Debunking 6 Common Myths About Competitive Intelligence

Key Takeaways:

When you think of the phrase competitive intelligence, your brain might jump to corporate espionage and similar misconceptions.

Sounds fun, but it’s not true!

In reality, competitive intelligence is not about spying or hoarding random data, but about turning insights about your competitors into practical decisions.

So, if you’d like to better understand competitive intelligence and use it to your company’s advantage, it helps to start by learning what it isn’t.

That’s why we’ll debunk six common myths and show what competitive intelligence looks like in practice.

Competitive intelligence, or even basic market scanning for that matter, used to be reserved for big strategy teams.

But these days, companies of all sizes are investing in practical technologies to stay competitive.

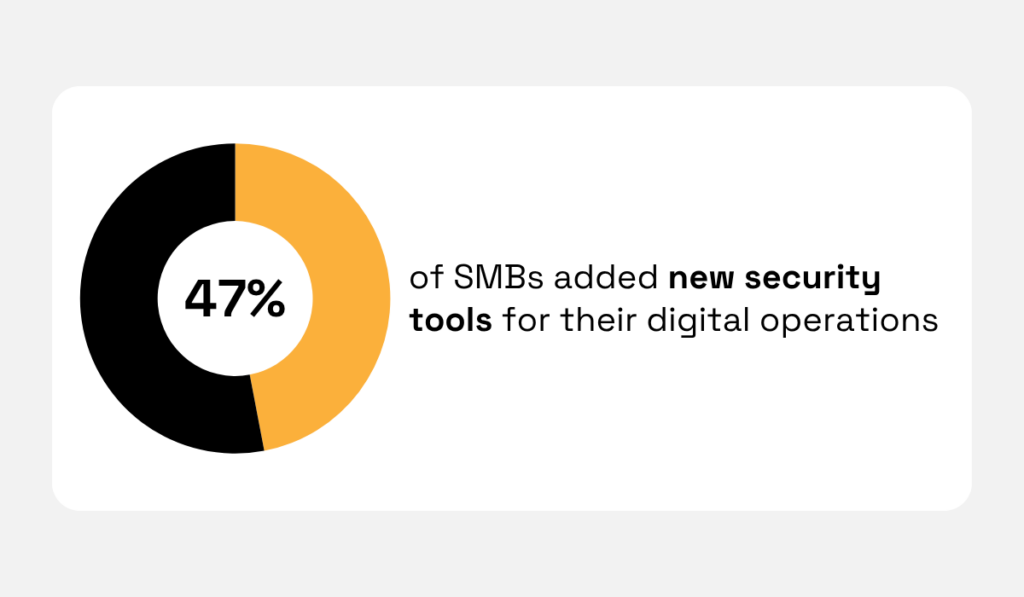

In the past year, almost half of small businesses brought in new tools to keep their digital operations secure.

Illustration: Veridion / Data: Verizon

Isn’t this proof that smaller teams adopt the tools they need when the value is clear?

The same mindset makes competitive intelligence doable for smaller teams, too.

However, you should keep in mind that there are some differences in how organizations of different sizes use competitive intelligence.

While a large enterprise could have its own internal databases on competitors and hire dedicated analyst support, it’s often sufficient for smaller businesses to use public alerts or basic web monitoring tools.

Each company size approaches it differently.

Not because smaller teams can’t do it, but because their goals, resources, and decision speeds vary.

The good news is that competitive intelligence scales naturally.

In the table below, you can see what that looks like in practice.

| Company size | Main focus | Typical tools and methods |

|---|---|---|

| Startups | Spotting market gaps, validating opportunities early | Free data sources, public alerts, basic web monitoring tools |

| SMBs | Tracking competitors, pricing, and partnerships | CRM integrations, automated monitoring, dashboards |

| Enterprises | Deciding where to compete and where not to | Dedicated competitive intelligence platforms, internal databases, analyst support |

So, whether you’re validating a new idea, growing a business, or even aligning global teams, the core principles of competitive intelligence stay the same.

It’s only the depth and the tools that change.

Competitive intelligence doesn’t include trench coats or fake moustaches.

It’s simply about gathering public information and using it smartly; not about covert activity.

Many people still confuse competitive intelligence with corporate espionage.

But in reality, it’s built entirely on ethical, publicly available information.

The goal isn’t to steal secrets, but to better understand market trends, customer behavior, and competitors’ moves so your company can make smarter choices.

Source: Veridion

If you’re doing competitive intelligence right, the process looks more like research than detective work.

When gathering intelligence, teams use open data sources such as:

Let’s say you’re a furniture retailer.

In that case, you could follow your competitors’ public catalogs to see which styles or delivery options attract customers.

You could maybe even visit a showroom. Either way, no hidden cameras or secret recordings are involved.

