6 Tips for Integrating ESG Goals into Your Business Strategy

Key Takeaways:

Consumers, regulators, and investors are increasingly demanding that companies prioritize the environmental and social impacts of their supply chains.

This is best achieved by integrating ESG goals into your business strategy.

But how do you ensure your company’s ESG efforts go beyond words?

In this article, we’ll walk you through six practical tips to help you weave ESG priorities into your strategy and drive real impact.

Before you can integrate ESG goals into your business strategy, you need a clear picture of where your company stands today.

Does your organization already apply some ESG practices, such as reducing emissions, promoting diversity and inclusion, or ensuring ethical supply chain management?

If so, how are these policies implemented, tracked, and measured?

Understanding your current ESG status is the essential first step.

It helps you identify gaps, set priorities, and align ESG goals with the areas where your company can make the most meaningful impact.

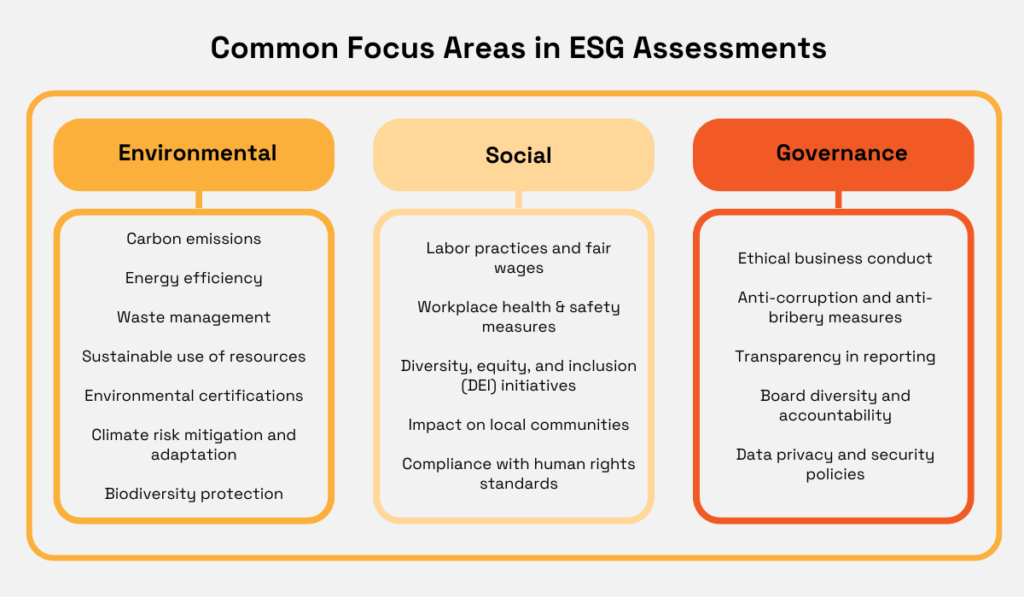

As a reminder, here are the key focus areas typically covered under ESG frameworks:

Source: Veridion

In essence, assessing your current status across ESG dimensions means conducting a full or partial materiality assessment, depending on what you’ve already done.

This process helps organizations identify the ESG issues that are most relevant to their operations, long-term success, and key stakeholders.

As Mark Thomas, President of Escoute Consulting, explains:

“Think of the materiality assessment as a guide or blueprint for ESG strategies.”

Conducting one typically involves extensive internal and external data gathering to evaluate which issues truly matter.

