Mistakes to Avoid When Using Market Intelligence Tools

Key Takeaways:

It’s no secret that market intelligence tools are serious game-changers.

They automate data collection from multiple sources in real time, delivering structured and verified insights with minimal human error.

This saves teams hours, or even days, of manual work, freeing them to focus on analysis and strategy.

However, aware of these benefits, many organizations rush into adopting these tools without enough planning or research.

And that enthusiasm can backfire.

Instead of fueling smarter decisions, the tools end up creating confusion, wasted effort, and missed opportunities.

That’s why we’ve rounded up the six most common mistakes companies make with market intelligence tools and, more importantly, how you can avoid them.

That way, you can get the most value from your solutions and put your insights to work with confidence.

It’s tempting to start implementing and using a market intelligence (MI) tool as soon as possible.

But if you don’t first identify what problem the tool is meant to solve, or what kinds of decisions it should support, you risk ending up with a solution that doesn’t really work for your business.

Charles Griffiths, Director of Technology and Innovation at AAG IT Services, a company providing expert IT support for logistics, agrees.

He notes that buyers are often drawn in by shiny new tools with advanced features that promise the world, but don’t actually fit their unique needs.

And that mismatch can cause serious problems:

Illustration: Veridion / Quote: LinkedIn

To avoid that, you need to choose wisely.

Don’t just go for the newest tool with bells and whistles you don’t need.

Instead, choose the one that solves your problems and fits your needs.

To do that, start by defining these problems and needs, and then set clear, measurable goals around them.

Griffiths explains:

Illustration: Veridion / Quote: LinkedIn

That’s the key: start with your pain points.

Are you spending too much time manually compiling MI? Struggling with unreliable suppliers? Or maybe your sales numbers aren’t where you want them to be?

Once you know that, set measurable goals with specific outcomes.

For example, instead of a vague goal like “speed up supplier sourcing,” define it as “reduce the time to identify suppliers from two weeks to three days.”

You can use the SMART framework to help you out with this step.

Source: Veridion

When your goals are clear and measurable, you’ll have a much better idea of what to look for in a market intelligence solution, and a much higher chance of choosing the right one.

Similarly, companies will sometimes rush into adopting tools without properly comparing options, checking features, or testing them thoroughly.

But this is a costly mistake.

It often results in wasted budget, low adoption, and frustration when the tool doesn’t deliver what was expected.

Remember, MI tools are not created equal. They can serve all sorts of purposes.

For example, our own solution, Veridion, works best for teams in procurement, risk management, ESG, and similar fields.

It draws on a database of over 130 million companies worldwide, enriched with deep contextual attributes such as firmographics, ESG insights, financials, and product information.

Source: Veridion

That means you can analyze a company’s strengths and weaknesses from every angle, including operational, financial, sustainability, and more.

By contrast, some MI tools focus on other areas, such as contact data, employee insights, or lead generation capabilities.

That’s why it’s so important to define your exact needs and compare tools against them.

