Debunking 5 Common Myths About ESG In Procurement

Key Takeaways:

What if the biggest reasons companies avoid ESG in their procurement processes aren’t even true?

Many of the most common objections are just myths, and they’re holding companies back.

Some say ESG is too expensive.

Others think it’s too complex or just not practical.

And even companies that do try often get it wrong by misunderstanding what ESG really means.

In this article, we’ll break down the five most common ESG myths in procurement and show you why ESG is simpler, smarter, and more rewarding than you might think.

Let’s dive in.

Many companies associate ESG with the environment, so they often focus all their efforts on becoming more sustainable.

They go to great lengths to work with sustainable suppliers, reduce their carbon footprint, and make other environmentally conscious decisions.

And yet, this alone doesn’t make them ESG-compliant.

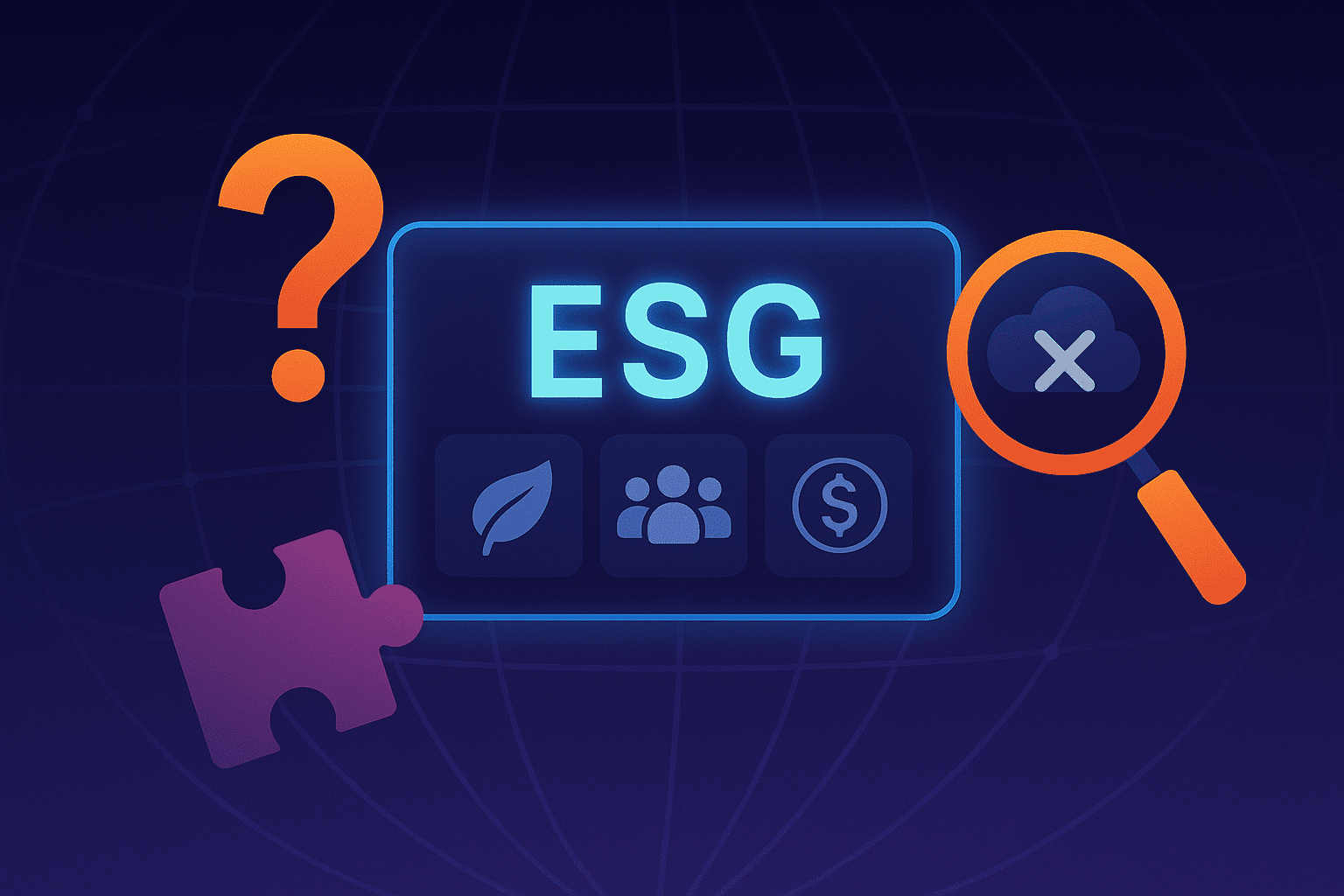

That’s because, in reality, ESG goes beyond environmental issues, as the acronym itself makes clear: Environmental, Social, and Governance.

