6 Mistakes to Avoid when Gathering Market Intelligence

Key Takeaways:

Whether it’s for sourcing suppliers or making strategic decisions, gathering marketing intelligence is a necessary process.

But if you’re not careful, you can easily make some avoidable mistakes along the way.

If you want to turn your research efforts into truly useful insights, this guide is for you.

We will walk you through six mistakes to help you gather intelligence more effectively and with greater confidence.

In modern markets, following traditional approaches to sourcing your data can be an issue.

Let’s say you are gathering intelligence using only basic sources like company press releases, supplier websites, or general market reports.

While these are certainly an excellent basis for your intelligence-gathering practices, you should not rely on them exclusively, as they are not always the best way to gain the deepest insights.

It’s important to consider some of the alternative and unconventional market intelligence sources, outlined below.

Source: Veridion

For example, say a company’s public statements suggested they are focusing on sustainable product design.

However, a look at their recent patent filings could reveal a completely different strategic direction, showing where their research and development investments are truly going.

With these alternative sources, you can also detect early signals, like significant changes in hiring patterns for specific roles or emerging legal disputes, which would likely be overlooked if you only followed mainstream sources.

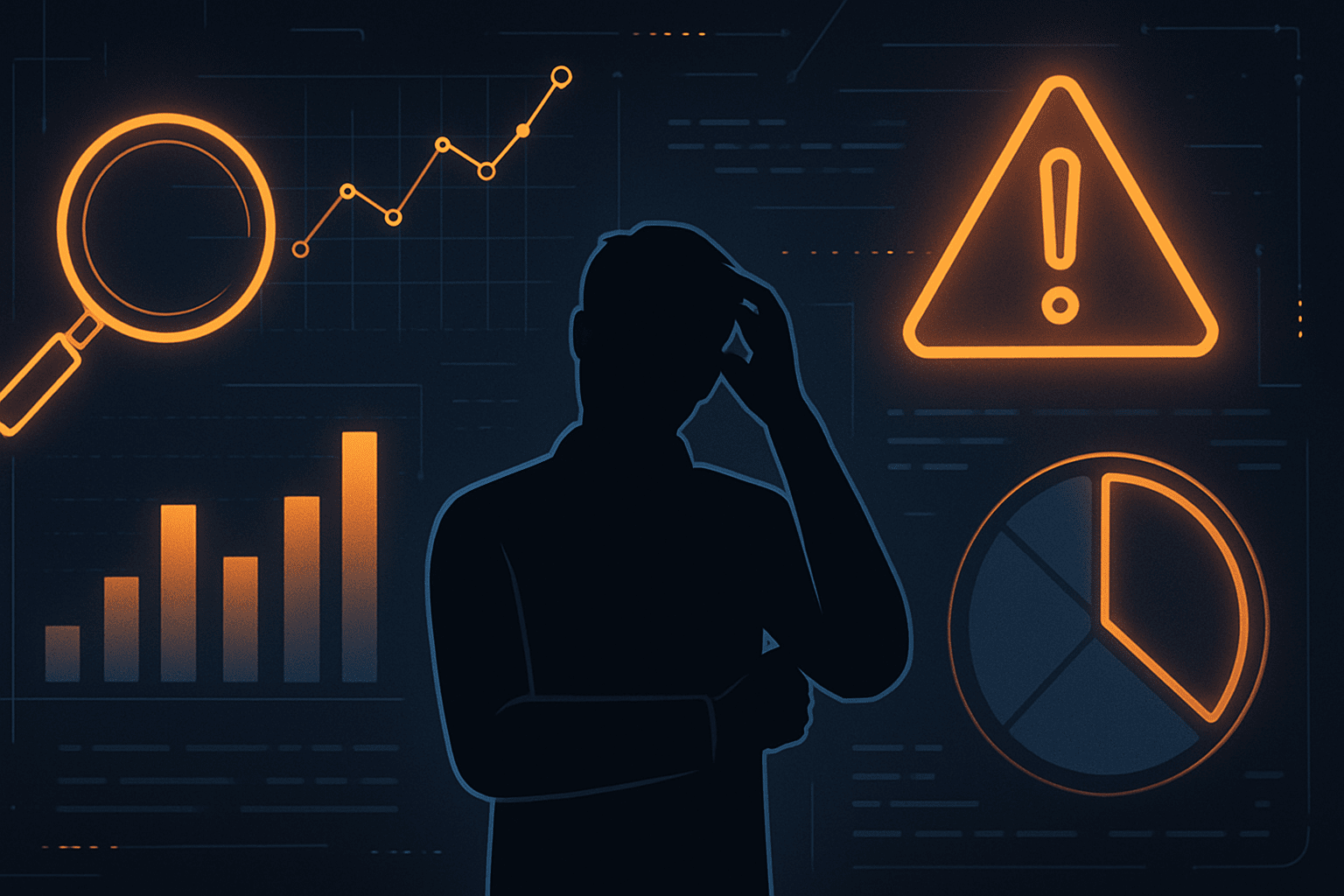

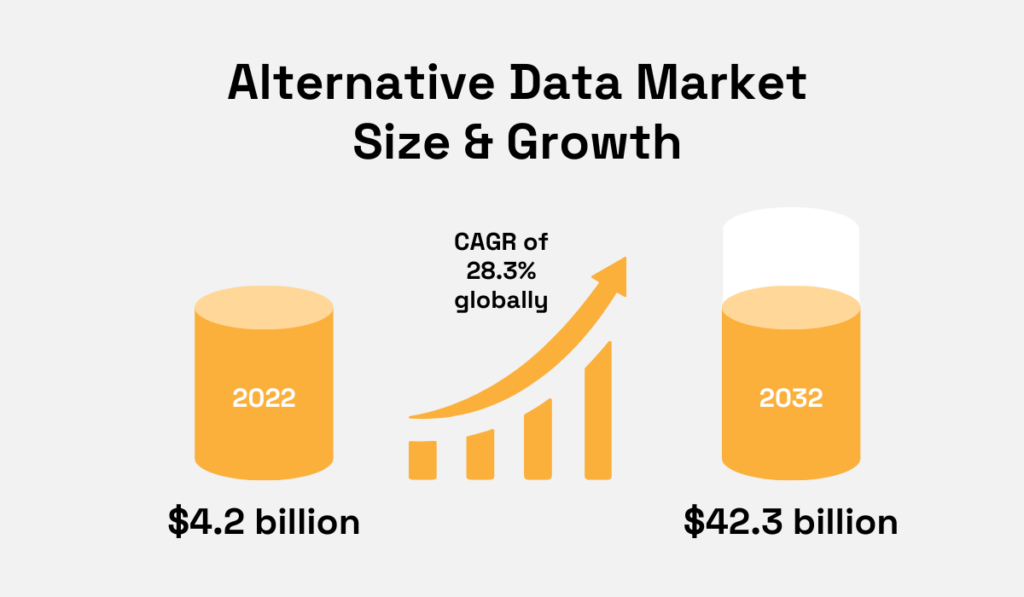

It is no wonder that the alternative data market industry is experiencing rapid growth, with its size estimated to reach $42.3 billion by 2032.

Illustration: Veridion / Data: GMI

Leading the charge in this growth are powerful software solutions that promise to expand both the amount and the quality of data you can gather.

Take our AI-powered data engine, Veridion, as an example.

Our custom algorithms constantly scan the entire web, with our advanced Machine Learning (ML) models classifying and structuring this vast amount of information into clean, usable data.

Globally, Veridion tracks over 120 million companies, enriching each company profile with more than 200 distinct attributes.

