Features to Look for in a Risk Intelligence Platform

Key Takeaways:

If you’re reading this article, you’re likely considering an investment in a risk intelligence platform.

That’s a smart move.

Today, data sits at the heart of risk mitigation, informed decision-making, and resilient operations.

But here’s the problem: there are so many platforms out there, each offering slightly different capabilities, pricing models, and use cases.

So, how do you choose the one that’s right for you?

That’s exactly what this article is here to help with.

In it, we’ve outlined seven key features to look for in a risk intelligence platform, explaining why they matter and how they can improve your operations.

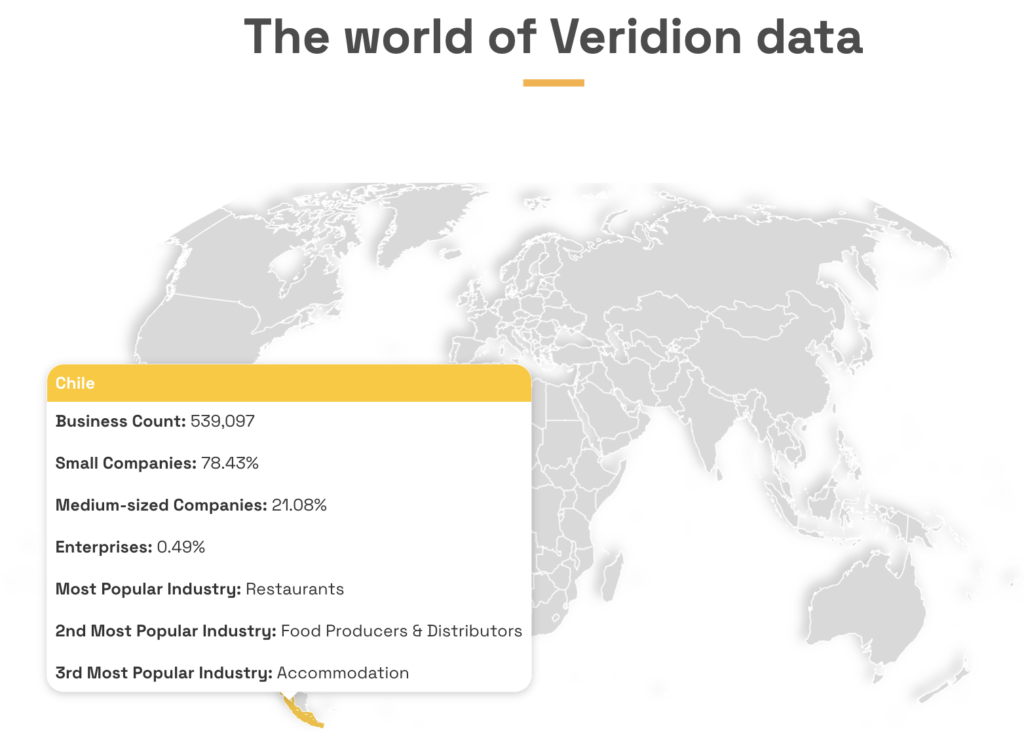

The first thing you need to ensure is that your risk intelligence platform can monitor risks across countries, regions, and industries—not just within local or limited markets.

Source: Veridion

Let’s face it, in today’s interconnected economy, disruptions rarely stay local.

A natural disaster, political unrest, regulatory change, or financial crisis in one country can have an impact across global supply chains, production, logistics, and customer demand.

Without global visibility, you can easily miss early warning signs, and by the time the disruption reaches you, it may be too late to react.