Here is a quick breakdown of all three dimensions:

Source: Veridion

Unfortunately, many procurement teams overlook the other two dimensions, focus solely on sustainability, and unknowingly expose their companies to risk.

Take Apple as an example.

The trillion-dollar company frequently boasts its commitment to sustainability.

In 2020, it announced plans to become 100% carbon neutral by 2030.

In 2022, it further urged its global supply chain to decarbonize all Apple-related production.

Source: Apple

But in 2019, Apple found itself in hot water after being accused of several labor violations in China.

The violations included withholding bonuses from workers and employing more contract workers than allowed to avoid providing benefits for full-time workers.

A new incident emerged again in 2024, when “the world’s largest iPhone assembler,” Taiwan’s Foxconn, was investigated for bribery and embezzlement.

Source: Reuters

These instances suggest that Apple failed to implement proper labor rights, anti-corruption, and anti-bribery measures across its supply chain.

While they appear to have managed the environmental side of ESG well, they likely overlooked the social and governance aspects.

This shows that focusing on sustainability alone won’t cut it.

When evaluating suppliers or introducing in-house measures, you need a more well-rounded ESG approach—one that covers all dimensions.

And you should make ongoing efforts to ensure your suppliers aren’t exposing you to ESG risks, not just environmental ones.

Now, you probably think that might be viable for big corporations with dollars to spare, but not for smaller businesses.

“It’s just too expensive.”

But is it, really?

Let’s examine and debunk that myth next.

Many companies believe that integrating ESG in procurement is expensive.

In fact, they often cite perceived cost as the top barrier to implementing ESG programs.

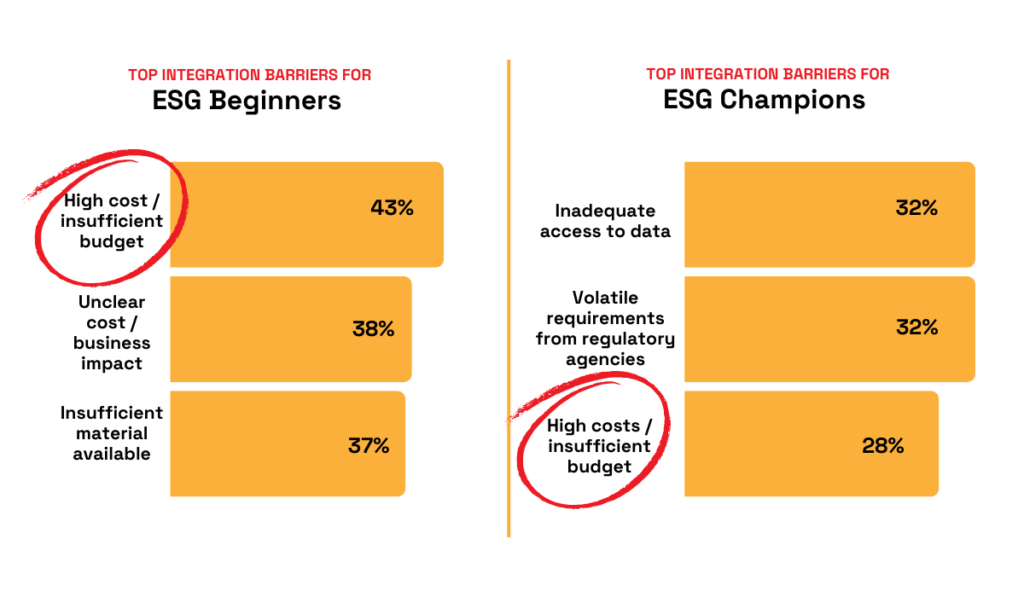

However, research shows this concern is more common among ESG beginners than experienced leaders.

