5 Types of Tools for SaaS Competitive Analysis

Key Takeaways:

What separates top SaaS companies from the rest?

Every single one invests in decoding their competitors through strategic analysis, which is something that most organizations still overlook.

SaaS competitive analysis means going beyond surface-level monitoring to understand why competitors gain traction and how to counter it.

This article explores five types of tools you can use to enhance your competitive intelligence (CI), with a focus on specific platforms and their key features.

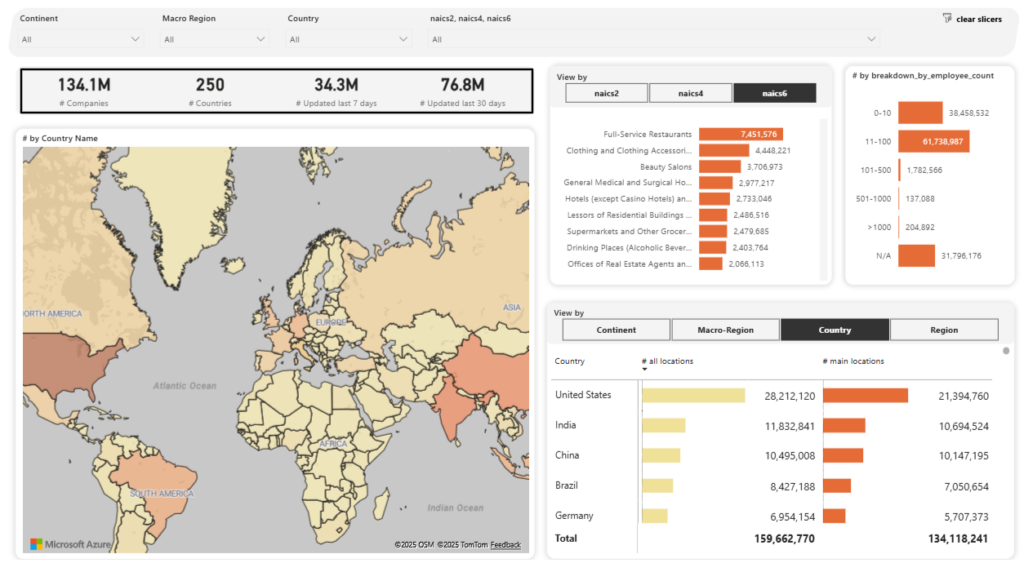

Company data tools provide granular company-level data, be it size, industry, funding, or geographic footprint, to support deeper market and competitor analysis.

These tools give you the building blocks for competitive discovery, including funding history, employee counts, HQ locations, product tags, and even inferred revenue or technographics.

In other words, SaaS teams can identify new entrants, potential partners, or acquisition targets with confidence, quickly answering practical questions such as:

Those are the filters that feed watchlists, refine lead scoring, and power acquisition-screening models.

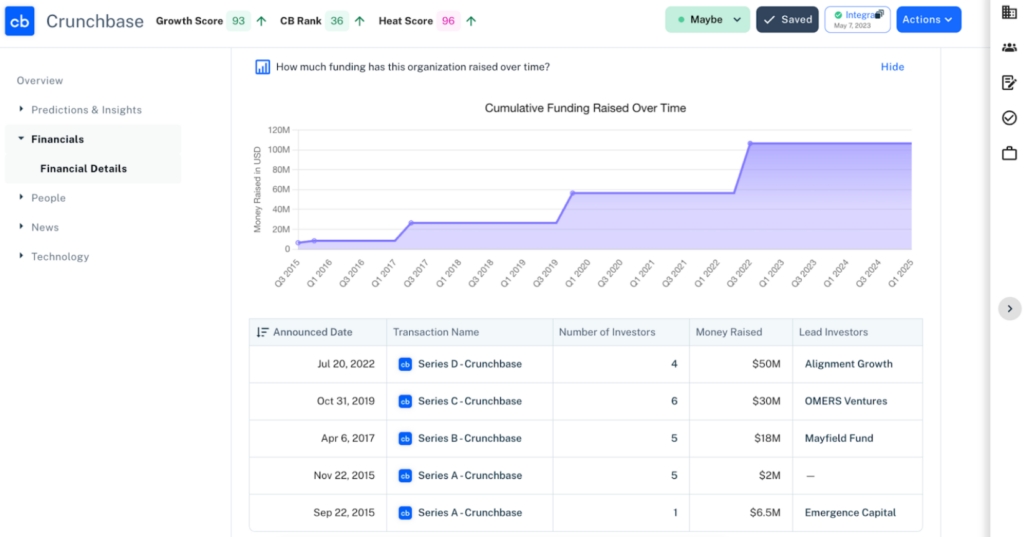

For example, Crunchbase provides more investment-focused datasets.

