Supplier Intelligence: A Guide to Gathering Location Data

Key Takeaways:

Do you know where your suppliers operate?

Not just the HQ.

The actual sites where goods are made, stored, or shipped—the factories, the warehouses, the subcontractors behind the curtain.

If you don’t, you’re one flood, strike, or protest away from chaos.

Delays. Fines. Broken contracts. Millions lost.

Yet, most companies still operate like this, with incomplete supplier location data and blind optimism.

This guide shows why that’s a risk you can’t afford, and how to finally see the full picture.

Every supplier location you can’t see is a risk you don’t control.

And in procurement, managing risk and staying in control is everything.

Your Tier 1 supplier might seem rock solid: reliable, cost-effective, great relationship.

But behind them sits a Tier 2 supplier you’ve never heard of. They make one small, essential part.

And their factory? It sits in a high-risk flood zone in Southeast Asia.

One storm, and your “stable” supplier goes offline. Production stalls. SLAs are missed. There’s nothing you can do—because you didn’t know the risk was there.

That’s not a rare scenario. It’s happening everywhere.

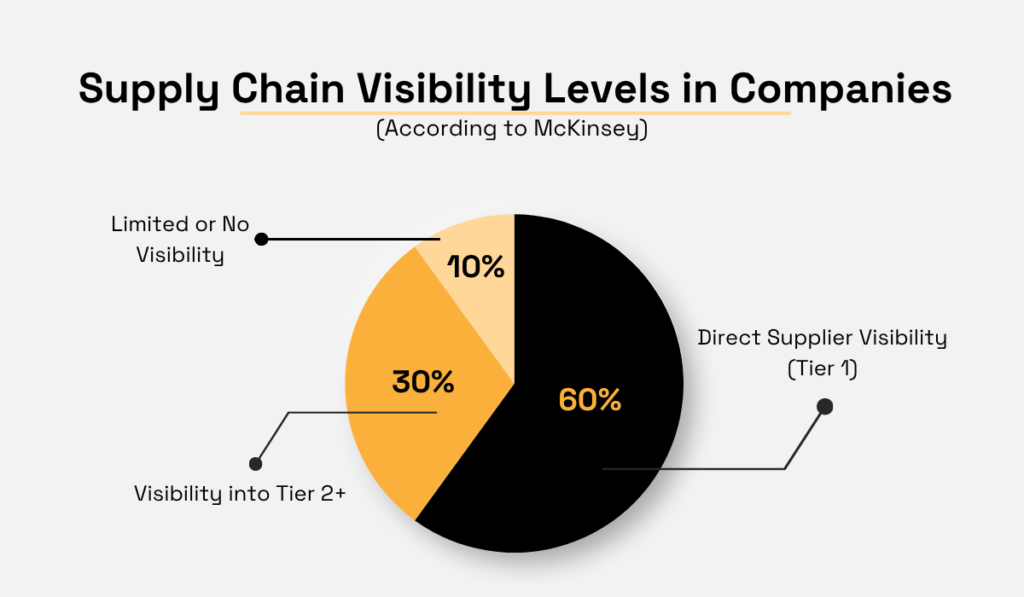

According to a McKinsey survey, only 60% of companies have full visibility into their direct suppliers, and just 30% can see further down the chain.

Illustration: Veridion / Data: McKinsey

That leaves 70% exposed, right where the most serious disruptions tend to begin.

And those disruptions are growing.

In 2024 alone, Resilinc reported a 38% rise in supply chain disruptions. Flood alerts were up 214%, and protests surged by 285%.

Factory fires dropped slightly, but overall risk continues to rise.

On top of that, geopolitical volatility—tariffs, sanctions, wars, export bans—shows no signs of slowing.

As Andrew Moxton, Senior Product Marketing Manager at Thomson Reuters, put it:

Illustration: Veridion / Quote: Thomson Reuters

The thing is, you can’t stop protests, undo floods, or rewrite policy.

But you can control how close you are to them, and how ready you are to respond.

And that starts with knowing where suppliers really operate, and what happens at each site.

But supplier location intelligence isn’t just about risk.

