How to Prove the ROI of ESG Initiatives

Key Takeaways:

A strong focus on environmental, social, and governance (ESG) principles has become a central part of modern business strategy.

While the positive impact of ESG initiatives is clear, procurement executives often struggle to justify these investments and demonstrate a tangible return on investment (ROI) to company leaders.

This article will help you tackle that challenge.

We will explore five practical methods for identifying and effectively communicating the benefits of your ESG efforts.

Let’s get started.

To prove that something has changed or improved, you first need a reference point.

So, before starting any new ESG initiative, you need to establish your baseline metrics.

This involves creating a detailed snapshot of your company and supply chain’s current performance on key ESG factors.

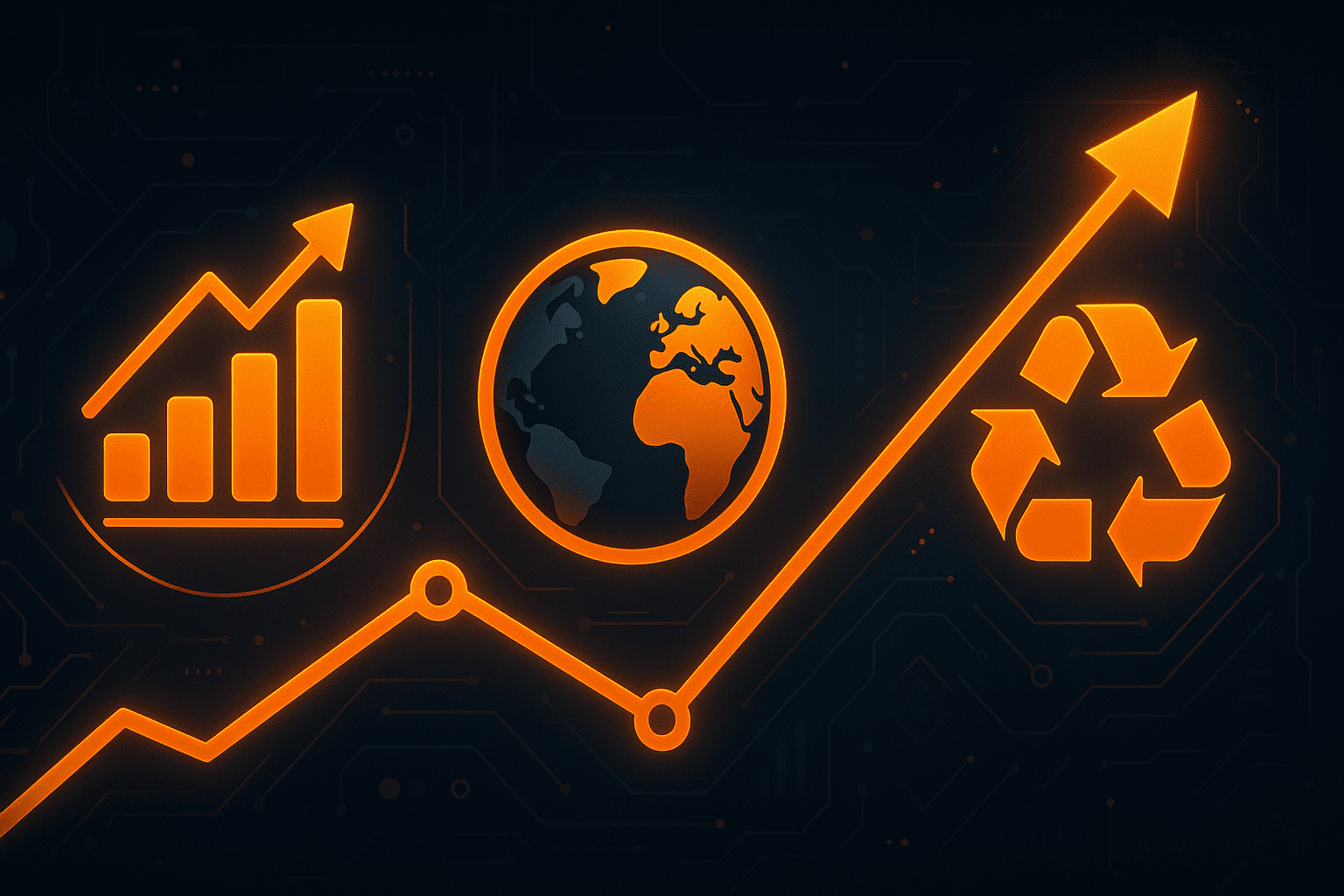

If you haven’t conducted an ESG audit recently, it is important to know what to measure.

