6 Competitive Intelligence Challenges to Overcome

Key Takeaways:

Understanding your competitors is essential for success.

Yet, many businesses still find it surprisingly difficult to do this effectively.

More often than not, collecting reliable information and using it wisely feels like an uphill battle.

As a result, strategies can end up being based on assumptions rather than solid facts.

If this sounds familiar, you’re in the right place.

In this article, we’ll take a closer look at six common challenges that organizations face when developing their competitive intelligence (CI) process.

A crucial challenge in competitive intelligence is getting a full and accurate picture of your competitors.

The problem is that important information is often scattered across various locations, including websites, official filings, product lists, and private databases.

And the list goes on.

Putting all these pieces together to build reliable competitor profiles takes a lot of work.

Plus, as you can’t examine absolutely everything, deciding which sources to focus on is crucial.

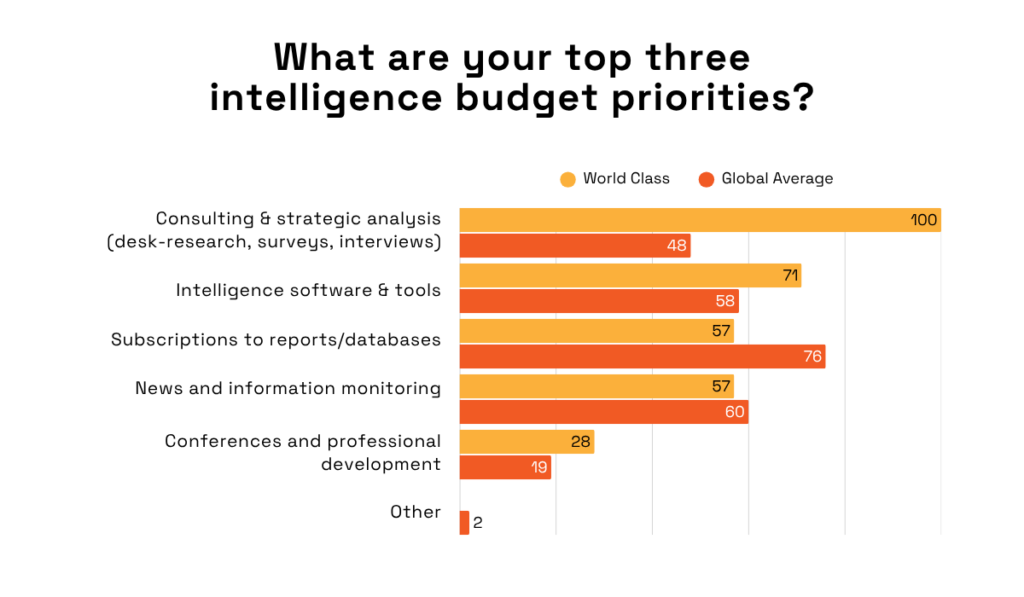

To see what this looks like in practice, the following graph from Valona’s Market and Competitive Intelligence report shows a clear difference in the sources that average companies prioritize compared to “world-class” ones.

Illustration: Veridion / Data: Valona

As you can see, top firms tend to focus more on direct research and specialized intelligence tools.

In contrast, average companies often rely more on general database subscriptions and news monitoring.

Of course, the best approach is to use a combination of these sources to get enough data.

But the challenge goes beyond collecting a large amount of information, as Cem Dilmegani, Principal Analyst at AIMultiple, points out.

Illustration: Veridion / Quote: AIMultiple

As he explains, some sources are simply harder to access and analyze than others, and we can infer that this may be why many companies opt for simpler database subscriptions.

After all, they may not have the time or resources for deeper work like customer surveys or hiring consulting firms.

So, how do you deal with this complexity? A good way is to use the right CI tools.

For example, Veridion is a data engine that utilizes its own proprietary AI and ML algorithms to automatically identify, verify, and organize market intelligence and competitor data from a variety of public and private sources.

