How Market Intelligence Platforms Drive Insurance Innovation

Key Takeaways:

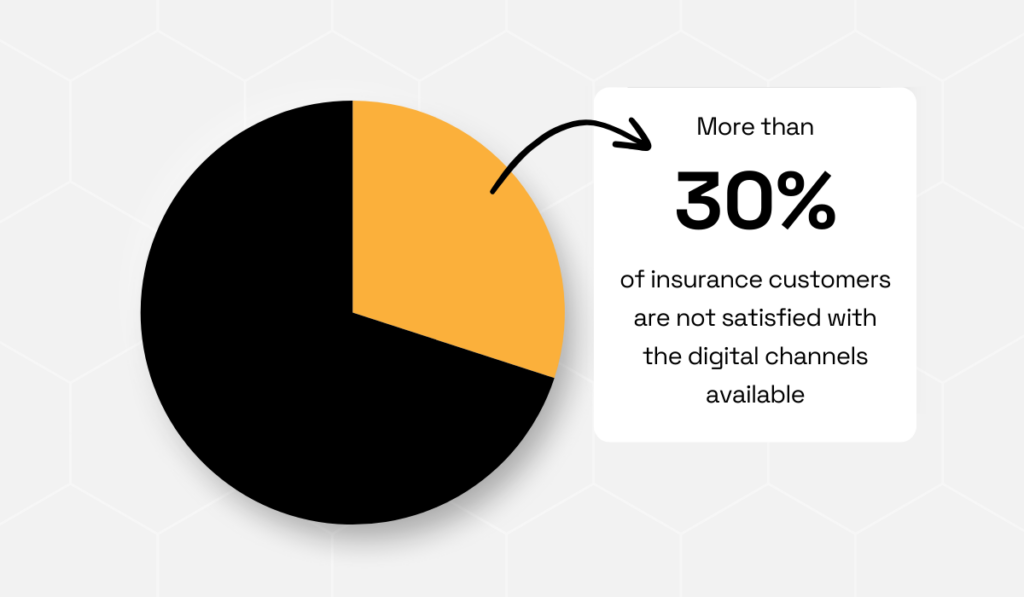

Did you know that recent studies reveal that 30% of insurance customers are dissatisfied with how their insurers communicate and engage with them?

It’s no secret that the insurance industry has been stuck in a long-standing rut for some time now, signaling an urgent need for meaningful change.

And let’s be clear: this need for change isn’t about keeping up with trends. It’s about ensuring the industry’s long-term viability.

So, what is one of the most powerful drivers of innovation in insurance?

Market intelligence.

In this article, we take a close look at five ways market intelligence is revitalizing the insurance sector, helping companies boost their efficiency, reputation, and, ultimately, their bottom line.

Let’s get started.

Market intelligence platforms aggregate real-time data from various sources, using analytics and AI models to flag anomalies and validate information.

This is especially valuable in commercial insurance, as it increases automation and significantly improves the accuracy of self-reported information about a claimant’s business and operations.

These platforms can typically generate a full business profile from just a name and address, enabling data pre-fill and more reliable validation of applicant details.

You can see what that looks like in the video below:

Source: Veridion on YouTube

This is a major step forward for what has traditionally been one of the most time-consuming and resource-intensive processes in insurance.

Instead of handling mountains of paperwork, insurers can now rapidly process and analyze data, improving decision-making and reducing the time from initiation to resolution.

As a result, operational efficiency increases while operating costs drop.

