Classifying Supplier Facilities by Operational Function

Key Takeaways:

Not all supplier sites are created equal.

From factories churning out products to labs developing the next innovation, each facility type carries unique operational risks and strategic importance.

Understanding these distinctions allows procurement teams to anticipate disruptions, allocate resources effectively, and ensure supply continuity.

In this article, we break down the main operational function categories and explore key benefits and data sources you can rely on.

Understanding the operational function of each supplier facility is critical for risk management, insurance underwriting, supply chain continuity, and vendor selection.

It’s simple: when you know what a supplier site actually does, you can assess exposure more accurately, prioritize mitigation, and avoid blind spots that quietly accumulate risk.

Still, achieving that level of supplier visibility is often a major challenge, with most organizations lacking meaningful location insight, especially beyond their Tier 1 vendors.

What’s worse, risk tends to emerge deeper in the network, and that’s exactly where transparency drops sharply.

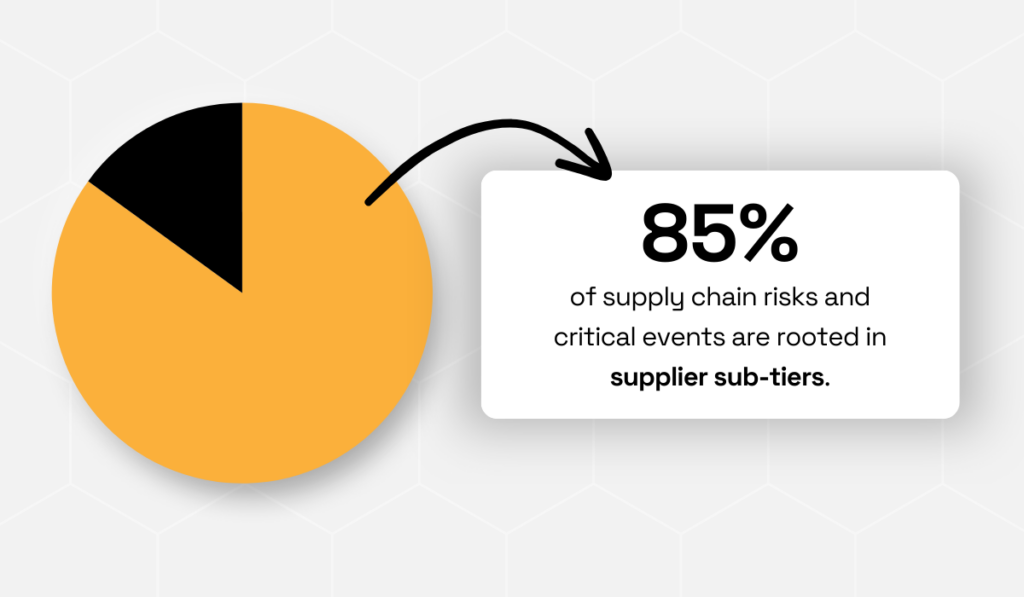

A study by Sphera, focusing on CPOs and CSCOs, found that 85% of supply chain risks and critical events originate in sub-tier suppliers.

Illustration: Veridion / Data: Sphera

Despite growing awareness of this issue, translating this intent into action can be very difficult.

