Top Market Data Vendors

From real-time news feeds to deep B2B firmographics and predictive market signals, market data vendors offer a wide range of solutions for business professionals.

No matter your industry or role, having access to the right data can significantly impact your bottom line.

But not all vendors are the same: the type of data they specialize in, their target users, and their industry focus can vary widely.

That’s why we’ve rounded up six top market data providers worth knowing.

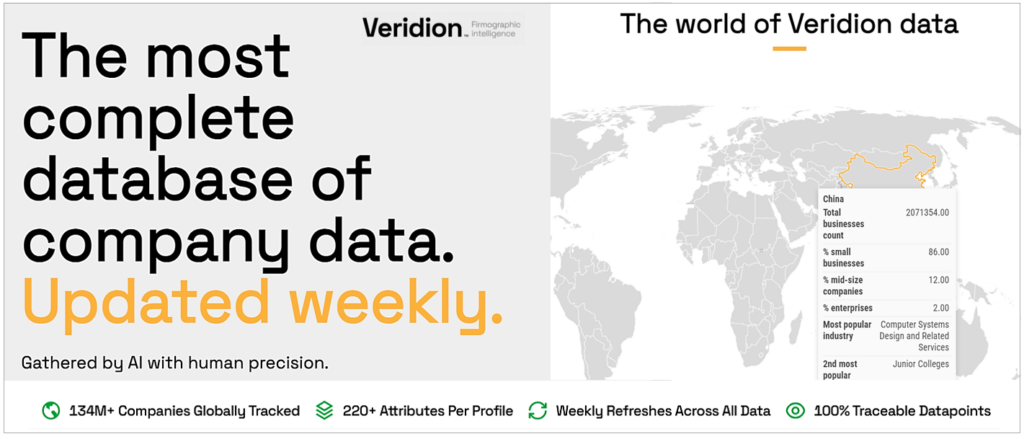

First on this list is Veridion, our own market data platform.

Veridion gives clients across industries access to AI-curated, verified, and regularly updated comprehensive business data.

As illustrated below, its global database currently covers more than 134 million companies, with each profile containing over 220 traceable data points.

All of this is refreshed weekly for accuracy and depth.

Source: Veridion

Veridion’s AI-powered algorithms continuously scan the web to collect, structure, and update data on all businesses with an active online presence worldwide.

This approach enables the delivery of highly accurate, near real-time market insights—ideal for teams that rely on fresh, granular, and scalable data.

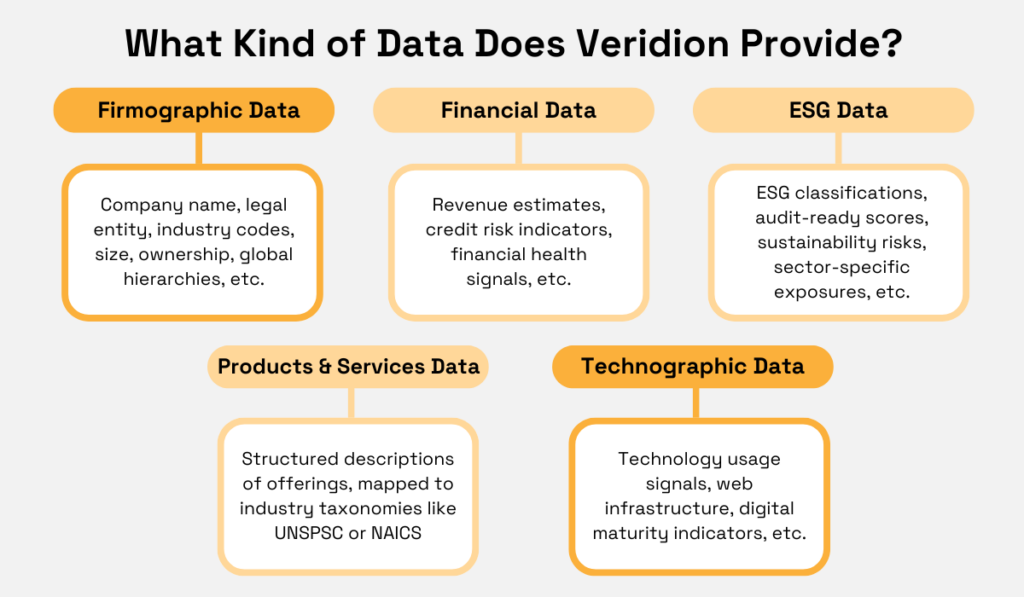

So, what types of market data does Veridion collect?

