6 Best Market Intelligence Tools

Companies and business professionals have been relying on market intelligence for decades.

So, it’s not a new concept. What is new is how that intelligence is gathered, analyzed, and delivered.

Today’s tools capture a vast range of data, helping businesses extract actionable insights and gain a competitive edge.

In this article, we highlight six leading market intelligence platforms, outlining what kind of intelligence they provide, who uses it, their key features, and pricing.

Let’s start with our own market intelligence platform, Veridion.

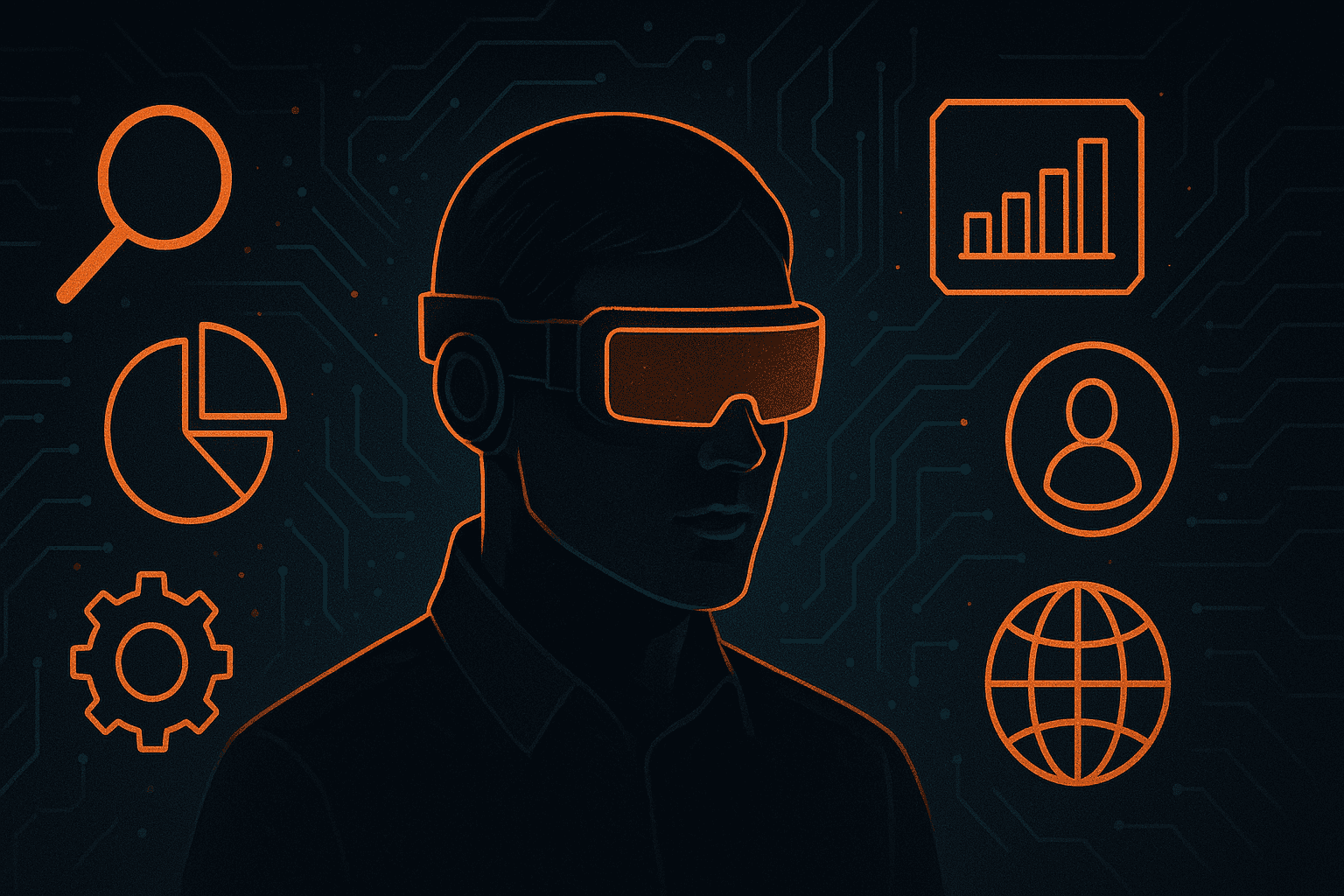

Veridion leverages advanced AI algorithms to gather, clean, and organize business data on more than 130 million companies worldwide, with a particular focus on private and small-to-medium enterprises.

The platform continuously pulls information from company websites, social media, news sources, and other online channels to deliver highly accurate, real-time company profiles.

This results in a global database refreshed weekly, with over 220 attributes per profile, ensuring unparalleled depth and precision.