It helps optimize everything from logistics to cost control.

When you know exactly where suppliers store, produce, and ship from, you can:

All of this directly cuts costs.

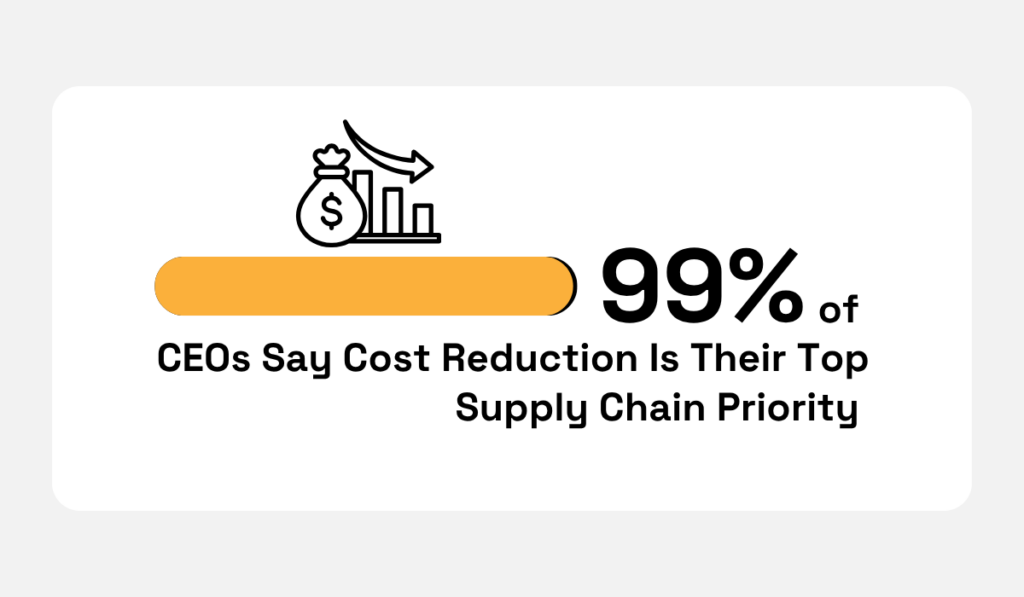

And that matters more than ever because cost reduction is no longer just a procurement goal.

It’s a board-level priority

Nearly every CEO now lists it as a top supply chain focus, according to Proxima.

Illustration: Veridion / Data: Proxima

Here’s an example.

You’re sourcing from a supplier based in Paris. They’ve listed their headquarters and a French distribution hub.

But what they didn’t disclose is a fulfillment center in Northern Spain, closer to your assembly plant and outside a current tariff zone.

So you route everything through France. Longer transit. Higher duties. More cross-border paperwork. All because one site was missing from your records.

Now multiply that across hundreds of shipments and dozens of suppliers. The inefficiency becomes a major cost driver—entirely avoidable with better data.

Location intelligence also protects against compliance failures.

Laws and regulations are constantly evolving. Some regions restrict certain exports. Others enforce strict labor or environmental standards.

If you don’t know where your suppliers operate, you can’t verify compliance.

And the burden is growing.

Anja Sadock, SVP of Marketing at TrusTrace, supply chain traceability software, said it best:

“With the onslaught of compliance regulation, it’s becoming imperative for everyone. The data burden is becoming unmanageable, and if we can’t have high-quality data, nothing else matters because we’ll be making analysis on the wrong assumptions.”

Lack of visibility can quickly become a legal and reputational crisis.

Take Hyundai, for example.

In 2022, parts suppliers in Alabama were found to be employing children. Hyundai said it wasn’t aware, but the headlines, investigations, and backlash were already in motion.

Source: The New York Times

Many global brands have learned the importance of location data the hard way.

During the 2011 Thailand floods, dozens of tech and auto giants were caught off guard.

Honda, Toyota, and Western Digital faced massive delays.

Their Tier 2 supplier sites were underwater, and they didn’t even know those sites existed.

The pattern has repeated again and again—during the war in Ukraine, the protests in France, the strikes in Germany, the droughts in Latin America.

