Keeping up With Global ESG Disclosure Requirements: A Guide

Key Takeaways:

If you’ve ever tried to make sense of ESG disclosure requirements and quickly got overwhelmed, feeling like you were staring at an alphabet soup of acronyms, you’re not alone.

The world of ESG is complex, ever-evolving, and often confusing.

So, how do you even start navigating it?

And why does it matter?

In this article, we break it all down.

Read on to learn how to stay ahead of regulatory expectations and how doing so can benefit your organization.

First, let’s take a look at what you stand to gain from staying ahead of ESG reporting requirements.

Above all else, staying on top of ESG disclosure requirements is a legal necessity.

Regulatory bodies around the world are tightening the rules, increasingly turning what were once voluntary disclosures into mandatory obligations.

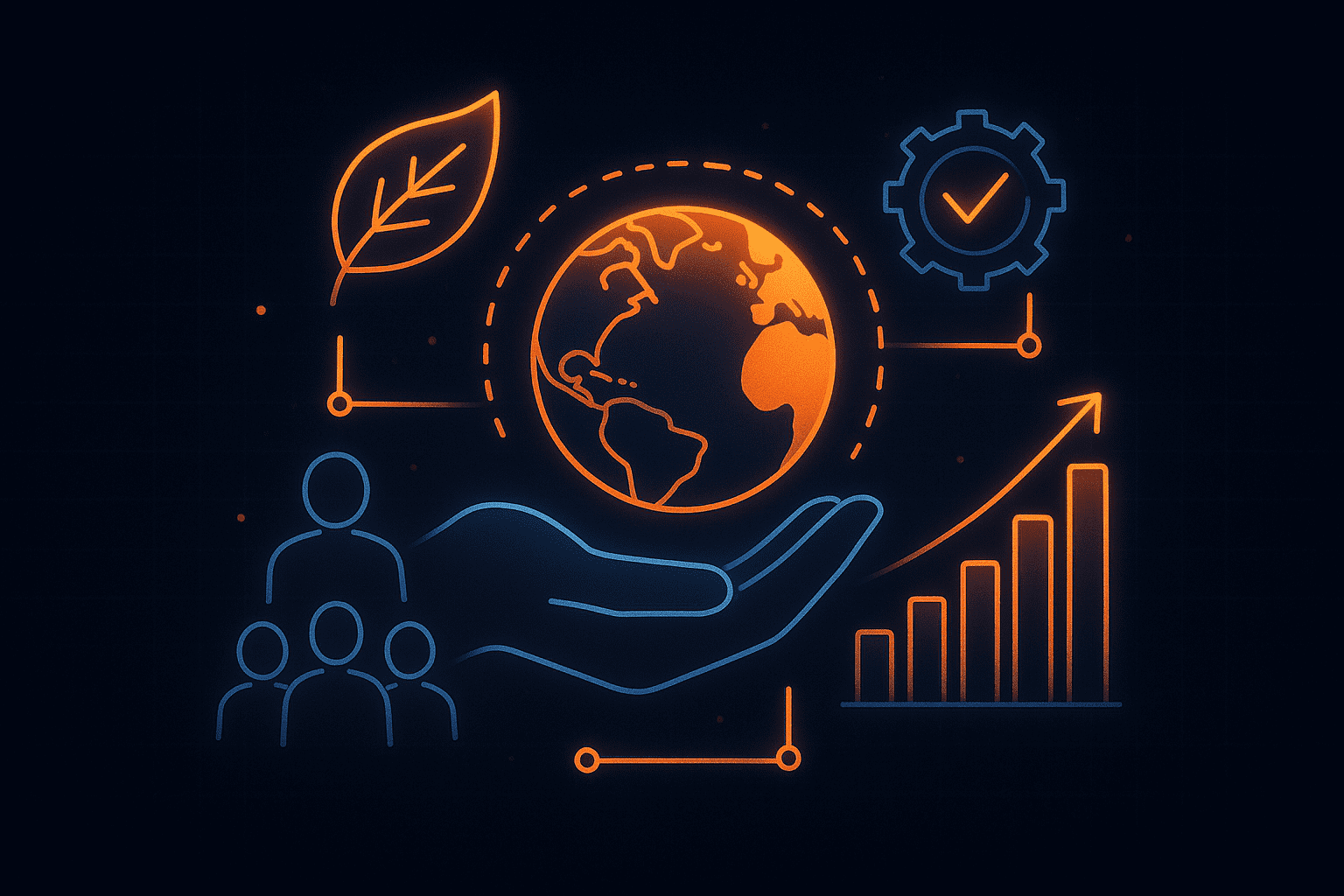

Just look at the numbers from the 2025 BARC survey. They clearly show how quickly the ESG compliance landscape is changing.