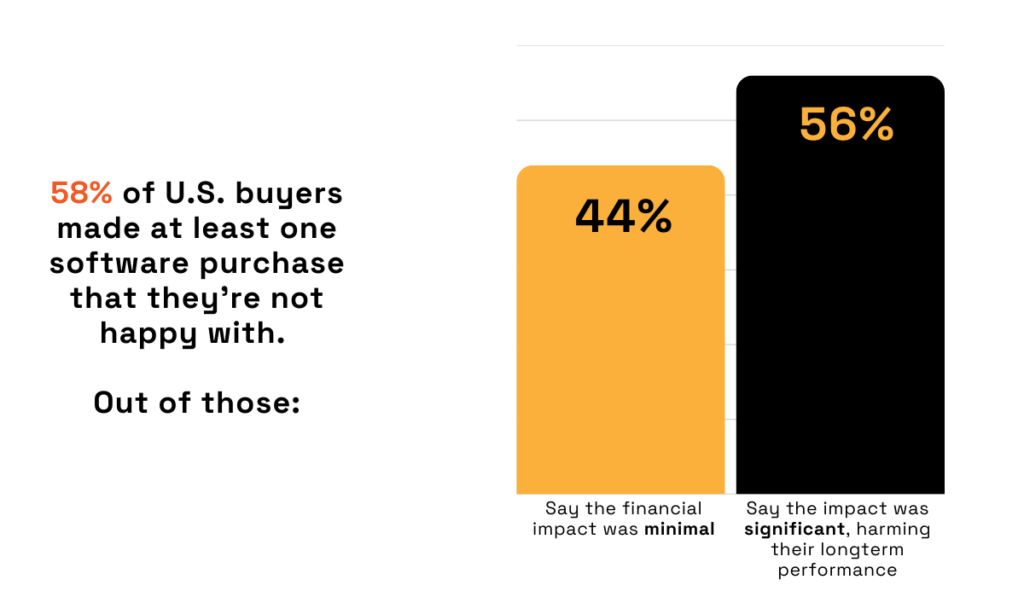

And if you think buyer’s remorse won’t happen to you, think again.

The 2024 Capterra survey found that plenty of software buyers regret their purchase.

While some experienced only minimal setbacks, others reported significant or even monumental consequences, including long-term performance issues and immediate risks to their business.

Illustration: Veridion / Data: Capterra

To avoid this, the survey recommends doing thorough research, reviewing user feedback, case studies, and product comparison websites, in addition to exploring vendors’ websites.

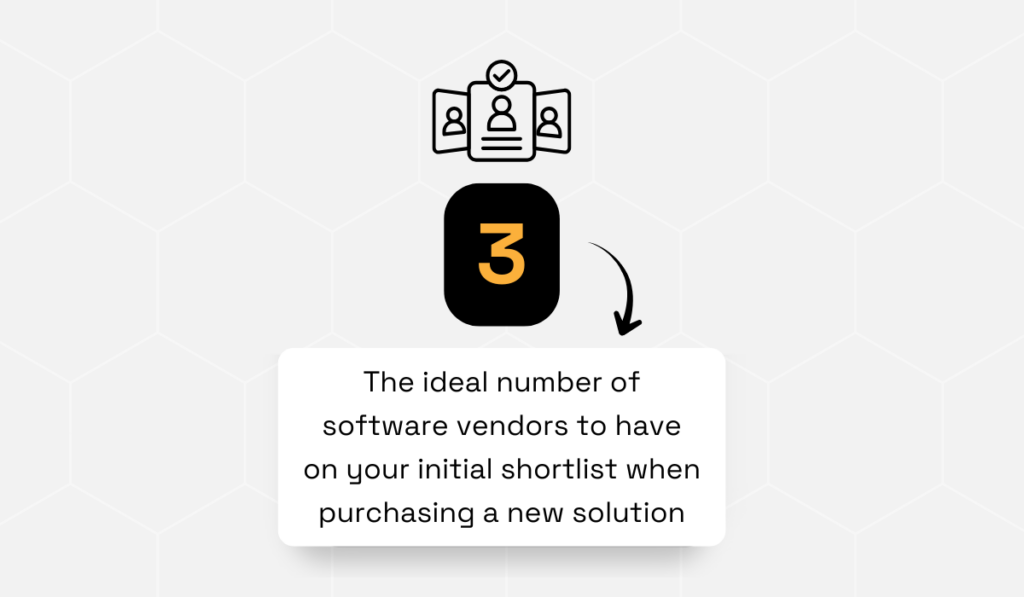

Interestingly, the data also shows that knowing when to stop with your initial candidate list is just as important as knowing where to start.

As it turns out, those who had three vendors on their shortlist had the least regret.

Illustration: Veridion / Data: Capterra

It seems that three is the sweet spot.

Fewer than that doesn’t provide enough options to compare, while more than three slows the process and often leads to decision paralysis.

Plus, with three, you can give each vendor proper attention with demos, free trials, and hands-on testing.

Bottom line: when evaluating software, go for depth over breadth.

The right choice comes from thoroughly exploring a few strong options, not drowning yourself in dozens.

