5 Best Practices for Vendor Selection

Key Takeaways:

Vendor selection is pivotal to business success, no doubt about it.

So why do so many organizations still get it wrong?

Too often, companies rely on gut feelings or brand familiarity and make rushed decisions, assuming that a quick choice will be “good enough.”

But the truth is far more risky.

Performance issues, security breaches, and budget overruns are the inevitable fallout of poor vendor selection decisions.

And they can disrupt operations faster than you expect.

That is why, in this article, we will walk you through the five best practices for vendor selection.

You will learn how to identify the right partners, minimize risks, and build relationships that strengthen your business.

Before you reach out to a vendor, take the time to articulate exactly what your organization needs.

Your requirements document should cover every angle:

But here’s something else you can’t overlook: payment fraud is rampant.

According to recent Trustpair research, 83% of U.S. companies have faced cyber fraud.

Illustration: Veridion / Data: Trustpair

This means your requirements document needs to include strict payment controls and vendor verification processes from the outset.

These safeguards reduce risk exposure before you sign a contract.

On top of that, don’t neglect operational factors.

This includes delivery timelines, service-level expectations, and ongoing maintenance expectations or support commitments.

Many companies formalize this stage through a Business Requirements Document (BRD), detailing why they need a vendor, what qualifications they seek, and what deliverables suppliers must provide.

Source: Veridion

Let’s illustrate how this works on a real example:

One growing training provider needed to select a learning management system.

They took a structured approach from the beginning.

First, they established eight priority requirements, and then evaluated over 30 vendors against those criteria.

From there, they invited 20 vendors to submit proposals and received 13 complete responses.

Source: Petra Mayer Consulting

The result?

They reduced their evaluation time and only focused on vendors who could actually deliver.

That’s the payoff of a clear Business Requirements Document.

When you clarify your needs upfront, you prevent misalignment and wasted effort later on.

In other words, you’ll only invest time in vendors who fit your needs, instead of cycling through candidates who were never going to work out anyway.

Now that you know what you need, it’s time to explore your options.

Don’t just reach out to the same vendors you’ve always worked with.

Instead, spend time researching the broader market to unearth every viable option.

Start by gathering data on market trends, pricing benchmarks, and supplier reputations.

Look into recent innovations within your industry. Who are the emerging players that are not yet on your usual contact list?

Understanding typical price ranges for what you need is also crucial.

It helps you spot red flags in proposals early, before you make a commitment.

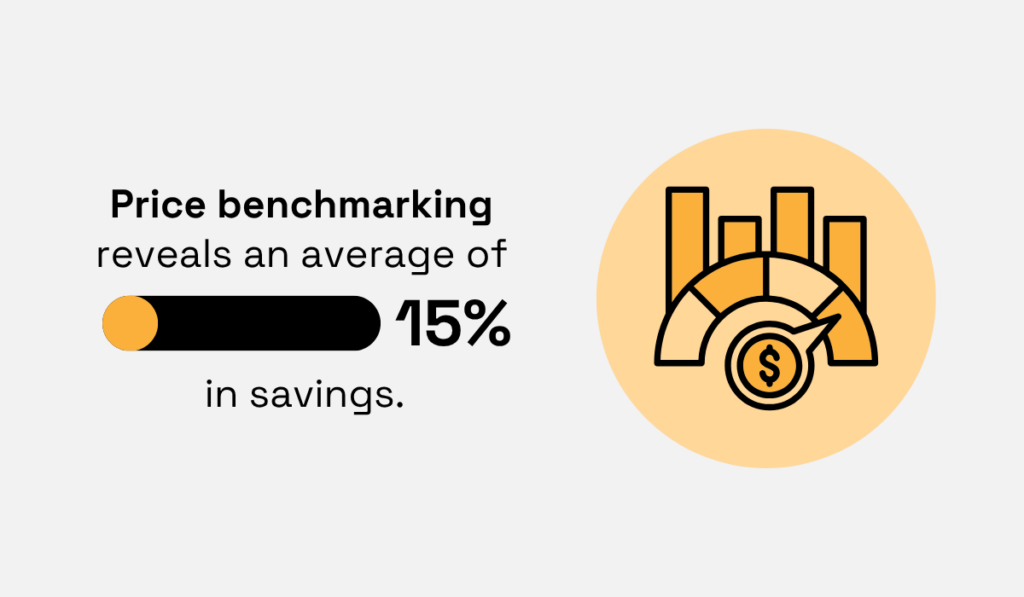

The financial impact of this step can be substantial, as price benchmarking often reveals significant savings opportunities.