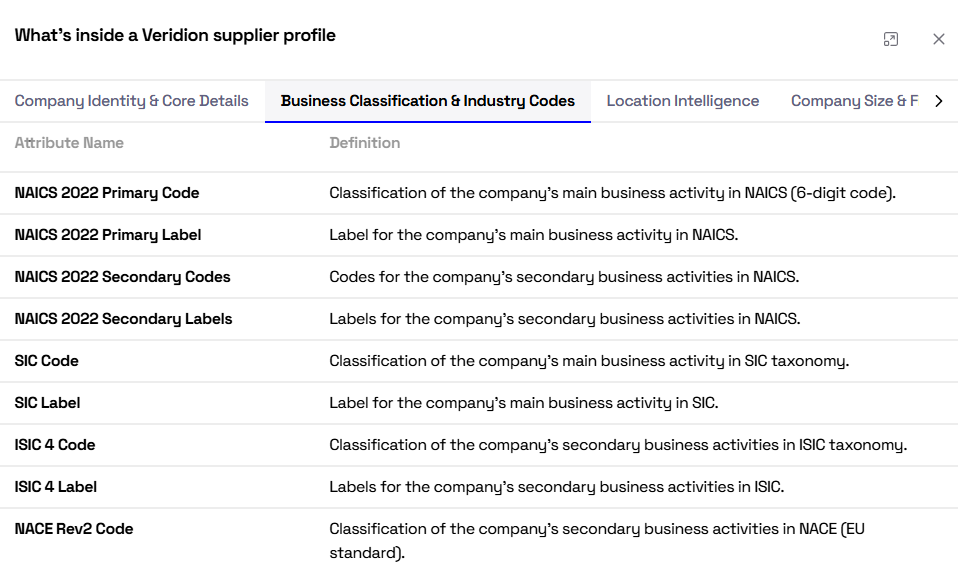

Here is just a small part of a supplier profile:

Source: Veridion

Best of all, you get weekly refreshes across this data, ensuring you receive the most timely and accurate information possible.

Simply put, by moving beyond generic sources with tools like Veridion, you can uncover the insights that give you a real competitive advantage.

Following naturally from the previous point about where you get your data is the issue of its quality and relevance.

It is one thing to use alternative sources, but if a new development occurs between the time you gather your data and the time you analyze it, you are essentially basing critical decisions on outdated information.

Unfortunately, this is a common challenge.

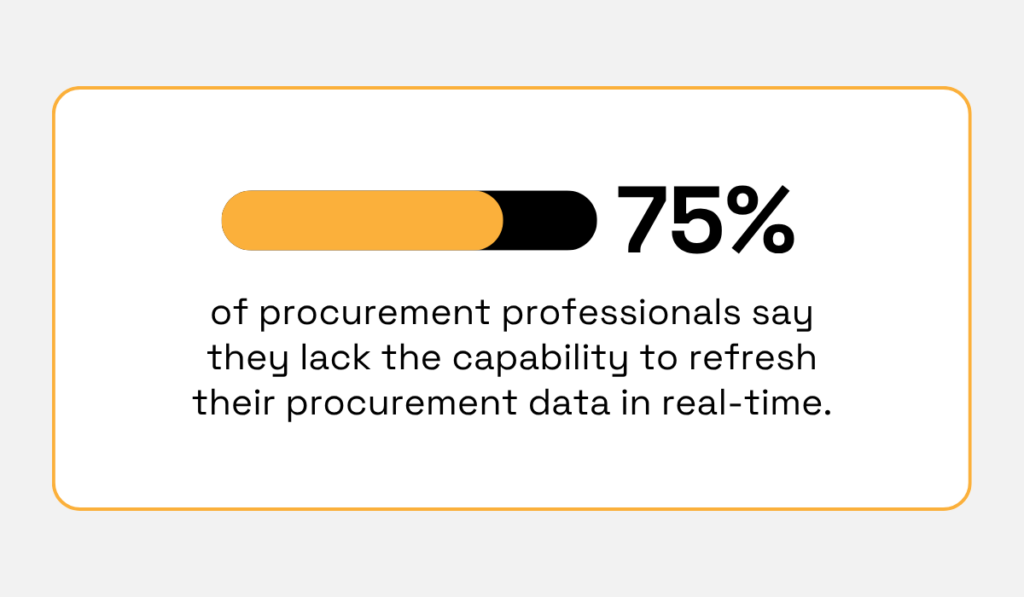

According to data from SpendHQ, a majority of procurement professionals report that they cannot refresh their supplier data in real time.

Illustration: Veridion / Data: SpendHQ

As markets evolve quickly, relying on monthly reports or static databases is not enough to stay updated.

Consider a company sourcing raw materials.

Real-time supplier intelligence about a sudden disruption, the supplier facing financial trouble, or a spike in shipping costs is critical for making immediate, cost-saving decisions.

Luckily, as Nicolas Walder from The Hackett Group explains, modern AI tools can be particularly good at bringing the most important signals and topics to light.

Illustration: Veridion / Data: Procurement Magazine

They can ingest and process large amounts of intelligence data and uncover the developments that truly matter, without getting lost in unimportant details.