Likewise, a car dealership could track publicly listed inventory and trade-in offers from nearby dealers to understand local demand.

Both examples show how competitive intelligence works in the open, using visible market signals rather than anything covert.

To keep your research practical, you could keep a log of what you checked (like links, dates, and quick notes), so anyone on the team can see the same facts and pick up where you left off.

If you can’t point to a public source for a piece of information, don’t use it.

Simply move on and find a signal you can cite. This will help you always stay in line with legal and privacy rules.

The first rule of competitive intelligence is, of course, watching your direct rivals.

Instagram responding to TikTok with Reels is a textbook example we already wrote about: watch a close rival and adjust your product.

However, good competitive intelligence doesn’t stop there.

You should also scan for:

That broader view helps you see risks and openings earlier than if you only watch “look-alike” brands.

Let’s make this concrete with a familiar brand: Nike.

With so many direct rivals, it’s easy to focus only on the obvious matchups.

Source: RankRed

But there’s much more to competition than direct competitors.

Lists of direct rivals are a good start, but they miss what shoppers actually compare in the moment.

The real picture is wider, and it affects day-to-day decisions on your products and pricing.

Windmill Digital has compiled a compact overview of competitor types, and you can check it to see how competition extends beyond direct rivals.

Source: Windmill Digital

Now, back to why the “indirect” side matters.

Let’s review the main groups and what to watch in each.

| Adjacent companies | These can pull the same shopper from you. For Nike, athleisure brands like Lululemon compete for wardrobe and attention, essentially for the same customer budget. |

| Substitutes | Substitutes solve the same need in a different way. A customer might spend on a Peloton or a gym membership this month instead of buying new training equipment. |

| New entrants | New players shift preferences fast. For example, Hoka grew by promoting extra-cushioned shoes that felt different on first try, pulling some regular Nike buyers to test a pair. |

So, even when a brand has obvious direct rivals, the smarter scan includes the wider set of choices that your customers consider.

Track them alongside the usual suspects, and you will spot changes earlier, not after they hit your numbers.

Sure, marketing teams use competitive intelligence to decide what to say about the product, which features to lead with, and where to reach buyers.

But it’s a myth, and a wasted opportunity, to think that only marketing needs it.