Each one is a reminder: You don’t get to choose the crisis. But you do get to choose how well you understand your supply base.

There are three main ways procurement teams gather supplier location data:

Here they are compared:

| Method | Examples | What Goes Wrong |

|---|---|---|

| Manual Research | On-site visits, contract reviews, public records, trade associations | Takes too much time. Often only reveals HQ. Hard to scale. |

| Supplier Input | Surveys, onboarding forms, supplier self-reporting in portals | Incomplete info. Vague or wrong addresses. No standard format. |

| Digital Tools & Databases | D&B, EcoVadis, ThomasNet, web scraping, performance metrics, location intelligence tools | Many tools rely on outdated or surface-level data. No way to verify or enrich it. |

As you can see, each method has its place. But each one also comes with its own set of issues.

And when you’re managing thousands of suppliers, those issues scale fast.

Manual research is slow and often only uncovers headquarters. Self-reported data is inconsistent and incomplete.

And digital tools, while promising, often rely on outdated or unverified sources.

The result is patchy data, little visibility, and a lot of hidden risk.

Let’s break down the core challenges procurement teams face when trying to get accurate, actionable supplier location intelligence.

Most supplier databases start and end with the headquarters address.

But that’s just one location. It doesn’t tell you where the real work happens.

A single supplier might have five or ten sites across different regions:

You need data on all of them—not just the HQ in Berlin.

Source: Veridion

And we’re still talking about Tier 1 suppliers, the ones you’ve vetted. Even with them, it’s easy to miss things, as the majority of suppliers use multiple sites, but only mention one or two.

Sometimes it’s intentional. Sometimes they just assume you don’t need to know. And even when they do list a few locations, it’s rarely the full picture.

As Ken Lyon, supply chain consultant at Transport Intelligence, says:

Illustration: Veridion / Quote: Financial Times

Now think about Tier 2 and Tier 3 suppliers.

Each layer of the supply chain brings more risk and less visibility.

And the deeper you go, the harder it gets to figure out where the actual work is happening.

Yet that’s exactly where critical operations are and where most of the blind spots live.

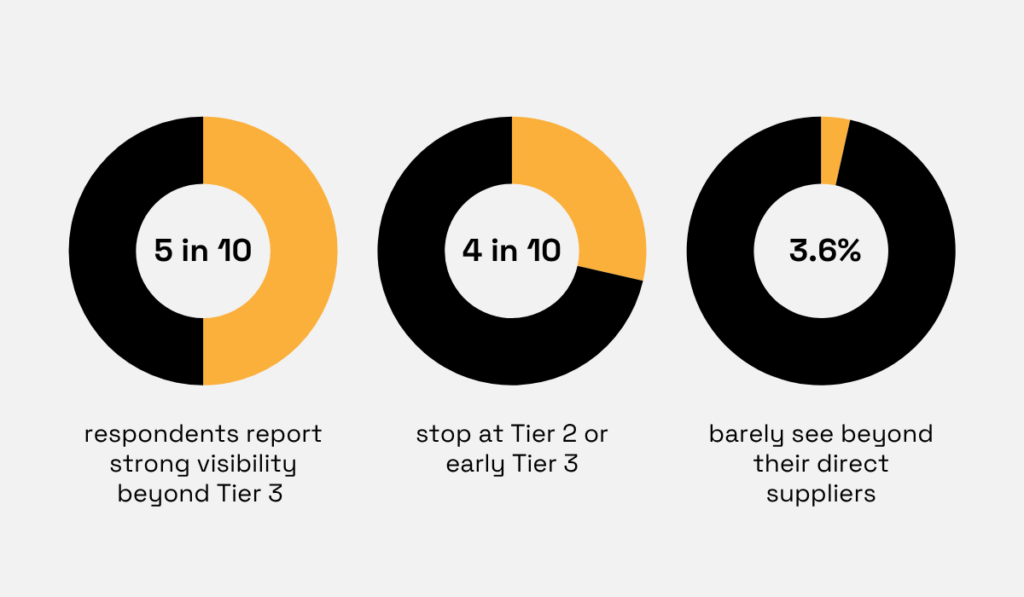

One recent survey found that while 5 in 10 companies claim visibility beyond Tier 3, nearly 70% say they struggle with data accuracy and quality from Tier 2–4 suppliers.