Here’s a breakdown of our core data categories:

Source: Veridion

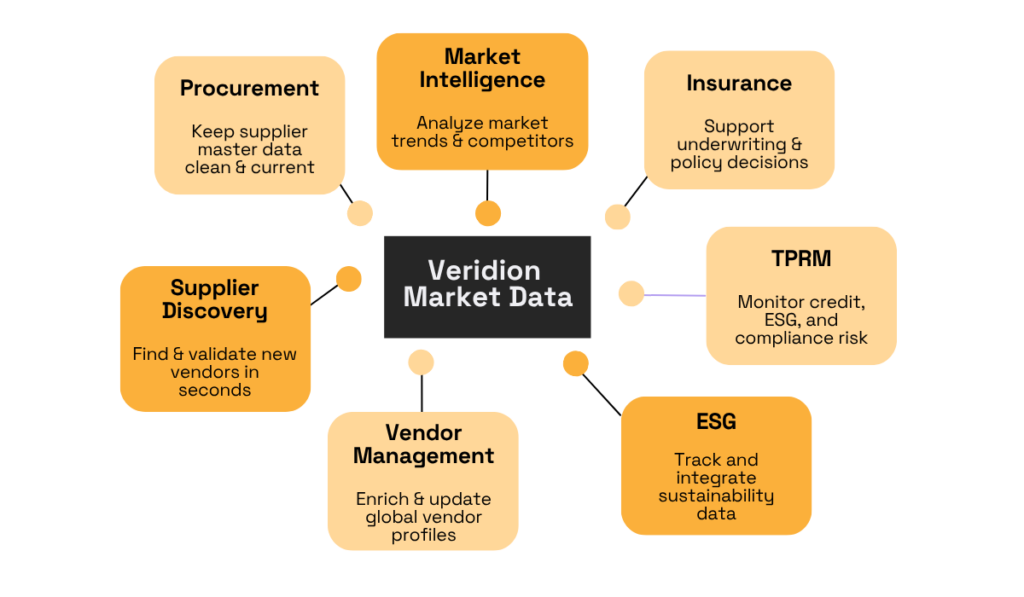

Veridion’s rich dataset supports a wide range of use cases across company functions, from go-to-market planning and risk management to compliance, procurement, and sustainability.

While the overview below is far from exhaustive, it highlights seven key verticals where Veridion’s market data brings the most value across industries.

Source: Veridion

These verticals unlock a wide range of use cases.

For instance, market intelligence and research teams use Veridion’s data to map market landscapes, conduct product research, and support competitive analysis.

Similarly, insurtech and insurance providers rely on it for underwriting and risk assessment, using granular, near-real-time business intelligence.

Meanwhile, procurement and sourcing teams turn to Veridion to discover, verify, and monitor suppliers with clean, accurate, and continually refreshed data.

This brings us to how clients actually access Veridion’s market data.

Most integrate it directly via APIs, embedding data search and enrichment functions into internal systems and analytics workflows.

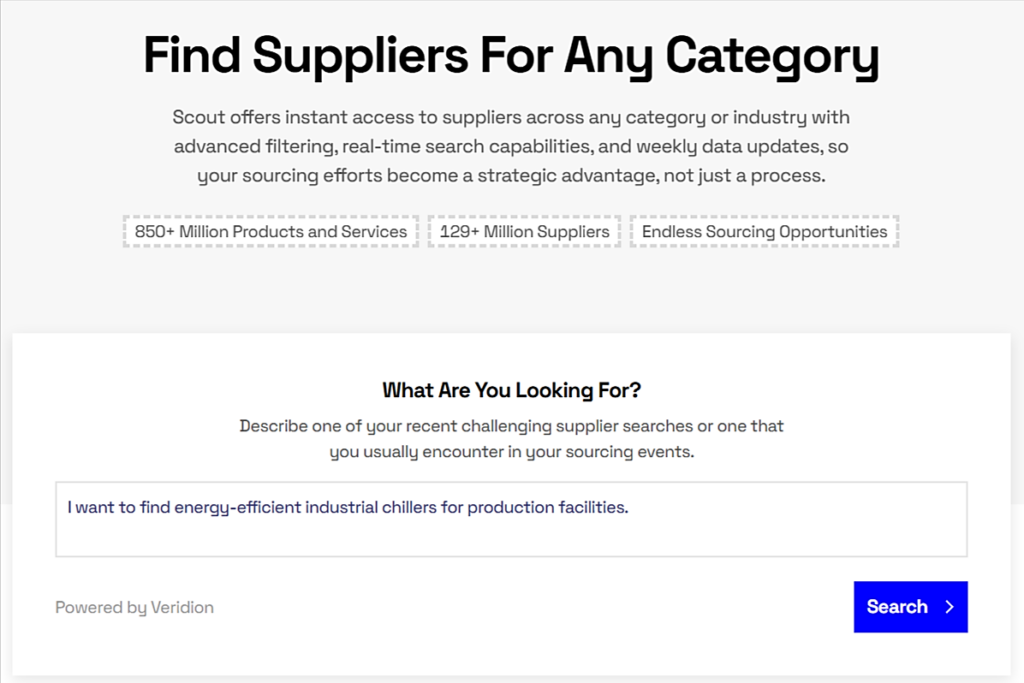

For fast, flexible supplier discovery, Veridion also offers Scout—a powerful natural-language search engine.

Source: Veridion

As shown, Scout enables users to search for suppliers across any industry, receive results in seconds, and filter them with precision.

Importantly, Veridion provides detailed insights into the products and services offered by companies—especially private businesses, a category often overlooked or poorly covered by traditional market data vendors.

Beyond sourcing, Veridion is widely used by risk management and compliance teams for real-time risk monitoring, credit risk evaluation, ESG compliance, and fraud detection.