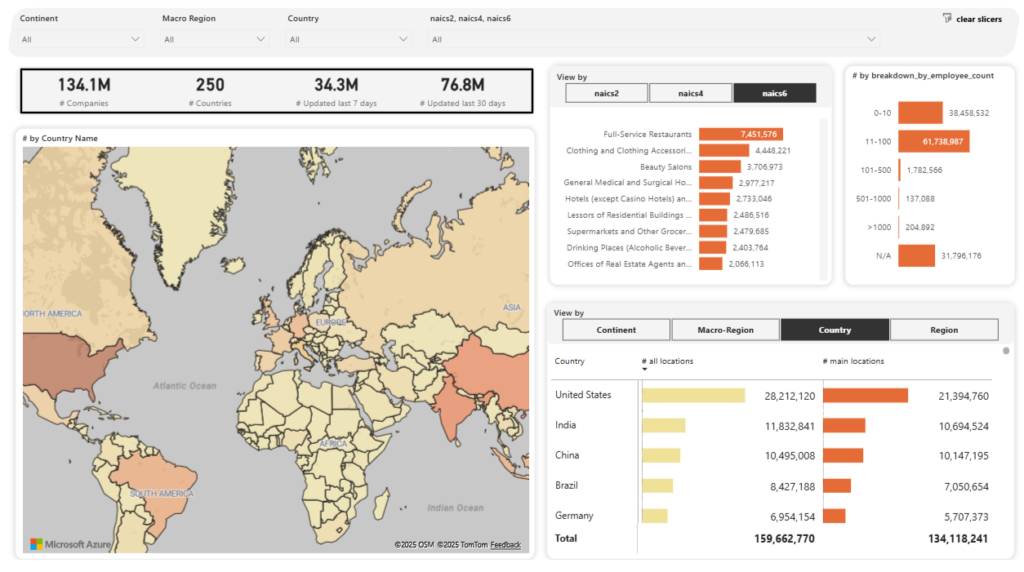

Source: Veridion

Inside its global database, each of the 130+ million company profiles has over 320 attributes, including key info like size, industry, financial health, product offerings, and ESG data.

Plus, Veridion’s Match and Enrich service can help you update existing databases and add new information.

What this means for you is that you get a platform that does the hard work of pulling scattered data together, so you don’t have to do it manually.

In the end, using a smart data system solves the fundamental yet challenging problem of gathering high-quality data, allowing your team to concentrate on transforming that information into a winning strategy.

The reality is that much of the available competitor information out there is of poor quality.

This can mean a database that’s not regularly updated.

Or, a premium, expert-verified intelligence report that contains some human errors or is incomplete.

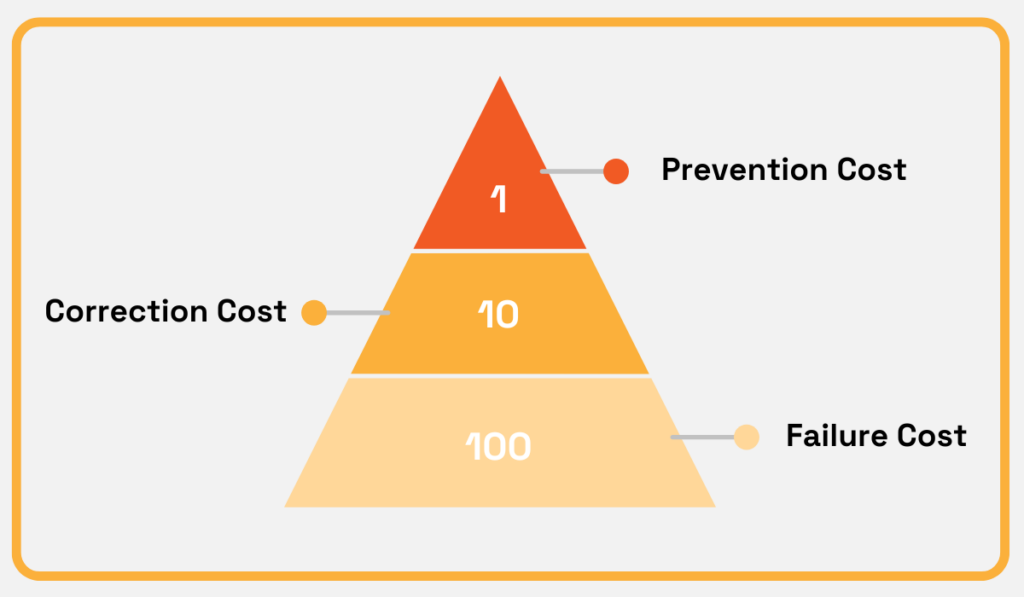

In any case, the principle known as the 1-10-100 rule becomes incredibly useful here.