Illustration: Veridion / Data: Sphera

That means even when companies can see beyond Tier 1, what they’re seeing isn’t always reliable.

So finding all relevant sites isn’t just a nice-to-have.

It’s the first step in understanding your actual supply chain.

And if you miss that step, everything else you build (risk models, logistics plans, compliance strategies) sits on shaky ground.

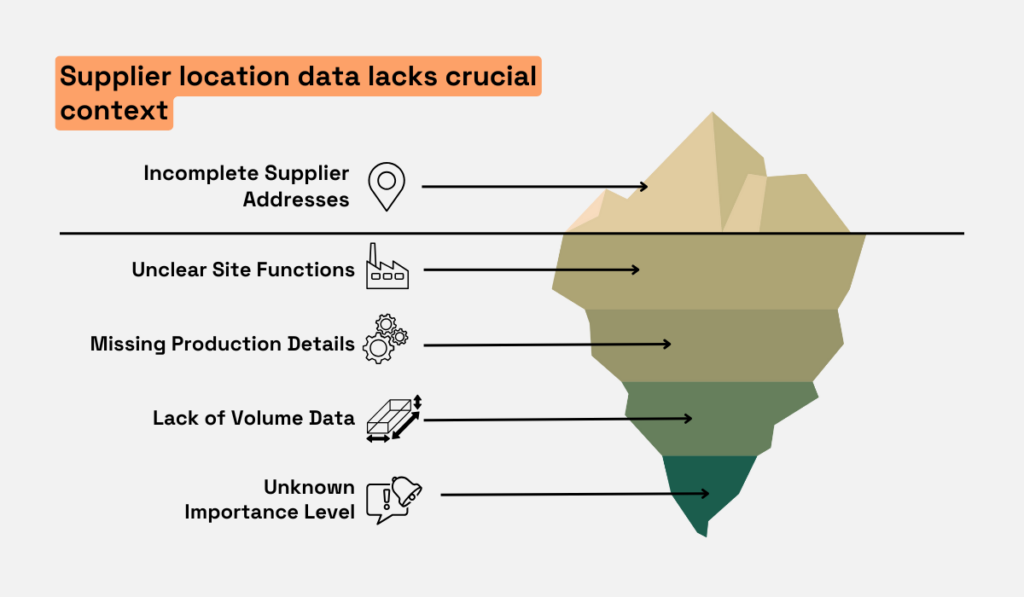

Finding the right addresses is only half the job. The other half is knowing what actually happens at each one.

That’s where many teams get stuck.

You might get a list of five supplier locations. But what does each site do?

Each one plays a very different role and carries a different level of risk.

But most supplier records don’t show that.

You get an address, maybe a label like “Plant #2,” and that’s it. No details on what’s being made there. No info on volume, importance, or fallback options.

Source: Veridion

This becomes a real problem when something goes wrong.

Let’s say a supplier has two locations.

One handles primary manufacturing. The other handles packaging.

A disruption at one will affect your operations very differently than the other. But if you don’t know which is which, you’re flying blind.

