5 Challenges of Using Market Intelligence Tools

Key Takeaways:

In the command center of modern enterprise procurement, the blinking lights of data dashboards promise clarity.

Yet, for many executives, the overwhelming flow of information often leads not to insight, but to indecision.

You are tasked with navigating supply chain disruptions, volatile commodity prices, and emerging risks from suppliers.

The right market intelligence (MI) tool should be your most trusted co-pilot, cutting through the noise to deliver actionable intelligence.

But what happens when the tool itself becomes a source of complexity?

In this article, we explore five key challenges of MI platforms, along with practical strategies to overcome them, so you and your team can harness these tools effectively.

Market intelligence tools often aggregate vast amounts of data from diverse sources, including news feeds, financial reports, social media, and supplier databases.

Having a lot of data sounds great in theory, but you can drown in noise if you don’t manage it.

Intelligence teams work harder than ever, yet still get blindsided because collecting data isn’t the same as deriving actionable foresight.

In practice, you may spend hours sifting through irrelevant signals or duplicate reports.

Without a clear way to filter and prioritize, you risk overlooking the truly important trends amid the clutter.

Therefore, the fundamental issue when working with data isn’t scarcity, but data relevance.

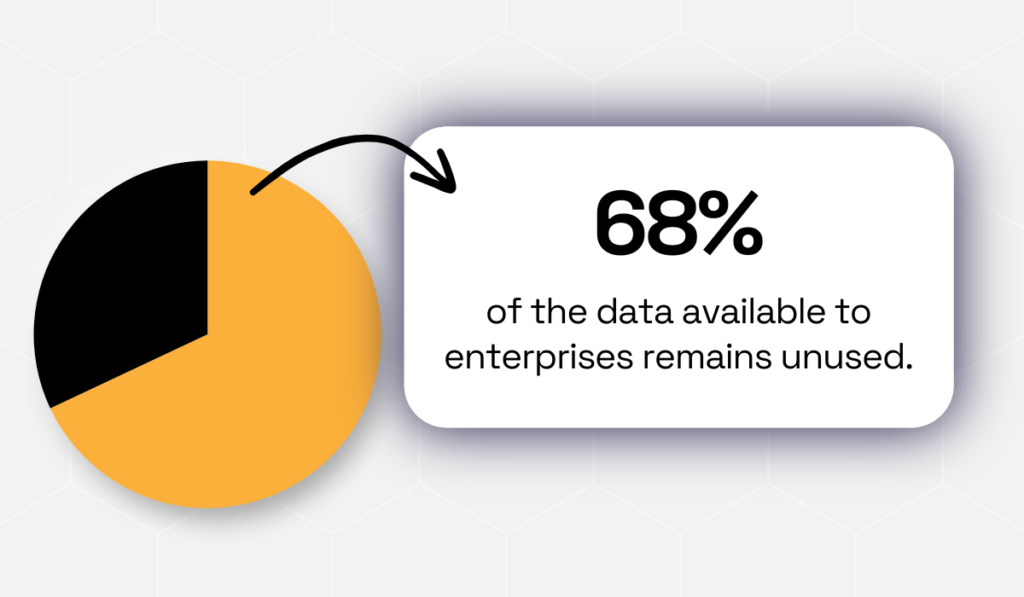

Research shows that 68% of the data available to enterprises remains unleveraged, representing wasted resources and missed opportunities.

Illustration: Veridion / Data: Seagate

When teams are bombarded with irrelevant information, critical signals can get lost in the noise, leading to analysis paralysis.

So, how do you tame the data flood?

First, implement strong filtering and visualization frameworks.

You can use AI-powered tools that automatically categorize and prioritize information based on your specific requirements.

Then, set up custom alerts for critical market movements, supplier disruptions, or regulatory changes that directly impact your operations.

Source: Veridion

This will empower you to stay ahead of the curve.

But before diving into data, identify the specific questions your market intelligence should answer.

Are you monitoring for supply chain disruptions? Evaluating supplier financial stability? Or perhaps tracking commodity price fluctuations?

Answering key intelligence questions ensures that your data collection remains focused and relevant, giving you a clear sense of purpose in your data analysis.

