Vendor Fraud Prevention Myths

Key Takeaways:

For procurement leaders, navigating a complex web of supplier relationships is a daily challenge.

Their focus is on value, efficiency, and resilience.

However, lurking within that meticulously managed vendor portfolio is a threat that most procurement leaders often underestimate due to persistent myths: vendor fraud.

Many enterprises operate under outdated assumptions, leaving them vulnerable to sophisticated schemes.

In this article, we debunk common misconceptions about vendor fraud and guide you on how to build a fraud prevention strategy grounded in the realities of the modern business landscape.

You might think fraudsters only target massive corporations, but data show that smaller companies are at high risk, too.

In fact, a report from the Association of Certified Fraud Examiners (ACFE) shows that small businesses faced more fraud cases than larger ones between 2002 and 2022.

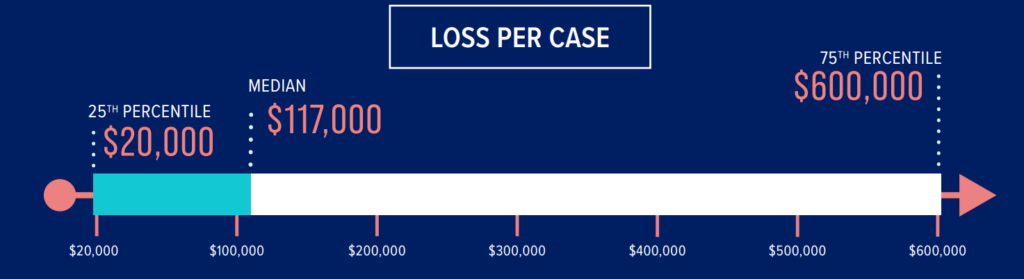

On top of that, every fraud case costs big money: about $117,000 on average.

Source: ACFE

Such huge losses can be catastrophic for a lean operation.

Fraudsters are opportunists. They seek the path of least resistance, and SMBs often present exactly that.

But what makes smaller companies vulnerable?

Often, it’s simple: they run with lean finance teams and fewer controls.

The companies may not have a dedicated fraud department, and approval chains can be relatively short.

According to Alexandra Lafaurie, VP of Product at JAGGAER, large corporations typically have dedicated security teams and controls in place, while smaller businesses don’t.

Illustration: Veridion / Quote: Trustpair

Fraudsters are aware of this, and they routinely target smaller firms whose tighter budgets often lead to weaker anti-fraud measures.

Lafaurie goes on to explain that, because smaller vendors are seen as less strategic, criminals exploit them easily by hijacking their bank accounts or credentials.

A fraudster doesn’t see a small business. They simply see an easier target with potentially weaker defenses.

So, treat your small or medium business as a target, not a safe harbor.

Enforce basic safeguards, such as segregated duties, multi-person approvals, and regular reconciliations, even if your procurement team is small.

Vigilance at every level means you defend assets before they’re drained, regardless of company size.

It’s commonly believed that fraudulent invoices or vendor accounts are clumsy, obvious, and will be caught by a vigilant accountant.

In reality, fraudsters are becoming increasingly stealthy, particularly with the use of AI tools.

Many vendor fraud schemes are designed to blend in with your legitimate operations.

Experts emphasize that vendor fraud is notoriously difficult to catch without strong controls.

Baptiste Collot, CEO of the fraud prevention platform Trustpair, warns that even well-trained staff can overlook elaborate schemes:

Illustration: Veridion / Quote: CFO

Fraudsters often exploit small, easy-to-miss discrepancies.

For example, attackers intercept genuine invoices and replace the payment details with fraudulent ones.

These subtle edits easily slip past busy accounts payable staff, and advancements in AI make their detection even harder.

In one headline-grabbing case, criminals used a deepfake AI video of a CEO to scam a company out of £20 million.

The video call looked and sounded authentic, convincing a finance employee to transfer funds.

This wasn’t a cartoon or blatant fraud. It was a high-tech con that managed to fool experienced staff.

Source: The Guardian

One thing is clear: vendor fraud does not announce itself.

You can’t rely on spotting glaring red flags alone, because often, the warning signs are buried in data.

In practice, detecting vendor fraud requires continuous analysis and cross-checking, rather than casual glances.

So, make an effort to build automated checks that compare each invoice and vendor change against historical patterns to ensure accuracy and consistency.

Flag any tiny deviations: a new invoice number series, an unfamiliar banking detail, or a duplicate vendor record.

Also, train staff to verify out-of-the-ordinary requests, even if the email appears to come from a known supplier.

Remember, modern fraud hides in plain sight. It’s up to you to look closely.

A vendor you’ve worked with for a decade might seem inherently trustworthy and poses no fraud risk.

However, complacency is a fraudster’s best friend.

Assuming a long-standing vendor relationship guarantees safety is dangerously misleading.

As Bill James, Customer Strategy Director at Creditsafe, provider of business credit reports, explains, finance teams often fail to be diligent about checking the invoices of vendors who have been reliable and honest.