Beyond essential financials, you can access fine details on the amount of money raised across specific funding rounds and visualize this trend.

Source: Crunchbase

From there, you can easily access a complete list of the company’s lead investors and explore based on the listed value.

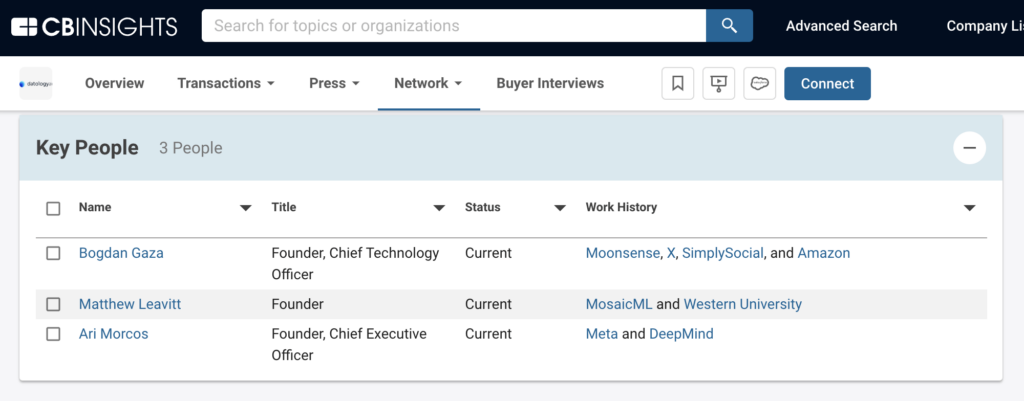

Meanwhile, providers like CB Insights give you a complete overview of how the company ranks in terms of momentum, market, money, and management.

Besides the Mosaic Score feature, one of the platform’s defining characteristics is its empirical view of the founding team’s experience, from past successes to key skillsets.

Source: CB Insights

For instance, shedding light on the company’s founding teams is especially significant in terms of engaging with AI startups, where you want to have experienced technologists on board.

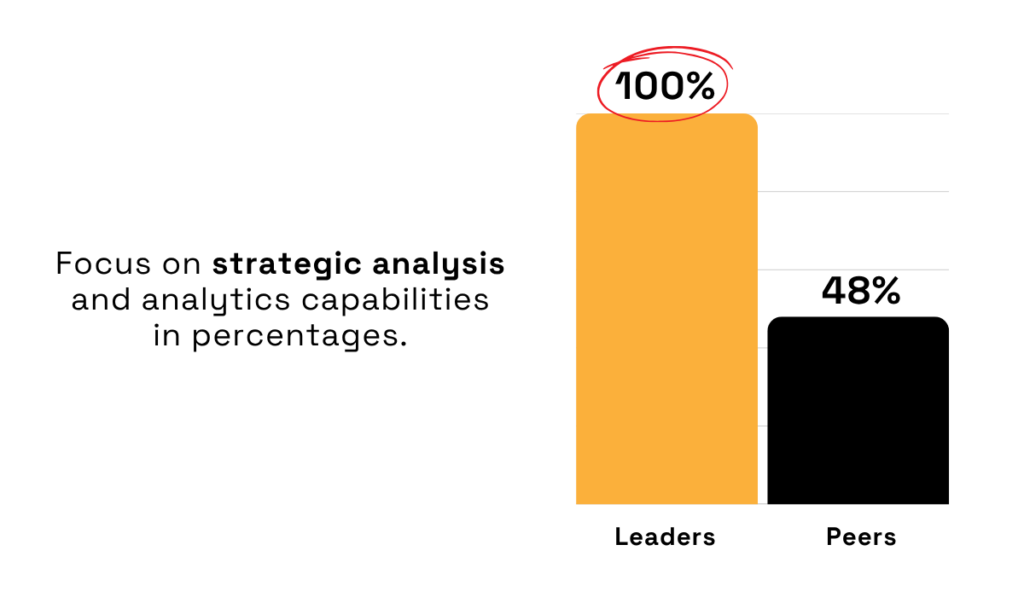

Research shows why this depth matters.

According to Valona’s report, world-class teams are aware that surface-level monitoring often fails to produce action, which is why 100% of them prioritize strategic analysis capacity, versus 48% of their peers who do the same.