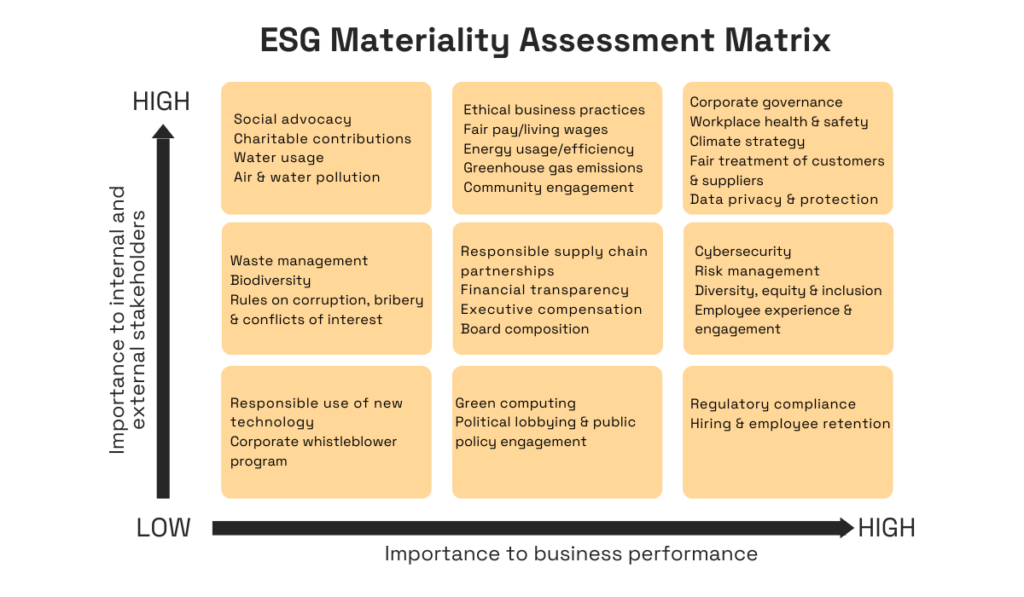

The findings are often visualized in a matrix that plots the significance of ESG topics to stakeholders on one axis and their impact on business performance on the other.

Here’s an example of what that might look like:

Illustration: Veridion / Data: TechTarget

Such matrices help identify ESG topics that matter most to both stakeholders and business performance, which is an important step toward a broader double materiality assessment.

The term double materiality refers to evaluating two dimensions:

To complete a full double materiality assessment, organizations often go further by quantifying their external environmental and social impacts alongside financial considerations.

Once you’ve assessed your current ESG position, the next step is to set clear, SMART goals and embed them into your corporate governance framework.

Integrating ESG goals into your corporate governance is essential for ensuring accountability and delivering lasting impact.

To achieve this, your company’s board and C-suite must do more than endorse ESG values.

They need to actively lead efforts to shape goals, set policies, and embed ESG into strategic decision-making.

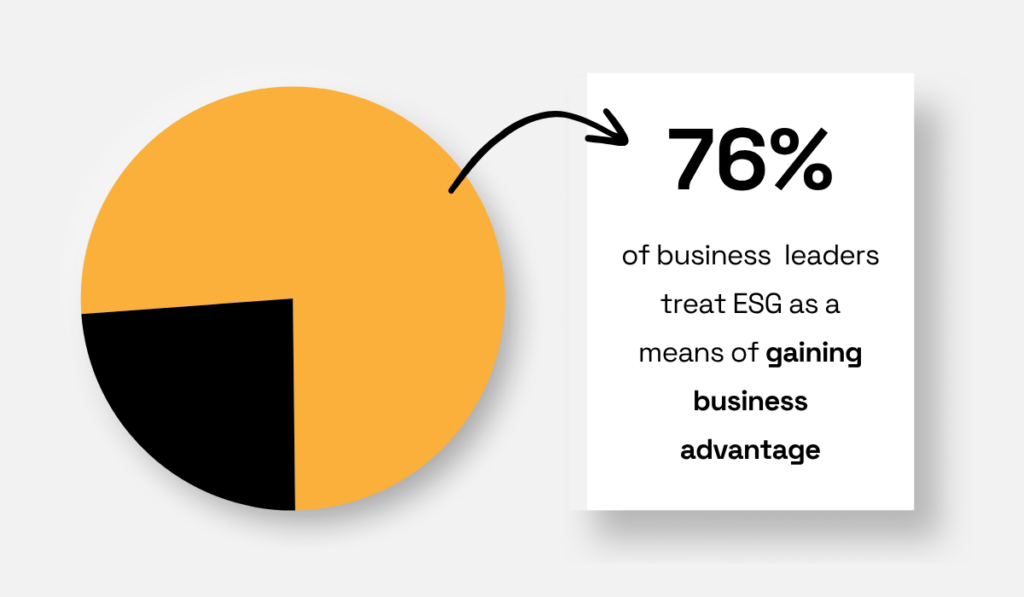

Fortunately, many corporate leaders already recognize the value of ESG integration.