Still, as Ash Sharma, the Chief Commercial Officer at Interact Analysis, suggests, we can go even further and include the human element:

“The best market intelligence firms will be consistently talking to people in the industry to understand “on-the-ground” trends.”

This means that even the best data needs context, which often comes from direct conversations with experts, customers, and other industry insiders.

This “on-the-ground” knowledge provides intelligence with nuance and depth that raw data alone might miss.

A balanced strategy ensures your insights are not only current but also deeply connected to the reality of your market.

Intelligence gathering efforts often happen in silos, where different departments focus only on their own specific needs.

For example, the marketing team might be tracking competitor campaigns, while the product team is researching new technologies, and neither team is sharing its findings with the other.

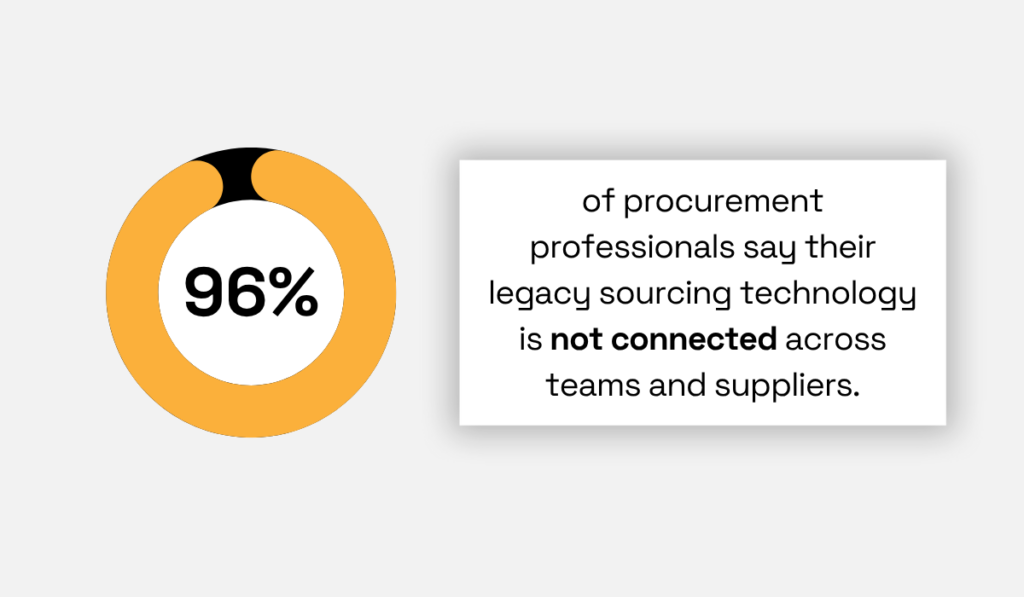

This is especially true for procurement teams, as shown by a 2023 report from Globality.

The report found that almost all procurement professionals say their sourcing technology is not connected across teams and suppliers.

Illustration: Veridion / Data: Globality

In other words, these teams are often working in isolation, which is a missed opportunity.

Why?

Well, other departments, like sales or marketing, have valuable on-the-ground insights that could enrich procurement’s understanding of the market.

They help define what information should be collected and why, leading to better overall intelligence gathering.

It is important to realize that, according to Archana Shetty, VP of IT projects at QNB Group, this mistake is not as simple as teams merely refusing to work together.

Illustration: Veridion / Quote: LinkedIn

It is a wider organizational issue that needs a multifaceted solution.

For starters, leadership should actively promote a culture of collaboration and better align team goals around shared intelligence.

Importantly, data gathering efforts should also be made more transparent.

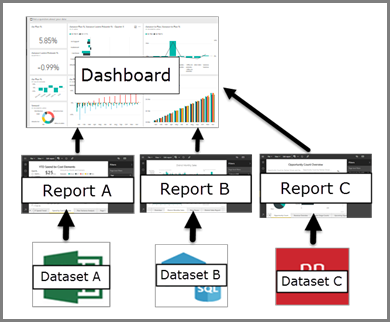

This goal can be achieved by using centralized data and procurement platforms or even tools like Power BI to consolidate siloed data and reports into unified dashboards.

Source: Microsoft

Tools like Power BI allow you to connect to various data sources, create interactive visualizations, and share them across your organization, giving everyone access to the same, up-to-date information presented in an easy-to-digest format.

Of course, breaking down these internal barriers and creating a single source of truth is hard.

