Bid Rigging Fraud: Comprehensive Guide

Key Takeaways:

In the high-stakes world of enterprise procurement, you operate on the front lines of your company’s financial health.

You navigate complex supply chains, manage critical vendor relationships, and are entrusted with securing the best possible value.

But beneath the surface of a seemingly competitive bidding process, a hidden threat can undermine your efforts, inflate your costs, and compromise your integrity: bid rigging fraud.

This comprehensive guide explains what bid rigging is, reviews common collusion tactics, and shows you how to spot warning signs and protect your procurement process.

Bid rigging fraud occurs when suppliers or vendors who should be competing against each other secretly collude to manipulate the bidding process.

Their goal?

To ensure that a predetermined company wins the contract.

This scheme undermines the very principle of fair competition, artificially inflates prices, and leads your organization to make purchasing decisions that do not reflect actual market value.

Corruption (including bid rigging) results in over $2.6 trillion in stolen funds globally each year, accounting for roughly 5% of global GDP.

Matthew Boswell, Commissioner of Competition at Competition Bureau Canada, points out that bid rigging enables companies and individuals to sidestep fair competition and artificially inflate the cost of public contracts for their own benefit.

Illustration: Veridion / Quote: Government of Canada

It is crucial to understand that bid rigging is not a minor ethical lapse.

It is a serious antitrust violation and a criminal offense in most jurisdictions, including under U.S. antitrust law enforced by the Department of Justice and EU competition law overseen by the European Commission.

Violations can result in massive fines, prison sentences for individuals involved, and civil damages claims.

To make matters worse, this type of fraud is not confined to public-sector procurement, either.

Instead, it is a widespread and damaging threat in private enterprise, affecting everything from raw-material sourcing to professional services contracts.

The Organisation for Economic Co-operation and Development (OECD) has highlighted that procurement collusion can increase contract costs by 20% or more, representing a massive drain on corporate resources.

The bottom line: bid rigging deliberately breaks the rules of competition and must be treated as a serious red-flag activity.

To effectively defend your organization, you must first understand the playbook used by colluding vendors.

These schemes are designed to create a facade of competition while ensuring a fixed outcome.

Let’s explore some of the most common ones in more detail, starting with bid suppression.

In this scheme, one or more vendors who would otherwise be expected to bid agree to refrain from submitting a proposal.

This ensures that a designated “winner” is the only credible bidder or faces only non-competitive offers, allowing them to secure the contract at an inflated price.

The firms that stay out of bidding often receive secret payoffs or are later promised subcontracts.

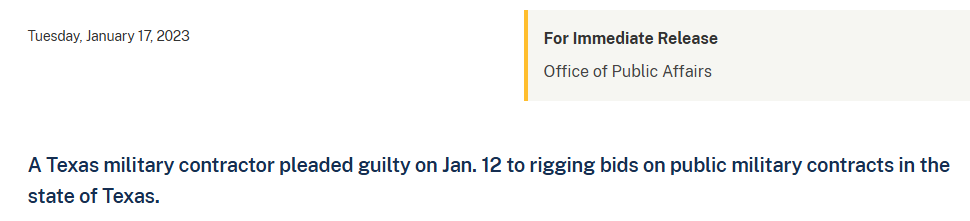

In one DOJ case, contractors in Texas submitted sham quotes to ensure a predetermined winner on military subcontracts, manipulating outcomes and securing $17 million in payments.

Source: DOJ

Complementary bidding, also known as “cover” or “courtesy” bidding, is another common fraud scheme type.

Here, some vendors submit intentionally high, fake, or incomplete bids to give the appearance of competition.

In reality, the losing bids are merely window dressing.

In another DOJ case, insulation contractors agreed on bid terms across public projects, including hospitals and universities, which resulted in significant overcharges and jail sentences.

These “complementary” bids are designed to lose but give the false appearance of a genuine, competitive auction.

On the other hand, in a bid rotation scheme, colluding vendors take turns being the winning bidder.

The group decides in advance who will win each contract, and the others either bid higher or stay out.

Over time, each conspirator “rotates” to win some contracts, splitting the profits.

For example, a study of Brazil’s procurement auctions found that 17% of auctions exhibited bid rotation, in which the lowest bidder would withdraw after the auction, allowing the second-lowest bidder to win.

This fraudulent strategy increased procured prices by 10-12%.

Illustration: Veridion / Data: SSRN

Next up, there are subcontracting arrangements.