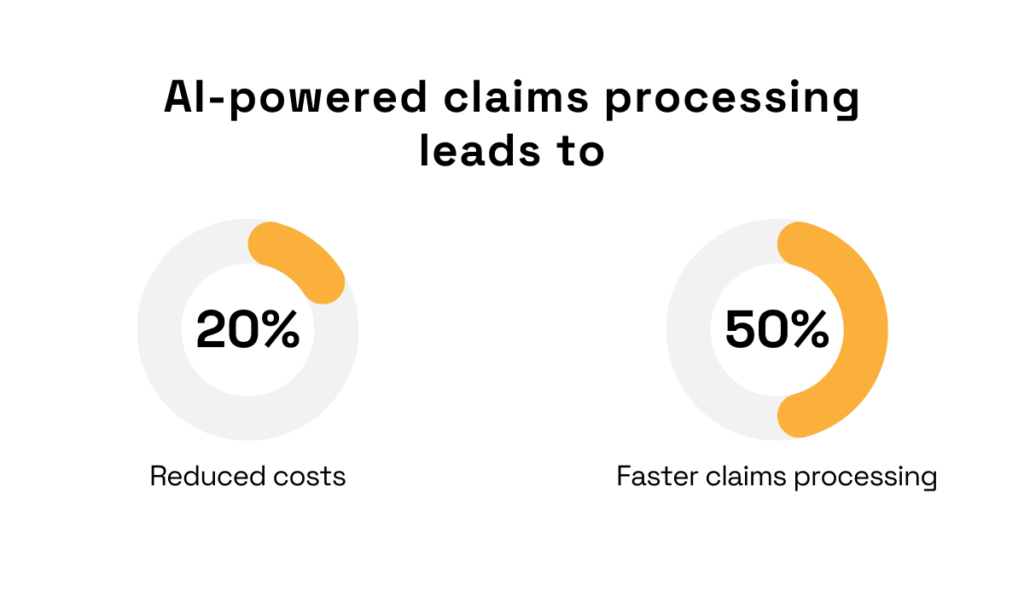

In fact, the BCG’s 2025 research has already shown that AI-powered claims management can reduce costs by up to 20% and increase claims processing speed by as much as 50%.

Illustration: Veridion / Data: BCG

Those are significant gains from automating just one part of the insurance lifecycle.

And the benefits extend to everyone: companies operate leaner and more cost-effectively, and customers get faster resolutions.

Even employees, freed from repetitive, low-value tasks, can finally focus on more complex and meaningful work.

Scott Logie, Membership Advocate at Data & Marketing Association UK, agrees:

Illustration: Veridion / Quote: The Fintech Times

In the end, claims processing is often the most critical moment in the insurer-customer relationship.

It’s the moment a customer has suffered a loss and needs the insurer to act quickly, fairly, and accurately.

At the same time, claim costs are rising, and insurers must make smart, responsible decisions.

The stakes are high on both sides.

Market intelligence helps make the process smoother, more precise, and more efficient, delivering better outcomes for everyone involved.

Premium leakage is a major challenge for insurers. Even small inaccuracies in data can lead to mispriced risk, resulting in millions in lost premiums and eroding profitability.

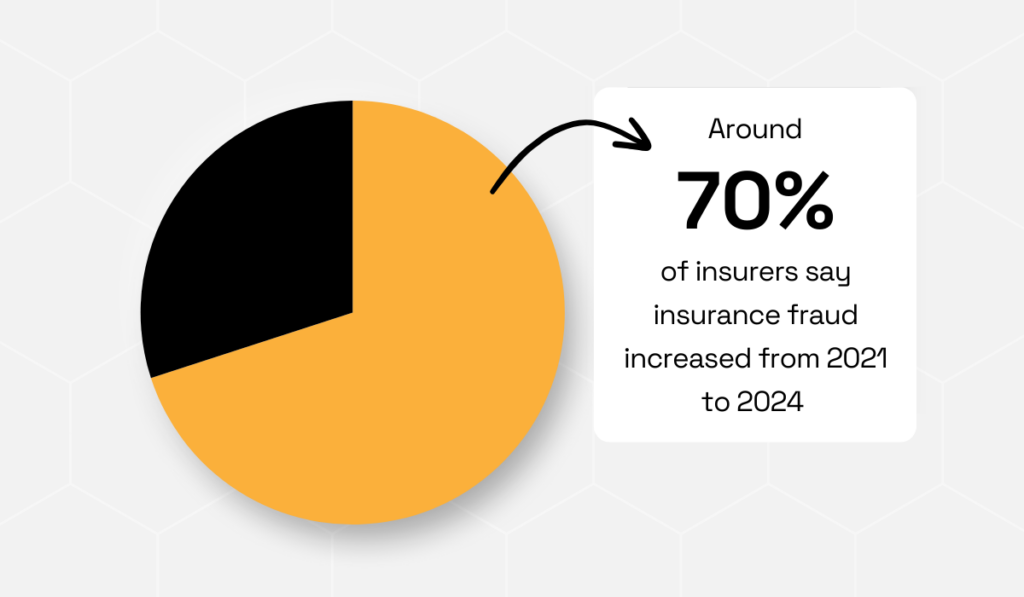

Fraud is a significant contributor to this issue, and it seems to be on the rise.