But when everyone contributes and has access to the complete picture, the entire organization can make smarter, more coordinated decisions.

Many businesses become too focused on their own internal operations and data and inadvertently ignore critical shifts happening in the competitive landscape.

This is a crucial mistake that leads to significant missed opportunities.

Let’s take a mid-market ecommerce platform as an example.

Without solid competitor analysis, this organization might have missed news like Shopify quietly rolling out a native integration that lets merchants create in-feed shoppable TikTok video ads directly from their Shopify admin.

Source: Shopify

Major shifts like these are why you need to consistently track changes like new partnerships, along with competitor pricing shifts, product launches, and even hiring trends.

Of course, as Jim Caldwell, co-founder of Atlantic Intelligence, explains, you need to be careful and accurate with competitor analysis.

Illustration: Veridion / Quote: Crayon

He emphasizes the importance of having accurate data on what your competitors are doing, where your company has an edge, and what changes you can make to improve.

According to Caldwell, the end goal is to take this competitor intelligence and turn it into strategic insights that can be used for decision-making.

But how should you approach this?

One great strategy is to look for sources that take little effort to analyze but can provide strong insights, like the ones shown in the table below.

| Source | How to access | Key signals | Insight |

|---|---|---|---|

| Press Releases | Company website or PR Newswire | Partnerships, strategic investments | Spot alliance launches (e.g., Shopify–TikTok) |

| Job Boards | LinkedIn, Indeed, company careers page | Open roles by department or skillset | A ramp-up in research and development job postings could signal new launches |

| Conference Slides | Investor relations site, SlideShare | Roadmaps, feature demos | Reveal timing for beta rollouts or milestones |

Tracking these kinds of subtle signals from competitors allows you to detect their intent long before it becomes obvious to the rest of the market.

If you couple that with sustained competitor monitoring using powerful intelligence platforms, you can unlock strategic clarity early on and switch from reactive to proactive business decisions.

Any decisions on how to collect and use market intelligence need to be strategic and align with broader team and company goals.

A lack of direction in this aspect can lead to teams wasting valuable time on irrelevant research and pulling in completely different directions.

What’s more, it can lead to intelligence being gathered just for the sake of it, with large amounts of data sitting unused in a database somewhere.

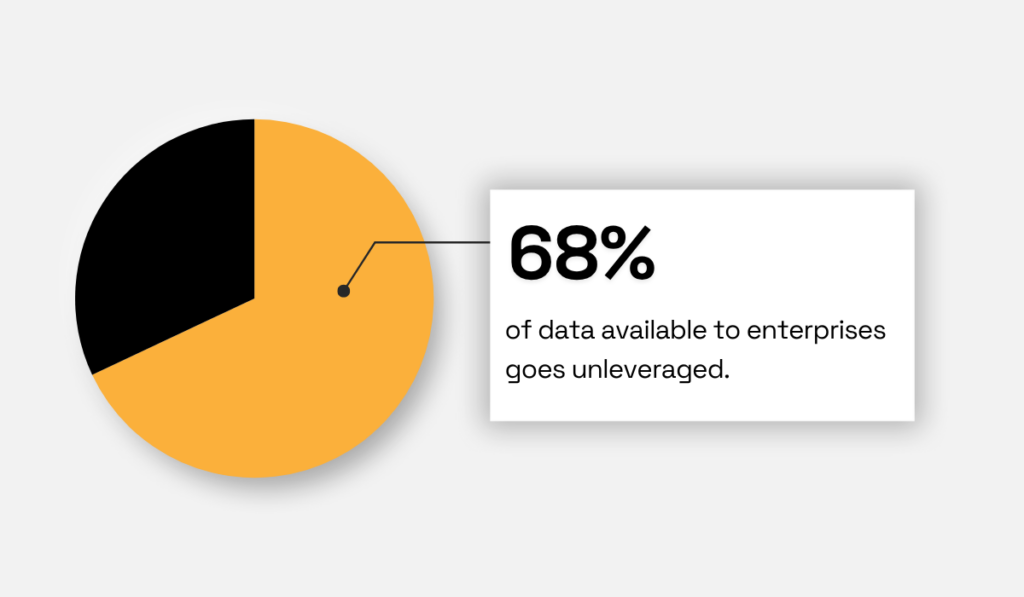

For many enterprises, that is exactly the case, according to Seagate.