Similarly, sustainability teams rely on Veridion’s comprehensive ESG dataset to align supplier strategies with sustainability goals and regulatory requirements.

To illustrate the scope and granularity of this data, see Veridion’s ESG taxonomy below:

Source: Veridion

With Veridion enabling teams to combine traditional procurement metrics with ESG and risk-based criteria, sourcing becomes both smarter and more responsible.

Moreover, you can set up real-time risk monitoring to receive automatic alerts about supplier changes, emerging risks, and shifting market dynamics.

Overall, Veridion’s AI-first approach to data collection and verification—combined with weekly refreshes—ensures clients have access to accurate, current, and actionable market data.

With broad use cases across functions and flexible pricing available upon request, Veridion stands out as a scalable solution for modern, data-driven enterprises.

FactSet is a leading financial market data provider known for aggregating information from stock exchanges, company filings, broker research, press releases, and more.

It delivers this data—paired with powerful analytics—to a wide range of financial professionals, including traders, portfolio managers, investment bankers, and research analysts.

Users can access FactSet’s market data through several delivery formats:

| FactSet Workstation | A desktop and mobile app offering integrated access to data, analytics, news, and workflow tools |

| Enterprise Data Feeds | Real-time and historical feeds for use in internal systems, trading desks, or risk platforms |

| APIs and SDKs | Allow flexible data extraction and integration into custom-built applications |

| FactSet Marketplace | A digital hub with 300+ data products from FactSet and third-party vendors |