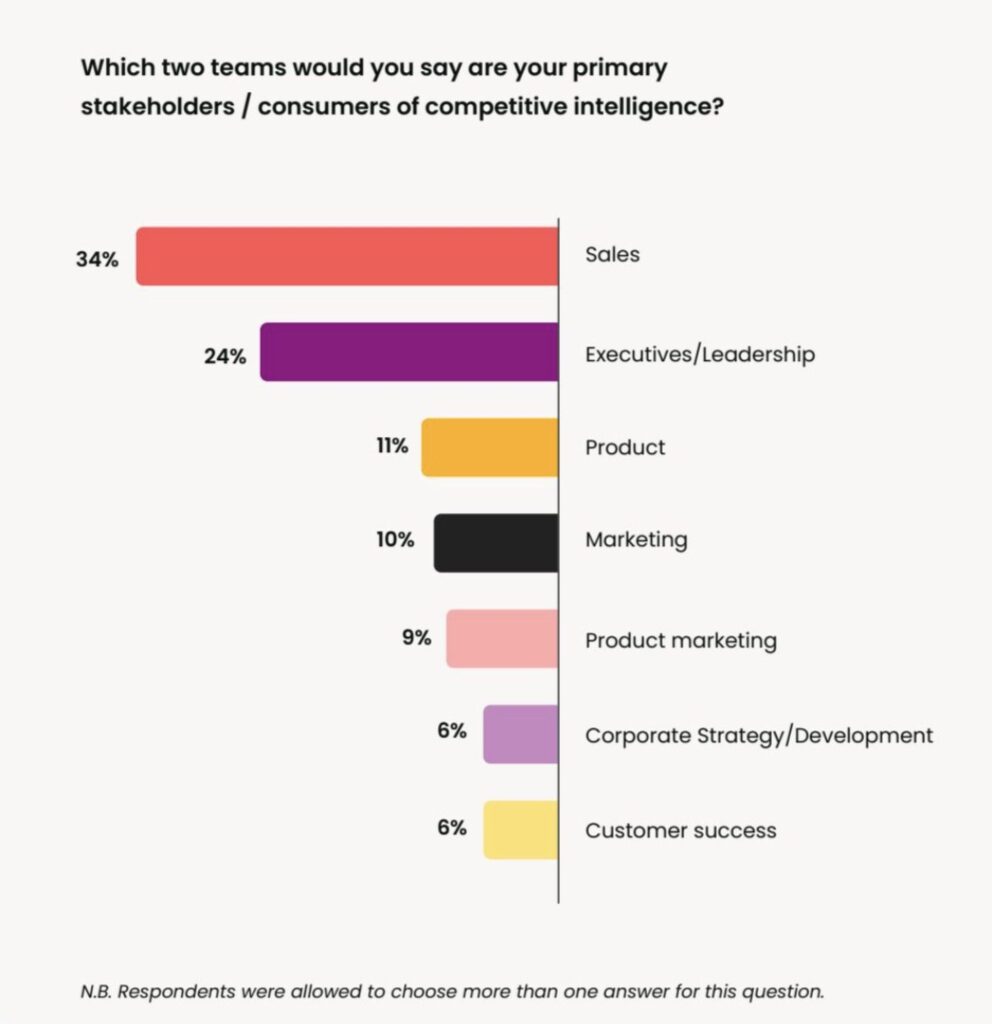

When researching what teams use competitive intelligence the most, Competitive Intelligence Alliance found that marketing teams are actually only the fourth biggest consumers, after sales, executives, and product teams.

Source: Competitive Intelligence Alliance

Let’s start with sales.

If your competitor launched a more affordable “family-size” product, your sales team could pull the facts online and come to the next meeting with your retail buyer equipped with evidence.

That way, your discussion would stay based on facts, not guesses.

In terms of product teams, competitive intelligence usually means watching what’s visible on the shelf and online.

Tracking how your competitors are developing their products, and how customers are reacting to that, shows which ideas are sticking and which are fading.

You can typically find such signals in product reviews, Q&A threads, and company ratings.

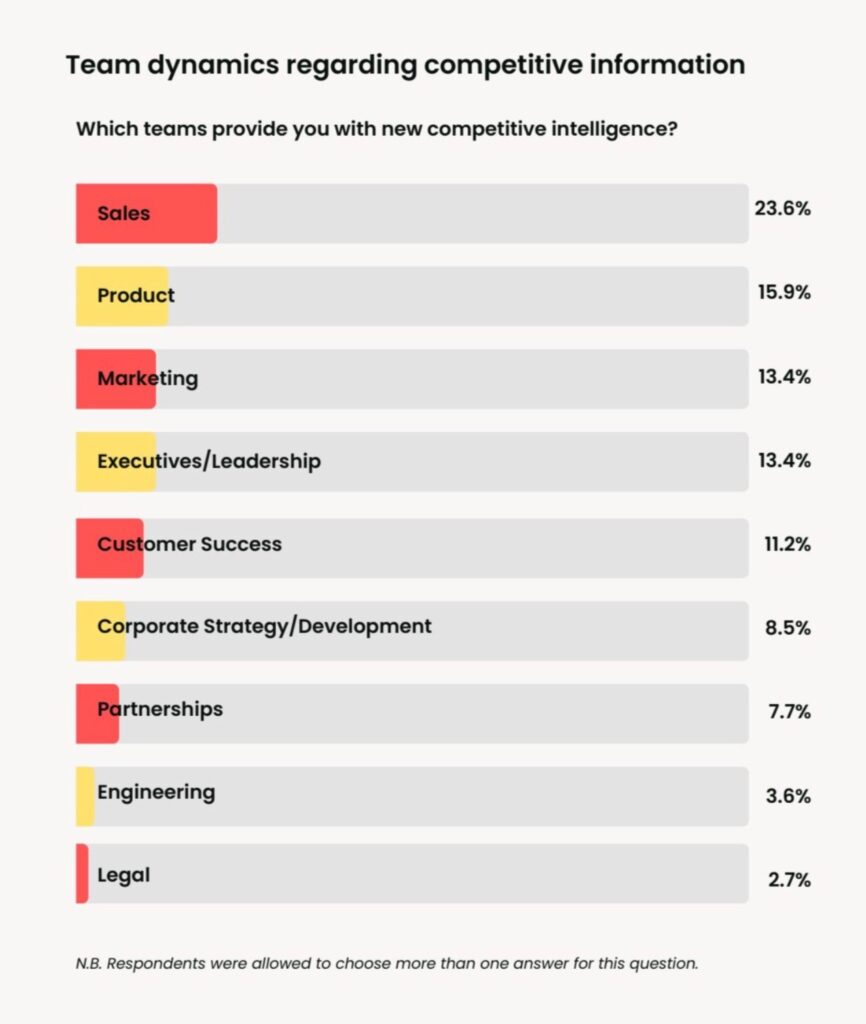

And now that it’s clearer that there are many uses for competitive intelligence besides marketing, it’s also worth noting what departments competitive information comes from.

You won’t be surprised to learn that the same report has shown that sales teams are the most common source, followed by product and marketing.

Source: Competitive Intelligence Alliance

In other words, just because marketing often presents competitive intelligence to the outside world, it doesn’t mean they own it.

Different departments work with competitive intelligence in different capacities, and when all of them share what they’re seeing, the whole company makes quicker, better calls.

