Where to Find Supplier ESG Data

Key Takeaways:

ESG compliance doesn’t depend only on your own operations.

To meet growing regulations and stakeholder expectations, you also need reliable ESG data from your suppliers.

Yet, finding that data isn’t always straightforward, especially when disclosures aren’t mandatory.

If you’re unsure where to start, here are seven practical ways to locate supplier ESG information and build a more responsible supply chain.

One of the simplest places to begin is the supplier’s official website.

Many mid-to-large suppliers publish sustainability or ESG reports each year, often under their investor relations or corporate responsibility sections.

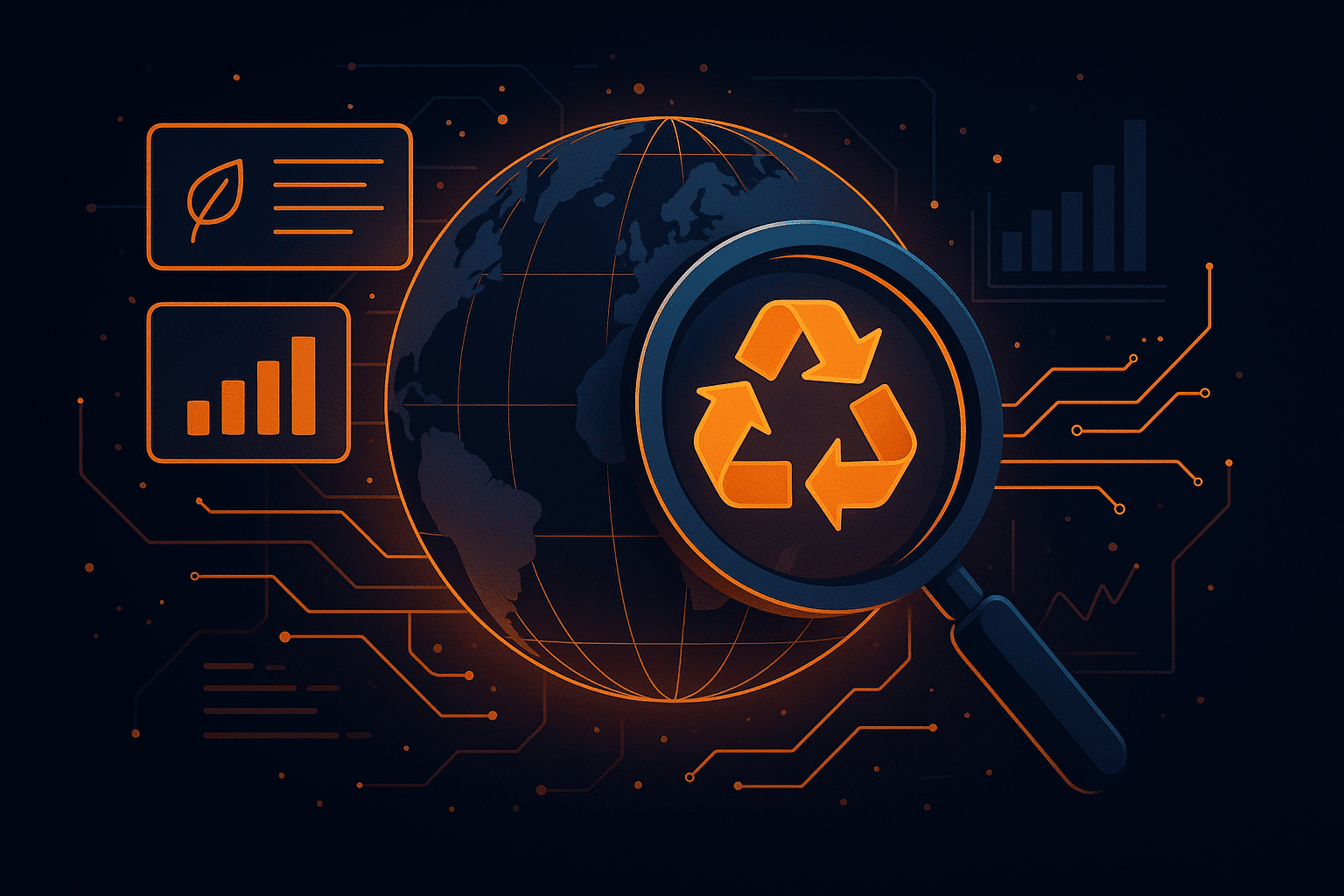

For example, BASF, a global chemicals company, provides detailed annual sustainability reports that include Scope 1, 2, and 3 emissions breakdowns, diversity and inclusion progress, and ethical sourcing commitments.