Source: Veridion

Off the bat, Veridion’s fresh, detailed profiles help solve several common challenges in market intelligence, including:

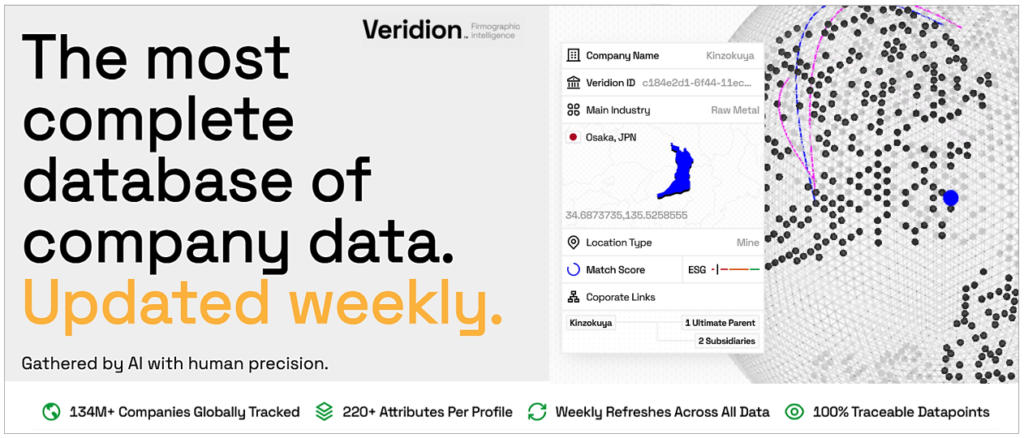

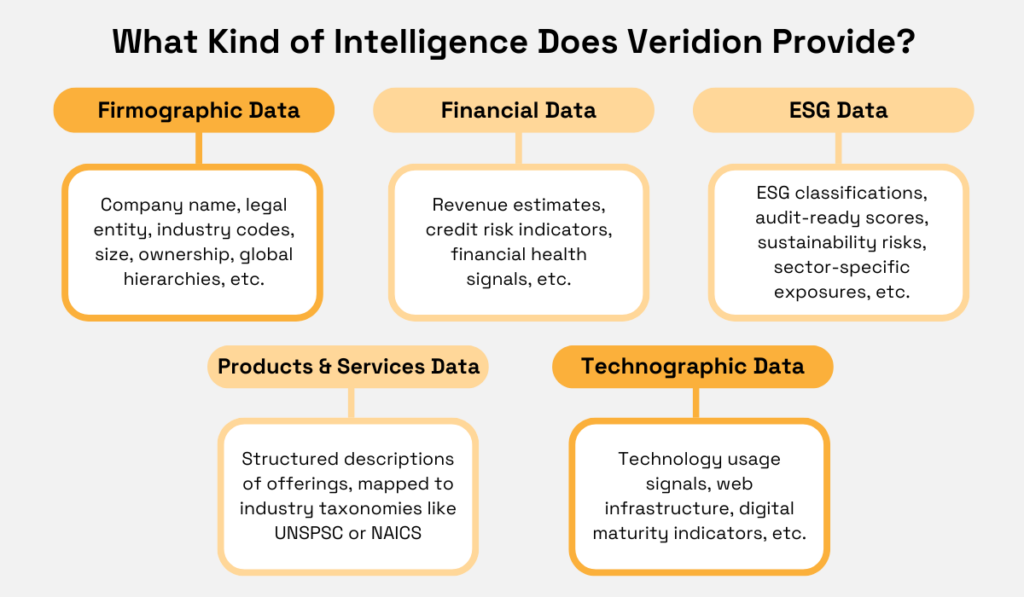

On top of this, Veridion collects a wide spectrum of market intelligence, making it valuable across industries and use cases.

Beyond firmographic basics like company size, ownership, and hierarchies, it provides financial health indicators, ESG classifications, and structured product and service data mapped to taxonomies such as UNSPSC and NAICS.

It also captures technographic signals—from web infrastructure to digital maturity—giving businesses a multidimensional view of any organization.

Here’s a summary of what Veridion provides:

Source: Veridion

For example, teams can leverage Veridion’s data to:

In short, Veridion provides a reliable, up-to-date single source of truth on suppliers, partners, and competitors across global markets.

This versatility translates into real-world impact.