The report found that more than two-thirds of the data available to businesses goes unleveraged.

Illustration: Veridion / Data: Seagate

This means that significant resources like time, money, and employee effort are wasted on collecting information that never contributes to a business outcome.

To remedy this problem, teams should always start with a clear direction on what their research will support.

They can ask simple questions to ensure their work is specific and purposeful, such as:

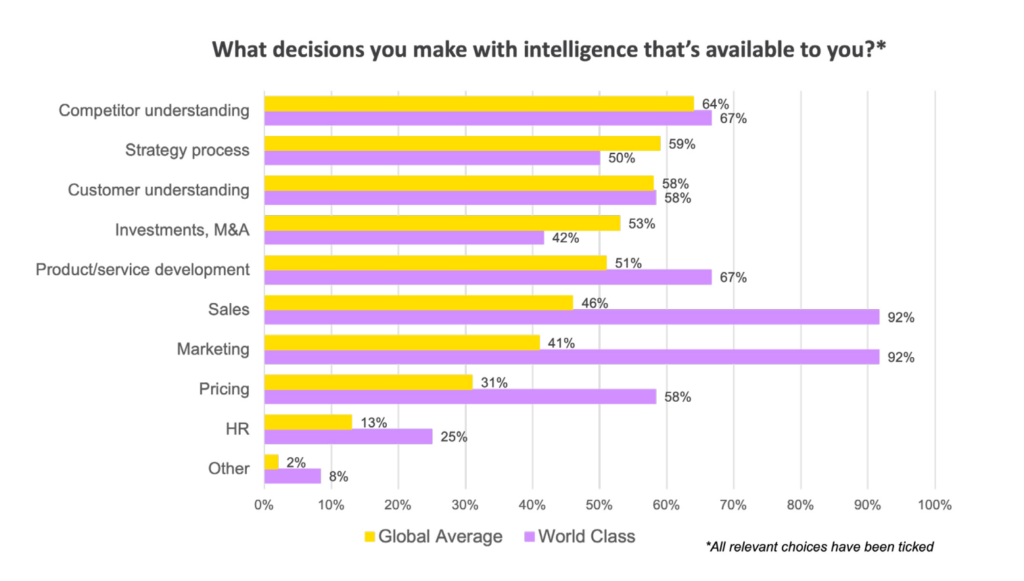

Of course, when in doubt about how you can best use intelligence or what areas to explore, you can turn to comparison data to see what others are doing.

For example, a report from Valona shows how companies from various industries use their market intelligence.

Source: Valona

As you can see, almost all companies use this data for understanding their competitors and customers and for strategic planning.

But organizations defined as “world-class” by the report also use this data for sales enablement, marketing campaigns, and even HR decisions.

Whichever goals your team decides on, the key takeaway is to be intentional with your efforts.

Ensuring every intelligence project is directly tied to a strategic business need helps avoid wasting resources and delivering measurable value.

Throughout this article, we have mentioned a few systems and tools that can support your market intelligence gathering processes.