Individual transactions often reveal savings between 5% and 50%, with an average of around 15%.

Illustration: Veridion / Data: NPI Financial

So, if you skip this step and go straight to negotiation, you’re likely overpaying.

Benchmarking before you negotiate gives you the data needed to challenge inflated quotes confidently.

The takeaway is simple: don’t confine yourself to only familiar names.

You might discover a new supplier offering a more innovative approach or better pricing.

Or, you might find that your current vendors are charging above-market rates.

Armed with accurate market intelligence, you can build a larger pool of qualified candidates and negotiate from a position of strength.

As you research, focus on these four key areas:

| Industry Trends | Are new technologies or regulations changing what vendors can offer? Understanding where your industry is headed helps you future-proof your choices. |

| Price Benchmarks | What are the standard rates or total cost of ownership for the products or services? This gives you a baseline for negotiations. |

| Quality & Reputation | What do case studies, customer testimonials, and independent reviews say about each vendor’s reliability and performance? |

| Innovation | Are there startups or niche providers that specialize in solving challenges like yours? |

Investing effort in market research ensures you don’t overlook high-performing suppliers or emerging innovators.

It also protects you from accepting overpriced deals simply because you weren’t aware of better options.

Ultimately, it broadens your choices, strengthens your negotiating position, and helps you identify the vendor that fits your organization’s needs best.

You’ve defined your requirements and identified potential vendors.

Now comes the critical part: evaluation.

At this stage, it is necessary to develop a data-driven evaluation process to make sure every supplier is assessed fairly and objectively.

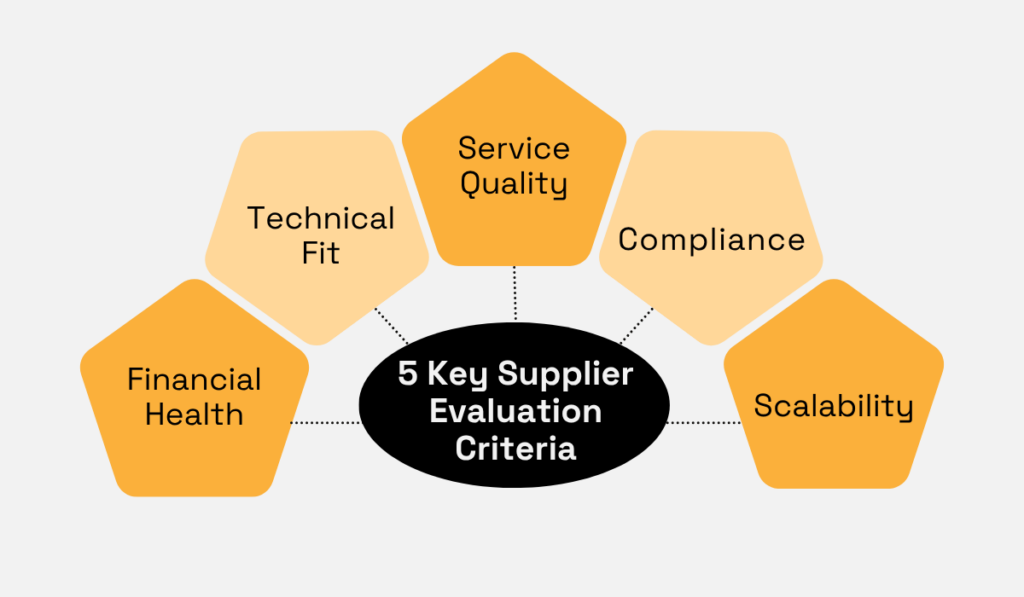

Start by defining clear criteria aligned with your organization’s priorities, such as the ones outlined in the image below.

Source: Veridion

Then score every vendor against these same standards.