Recent research shows that around 70% of insurers have seen suspected fraud increase over the past three years.

Illustration: Veridion / Data: InsuranceFraud

But fraud is only part of the problem.

Underwriters may also miscalculate risks due to inexperience or poor data, leading to policies that are underpriced relative to the actual risk level.

These errors in the initial underwriting process often show up later as financial losses during claims.

In any case, premium leakage always comes back to the same root cause: bad data.

This is exactly the problem market intelligence is designed to solve.

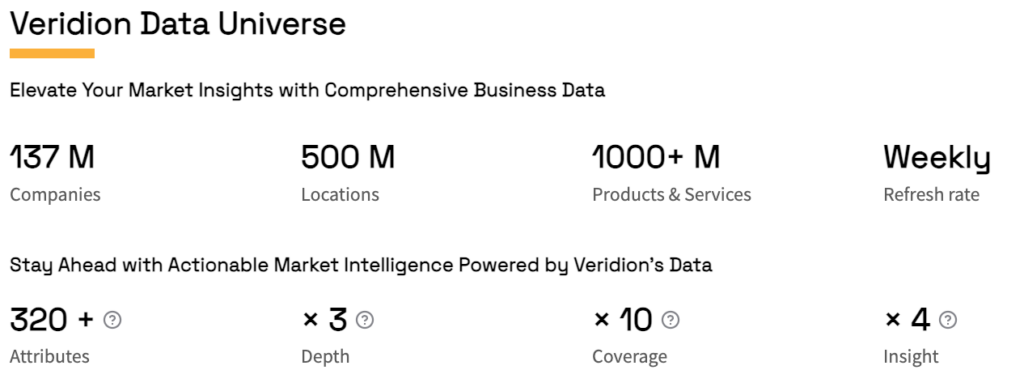

Take, for example, our own AI-powered market intelligence platform, Veridion.

By enabling users to validate businesses with unprecedented accuracy, Veridion helps commercial insurers reduce risk and make underwriting decisions with far greater confidence.

Here’s a brief overview of what our database offers:

Source: Veridion

Our data supports continuous monitoring of underwriting risks, business activity, operational changes, locations, policies, and more, ensuring decisions are always grounded in deep, real-time insights.

Let’s see what that might look like in practice.

In 2024, a commercial insurer adopted our Environmental, Social, and Governance (ESG) dataset to help tailor an insurance policy for ChemPro, an industrial chemical manufacturer.

The manufacturer had a complex risk profile due to its regulatory and litigation history, which meant the insurer needed a truly comprehensive assessment to be able to price the risk accurately.

Veridion delivered exactly that:

| Insights from News and Commitments | Scanning global and local news sources to assess ChemPro’s ESG initiatives, public commitments, and real-world performance |

| Industry Classification and Product Data | Using AI to detail ChemPro’s products and services, including identifying chemical processes and highlighting products linked to sustainable applications, such as renewable energy |

| Locational Data | Providing detailed information on all ChemPro manufacturing sites, including one located in a high-risk, disaster-prone area |

| Financial Data | Supplying revenue data to help evaluate ChemPro’s economic stability and risk exposure |

Thanks to this rich risk profile, the insurer determined it needed to increase premiums by 30% to account for elevated liability risks and the additional exposure posed by the high-risk location.

Ultimately, this helped them eliminate what would have been significant premium leakage and protect profitability.

Market intelligence platforms allow you to track all kinds of customer data, including their needs, behavior, channel preferences, and other factors that help identify emerging expectations.

With these insights, you can make targeted improvements to boost customer experience and, more importantly, increase retention.

After all, today’s customers expect nothing less than Amazon-level convenience, personalized offerings, and lightning-fast service, even from insurers.

Those who fail to modernize will lose customers to competitors.

Yet, many seem to be making that very mistake. According to a 2023 McKinsey survey, a lot of insurance customers are dissatisfied with existing digital channels.

Illustration: Veridion / Data: McKinsey & Company

Modern consumers expect seamless digital experiences.

They want to check accounts or submit paperwork via their phone. They want quick chat options and self-service portals.

But so many insurers fail to meet them where they are, missing a major opportunity.

