Top 6 Sources of Insurance Market Intelligence

Insurance professionals increasingly rely on verified third-party data to navigate rapidly evolving regulations, emerging risks, and shifting market dynamics.

From underwriting and claims insights to regulatory updates and competitor tracking, the right insurance market intelligence software can make all the difference.

This article explores six leading platforms in the field, focusing on their unique strengths, features, and ideal use cases that will help you fill the gaps, ensure data accuracy, and stay ahead.

First up is a solution we know best: our own market intelligence platform, Veridion.

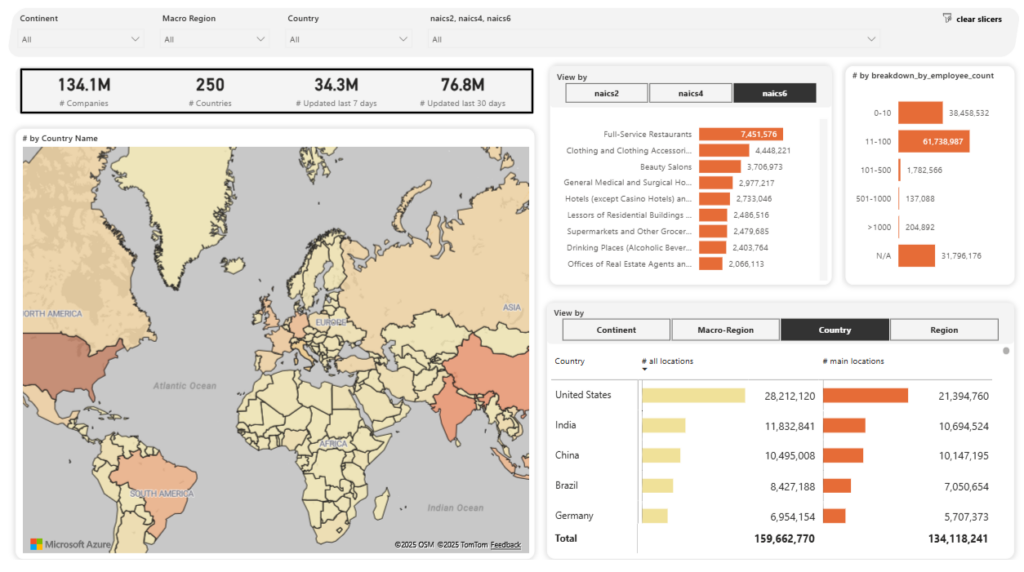

Veridion maintains weekly-updated profiles on over 130 million businesses worldwide, including small and medium enterprises, which are often underrepresented in traditional data sets.

Source: Veridion

Enabled by AI-driven data collection and processing, this freshness and depth directly address persistent challenges in insurance analytics, such as limited coverage of digital-first firms, outdated records, and fragmented datasets.

Despite this scale, the platform remains highly accessible, thanks to a user-friendly interface and natural language search.

Veridion’s Match & Enrich capability generates complete business profiles even with just a company name and address, thereby streamlining workflows for client vetting, partner discovery, and policy validation.

Source: Veridion on YouTube

Veridion’s AI-powered data also enhances monitoring of underwriting risks, business activity, locations, policies, and product types.

By enriching traditional underwriting processes with detailed firmographics, operational activity, industry classifications, and location-specific risk indicators, insurers can make faster, more precise decisions.