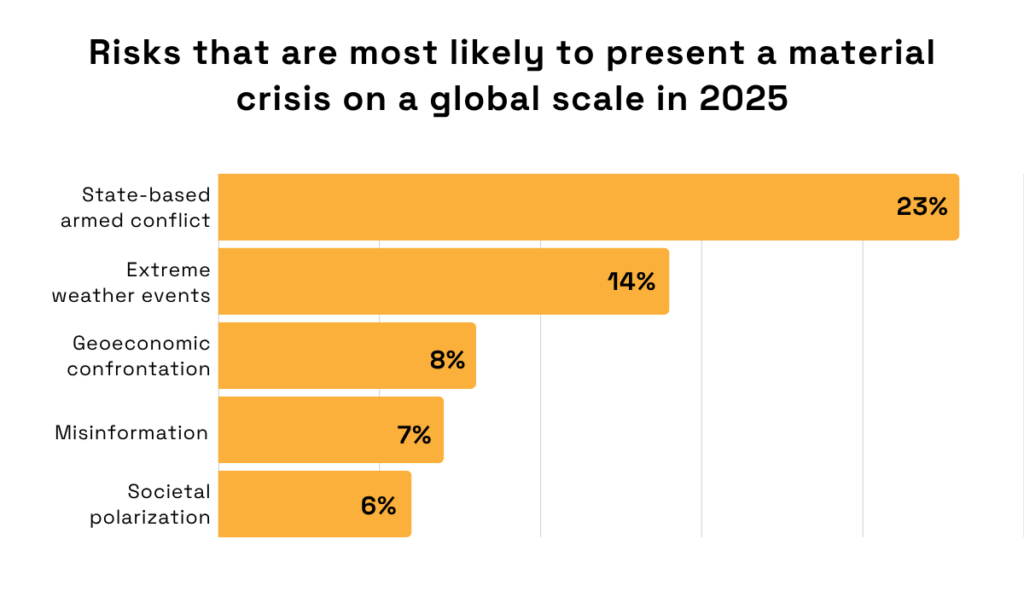

The 2025 World Economic Forum study confirms that risk is both global and multifaceted.

When respondents were asked to identify the risk most likely to trigger a material crisis on a global scale in 2025, their answers varied widely, from armed conflicts to extreme weather events.

Illustration Veridion / Data: World Economic Forum

This comes as no surprise.

Over the past year alone, we’ve seen conflicts escalate, extreme weather intensify, political and societal divisions deepen, and technology accelerate the spread of misinformation.

Each of these has significant implications for businesses worldwide.