A PwC study, ESG Empowered Value Chains 2025, found that high costs and insufficient budget are indeed the top challenges for ESG beginners.

For ESG champions, however, these concerns drop to the third spot.

Illustration: Veridion / Data: PwC

This suggests that ESG beginners tend to focus more on short-term costs than long-term value.

They also likely lack a full perspective on how ESG investments pay off over time, which is reflected in their ranking of “unclear business impact” as the second most critical challenge.

In contrast, ESG leaders may not worry about costs as much because those concerns fade in the light of tangible benefits.

Firstly, ESG compliance helps companies save money, whether by avoiding regulatory penalties, improving efficiency, or lowering insurance premiums.

Beyond that, it can also increase revenue by attracting new customers and investors or helping secure more favorable contracts.

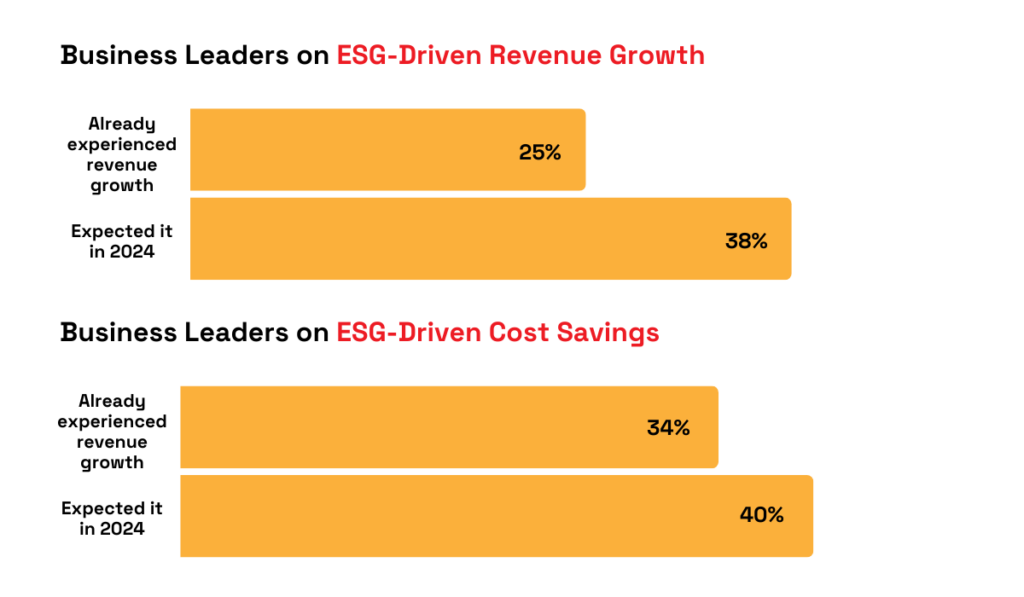

And the data confirms this.

A 2023 survey found that a quarter of European businesses investing in sustainability had already experienced revenue growth, while 38% expected it in 2024.

Meanwhile, 34% reported cost savings, and 40% expected to achieve them in 2024.

Illustration: Veridion / Data: DNV

Even if your procurement team or leadership isn’t yet convinced of ESG’s ROI, you can start small until everyone builds confidence.

For example, a wind turbine manufacturer reduced lighting costs by 60% simply by switching to LED tubes.

Your company could probably do the same.

Other low-cost initiatives include employee training, introducing anonymous employee surveys, drafting a basic Code of Conduct, or adding ESG clauses to supplier contracts.

You can implement these initiatives no matter your company’s size, which brings us to another common misconception.