A recent survey of over 500 sustainability leaders across the US, UK, France, and Germany found that 76% see ESG as a key driver of business advantage.

Illustration: Veridion / Data: Sweep

This widespread recognition of ESG’s business value can serve as a strong starting point for building management buy-in.

But that’s just the beginning.

To turn intent into action, organizations need to embed ESG principles and priorities into a robust corporate governance framework.

That means defining clear roles and responsibilities at every level—from the boardroom to operational teams—to ensure ESG goals are integrated into strategy, policies, and day-to-day decisions.

A well-structured governance model also provides the foundation for effective ESG data collection, monitoring, and reporting.

Here’s how ESG goals, ownership, and data governance typically take shape:

Source: Veridion

Of course, this structure reflects a common model for large enterprises.

In reality, governance setups vary across companies depending on factors like size, industry, and regulatory environment.

For instance, smaller organizations may not have dedicated ESG committees or sustainability teams.

Instead, ESG responsibilities might be combined with other roles or managed through ad hoc working groups.

The same applies to ESG risk management.

In many companies, risk assessment, monitoring, and mitigation are handled jointly by sustainability teams, risk officers, compliance, and legal departments.

Regardless of structure, many organizations centralize ESG accountability under a Chief Sustainability Officer (CSO).

This is confirmed by the same survey mentioned above:

Illustration: Veridion / Data: Sweep

While CSOs often lead the charge, the variety of responses highlights that turning ESG goals into action is, by definition, a team effort.

More precisely, integrating ESG into your business strategy requires close cross-functional collaboration across key departments, including procurement, finance, legal, operations, and marketing.

Ultimately, these teams operationalize ESG goals in everyday decisions, policies, and processes.

They’re also the ones who need to make sense of ESG data and translate it into meaningful action.

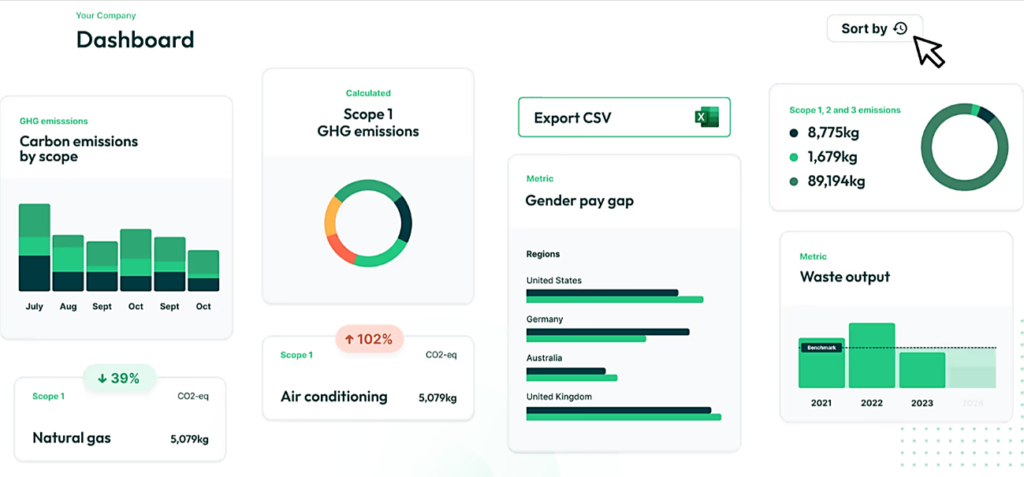

Collecting and organizing ESG data is essential for turning ambition into action.

High-quality data enables sound internal decisions, ensures credible external reporting, and helps you track progress toward your ESG goals.