It states that it costs very little to prevent using poor data, more so to clean it up later, and a lot later on if you do nothing.

Source: Veridion

As an example, it might cost you a small amount of time to double-check a competitor’s revenue figure when you first find it.

However, it will cost you much more time and effort to fix all your reports if you realize the number was wrong months later.

And it could cost a fortune if you make a major strategic decision based on that information.

At first glance, the solution to the data quality issue seems straightforward: use better sources, such as government and regulatory filings, official company communications, and reputable news outlets.

But what if you need to look at broader, fresher data that has a higher risk of being poor quality?

In that case, it is once again a good idea to use a robust software solution, with some reputable options shown below.

Source: Veridion

For instance, the Bloomberg Terminal is well-known in the financial industry for its highly accurate and reliable data.

At the same time, a tool like AlphaSense can be utilized by a broader range of industries and specializes in interpreting business documents.

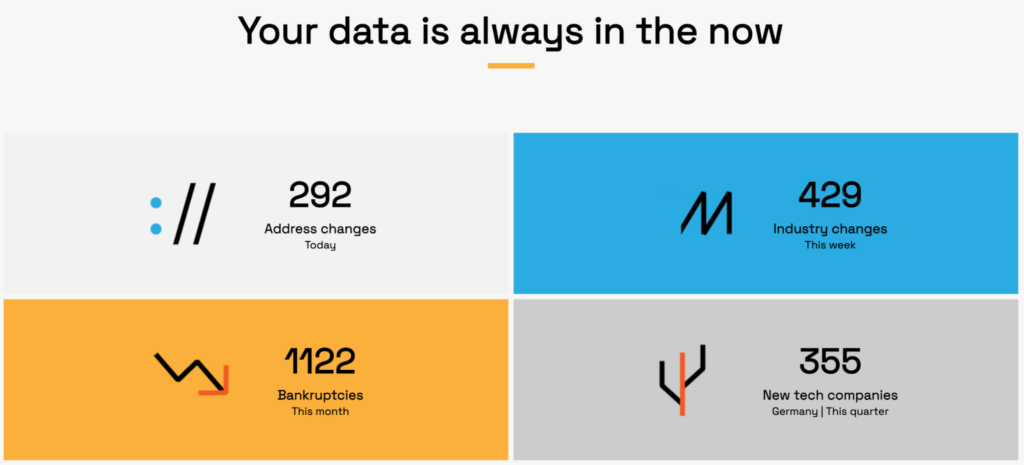

However, beyond specific use cases, you also need to ensure data freshness.

A piece of information that was accurate last month might be outdated today, which is why platforms like Veridion refresh their records on a weekly basis.

Source: Veridion

For a comprehensive overview of these tools and others, refer to our article on the topic.

To summarize, combining high-quality data sources with regular data refreshes is your best defense against making poor decisions down the line.

You might think that once you have plenty of accurate data, the hardest part is over.

However, making sense of all that information is another major challenge.