It’s also helpful to transform complex datasets into intuitive visual formats.

Interactive dashboards enable you to quickly identify patterns, trends, and anomalies without having to sift through spreadsheets.

By funneling data into targeted views, you’ll spend less time scrolling and more time on insights that drive decisions.

Even the best filtering can’t fix bad inputs.

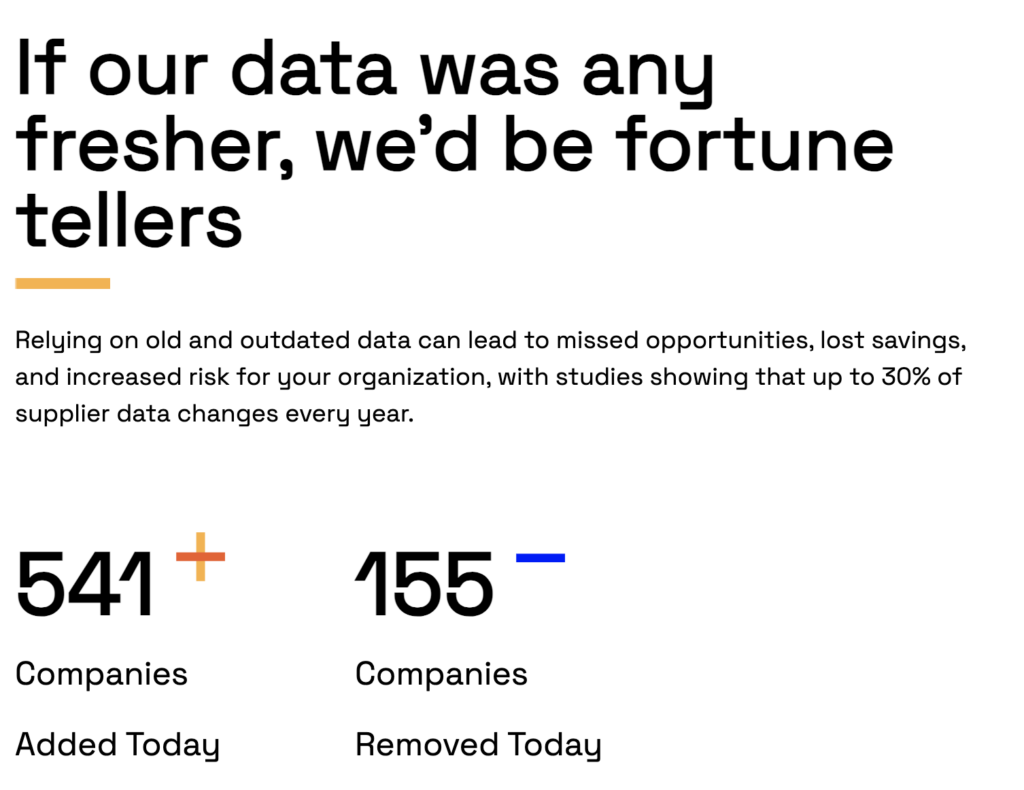

Another major pitfall of MI tools is the use of unreliable or outdated data.

Many data sources, especially publicly crowd-sourced or third-party feeds, can be incomplete, inaccurate, or just old.

And in procurement, relying on stale info can mislead decisions.

Imagine calculating a supplier’s capacity with last-quarter production figures when they’ve since ramped up output—your buying strategy could be off by miles.

