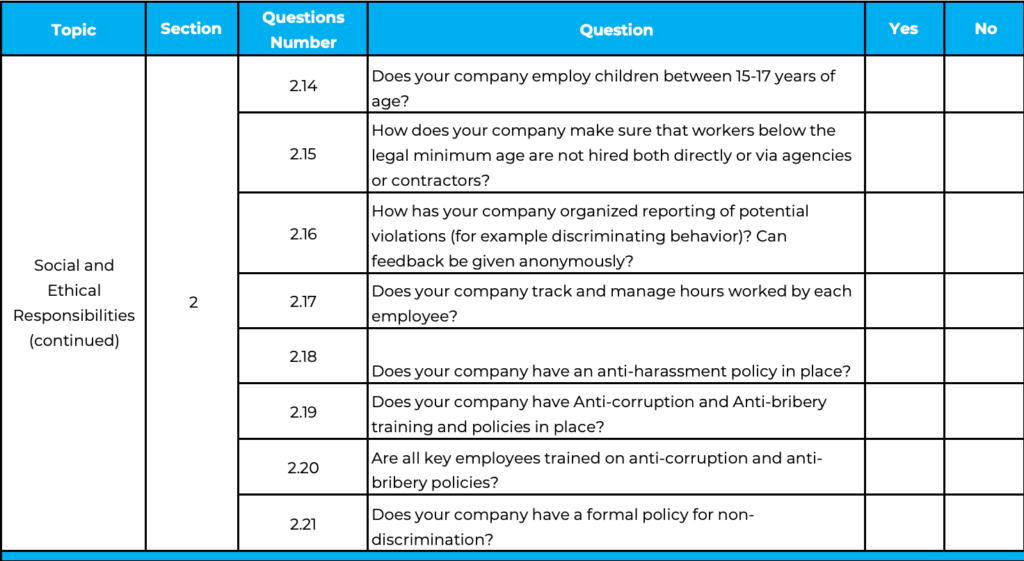

For instance, Case Paper, one of the largest paper merchants in the U.S., frequently uses yes/no questions in its ESG surveys for quick compliance checks:

Source: Case Paper

These are easy to answer and evaluate, but offer limited insight on their own.

That’s why they’re often supplemented with quantitative questions as they gather measurable data and help track performance across suppliers or over time.

Qualitative questions, such as “How do you ensure ethical labor practices?”, can also be valuable for understanding processes and approaches in more depth.

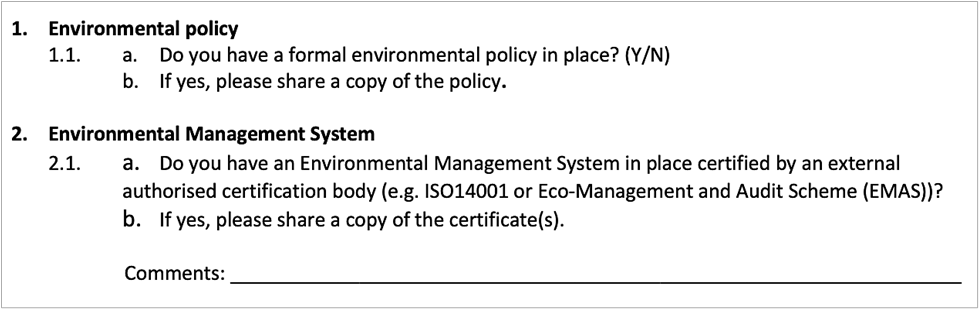

It’s important to include questions about policies and certifications, too.

Organizations like UNICEF do this to verify documentation, evaluate credibility, and better understand supplier practices:

Source: UNICEF

This also tells them how prepared suppliers are to mitigate certain risks.

Similarly, questions about reporting procedures—such as how data is collected or how often it’s updated—can provide insight into a supplier’s internal ESG tracking mechanisms.

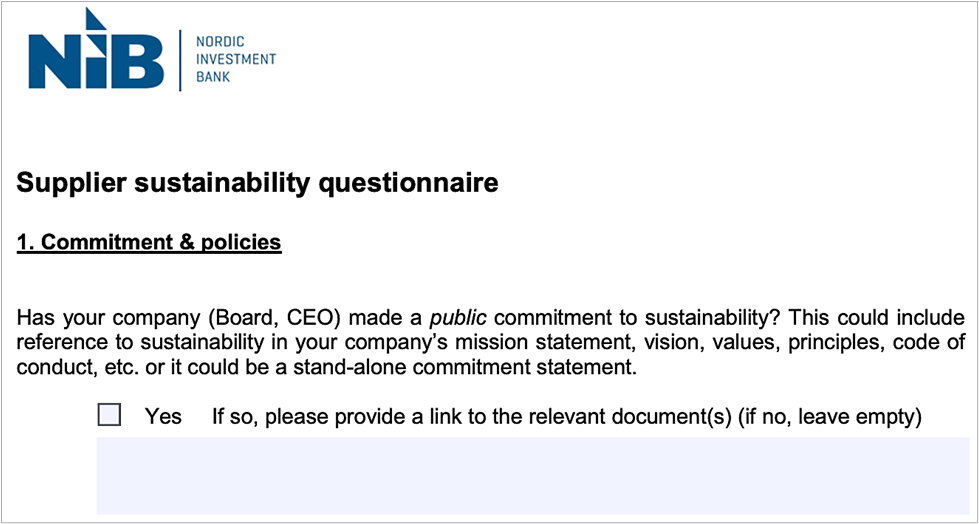

Another common area covered by questionnaires is transparency.