Common baseline metrics include carbon emissions, water usage, energy consumption, waste generation, and workforce diversity.

Source: Veridion

Take Google as an example.

Faced with growing sustainability concerns and regulations, Google began tracking its carbon footprint and emissions.

This allowed the company to reduce its emissions and achieve carbon neutrality by 2007.

With this new baseline established, Google launched new ESG initiatives that led to 100% renewable energy use for its operations in 2017 and set even more ambitious goals for 2030.

To collect these baseline metrics yourself, you can use your internal systems, such as enterprise resource planning (ERP) software or detailed spreadsheets.

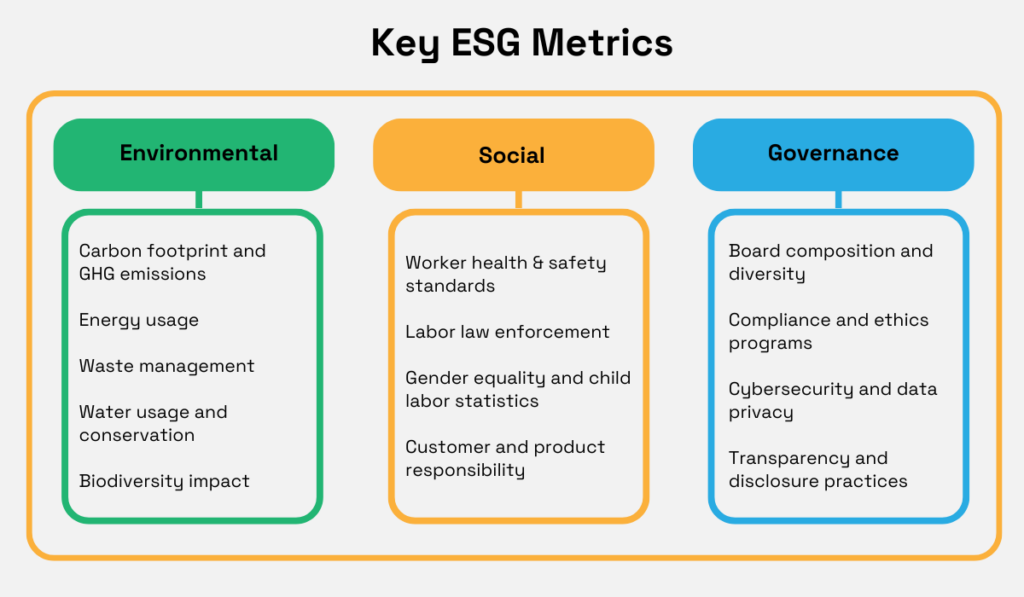

However, getting a second opinion from an external expert can be valuable.

For this, you can use third-party auditing organizations like DQS.

Source: DQS

A third-party audit provides an unbiased, external perspective on your operations.

They add credibility to your data, which can be very important when presenting your findings to executives or external stakeholders.

One challenge, however, is data gaps or inconsistent data quality from suppliers.

To bridge these gaps, you can use tools like Veridion.

Our AI-powered business data engine has in-depth information on over 120 million companies across 200 business locations worldwide, including an extensive ESG taxonomy shown below.

Source: Veridion

Veridion collects data from multiple sources, including the news, regulatory filings, government databases, social media, and other public records.

Getting your existing supplier base evaluated with Veridion is as simple as having the platform validate, deduplicate, and enrich your data with fresh supplier information, updated weekly.

Tools like these can be essential, as starting with a solid and comprehensive foundation of ESG metrics is the only way to track progress accurately.

Being thorough and granular with this initial assessment will help you accurately measure progress down the line.

Baseline metrics help track the success of your ESG initiatives, but they do not tell the entire story.

While sustainability and ethical improvements benefit everyone, executives and key stakeholders often want to see concrete financial data for any business activity.

Yet, as ESG leader Dr. Choen Krainara explains, companies often struggle with this part.

Illustration: GoCodes / Quote: LinkedIn

To get better long-term support for your sustainability and ethical efforts, you will have to turn your ESG results into financial metrics.