In 2023, only 38% of companies said compliance was the main reason for their ESG reporting.

Fast forward to 2024, and that number jumps to 59%.

Illustration: Veridion / Data: BARC

So, to stay compliant, you need to ensure your reporting aligns with both local and international ESG frameworks.

Fail to do so, and you might face fines, penalties, business restrictions, and even lawsuits.

These can have a major negative impact on your operations.

Take the European Union’s Corporate Sustainability Reporting Directive (CSRD), which came into effect in 2023.

The directive carries heavy consequences for non-compliance, including fines of up to 5% of a company’s net worldwide turnover, according to the World Economic Forum.

And it’s not only a European problem.

In the U.S., the Securities and Exchange Commission (SEC) is cracking down as well.

Here are just a few recent examples:

Clearly, regulators aren’t taking ESG lightly.

Whether you’re operating in the EU, the U.S., or beyond, ignoring ESG disclosure requirements could cost your company dearly in terms of profitability, reputation, and business opportunities.

The only way to stay compliant is to stay informed.

When it comes to ESG disclosures, it’s not just regulatory bodies watching.

The entire market is paying attention, including investors and consumers.

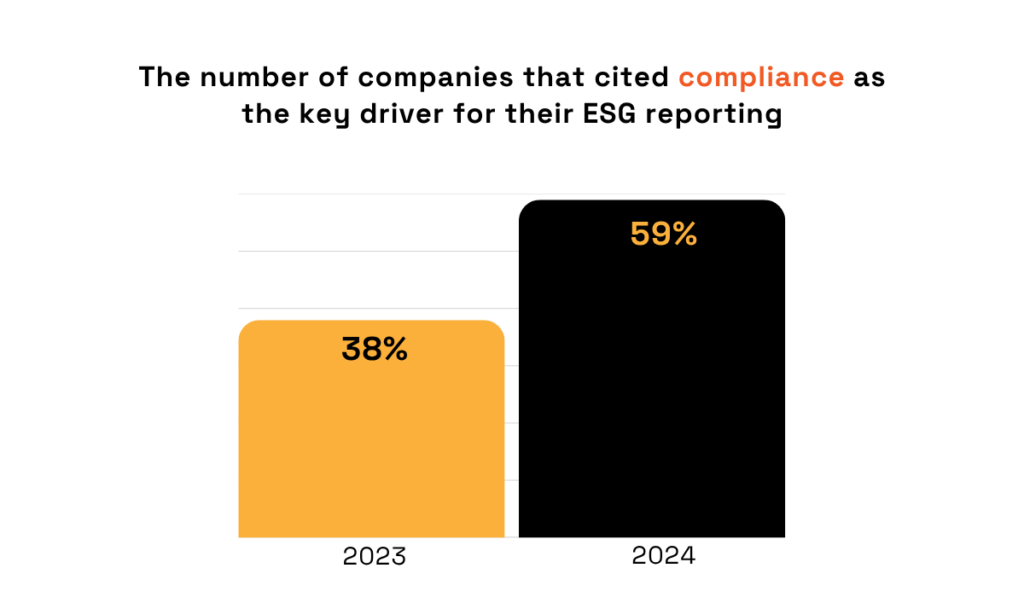

ESG performance is increasingly tied to financial performance, and institutional investors now expect detailed ESG disclosures to assess long-term value, risks, and resilience.

In fact, a 2021 PwC survey found that 75% of UK investors now factor ESG risks and opportunities into their investment decisions.

Illustration: Veridion / Data: PwC

Staying ahead of ESG disclosure requirements signals to them that your organization is reliable, informed, and aligned with evolving standards.