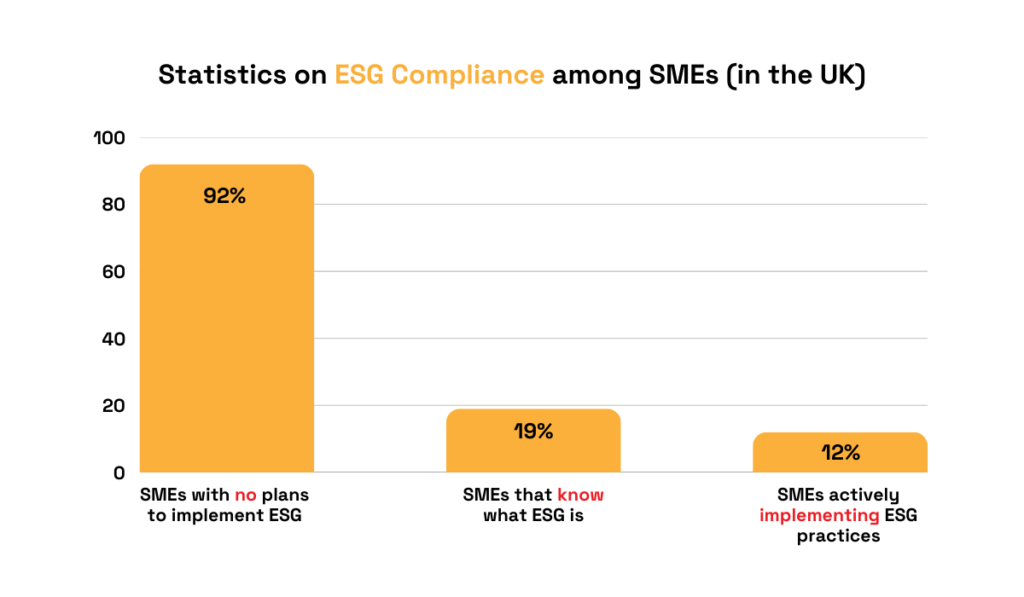

A 2023 study of the UK’s small to medium-sized enterprises (SMEs) revealed several troubling statistics.

Firstly, it found that only 19% of SMEs know what ESG is.

On top of that, only 12% are actively implementing it, while 92% have no plans to do so in the future.

lIllustration: Veridion / Data: ID Crypt Globa

However, as many experts point out, SMEs can both greatly contribute to and benefit from ESG initiatives.

One of them is Phil Kenmore, the CEO of The Open University, who notes that SMEs make up over 99% of the entire private business sector, making them essential to achieving critical ESG goals.

Illustration: Veridion / Quote: SME Web

Again, it’s not just about SMEs contributing to ESG initiatives.

They stand to gain from it, too.

According to Kenmore, ESG-compliant SMEs will be better positioned to secure big contracts, especially as large enterprises increasingly prioritize ESG in their procurement.

Other thought leaders, like Kawal Preet, President of APAC at FedEx Express, also agree that proper ESG strategies make SMEs more competitive.

Illustration: Veridion / Quote: Forbes

And even if some SMEs believe they can afford to ignore ESG for now, the external pressure is only growing.

Sustainability reporting, for example, is quickly becoming a key requirement not just for participating in supply chains but also for accessing financing and meeting regulatory demands, as highlighted in the OECD 2025 report.

The key here is, once again, to start small.

For example, SMEs can adopt ESG software solutions tailored to limited budgets.

They can also follow standardized reporting frameworks like the GRI Standards, which are free and suitable for businesses of all sizes.

But to use these frameworks effectively, you’ll need access to reliable ESG data, including data from your suppliers.

And that leads us to the next common myth about ESG.

Many companies believe that supplier ESG data is unreliable or simply too difficult to collect and manage.

But in reality, they’re often the ones creating the problem.

Many of them still use outdated methods to collect ESG data.

Most commonly, they rely on suppliers to self-report through their own assessments, which is problematic for many reasons.

First, who’s verifying that the data suppliers provide is accurate?

Second, they’re probably submitting it using their own, non-standardized templates.

So, when you receive it, you still need to standardize data across your supplier base, which can be a time-consuming task.

In that case, yes: collecting ESG data, or any supplier data, is difficult.