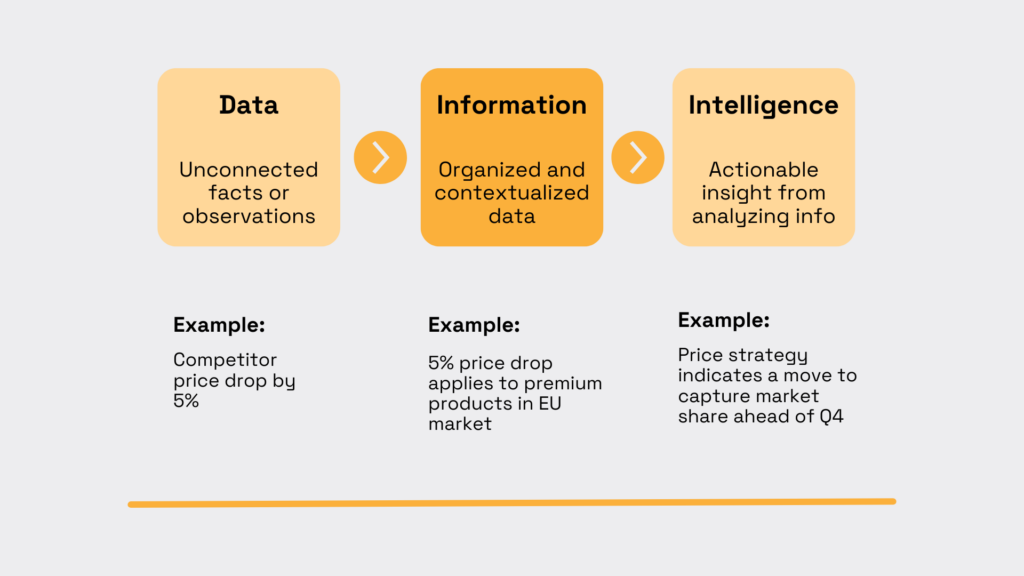

In fact, even with the best data, you still need to figure out how to turn it into useful information and, ultimately, into actionable intelligence.

The image below illustrates a simple example of this process.

Source: Veridion

Working with raw data alone can easily lead to mistakes.

For instance, you might see data showing that a competitor has lowered the price of their main product.

Without proper interpretation, you might assume they are struggling financially.

But if you interpret that data in the right context, it can point to a strategic move to aggressively capture market share in a premium segment.

To avoid these kinds of misinterpretations, it helps to rely on established frameworks.

For instance, there is the PESTLE analysis framework, which stands for Political, Economic, Social, Technological, Legal, and Environmental factors.

Source: Veridion

In competitive intelligence, you could use PESTLE to understand the larger forces affecting your entire industry, helping you see how external changes might impact both you and your competitors.

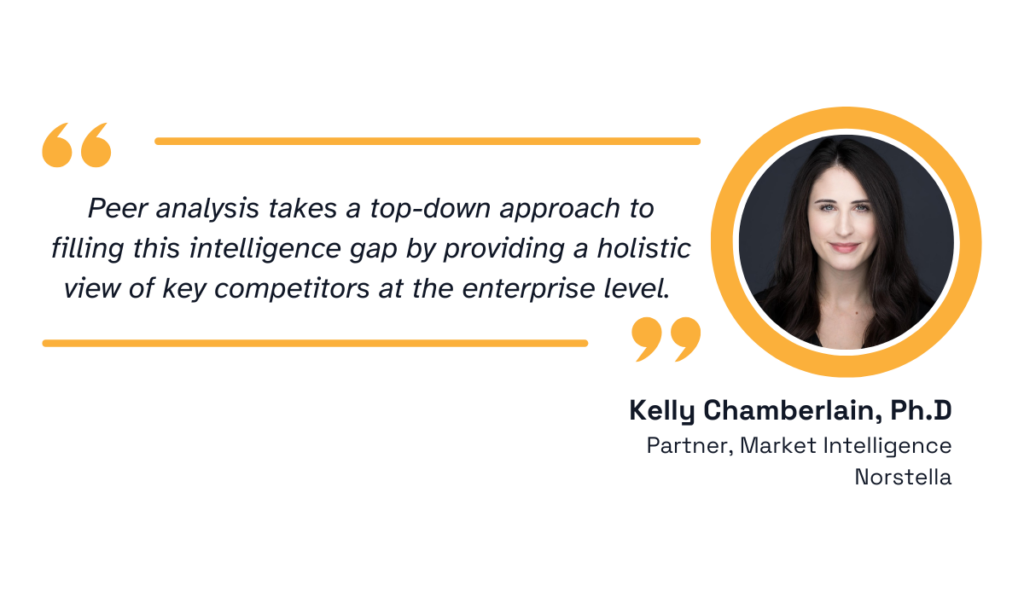

Narrowing down the focus, we have methods like peer analysis.

As Kelly Chamberlain, a partner at Norstella, explains, this approach aims to understand competitors’ broader strategic direction, innovation goals, and responses to market or regulatory changes.