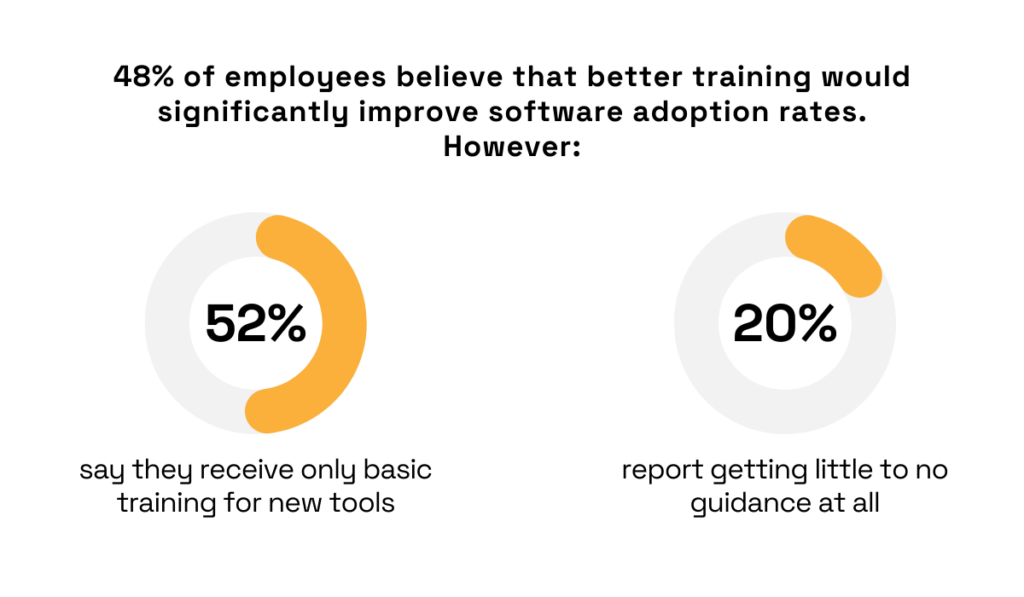

Organizations often purchase MI tools expecting teams to use them effectively right away, without any structured training or guidance.

But here’s the reality: modern solutions, especially those with advanced AI capabilities, aren’t easy to figure out on your own.

Your team will need at least some training in order to become a pro user.

Leaving your team to navigate the tools alone can lead to incorrect usage and missed opportunities.

They may only learn the basic functions, consequently overlooking advanced features or workflows that unlock real value.

In some cases, lack of proper training can even lead to outright rejection of the tool.

According to the 2025 Yooz survey, many employees believe that better training would significantly improve software adoption rates.

Yet, most receive only basic, or no training at all.

Illustration: Veridion / Data: Yooz

But the problem goes even deeper.

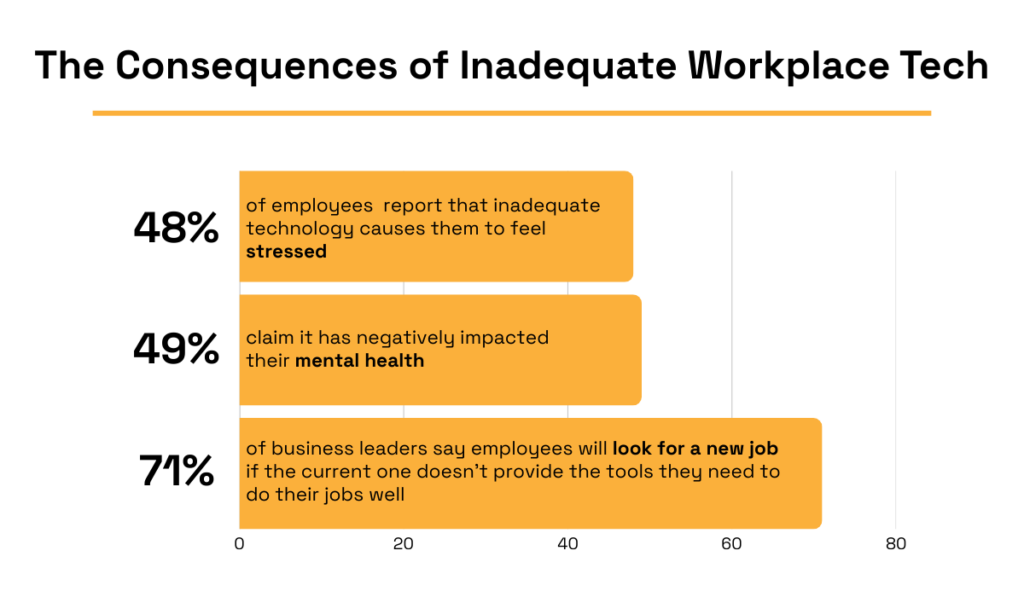

A Freshworks study found that inadequate workplace technology is driving employee stress, negatively impacting mental health.