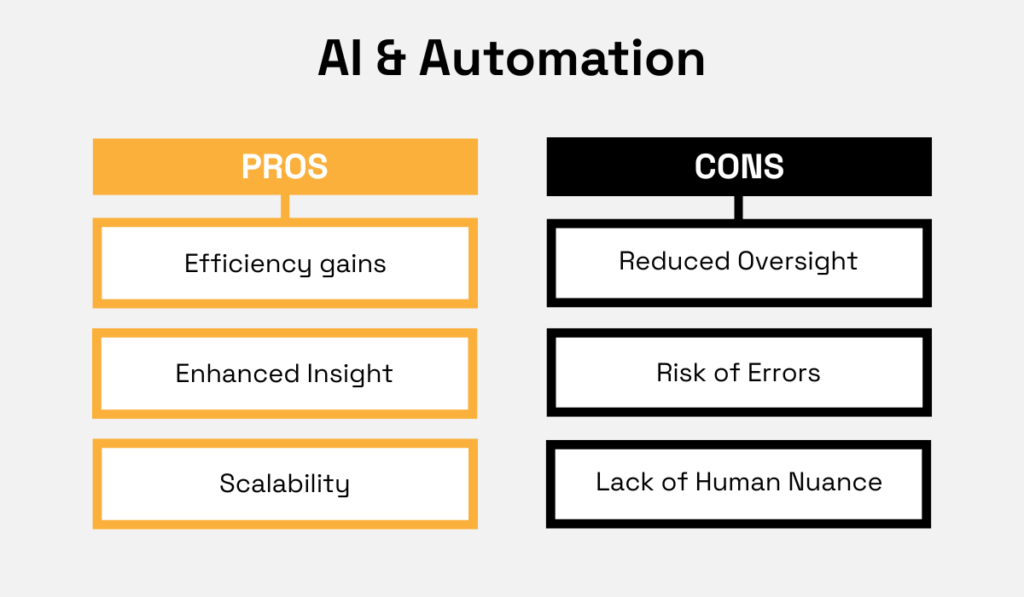

But, as a final mistake to avoid, you need to be aware of the limits of technology like automation and artificial intelligence.

While powerful, these tools are not infallible and should not be used without careful human oversight.

Source: Veridion

Automation and AI work great for speeding up processes and scaling research efforts tremendously.

But this efficiency can sometimes come at the cost of nuance and the quality of any insights you get.

As written in an article by AMPLYFI, “the improper or misguided use of consumer AI models like ChatGPT can actually increase human workload, diluting the quality of information with inaccuracies.”

The article further elaborates that any mistakes need to be double-checked and often reworked by a person.

So, any efficiency gains you thought you made initially can be quickly lost.

That’s why it is best to use human expertise alongside systems that are specifically designed to gather market intelligence.

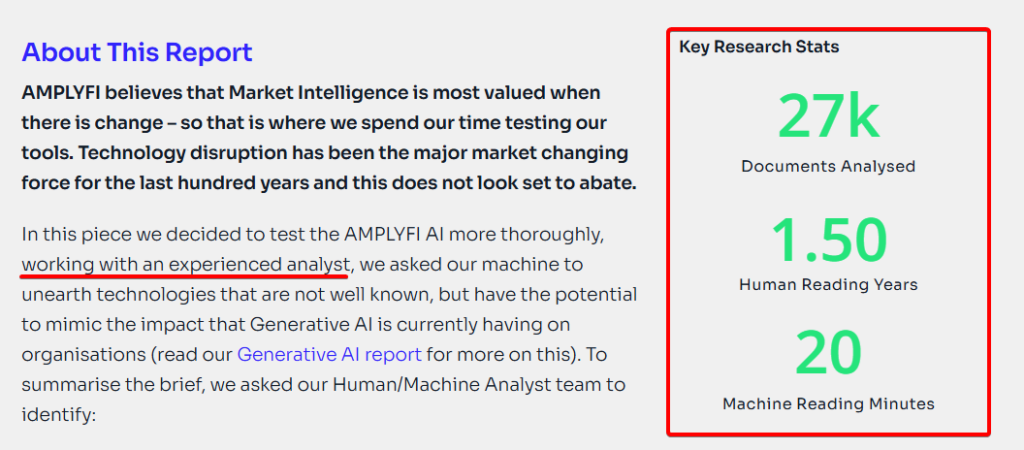

To illustrate a best-case scenario of how this might work, take a look at the following report.

Source: AMPLYFI

To explore how human-AI collaboration can work in practice, AMPLYFI used its proprietary AI system alongside an experienced human analyst to create a market intelligence report on potentially disruptive, cutting-edge technologies.

The AI’s role was to consume a vast amount of documents—a task that would have taken a human one and a half years to complete—which the AI did in just a few minutes.

But instead of simply following the AI’s results, the analyst verified the findings, structured the raw output, and cleaned up the data where necessary, with great results.

In summary, the most effective approach is a partnership.

AI and automation can handle the heavy lifting of processing enormous volumes of data at incredible speeds, while the human analyst provides the critical thinking, validation, and strategic interpretation.

This approach ensures that the final intelligence is both comprehensive and truly insightful.

And that brings our guide to a close.

We’ve explored common mistakes, from relying on poor-quality data and lacking collaboration, to misaligning intelligence efforts with business goals.

We also looked at the danger of overly automating processes and balancing tech like AI with human expertise.

Hopefully, you can now spot these common pitfalls in your own work and make adjustments.

By avoiding them, you can gather intelligence that helps you make smarter, more confident decisions.