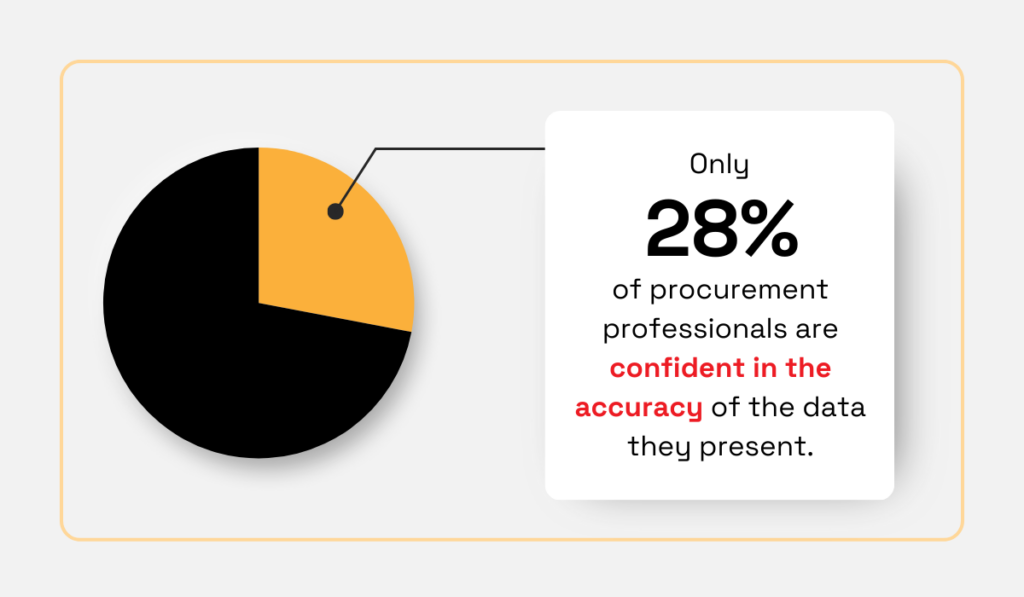

And it’s no wonder that so few procurement professionals trust the information they’re expected to present.

Illustration: Veridion / Data: SpendHQ

But that doesn’t mean that reliable supplier ESG data doesn’t exist.

It does—and third-party, unbiased providers are already collecting it and making it usable.

Veridion is a standout example.

It gathers company data using AI from multiple public sources, updates it weekly, and pays special attention to critical ESG factors.

Whether you’re looking into a company’s carbon footprint, water usage, labor practices, or anti-bribery policies, Veridion helps you find the answers.

Veridion currently has a global database of over 120M companies and a robust collection of supplier data points.

This includes basic company data, like firmographic and product information, but also granular data related to environmental, social, and governance practices.

You can see a list of key ESG topics covered here.

Source: Veridion

All data is extensively validated to provide greater accuracy than other providers.