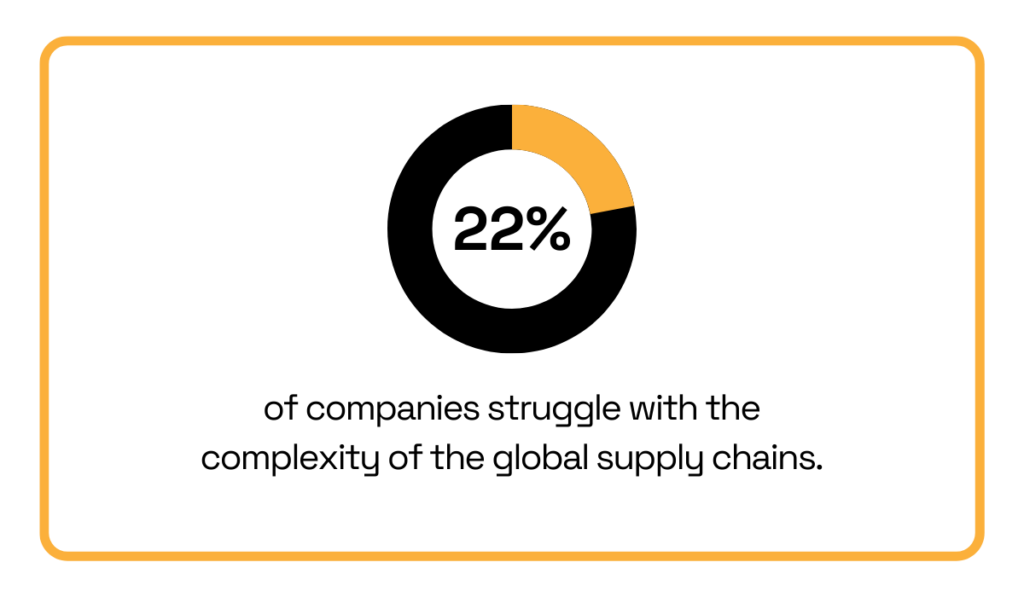

Namely, the same research shows that organizations attempting N-tier supply chain mapping face persistent barriers, with 22% of respondents citing cost and implementation complexity as primary obstacles.

Illustration: Veridion / Data: Sphera

This challenge reflects the reality of modern supply networks.

They span multiple tiers, jurisdictions, and regulatory frameworks, all of which are changing constantly.

Facilities open, close, relocate, or expand while operational roles evolve as suppliers diversify services or consolidate functions.

According to Industry Select, roughly 70% of business professionals across multiple industries reported at least one location-related change on their business cards within a single year.

At enterprise scale, this level of change makes it easy to lose track of which supplier facilities are operationally critical and how they should be classified.

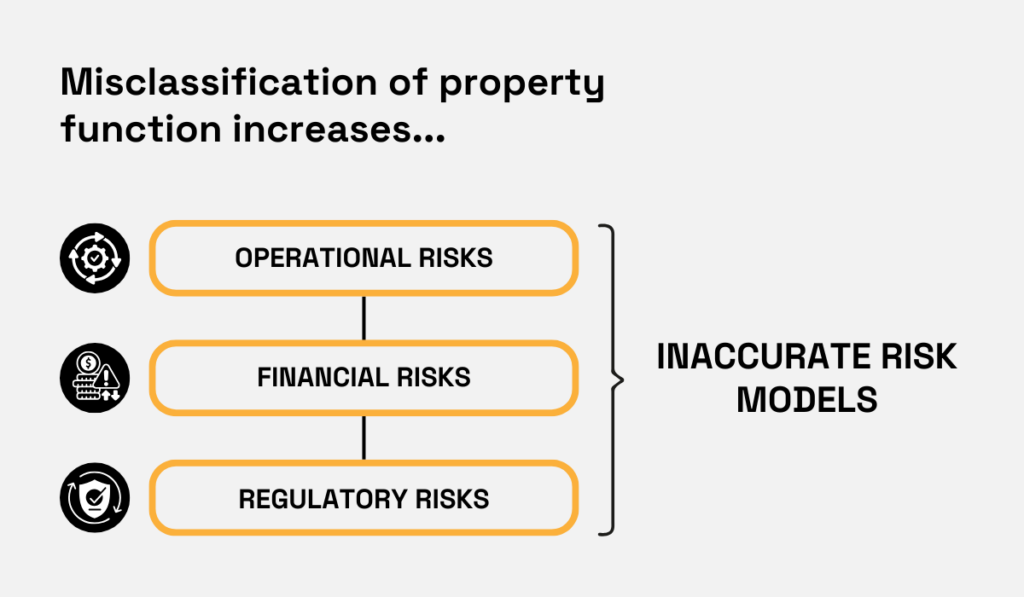

And misclassification has tangible consequences.