Illustration: Veridion / Quote: Evaluate

In contrast to the high-level view of peer analysis and PESTLE, you can also use a more granular method, such as a detailed, feature-by-feature comparison of your product against that of a competitor.

This commonly used practice can help you pinpoint specific advantages or disadvantages in your offerings.

These few examples are just scratching the surface of data analysis, so it’s best to research and use a mix of frameworks and methods that fit your specific situation.

This helps you make sense of your data and ensures your conclusions are grounded in facts, not assumptions.

Some of the most valuable data you could potentially obtain can easily raise serious ethical and legal questions.

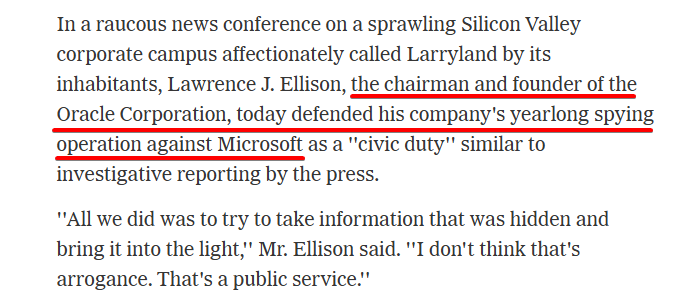

A prime historical example involves Oracle Corporation, which, back in 2000, funded a year-long spying operation against Microsoft.

Source: NY Times

While Oracle’s chairman at the time, Larry Ellison, defended the action by saying it was in the interest of public transparency, others could interpret this issue very differently.

In fact, this kind of action can land a company in serious reputational or legal trouble.

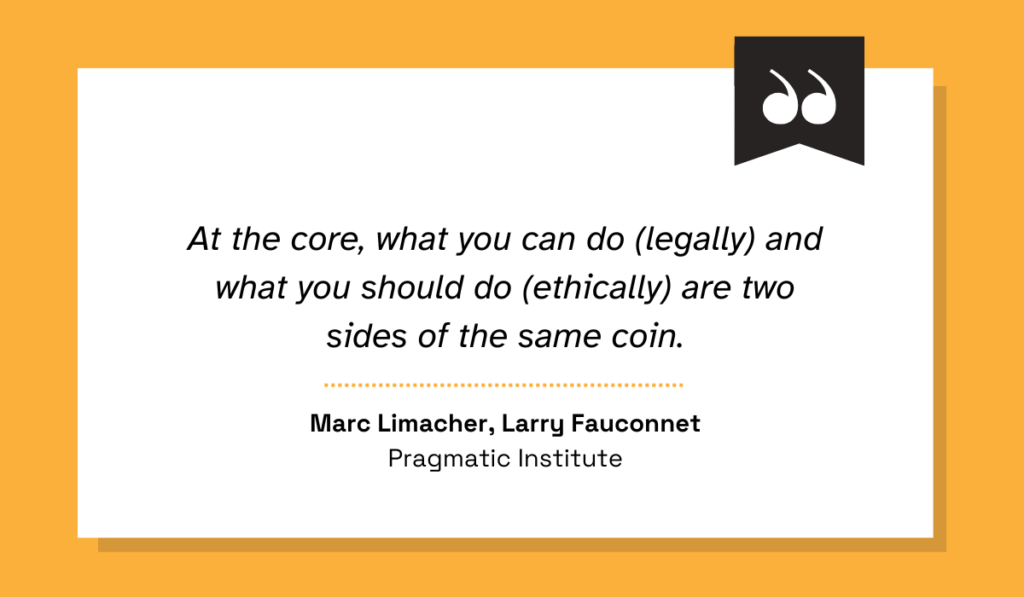

So, for the right attitude toward this issue, we can echo the words of Marc Limacher and Larry Fauconnet, as quoted below.

Illustration: Veridion / Quote: Pragmatic Institute

It’s vital to stress that maintaining transparency and high ethical standards both protects your organization legally and builds credibility within the market.

Therefore, you must be extremely careful about where you source your information, paying close attention to not stray into the grey or unethical area.