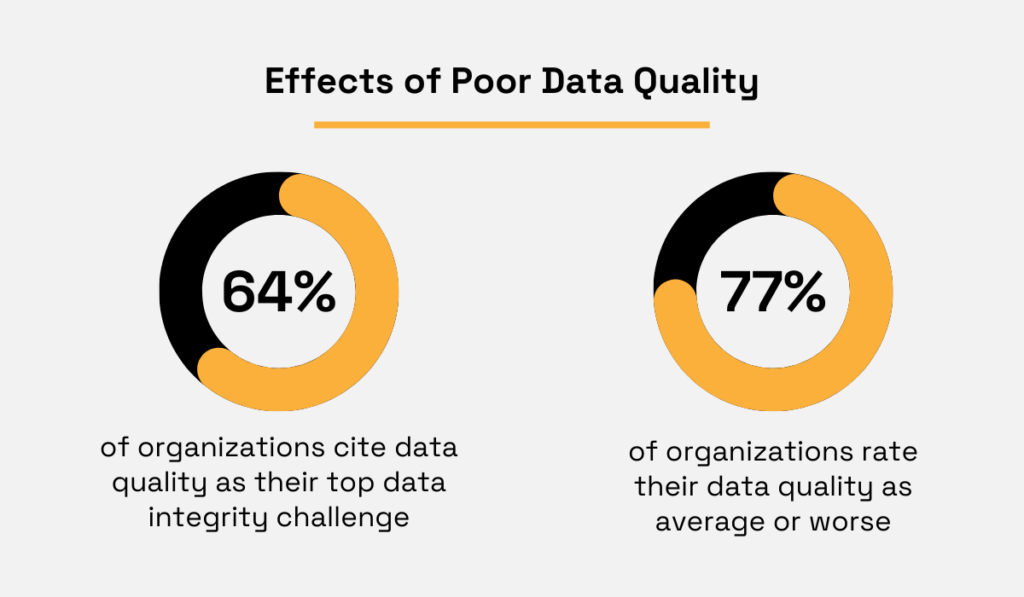

Precisely’s 2025 Data Integrity Trends and Insights report shows that 64% of organizations cite data quality as their top data challenge, and 77% rate their data quality as average or worse.

Illustration: Veridion / Data: Precisely

On top of that, poor data is expensive.

Gartner estimates that organizations lose $12.9 million annually due to data quality issues—precisely the opposite of what MI should achieve.

For procurement professionals, data inaccuracies can manifest in various ways, including outdated supplier information, incorrect financial records, or incomplete market assessments.

In addition to source quality, many tools claim to provide “real-time” intelligence but actually update infrequently.

If your industry moves fast, even a day-old price index might mean a missed deal.

What if a competitor launched a new product yesterday, and your data only catches it next week? That lag could mean your strategic response is already too late.

In short, outdated MI creates blind spots at the worst possible time.

To improve data quality, select MI tools that utilize verified, comprehensive data sources.

For example, Veridion’s data for market intelligence utilizes AI-powered bots that continuously scan and verify data from various online sources, ensuring higher accuracy rates.

Source: Veridion

Veridion emphasizes sourcing verified company and market info, giving you confidence that what you see is current.

The right tools deliver timely, accurate, actionable data.

By insisting on high-quality inputs, you minimize the risk of making decisions on faulty intelligence.

AI is only as smart as the data it consumes, so feed your tools clean, current data.

Your MI tool shouldn’t be an isolated silo.

Yet, many organizations struggle to integrate market intelligence tools with their existing systems, such as CRMs, ERPs, procurement platforms, and analytics suites.

Why is this such a big issue?

Because disconnected tools create duplicate work, operational inefficiencies, and confusion.

For example, if sales manually pull competitive data into CRM while analysts do the same in a separate MI dashboard, you can easily end up with inconsistent figures and wasted effort.

The alarming thing is, the 2023 report from Globality found that nearly all procurement professionals say their sourcing technology isn’t connected across teams and suppliers.

Illustration: Veridion / Data: Globality

This fragmented architecture leads to data silos, where each team uses its own version of the truth, resulting in inconsistent information across the organization.

And when market intelligence exists in isolation, its value diminishes dramatically.

On the other hand, the more your MI data flows seamlessly into familiar tools, the more value it delivers.

To avoid integration headaches, opt for MI solutions with robust API support that enable seamless connectivity with your existing tech stack.

Modern APIs enable automated data synchronization between systems, removing the need for manual transfers and ensuring consistency across platforms.