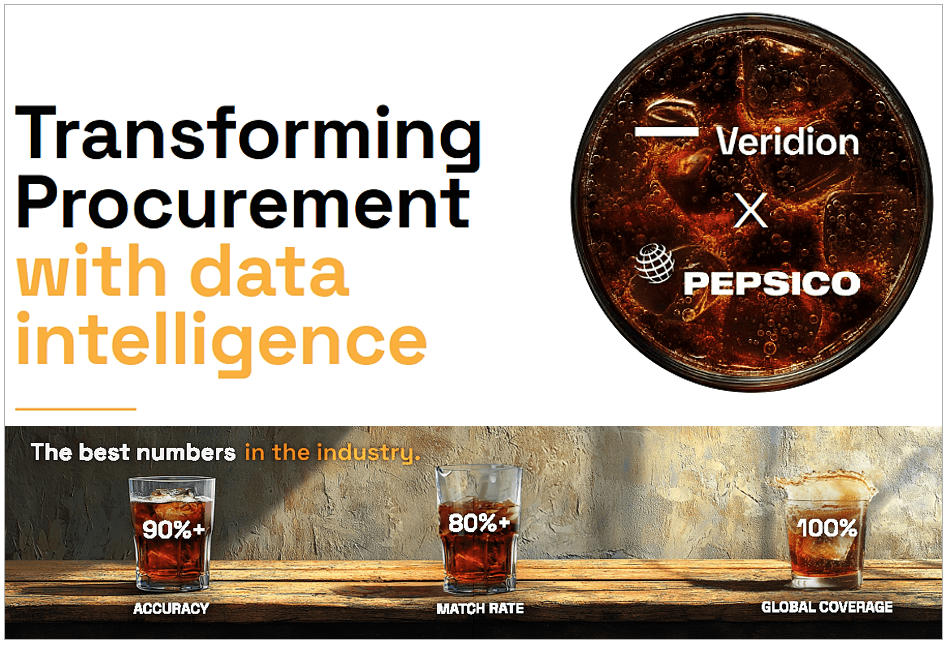

For instance, PepsiCo leverages Veridion’s global dataset as a foundation layer for decision-grade data in procurement, risk management, market analysis, and sustainability initiatives.

Source: CPO Strategy

In essence, Veridion’s real-time business data creates a new foundation for market intelligence.

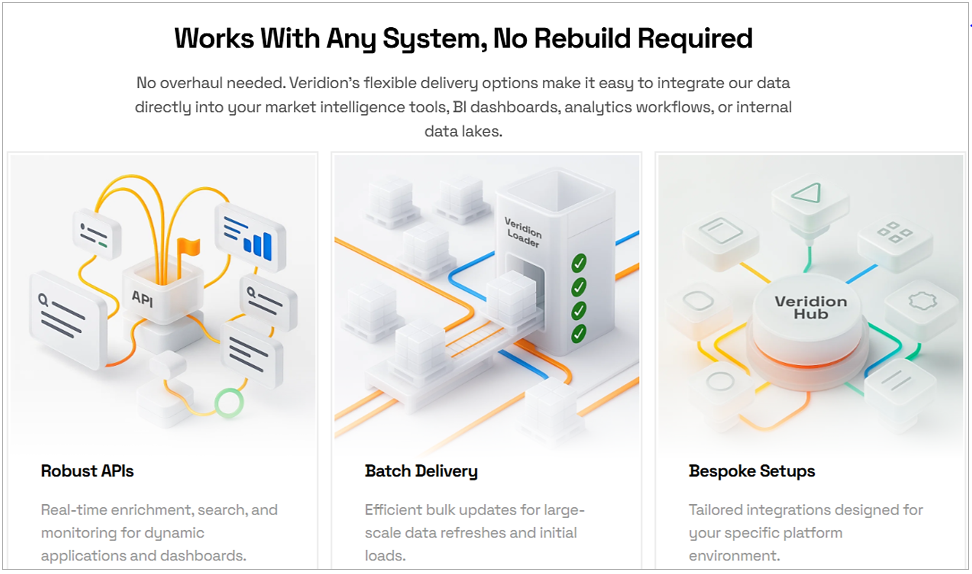

It does so by feeding its data seamlessly into your existing analytics solutions.

In other words, companies don’t need to rebuild or overhaul their systems. Instead, Veridion offers flexible data delivery options to match different needs.

Data can be accessed through robust APIs for real-time enrichment, batch delivery for large-scale updates, or bespoke setups tailored to specific environments.

Source: Veridion

In addition to flexible integrations, Veridion also provides tailored data samples so organizations can evaluate how its intelligence fits their specific needs.

Pricing is available on request and varies depending on data scope and usage.

For emerging companies, Veridion runs a Startup Program with accessible, customized plans.

If you’re seeking business intelligence with unprecedented precision, global coverage, and real-time usability, Veridion is a powerful choice for market, investment, risk management, and procurement teams alike.

