Top 7 Market Intelligence Software

Ever wonder how top companies stay ahead of the curve?

One piece of the puzzle is using the right tech.

A great market intelligence platform can give a business a significant advantage, helping it gather and analyze vast amounts of data to spot emerging trends and opportunities.

So, in the following chapters, we’ll review the best market intelligence platforms, comparing their features, capabilities, and use cases to help you choose the right solution for your business.

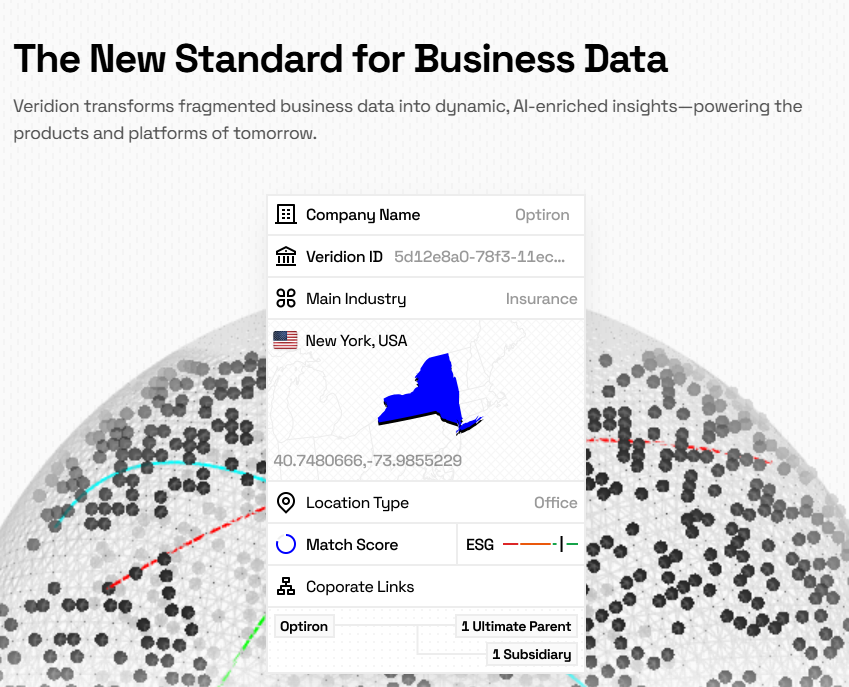

First off, let’s explore Veridion, our own market intelligence platform.

Veridion’s core is automated web-scale collection and enrichment of business data, with a database covering both public and private enterprises that are harder to discover elsewhere.

Source: Veridion

Key strengths of the platform include:

The system uses proprietary AI and ML algorithms to scrape company sites, job pages, social posts, news, and public filings.

These algorithms then clean up and organize the data into detailed company profiles.