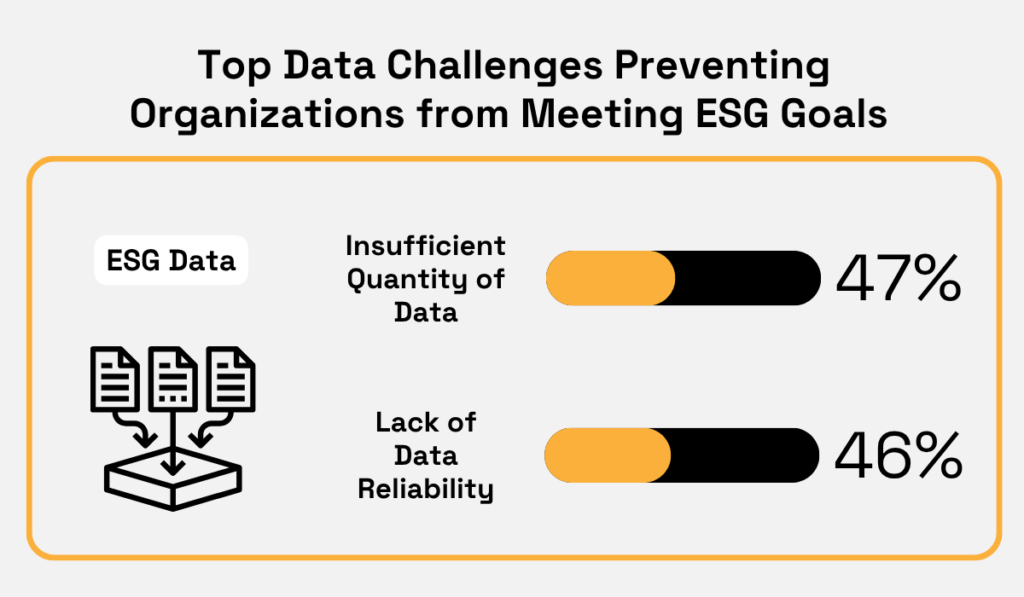

But getting the right ESG data is no easy task.

Many organizations find it difficult to collect reliable data from across their operations and supply chain, and even harder to combine it into one trusted source of truth.

A recent D&B survey reveals the top data obstacles holding companies back:

Illustration: Veridion / Data: BusinessWire

These ESG data management challenges, along with data silos, inconsistent standards, and reliance on outdated sources, expose companies to risks ranging from regulatory non-compliance to reputational damage.

Yet, there’s a clear upside.

81% of respondents said their data-driven ESG strategy increased profit, while 79% credited ESG data insights with revealing growth opportunities.

A critical first step is centralizing ESG data across operations, supply chains, and reporting frameworks.

Often, companies already hold much of this data in ERP, HR, or supplier systems.

They just need to organize, enrich, and make sense of it before feeding it into an ESG management tool like the one shown below.

Source: KEY ESG

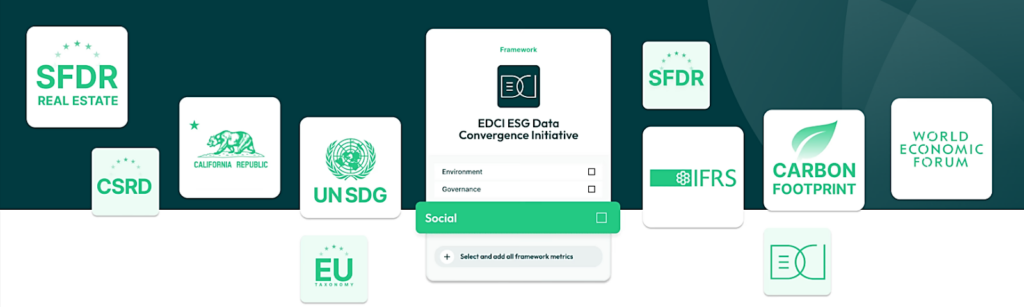

ESG management solutions enable you to visualize, analyze, and calculate key ESG data points.

With standardized, reliable data, you can track ESG goal progress and ensure compliance with a range of reporting frameworks.