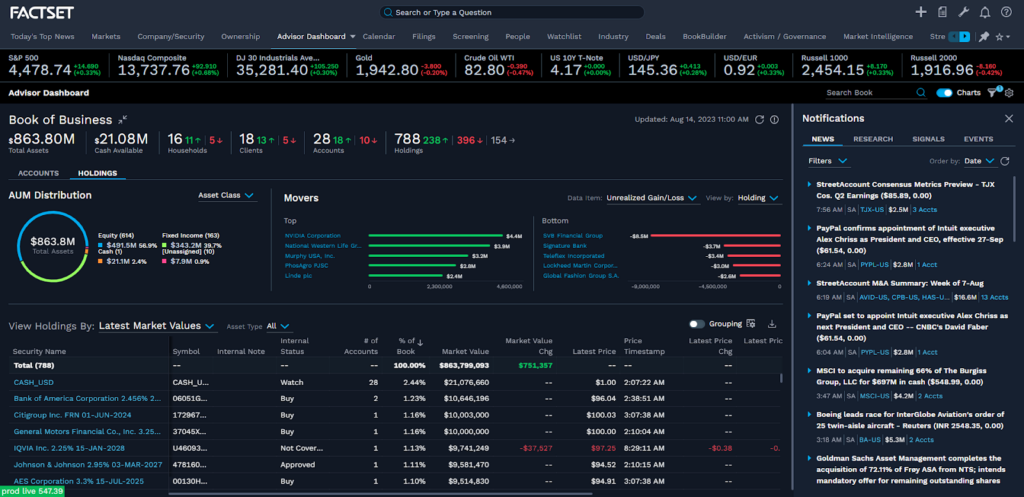

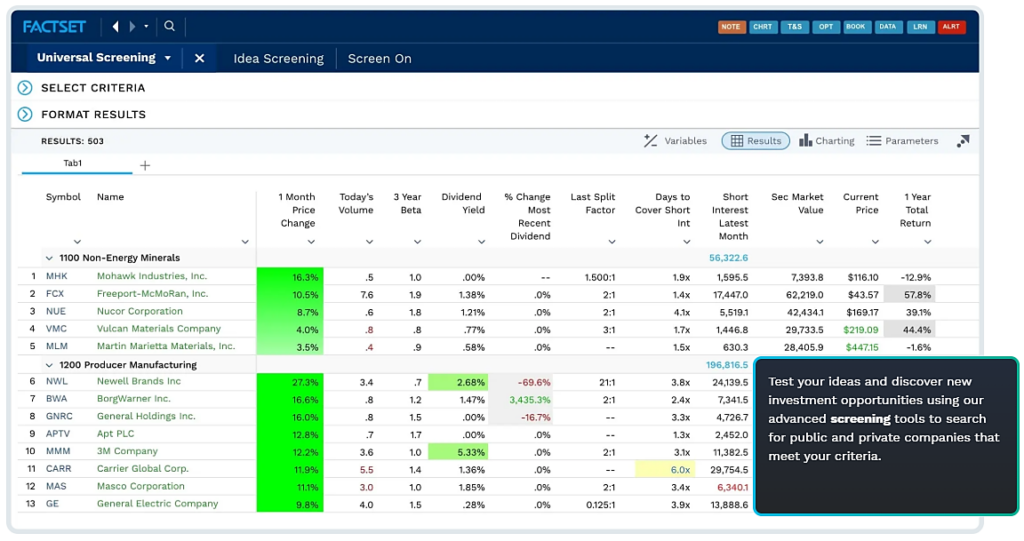

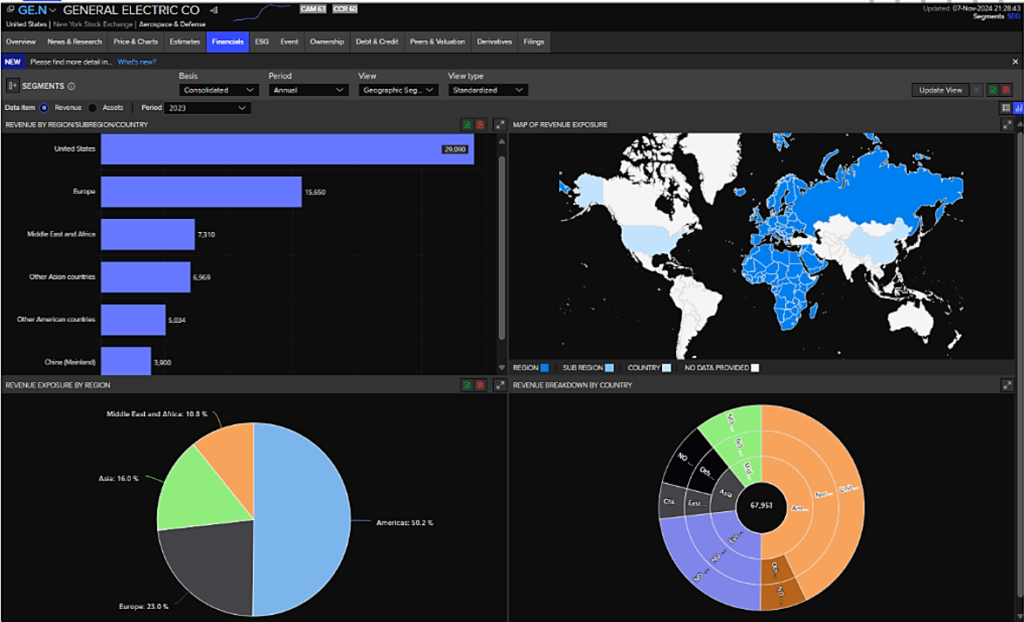

Below is a look at the FactSet Workstation interface on a desktop:

Source: FactSet

The Workstation includes AI-powered search and chat capabilities, designed to streamline research, uncover insights faster, and support collaboration across teams.

This tool—along with FactSet’s other delivery methods—supports a wide range of use cases across financial and strategic roles.

For example, investment analysts and quant teams use the platform to backtest strategies and generate signals, while risk and performance teams track portfolio attribution and market exposure across asset classes in real time.

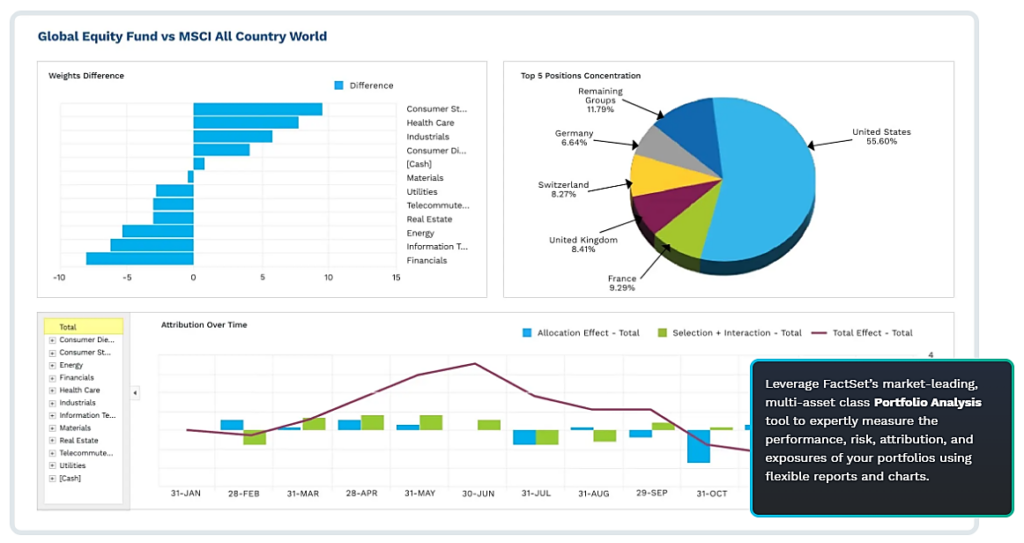

Portfolio managers also rely on FactSet’s analytics to visualize performance trends, assess risk, and make more informed allocation decisions.

Source: FactSet

Another key use case is investment screening.

Whether you’re filtering companies by financial ratios or scouting acquisition targets, FactSet enables fast, criteria-based discovery across public and private markets.

Source: FactSet

Among its many investment-focused tools, FactSet’s customizable news feed stands out.

It delivers real-time, curated market updates through the Workstation, API, or even directly to your email inbox, tailored to your specific interests.