Competing vendors may agree that the designated “winner” will subcontract a portion of the work to the losing bidders in exchange for their cooperation.

The losers withdraw or submit uncompetitive bids and are rewarded with lucrative subcontracts, effectively making them paid accomplices in the fraud.

In a case coming out of Quebec, paving companies coordinated who would win each contract and split the work afterward.

The Competition Bureau Canada prosecuted the participants, who were fined up to $1.5 million.

Source: Yahoo Finance

When it comes to phantom bidding schemes, fake bids are submitted by nonexistent or fake entities to inflate the apparent competition.

For instance, a rigging group might create a shell company that submits a higher bid or submits bids under duress.

The sole purpose of these offers is to confuse the buyer into thinking multiple parties bid.

Law enforcement calls these “phantom bids,” noting they create an illusion of competition when the outcome is pre-arranged.

Finally, we have market sharing, where competing firms agree to divide up contracts by geography, customer type, or industry segment.

For example, Company A might only bid on contracts in the north, while Company B avoids that region and bids elsewhere.

This cartel-like arrangement prevents them from truly competing against each other.

Each of these schemes hides the truth of the bidding process.

In all cases, colluding contractors manipulate who wins and at what price.

By recognizing these patterns, you can start suspecting foul play whenever only one company consistently benefits.

Being alert to warning signs is critical for procurement teams.

You can detect possible bid rigging by analyzing bidding patterns and observing unusual vendor behavior.

Vigilance and data analysis are your most powerful tools for uncovering collusion.

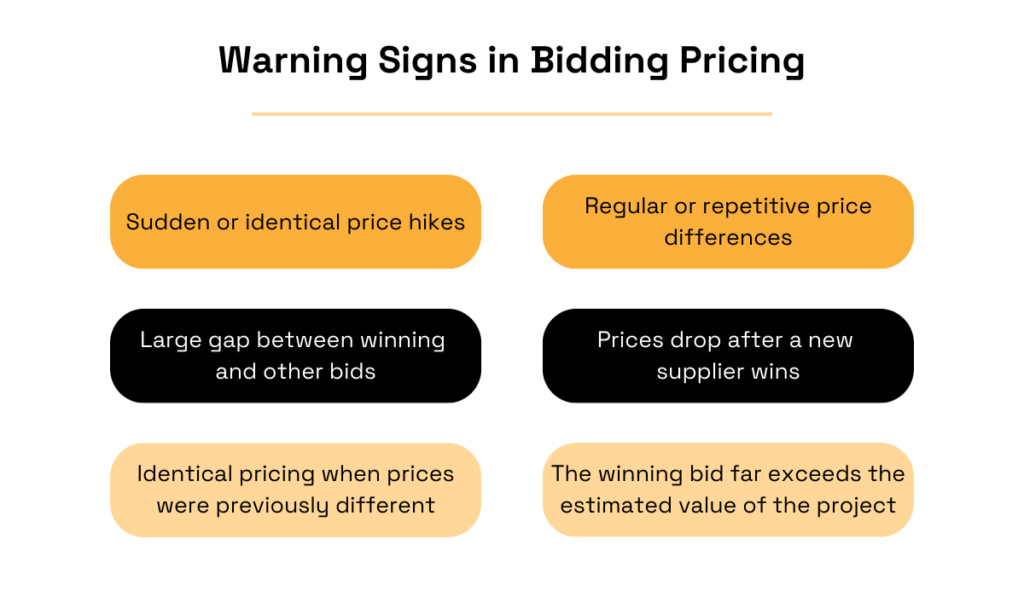

The OECD’s guidelines suggest that consistent price clustering, repeated bid spreads, and synchronized percentage increases can indicate collusion.

So, watch the numbers carefully.

Look for unusually uniform bids or coordinated price shifts that don’t make sense under regular competition.

For example, if several bids submit identical pricing or follow a precise formula, it could suggest collusion.

Bids that are suspiciously close to each other in value, or multiple companies raising prices by the exact same amount from one year to the next, are also a red flag.

Likewise, extreme bid spreads warrant scrutiny.

If the winning bid is far above what you estimated, or if only one bid is low and the next-highest bids cluster together, this pattern suggests an arranged result.

Monitoring multi-year trends helps, too.

When bid prices remain stubbornly flat over time despite changing market costs, or if discounts or price volatility suddenly disappear, those are warning signs.

Here’s a bid-rigging detection list at a glance:

Illustration: Veridion / Data: OECD

In short, any bidding pattern that looks too coordinated—identical bid amounts, synchronized price hikes, formulaic bid differences—should prompt deeper review.