Source: KEY ESG

Of course, the real challenge is aggregating fragmented data from internal and external sources, filling gaps (e.g., supplier ESG data and Scope 3 emissions), and ensuring data accuracy.

As we’ll discuss next, third-party data, including insights into regional and supplier-specific ESG risks, is essential for selecting the right partners on your company’s ESG journey.

Choosing the right suppliers and partners is critical to maintaining your company’s ESG credibility.

Even the best internal policies can fall short if your supply chain includes partners who don’t meet ESG standards.

One recent example highlights how damaging that can be.

Dior came under scrutiny when Milan-based, Chinese-owned suppliers forced workers to sleep in the factory and endure excessively long hours.

Source: Forbes

Although Dior was not found criminally guilty, the company was placed under judicial administration for a year due to negligence in monitoring its suppliers’ working conditions.

Cases like this show why ESG-aligned supplier selection and continuous monitoring—through proper due diligence, clear codes of conduct, and regular audits—are essential.

But identifying compliant, reliable partners at scale is no small task.

Given the complexity and volume of supplier ESG data, manual collection and analysis can be prohibitively time-consuming and prone to error.

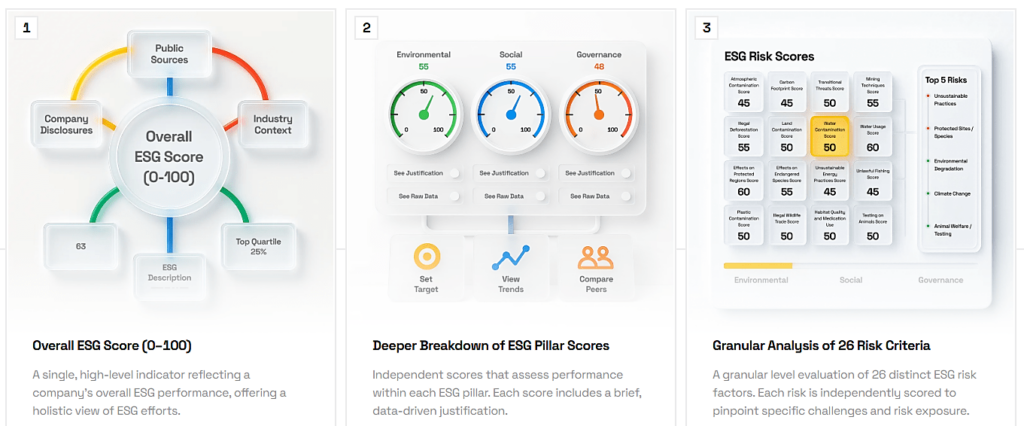

That’s where supplier intelligence platforms like our Veridion come in, helping you identify and select suitable suppliers based on their ESG performance.

Veridion provides three distinct layers of ESG scoring, as shown below:

Source: Veridion

From an overall ESG score to a detailed breakdown of 26 risk criteria, Veridion delivers up-to-date insights into supplier performance, refreshed every week.

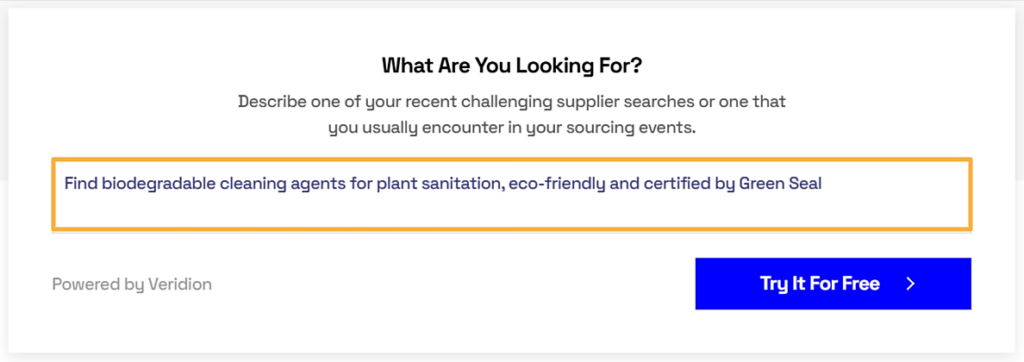

In addition, Veridion’s AI-powered supplier discovery tool, Scout, lets you search for ESG-compliant suppliers using natural language.