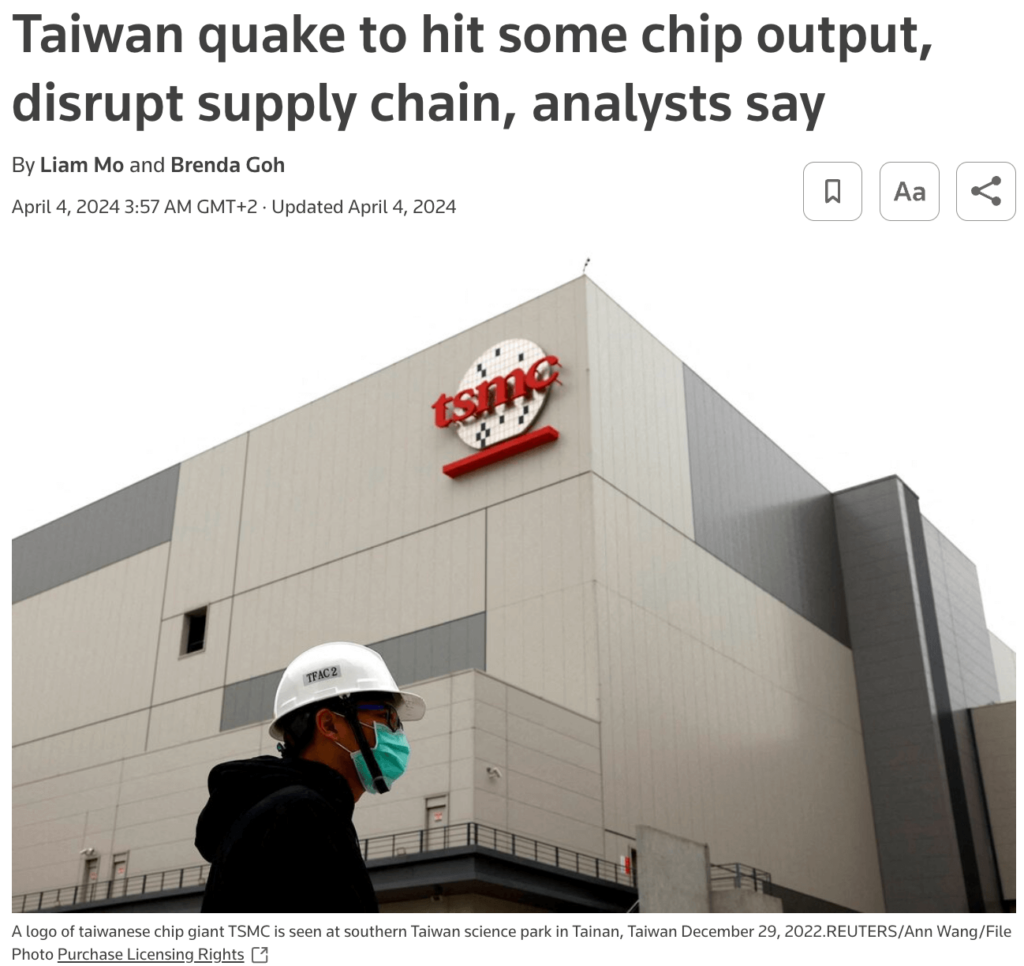

Take Taiwan’s 2024 earthquake as an example.

Because the island is central to the global semiconductor industry, this one event raised immediate alarms about chip shortages, impacting giants like Nvidia, Apple, and Qualcomm.

Source: Reuters

That’s the nature of today’s world: a single disruption, even if it’s thousands of miles away, can rattle entire industries overnight.

This is exactly why you need global coverage.

A risk intelligence platform with this feature gives you a holistic view of exposures, so you can spot risks early, wherever they emerge, and boost your resilience and agility.

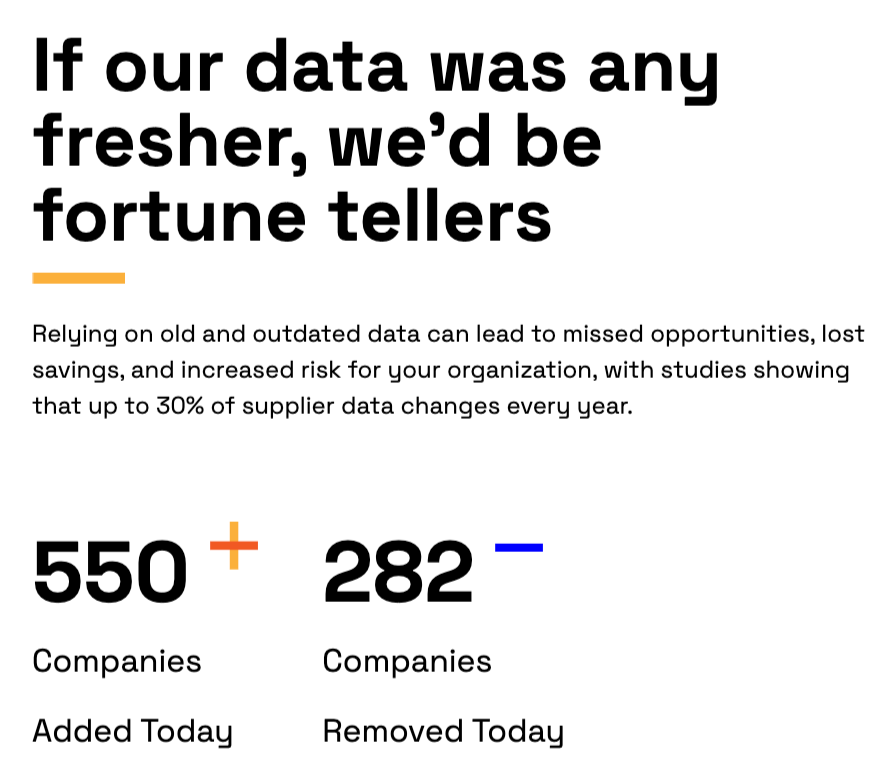

Your risk intelligence platform should also refresh its data at short, regular intervals to capture the latest information.

Depending on the type of risk and source, this may mean real-time feeds, daily updates, or even hourly refreshes.

Source: Veridion

After all, disruption can strike not just anywhere, but anytime.

And you need to be ready.

If, say, a supplier goes bankrupt, a regulatory change is announced, or a cybersecurity incident occurs overnight, relying on outdated data forces you into reactive mode.

This only increases the likelihood of financial losses, operational disruptions, and reputational damage.

But with real-time or near-real-time data, you see problems as they emerge and can make smarter, faster calls.