This is often done by using financial proxies—factors that translate non-financial ESG outcomes into hard-cash impacts.

A simple example would be focusing on improving working conditions to reduce employee turnover.

You can then calculate the financial savings by estimating the costs avoided in recruiting and training new staff.

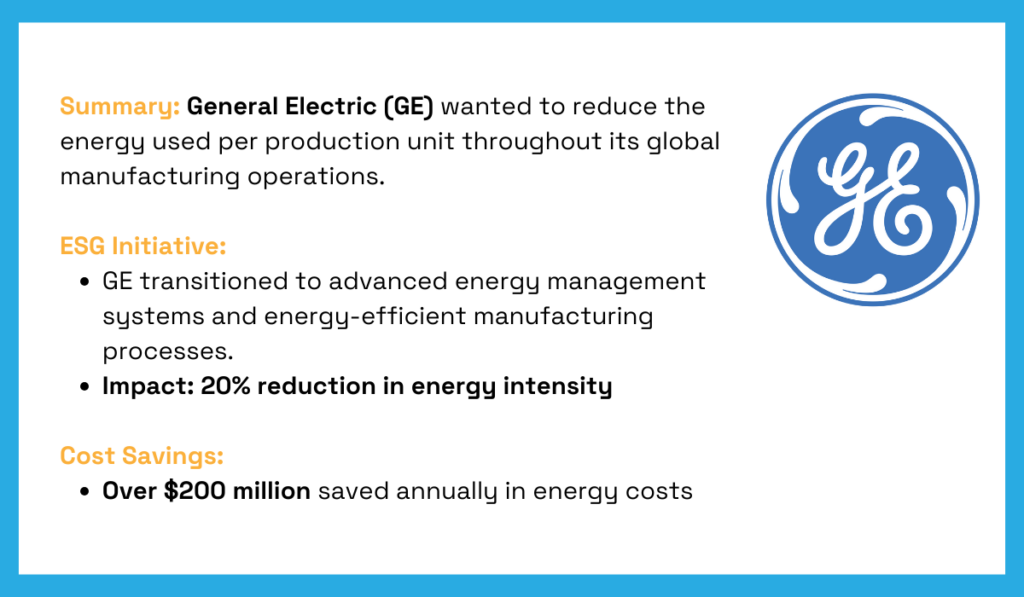

Let’s also look at a real example from General Electric.

By translating a metric like “energy intensity” into the company’s actual energy bill, GE was able to show exactly how much money it saved.

This made it much easier to justify the initial investment in their ESG initiative to reduce energy use.

Illustration: Veridion / Source: EOXS

It’s worth pointing out that while direct money savings are great, you need to differentiate between direct and indirect value attribution.

Take a look at the table below, showing the impact of positive improvements in the three ESG metrics.

| Metric | Direct Impact | Indirect Impact |

|---|---|---|

| Energy consumption (environmental) | Cost reduction on utility bills | Stronger brand reputation and ability to charge a premium price |

| Worker rights violations (social) | Potential cost avoided in fines and legal costs | Higher productivity and lower absenteeism |

| Board diversity (governance) | No immediate impact | Better decision-making, risk mitigation, greater innovation |

Some ESG initiatives, like reducing energy use, generate direct cost savings.

Others, such as improving worker practices, act as preventive measures that avoid potential costs like fines and legal fees while also improving employee satisfaction and productivity in the long run.

Finally, governance or social factors like board diversity may not have any immediate financial impact.

Still, they can lead to significant future benefits, such as an enhanced brand reputation, improved innovation, or better access to capital from ESG-focused investors.

When building your ROI case, consider both immediate cost savings and long-term value creation.

Demonstrating how your ESG initiatives reduce risk and create sustainable growth will make your business case far more compelling.

Translating ESG into finance metrics will naturally need the help of finance teams.

After all, they are the experts in financial modeling and analysis, and their involvement ensures that your ROI calculations are both accurate and credible to leadership.

Plus, as Amy Rojik, managing partner of BDO USA, explains, integrating sustainability initiatives into a company’s overall cost management practices is essential.

Illustration: Veridion / Quote: BDO

For instance, instead of simply cutting costs across the board at the first sign of a slowdown, finance teams included in ESG analysis can help move beyond short-term ESG cost and find its true financial significance.