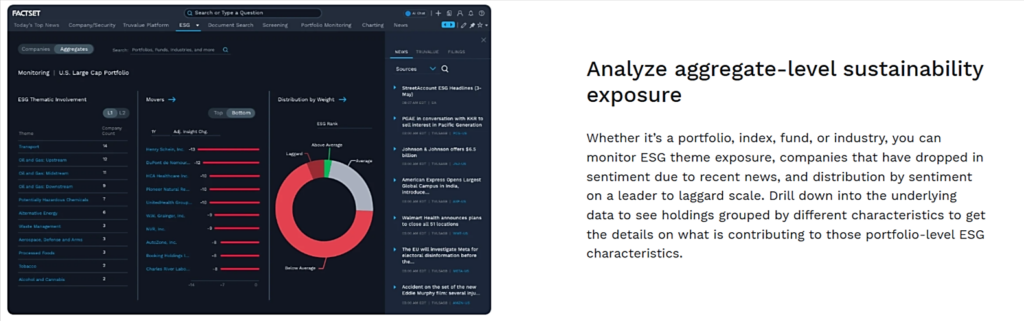

Another notable feature is the ESG Select Workstation, a centralized dashboard that integrates ESG data from FactSet, third-party providers, and even your internal sources.

Source: FactSet

As shown, this interface allows users to monitor sustainability exposure across portfolios, indexes, funds, or industries.

In terms of data coverage, FactSet offers 40 proprietary datasets and access to over 850 third-party datasets, spanning more than 86,000 companies globally.

FactSet’s pricing is not publicly listed but is available on request.

To recap, FactSet is a comprehensive, institutional-grade market data platform ideal for investment professionals seeking integrated analytics, deep historical datasets, and scalable delivery options.

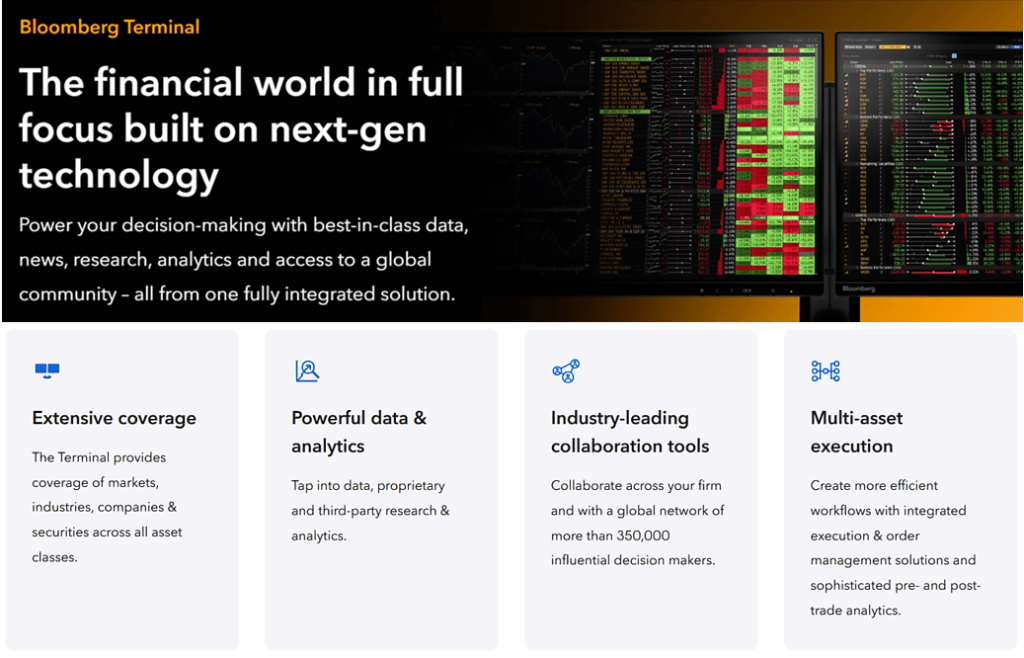

Bloomberg Terminal is one of the most established and powerful platforms in the financial world, offering a fully integrated solution for real-time market data, analytics, trading, and research.

Used by over 350,000 professionals globally—from traders and portfolio managers to brokers and analysts—it delivers trusted information across every asset class, region, and sector.

With an intuitive interface and high-speed infrastructure, Bloomberg consolidates data from 330+ exchanges and over 5,000 sources into one ecosystem.

The result: a single screen that enables fast, confident decision-making backed by proprietary analytics, charting tools, and curated news content.

Source: Bloomberg Terminal

In addition to its broad market coverage and powerful analytics, the Bloomberg Terminal includes built-in collaboration tools and multi-asset execution features.

These capabilities support both pre- and post-trade workflows, making the platform a staple on institutional trading desks worldwide.

Beyond traditional financial data, Bloomberg also offers a growing range of alternative datasets.

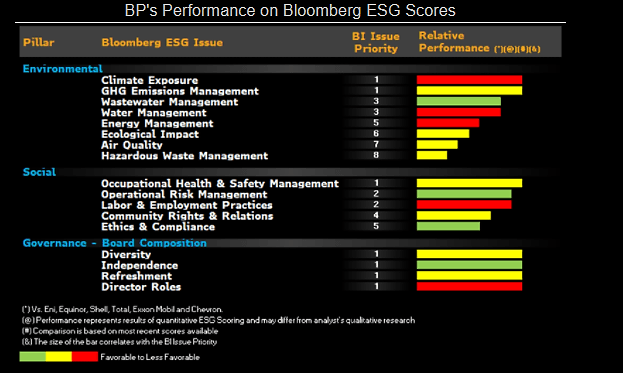

These cover sentiment analysis, supply chain insights, event-driven indicators, and proprietary ESG scores.