For example, the Nordic Investment Bank includes questions on whether ESG information and targets are publicly available.

Source: NIB

This helps them assess their partners’ accountability and gauge how serious they are about their ESG commitments.

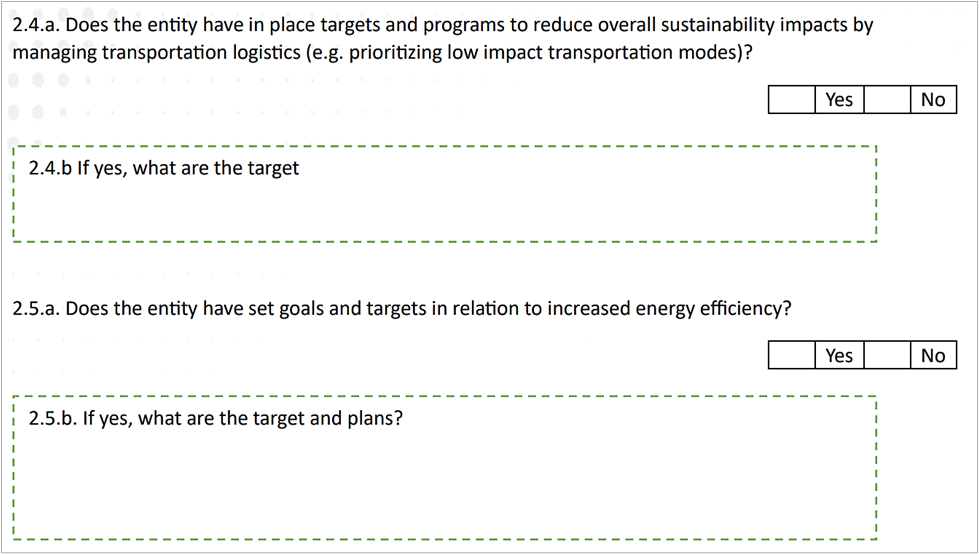

You could also inquire with suppliers about the future outlook, just like FNRCO, a human resource consulting company in Saudi Arabia, does.

By asking forward-looking questions about suppliers’ targets and commitments to improvement, they can assess their ambition and intent to progress on ESG matters:

Source: FNRCO

At the end of the day, there’s no one-size-fits-all ESG questionnaire. There are tons of question types and topics you can explore.

The key is to strike a balance: Collect all the essential information without overwhelming your suppliers.

That’s why it’s best to collaborate with them to design surveys that are effective, practical, and beneficial for both parties.

The biggest issue with ESG questionnaires is data reliability.

This is primarily because they rely on self-reported information, which, unfortunately, can be biased and not entirely accurate.

Kuni Chen, Co-Vice Chair, Sustainable Investing Group at CFA Society New York, a financial services forum, puts it plainly:

Illustration: Veridion / Quote: Business Insider

And he’s right.

That’s why you can’t just take ESG questionnaire results at face value. You’ve got to read between the lines and piece together the full picture.

But it gets even trickier.

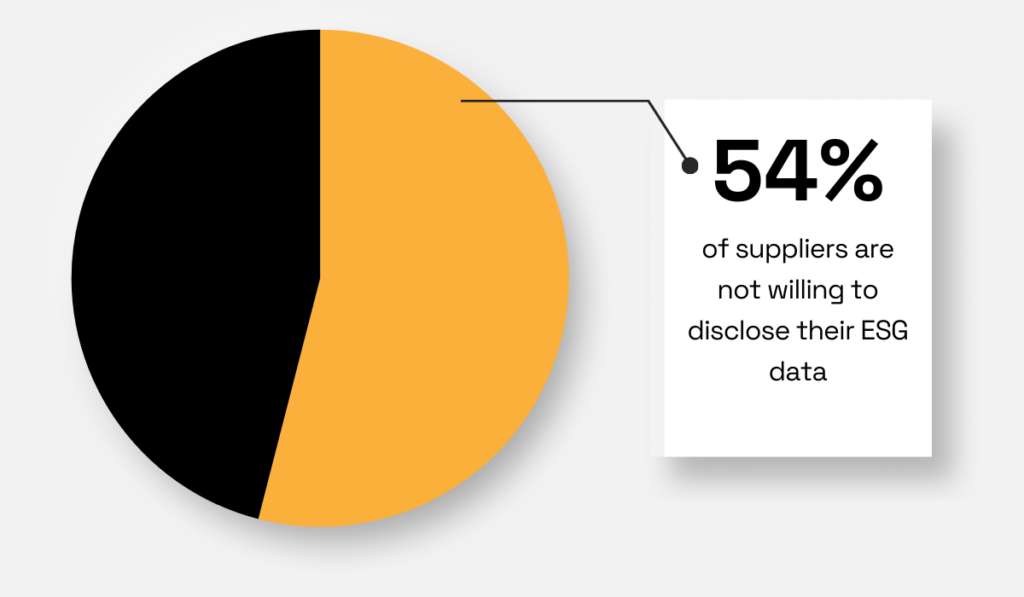

Suppliers—particularly the smaller ones—often don’t have the time, resources, or even desire to fill out ESG surveys, especially if they are constantly bombarded with them.