Illustration: Veridion / Data: Valona Intelligence

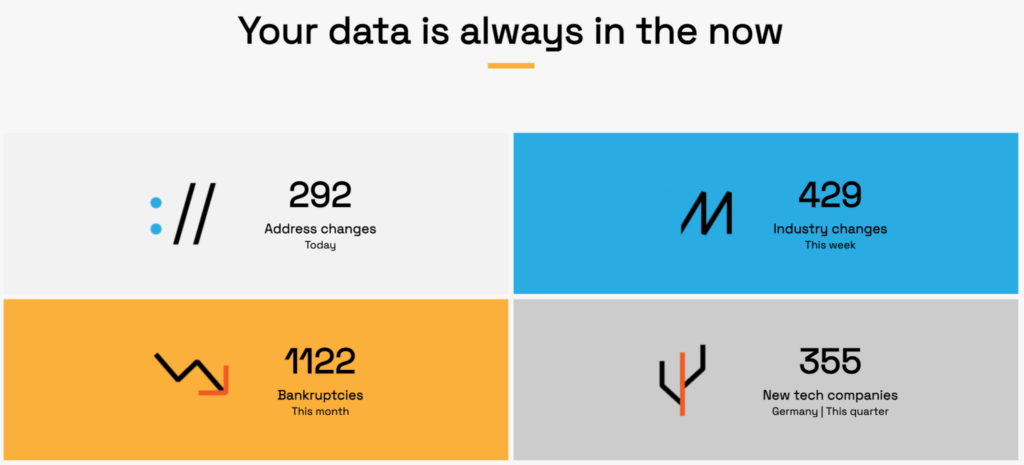

If you want reliable signals about who’s in your market, where they operate, and what they actually do, you need company-level data that’s granular, structured, and continuously refreshed.

Veridion is a prime example of that analysis capacity in action.

Our AI-powered intelligence platform delivers extensive global coverage and weekly updates to ensure you’re acting with the freshest possible information.

Source: Veridion

By accessing our database spanning 130+ million businesses across 500 million locations, you have everything you need to enrich CRMs, power watchlists, and surface acquisition or partner targets at your fingertips.

Each in-depth profile covers 320+ data points, from organizational hierarchy to technographics and ESG, but the system’s intuitive interface and natural language search make it accessible to non-technical teams as well.

Source: Veridion

Company data tools are essential for navigating the competitive SaaS landscape.

Plus, knowing which entities are worth tracking is essential before you start listening to chatter or chasing social buzz, which brings us to our next tool type.

Social media monitoring tools turn public chatter into operational intelligence for SaaS teams.

They capture competitor mentions, surface campaign momentum, and flag real customer pain points across X (Twitter), LinkedIn, Reddit, and industry forums.

These monitoring platforms will help you:

The ability to filter the noise and uncover key market signals translates to enterprise teams making faster, evidence-based moves while facing fewer surprises.

It’s no wonder that the recent study by Brandwatch shows that 62% of marketers now rely on social listening as a core data source.