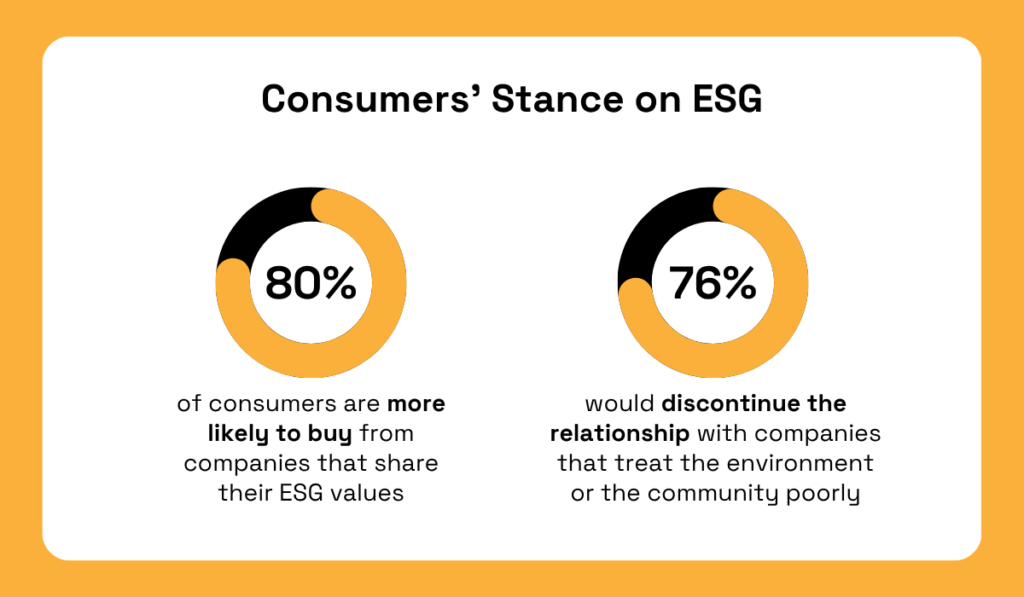

Consumers are paying close attention, too.

They expect businesses to invest in improving the environment and society, and they’re prepared to reward or penalize them accordingly.

According to another PwC research, around 80% of consumers are more likely to buy from companies that share their values on ESG issues.

On the flip side, 76% say they’ll walk away from businesses that treat employees, communities, or the environment poorly.

Illustration: Veridion / Data: PwC

In this context, transparent ESG reporting can help you build trust and brand loyalty by showing a commitment to the values your customers care about.

So, think of keeping up with disclosure requirements as a strategic move, rather than just an obligation.

Because if you do it successfully, it could help you stand out, earn trust, strengthen your reputation, and unlock some new, exciting opportunities for your company.

Many overlook the fact that proper handling of ESG disclosures doesn’t just protect against regulatory non-compliance and reputational damage.

It also helps mitigate broader operational risks.

After all, environmental or social incidents can directly disrupt business activities, leading to downtime, increased costs, or even long-term harm to a company’s ability to operate.

For example:

Being proactive about ESG disclosure requirements strengthens internal risk awareness and control mechanisms.

In a way, it forces you to identify and assess possible ESG risks, which naturally leads to stronger controls, like better planning, more thorough supplier vetting, and faster response capabilities.

Besides, ESG disclosures often include scenario analyses, helping you plan for extreme events and bolster operational resilience before any disruptions occur.