You can quickly find companies that meet both traditional requirements and ESG standards in just seconds.

To illustrate, here‘s an environmentally-focused search:

Source: Veridion

This search returned over 1,000 companies in just a few seconds. You can then filter results by region, production capacity, and other relevant criteria.

What sets Veridion apart is its global data coverage.

Its algorithms scan the entire web, so the platform includes companies with an active online presence anywhere in the world.

The bottom line is clear:

To choose partners that align with your ESG goals, you need reliable, current supplier ESG data, and the right tools to manage it efficiently.

Rather than viewing ESG as just a compliance exercise or cost center, companies are increasingly harnessing it as a catalyst for innovation.

ESG goals can inspire new business models, circular economy initiatives, low-carbon product lines, and sustainable service offerings.

This mindset helps businesses stay ahead of regulatory demands while unlocking new growth opportunities.

For example, supplier diversity programs have become a powerful source of ESG innovation, with 46% of organizations naming supplier-led innovation as their biggest advantage.

Illustration: Veridion / Data: JAGGAER

Driving ESG-focused innovation requires the right internal structures.

Many companies set up dedicated innovation challenges, ESG-focused R&D, or supplier programs that incentivize sustainable breakthroughs.

Early Supplier Involvement (ESI) is another powerful approach.

It involves engaging suppliers early in product design to tap into their technical expertise and drive ESG-oriented process improvements.

A standout example is the collaboration between Dow and P&G.

Source: Packaging Dive

These two companies partnered to develop a proprietary recycling technology that processes hard-to-recycle plastic waste, contributing to lower carbon emissions and a more sustainable supply chain.

To amplify the impact of such initiatives, companies should integrate ESG goals into their core innovation strategy, set measurable targets, and reward teams for ESG-related ideas.

Lastly, promoting these initiatives helps strengthen brand value and shows customers, investors, and employees that ESG creates real business value.

Traditionally, many companies have treated ESG as a costly compliance exercise rather than a true business advantage.

To change this perception among key stakeholders—management, employees, and investors—you need to quantify the business value of your ESG initiatives.

This means demonstrating clear links between ESG efforts and financial outcomes, such as:

The stakes are high.

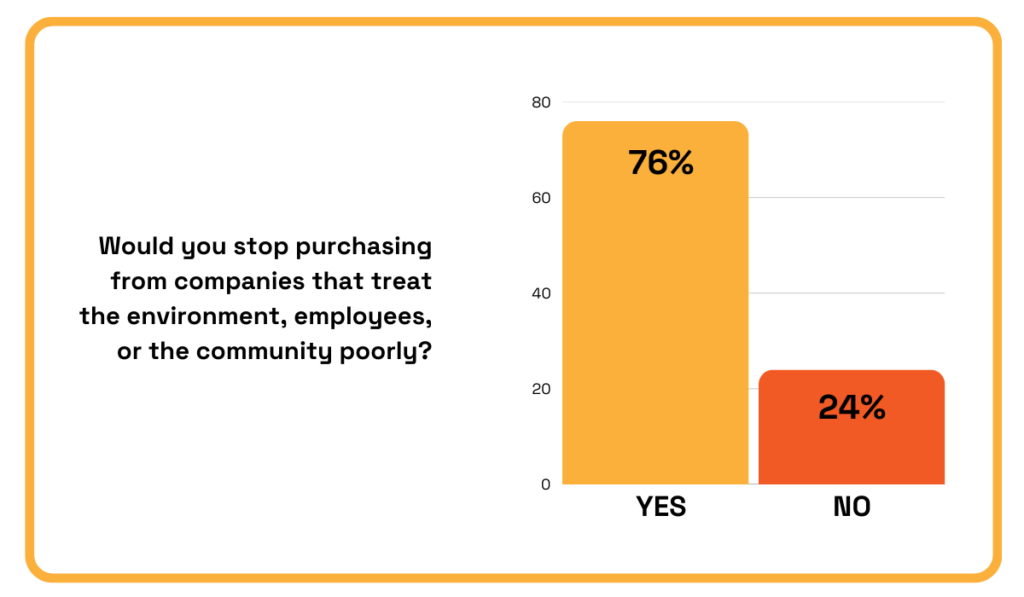

A PwC survey showed that 76% of consumers would stop buying from companies that violate ESG principles.