The 2023 collapse of Silicon Valley Bank is the perfect case in point.

As the 16th-largest bank in the U.S., SVB’s sudden failure disrupted many of the world’s leading tech companies that depended on it for lending, cash management, and investment banking.

Replacing those services proved difficult, especially in the short term.

Konstantin Dzhengozov, Co-Founder and CFO of Payhawk, an all-in-one finance orchestration platform, commented:

Illustration Veridion / Quote: Finextra

Dzhengozov also explained that crises like this can strike suddenly and that no institution is immune, calling the collapse a wake-up call for companies.

In other words, no one can afford to wait when it comes to risk intelligence.

You need your risk data fresh and regularly delivered.

Otherwise, you’ll never be able to act in time to actually do something about potential disruptions.

Similarly, the system should send alerts when new risks emerge or existing risks escalate.

These notifications are delivered automatically, whether via email, dashboard alerts, mobile apps, or integrated systems, without requiring any manual monitoring.

Source: Veridion

This is extremely valuable because relying solely on periodic reports or manual checks may mean missing important warning signs.

With automated alerts, you’re informed the moment an event occurs, enabling you to switch from reactive to proactive mode and minimizing potential damage.

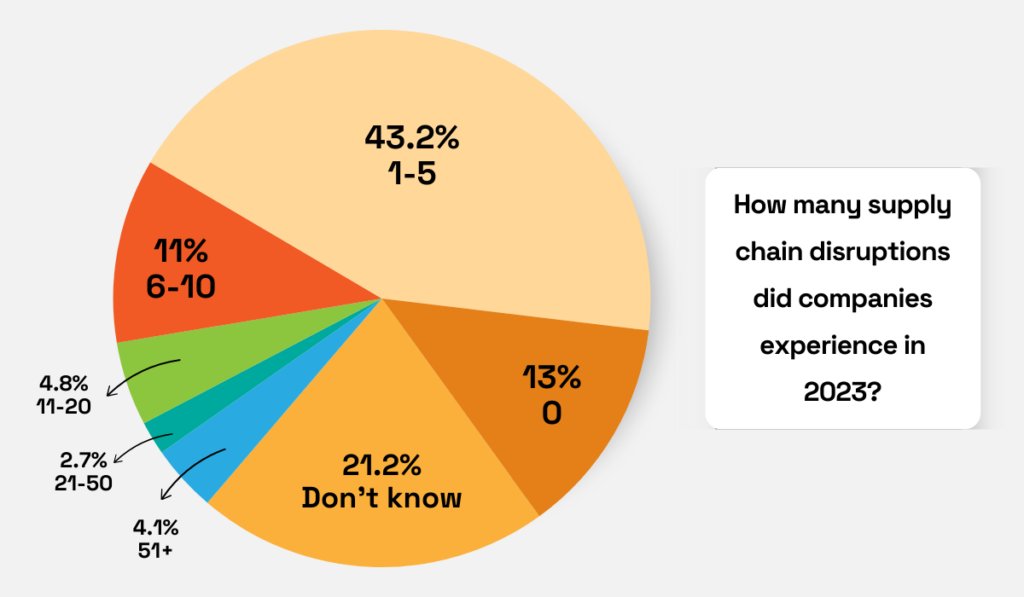

The BCI Supply Chain Resilience Report shows why this is so important nowadays.

As it turns out, most companies experience between one and five supply chain disruptions, while some face as many as 10 to 50 incidents in a single year.

Illustration: Veridion / Data: The Business Continuity Institute

Keeping track of so many risks manually is impossible.

You need a system that does it for you, letting you know as soon as something goes wrong.

That’s exactly how things work at Marriott International.

With nearly 8,700 properties across 139 countries, monitoring potential risks used to be a significant challenge for the company.

But after implementing a risk intelligence platform with real-time alert monitoring, Marriott was finally able to track developing trends and assess their potential impact on operations.

Morgan Dibble, Sr. Director of Operations Support & Intelligence at Marriott International, explained:

Illustration Veridion / Quote: Esri

For example, alerts about floods or storms directly inform investment decisions in areas increasingly vulnerable to climate impacts.

This makes all the difference.