When a supplier facility’s function is inaccurate or overly generalized, exposure to operational, financial, and regulatory risk becomes distorted, ultimately contributing to inaccurate risk models.

Source: Veridion

To put it differently, this imprecision makes it more likely that high-impact sites will be treated as low-risk locations, while critical dependencies remain hidden.

This is where operational function classification becomes essential.

Understanding the nature of suppliers’ operations at a specific site gives you insight into specific compliance obligations, where disruptions would pose the greatest risk, and how quickly recovery is possible.

Traditional classification systems often fail to provide this level of insight.

As David Gallihawk, Chief Product Officer for Experian UK&I, a global data and technology company, explains, standard industry codes struggle to reflect mixed or evolving operations:

Traditional SIC codes may not accurately reflect mixed business operations. Think breweries that also function as bars and restaurants or construction firms that handle hazardous materials like asbestos.

The same limitation applies to supplier facilities.

Some warehouses hold spare parts while others house essential logistics or R&D centers.

Each function comes with distinct risk profiles and supply chain implications.

Treating them as interchangeable obscures the very differences procurement teams need to manage risk effectively.

That’s why differentiating supplier facilities by operational function is foundational.

And it’s exactly what we’ll break down next.

Every supplier facility has a distinct purpose, defined by key activities and processes, as well as by the assets it houses.

Recognizing these differences is critical.

It helps determine operational importance, reveal hidden dependencies, and mitigate the potential impact of disruptions on your supply chain and business performance.

From a procurement perspective, manufacturing plants often sit at the core of supply continuity, directly influencing lead times, product availability, and contractual performance.

They also concentrate risk.

Manufacturing plants typically house high-value machinery, specialized tooling, production lines, and skilled labor, all of which are difficult to replace or relocate quickly.

As such, when something goes wrong, the impact is rarely isolated.

Just consider the scale of disruption.

ABB’s global survey of more than 3,000 plant maintenance decision-makers found that unplanned downtime costs organizations an average of $125,000 per hour.

Illustration: Veridion / Data: ABB

Based on criticality, that number can and usually is much higher.

Sites producing single-sourced components, regulated materials, or custom parts can quickly become bottlenecks when downtime occurs.

And the more operationally critical the plant, the higher the downstream impact on customers, revenue, and contractual obligations.

Beyond downtime, manufacturing plants also introduce heightened compliance complexity, in terms of:

Since all of these vary significantly by activity and geography, accurate classification helps you understand which supplier sites demand closer monitoring, contingency planning, or diversification, and prioritize accordingly.

To sum up, manufacturing plants are operational anchors, and misclassifying them blurs the very risks procurement teams are expected to anticipate.

Warehouses and distribution centers are primarily focused on storage, inventory management, and logistics operations.

Unlike manufacturing plants, their value is reflected in ensuring products are in the right place, at the right time.

As such, misclassifying these sites can mask operational dependencies and inflate or obscure risk exposure.

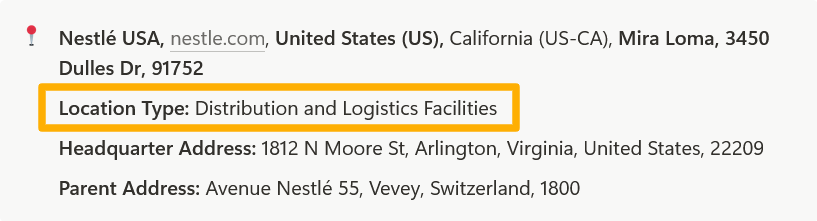

Take Nestlé USA as an example. Their facility at 3450 Dulles Dr, Mira Loma, California, is often mistaken for a corporate site.

Source: Veridion

In reality, this site is a distribution and logistics hub that is distinct from their corporate offices in Arlington, Virginia, or the parent headquarters in Vevey, Switzerland.