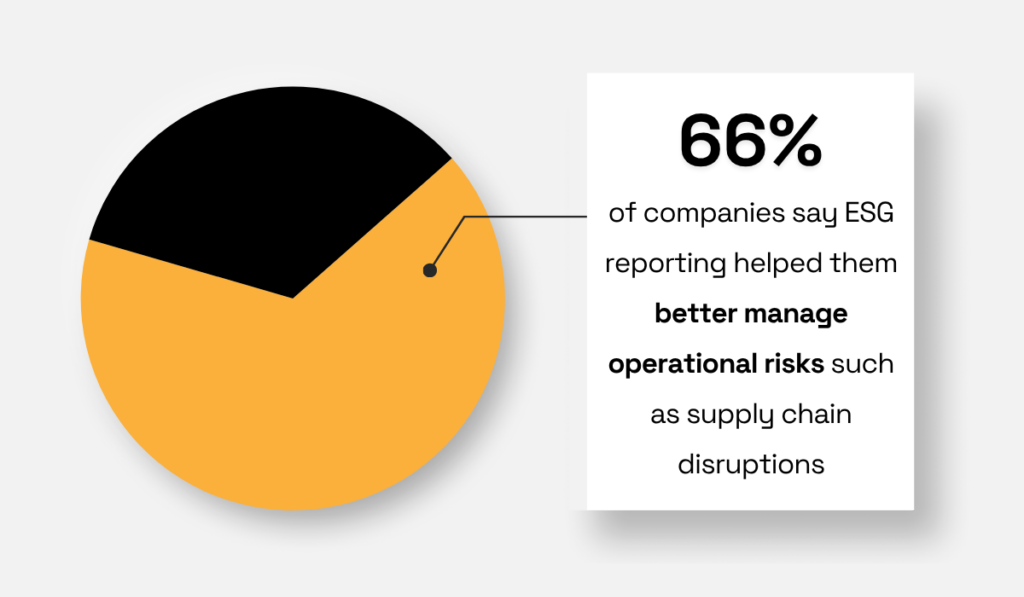

In the end, the numbers speak for themselves.

A 2025 DNV survey shows that 66% of companies agree that ESG reporting helps them better manage operational risks like supply chain disruptions.

Illustration: Veridion / Data: DNV

So while some still see ESG reporting purely as a burden, forward-thinking organizations are using it to protect their operations, strengthen brand trust, and stay ahead of the curve.

Which group are you in?

Now, let’s explore some specific steps you can take to ensure more efficient ESG reporting.

Different countries, regions, and industries have distinct ESG reporting requirements, so the very first step you need to take is to find out which regulations apply specifically to you.

This means identifying the relevant ESG disclosure rules, standards, and frameworks based on factors such as:

A good place to start is with a basic Google search.

You’ll definitely find a wealth of ESG resources online.

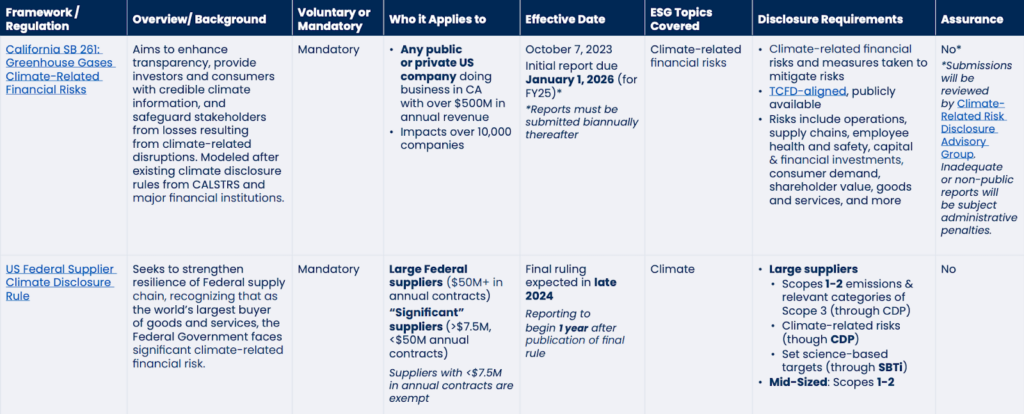

For instance, the consulting firm Point B provides an excellent overview of key frameworks and standards across the U.S., Europe, and other regions.

It breaks down key info like scope, background, whether the disclosure is voluntary or mandatory, who it applies to, effective dates, and more.

Here’s a small portion of that overview:

Source: Point B

As you can see, it’s pretty thorough—and a great place to begin.

After you identify the regulations likely to apply to your organization, you can start building a centralized ESG rulebook for your company.

Be sure to record each regulation’s scope, timelines, and reporting formats, and prioritize based on impact and implementation deadlines.

Once you know what applies to you, you’ve already tackled a significant portion of the work.

You’ll be aware of what’s expected of you and of the steps to get you there, which will give you more confidence going forward.

Having a cross-functional team with clearly defined roles spreads the workload and strengthens accountability across the organization.

As a result, staying on top of ESG disclosures becomes much easier and more efficient.

Alex Hardwick, Director of Sustainability Planning & Enablement at Cority, an EHSQ software provider, agrees that an ESG team is a must.