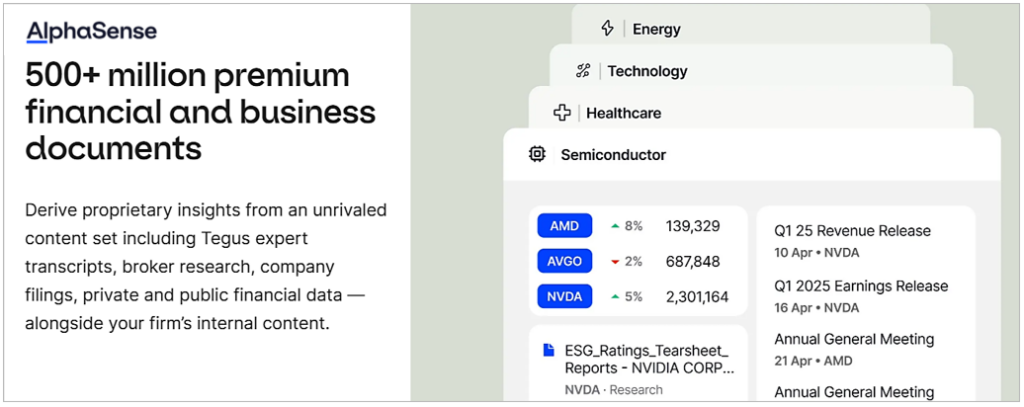

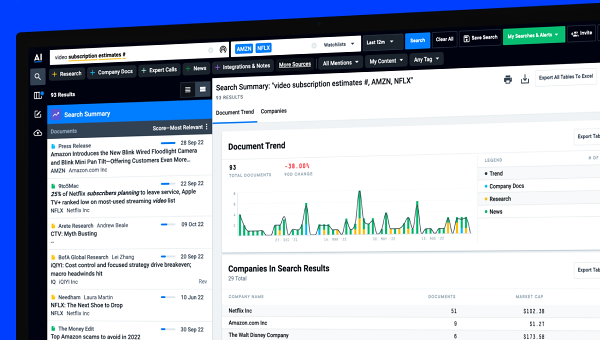

While Veridion excels at scraping the web for real-time company data, AlphaSense specializes in interpreting business documents through AI-powered search and summarization.

The platform aggregates information from over 10,000 private, public, premium, and proprietary sources.

This includes company filings and earnings transcripts, analyst research such as Wall Street Insights®, expert call transcripts, news, industry reports, trade journals, and regulatory documents.

Together, these sources form one of the most comprehensive content libraries available for business and financial professionals.

Source: AlphaSense

Because AlphaSense collects and summarizes insights from such a broad range of sources, it supports a variety of market intelligence use cases, including:

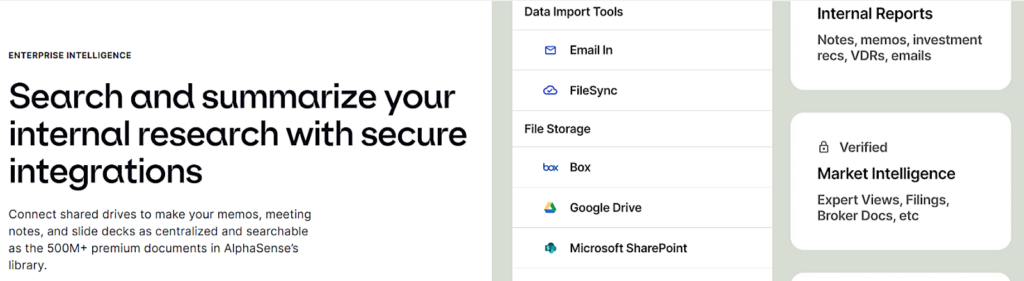

Beyond external sources, AlphaSense also lets organizations integrate their own internal documents, making meeting notes, memos, and slide decks just as searchable as its extensive document library.

Source: AlphaSense

Like most modern market intelligence platforms, AlphaSense is cloud-based and accessed through a secure web browser or integrated into enterprise systems.

Clients subscribe on a licensing basis and primarily interact with the platform through its AI-powered search engine.

Intelligence is also delivered via customizable dashboards, advanced analytics, and workflow-specific AI agents such as Deep Research.

Source: AlphaSense

Deep Research AI synthesizes insights across AlphaSense’s vast library, cutting analysis time from days to minutes.

The company has also recently introduced a new AI agent, Autonomous Interviewer, which independently conducts and transcribes expert interviews, adding unique qualitative depth to its document-driven intelligence.

Pricing is not publicly disclosed and is available only upon request from AlphaSense’s sales team.

Source: AlphaSense

To recap, AlphaSense focuses on extracting qualitative insights from unstructured business documents and expert calls using AI-driven search and summarization.

In contrast, Veridion provides a real-time source of structured company data that feeds analytics solutions to generate actionable insights.

Together, they demonstrate two distinct yet complementary approaches to market intelligence collection and analysis.