Genuine competition usually produces a reasonable spread. When it doesn’t, ask why.

Data is only part of the story.

You must also watch how bidders behave before, during, and after the tender.

Colluding vendors often give subtle (or not-so-subtle) clues in their actions and communications.

Watch out for pre-bid coordination.

In a sophisticated case of municipal bond fraud, financial institutions and brokers colluded on the bidding process for the investment contracts.

A key piece of evidence was email and instant message communications between supposed competitors, who would often congratulate each other on “winning” a bid that had been pre-arranged.

This case led to convictions and billions in restitution and penalties, showing how digital footprints can unravel a conspiracy.

Source: Reuters

If you learn that competing suppliers are meeting privately or discussing upcoming projects, treat it as a red flag.

Similarly, if one bidder repeatedly appears to bid on behalf of another, like submitting two bids in a single bid envelope, or using identical contact information, it may indicate that one company is covering for the other.

The OECD warns that firms sharing consultants, addresses, or key personnel could be colluding.

For example, if two supposed competitors list the same address or share directors, that overlap is highly suspicious.

Procurement staff should flag any vendor pair that seems too closely tied.

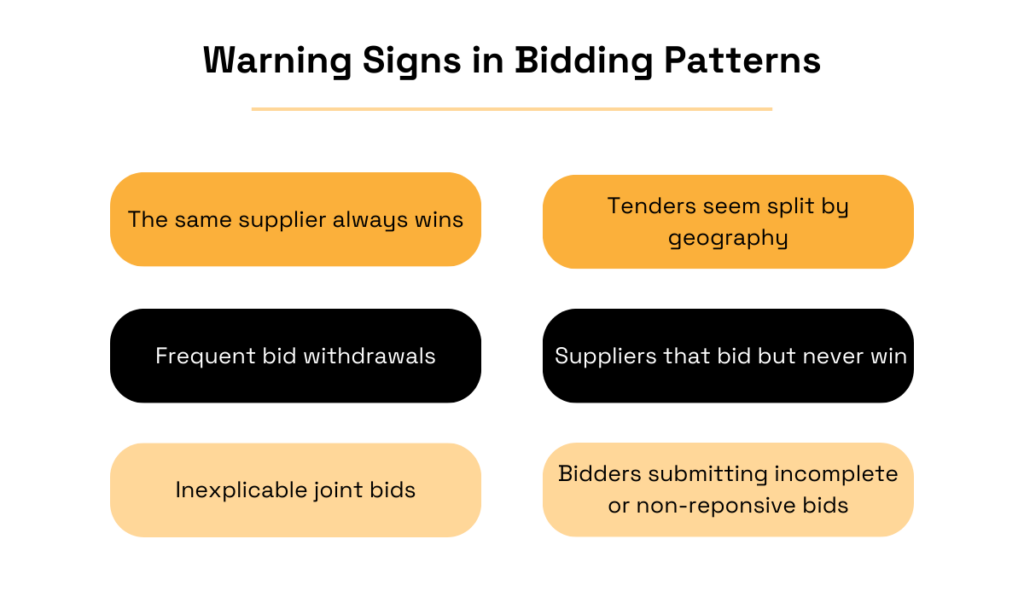

Other red flags include unusual withdrawals and turn-taking.

If a normally active bidder suddenly withdraws at the last minute without a good reason, consider why.

Procurement authorities have noted patterns in which certain companies always bid but never win, or in which the same small group of firms take turns winning in rotation.

A repeated cycle of one firm winning, then the next time a different firm winning by a similar margin, is a textbook sign.

Illustration: Veridion / Data: OECD

Ultimately, document everything and keep notes on any unusual statements or behaviors.

For instance, if a supplier openly hints that “one company usually wins these,” or if a bidder asks suspicious questions like, “What’s the most we can bid?”, write it down.

Together with pricing anomalies, a pattern of strange behavior can build a convincing case of bid rigging.

You can’t change the fact that vendors might try to collude, but you can change your process to make it much harder for them to do so.

The strongest defenses are good vetting, strict transparency, and maintaining genuine competition.

Let’s explore these in more detail.

Comprehensive vendor due diligence is one of your strongest defenses against bid rigging.

But it’s not enough to check references. Instead, you need to dig deeper to uncover hidden relationships.

Before any bidding begins, vet each vendor’s legitimacy, track record, and ownership.

Verify the company’s registration, check its key executives, confirm contact details, and look for hidden links.