Illustration: Veridion / Data: Brandwatch

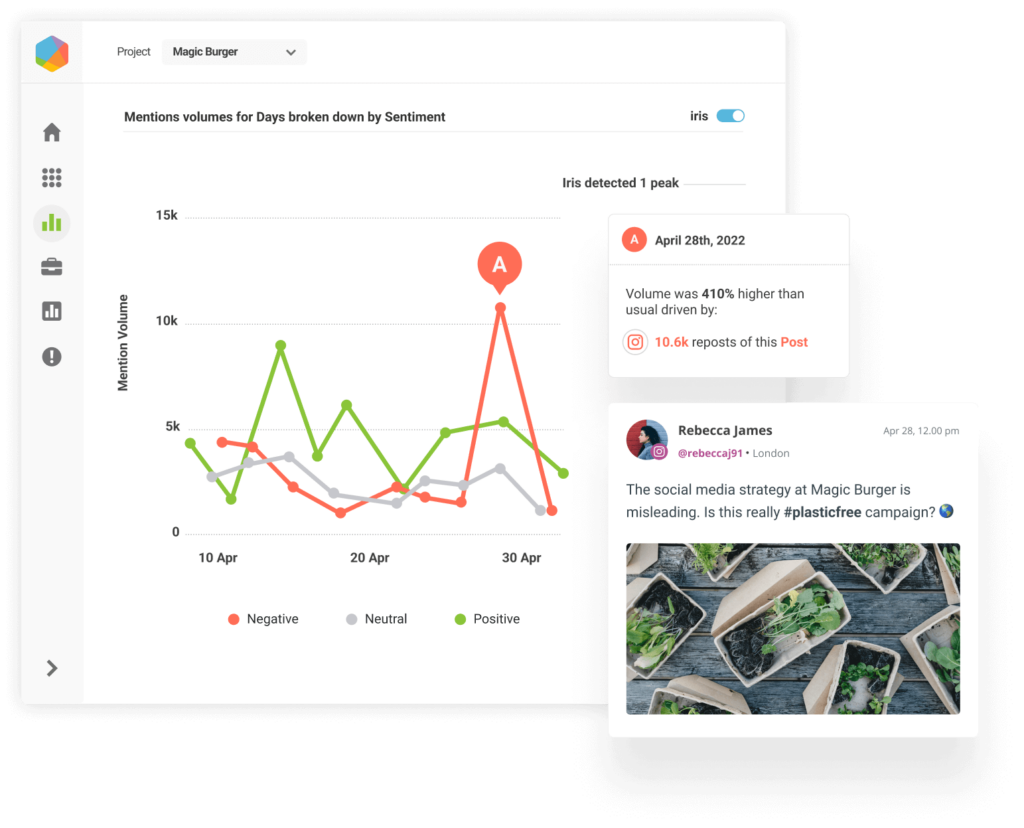

If you want to embed this intel straight into product, comms, and demand workflows, there are a couple of solutions to consider, starting with the aforementioned Brandwatch.

Focusing on deep social media listening, Brandwatch provides extensive coverage and historical data, with a couple of notable integrations (e.g., with PR monitoring) to provide a unified communications hub.

Its crisis management features are especially notable as they can empower teams to spot negative mentions as they happen and even recommend appropriate messaging and mitigation strategies.

Source: Brandwatch

Besides digging into specific audience mentions, the live data and powerful analytics help you determine whether a certain ‘crisis’ has the potential to really affect your reputation, or if it’s actually occurring in a bubble.

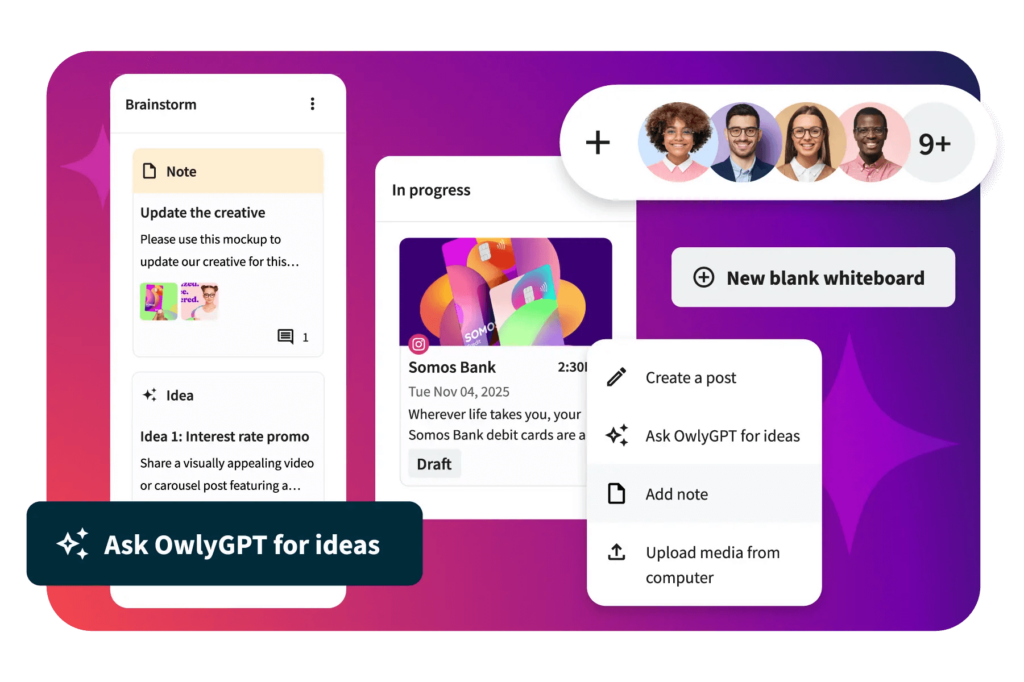

Likewise, Hootsuite’s platform delivers robust social listening capabilities.

Its Blue Silk™ AI picks up on and analyzes millions of online conversations for key insights, which are then condensed into clear, insightful dashboards.

Teams can ask questions about competitors directly, and then seamlessly move to brainstorming and content production rooted in the latest insights on messaging.

Source: Hootsuite

At the same time, AI-recommended scheduling can help you time your new posts for maximum impact.

Of course, choosing the right tool depends on both your key objectives and how well it can integrate with your existing stack (Slack, Salesforce, BI) to ensure alerts and insights land with the right people.