Instead of waiting for reports or manually checking every risk, Marriott can stay informed, proactive, and ready for whatever comes next.

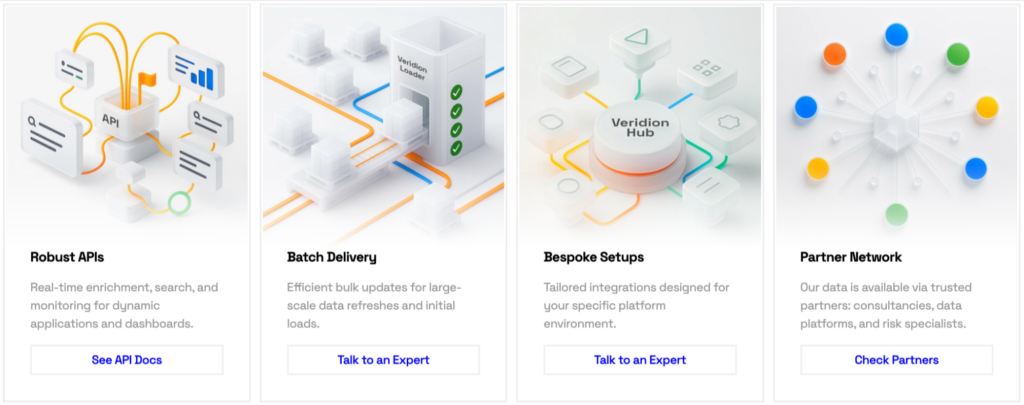

Your risk data needs to easily integrate with market intelligence tools, BI dashboards, analytics workflows, internal data lakes, and more.

Source: Veridion

This ensures you receive all relevant information in the format that best supports your workflows, thereby boosting adoption, saving time, and improving decision-making.

After all, what good is risk data if it sits in a silo, inaccessible to the people who need it most?

Stuart Peck, Account Director at NCC Group, a global cyber security and resilience company, puts it this way:

Illustration Veridion / Quote: CSOonline

Achieving this level of understanding requires proper data integration.

Risk insights need to reach the right people in a format that works for them, so they aren’t wasting time reformatting or hunting for data.

When actionable insights are delivered directly, teams can respond immediately and coordinate risk mitigation more efficiently across departments.

Ammar Maraqa, Chief Strategy Officer at Cisco, a multinational technology company, agrees that data needs to be used the right way in order to make an actual difference:

“Organizations that prioritize investments in collecting and using their data have full visibility into their digital systems and business performance, which makes it easier to adapt and respond to disruptions, security threats and changing market conditions.”

Part of that is ensuring your risk intelligence platform offers flexible data delivery options, so insights can be used effectively and meaningfully.

Because in the end, risk data is only as valuable as your ability to use it.

Don’t forget to check whether your risk intelligence platform complies with regulations such as GDPR, CCPA, and other global privacy laws when collecting, storing, and sharing data.

Most platform vendors provide this information in their privacy policies, usually available on their websites, like this:

Source: Veridion

It’s vital to review this information before investing in a solution because mishandling sensitive data can lead to hefty fines, legal action, and reputational damage.

If you rely on risk intelligence, you must ensure the platform you use protects personal data and complies with applicable laws, especially when monitoring suppliers, employees, or customers.

In recent years, several companies have faced significant consequences for failing to comply with these regulations.

For example:

These are only a few of the many examples that illustrate just how severe the consequences of violating data privacy laws can be.

So, don’t let your risk intelligence platform—the very tool meant to make your business more resilient—end up putting you at greater risk.

Nowadays, platforms that track ESG risks are another must-have.

Here are some examples of ESG topics that are typically covered:

Source: Veridion

Remember, ESG performance is becoming increasingly important to investors, regulators, and customers alike.

This means that poor ESG performance, or partnerships with companies that violate ESG standards, can easily put your operational efficiency, profitability, and reputation at risk.

To make matters worse, the ESG legal landscape is becoming more complex every day, with new rules and regulations constantly emerging.

Elizabeth Meyer, Chief Legal Officer at Novata, a certified B Corp that helps private markets navigate ESG data management, elaborates:

Illustration: Veridion / Quote: Climate Action

The only way to stay compliant, responsible, and resilient is by proactively monitoring ESG risks.