Source: BASF

As an active member of the Together for Sustainability initiative, BASF requires its suppliers to provide carbon footprint data for key raw materials to help decarbonize its upstream value chain.

This level of transparency makes it easier for buyers to assess ESG performance directly from published reports.

Smaller suppliers, however, might not release comprehensive reports like BASF does.

But they do often highlight certifications or specific environmental initiatives directly on their websites.

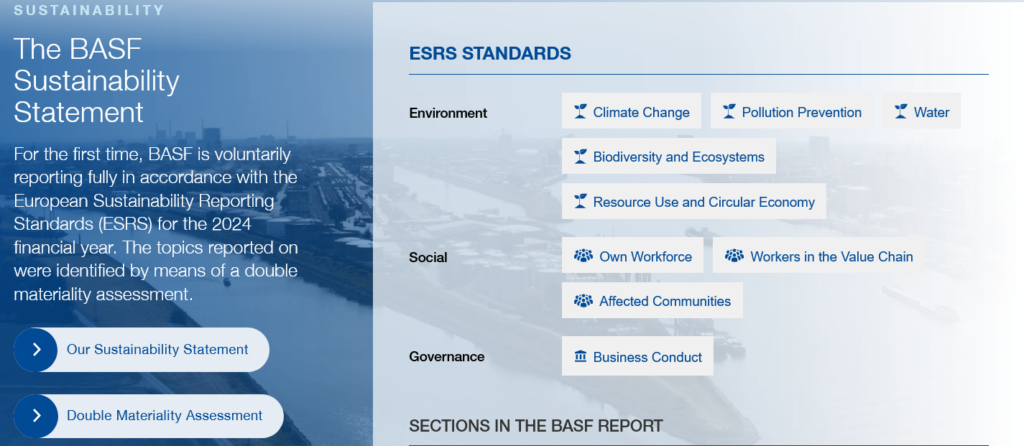

Take Lebenskleidung, for example.

This small organic textile supplier in Germany prominently displays its GOTS (Global Organic Textile Standard) certification on its homepage, along with detailed explanations of its fair trade and environmental commitments.

Source: Lebenskleidung

These types of disclosures, even if brief, provide assurance of their sustainability efforts.

But be cautious: sometimes, ESG claims on websites are overstated or misleading.

In one case outside the supplier context, BNY Mellon, a major financial services company, claimed between 2018 and 2021 that its funds underwent “ESG quality reviews.”

However, the SEC found these reviews were not conducted, resulting in a $1.5 million penalty in 2022.

Source: Reuters

While this example concerns financial products, the principle applies to supplier ESG claims as well.

If a company misrepresents its ESG processes, buyers risk regulatory consequences and reputational damage by relying on unverified data.

Another effective way to obtain supplier ESG data is simply to request it directly.

During onboarding or periodic supplier reviews, ask suppliers to share their ESG documentation.

This can include:

The most streamlined method for gathering this data is through supplier ESG questionnaires that cover all three ESG pillars.

For example, you might ask about environmental practices like waste management and energy use, social policies covering worker safety and diversity, and governance aspects such as anti-corruption policies or board diversity.

But beyond simply asking suppliers about these ESG practices, it’s important to ask suppliers to attach supporting certifications and policy documents alongside their responses.