Illustration: Veridion / Data: PwC

In other words, ESG is no longer optional in the eyes of your customers. Falling short can directly impact revenue and brand loyalty.

But consumer sentiment is only part of the picture.

Proactive ESG risk management helps prevent costly disruptions and protects your brand reputation.

Strong ESG programs also enhance investor confidence, attracting capital from funds that prioritize sustainability.

Perhaps the most compelling case for ESG lies in its financial returns.

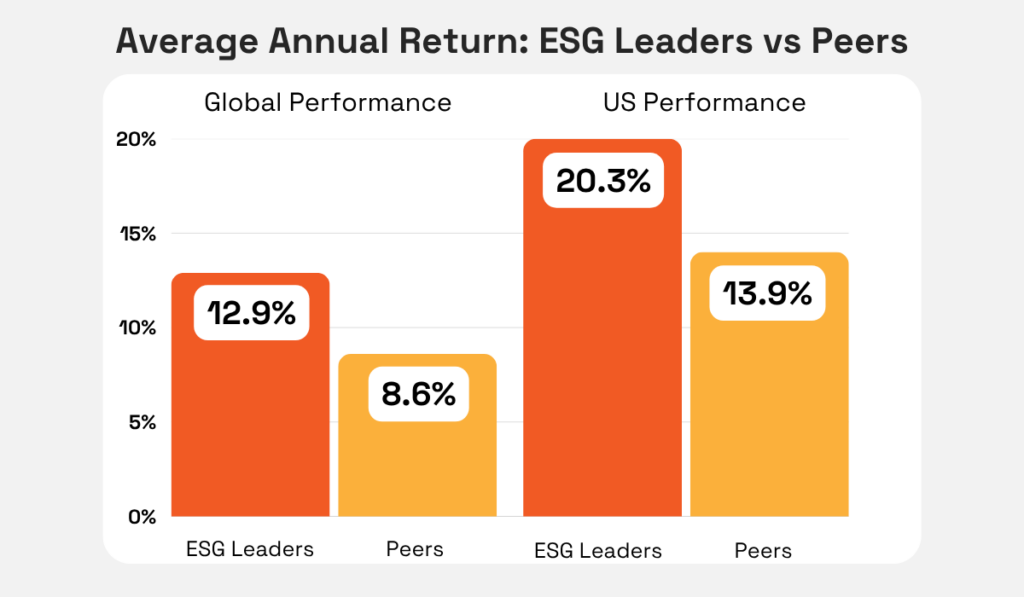

A 2023 study by consulting firm Kroll found that companies with high ESG ratings consistently outperform their peers.

Illustration: Veridion / Data: Kroll

As shown, companies with strong ESG ratings enjoy a 4.3% higher average annual return globally, and an even greater 6.4% advantage in the US.

While the study doesn’t pinpoint all the sources of these gains, factors like government grants, green bonds, and ESG-linked loans likely contribute.

These financial incentives help offset the costs of ESG initiatives, making them even more attractive.

Ultimately, by quantifying ESG’s business value, you send a clear message to management and stakeholders:

ESG isn’t just a moral imperative; it’s also a smart financial strategy.

When ESG goals are thoughtfully integrated into your business strategy, they drive innovation, strengthen supplier partnerships, and deliver measurable business value.

By leveraging data and the right tools, you can turn ESG into a powerful competitive advantage—one that benefits your company, your stakeholders, and the wider world.

So, the question is no longer whether ESG matters, but how effectively your company can act on it.