As shown below, these ESG scores let users drill down into a company’s environmental, social, and governance performance and benchmark it against industry peers.

Source: Bloomberg Terminal

From ESG screening to macroeconomic modeling, the Bloomberg Terminal supports a wide range of financial workflows.

Portfolio managers, researchers, traders, and corporate finance teams use it for investment research, strategy backtesting, trade execution, portfolio analysis, and event-driven planning.

Premium proprietary datasets such as Bloomberg’s VWAP (Volume Weighted Average Price), Generic Price (BGN), and Composite Rate (CMP) are widely used for pricing, valuation, and benchmarking across asset classes.

Source: Stack Overflow

For quantitative analysts and developers, Bloomberg’s APIs and B-PIPE feed allow real-time and historical data integration into risk engines, trading systems, and machine learning models.

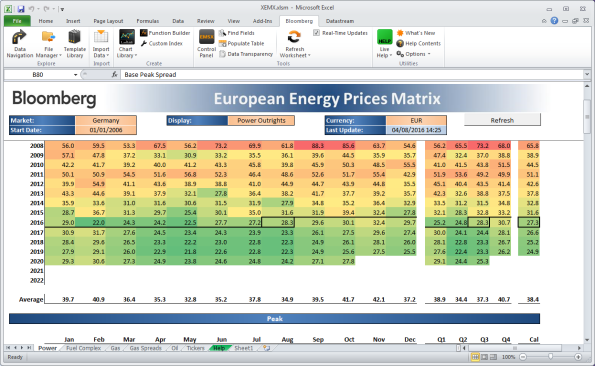

As for day-to-day users, the Excel Add-In offers easy access to Terminal data for modeling, reporting, and custom analytics workflows.

Source: Bizlib247

In addition to desktop access, Bloomberg provides cloud delivery, mobile apps, and remote access through Bloomberg Anywhere.

Pricing is available on request and depends on the configuration. While there’s no free trial, live demos are available.

To sum up, Bloomberg Terminal remains a gold standard for integrated, real-time financial data, as it offers unmatched depth, global coverage, and specialized tools for financial professionals.

LSEG Workspace is the London Stock Exchange Group’s modern, cloud-based market data platform.

It’s also the successor to Refinitiv Eikon following LSEG’s acquisition and phase-out of the legacy product.

Built for today’s fast-paced financial workflows, it offers a personalized ecosystem of market insights, real-time news, analytics, and productivity tools tailored to professionals across asset classes.

Its extensive content coverage supports a wide range of use cases—from portfolio management and equity research to fixed income analysis and macroeconomic forecasting.

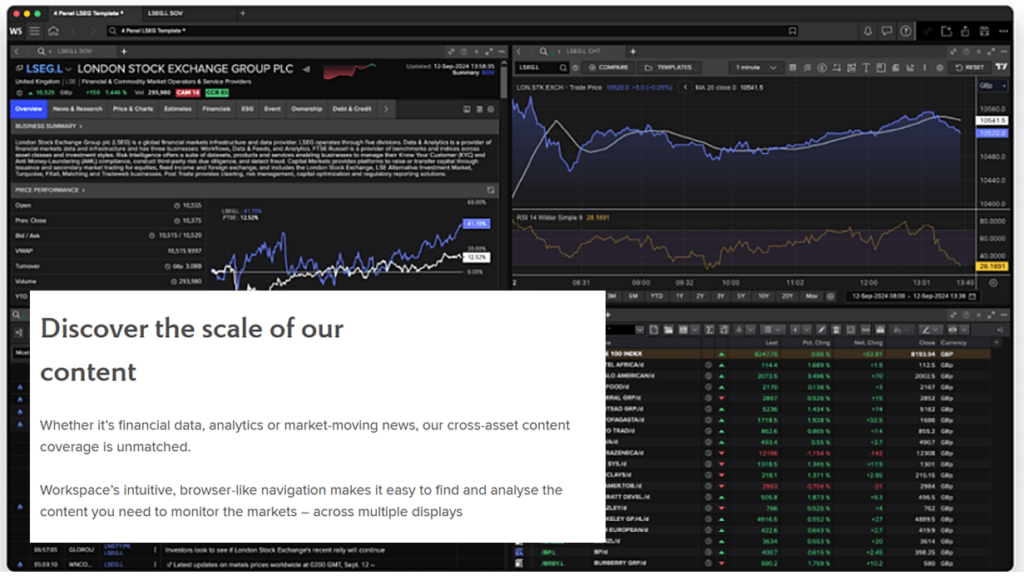

Source: LSEG Workspace

From multi-monitor setups to mobile access, LSEG Workspace combines deep data coverage with intuitive navigation.

This helps professionals stay informed and make faster, smarter investment and business decisions.