Mislabeling hubs like these would drastically underestimate the operational impact if, for example, a temporary power outage or staffing shortage interrupts distribution.

Even a short disruption could delay shipments to multiple retail partners, create inventory bottlenecks, and ripple across contracts and customer expectations.

Meanwhile, correct classification enables you to:

The bottom line is this: Accurately distinguishing warehouses from other facility types ensures procurement teams can prioritize monitoring, prevent interruptions, and optimize supply chain flow.

R&D facilities are specialized labs or experimental sites where new products, technologies, or formulations are developed and tested.

These sites combine highly skilled personnel, sensitive intellectual property, and specialized equipment, making them critical operational and strategic assets.

However, they also carry unique risks, including chemical or biological hazards, regulatory non-compliance, data exposure, and IP theft.

Even minor disruptions can delay product launches or compromise proprietary research, affecting revenue and competitive positioning.

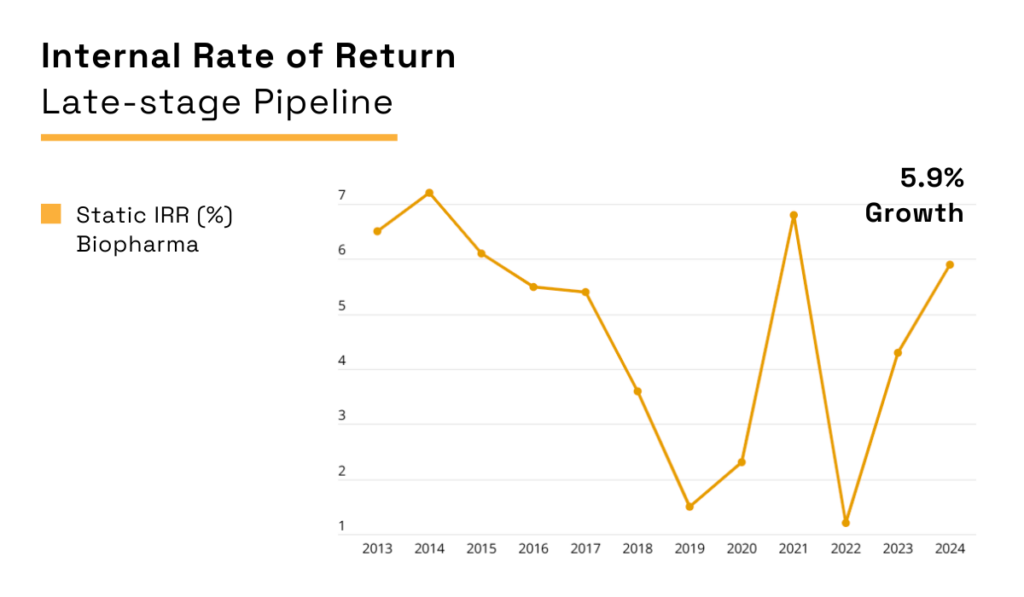

Deloitte’s analysis of leading biopharma companies’ investment in research and development highlights this value.

Namely, after years of declining returns, the average internal rate of return on pharmaceutical R&D grew to 5.9% in 2024.

Illustration: Veridion / Data: Deloitte

And dedicated R&D facilities are central to these efforts.

For procurement teams, classifying a facility correctly as R&D, rather than a general warehouse or production site, is essential.

Accurate categorization helps you:

Misclassification risks underestimating operational exposure or overlooking critical compliance obligations.

In conclusion, R&D facilities are strategic hubs, and knowing their true function ensures that your supply chain and risk planning reflect the real stakes.

Corporate offices primarily handle administrative, financial, and managerial functions, and generally present lower physical risk than manufacturing plants or warehouses.

That said, these sites carry cybersecurity, fraud, and data integrity risks due to employee access to sensitive business information, financial records, and vendor data.

Misclassifying the operational function of these sites directly leads to poor resource allocation in terms of insurance or cyber monitoring.

After all, cyber threats are tangible and costly.