But fraudsters count on this to happen, often exploiting the trust built through years of doing business:

Illustration: Veridion / Quote: Creditsafe

Procurement and finance teams may grow complacent once a vendor relationship is long-standing, which is precisely what fraudsters expect.

Such relationships breed trust, and trust can lead to relaxed controls.

The solution?

Consistent re-verification. In other words, treat every vendor like they’re new to your system.

Regularly reverify vendor details, including company name, address, bank information, and key contacts.

Don’t assume that a five-year-old contact or account number is still valid.

In particular, watch for vendor reassignments or acquisitions: the vendor you trust today might have new owners or accounts next month.

Thankfully, you can automate much of this.

For instance, Veridion’s continuously updated company database covers over 134 million suppliers worldwide.

Our system refreshes data weekly, so if a supplier changes their address, adds a new director, or sets up a new bank account, you will receive an alert.

Source: Veridion

By integrating such tools into your workflows, your team spends less time manually checking and more time responding to genuine anomalies.

No matter how reliable a vendor has been, a proactive, data-driven approach to re-screening is a critical layer of defense.

Even your oldest vendor should be treated as if they just joined your roster.

It’s tempting to think that investing in a state-of-the-art fraud detection platform is a silver bullet that will solve all your problems.

Yes, technology is a powerful tool, but it is just one part of the equation.

Fraud prevention requires something more than software. It needs human expertise.

As Brittany Carmichael, Client Services Supervisor at Corcentric, notes, even the most advanced technology has its limits.

Automation can only take organizations so far, and proper protection ultimately depends on human oversight.

Illustration: Veridion / Quote: Corcentric

The reason behind this?

The fact that automated systems often miss subtle social-engineering scams or cleverly disguised fraudulent invoices.

Carmichael emphasizes that effective fraud prevention requires a hybrid approach:

Advanced analytics and algorithms can flag anomalies, but experienced professionals must investigate and act on these alerts.

Automated systems are excellent at flagging anomalies based on pre-defined rules, but they can generate false positives, be circumvented by novel schemes, and lack contextual understanding.

A machine learning model might see a duplicate invoice number and alert you, but it won’t know if a legitimate year-end purchase really required duplicate billing.

Only a trained human can ask the right questions:

“Did we actually order this? Why is this invoice out of sequence?”

A 2023 report by Juniper Research predicts that AI-powered fraud detection platforms will save banks over $10 billion annually by 2027.

However, the key is in the implementation.

The most effective fraud prevention strategies combine data-driven alerts with well-trained staff who understand how to interpret and act on them.

Use data-driven alerts and anomaly detection, but pair this with well-defined policies and informed staff.

For instance, require that any vendor bank detail change be confirmed by a real person on a verified phone line or in person.

And make sure someone routinely “plays devil’s advocate” by auditing random invoices to see if the tech missed anything.

In short, technology should augment, not replace, internal controls, regular audits, and a culture of employee awareness.

Your team needs to be the intelligent engine that investigates the red flags the system raises.

Another common belief is that vendor fraud is exclusively an external threat perpetrated by shadowy figures on the internet.

The truth is that vendor fraud isn’t just an external issue—insiders can also be involved.

Without proper oversight, employees or contractors might collude with corrupt vendors.

An employee might create a shell company and approve invoices for payment, thereby circumventing the proper approval process.

Alternatively, they could collude with an existing vendor to approve inflated invoices in exchange for a kickback.

These schemes are often enabled by a lack of segregation of duties, where one person can create a vendor, approve an invoice, and process a payment.

Many executives overlook internal risks, but experts emphasize that insider fraud poses a significant threat.

Jim Lucier, CEO of AP-automation vendor Medius, insists that firms cannot afford to be complacent about insider fraud.

He notes that prevention starts with encouraging reporting and implementing checks that catch collusion between staff and vendors:

“Building a culture where employees feel comfortable to report their suspicions could save organizations millions in the long run.”

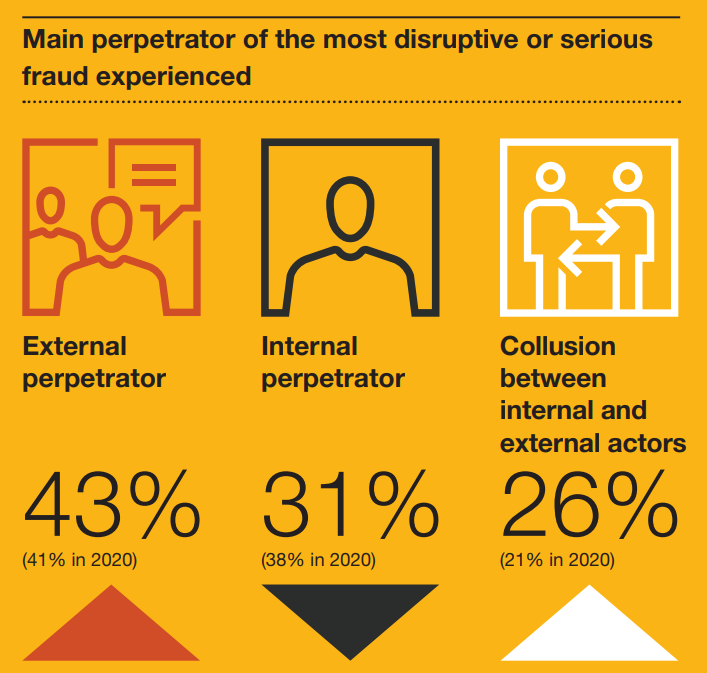

Statistically, insiders play a significant role.