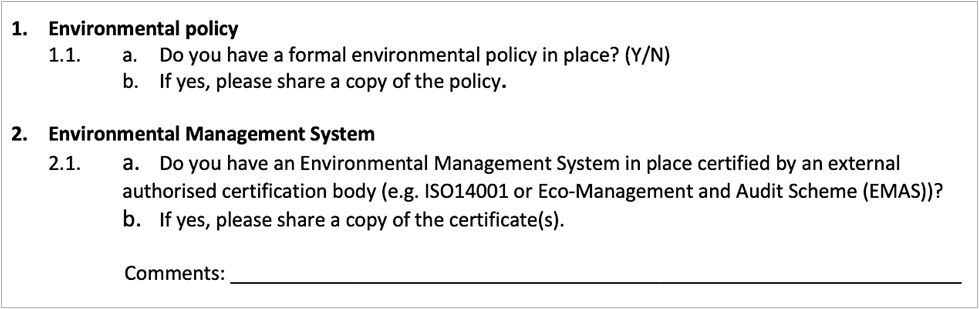

UNICEF does that in their supplier sustainability questionnaire:

Source: UNICEF

Most reputable suppliers expect these requests and have documentation ready to share.

However, it’s important to remember that smaller suppliers may lack the time or resources to complete extensive ESG surveys, particularly if they receive multiple similar requests from different customers.

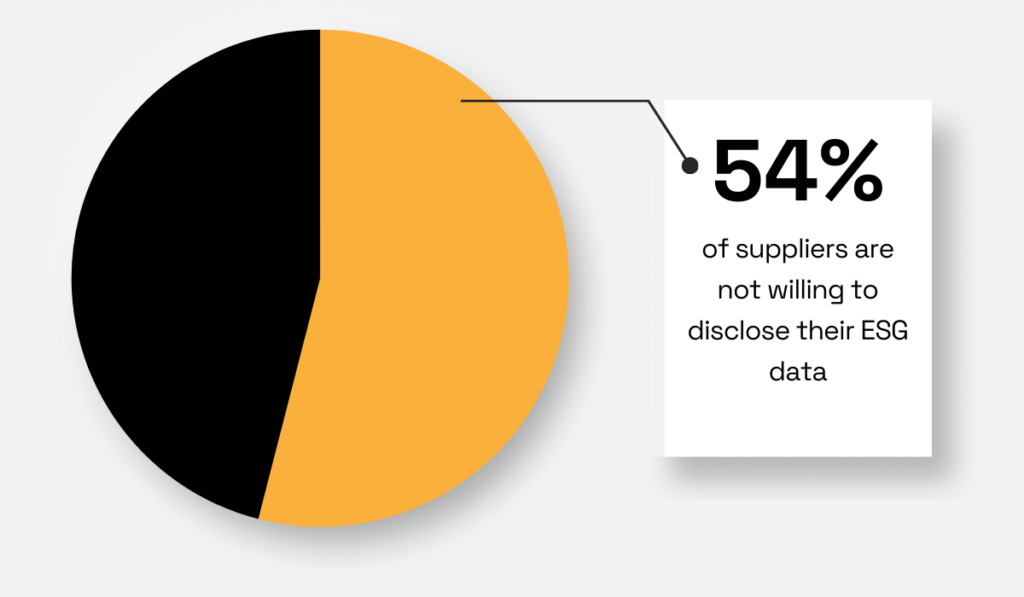

On top of that, a 2021 survey by Alcumus found that 54% of suppliers aren’t willing to share their ESG data at all, highlighting the need to approach such requests more thoughtfully.

Illustration: Veridion / Data: Alcumus

If that’s the case with your potential suppliers, there are some other methods to find their ESG data.

Beyond questionnaires and direct requests, it’s also crucial to check certifications and audit bodies.

Verified certifications such as B Corp, FSC, GOTS, ISO 14001, or RSPO can provide reliable proof of a supplier’s ESG commitments.

For example:

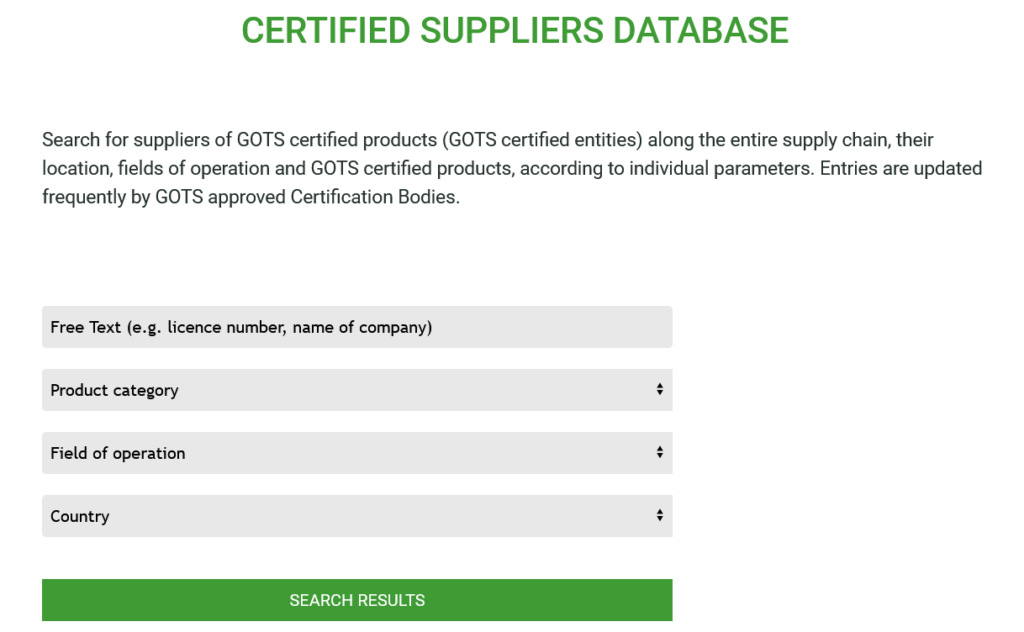

Often, these organizations have publicly available databases on the certified suppliers.

Below is an example of a GOTS-certified supplier database:

Source: Global Standard

But if you find certifications on a supplier’s website, always confirm them directly with the issuing body.

That way, you can make sure they are valid and current, as suppliers may sometimes display outdated or misleading claims.

Unfortunately, this is a frequent practice, making supplier data quality a significant challenge for procurement teams.

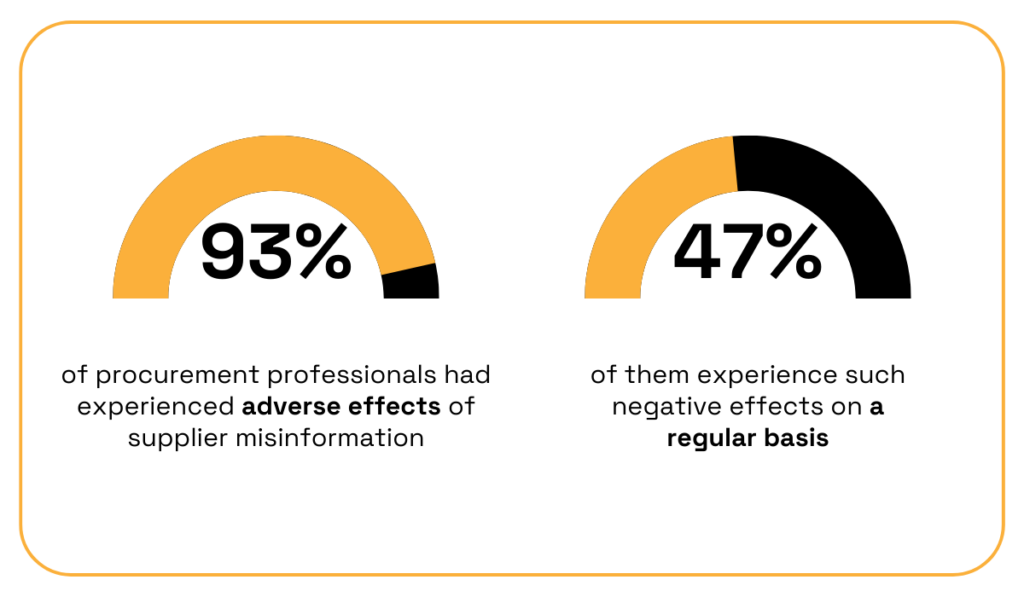

A TealBook survey revealed that 93% of procurement and supply chain leaders had experienced negative consequences due to inaccurate supplier data, with nearly half facing such issues regularly.

Illustration: Veridion / Data: TealBook

Errors or misinformation about supplier certifications can result in missed deadlines, compliance breaches, and financial losses.