According to IBM’s Cost of a Data Breach 2025 Report, the global average cost of a data breach is $4.4 million, with breaches caused by third parties consistently among the most expensive.

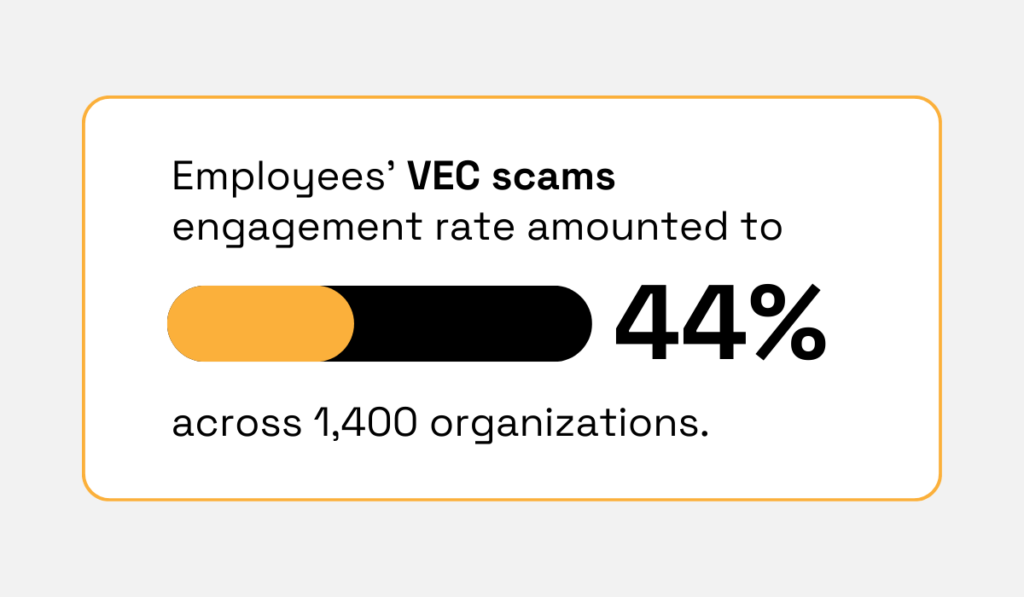

Moreover, the email security platform Abnormal found that 44% of vendor scam emails triggered employee interaction, such as replying or forwarding, across more than 1,400 monitored organizations.

Illustration: Veridion / Data: Abnormal

For procurement teams, correctly classifying corporate offices helps you:

Proper classification ensures offices are managed for cyber and data risk, keeping your supply chain resilience and vendor oversight precise.

Service centers provide technical, customer, or support functions that are often critical for maintaining product quality, operational uptime, and customer satisfaction.

These facilities are directly tied to client interaction, service delivery, and revenue generation, making their functional classification particularly important.