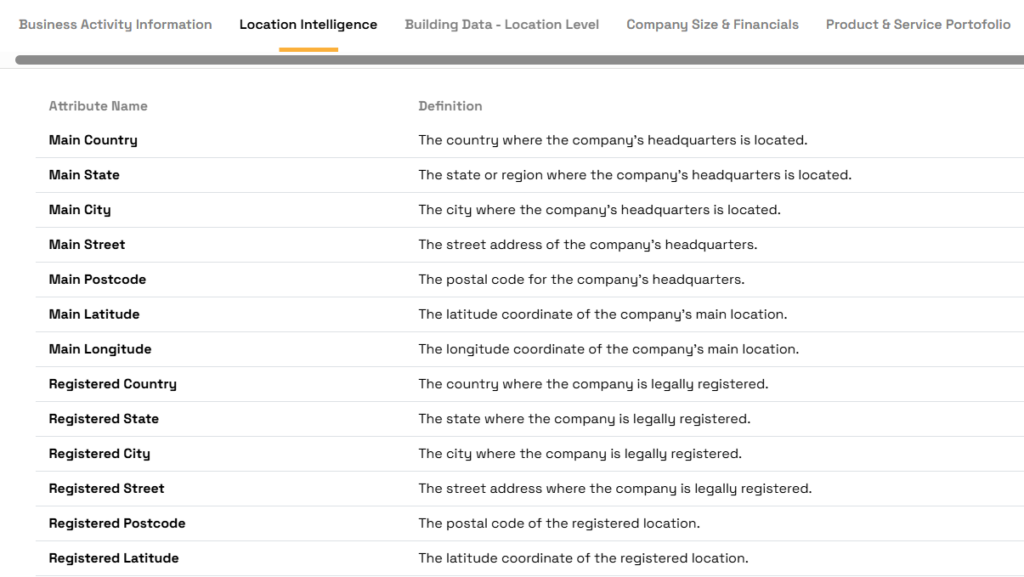

Location intelligence is a key differentiator in validating address types and the company’s operational status to easily map all connections to dealers, partners, and subsidiaries.

Source: Veridion

For commercial insurers, this allows them to:

The integration of climate risk data further allows insurers to identify exposure to wildfires, hurricanes, or floodplains, enabling precision risk modeling and tailored premium strategies.

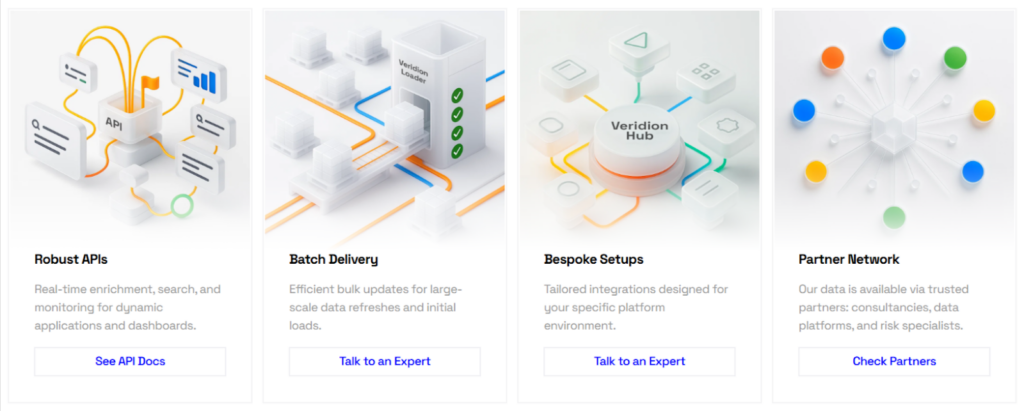

Finally, through robust APIs, batch delivery, and bespoke setups, Veridion continuously expands datasets while aligning new information with existing records.

Source: Veridion

With duplicate entries eliminated and profiles standardized, your team can make the most of fresh, in-depth, and actionable insights.

In short, Veridion’s enhanced data layer gives insurers the confidence to underwrite smarter, manage risk proactively, and optimize portfolio performance.

Now it’s just up to you to reach out.