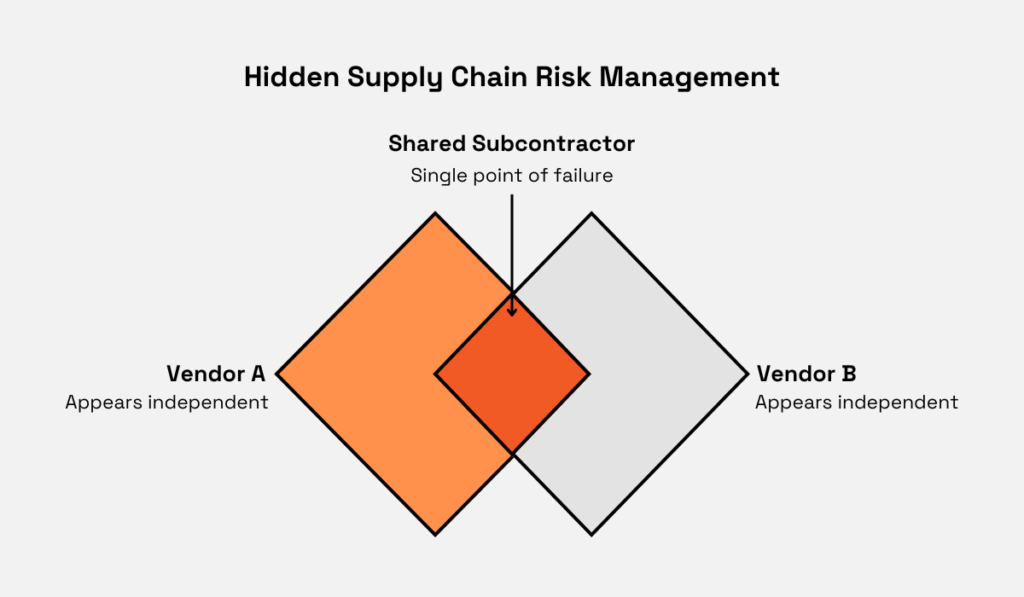

It also matters for planning.

You might think you’re double-sourcing a part, but in reality, both vendors rely on the same subcontracted plant in Slovakia.

If that site goes down, both “independent” sources are affected.

Source: Veridion

That’s why understanding address functions is just as important as collecting the addresses themselves.

You don’t just need to know where your suppliers are.

You need to know what they do there.

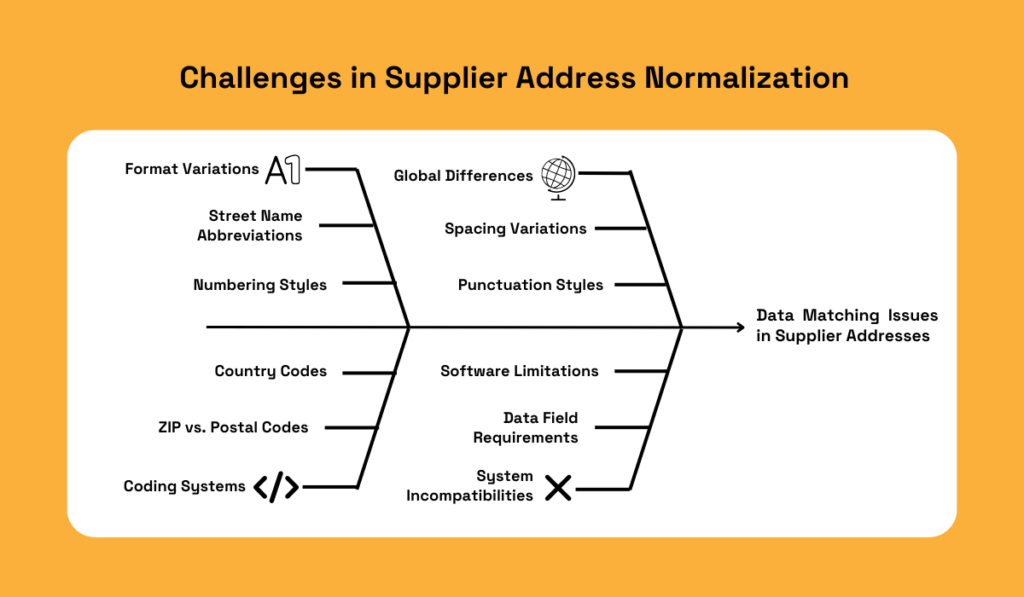

Even when you collect the right addresses and know what happens at each site, you still have one more problem: getting the data to match.

Supplier addresses come in all formats. Some say “123 Main St.” Others write “123 Main Street.”

One system uses ZIP codes, another uses postal codes. Some list full country names, while others use two-letter codes.

It’s a mess.

And when you work with global suppliers, it only gets harder.

Spacing, punctuation, and abbreviations—it all varies.

Illustration: Veridion

These small differences create big issues.