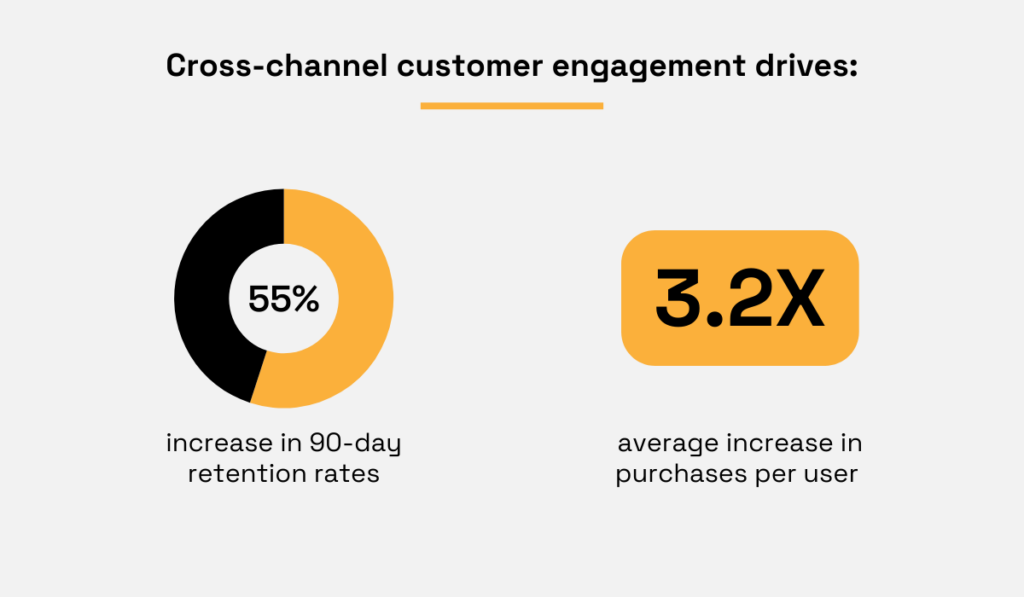

The 2023 Braze study backs this up, revealing that engaging customers on the channels they actually use significantly increases retention and even boosts purchases.

Illustration: Veridion / Data: Braze

This is why you need market intelligence.

It shows you what your customers want and how to reach them best.

A good example of an insurer that actually pays attention to consumer intelligence is Zurich Insurance Group.

Aleksandar Vidović, CEO of Zurich’s AI and analytics company ZCAM, maintains:

Illustration: Veridion / Quote: Business Insider

That’s why Zurich implemented an intelligence platform that simplifies communication with clients and tracks the data needed to provide tailored experiences.

For example, the system tracks each client’s current policies and prior interactions, as well as integrates with additional AI tools for tone analysis and feedback management.

These insights guide agents in recommending the customer’s next steps, taking inspiration from tech leaders like Spotify.

Vidović explains:

“When we listen to Spotify, we get a playlist, and then it recommends the next best song. We use the same modeling to recognize the most appropriate product for a customer based on their needs.”

As a result, the company benefits from drastically improved efficiency, increased customer satisfaction, and higher engagement.

It’s proof that when you genuinely listen to your customers, they notice and reward you with loyalty.

Market intelligence doesn’t just support customer retention, but can also help attract new clients.

That’s because it provides insights into trends, competitors, consumer feedback, emerging risks, and more, enabling companies to research and develop products that truly resonate.

For insurers, the product development process has traditionally involved long research cycles and guesswork, making it quite time-consuming and inefficient.

In today’s fast-evolving world, that’s a big problem.