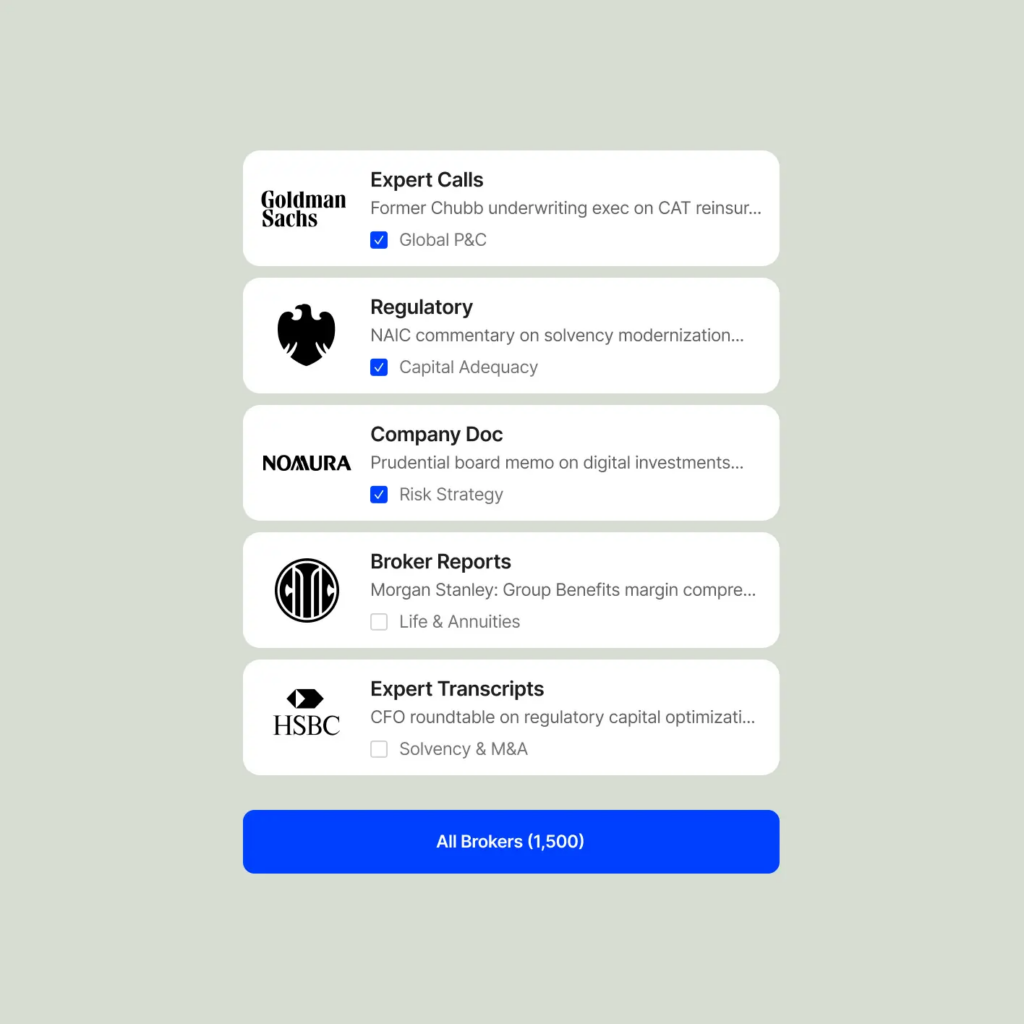

AlphaSense is an AI-powered market intelligence platform that interprets business and financial documents through advanced search, summarization, and trend analysis.

By providing insurance professionals with a unified research environment, the platform jumpstarts the process of piecing together insights from NAIC bulletins, regulatory newsletters, and analyst commentary.

Source: AlphaSense

While it can’t match Veridion’s numbers, AlphaSense aggregates content from an impressive 10,000+ private, public, premium, and proprietary sources, including company filings, earnings call transcripts, expert calls, and trade journals.

For insurers, this breadth of coverage enables:

Much of it comes down to the platform’s customizable dashboards, which enable users to filter and visualize insights by sector, geography, or theme for faster access to decision-grade intelligence.