And what happens when employees feel stressed or unsupported at work?

They leave.

In fact, seven in ten business leaders acknowledge that employees will consider looking for a new employer if their current job does not provide the tools needed to do their jobs well.

Illustration: Veridion / Data: Freshworks

In other words, software training is a vital part of keeping your team happy, healthy, and engaged.

So, when implementing your new MI tool, be sure to provide efficient onboarding, role-based training, as well as ongoing refreshers.

You don’t need to reinvent the wheel here. Many tools already offer a variety of training resources.

Your job is to take advantage of them.

While the available resources vary by company, tool, and subscription level, they often include:

So, before purchasing a solution, check what’s available.

Make sure your team will have the support and knowledge they need when they hit a roadblock.

Just because a tool collects large volumes of raw data doesn’t mean it will automatically produce useful intelligence.

Many make the mistake of treating raw numbers or automated reports as actionable insights without proper analysis.

Rebecca Fiebrink, Professor at the Creative Computing Institute at University of the Arts London, notes:

Illustration: Veridion / Quote: Nature

That’s right: Once you have the data, it’s up to you and your team to ask the right questions, interpret the results, and provide broader context.

Otherwise, you may become overwhelmed by all these charts and metrics, unsure about which actions to take.

Worse, you might misinterpret the data, as raw figures can suggest trends that aren’t meaningful unless contextualized.

For example, a competitor’s product sales spike might be seasonal rather than indicative of their new bold strategy.

That’s why it’s important to ask: “So what?” and “What next?”, connect data to real impact, and provide actionable recommendations.

To do this effectively, you first need a data-literate team.

Data science expert and founder of AskEnola, an AI Super-Analyst, Piyanka Jain, puts it this way:

Illustration: Veridion / Quote: MIT Sloan School of Management

Simply put, data literacy is key to turning insights into action.

A data-literate workforce can analyze information effectively and act on it.

One great method is teaching them to look at data analysis as storytelling and frame insights like a story:

When your team can tell these data stories, your MI tool becomes far more than a reporting engine.

It becomes a driver of well-informed, data-driven decisions.

When your MI tools start delivering a flood of data, it’s tempting to focus only on the numbers they provide and overlook valuable internal insights from systems like:

Neglecting these internal sources can be a problem, as it may lead to an incomplete understanding of the market and your position within it.

Sven M. Bannuscher, VP of Business Operations at Activate Marketing Services, LLC, a company providing marketing services for techmarketers, agrees:

Illustration: Veridion / Quote: LinkedIn

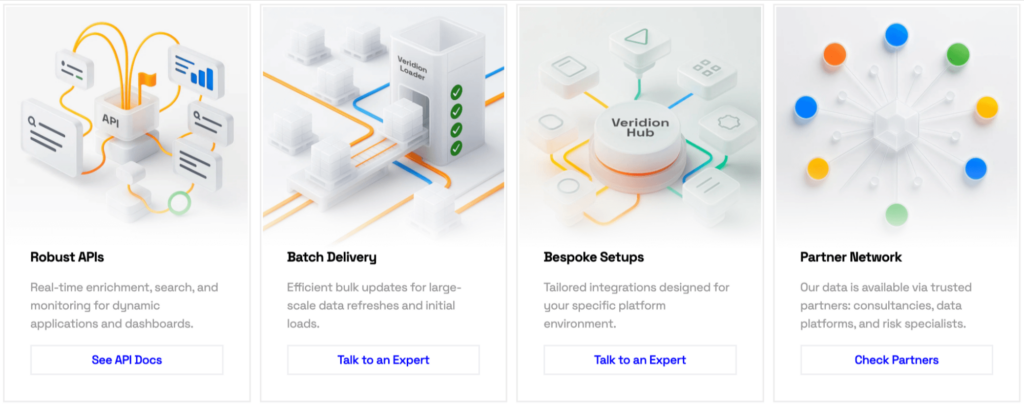

To avoid this issue, choose tools that easily integrate with your internal systems and, if possible, set up workflows that automatically feed internal insights into your MI platform.