He offers some advice:

Illustration: Veridion / Quote: Cority

As a result, Hardwick maintains, you get a team of individuals connected to professional and industry bodies who can help catch updates one person might miss.

When assembling your ESG task force, be sure to include representatives from various departments for a more well-rounded perspective.

After all, sustainability reporting is inherently cross-functional. It impacts nearly every area of the business.

Here’s how different functions contribute:

| Sustainability and Corporate Responsibility | Provide insights into company-wide sustainability initiatives and practices |

| Human Resources | Supply data on employee welfare policies and programs |

| Legal and Compliance | Monitor regulatory obligations and reporting requirements |

| Information Technology | Identify, gather, and analyze both existing and new data streams |

| Supply Chain | Report on responsible sourcing and supplier practices |

| Finance | Align ESG metrics with financial disclosures and reporting standards |

For the best results, try to embed ESG into daily operations.

It shouldn’t feel like extra work, but a part of company culture.

Evgeny Tretyakov, Audit Director at KPMG LLP in Singapore, advises:

Illustration: Veridion / Quote: LinkedIn

In other words, tie ESG to what already matters to your teams.

When people see ESG reporting as part of their job—not a side project—it becomes easier to manage, track, and improve.

Engagement goes up, results follow.

If you feel that doing your own research or assembling an internal team might not be enough, especially in the beginning, you can always turn to external expertise.

After all, the world of ESG requirements is incredibly complex.

Engaging ESG consultants, legal experts, or auditors can help you interpret all these regulations, validate your reports, build strategies that actually work, and more.

Here are some of the services you can typically expect from an ESG consultancy:

Source: SLR

However, choose your partners wisely.

ESG is a rapidly growing field, and many new consultants are entering the market.

Joel Bradbury, Senior Consultant at Source, a provider of intelligence focused on professional services, elaborates:

Illustration: Veridion / Quote: Financial Times

With this increased demand comes variability in quality. Not all consultancies are equally well-versed in current or emerging regulations.

So, when selecting a consultant, look for these key qualities to minimize risk:

| Certifications | A firm with relevant industry certifications and familiarity with a range of ESG reporting frameworks is more likely to meet your needs. |

| Client stories | Proven results and case studies are a good sign of credibility. |

| Extensive experience | Look for a strong track record in environmental initiatives and ESG consulting. It’s also important that their own ESG practices are up to standard. |

| No overpromising | Be cautious of consultants who guarantee fast results or simplified solutions. |

By finding a reliable and experienced consultant, you’ll be doing yourself a favor.

It’ll save you significant time, reduce risk, and help you stay compliant without losing your mind.

It’s definitely a smart way to begin your ESG disclosure journey on solid footing.

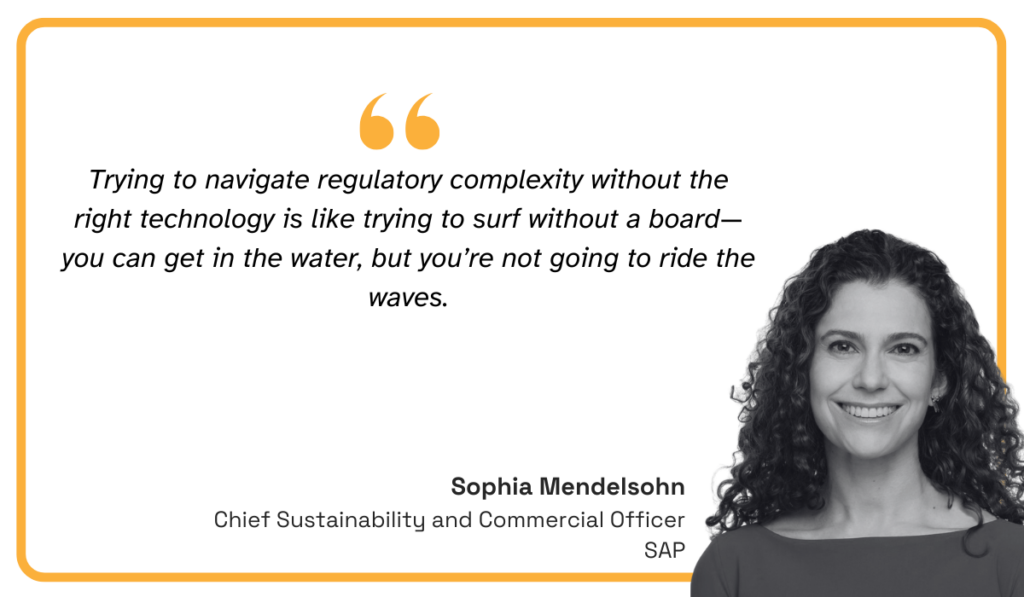

Technology plays a major role in managing complex ESG data and disclosures efficiently.