When you connect listening to your workflows, social monitoring shortens your reaction time while driving smarter engagement.

Keyword research tools help SaaS teams uncover the organic playbooks driving competitors’ visibility.

This can range from identifying which topics attract the most traffic to tracing backlinks that sustain their authority.

These platforms turn search data into a competitive map, enabling you to:

With tools like Ahrefs, SEMrush, and Moz, you can analyze ranking trends, monitor keyword movements, and compare content performance across entire domains.

That means seeing exactly which themes bring competitors their inbound leads, rather than relying on guesswork.

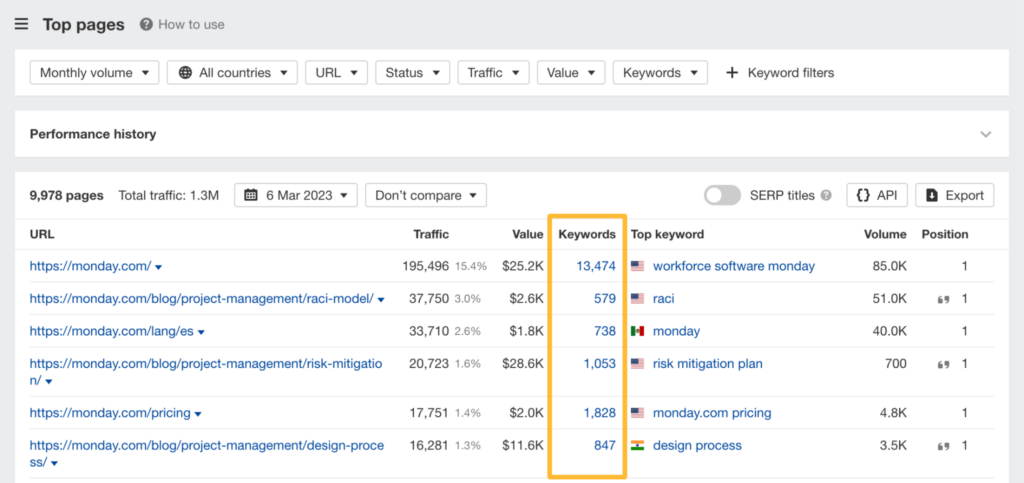

A quick search of Ahrefs’ Site Explorer shows just how granular this visibility can be.

You can pull a competitor’s top pages, analyze traffic share by keyword, and even check how much of that traffic comes from branded vs. non-branded searches.

Source: Ahrefs

This information then becomes central to finding potential subtopics you could cover on your page.

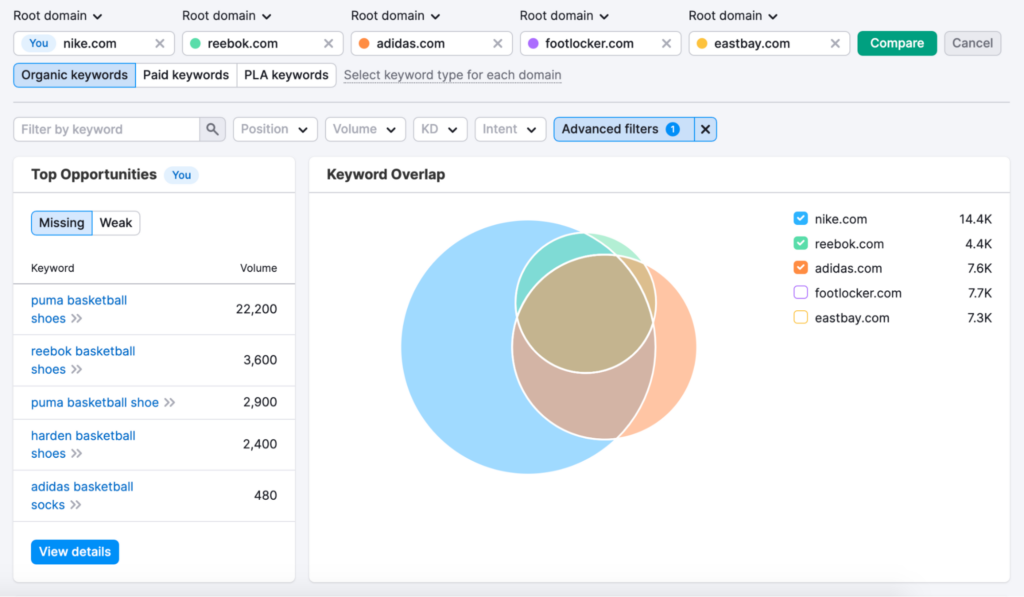

SEMrush adds another layer with its Keyword Gap tool, which compares multiple competitors at once to help you instantly spot missed opportunities and high-intent keywords.