The following table clearly shows what type of data and activities fall into each category.

| Ethical | Grey area | Unethical |

|---|---|---|

| Accessing publicly available information | Posing as a potential customer | Stealing trade secrets, source code, or internal documents |

| Using independent research reports | Signing up for competitor newsletters, software demos, or trials | Hacking computer systems or databases |

| Interviewing industry experts, customers, and suppliers | Interviewing former employees | Paying or bribing competitors for proprietary information |

When we get down to it, staying on the legal side is fairly straightforward.

You must use publicly available, compliant sources such as company websites, press releases, or official market reports.

However, while some activities can go both ways and depend on context, methods that involve intentional theft, misleading rivals, or corporate espionage are always illegal and should be avoided.

By establishing a clear ethical policy, you can protect your business and ensure your team collects information responsibly.

Collecting and correctly interpreting competitor data is key, but that effort is wasted unless you can transform the findings into actionable insights.

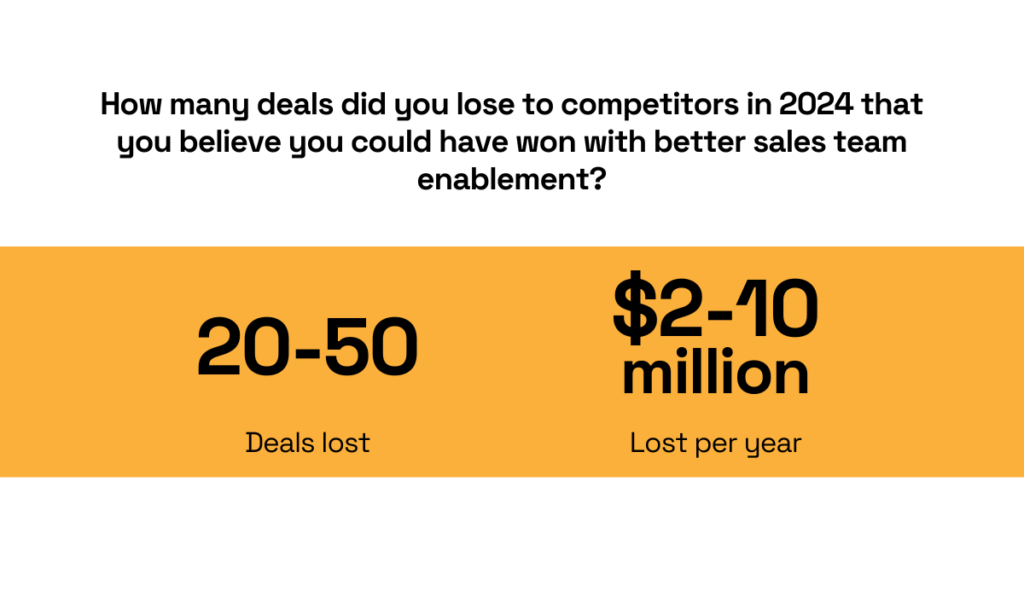

In fact, according to the 2024 Crayon study, between 2 and 10 million USD is lost per year simply because sales teams do not receive the right competitive intelligence at the right time.

Illustration: Veridion / Data: Crayon

This significant loss happens because the intelligence either isn’t made actionable or, more commonly, it gets isolated within one department and doesn’t get shared across the company.

To address the latter issue of siloed data, David McGuckin, CEO of Opinly.ai, a company specializing in AI-driven market intelligence, explains that focusing on company culture is essential.

Illustration: Veridion / Quote: Opinly

Competitive intelligence can help many different departments, but only if it’s properly integrated throughout the organization.

As McGuckin elaborates, CI can influence everything from refining sales pitches to guiding product development and strengthening your market positioning.

Therefore, it’s essential to have teams communicate and collaborate effectively to ensure that the intelligence gathered by one group immediately benefits others.