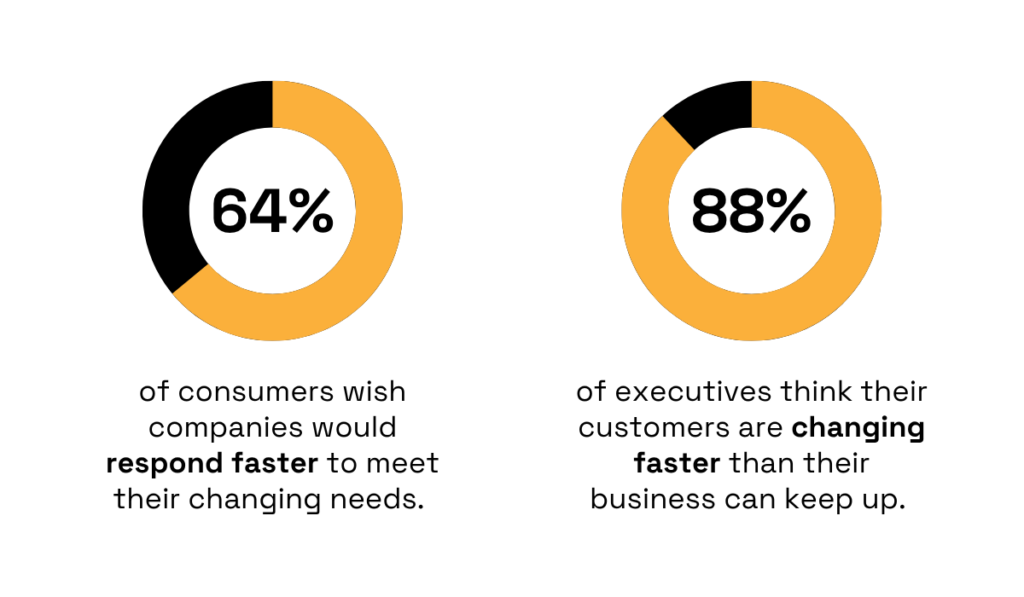

According to a 2022 Accenture survey, the majority of executives across industries admit they struggle to keep pace with customers’ evolving needs.

Meanwhile, consumers are frustrated that companies aren’t moving fast enough to meet their expectations.

Illustration: Veridion / Data: Accenture

In other words, expectations for companies to “read minds” are rising, while those very minds are changing faster than ever.

This is where market intelligence comes in.

It reduces uncertainty, highlights opportunities for innovation, and helps develop products that meet both customer needs and business goals.

After all, there’s always room to innovate, even in insurance.

For instance, just in recent years, new products have emerged covering everything from cannabis and cryptocurrency to the gig economy.

They were each born from paying attention to the data and identifying new customer demands.

Take Coverdrone, for example.

They provide insurance for drone pilots and operators across the UK, EU, Canada, Australia, and New Zealand.

Their Management Consultant Richard Webb notes:

Illustration: Veridion / Quote: Insurance Times

Put simply, the sector is growing rapidly, and Coverdrone is perfectly positioned to capitalize on that growth.

Webb explains why that is:

“The product is already exceptionally strong, but what stands out is how the team listens to customers and adapts quickly. That responsiveness is what keeps Coverdrone ahead.”

And the company isn’t stopping its investment in data-driven product development any time soon.

Currently, they are planning to launch new chemical and cargo liability extensions in the coming months, reflecting the evolving global use of drones.

This is the power of having the right data in your hands: the possibilities are virtually endless.

Because when you see the full picture, it’s far easier to spot the gaps and learn how to fill them.

In insurance, understanding risk is central to business success.

It’s what enables insurers to identify, assess, and mitigate potential hazards, helping them offer competitive pricing and maintain regulatory compliance.

But here’s the problem: risks are on the rise and evolving faster than ever.

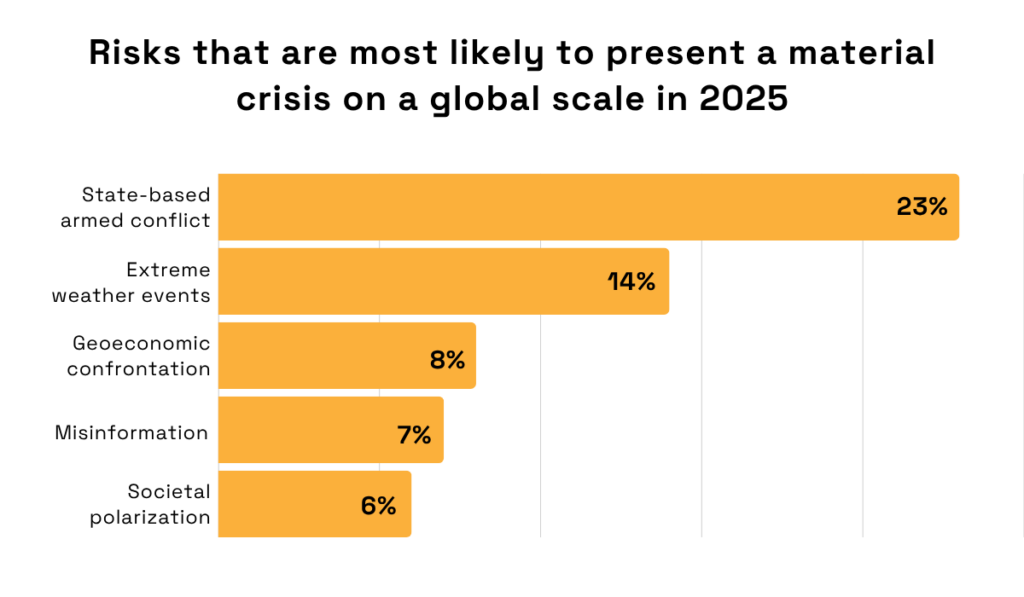

Recently, the World Economic Forum asked companies across industries to identify the risk most likely to trigger a material global crisis.