Pay attention to data delivery options, ensuring they are flexible enough to work with your BI dashboards, analytics workflows, or internal data lakes.

Source: Veridion

This allows you to see the complete picture with minimal effort.

You won’t need to manually combine data from multiple sources. Instead, the system will handle it for you.

This means you get everything you need to understand your own performance, the market, your competitors, and your customers, all in one place.

That kind of visibility directly translates into faster decisions, smarter strategies, and a serious edge over the competition.

It can be tempting to present everything you find at once.

However, delivering overly dense dashboards or failing to tailor communication to your audience can render your MI tool practically irrelevant.

Insights that aren’t understood or acted upon don’t influence decisions, and your stakeholders may tune out completely.

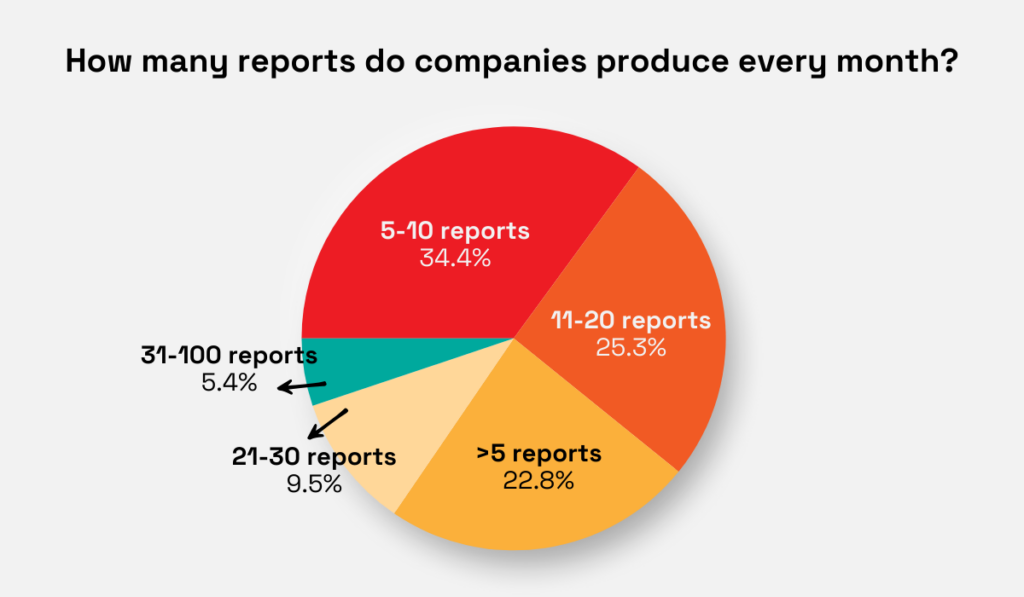

The 2023 Databox survey shows that nearly 35% of teams produce five to ten reports every month.

Illustration: Veridion / Data: Databox

In other words, your report isn’t the only one stakeholders are going to read, so presenting information effectively is vital to keeping them engaged.

That’s why it’s smart to use storytelling and visuals to make your findings digestible, impactful, and decision-ready.

Duncan Ross, Global Head of Research at the global news magazine, Newsweek, is all for the power of data visualization:

“We all know that the way we react to things visually is very different than the way we react to things intellectually. So that ability to see patterns and interpret things using images can give powerful insights you can’t get, or you can’t easily get, by simply looking at numbers.”

But it’s not about cramming in as many visuals as possible.

How you format your reports can make or break them.

Here are some tips to get it right:

Follow these steps, and your reports will be understood, remembered, and acted on.

After all, this is the whole point, isn’t it?

If the insights from your MI tool never reach the right eyes, not only are you missing out on potentially game-changing insights, but you’re also failing to get a return on the investment for the tool.

All in all, the real power of market intelligence tools lies not just in the technology itself, but in how efficiently you implement and use it.

When chosen carefully, integrated thoughtfully, and used with skill, they can truly unlock unparalleled insight, clarity, and opportunities for growth.

So, take the time to get it right, equip your team, and trust the process.

With intention and persistence, these tools can help you see further, act smarter, and steer your business towards success.