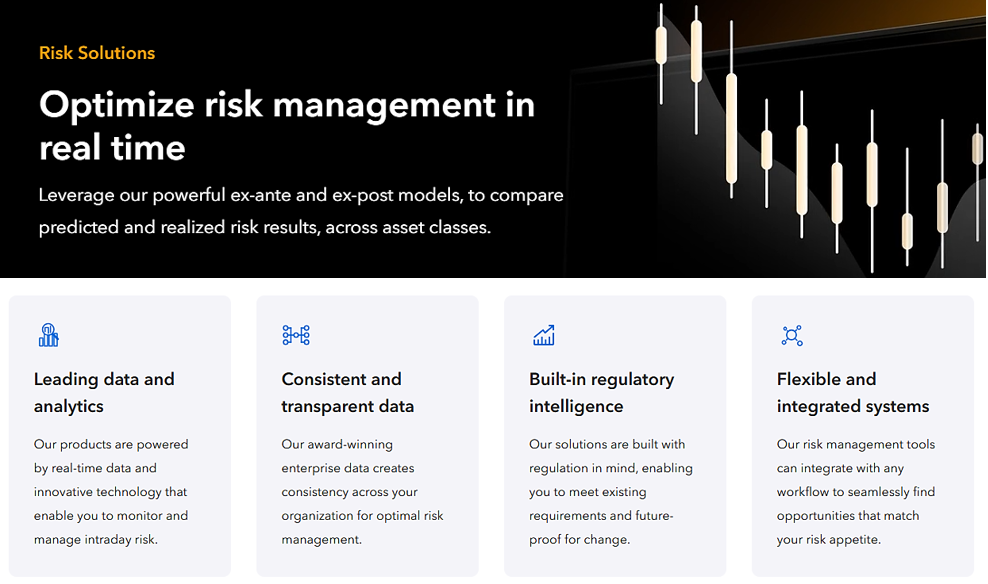

Bloomberg Terminal is one of the oldest and most widely used trading and market execution platforms, providing live data streams and order capabilities.

As such, it’s particularly well-suited for traders and asset managers who require frequent, rapid market actions.

Beyond trading, Bloomberg Terminal integrates a wide range of market intelligence capabilities, including:

Overall, users gain access to extensive Bloomberg Intelligence (BI) directly within the Terminal’s interface.

Source: Bloomberg Terminal

Bloomberg Terminal’s extensive data and analytics support a variety of market intelligence use cases.

As mentioned earlier, traders and portfolio managers use it for real-time market monitoring, price discovery, and trade execution.

Conversely, more hands-off analysts and strategists leverage its financial, macroeconomic, and ESG data to build models, benchmark performance, and generate investment insights.

Corporate development and M&A teams rely on Bloomberg’s research and filings coverage to identify opportunities and assess risks.

Source: Bloomberg Terminal

Beyond the Terminal itself, Bloomberg delivers data through interactive dashboards, alerts, APIs, and Excel integrations.

Pricing for these services is not publicly disclosed, but a free demo can be ordered.

So, while the Terminal’s hallmark remains live trading access, it also serves as a powerful platform for market intelligence and analysis.

Compared to other tools, Bloomberg’s focus on financial market data and analytics makes it more similar to AlphaSense than Veridion.

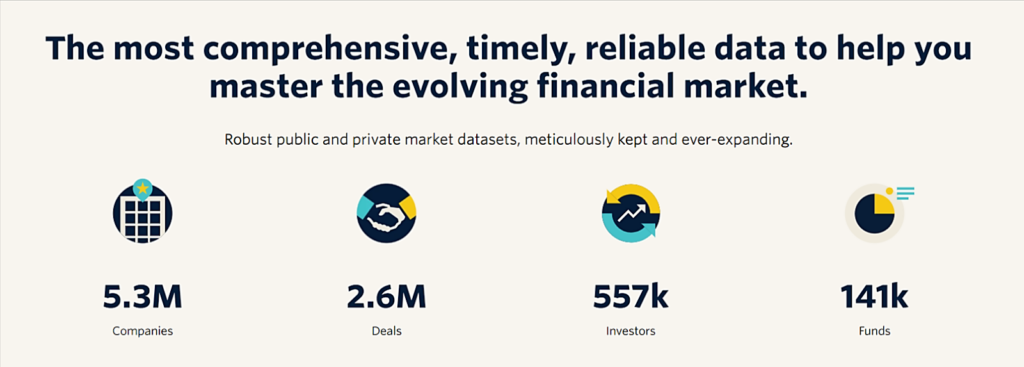

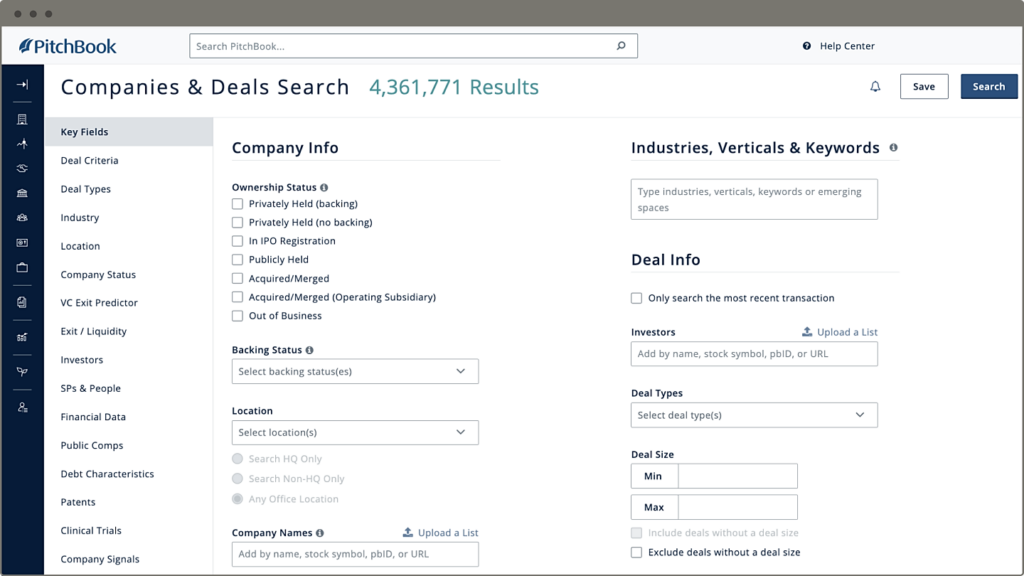

PitchBook is a market intelligence platform specializing in venture capital, private equity, and M&A data.