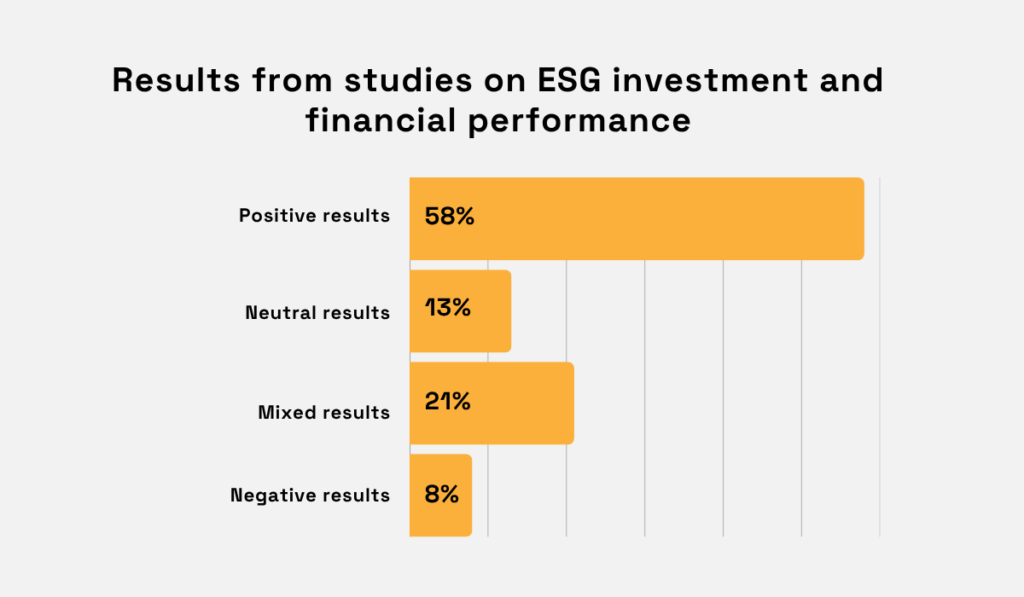

The good news is that ESG initiatives overwhelmingly produce positive financial performance results.

NYU Stern analyzed over 245 different studies on the relationship between sustainability initiatives and financial performance.

Below are the results for the corporate studies.

Illustration: Veridion / Source: NYU Stern

As you can see, the results are overwhelmingly positive, as more than half of all studies showed positive effects of ESG projects on corporate finances.

However, the study also noted that these financial benefits tend to become more significant over a longer timeframe rather than immediately.

Therefore, you will want your CFOs and finance teams to carefully integrate your ESG initiatives into the long-term budgeting process.

This is important for planning future investments and properly monitoring financial gains over several years, ensuring that immediate pressures don’t cause you to miss out on long-term value.

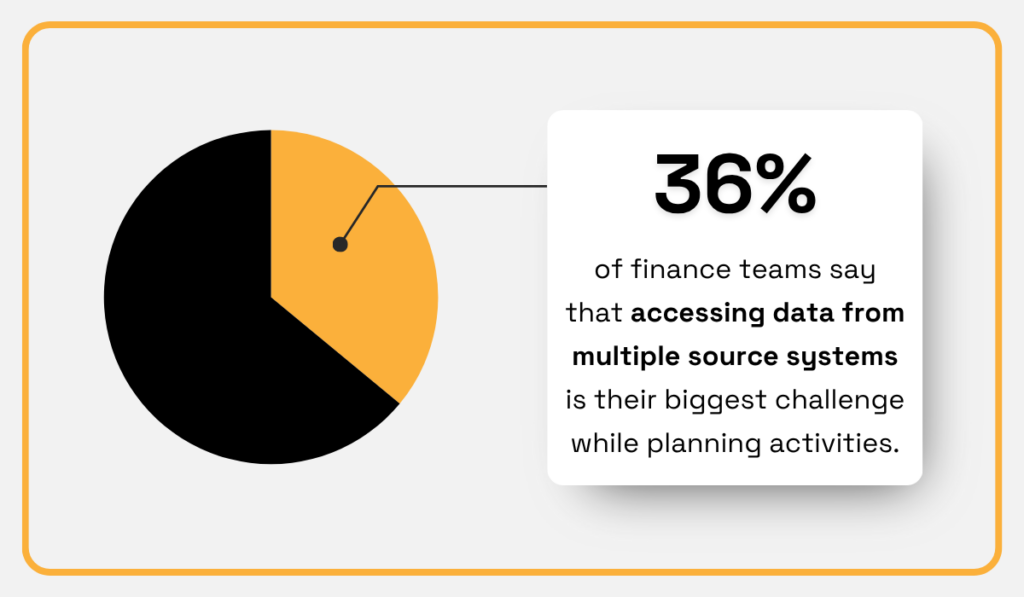

For this collaboration to be effective, finance teams need access to all relevant ESG data.