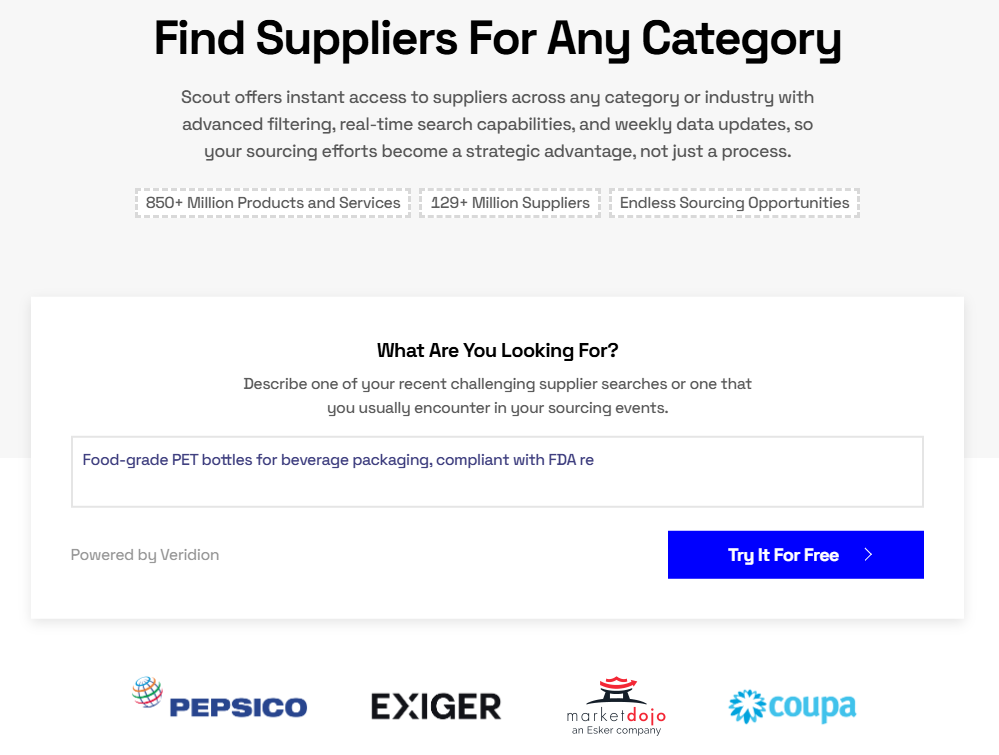

Additionally, Veridion has an AI-powered search engine, Scout, that lets you find suitable and ESG-compliant suppliers more easily by entering natural-language prompts.

Source: Veridion

With Veridion, your team can easily:

So again, the problem isn’t that reliable ESG data doesn’t exist.

If you’re struggling to find it, chances are you’re simply using the wrong approach.

Finally, many companies believe that trying to follow ESG standards introduces complexity and friction.

They also think this further slows down procurement workflows.

But research and expert insights suggest the issue isn’t the ESG standards themselves.

Rather, it stems from how companies approach them and the challenges they already experience within their supply chains and procurement workflows.

Take Katharina Hefter, a managing director at BCG and a co-author of BCG’s Global ESG, Compliance, and Risk Report 2024.

She explains that companies often adopt fragmented solutions to address ESG, compliance, and risk, creating operational inefficiencies instead of streamlining them.

Illustration: Veridion / Quote: Boston Consulting Group

Sheri Hinish, EY Global Sustainability Lead, adds that suppliers often don’t want to or can’t engage in sustainability initiatives, at least not as much or as fast as they should.

This lack of cooperation around ESG requirements creates additional friction.

But it’s important to recognize that it’s not ESG creating these problems.

In fact, many of these issues have existed for years.

A lack of supplier visibility, for example, didn’t start with ESG.

It just became harder to ignore.

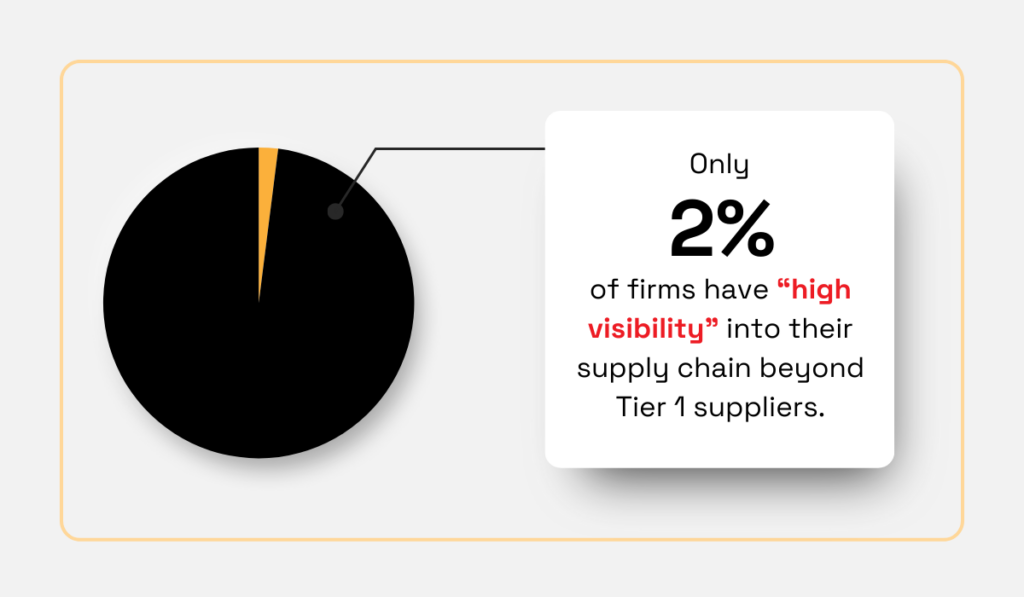

According to Deloitte’s 2023 survey, only 2% of firms feel they have “high visibility” beyond Tier 1 suppliers—and that’s across the board, not just in relation to ESG.