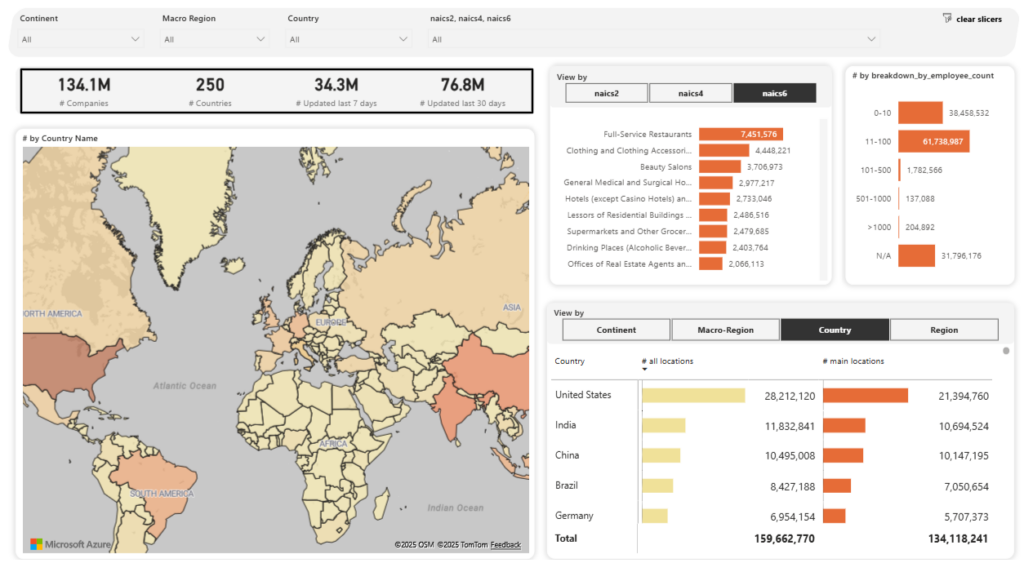

Veridion’s database is extensive, covering over 130 million companies in over 200 countries worldwide, with more than 300 attributes per company profile.

Source: Veridion

These attributes go beyond basic firmographic information, as each profile has detailed product and service tags, technographic signals, ESG information, and financial indicators.

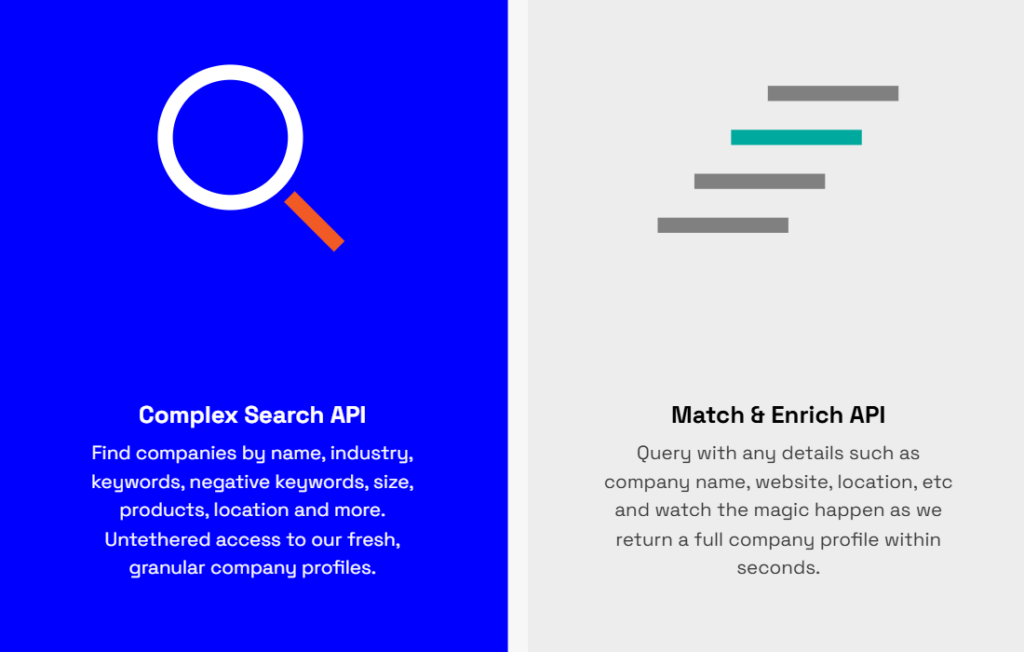

Importantly, the data is easily accessible through two key APIs, which are shown below.

Source: Veridion

The Complex Search API lets you build targeted queries to find the exact companies you’re looking for, while the Match & Enrich API matches, deduplicates, and enriches your existing vendor lists.

Both APIs are designed to feed BI dashboards, MDM systems, and other market-intel tools with either streaming or batch data outputs.

In summary, while some other platforms on our list specialize in things like sales enablement or financial data, Veridion prioritizes breadth and granular company data.

This makes it excellent for procurement, market risk assessments, and product and technology mapping.

If you need an integratable, up-to-date “single source” of structured company and supplier facts, Veridion is your best choice.

Next up is S&P Global, an industry heavyweight that has built a reputation for rigorous, audit-ready market data and analytics.

S&P’s role in market intelligence centers on delivering validated financials, credit data, and sector research that analysts can trust.

It also aggregates primary-source filings and proprietary credit models that feed institutional decision-making.