For example, does one vendor share an address, phone number, or executive team with another bidder?

If so, consider that a red flag.

And then, deploy every tool you have to uncover these connections.

For example, third-party business databases can identify when two suppliers share the same ultimate parent company or appear on each other’s credit reports.

According to a World Bank report, the use of e-procurement tools has been credited with saving procurement budgets by more than 10% and lowering fraud incidents by an estimated 25%.

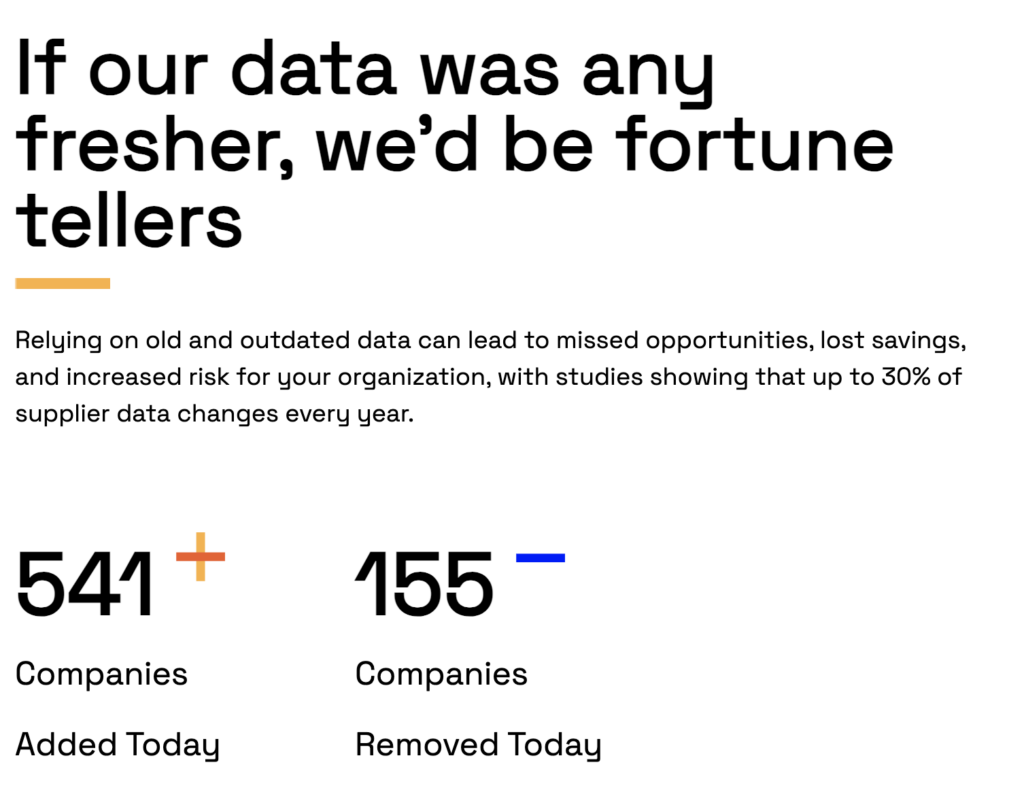

And one of the tools that could help you is Veridion.

Veridion’s company data and Match & Enrich API help procurement teams uncover hidden connections by providing global business intelligence on over 134 million companies.

Source: Veridion

By automating the discovery of supplier relationships and validating vendor information at scale, Veridion reduces manual effort and strengthens risk management.

This level of visibility empowers procurement teams to make faster, better-informed sourcing decisions and proactively identify potential compliance issues.

But due diligence shouldn’t end at onboarding.