Illustration: Veridion / Data: Deloitte

So, is ESG slowing things down?

Not really.

It’s simply shining a spotlight on gaps that companies have neglected for too long, like weak oversight, disjointed data, and the absence of clear supplier evaluation criteria.

The truth is, these problems need fixing regardless.

ESG may just be the push companies need to finally address them.

And when implemented correctly, ESG practices can actually streamline procurement.

They help teams identify trustworthy partners faster and reduce future risks that can disrupt operations.

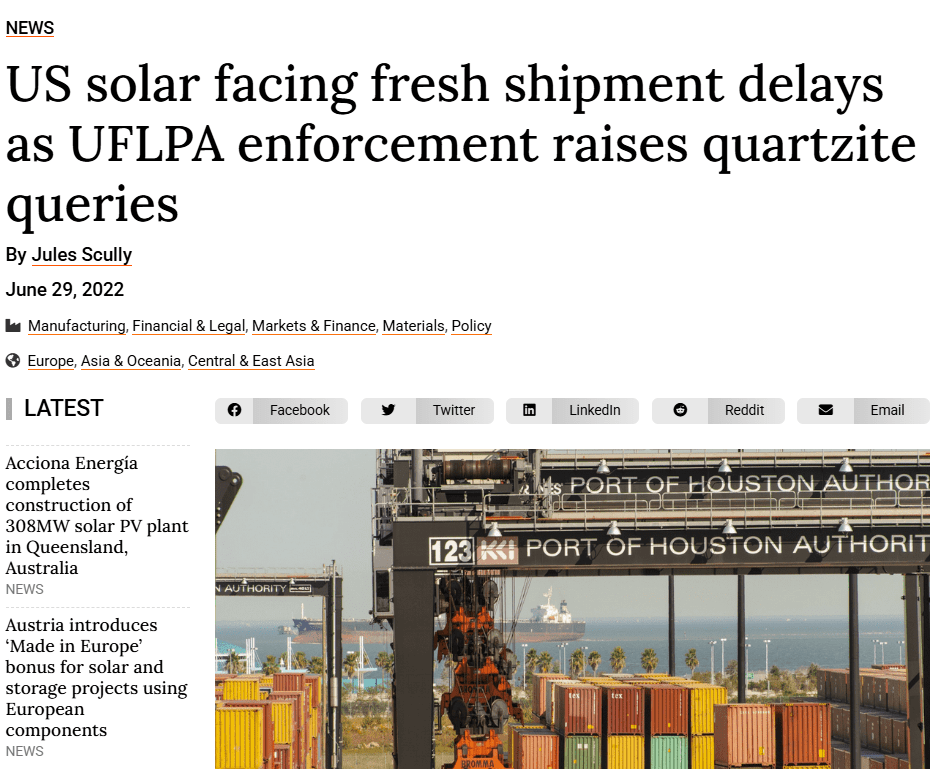

And disruptions can indeed create costly delays for companies.

For instance, in 2024, the US solar industry faced a crisis when the CBP detained $43 million worth of Indian electronics equipment due to forced labor concerns.

Philip Shen of investment bank ROTH Capital Partners estimated that the shipments could be delayed by up to 12 months, as the parties involved in the supply chain lacked the required documentation.

Source: PV Tech

This is what happens when ESG isn’t integrated from the beginning.

Delays, disruptions, and financial setbacks end up costing far more than proactive planning ever would.

Of course, adding ESG to procurement processes won’t be effortless.

But few changes to core operations ever are.

Still, it’s clear which path is safer.

Integrating ESG now helps you build resilience and avoids much bigger headaches down the road.

By now, it’s clear that many of the beliefs holding companies back from ESG are more myth than fact.

Even when there is a grain of truth in them, the long-term value almost always outweighs the challenges.

Add to that the growing pressure from customers, investors, and regulators, and delaying ESG adoption becomes a risky move.

The good news?

You don’t have to do everything at once.

Start with what’s viable and meaningful for your business.

What matters most is taking that first step.

Once you do, momentum builds, and you’ll find it far easier to scale your ESG efforts over time.