This results in what’s known as “supplier fatigue” and ultimately, lower response rates.

In fact, a 2021 survey by Alcumus found that 54% of suppliers aren’t willing to share their ESG data at all.

Illustration: Veridion / Data: Alcumus

That’s a serious problem.

When relying on incomplete or inaccurate data, you may unknowingly engage in greenwashing—exaggerating or misrepresenting your ESG performance.

This can damage your credibility with consumers and even expose you to legal trouble.

So, the big question is: should you ditch ESG questionnaires altogether?

Not at all.

They are still valuable tools, but they can’t be your only source of truth.

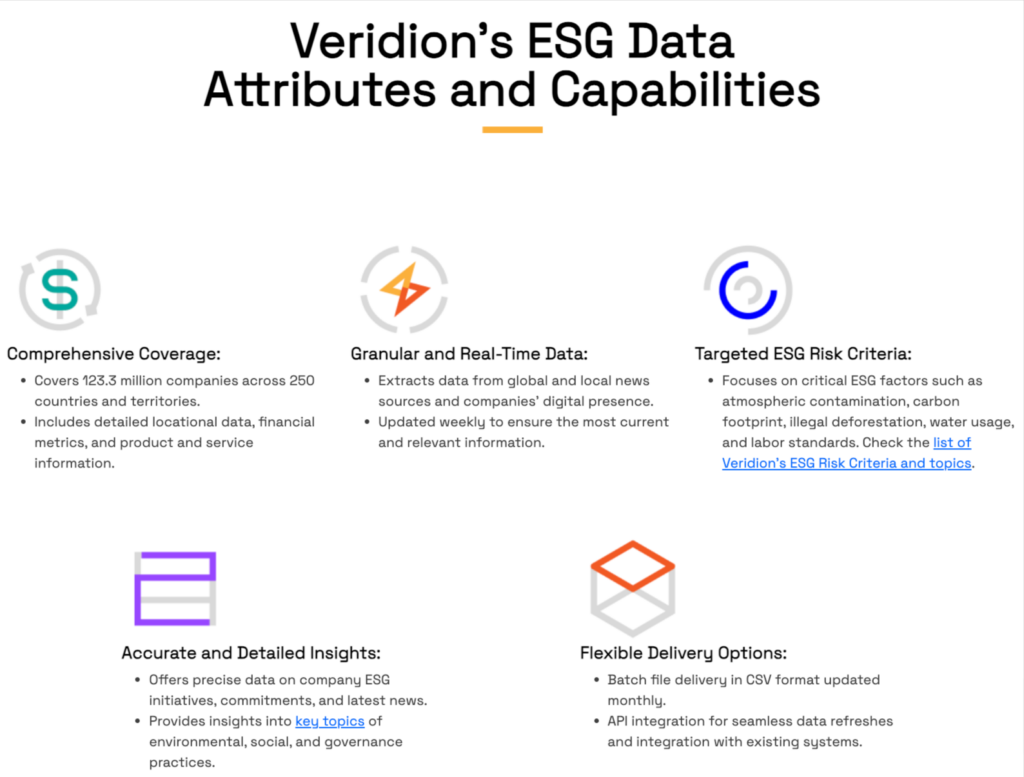

To ensure complete data reliability, consider verifying it using AI-powered supplier intelligence platforms like Veridion.

Veridion offers access to a continuously updated database of over 120 million companies all around the world.

Source: Veridion

It gathers and analyzes data from company websites, public news, and other trusted sources, ensuring each profile reflects both the company’s official statements and how it’s publicly perceived.

With integrated sentiment analysis, Veridion evaluates the tone and intent behind ESG actions, helping you distinguish between real performance and empty promises.

Whether you’re interested in monitoring carbon emissions, labor practices, or any other ESG metrics, Veridion provides more accurate insights than any other provider.

Here’s the list of all ESG topics we cover:

Source: Veridion

You can leverage this information to validate your questionnaire data and build a full 360° view of your supplier network.

Because when it comes to ESG, relying on guesswork only opens the door to risk.

So, use Veridion to stay well-informed, agile, and resilient.

Supplier ESG questionnaires are a must-have for procurement professionals who want to help their company meet stakeholder expectations and shield it from risks.

Think of them as your first line of defence in a world where supplier noncompliance can easily tank your reputation or halt your operations.

But as critical as they are, questionnaires alone aren’t enough.

Yes, you need to be asking your suppliers these questions, but you also need to challenge the answers and verify the facts.

Only through reliable, vetted data can you identify red flags and turn ESG into a real competitive advantage.