Consequently, it’s a go-to for investment teams, corporate finance, and risk groups who depend on audited financials and credit metrics alongside industry research.

However, that doesn’t mean S&P Global doesn’t provide broader market intelligence data.

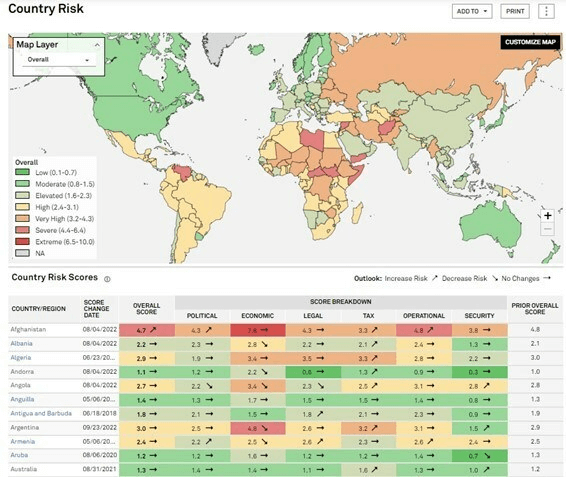

For example, consider their Country Risk Scoring.

Source: PR Newswire

Country risk scoring is S&P’s structured assessment of a nation’s political, economic, and financial vulnerabilities.

So, it combines rigorous fiscal metrics and credit outlooks along with more general governance indicators and risk factors to assess the overall country risk.

Key strengths of this platform:

It’s also worth mentioning S&P’s AI capabilities, particularly via its Capital IQ platform.

Source: S&P Global

This tool is S&P’s integrated analytics workspace that bundles screening, normalized financials, peer comps, Excel plug-ins, and API access into one environment.

Increasingly augmented by AI, it offers faster data normalization and insight generation.

Capital IQ further builds S&P’s value for financial teams by turning validated, long-form financials into ready-made dashboards and screens.

This contrasts with tools like Veridion that provide more general data than financial depth.

Overall, you might want to choose S&P Global when financial accuracy, credit analytics, and institutional-grade modeling are your primary market-intel needs.

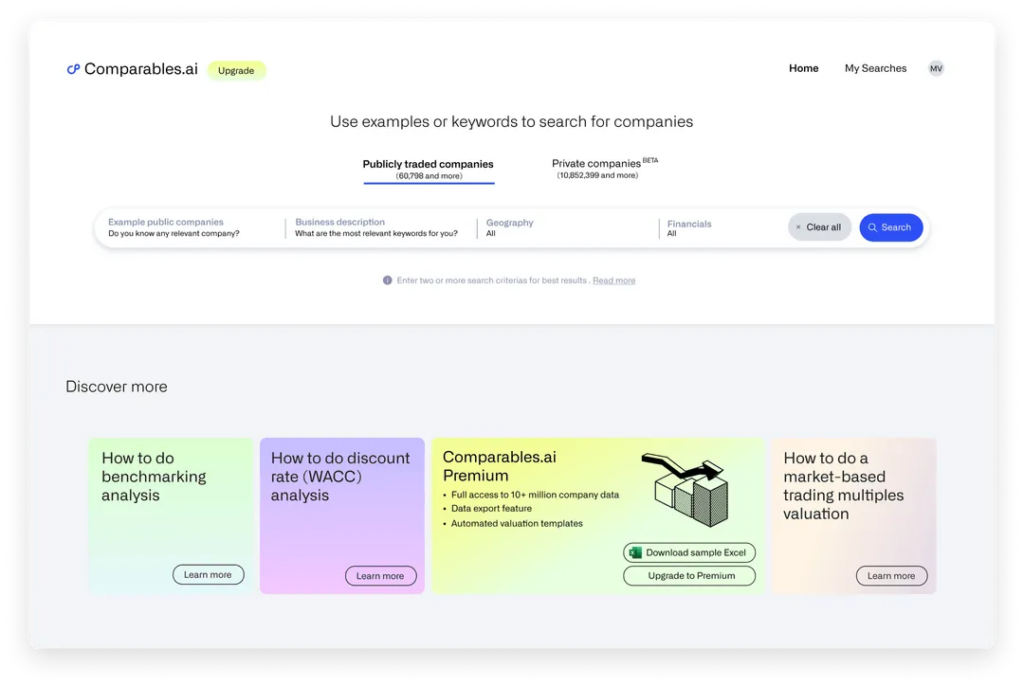

Third on our list is Comparables.ai, a valuation engine that’s fast and data-rich, focusing on company comparables and mergers and acquisitions (M&A) support.