The visualization below reveals the overlap between keyword portfolios, while filters let you isolate “untapped” or “weak” keywords for targeted optimization.

Source: SEMrush

Every shared, missing, or unique keyword is displayed in a sortable table, helping you decide which topics deserve immediate coverage compared to those that can wait.

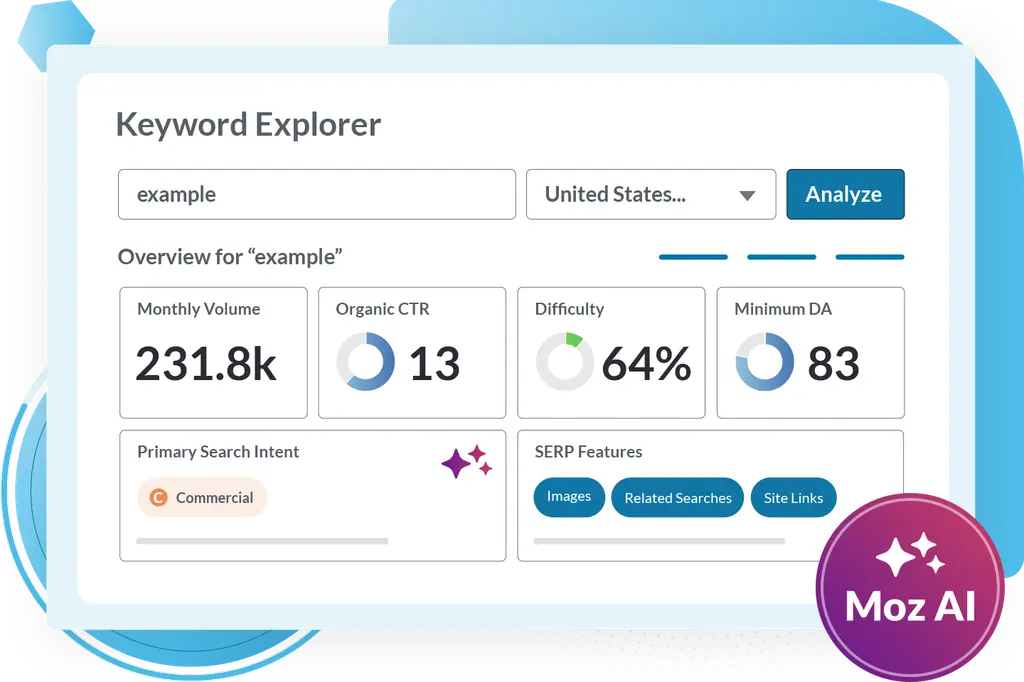

Finally, Moz remains a go-to for simplified SERP tracking and domain authority metrics.

For SaaS teams looking to benchmark themselves against niche players, Moz’s Keyword Explorer delivers valuable context in terms of estimated click-through rates, search difficulty, and related questions users are asking.

Source: Moz

Integrating keyword insights directly into content planning means shaping your go-to-market narrative around verified user intent.

That way, competitor keywords become your roadmap for relevance, helping you identify what to write, where to invest, and how to differentiate.

Ultimately, SEO boils down to owning the conversations your buyers are already having, and these tools can lend you a helping hand.

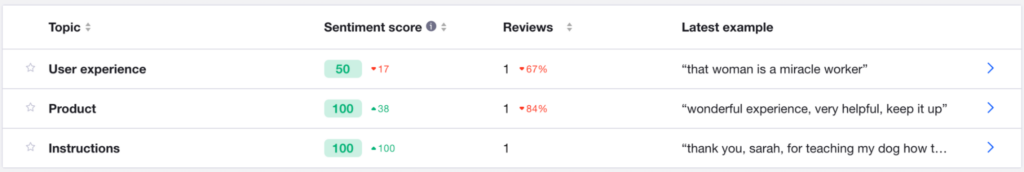

Customer sentiment analysis tools aggregate user feedback, helping you pinpoint competitor strengths and weaknesses.

Think of it this way:

If reviewers consistently praise a rival’s “responsive support team,” that’s a signal to either emphasize your own fast response times immediately or identify whether you need to make improvements.

On the other hand, if users complain about “complex setup” or “missing integrations,” that’s your cue to showcase simplicity and ecosystem breadth.

In other words, the goal is to swiftly interpret public opinion and use it to guide your product and marketing strategy.