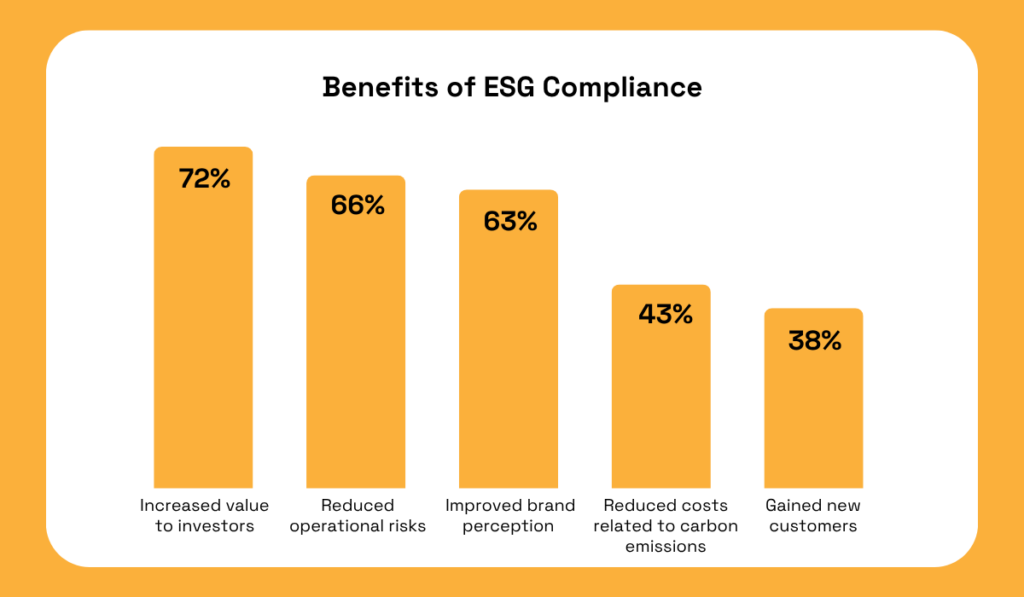

Now, here’s some good news: investing in ESG compliance doesn’t just help avoid fines or scandals.

It can also unlock some real business value, from attracting new customers to cutting costs.

According to DNV research, these are some of the most frequently cited benefits:

Illustration: Veridion / Data: DNV

So don’t view ESG insights as an unnecessary add-on to your risk intelligence platform.

Today, they can be the difference between suffering significant business setbacks and building a reputation as a trustworthy, responsible company that cares for its customers and the planet.

Finally, make sure your risk intelligence platform can assess the operational performance and resilience of your key suppliers.

With this feature, you can catch any potential issues early, address them before they cause significant damage, and keep your operations running smoothly.

Andrei Quinn-Barabanov, Supply Chain and Risk Management Leader at Moody’s Analytics, a financial intelligence provider, notes that monitoring financial health is particularly important in this context:

Illustration: Veridion / Quote: Procurement Magazine

Our own AI-powered platform, Veridion, enables you to monitor just that—and so much more.

With weekly updates, global coverage, and rich company profiles, Veridion gives you a real-time view of your partners’ strengths and weaknesses in all aspects of their business operations.

Currently, we offer access to over 220 supplier attributes, like ESG scores, financials, and product data, for over 130 million companies worldwide.

Source: Veridion

This means you can detect any type of risk in your supplier portfolio in advance and take immediate corrective action.

For example, you can monitor the financial stability of your vendors to prevent disruptions from insolvency.

Or, you could analyze their geographical distribution to identify risks such as political instability, sanctions, or environmental challenges.

Ultimately, your suppliers play a major role in your business’s success, and you deserve to know how stable and reliable they are.

This is where Veridion comes in, delivering always-fresh, detailed insights that help you avoid any unpleasant surprises and maintain operational resilience.

So, there you have it.

With these capabilities, you can trust your risk intelligence platform to deliver insights that are accurate, relevant, and always up to date.

But remember: never just take a vendor’s word for it. Instead, dig a little deeper.

Check out online reviews, ask the providers for more details, and, if possible, schedule a free trial or demo.

There’s no better way to see if a platform really works for you than by experiencing it firsthand.

What you discover on your own will always tell you more than any polished marketing page ever could.