This is easier said than done, as more than a third of finance teams say siloed data is one of their biggest challenges.

Illustration: Veridion / Data: Vena

When finance teams are included from the start and have full visibility of your ESG metrics, they have all the necessary data beforehand.

This will give them enough time to properly quantify the ESG impact in business terms, validate your ROI calculations, and ensure that all reporting aligns with investor expectations.

In short, including your finance teams adds structure, consistency, and credibility to your ROI reporting.

It ensures your ESG results are translated into the financial language that drives strategic business decisions.

To successfully prove the ROI of your ESG initiatives, you need the right data insights, presented in an easily digestible way for stakeholders.

Unfortunately, even in scenarios where companies have excellent sustainability programs, their ESG tracking and reporting practices often remain poor.

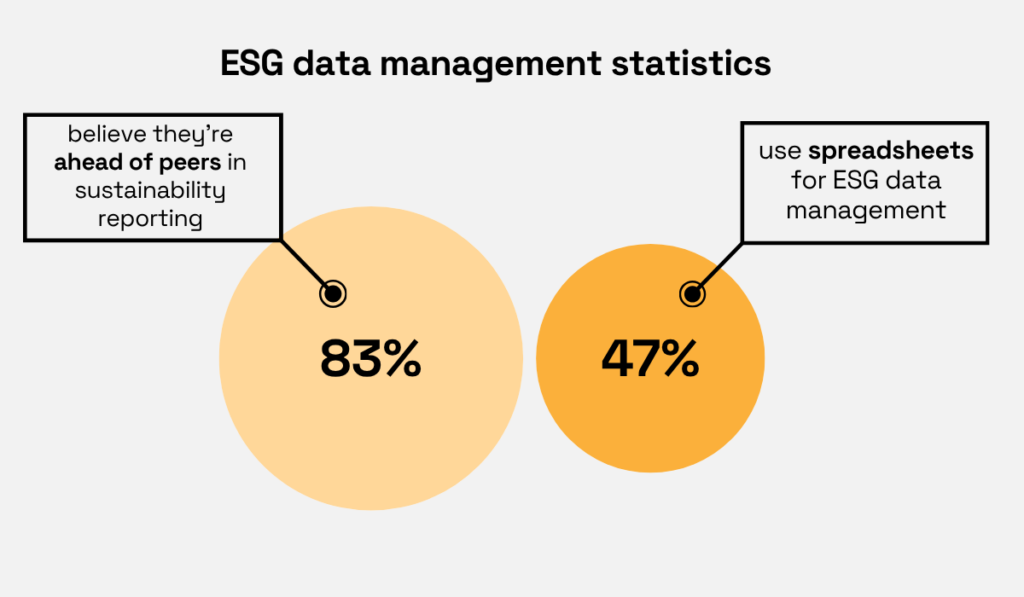

A 2024 KPMG sustainability survey explores this topic in more depth.

The study involved 550 board members, executives, and managers from public and private companies with revenues exceeding $1 billion, primarily in North America and Europe.

The results showed that while most companies believe they are better than their peers in sustainability reporting, almost half still use spreadsheets to manage this complex process.

Illustration: Veridion / Data: KPMG

It is very important to fix this gap in your own organization by implementing dedicated software solutions.

After all, modern ESG management and analytics systems are excellent for collecting reliable data from various sources, tracking progress against your goals in real-time, and even generating new insights that would be hard to discover using traditional methods.