Source: AlphaSense on YouTube

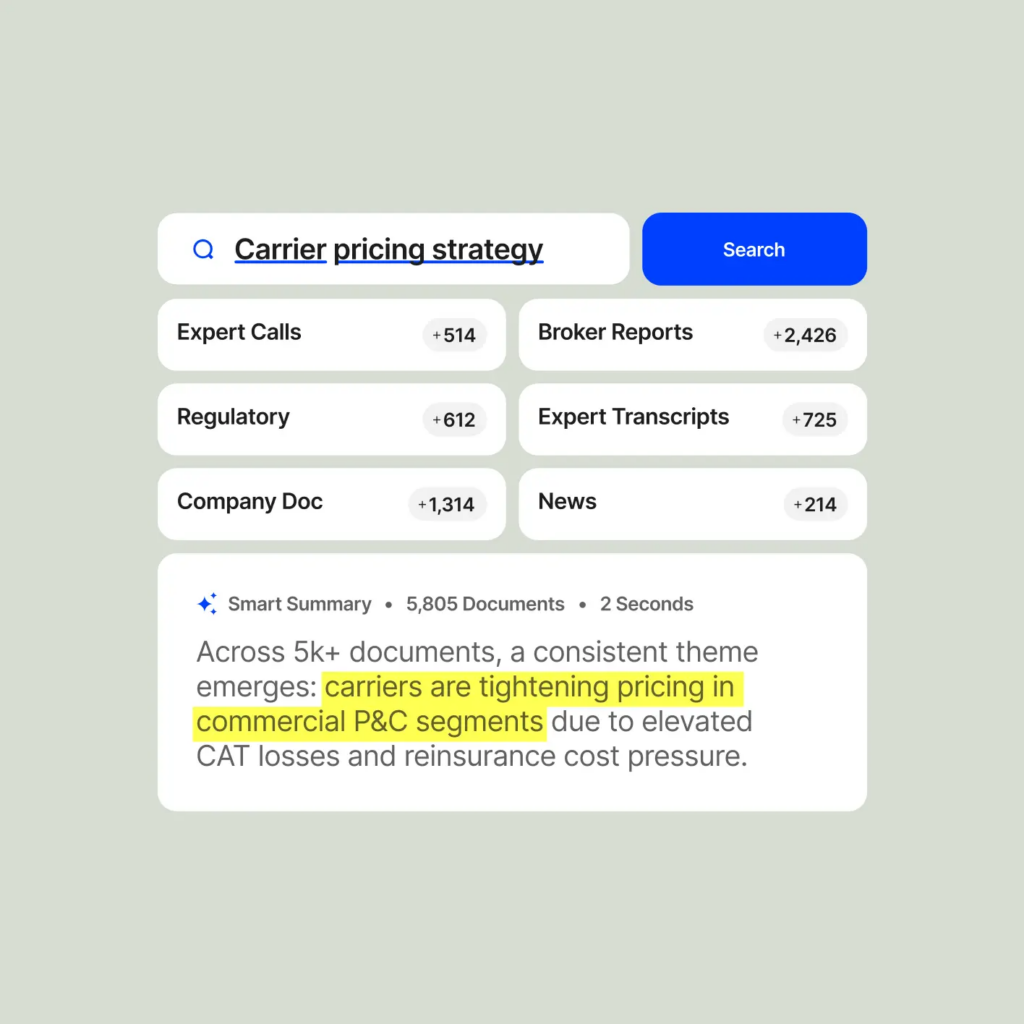

The key point of interaction is the platform’s AI-powered search engine, enabling you to receive data-backed advice on key considerations, such as carrier pricing strategies.

Source: AlphaSense

The same AI layer can also be used to index your company’s internal content, making institutional knowledge easy to search and summarize on request.

According to G2 reviews, users consistently praise AlphaSense’s AI summaries for cutting research time and surfacing high-value insights automatically.

However, several reviewers note limitations in industry-specific reporting and occasional difficulty sorting search results, which can hinder precision during deeper investigations.

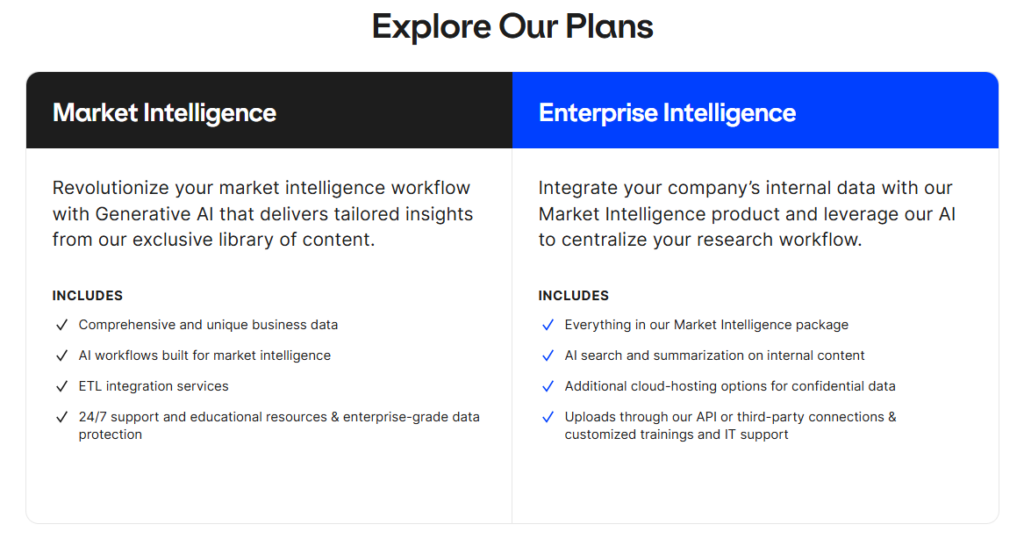

Pricing is available only upon request, but you can check the website for more details on the dedicated plans.

Just keep in mind that only the premium Enterprise Intelligence offering comes equipped with AI search and summarization capabilities.

Source: AlphaSense

To recap, if you don’t require niche industry data, AlphaSense is an excellent choice for insurance firms seeking quick cross-source synthesis and automated insight discovery.

S&P Global is one of the most established providers of financial and credit analytics, which have long been regarded as a cornerstone for insurance market intelligence.

Unlike platforms that prioritize open-web coverage, S&P specializes in validated financials, credit data, and regulatory filings, providing insurers and reinsurers with reliable indicators of counterparty strength and solvency trends.