They lead to duplicate records, mismatches across systems, and breakdowns when syncing data between tools like your ERP, risk platform, or logistics software.

These issues surface most often during crises.

You try to pull a supplier map during a disruption, but the data doesn’t line up. Or you attempt a bulk compliance check, and your system flags a dozen “unknown” sites that were just entered in slightly different ways.

That’s why normalization matters.

So even after you collect supplier locations and understand what happens at each one, the job’s not done until that data is cleaned, structured, and consistent across every platform you use.

So, how can you overcome all the challenges of gathering supplier location data?

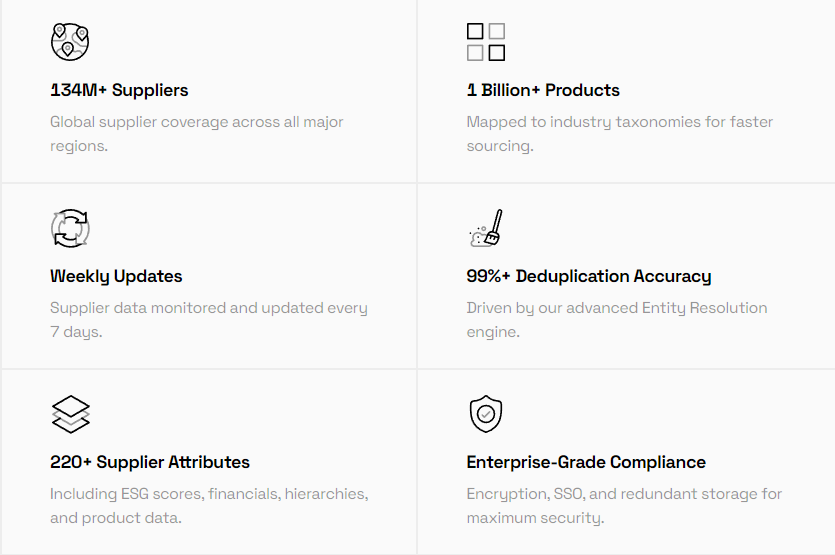

The answer is Veridion, our AI-powered data platform, built to give you structured, verified, and always up-to-date supplier information at scale.

The platform covers more than 130 million companies, maps over 400 million business locations, and spans 250+ countries.

Source: Veridion

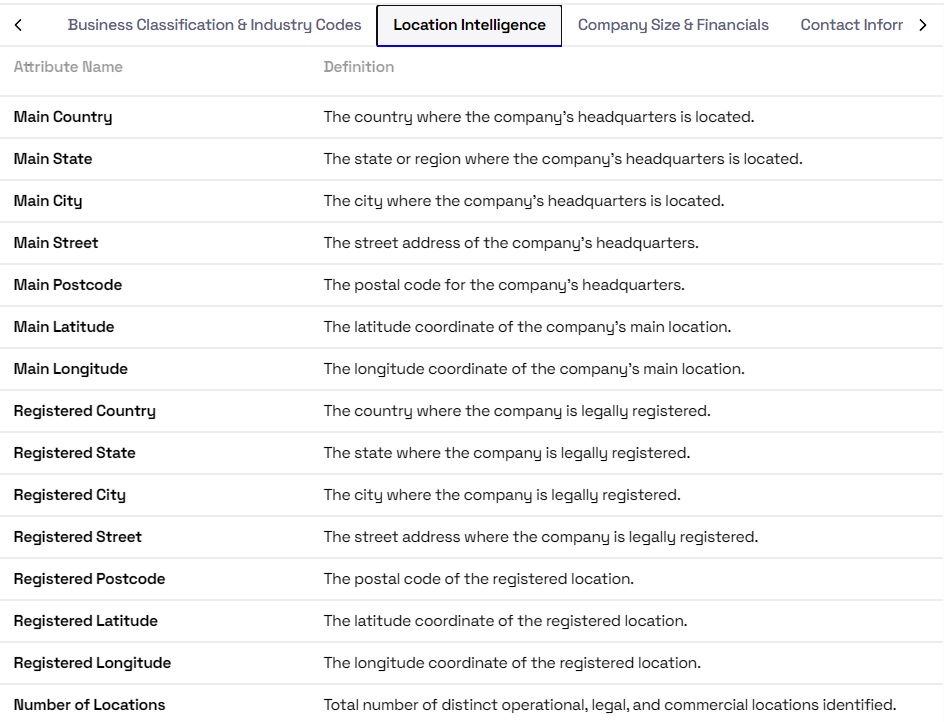

When it comes to location intelligence, Veridion goes beyond just listing addresses.