When ESG regulations are involved, the stakes are even higher, potentially leading to fines, penalties, and damaged consumer trust.

For example, in 2024, LVMH-owned Dior’s production arm in Italy, Manufactures Dior, faced a major scandal.

One of its leather goods subcontractors, AZ Operations, was revealed to be a front for an operation exploiting undocumented workers in sweatshop-like conditions.

Source: Google

Despite passing multiple environmental and social audits in the preceding months, court investigations found the company effectively non-existent as a legal entity, operating outside labor laws.

This failure of certifications and audits to detect severe ESG violations led to Dior being placed under court administration, triggering reputational damage, regulatory scrutiny, and internal operational upheaval.

This is why it’s critical to verify certifications and audits, and complement them with reliable ESG data sources before relying on them for compliance or strategic decisions.

Manually checking every ESG claim from suppliers can be extremely time-consuming.

That’s why many procurement and sustainability teams rely on third-party ESG data providers to simplify this process and ensure accuracy.

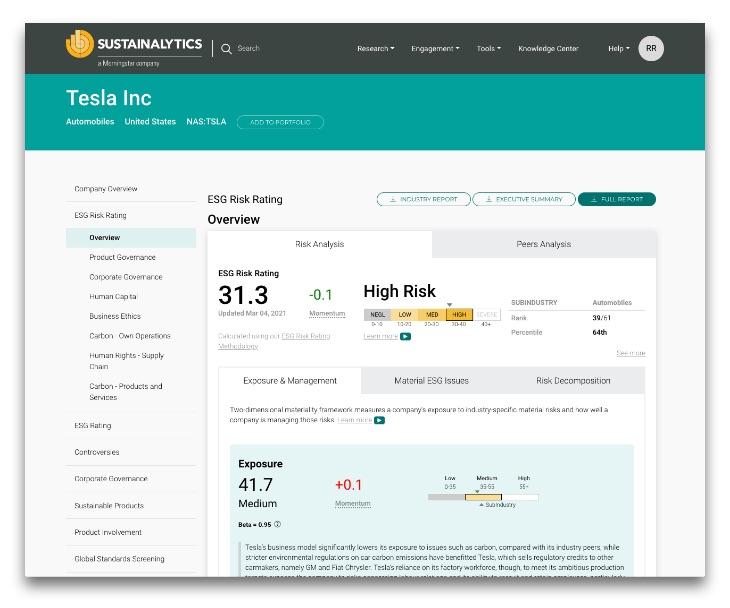

Platforms like EcoVadis, Bloomberg, Carbon Disclosure Project (CDP), Sedex, and Sustainalytics aggregate and verify supplier information from multiple sources.

They provide insights into a supplier’s performance in areas like emissions, labour rights, and governance standards, and calculate a company’s ESG risk rating.