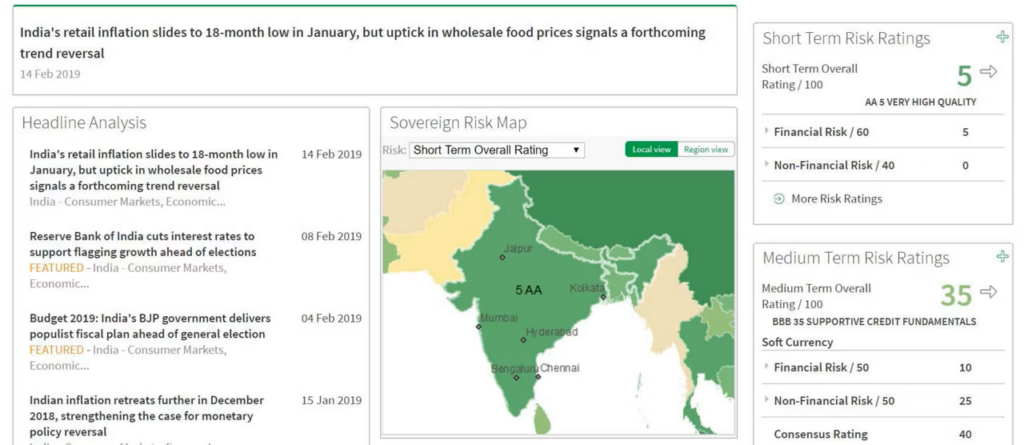

Its Country Risk Scoring framework, for instance, combines macroeconomic metrics, governance indicators, and fiscal stability data to help underwriters and risk officers assess exposure to volatile regions.

Source: S&P Global

These can be used to:

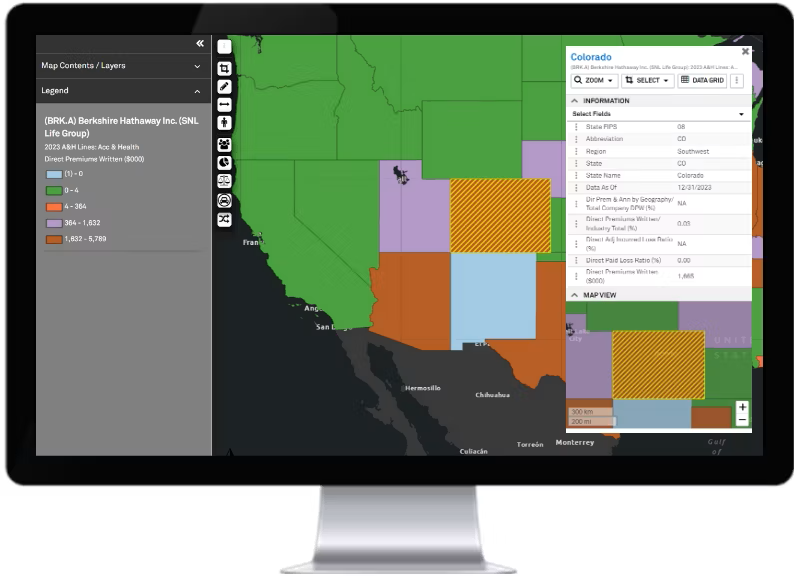

Most insurance teams engage with S&P Global through its Capital IQ platform, which provides extensive coverage on 13,257+ global insurance companies.

This workspace merges audited data, screening tools, and Excel/API integrations, giving you an inside look at your peers.

Think of it as having comprehensive access to statutory data, rate filings, and product filings based on state or line of business.

Source: S&P Global

The addition of AI-driven data normalization further speeds up analysis, automatically tagging and standardizing financial metrics.

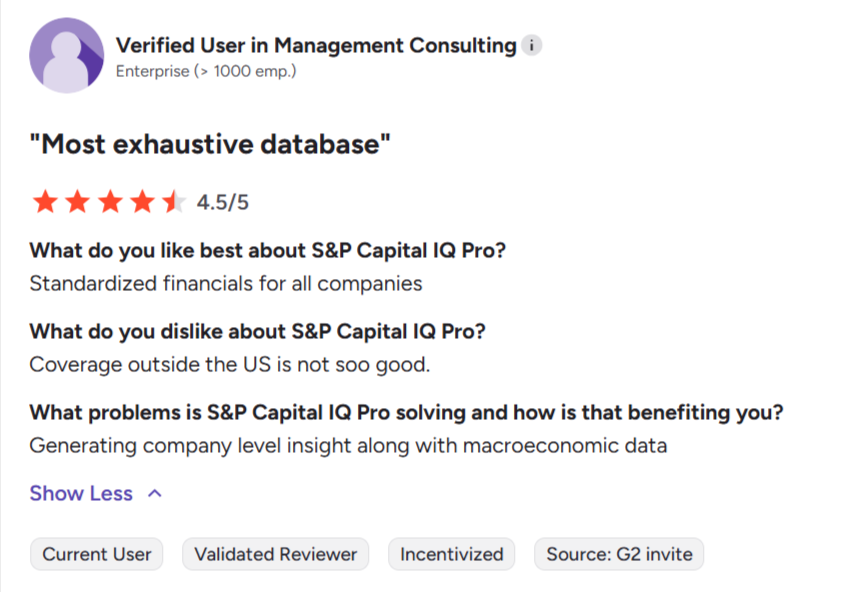

While widely praised for data accuracy and depth, some reviewers report that the coverage doesn’t include enough SMBs, as well as that it’s limited to specific regions.