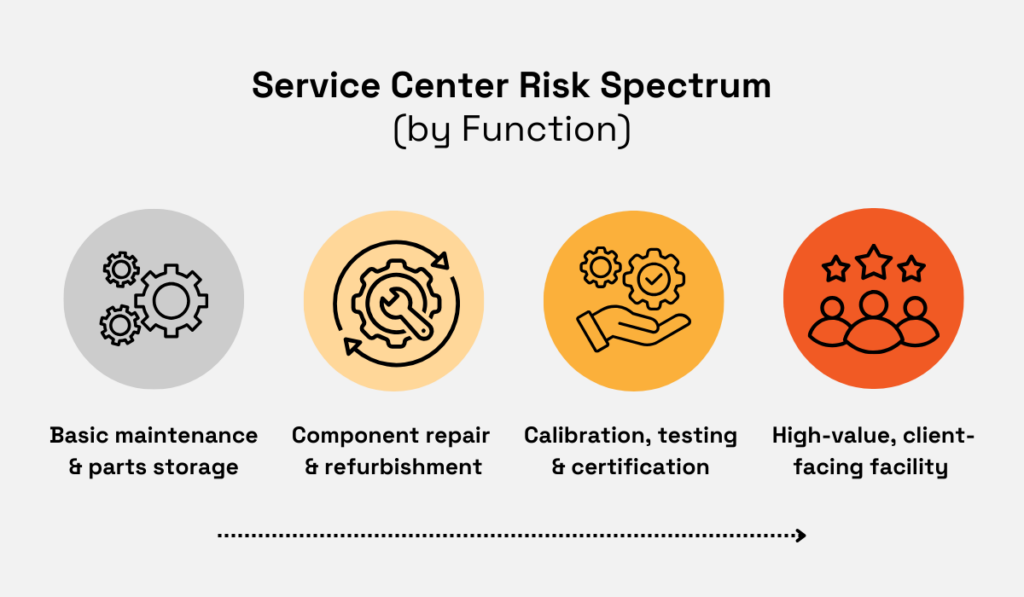

The risk profile varies: Some handle high-value repairs, calibration, or technical support, while others provide frontline customer service.

The truth is, as these sites move closer to revenue, compliance, and customer interaction, their functional risk rises sharply, as shown below.

Source: Veridion

Here’s a recent example that illustrates this vividly.

During the Christmas period, the busiest of the year for many companies worldwide, Woolworths New Zealand contact center staff went on strike for the third time in two weeks.

This disrupted phone and email support, critical elements for handling online orders, complaints, refunds, and loyalty program queries.

Source: CX Today

The strike highlighted how labor, remote work policies, and outsourcing plans can directly affect service continuity.

Correctly classifying service centers allows procurement and operations teams to:

Understanding these facilities ensures that operational and revenue-critical sites are monitored and managed with the appropriate level of oversight and risk mitigation.

Accurate classification of supplier facilities requires leveraging multiple data sources, each providing a different perspective on a site’s function.

Procurement teams typically start with public business registries and filings, satellite imagery, mapping tools, corporate websites, and press releases.

These sources provide the first layer of verification, confirming ownership, property footprint, or tracing announced expansions.

Other common data sources include supplier self-reports, questionnaires, and third-party data providers.

Source: Veridion

Supplier questionnaires can provide detailed insight into operational activities, capacity, or processes, but may be incomplete or biased.

Third-party sources, in contrast, bring consistency and external verification but often lack real-time updates or granular site-level information.

Combining all these sources enables you to cross-validate information, fill gaps, and improve confidence in facility classification.

Despite this wealth of data, challenges persist.