In a global survey, PwC found that 43% of fraud cases were committed solely by outsiders.

But 26% involved collusion between insiders and external parties. Internal employees, on their own, accounted for 31% of the reported fraud cases.

Source: PwC

Preventing internal vendor fraud requires tightening controls over both personnel and documentation.

Key steps include:

Together, these practices create obstacles that fraudsters and crooked insiders will avoid.

You’ll be surprised how often routine cross-checks catch scams before a dollar is lost.

At first glance, stringent controls and proactive fraud prevention programs do require effort and may seem too costly, complex, and time-consuming to justify.

But the cost of fraud is far higher.

This is a classic case of “an ounce of prevention is worth a pound of cure.”

While there is an upfront investment, it pales in comparison to the financial, operational, and reputational damage that can result from a successful fraud event.

Remember the figure of $117,000 per fraud case for small businesses we mentioned at the beginning?

For larger enterprises, that figure can multiply rapidly.

Studies show that the price of fixing the consequences of fraud can far exceed the cost of prevention.

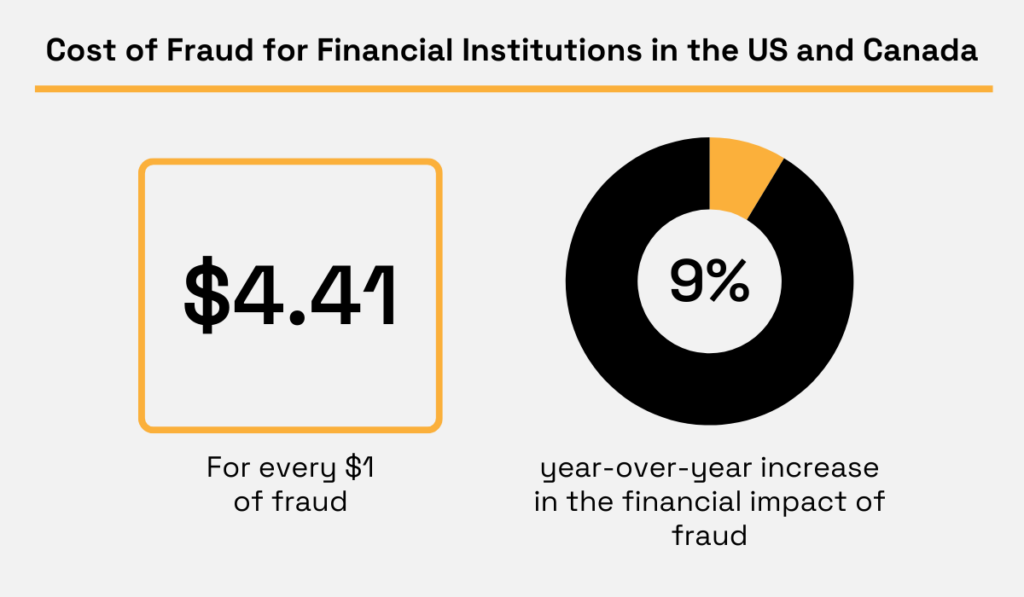

For example, one analysis found financial institutions in the U.S. and Canada incur an average cost of $4.41 for every $1 of fraud due to fines, fees, the face value of fraudulent transactions, and the costs and effort associated with replacing lost or stolen merchandise.

Illustration: Veridion / Data: LexisNexis

Investing in preventing fraud will give you a higher return on investment than investing in fraud detection.

Why?

Because stopping fraud before it happens saves legal fees, lost funds, and business disruption.

Moreover, modern automation is making prevention leaner.

Verified data sources and workflow tools can handle routine checks, so your staff isn’t overwhelmed with manual work.

For instance, automated vendor verification can instantly flag if a company name, address, or tax ID has changed, freeing your team from looking up records one by one.

Rule-based systems can automatically reject invoices from vendors not registered in the system.

And the time saved on processing and investigating obviously fraudulent claims far outweighs the few minutes needed to set up these rules.

Think of it this way: each hour you spend on catching fraud early may save you plenty of hours (and tens of thousands of dollars) in damage control.

The landscape of vendor fraud is not static.

It is evolving at a frighteningly rapid pace, driven by new technologies.

The myths that once provided comfort are now your greatest vulnerability.

So, move beyond these myths. Take a layered approach, and you’ll build a resilient vendor-payments process.

The takeaway is simple: vigilance and prevention pay off.

With the right combination of data-driven tools and alert staff, you can safeguard your organization’s bottom line against vendor fraud.

And remember: every check you put in place today can keep fraudsters out tomorrow.