Source: G2

However, it’s essential to note that most of the available reviews date back to 2021, meaning that the S&P team has had numerous opportunities to improve its platform.

Sites like Vendr provide pricing estimates, but, like the other solutions on the list, you will need to reach out directly for a quote.

While not a key provider of real-time business data, S&P Global excels in contexts that require audited, historical, and credit-certified intelligence.

Infodesk is a market intelligence platform designed to help organizations capture and act on competitive signals.

Since its 2025 rebrand, Infodesk has been positioning itself more explicitly toward different use cases, including insurance.

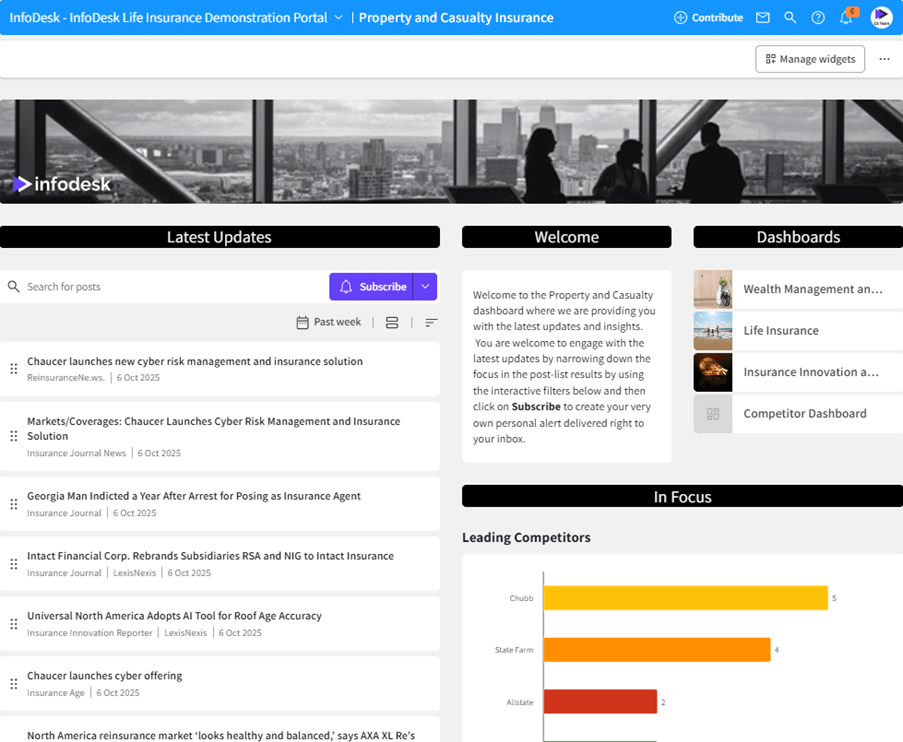

The platform’s main interface comprises several dashboards, as well as sections with the latest updates and key insights.

Source: Infodesk

While the interface is functional and not overly cluttered, it appears slightly dated compared to newer AI-native dashboards.

Unlike S&P Global’s quantitative financial datasets or AlphaSense’s reliance on proprietary filings, Infodesk leans on open-web and licensed content aggregation.

Its database covers more than 70,000 verified sources, spanning market updates, policy signals, sustainability disclosures, and competitor announcements.