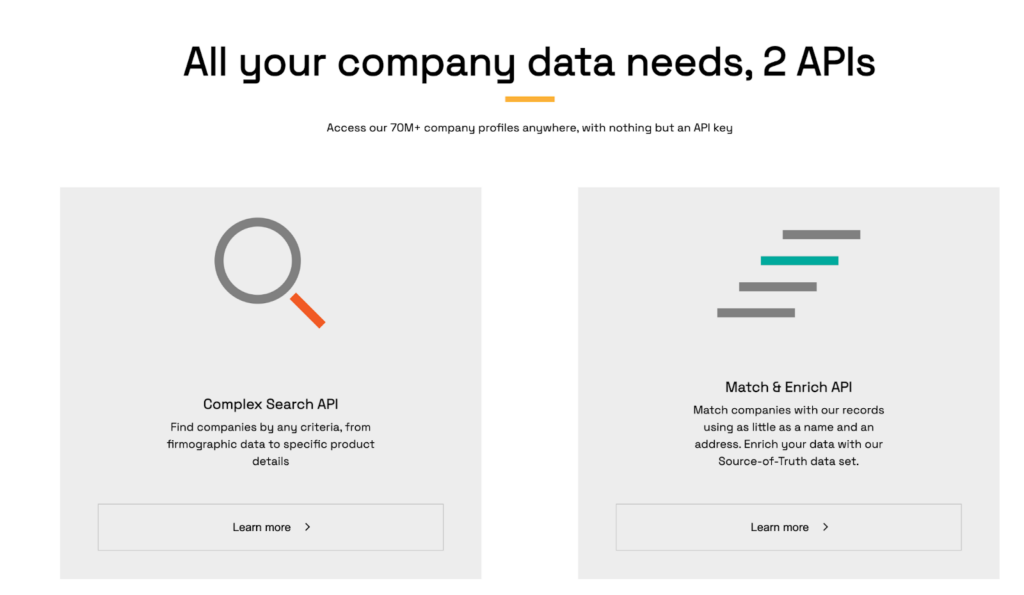

For example, Veridion provides Search and Match and Enrich APIs that let you pull market data directly into your dashboards or ERPs.

Source: Veridion

When evaluating tools, look for mentions of “Open API,” “Zapier connectors,” or direct integrations with platforms like Salesforce, Tableau, or other relevant platforms, so that data movement can be automated.

Additionally, create a centralized data repository where market intelligence can be stored, accessed, and analyzed alongside internal operational data.

This approach breaks down silos and enables more comprehensive analysis by combining external market data with internal performance metrics.

By streamlining connectivity, you eliminate duplicate entries and ensure that all teams work from the exact, up-to-date figures.

The result is faster, more consistent decision cycles.

And that is exactly what data-driven procurement needs.

Sophisticated MI platforms often come with steep learning curves.

They pack advanced features like natural language search, AI analytics, and customizable alerts.

But these can be overwhelming for new users.

So, if your team doesn’t receive the proper training, they may not use the tool effectively, or at all.