Source: Sustainalytics

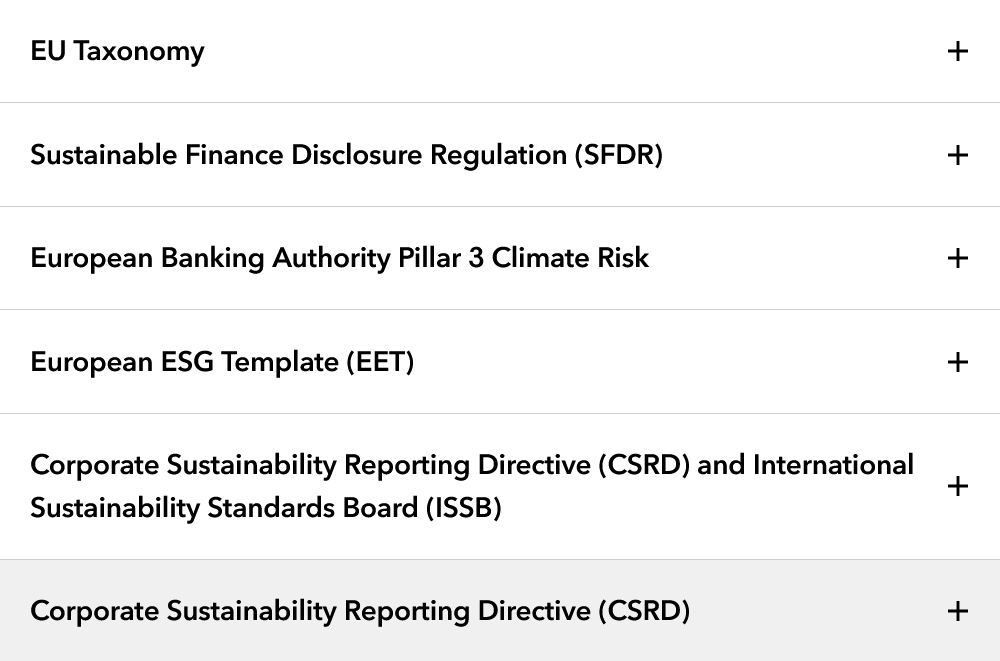

For example, Bloomberg offers ESG data that helps companies comply with regulations such as the Corporate Sustainability Reporting Directive (CSRD), the Sustainable Finance Disclosure Regulation (SFDR), and the EU Taxonomy.

Source: Bloomberg

Their Data License platform includes climate risk data aligned with European Banking Authority Pillar 3, emissions reporting in line with ISSB standards, and corporate sustainability disclosures required under CSRD.

This kind of data is tailored to meet regulatory requirements as they evolve, ensuring companies have up-to-date and compliant information.

However, the usefulness of these tools depends on what specific ESG data you need, and whether or not you want to pay for it, as one user on Reddit describes:

Source: Reddit

When it comes to free ESG data, options are limited, as another Redditor explains:

“Free ESG data is limited, but check out ec.europa.eu, Refinitiv’s open ESG portal, and Our World in Data for environmental metrics.”

In summary, ESG data providers are not free, but they are often the most efficient and reliable way to assess suppliers at scale.

And if you want to explore these platforms in detail, you can read our guide to the best ESG data providers.

Another effective way to find supplier ESG data is to review public company filings.

If your supplier is publicly listed, they are legally required to disclose certain ESG-related information in their reports and filings, which are reviewed by regulators and investors.

This makes them more reliable than informal claims or marketing materials.

For suppliers based in the United States, you can access annual 10-K filings through the SEC’s EDGAR database.

Source: SEC.gov

These documents often include ESG disclosures within risk factors or sustainability strategy sections.

This has become even more important since 2024, when the SEC adopted final rules on climate-related disclosures for investors.

Under these rules, public companies must provide information aligned with the Task Force on Climate-related Financial Disclosures (TCFD), including details on their governance, strategy, risk management, and climate-related targets and goals.

In Europe, publicly listed companies publish sustainability reports aligned with regulations like the CSRD.

These reports are usually available on their investor relations pages or through national business registers and often include:

While these documents can be lengthy and technical, they provide direct, legally accountable statements from companies.

This makes them a valuable resource when you need to verify a supplier’s ESG commitments or identify potential compliance risks before making strategic decisions.

One practical and often quick way to gather ESG information about your suppliers is by exploring news articles, industry journals, NGO reports, and professional networks.

Searching supplier names in Google News or sustainability publications can reveal ESG initiatives or controversies that might not appear in formal reports.

LinkedIn is also useful for this purpose.

By checking if a company employs sustainability-related roles like “Sustainability Officer” or “ESG Manager,” you can get a sense of how seriously they take their ESG commitments internally.

Source: LinkedIn

Beyond that, online forums and communities—such as B2B discussion groups or Reddit—offer informal but valuable insights from other professionals who may share real-world experiences about a supplier’s environmental or labor practices.

For example, one Reddit user shared their struggles sourcing genuinely ethical fabrics in the UK and uncovered widespread greenwashing, highlighting how difficult it can be to verify claims:

“I spent last year trying not to buy from forced labour and ended up deep diving into fair trade fabrics (I’m a seamstress), but found them so hard to source in the UK. I also bumped into so much greenwashing. There is a brand here called ‘Thought’ that makes bamboo socks, which they sell through fair trade stockists. When I looked into it, they didn’t have fairtrade certification, were made in China, and there isn’t necessarily a case for bamboo being especially eco-friendly.”