Their answers ranged widely, from armed conflicts to extreme weather events.

Illustration Veridion / Data: World Economic Forum

For insurers, this kind of volatility creates significant uncertainty, making it challenging to price policies accurately, manage solvency, and sustain profitability.

Market intelligence is the only solution.

By continuously tracking geopolitical shifts, climate patterns, regulatory changes, societal trends, emerging technologies, and more, it provides early-warning signals, allowing insurers to act proactively.

Davinder Singh, SVP and COO of Global Insurance at Genpact, an advanced technology services and solutions company, puts it perfectly:

“The insurance industry is quite heavy. It’s not a tangible product. We sell promises and those promises and risks which we insure are based on a lot of data, a lot of historical data, a lot of future projections, a lot of probability, a lot of financial information.”

That’s right: real-time, accurate information is vital for staying ahead of disruption, especially in a world where risks unfold rapidly and have massive impacts.

Take the recent California wildfires, for example.

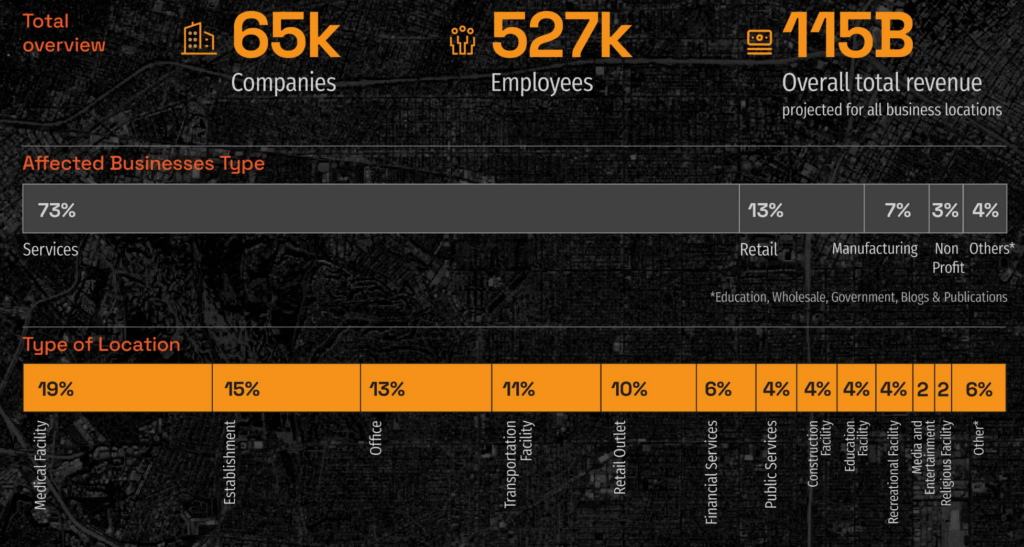

In less than a week, they destroyed tens of thousands of structures, displacing families and businesses.

Here’s a brief overview of affected businesses:

Source: Veridion

Ultimately, this event had a profound impact on the commercial insurance landscape, too.

Estimated insured losses surpassed $20 billion, highlighting the need for commercial insurers to rethink their risk strategies and integrate dynamic data solutions.

In situations like these, market intelligence is crucial, as it helps to do the following:

Source: Veridion

With these insights, insurers can pinpoint vulnerabilities across regions, refine risk models, and develop tailored premium strategies.

Today, insurers face a choice.

They can either let events unfold at their own pace, reacting to changes in customer needs, competitor moves, or market trends, and hoping their business survives.

Or, they can take a proactive approach, leveraging market intelligence to anticipate trends and risks and stay ahead.

Those who choose the latter are more likely to achieve remarkable success: not just in terms of profits, but also when it comes to improving customer satisfaction, reputation, and innovation.

So, which path will you take?