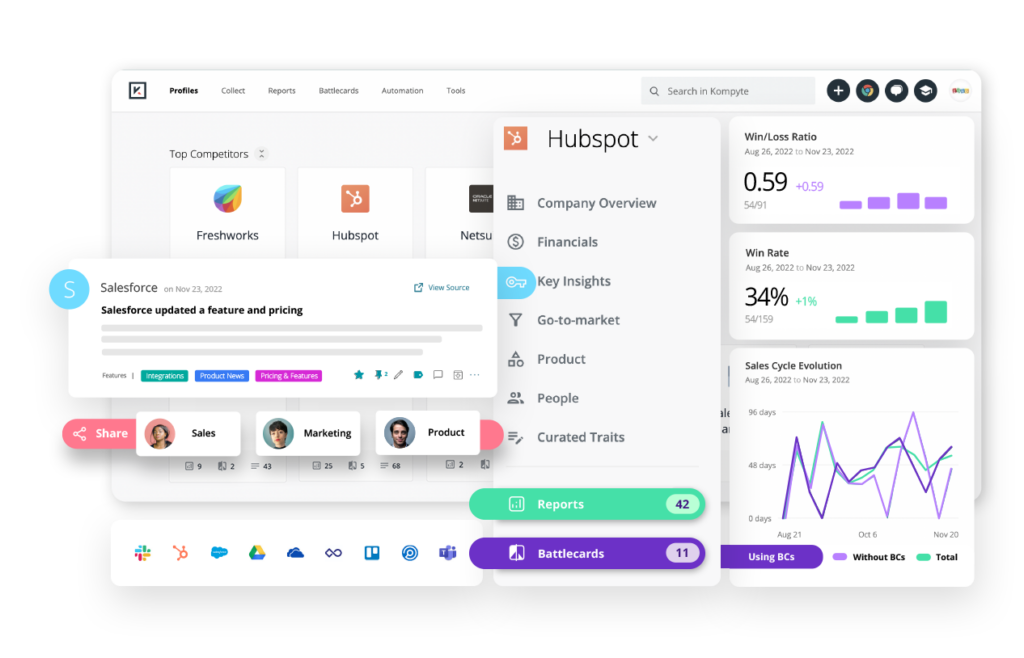

One effective way to facilitate this collaboration is by using the right systems.

For example, tools like Kompyte can be used to gather and distribute competitive information efficiently.

Source: Kompyte

Such platforms help by turning complex data into clear visualizations and easy-to-digest summaries, making it simple for product managers, sales reps, and executives to quickly grasp the implications.

These tools act as a central hub, ensuring that critical insights are immediately accessible to everyone who needs to react.

By breaking down internal data silos and using systems that simplify the delivery of intelligence, you ensure that every piece of data moves beyond a simple report and becomes a catalyst for winning business decisions.

Finally, it’s essential to stress the inherently dynamic nature of the modern market.

Industries evolve so quickly that competitive intelligence that was relevant today can become obsolete within weeks or even days.

Therefore, it’s necessary to understand CI not as a one-time project, but as a continuous process.

You need to have methods and processes in place that enable your organization to stay agile.