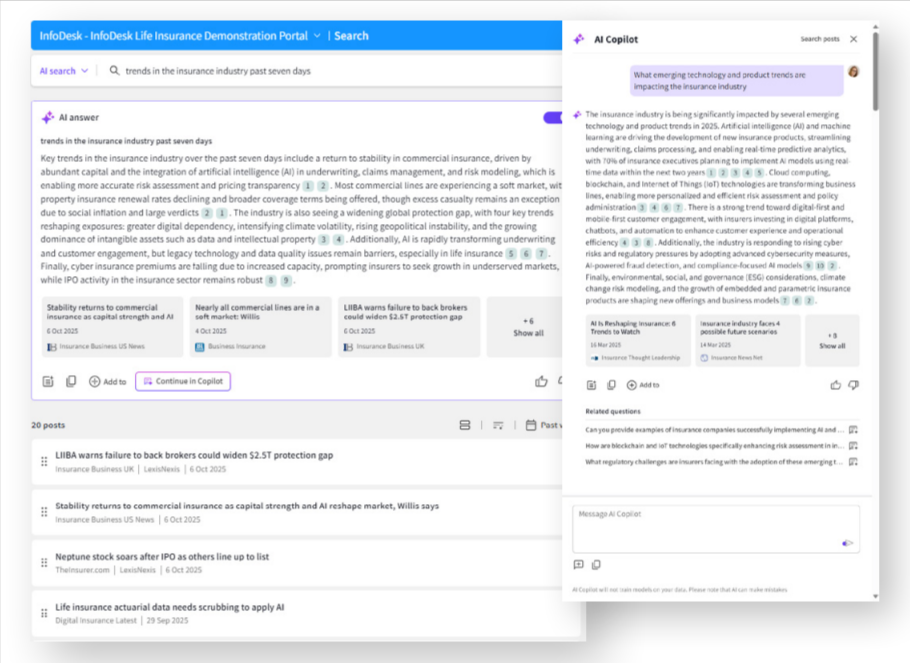

Beyond aggregation, Infodesk recently introduced AI summarization to condense articles and bulletins into digestible takeaways.

Source: Infodesk

However, these tools remain simpler in scope and focus primarily on text summarization rather than full cross-document synthesis and contextual analysis.

The platform supports several collaborative and traceability features that may appeal to compliance-focused insurance teams, including:

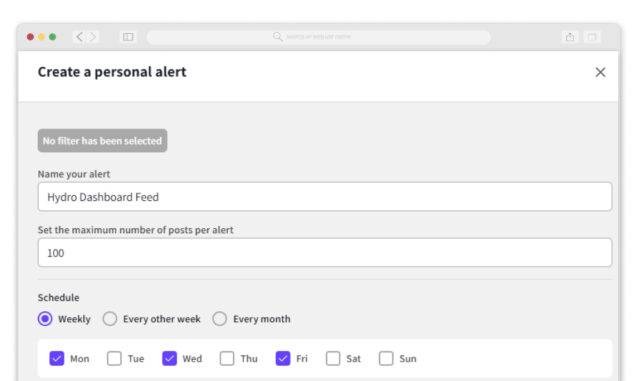

Infodesk focuses on simplicity and ease of use, both of which are exemplified in the alert feature, which contains only the essential fields.

Source: Infodesk

However, Infodesk’s greatest strength doubles as its biggest weakness.

Namely, there are no native modules for risk modeling, actuarial benchmarking, or underwriting support, which limits its value for insurance teams in need of more robust solutions.

Pricing is not publicly disclosed and is available only through direct inquiry.

While this is standard practice, the lack of verified feedback on sites like Capterra and G2 at the moment means that potential buyers have limited visibility into implementation quality or customer experience.

In short, Infodesk is a practical, content-driven platform that caters to insurers prioritizing broad situational awareness and collaborative monitoring over quantitative or AI-intensive analysis.

Sindup offers a market intelligence platform suitable for a variety of use cases, including insurance.

The platform aggregates data from 50+ million international sources, helping insurers track emerging threats like climate risk, insurtech disruption, and regulatory changes.

Source: Sindup on YouTube

It’s important to note that Sindup emphasizes broad monitoring over deep firmographic and location‑level intelligence, or detailed insurance specialist data.

Sindup has developed a proprietary technology, FilterLive™.

Available natively in the platform, this deep learning technology recognizes appropriate information according to the interests of each user:

The platform’s universal search across external sources, dashboards with widgets (pie charts, keyword clouds, graphs), and connectors with internal tools (CRM, Slack) bring insight to internal stakeholders.

The solution’s focus on collaboration, rapid response, and interactiveness is evident in its mobile application.

It gives analysts an interface that allows them to scan and check key information on the go and in offline mode.

Source: Sindup

Collaboration features (tagging, shared workspaces) help teams align around signals and weave insight into action.

All these help in monitoring emerging risks and regulatory shifts in real‑time, identifying disruptive technologies, tracking societal and environmental trend signals to inform product innovation and claims prevention.

On the flip side, Sindup’s positioning bears some limitations. Also, verified user reviews and detailed feature ratings are hard to find.

G2 and Capterra listings show few reviews, making it hard to gauge deployment ease, data latency, or support quality.

Pricing is likewise not publicly published, so interested insurers must request a quote.

In short, if your insurance organisation prioritises trend and ecosystem monitoring—tracking transformation, insurtech moves or regulatory shifts—Sindup offers a lightweight, configurable intelligence hub.