These less formal sources add important context and can help you spot issues before they become risks.

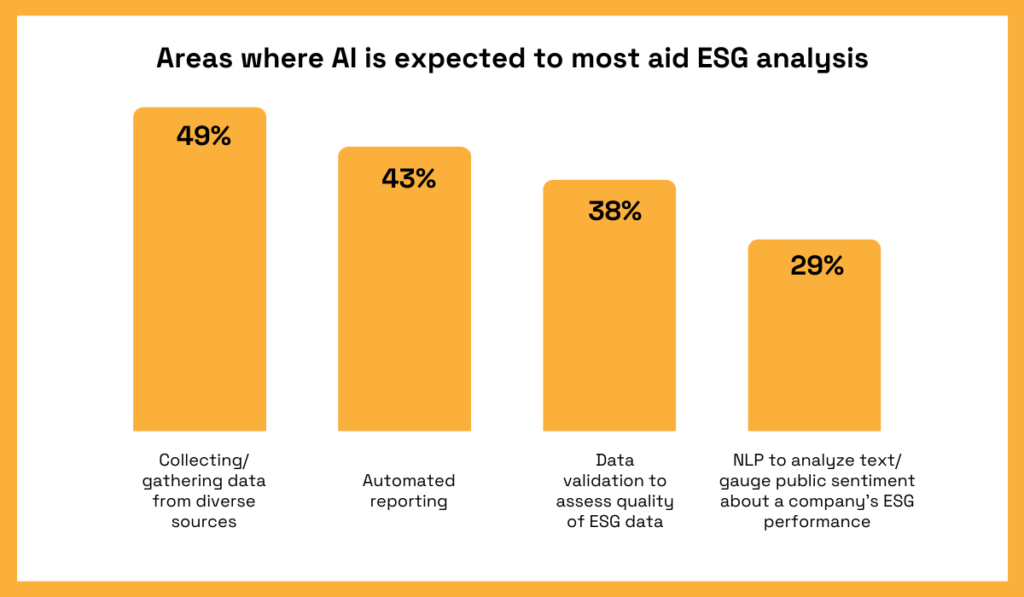

For the most comprehensive and efficient approach, AI-powered supplier intelligence platforms combine all these data streams into one.

In fact, a Capital Group survey found that 63% of businesses already use or plan to use AI for ESG analysis.

These tools automate data collection, validation, and analysis, pulling insights from diverse sources like certifications, filings, news, and audits.

Illustration: Veridion / Data: Capital Group

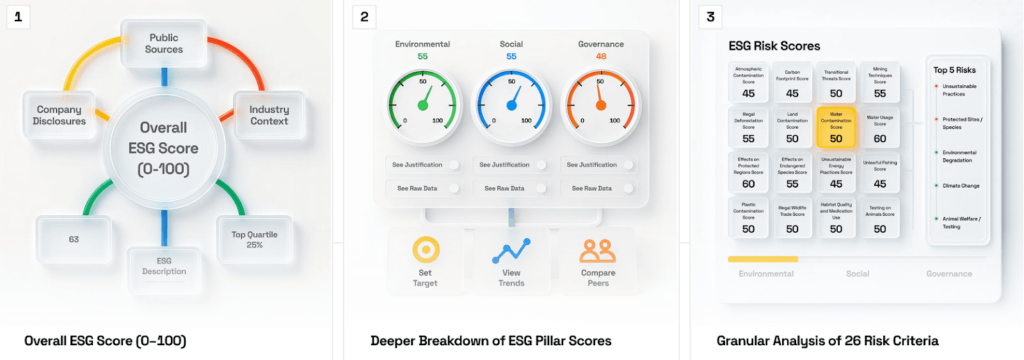

Veridion is one of the leading platforms in this space.

It uses advanced algorithms and natural language processing to gather ESG data from over 130 million companies in 250+ geographies, even when suppliers don’t publish reports.

The platform interprets not just keywords, but context, helping you understand real-world ESG performance and risks.

Each supplier profile includes more than 80 data points, from firmographics and certifications to ESG risk scores.