At its core, Comparables.ai accelerates M&A screening and company benchmarking by producing normalized comparable sets and automated valuation benchmarks.

So, teams use it to shorten due diligence cycles and find relevant buyers or targets much faster.

Source: Comparables.ai

Compared with the platforms we’ve covered, Comparables.ai claims to have one of the largest databases.

It boasts 330M+ active companies, mixing public and private business coverage to maximize hit rates for rare or private M&A targets.

However, its company attributes are finance-and-ownership focused, so product or supplier taxonomies and non-financial attributes are less emphasized than on a platform like Veridion.

On the other hand, the platform has 10 years of M&A transaction data that’s updated daily, which directly feeds its valuation and comp outputs.

Key strengths:

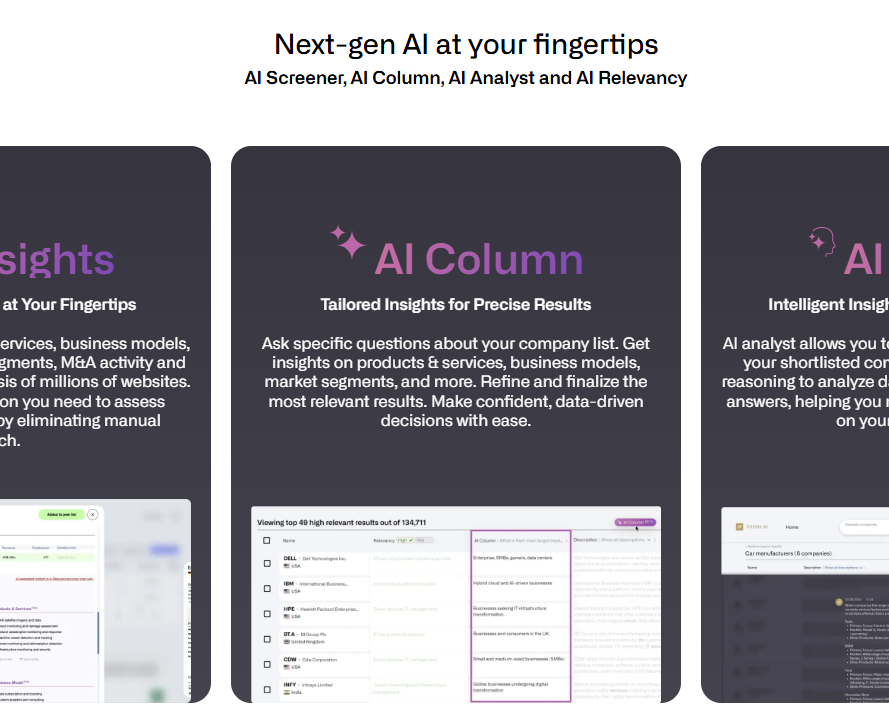

Comparables.ai also heavily spotlights its AI features, which include AI screeners and analysts to speed up insight generation.

Source: Comparables.ai

For example, their AI Column capability lets you ask targeted questions about a shortlist and returns AI-generated responses for each of the listed companies in a separate column.

These AI tools are essentially designed for speed and scaling analyst workflows rather than replacing detailed manual validation.

So, in case you need fast, large-scale comparables and M&A screening, this platform is worth exploring further.