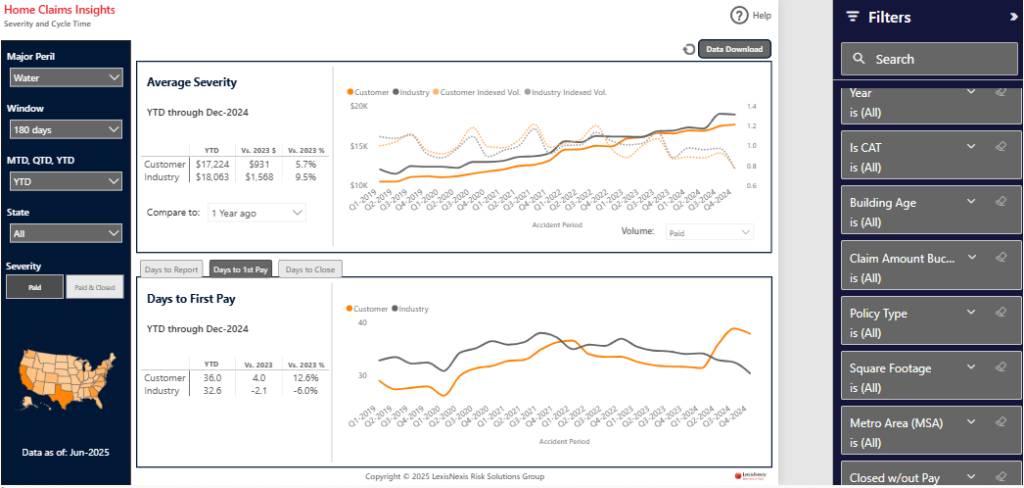

LexisNexis Insurance Market Insights is a specialised analytics suite targeting the insurance industry’s need for near‑real‑time underwriting, claims, and shopping behavior intelligence.

Leveraging contributory databases that cover ~99 % of the U.S. auto insurance market (claims) and ~96 % (policy), the tool provides filtered dashboards for underwriting, claims severity, policy switching, and market benchmarking.

For example, users can segment by peril type, ZIP/MSA, renewal/new business status, and building age.

These capabilities are highly relevant for carriers evaluating catastrophe risk or homeowner exposure.

Source: LexisNexis

LexisNexis is built for insurance‑specific workflows: underwriters, pricing analysts, and claims teams needing granular metrics and market benchmarking.

For instance, carriers leveraging the platform cite faster trend‑turnaround and richer comparators for loss cost benchmarking.

Source: LexisNexis

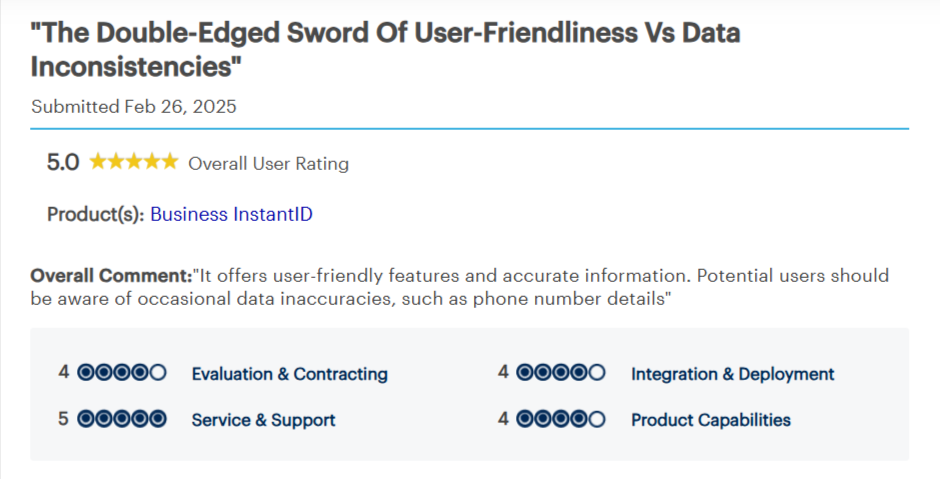

Review platforms (e.g., Gartner) reflect this strength:

LexisNexis Risk Solutions holds a 4.6‑star rating across 24 reviews in the Data & Analytics market sector.

Source: Gartner

However, some cons surface: the system’s steep pricing and complexity of configuration make it more appropriate for enterprise carriers than smaller midsize firms.

Also, its focus on U.S. auto/home lines means insurers with global P&C books or niche specialty lines may find coverage less robust.

Pricing is not published, and implementation typically involves enterprise licensing and integration into existing analytic or BI stacks.

In short, if you’re an insurance carrier or reinsurer needing benchmarked claims, underwriting, or shopping behaviour intelligence with deep industry fidelity, LexisNexis delivers.

No matter your preferred use case, choosing the right market intelligence platform gives you the ability to transform raw data into actionable insights.

Whether you prioritize AI-driven document search with AlphaSense, audited financials with S&P Global, or granular firmographic and location intelligence through Veridion, each solution brings a distinct advantage.

For insurers, the balance lies in pairing depth of coverage, ease of use, and workflow integration.

By selecting tools that complement your analytics processes, your team can confidently monitor trends, assess risk, and make faster, more informed decisions across underwriting, claims, and strategic planning.