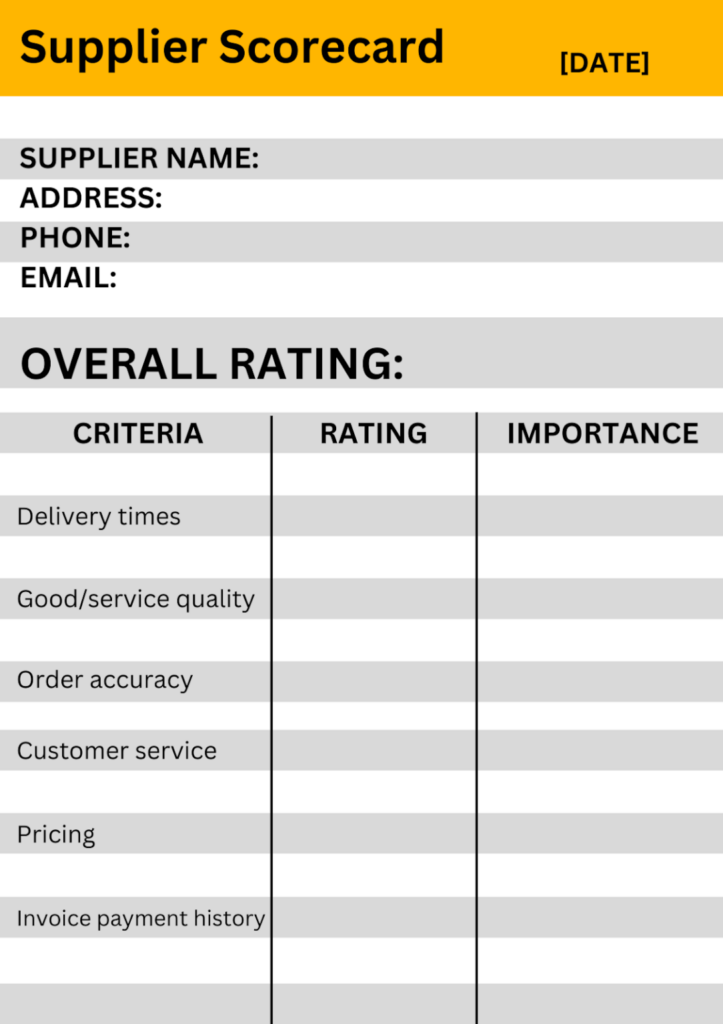

Use a scorecard or weighted scoring matrix to make your comparisons data-backed, rather than opinion-based.

Here’s how it works: assign higher weights to the criteria that matter most to your business goals.

If technical expertise is essential, give it more weight. If on-time delivery has a huge impact on your operations, prioritize that.

Price might carry less weight if you’re building a long-term partnership where reliability matters more than short-term savings.

This weighted approach ensures your final score reflects what actually matters to your organization.

Source: Tipalti

When your criteria are explicit and standardized, you minimize bias and avoid decisions based on gut feelings.

However, many procurement teams make the mistake of focusing solely on vendors who can solve today’s problems at the lowest cost.

That approach is shortsighted.

Vendor relationships are more successful when treated as strategic partnerships rather than transactional purchases.

So, as you evaluate each supplier, look beyond their current capabilities.

Consider whether they have the vision, flexibility, and commitment to support your long-term goals.

Why?

Because a vendor with a slightly higher price today might offer a strategic solution that perfectly matches your long-term goals.

This idea is perfectly summarized by Bull Murphy, the former Senior Managing Director and Chief Technology Officer at Blackstone.

When they select vendors, he explains, they focus on the future, and not the present.

Illustration: Veridion / Quote: Medium

That’s exactly why your standardized criteria should evaluate more than a supplier’s current performance.

They should help you gauge future potential.

Because the right vendor is not just capable today. They are positioned to grow alongside you tomorrow.

Risk assessment isn’t something you tack on at the end.

It should be part of your vendor selection process from day one.

That way, you can catch potential deal-breakers before you’ve invested significant time or resources.

The four critical risk areas to assess include:

| Financial Stability | Check a vendor’s credit ratings, debt levels, and bankruptcy records. A financially unstable supplier is unlikely to deliver reliably. |

| Cybersecurity Posture | Review their security ratings, breach history, and even the security of their third-party partners. |

| Regulatory Compliance | Confirm that vendors adhere to relevant regulations and standards, such as data privacy laws, industry regulations, and sector-specific frameworks. Request audit reports early to verify compliance. |

| Operational Reliability | Assess their supply chain reliance. A natural disaster, political event, or transportation bottleneck in their region could disrupt your operations overnight. |

If you skip these checks, you will be exposed to massive financial and reputational damage.

Home Depot learned this lesson the hard way—twice.

Craig Harber, President Security Evangelist at Coastal Cyber LLC, a cybersecurity company, explained what happened:

Illustration: Veridion / Quote: SC Media

This exposed Home Depot to serious risk.

Attackers could use that leaked data for phishing attacks, opening a path for potential ransomware attacks.

And this wasn’t Home Depot’s first experience with vendor-related breaches, either.

Back in 2014, hackers used a supplier’s credentials to penetrate their network.

They deployed custom malware that stole payment card data from over 52 million customers.