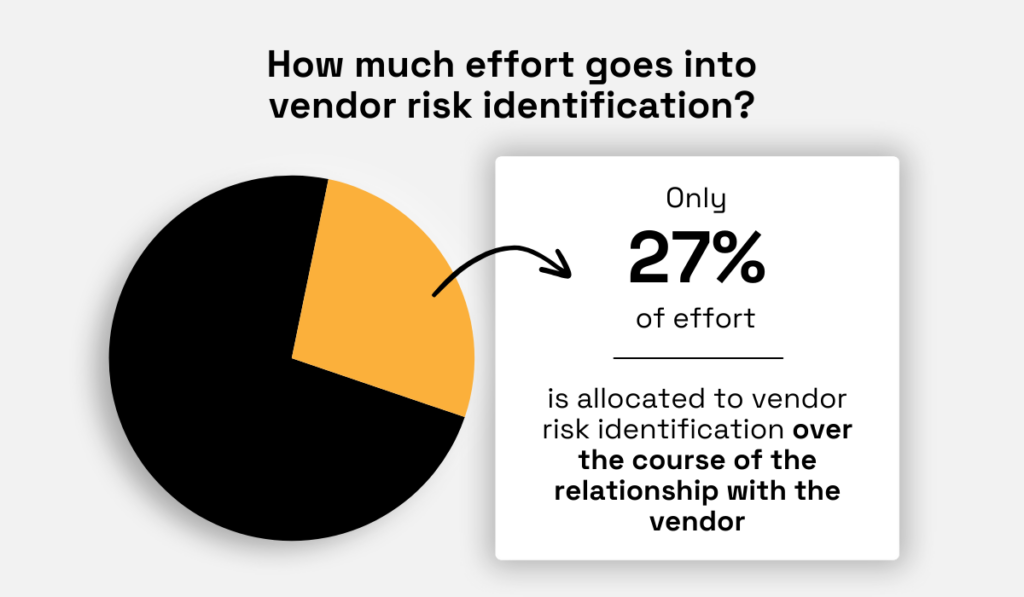

Gartner’s research shows that legal and compliance leaders dedicate only 27% of their efforts to identifying risks in the course of an actual vendor relationship.

Illustration: Veridion / Data: Gartner

Instead, most of the effort is put into onboarding and recertification.

So, why should you pay more attention after onboarding?

Because the corporate landscape changes constantly. Companies are acquired, ownership shifts, and new relationships form.

Continuous monitoring of your supplier base helps you catch these changes early.

Even after a contract is awarded, continue to verify that vendors remain independent and compliant.

Gather and review tax records, updated corporate filings, and any news on ownership changes.

A strong vendor risk assessment (VRA) report will document all these checks.

Finally, relying on a small, entrenched group of suppliers makes your organization a prime target for collusion.

Actively cultivate a diverse and expanding roster of qualified vendors to introduce genuine competition.

Even with all due diligence, the procurement process must be clear, consistent, and well-documented.

Transparency is an antidote to collusion, so use open, structured procedures to ensure an audit trail at every step.

First, define clear evaluation criteria in advance. Publicly state how bids will be scored, which factors matter most, and who will score them.

Use a formal scoring matrix to evaluate bids, such as the one you can see below.

Illustration: Veridion / Data: USAC

Second, keep communications with bidders formal and recorded. Don’t disclose who else has bid, and do not let any one vendor influence another’s proposal.

Maintain a single, transparent channel for all bidder questions and answers.

Circulate all Q&As to every bidder simultaneously to prevent any single vendor from gaining an informational advantage.

Third, maintain strong oversight.

Use multiple reviewers for each bid evaluation to prevent bias or under-the-table deals.

Keep detailed procurement records—who approved what and when—so any irregularities stand out more clearly.

And if any doubt arises, consider bringing in auditors or even competition authorities.

The bottom line is, you need to make your process as bulletproof and transparent as possible.

While sometimes necessary for proprietary technology or extreme urgency, sole-source contracting eliminates competitive pressure and creates a perfect environment for price manipulation.

To keep pricing honest, always encourage multiple bidders: advertise widely, allow enough time for proposals, and keep your requirements inclusive so more firms qualify.

And if you find yourself in a situation with only one qualified vendor, proceed with caution.

Require a robust internal justification memo and follow the strict rules.

For example, U.S. federal guidelines (FAR Part 6.302) state that any sole-source award requires detailed justification and approval by agency procurement officers.

Document every step: explain why no other vendor could meet the specs and how the price was validated.

Even then, still seek competitive input if possible.

For complex projects, consider using a Request for Proposal (RFP) with negotiated terms rather than a simple Request for Quotation (RFQ).

The more nuanced evaluation can make it harder for colluders to guarantee a win for a specific member.

Remember, competition drives prices down and improves outcomes.

By making competition the norm and sole-source the rare exception, you reduce opportunities for bid riggers to exploit your process.

Bid rigging is a subtle but serious threat that drives up costs and hurts fair competition.

As a procurement professional, your vigilance is the best defense.

Remember the key takeaways: know your vendors, analyze bid data for unusual patterns, and enforce transparent procedures at every step.

Even small changes—like adding one more check in the bid analysis or double-checking vendor ownership—can make a big difference.

By staying one step ahead of fraudsters, you’ll safeguard your procurement and contribute to your company’s success.