Like AlphaSense and Bloomberg, it focuses on financial market information such as company valuations, deal histories, investor activity, and leadership profiles.

Rather than covering all businesses, PitchBook curates its dataset around companies engaged in investment, fundraising, and deal activities.

Here’s an overview of the platform’s current research coverage:

Source: PitchBook

PitchBook’s public and private market datasets make it particularly useful for professionals engaged in sourcing, evaluating, and structuring investments.

Venture capitalists and private equity investors use it to track emerging startups, benchmark valuations, and identify new investment opportunities.

Investment bankers and corporate development teams rely on PitchBook’s deal histories to analyze market trends and structure transactions, while consultants and strategists leverage it to map investor relationships and understand competitive landscapes.

These use cases come together in the platform’s advanced Companies & Deals Search function, which filters millions of data points into tailored, actionable lists.

Source: PitchBook

Users can search companies by industry, location, age, investors, funding stage, and more.

Compared to other tools on this list, the extent of information provided is more restricted than in AlphaSense and Bloomberg.

More precisely, there are no SEC or other filings, no expert analytics added, and limited access to earnings records and equity research.

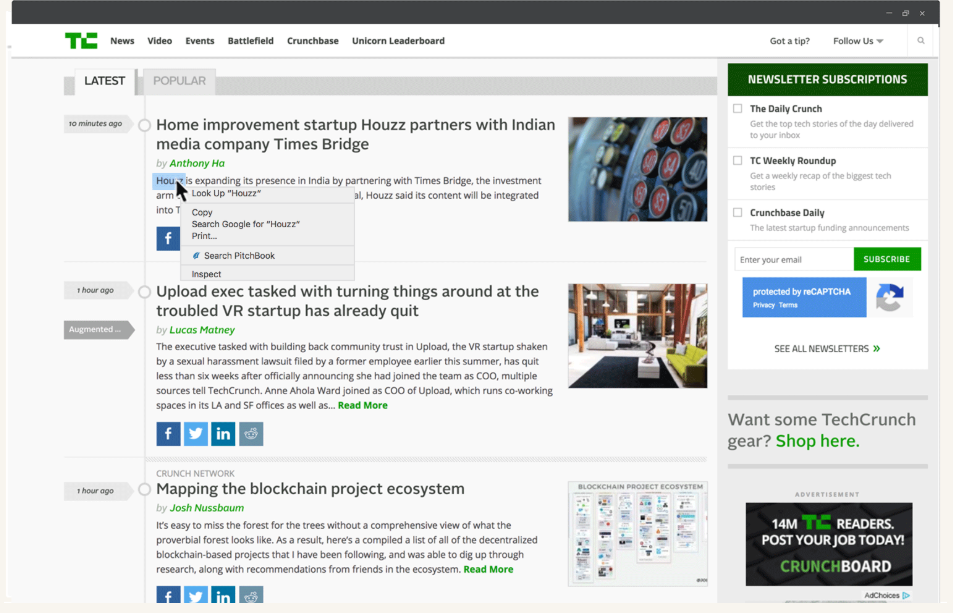

PitchBook supports integrations and APIs that allow you to import and export data to other applications.

It also offers a Google Chrome extension that enables you to access PitchBook services directly from your browser.

Source: PitchBook

This extension saves time by allowing users to highlight a company name while browsing and instantly get hard-to-find information like its valuation or C-suite contact info.

While pricing is not publicly disclosed, you can ask for a quote and a free trial.

In short, PitchBook excels at intelligence for deal sourcing, venture capital, and M&A research, but it lacks the broader coverage of other platforms.