The cost?

Home Depot paid $17.5 million in settlements, plus an additional $198 million in litigation costs and response efforts.

Source: Reuters

That’s $215.5 million because they didn’t properly vet a vendor’s security posture.

The lesson is clear: any vendor relationship can introduce serious risk.

That’s why early risk analysis is both defensive and guides smarter choices.

It ensures you partner with suppliers whose risk profiles align with your organization’s tolerance.

For example, a vendor with weaker financial standing or less mature cybersecurity might be acceptable for a small, non-critical project.

But they’re completely unacceptable for handling sensitive data or powering core operations.

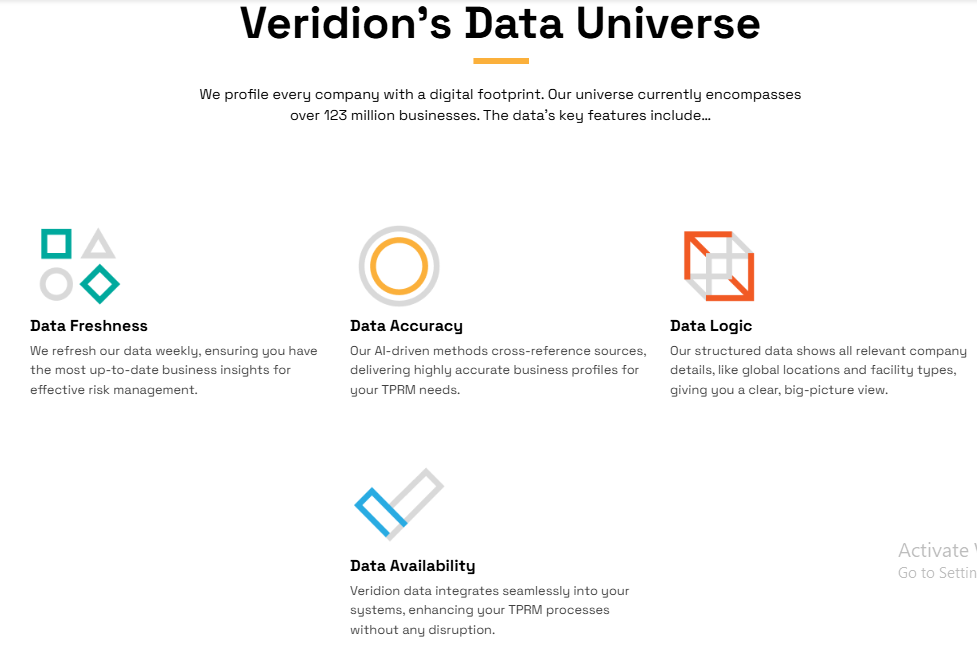

Fortunately, early-stage risk profiling no longer requires guesswork or manual searches.

Partners like Veridion make it possible to access vast datasets of verified, up-to-date company data.

This way, you can proactively assess vendor credibility, financial stability, risk signals, and compliance posture before you sign a contract.

Source: Veridion

Integrating this intelligence into your initial screening ensures every supplier you consider already meets your baseline risk criteria.

This saves you from future headaches and protects your business from preventable harm.

Vendor selection is never a solo activity. It requires input from a cross-functional team.

So, involve the right people from the start: representatives from procurement, legal, IT, finance, and operations.

This cross-functional approach ensures your chosen vendor meets both technical specifications and strategic business goals.

Patrick Gilgour, Managing Director at the consulting firm Protiviti, agrees:

Illustration: Veridion / Quote: CIO

Imagine this scenario:

IT selects a vendor with advanced features, finance balks at the price, and operations finds it too complicated to use effectively.

This means you’ve wasted months and damaged internal relationships.

A collaborative process, on the other hand, balances these competing needs, reduces blind spots, and leads to sustainable vendor choices.

When you surface these issues early, you avoid post-implementation surprises that derail projects and burn budgets.

Just as important, inclusive collaboration strengthens buy-in from all departments.

When stakeholders have a seat at the table and their concerns are heard, they are far more likely to champion the chosen solution.

Selecting the right vendor has never been about chasing the lowest price, picking based on assumptions, or prioritizing features.

It involves finding a partner who supports your business now and has the capacity to grow alongside you.

When you define your requirements clearly, research the market thoroughly, evaluate vendors objectively, assess risks from day one, and bring the right stakeholders into the conversation, you’re not merely checking boxes.

You’re building a foundation for success.

These five best practices make vendor selection less of a risky guess and more of a real competitive advantage.