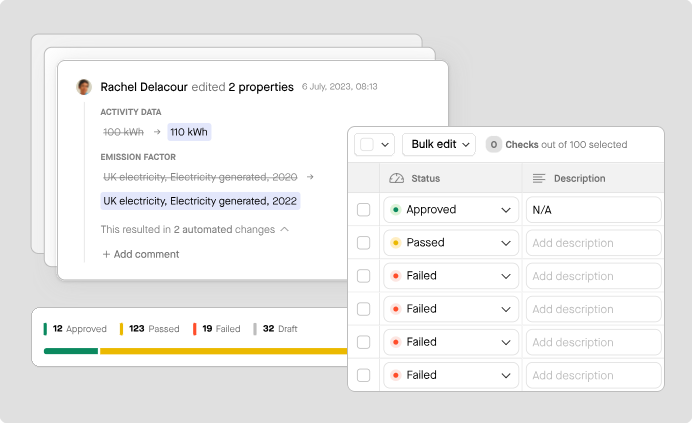

Take the platform Sweep, as an example.

Among its offerings, Sweep helps you manage and track all of your ESG data in one place and enables simplified ESG disclosure for regulators and investors.

Source: Sweep

When all of your ESG data is centralized, platforms like this have features like audit-ready reporting templates, emissions forecasting, and real-time compliance tracking to help assess whether you’re meeting complex ESG requirements.

But even beyond just simplified reporting, software can help you get more out of your data.

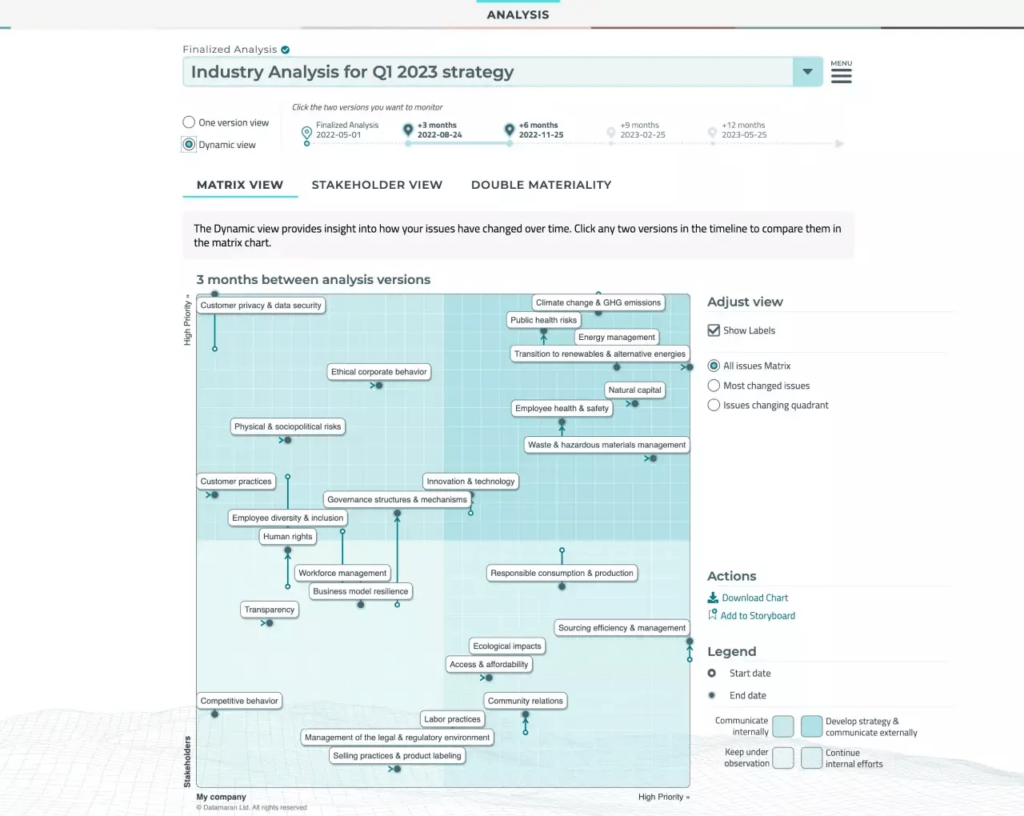

Platforms like Datamaran can go deeper and give you a detailed analysis for your ESG strategies, even helping you prioritize the key next steps your organization should take.

For example, the image below shows Datamaran’s ESG risk analysis report and priority matrix.

Source: Datamaran

Assessing your key ESG metrics through powerful analytics features like these enables more confident, data-backed decision-making and elevates your insights from simple observations to strategic recommendations.

Ultimately, the right tools make it significantly easier to build a clear, compelling, and credible business case for the ROI of your ESG programs.