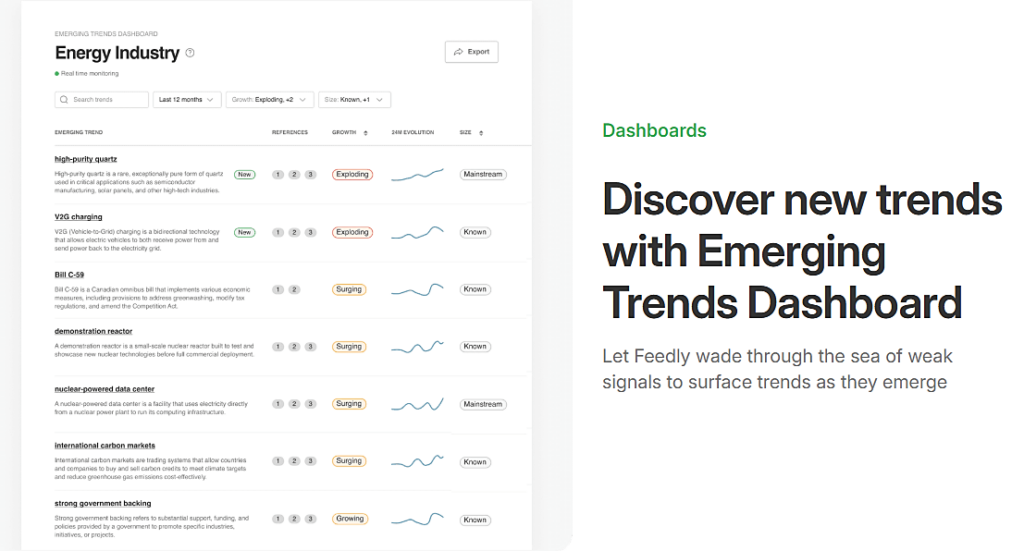

Feedly Market Intelligence is an AI-powered platform that continuously scans broad public web sources for market and competitive intelligence.

It collects real-time insights from over 140 million open online sources, including business magazines, trade publications, research journals, and social media.

Using machine learning and natural language processing, Feedly classifies and evaluates data, understands context, and delivers relevant intelligence.

One of Feedly’s biggest strengths is trend discovery.

Its automated tools filter out noise, track early market signals, and surface emerging trends as they develop.

Source: Feedly Market Intelligence

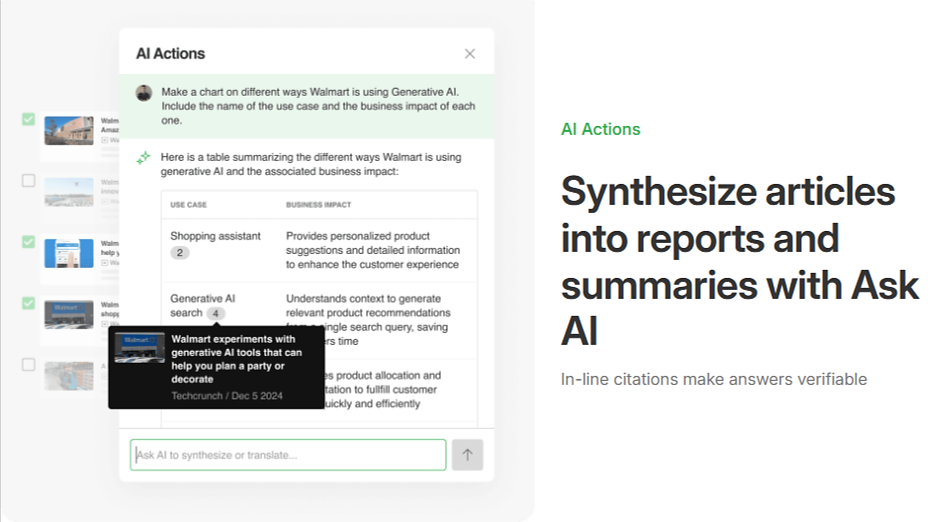

Beyond trend tracking, Feedly enables users to create curated news feeds tailored to their industry and specific priorities.

It also lets teams package insights into custom newsletters, making it easy to keep stakeholders aligned.

Additionally, Feedly’s AI assistant, Ask AI, can synthesize multiple articles into concise reports and summaries, saving significant research time.

Source: Feedly Market Intelligence

With its emphasis on news monitoring and insight sharing, Feedly is best suited for corporate strategy, innovation, and competitive intelligence teams that need to track industry trends, monitor competitors, and identify emerging technologies.

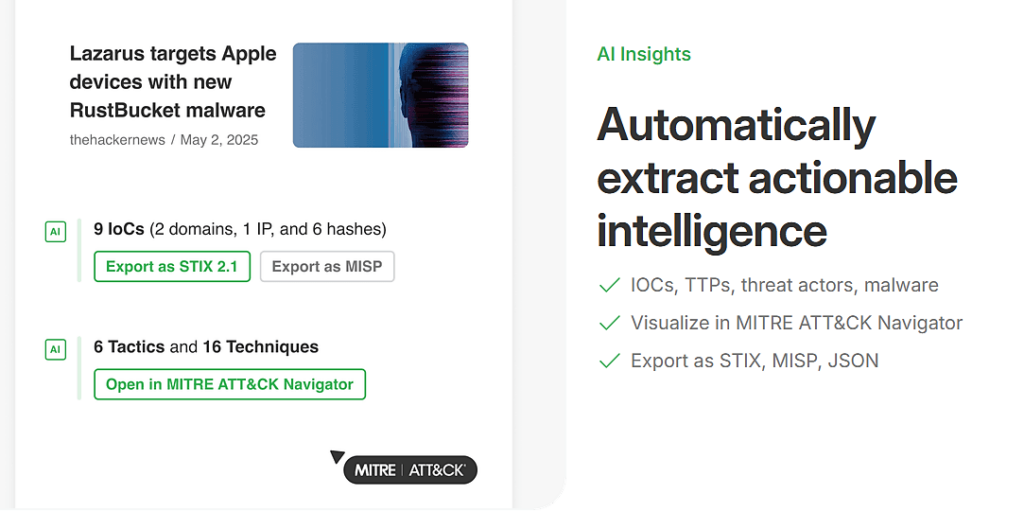

Another notable feature is Feedly’s Threat Intelligence, designed specifically for cybersecurity teams.