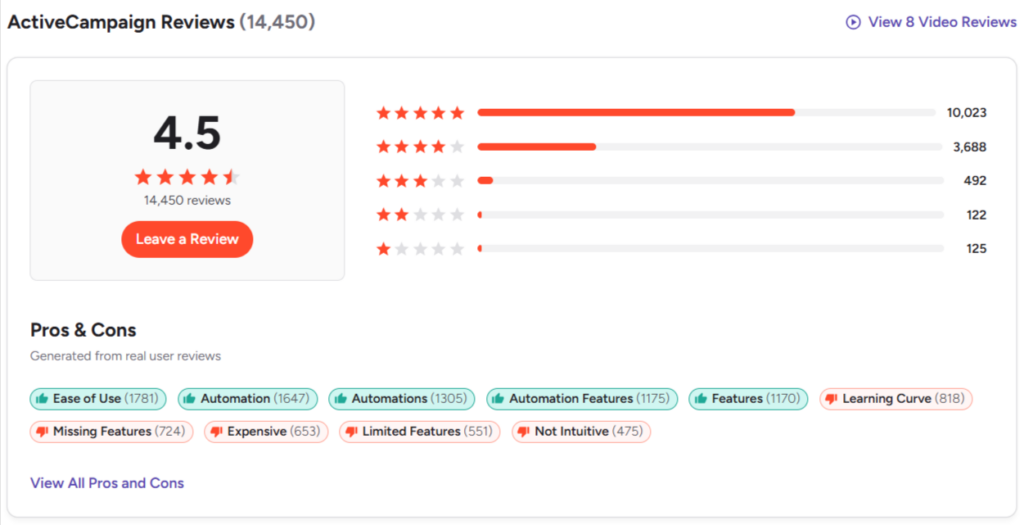

Platforms like G2, Capterra, and Trustpilot cover multiple SaaS categories to reveal exactly what customers value, and where competitors fall short.

On G2, competitor pages aggregate verified reviews and break feedback into clear sections, with main pros and cons immediately highlighted and the ability to filter reviews by company size or role.

Source: G2

You can also access and analyze category-level insights from G2’s data to understand industry trends and contextualize information.

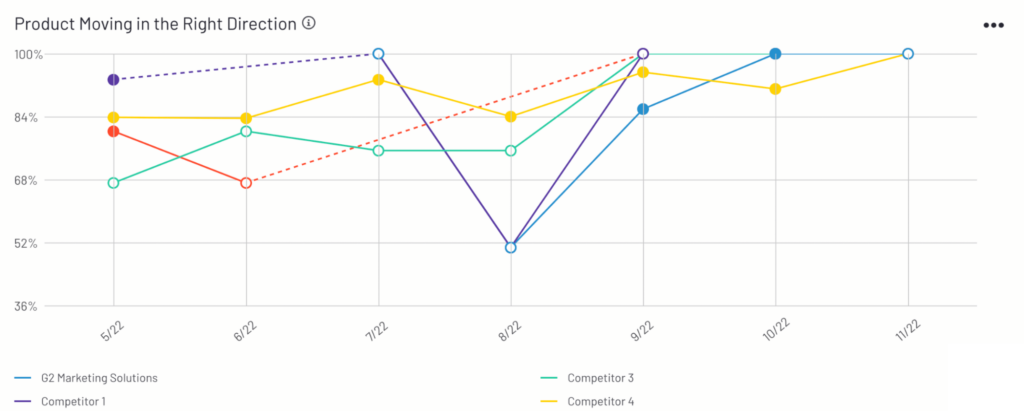

G2 Market Intelligence provides a visual overview of sentiment trends, giving you a quick way to spot weakening customer satisfaction and key points to strike.

Source: G2

Capterra complements this with its comparative grids, which display category leaders across metrics such as ease of use, support quality, and feature completeness.

You can quickly see how each product stacks up based on verified customer experience.

Source: Capterra

Meanwhile, Trustpilot offers a slightly different angle by analyzing linguistic patterns within written reviews.

Its AI-driven clustering groups recurring phrases and identifies shifts in tone, giving you scalable insights without manual tagging.

Source: Trustpilot

The ability to flag specific speech patterns is especially significant given the number of fake reviews that are flooding platforms, giving you a skewed picture of actual strengths and weak points.

In this way, Trustpilot and other platforms can retain their fundamental integrity even as the volume of reviews increases over time.

Together, these tools help SaaS teams move beyond static ratings and capture authentic market sentiment to enhance their messaging accordingly.

After all, what users praise or criticize publicly today determines what wins tomorrow, and these tools make sure you hear it first.