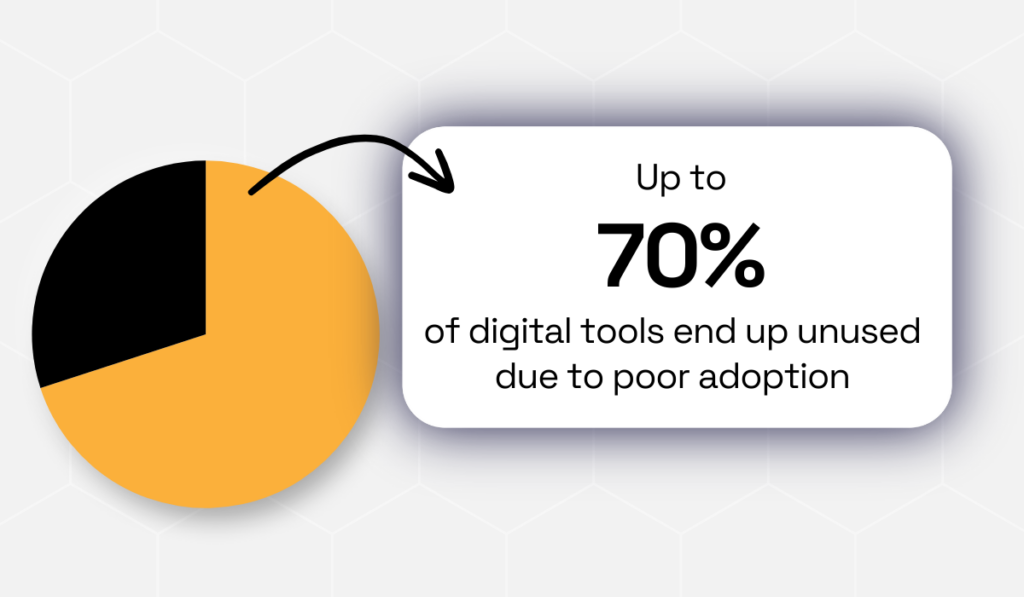

In fact, adoption is a widespread problem.

One report found that as much as 70% of intelligence tools end up unused, becoming expensive digital paperweights.

Illustration: Veridion / Data: Xpert.digital

No matter how powerful and advanced a platform is, it can’t help you if staff don’t know how to use it.

This is supported by another recent survey that found that 67% of employees don’t feel ready to work with AI technologies.

On top of that, 58% of business leaders report that their teams lack the necessary skills to adopt AI effectively.

These gaps translate directly into delays.

Employees spend time troubleshooting rather than generating insights.

To tackle complexity and boost adoption, choose intuitive platforms with customizable interfaces.

Your solution should enable users to customize dashboards and reports according to their specific needs.

Visual workflows, drag-and-drop functionality, and preset templates can significantly reduce the learning curve for non-technical team members.

Miro Kazakoff, a senior lecturer at MIT Sloan, agrees:

Illustration: Veridion / Quote: MITSloan

Additionally, invest in training and support.

You can schedule hands-on training sessions (in-person or virtual) that walk users through the platform’s key functions.

Then, identify early adopters in your group to become internal experts.

This team can be responsible for promoting best practices, developing standardized procedures, and providing ongoing support.

They can also help colleagues overcome usability challenges and maximize the tool’s value.

The bottom line is that even the most powerful MI system is only as good as the people using it.

By backing the rollout with leadership buy-in and continuous skill-building, you ensure the tool pays off rather than collects dust.

Top-tier MI platforms charge premium prices, no doubt about it.

Yes, entry-level plans might start in the low hundreds per user/month, but enterprise packages can cost tens of thousands of dollars annually.

According to some sources, a platform like ZoomInfo offers a Copilot Enterprise that costs $32,995/year.

For many businesses, especially those with limited budgets, these high costs can be challenging to justify, particularly when ROI isn’t immediately apparent.

The cost challenge is especially pronounced for organizations that previously relied on free or low-cost information sources.

Even large companies worry about overbuying features they don’t need.

As Ritish Reddy, Co-Founder of Zluri, a SaaS management platform, explains, there is often a lot of bloat in enterprise software stacks in particular.

So, the challenge is identifying what’s truly necessary, cutting out the rest, and building a stack that fits the organization’s actual needs.

Illustration: Veridion / Quote: Forbes

Transitioning to comprehensive market intelligence platforms requires both financial investment and cultural adjustment toward valuing data-driven decision-making.

To control costs, approach new MI tools as an investment decision.

Don’t just ask “Can we afford this?” but “What will this ROI look like?”

Start by calculating how better intelligence could improve your procurement outcomes.

For example, try to see if you could spot a sourcing risk early and save 5% on spend.

Then, compare that to the total cost of ownership (subscription + maintenance).

Another thing to consider is free trials.

Many providers offer pilot periods or limited trials to demonstrate their products or services.

So, use these to test whether the insights you get justify the license fee.

You can also look for vendors that allow you to purchase only what you need, like data for specific markets or fewer API calls.

This approach can make sophisticated intelligence more accessible while controlling costs.

Market intelligence tools can transform procurement, but only if you navigate their pitfalls.

Remember the five key takeaways: filter the flood of data to find the signal, verify data quality before taking action, integrate tools with your systems, train your team on complex features, and justify the cost through clear ROI.

Addressing these challenges head-on will turn MI investments into strategic advantages.

With the proper practices in place (and reliable data from partners like Veridion), you’ll be equipped to make faster, smarter decisions in a competitive market.