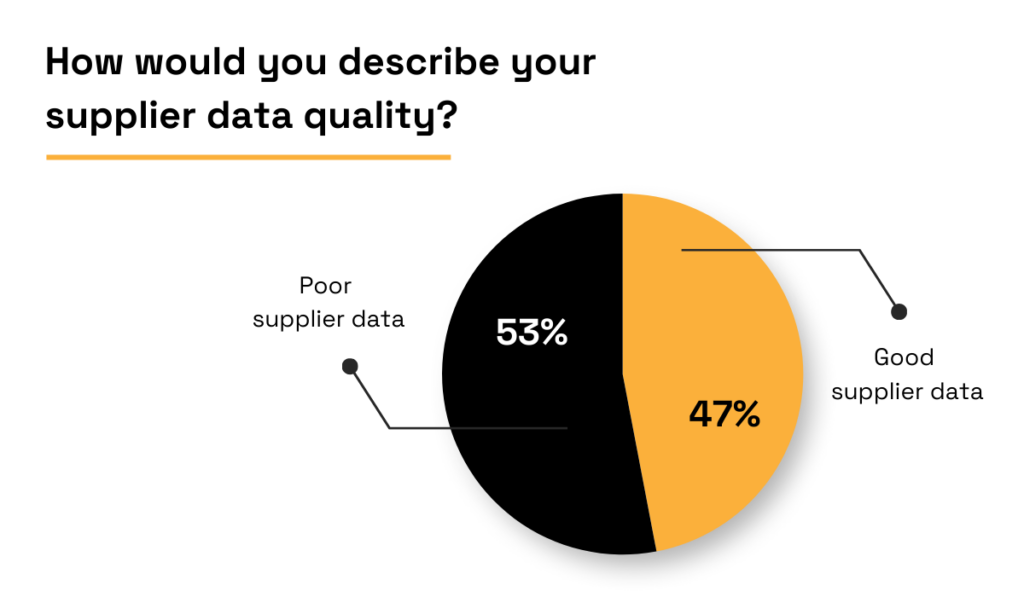

TealBook’s 2025 survey revealed that 17.6% of procurement executives cited unreliable supplier data as a top challenge, while 53% rated their supplier data quality as poor.

Illustration: Veridion / Data: TealBook

Even more importantly, these gaps tend to be even more pronounced when it comes to operational function insights.

As explained by Tim Herrod, procurement expert and Co-founder of a strategic advisory firm

InTension Inc, the ability to connect multiple datasets has become critical for success:

Illustration: Veridion / Quote: Tealbook

This is where AI-powered location intelligence offers a solution.

By analyzing structured and unstructured data, including multilingual sources, platforms can generate accurate, real-time insights across the entire supplier ecosystem.

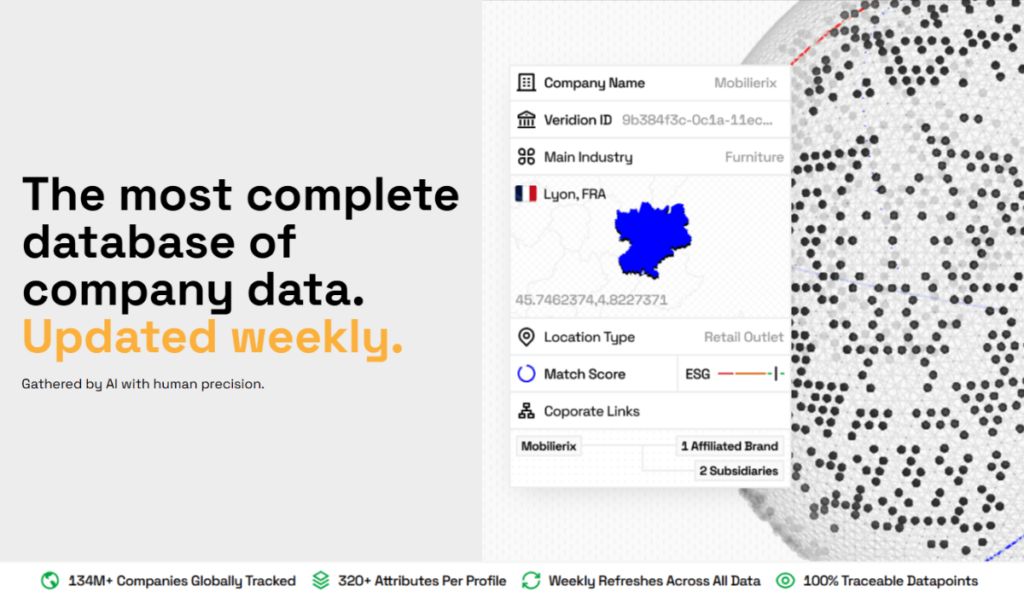

Veridion, for instance, maintains profiles for more than 130 million suppliers worldwide, refreshed weekly to capture ownership, operational changes, or status updates.