It shows what each location actually means for your supply chain.

Source: Veridion

You’ll know whether a site is a corporate HQ, a factory, a logistics hub, or just a satellite office.

You’ll know if the site is fully operational, shut down, inactive, or simply a legal registration with no real activity.

And you’ll know if it’s owned by the parent company, managed by a subsidiary, or used by a third-party partner.

Every location Veridion provides comes with context:

| Detailed classification | 100+ location types (factories, farms, offices, data centers, etc.) |

| Building-level info | Area, building structure, employee count, revenue indicators, etc. |

| Proximity insights | How close a site is to roads, rivers, ports, flood zones, and other risk factors. |

| Ownership links | Clear links between parents, subsidiaries, affiliates, and subcontractors. |

This means you’re not just getting location data.

You’re getting full operational intelligence.

Here’s how we make that possible with the 4-Layer Methodology:

| Step | What We Do | Why It Matters |

|---|---|---|

| 1. Data Collection & Aggregation | Veridion scans billions of web pages and records every week: company websites, maps, government filings, news, social media, and more. | It finds both official and unofficial supplier sites, even the ones most systems miss. |

| 2. AI-Powered Structuring | Our models extract, classify, normalize, and enrich raw data, filling in gaps, removing duplicates, and classifying each site. | You get standardized, ready-to-use data for logistics, ESG, or risk models. |

| 3. Verification & Scoring | All data is scored for confidence and cross-checked using both deterministic and probabilistic methods. | Only high-confidence, up-to-date data makes it through. |

| 4. Ongoing Monitoring | The system refreshes every week to detect location changes, expansions, closures, or new subsidiaries. | You’re always working with the latest data, so nothing slips through unnoticed. |

This structure gives you a real, working view of your supply base.

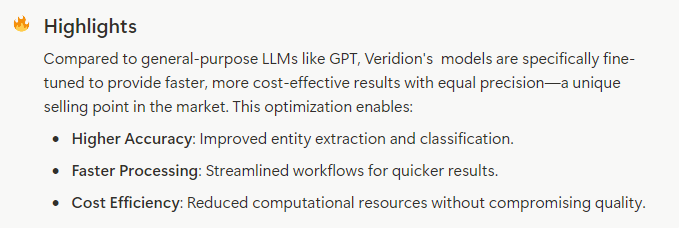

Unlike most tools that rely on generic, open-source models, Veridion uses custom-trained algorithms built specifically for supplier address data.

These models handle incomplete formats, eliminate duplicates, resolve inconsistencies across regions, and accurately classify each location.

The result is faster, more reliable, and more scalable location intelligence, ready to power logistics, risk, ESG, and compliance workflows without manual cleanup or guesswork.

Source: Veridion

In a recent test, Veridion identified over 21,000 additional business sites in a sample area compared to a leading provider and achieved a 97.2% match rate across nearly 10,000 companies.

So, while other platforms give you a few addresses and hope they’re accurate, Veridion gives you a structured, real-time map of where suppliers operate, what those locations do, and how they connect.

This means you aren’t just getting a dot on a map. You’re getting the full story behind it: who’s there, what they do, who they belong to, and whether it’s worth your trust.

That’s how you stop relying on assumptions and build real supply chain visibility.

It’s not the supplier you know that causes the problem. It’s the one you didn’t know existed.

A warehouse left out of your system, a factory not flagged as high-risk, or a subcontractor no one tracked.

That’s where delays begin, where compliance breaks, and where money leaks out.

But when you know exactly where your suppliers operate, and what each site does, you stay in control.

You move faster, plan smarter, and cut risk.

That’s what real supplier location intelligence looks like.