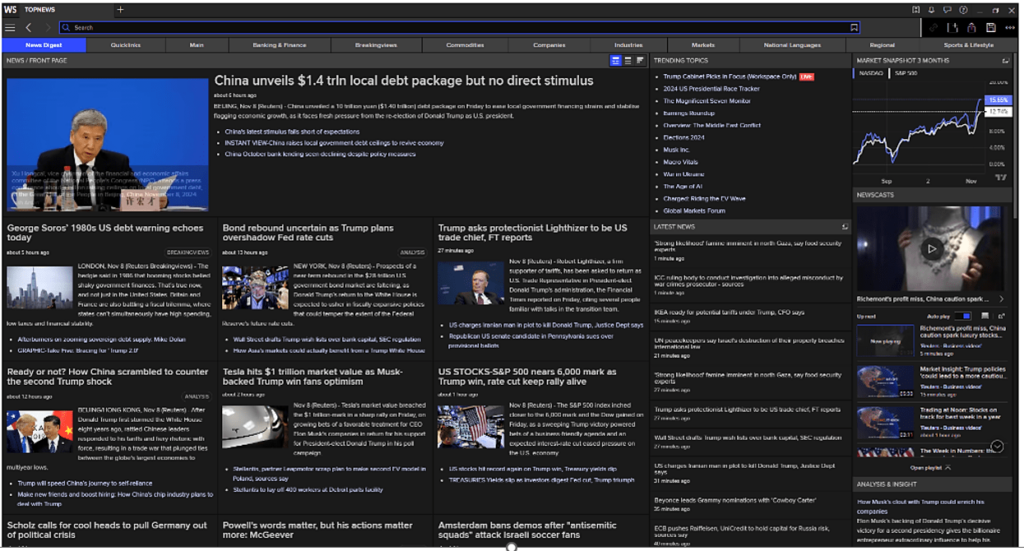

A key strength of the platform is its unrivaled news coverage, starting with exclusive access to Reuters, which is trusted worldwide for speed, accuracy, and market-moving insights.

This is further enriched by real-time feeds from over 10,000 other authoritative sources, including Dow Jones, The Economist, S&P Global, CNBC, and more.

Delivered through a customizable, real-time interface, this comprehensive news stream keeps users ahead of critical developments across markets.

Source: LSEG Workspace

Beyond the news feed, LSEG Workspace delivers powerful analytics and time series capabilities.

Its Datastream module offers over 120 years of global financial and macroeconomic data—making it one of the most comprehensive time series databases available.

Workspace also includes Lipper fund performance data, global multi-asset pricing and analytics, and deep company fundamentals that cover 99% of global market capitalization.

Source: LSEG Workspace

LSEG Workspace also supports sustainability-focused investment decisions, with ESG data spanning over 1,000 metrics across industries and regions.

As a cloud-based solution, it’s accessible via browser, desktop, or mobile, thus offering flexible access to data and tools wherever professionals work.

Integration with Microsoft Office—plus developer resources like CodeBook and LSEG APIs—enables users to build custom models and workflows using familiar environments.

Pricing is available on request and varies by configuration and user role.

Altogether, LSEG Workspace is a modern, investment-oriented platform built to serve financial professionals like investment bankers, portfolio managers, and analysts with the depth, speed, and flexibility needed to navigate today’s markets.

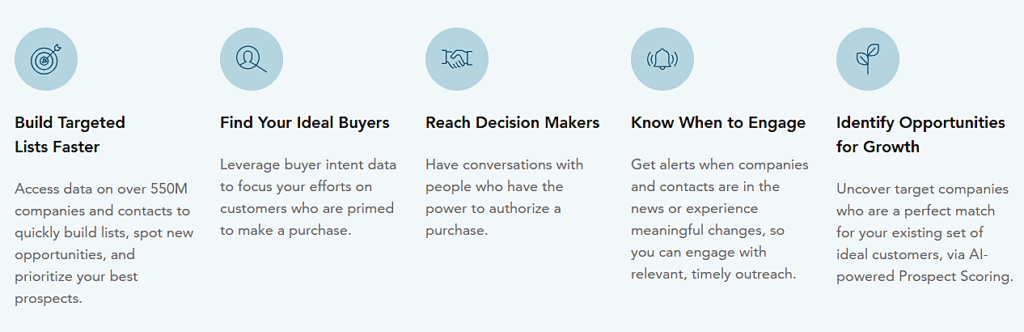

D&B Hoovers is a market data platform focused on company intelligence, contact data, and buyer intent, not financial metrics.

Unlike equity-oriented platforms, it’s designed for sales, marketing, and business development teams that need to identify, prioritize, and engage potential customers.

With access to 550M+ global company profiles and real-time sales triggers, it helps users connect with the right prospects at the right time.

Source: D&B Hoovers

While D&B Hoovers can also be used to evaluate suppliers or partners, its company profiles typically offer only high-level product and service information.

This makes it less effective for supplier discovery compared to more specialized platforms like Veridion.

For lead generation, users can quickly build targeted prospect lists using advanced search, segmentation tools, and AI-powered filters that incorporate buyer intent signals.

These capabilities are especially valuable for teams looking to shorten sales cycles and boost conversion rates.