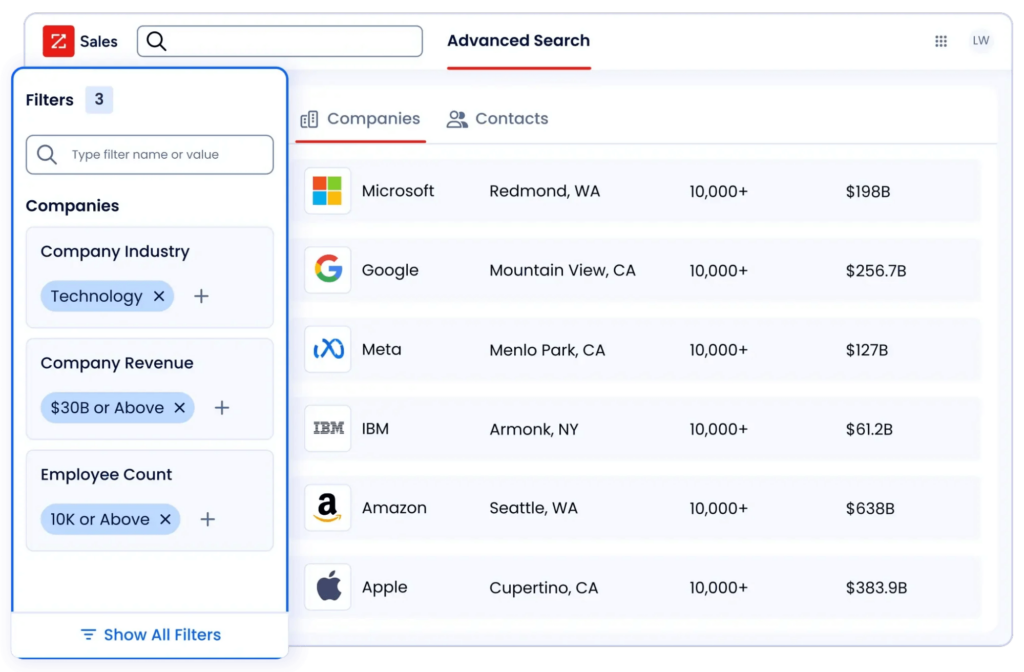

Next up is ZoomInfo, a go-to-market (GTM) intelligence platform built to turn company and contact data into action.

If Comparables.ai is the M&A and valuation engine and S&P Global is the financial-data heavyweight, we can look at ZoomInfo’s niche as sales and GTM support.

ZoomInfo combines a massive B2B company and contact database with intent, technographic, and enrichment tools so revenue teams can find and engage the right buyers quickly.

Source: ZoomInfo

ZoomInfo’s database is very large, with hundreds of millions of contacts and roughly 100M company profiles, but its strongest coverage and richest records skew toward North America.

In fact, they have relatively fewer, shallower profiles in non-NA markets, with around 34 million company profiles and 200 million professional contact profiles.

As you can see, you get a large contact database through this platform (over 600 million contacts in total), which is different from every other tool we covered so far.

Key strengths:

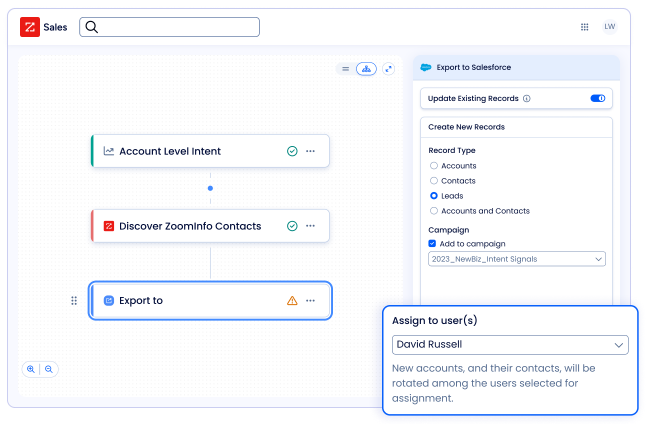

On top of all this, ZoomInfo supports GTM automation.

As the image below illustrates, you can build lead-flow funnels that filter companies, pick the right contacts, and route them to the right reps or campaigns automatically.