Source: Veridion

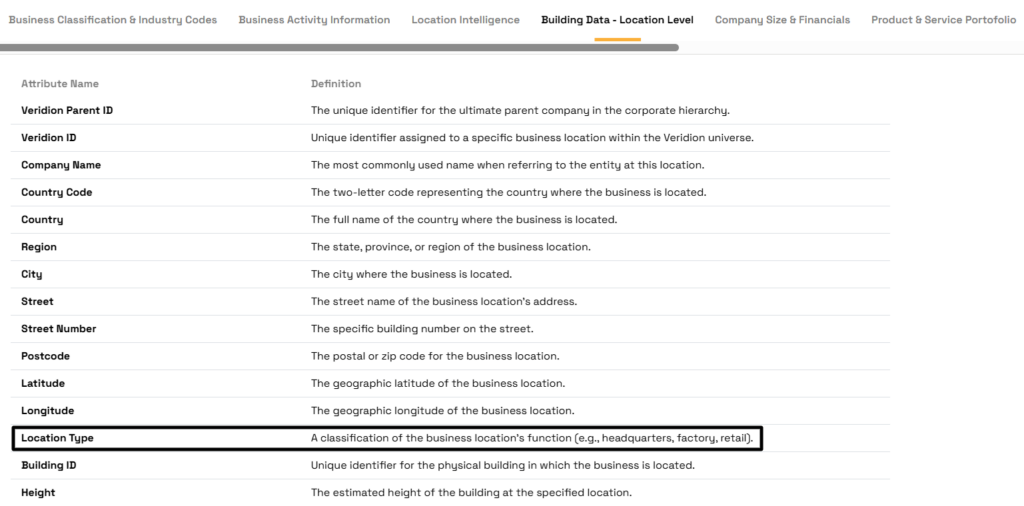

In addition to broad, global coverage, our platform delivers unparalleled depth.

Each profile contains over 320 data points, from industry classification and ownership structure to invaluable building location data.

Supplier locations are tagged with over 100 labels, such as factory, warehouse, or retail outlet.

This allows teams to map multiple functions at a single site, link revenue and employee counts to specific locations, and detect discrepancies between filings and actual operations.

Source: Veridion

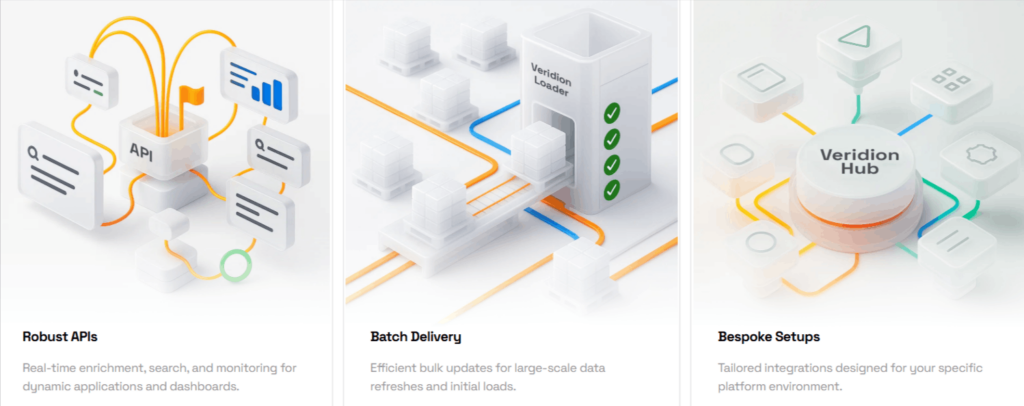

All this information is centralized in a single dashboard and integrates seamlessly with existing systems.

For procurement teams, the result is better risk profiling, improved operational oversight, and more informed supply chain decisions.

Source: Veridion

By systematically combining traditional public records, supplier input, third-party data, and AI-powered insights, enterprises can overcome the persistent challenge of incomplete or outdated supplier information.

All in all, accurate classification of supplier facilities serves as a strategic foundation for supply chain resilience, operational planning, and proactive risk management.

Accurately distinguishing supplier facilities by both property type and function translates to smarter procurement and more resilient supply chains.

By identifying which sites drive production, manage inventory, handle customer interactions, or develop innovations, you gain actionable insight into risk exposure and key operational dependencies.

As supply networks grow in complexity, this clarity allows you to prioritize monitoring, plan contingencies, and make data-driven decisions.

Want to keep operations running smoothly even under pressure?

Assess your current procedures, flag gaps, and explore tools that can help you streamline the classification of current and future supplier facilities while maintaining accuracy.