Out of all the myths we’ve outlined, this one is the most likely to sound true.

After all, competitive intelligence can be time-consuming.

But that only happens if you’re relying solely on manual processes.

If your intelligence gathering process looks something like this:

…well, you’ll spend hours collecting crumbs and still miss important changes.

Reliance on manual tools truly is one of the biggest challenges in data management.

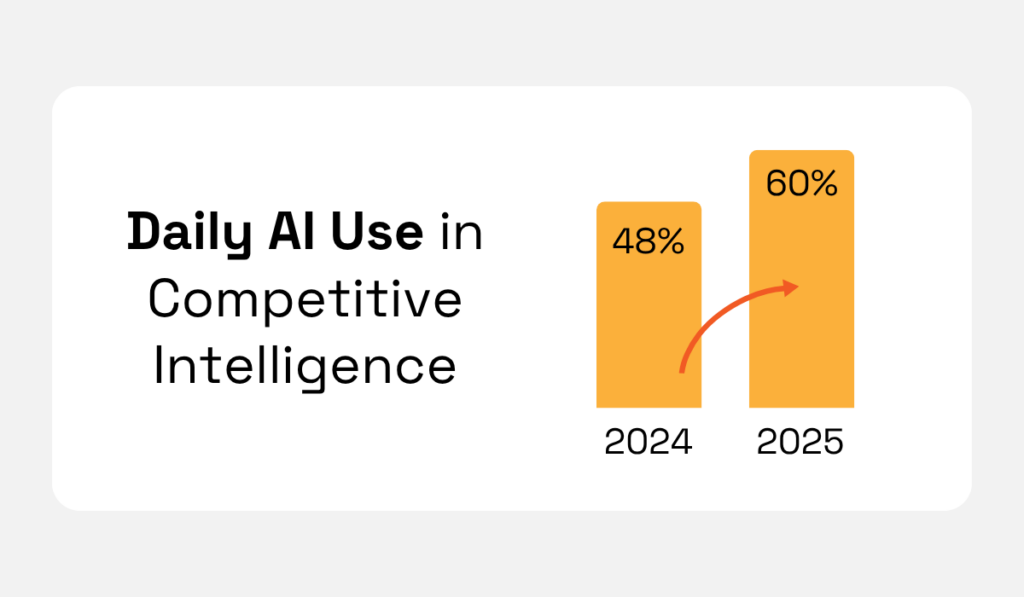

That’s why more and more companies are implementing automated tools for this purpose.

In fact, according to Crayon’s research, the number of companies using AI tools daily for competitive intelligence jumped from 48% in 2024 to 60% in 2025.

Illustration: Veridion / Data: Crayon

One such tool that could help you approach competitive intelligence in a more time-efficient way is Veridion, our company data platform.

Veridion continuously collects, cleans, and structures public business information so you can scan markets and competitors without manual scraping.

In addition to letting you search large databases of company records, it also provides AI-generated company summaries and business tags.

Source: Veridion

These make it quicker to understand what a company does, group similar firms, and filter a segment in minutes.

Automating as much of competitive intelligence as you can reduces the hours spent collecting and double-checking data and frees your team to focus on the part that matters: deciding the next move.

So, why would you spend hours scraping five retailer sites when you could review one weekly feed?

So far, we’ve seen that company size doesn’t limit who can use competitive intelligence.

We’ve also seen that it’s actually time-efficient, contrary to a common myth.

With that in mind, here’s a question: why don’t more companies implement competitive intelligence solutions?

This leads us to our final myth: that all of this is too expensive to implement.

But the reality is, this doesn’t have to be the case.

If you’d like to start using competitive intelligence but you’re working on a budget, you can start with resources you already have:

Granted, combing over these manually will take you some time, but it’s still doable.

You should also keep in mind that there are business data providers suitable for every budget, so you might want to shop around and sign up for discovery calls and free trials until you find a good fit for your use case and budget.

Try a couple side by side, compare data coverage and update frequency, and only then commit.

And even if you decide to go with a seemingly more expensive option, remember that competitive intelligence can pay for itself.

Source: Veridion

Investing in competitive intelligence today can help you avoid missed opportunities or reduce the time you need to respond to market changes, saving you money tomorrow.

So, while competitive intelligence tools might come with an upfront cost, they prevent you from making costly mistakes.

And with so many tools available that are built to be self-serve and easy to set up, your team can use them directly and get value from them quickly.

As you’ve seen, most of the myths related to competitive intelligence are just that: myths.

We may be sorry if we’ve crushed any fantasies about files stamped with big red “TOP SECRET” labels, but we’re glad if this has shown you how practical competitive intelligence is for everyday decisions.

With a simple routine and the right tools, you can spot opportunities sooner, react faster to market changes, and save money along the way.