Source: ZoomInfo

In short, ZoomInfo is best for sales and demand-gen teams that need scalable prospecting, intent-driven prioritization, and CRM-facing automation, especially for the North American market.

Staying in the sales-enablement and GTM niche, let’s look at Cognism, a tool that packages compliant, high-quality contact data and intent signals for outbound teams.

Cognism combines proprietary data collection and organization, human verification, and third-party client intent signals to surface the B2B contacts in prime markets.

Its unique focus is on increasing your team’s connect rates and reducing time wasted on bad numbers.

Source: Cognism

Under the hood is Orion, Cognism’s AI-powered data collection and validation engine.

Similar to tools like Veridion, Cognism’s Orion ingests content from a variety of sources.

It analyzes the news, company sites, reports, public registries, and partner feeds, stitches dozens to hundreds of datapoints per record, then runs multi-layered verification.

Uniquely, as part of that verification pipeline, Cognism applies human checks and compliance filters, such as GDPR/CCPA checks and do-not-call (DNC) lists, to reduce risk and improve accuracy.

Similar to ZoomInfo, Cognism embeds intent data via its Bombora partnership, letting teams combine in-market signals with verified contact info to time outreach.

Key strengths:

It’s worth highlighting Diamond Data®, Cognism’s phone-verified offering.

Source: Cognism

With this feature, records are hand-or machine-verified to surface working mobile numbers and direct dials.

This capability is something that many of Cognism’s customers credit for their higher connect rates.

This makes Cognism best for GTM teams that need legally safe, high-quality contact data with intent signals to power their outbound sales pipelines.

Sixth on our list is Valona’s market intelligence platform, a purpose-built hub for competitive and market intel across industries.

Valona positions itself as a complete platform that caters to product, strategy, and GTM teams.

It ingests internal and external feeds, normalizes market signals, and turns them into analyst-ready reports.

As shown below, the platform acts as a central hub for your intelligence needs, automating data ingestion and enrichment, and then delivering a range of analytics, alerts, and shareable reports.

Source: Valona Intelligence

Valona pulls from over 200,000 global sources (a mix of public and paid feeds), though the exact database size is not publicly specified.

This source breadth is routed through configurable pipelines, allowing you to prioritize industry verticals, competitors, or topics of interest.

Key strengths:

Compared with broader enrichment tools like Veridion or ZoomInfo, Valona is tuned for competitive intelligence and sales enablement rather than universal company enrichment.

For example, Valona’s battlecards aggregate product changes, pricing moves, and messaging shifts into concise one-pagers.

Reps can use those to counter competitors in real time, complete with recommended talking points and win/loss signals.

Source: Valona Intelligence

What’s more, Valona uses over 30 different AI models to ingest content in over 115 languages, which is especially useful if you need market intelligence data for large non-US markets such as China.

Also, its Insights Engine synthesizes the vast amount of data volume into short executive summaries—also available in many different languages.

In short, Valona is best when you need tactical, multilingual competitive monitoring and operationalized intelligence for product, sales, and strategy teams.