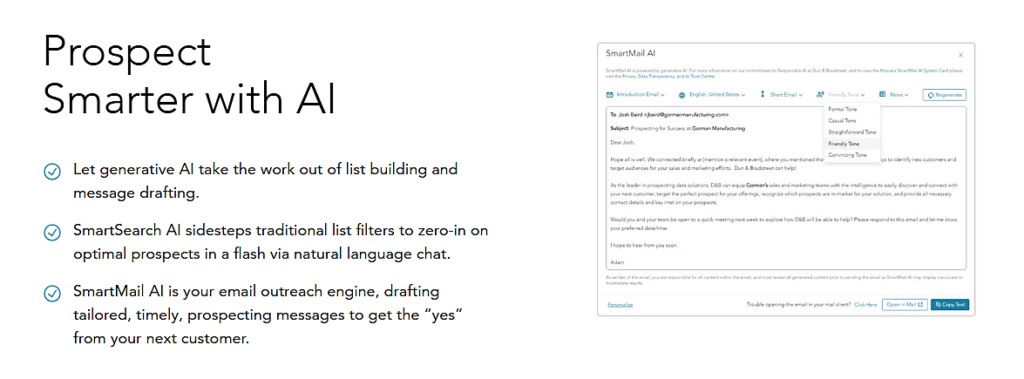

Tools like SmartSearch AI and SmartMail AI further accelerate outreach, using natural language queries, automated list building, and personalized email drafting within a single interface.

Source: D&B Hoovers

D&B Hoovers also offers real-time trigger alerts and intent signals, helping users time their outreach around meaningful business events, like funding rounds, leadership changes, or expansion plans.

This flexible platform is accessible via a web portal or can be integrated into CRM and marketing systems through APIs.

While pricing is not publicly listed, a free trial is available upon request.

Overall, D&B Hoovers is a go-to platform for sales, marketing, and business development teams seeking reliable, real-time market data to uncover new opportunities and drive growth.

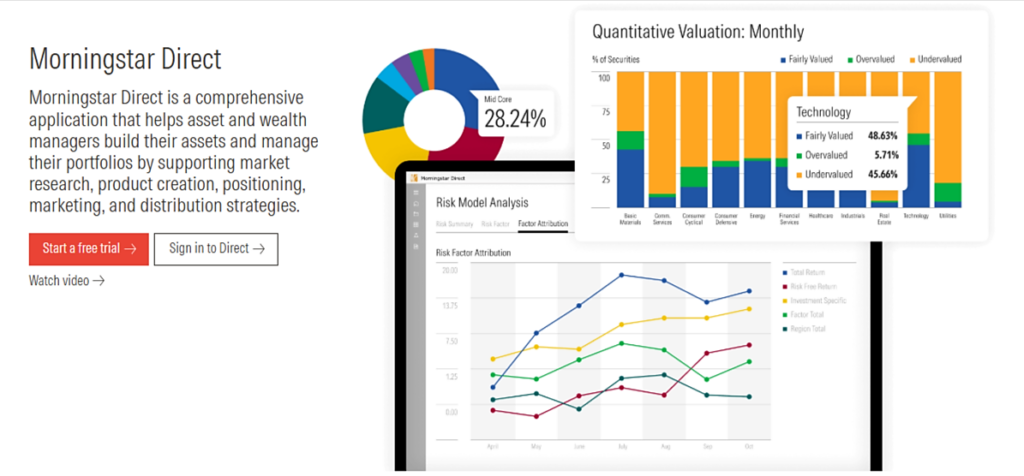

Morningstar is a trusted provider of investment data, research, and analytics.

It is best known for its ratings and insights on mutual funds, ETFs, equities, and sustainable investing.

Its market data covers global equities, managed funds, fixed income, private markets, ESG metrics, and benchmark indices.

This breadth supports everything from security selection to portfolio optimization, market research, and compliance.

Morningstar offers a suite of tools tailored to different audiences.

For example, Morningstar Direct serves institutional investors and asset managers with powerful tools for research, strategy, and product development.

Source: Morningstar

Financial advisors rely on Morningstar Advisor Workstation for client reporting and personalized recommendations, while traders and analysts use Morningstar Market Monitoring for real-time dashboards, news feeds, and curated watchlists.

Individual investors can turn to Morningstar Investor, which includes tools like Portfolio X-Ray, Stock Intersection, and trusted fund and stock ratings.

Source: Morningstar

This is the only Morningstar platform with transparent pricing—$34.95/month or $249/year, with a free trial available.

Morningstar also supports integration through APIs, real-time feeds, Excel plug-ins, and a Python package for advanced analysis.

These flexible delivery options make it easy to embed Morningstar data into workflows, dashboards, and digital products across a range of users.

In summary, Morningstar delivers a broad spectrum of market data, monitoring tools, and analytics for both investment professionals and individual investors.

Choosing the right market data provider really comes down to what your team needs—whether it’s deeper financial research, better investment decisions, vetting suppliers, or generating quality leads.

From trading terminals packed with real-time insights to flexible, API-ready data platforms, today’s tools are designed to support smarter, faster decisions.

Understanding what each provider does best helps you find the right fit and stay ahead in a market that’s always moving.