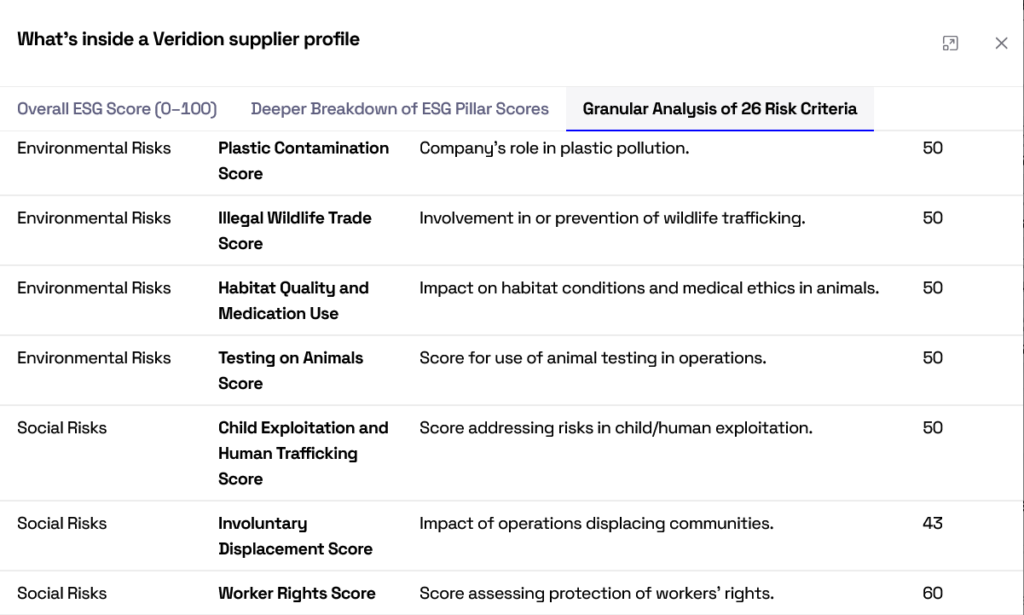

You get an overall ESG score, detailed environmental, social, and governance scores, and a breakdown of 26 ESG risk factors with supporting data.

Source: Veridion

Below is just a small part of what a granular analysis of risk criteria looks like in a supplier profile:

Source: Veridion

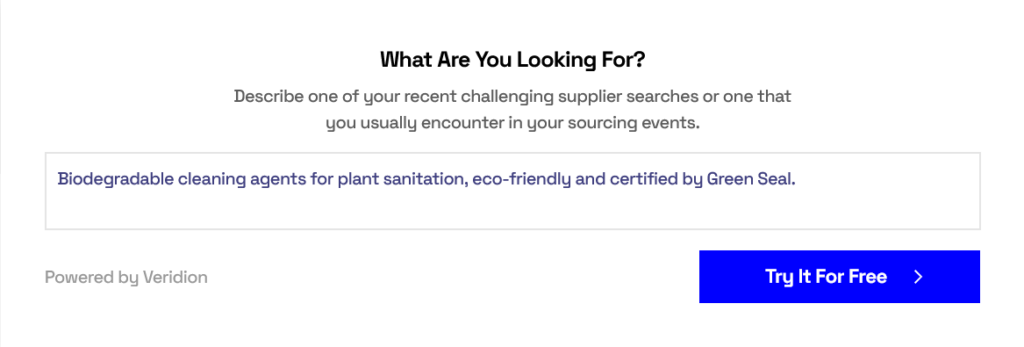

You can also search for suppliers using natural language and apply custom ESG filters upfront.

Source: Scout

This way, you’re more likely to partner with suppliers that match your sustainability goals from the start.

Veridion integrates with your existing tools, such as ERPs or SRMs, making it easier to monitor ESG risks at scale with verified, continuously updated data.

Compared to manual checks or static reports, this approach delivers broader coverage, faster insights, and far greater reliability.

Finding supplier ESG data is possible, but it’s often time-consuming and inconsistent.

From official websites to certifications and databases, each source has its limits.

That’s why more companies now rely on AI-powered platforms.

They help you uncover accurate, up-to-date ESG insights at scale, without the usual guesswork.

So, if your goal is a responsible, transparent supply chain, start with the tools that make ESG data easier to access, understand, and trust.