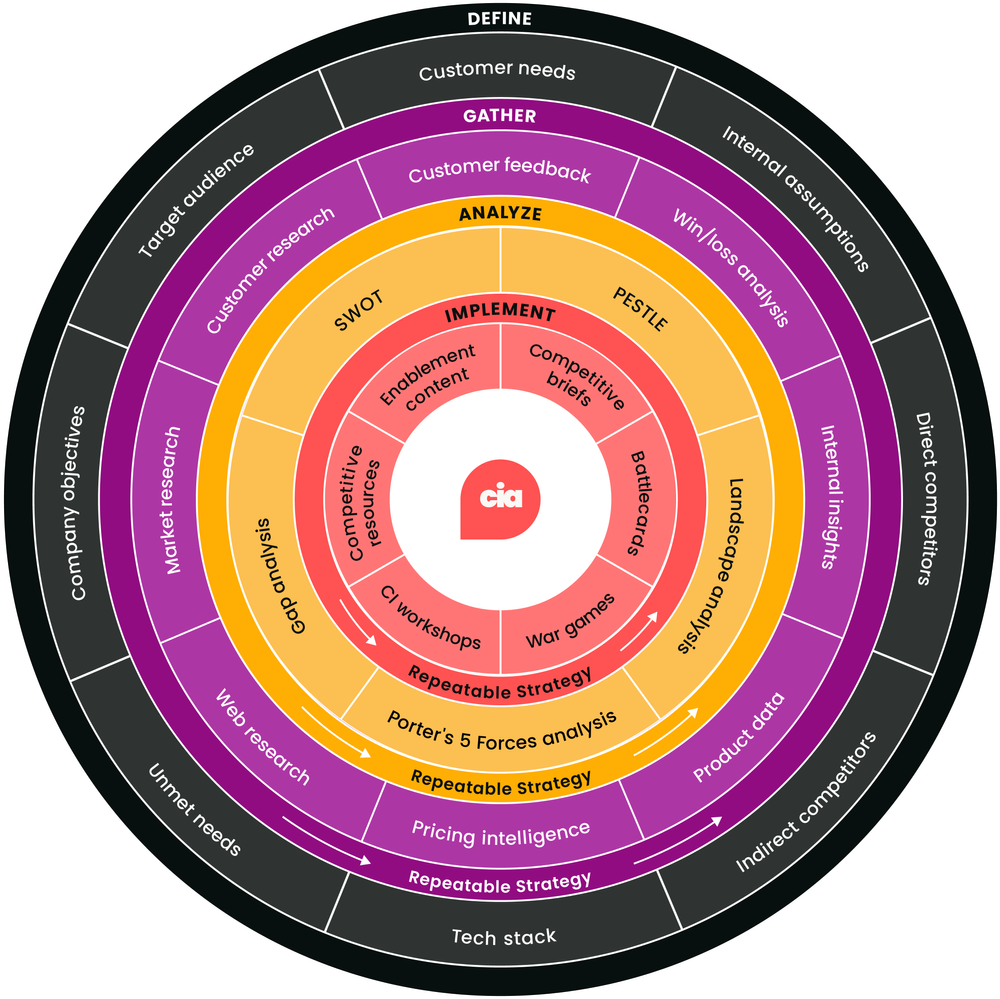

The essential nature of the CI process is nicely illustrated in this framework by the Competitive Intelligence Alliance (CIA), often referenced in intelligence circles.

Source: CIA

This model outlines four distinct stages—Defining, Gathering, Analyzing, and Implementing —which should be executed continuously, without a fixed end date.

For instance, the gathering stage would need a repeatable strategy for constantly collecting user feedback, product data, price intelligence, and more.

A variety of systems can be used for this.

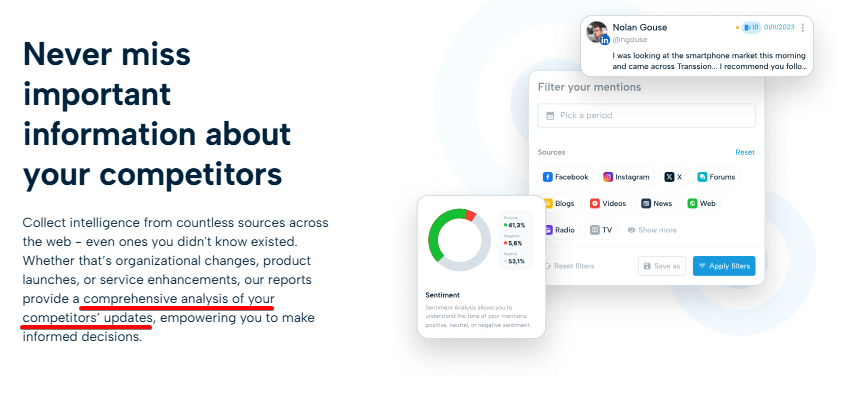

On top of specialized CI databases, tools like Mention are valuable for social and media listening, catching early signals of competitor announcements or public sentiment.

Source: Mention

This continuous stream of fresh information can then be quickly fed into your analysis frameworks, and the resulting insights must be implemented just as quickly.

The process should not be interpreted as a step-by-step process.

Instead, CI should always be treated as a continuous, cyclical process, enabling teams to adapt their strategies as soon as new developments occur rather than playing catch-up.

You’ve now explored six of the most common competitive intelligence challenges and, more importantly, how to overcome them.

We discussed the difficulties of collecting accurate data, interpreting it correctly, and maintaining strong ethical standards throughout the process.

We also emphasized the importance of transforming raw information into insights that truly drive better decisions.

We hope this gives you a clearer path forward.

By applying these solutions, you can build a more effective intelligence program and make more confident, informed decisions for your business.