While internal ESG analysis is crucial, comparing your performance to external benchmarks can add significant credibility to your efforts and provide essential context for your results.

Plus, they are extremely helpful for seeing where you can improve your initiatives.

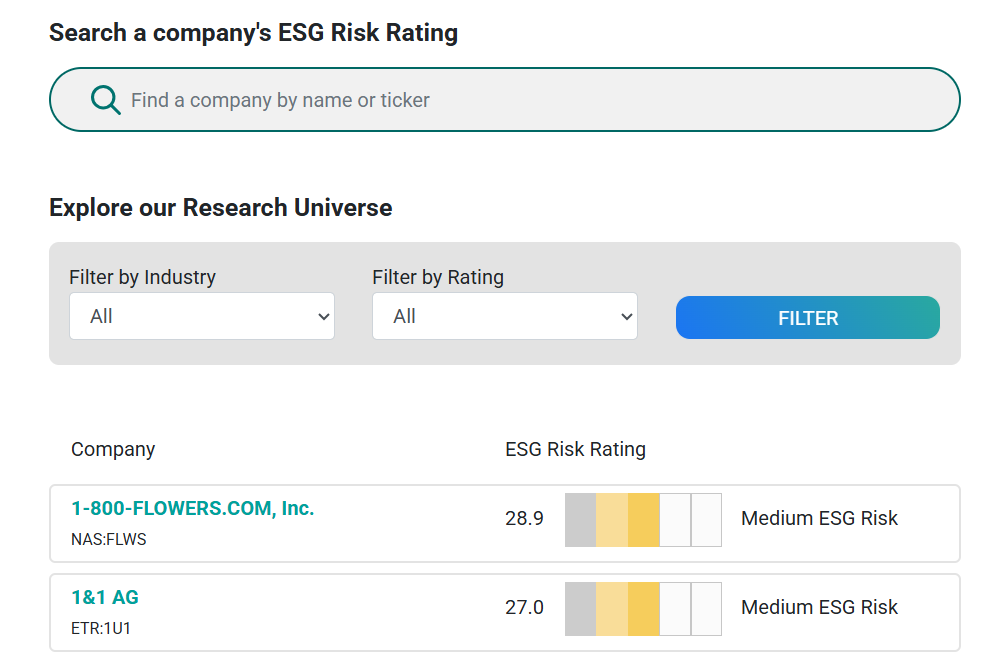

For example, Sustainalytics, a company that rates the sustainability of listed companies, has an ESG risk rating feature where you can search for companies by industry.

See how this looks in the image below.

Source: Sustainalytics

Comparing your company to others in the same industry is a great way to understand how you perform on industry-specific challenges and helps you set realistic goals for your own programs.

You can also benchmark more broadly.

Mitch Jones, Director of Market Strategy at Sustainable1, an S&P Global resource for ESG insights, comments on this idea.

He explains that with some types of ESG scoring, you can compare your company’s performance across different industries.

Illustration: Veridion / Quote: LinkedIn

This kind of cross-industry comparison can be great for external validation, showing how your company stacks up against a wider competitive landscape.

Benchmarking is also extremely important for investors.

For example, Antler, a global early-stage investor and a leader in sustainability management, requested a benchmark report from Novata to assess the ESG performance of its portfolio companies.

Source: Novata

Novata compared over 500 Antler portfolio companies against its broad ESG benchmarks.

The results showed that while Antler companies performed well in areas like data privacy and protection, there was room for improvement in Diversity, Equity, and Inclusion (DEI) and in formalizing Code of Conduct policies.

As Antler partner Rosalind Bazany noted, these benchmarks gave them “a clear view of where our companies stand and where they can push further.”

In short, benchmarking provides an objective, external perspective on your ESG performance, proving that your initiatives are not just internally meaningful but also credible on a larger scale.

Today, we explored how to set and track benchmarks for key ESG indicators and why including finance in the mix can translate sustainability efforts into a language that resonates with executives.

The key takeaway is that while proving the ROI of ESG initiatives may seem challenging, it is entirely achievable with a structured approach.

By diligently tracking ESG metrics, involving your finance team early, and comparing your results to relevant benchmarks, you can build a compelling business case.

This not only demonstrates the value of your ESG efforts to executives and stakeholders but also positions your company for long-term, sustainable success.