Competitive intelligence (CI) platforms centralize every fragment of market activity to automate competitor monitoring and transform scattered data into structured, actionable insights.

According to Crayon, 44% of businesses now update their competitive intelligence resources daily or weekly.

Illustration: Veridion / Data: Crayon

The focus on fresh insights spans across industries and only serves to highlight just how fast SaaS markets move.

And navigating this landscape is much easier with broader CI platforms like Crayon, Klue, and Kompyte.

They automate the constant tracking of competitor news, product updates, pricing changes, and hiring patterns, giving your teams a unified, real-time view of the competitive landscape.

Crayon excels at continuous data capture and smart visualization.

The platform automatically logs every website change, press release, and product update across tracked competitors, tagging insights by relevance and business impact.

Source: Crayon

Data aggregation includes even AI summaries of call recordings, which contain invaluable competitive intel, but are often underutilized.

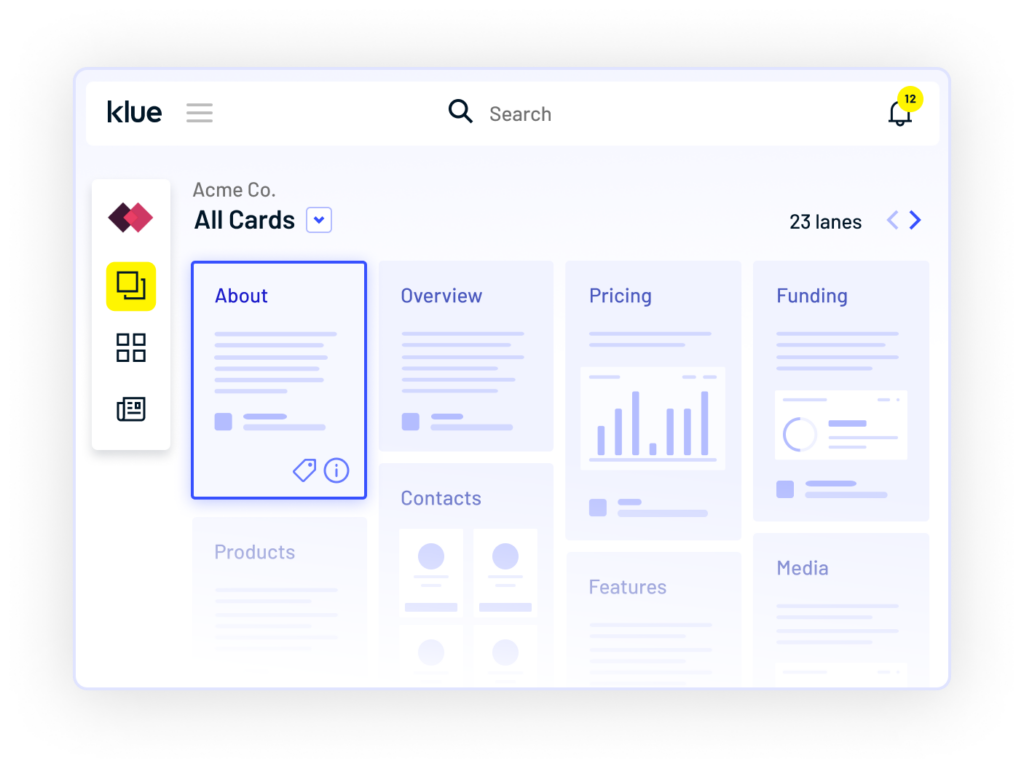

Meanwhile, Klue focuses on internal enablement and collaboration by providing a single, intuitive workspace.

All competitive material, from battlecards and product comparisons to win-loss notes, is consolidated in one place, with seamless battlecard creation making the data digestible and easy to distribute.

Source: Capterra

The system even tracks which insights influenced specific deals, turning intelligence into measurable revenue impact.

For large SaaS enterprises, passive, manual monitoring won’t do.

Ultimately, the less time you spend combing through RSS feeds or dismantling data silos, the more time you have to act on verified strategy shifts, refine positioning, and leave competitors unable to catch up.

Whether it’s uncovering keyword gaps, analyzing paid campaigns, or monitoring sentiment shifts, the tools we covered here share one purpose.

They turn raw data into actionable intelligence.

In SaaS contexts, a seamless flow of data is the only way to consistently outpace the market.

No matter which combination of tools you adopt, your success will depend on balancing usability with analytical depth to achieve true 360° visibility into your market landscape.

To conclude, equip your team with tools that simplify intelligence and complement your existing tech stack, and competitive analysis will evolve from occasional check-ins into everyday strategy.