It automates many time-consuming, complex tasks, like data collection, compliance tracking, and reporting, boosting overall efficiency, accuracy, and transparency.

Sophia Mendelsohn, Chief Sustainability and Commercial Officer at SAP, puts it perfectly:

Illustration: Veridion / Quote: Sustainability Magazine

One of the digital ESG reporting essentials is ESG compliance software.

It is designed specifically to support the tracking and reporting of your ESG initiatives, helping you stay on top of any changes in the regulatory landscape.

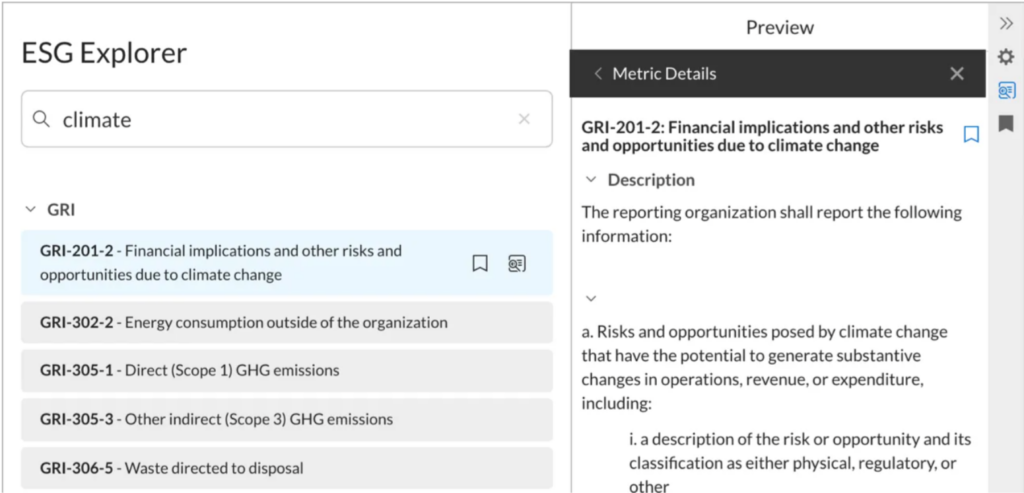

For example, Workiva’s ESG Explorer lets you browse and compare multiple frameworks, standards, and questionnaires without toggling between different PDFs and websites.

Everything is in one place.

You can also filter disclosures by your organization’s industry and frameworks, explore descriptions and metrics, and even bookmark the ones that matter most:

Source: Workiva

That way, the entire organization can stay aligned with all relevant disclosure requirements without much hassle.

Now, let’s talk supply chain due diligence, a huge component of ESG reporting.

How do you ensure you get real, reliable data about thousands of suppliers, especially those beyond Tier 1?

The answer is Veridion.

This AI-driven intelligence platform empowers procurement, risk, and ESG teams to instantly assess ESG exposure across more than 100 million global companies.

Source: Veridion

It helps organizations stay compliant by mapping supplier data against evolving disclosure standards and identifying potential red flags before they escalate into liabilities.

In short, if something in your supply chain goes against current ESG rules and regulations, Veridion will let you know.

Overall, pairing platforms like Workiva and Veridion equips you with everything needed to confidently manage ESG data and disclosures.

You get accurate, fresh insights, stay ahead of regulations, and ensure full transparency across your reporting, from in-house practices to the deepest tiers of your supply chain.

Hopefully, the ESG disclosure landscape feels a little less daunting now.

Sure, it takes some effort to get your bearings, but once you do, doors start opening.

You become a magnet for conscious consumers and forward-thinking investors, you’re better prepared for unexpected disruptions, and you steer clear of compliance risks.

It’s a win across the board.