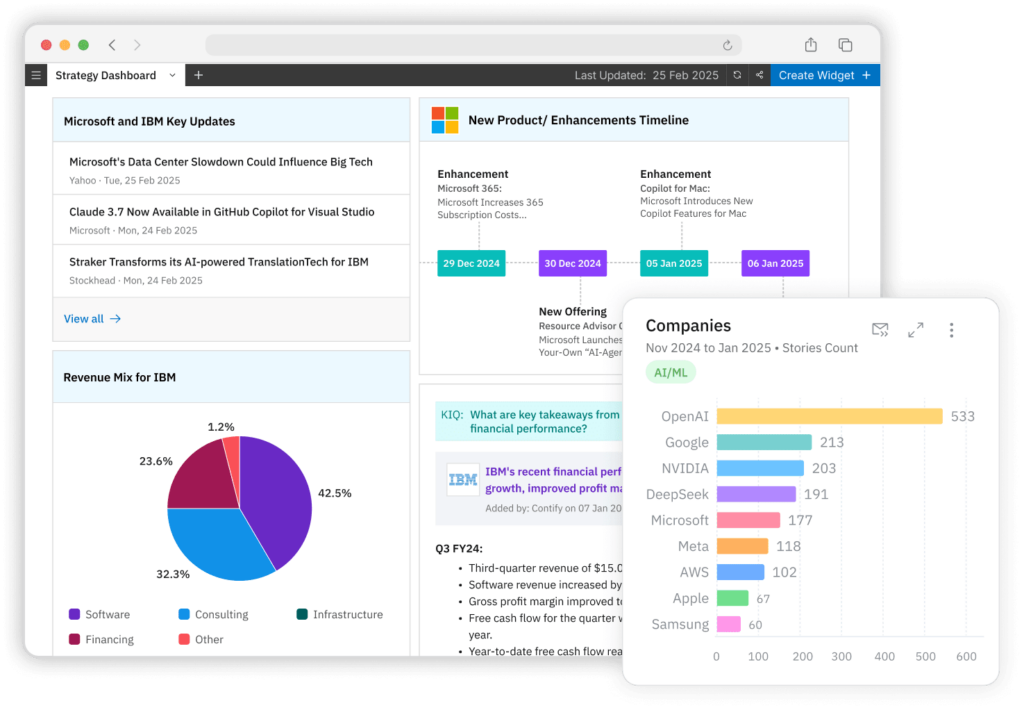

Contify is a competitive- and market-intelligence platform that leans on AI-assisted signal triage and deep customization to turn noisy web content into prioritized, actionable intelligence.

Contify’s core offerings combine continuous monitoring with AI-powered filtering and human data curation so teams receive tailored alerts, reports, and analyst-ready briefings.

In practice, it’s used to surface competitor moves, regulatory shifts, and market trends while letting users shape what “important” means for them.

In fact, Contify offers extensive personalization: editable dashboards, topic widgets, and saved views that let you visualize the exact companies, industries, and themes you want to track.

Source: Contify

A unique Contify capability is its Key Intelligence Questions (KIQs) framework.

With it, you define the specific questions your organization needs answered, like “Which competitors launched new pricing models this quarter?”

The platform then maps incoming signals to those questions, prioritizing items that answer them. This turns streams of mentions into targeted answers and reduces analyst triage time.

Key strengths:

Contify is most similar to Valona in offering a full intelligence solution, but emphasizes personalization and KIQ workflows as its organizing principle.

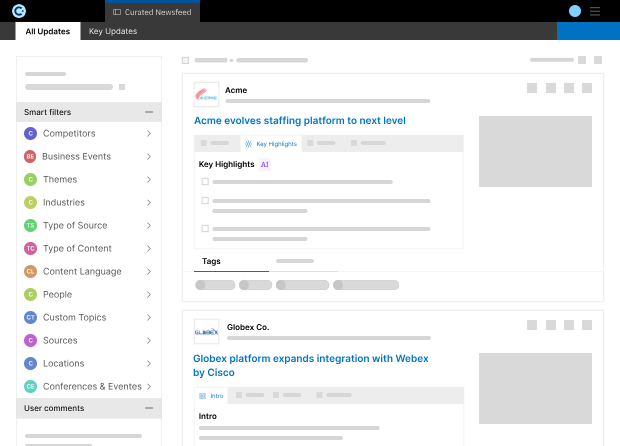

Other notable features include a real-time Newsfeed, an Insights module that auto-summarizes trends, and automated Newsletters that distribute curated market insight briefs to stakeholders.

Source: Contify

Finally, Contify’s AI assists with many of the platform’s functionalities, like insight summarization, relevance scoring, and trend detection, speeding analysts from source to insight.

Overall, you’ll want to explore Contify more if you need highly configurable and personalized market monitoring that can be used across business functions and industry verticals.

That wraps up our look at seven leading market intelligence software options.

We’ve looked at these platforms’ key features, strengths, and weaknesses, aiming to give you a starting point for your search.

Ultimately, the best system for you will depend on your specific needs and resources.

So, take this information and start researching the platforms that resonate most with you.

Compare free trials, explore some demos, and hopefully you can find the perfect fit to drive your business forward.