This capability helps security professionals stay ahead of emerging risks by providing real-time intelligence on threats such as IOCs, TTPs, malware, vulnerabilities, and cyber-attacks, along with the context needed for effective response.

Source: Feedly Market Intelligence

Threat Intelligence is offered as a separate package, with pricing not disclosed.

By contrast, Feedly Market Intelligence pricing is public.

The Standard plan costs $1,600 per month (billed annually), while the Advanced plan is $2,400 per month (billed annually).

Compared to other platforms, Feedly resembles Veridion in how it aggregates data from open external sources.

However, its company-level datasets, especially with regard to product and service specifications, are less comprehensive.

What sets it apart is the combination of built-in analytics, trend monitoring, and the option to extend its functionality into cybersecurity.

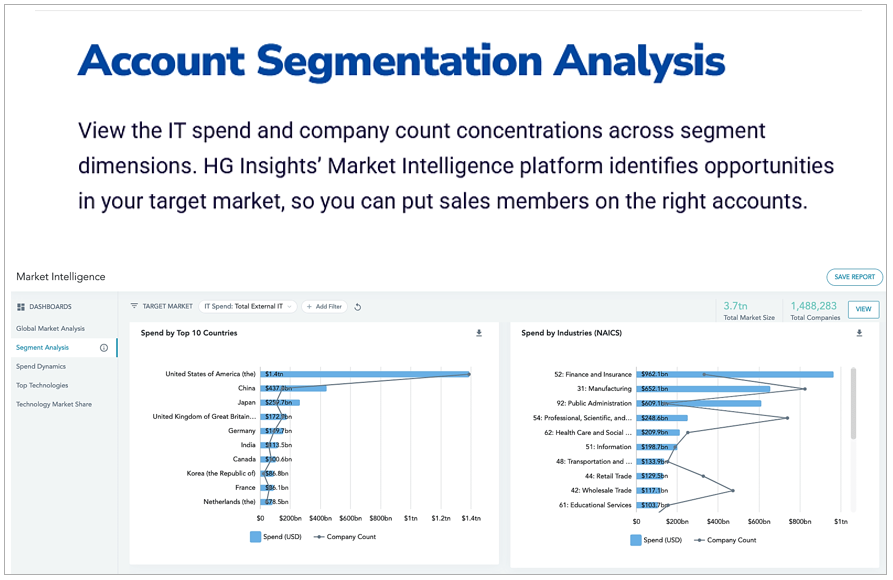

If your business operates in the B2B technology space, HG Insights may be the right intelligence tool for your team.

This platform specializes in delivering detailed, AI-powered technology and IT spend intelligence designed primarily for B2B strategy, sales, and marketing teams.

Its market intelligence includes:

Here’s a look at the TAM analysis feature:

Source: HG Insights

HG Insights also provides revenue growth analytics that combine technology usage, spend data, and buyer behavior to help teams optimize their go-to-market strategies.

As such, it is most valuable for technology vendors and IT service providers looking to size markets, sharpen campaigns, and prioritize accounts.

Strategists can size markets by IT spend, installed technologies, and firmographics, while also spotting whitespace opportunities.

Marketing teams can sharpen account-based campaigns with precise segmentation and improved targeting.

Meanwhile, sales teams can prioritize accounts with the highest buying potential and uncover competitor displacement opportunities.

Here’s how HG Insights visualizes account segmentation to direct sales teams toward the right opportunities:

Source: HG Insights

HG Insights comes as a self-serve cloud platform accessible via any web browser.

Its datasets can also be integrated into third-party systems through APIs and connectors, making it easy to enrich internal records and support automated workflows.

Pricing is not publicly disclosed, so prospective users need to request a quote. A free demo is available.

With its narrower company coverage and strong focus on technographics and IT spend, HG Insights differs from broader tools like Veridion.

This tool excels as a specialist solution for B2B IT providers who need precision targeting intelligence to drive go-to-market planning.

Whether your focus is financial markets, company data, deal tracking, or technology insights, selecting the right market intelligence platform, or a combination of them, depends on your team’s priorities.

By understanding what each tool offers and aligning it with your needs and budget, you can identify the best fit.

Done well, this alignment turns vast data streams into actionable insights that drive smarter, faster business decisions.