Insurance Underwriting Risk Profile for Pharmaceutical R&D Labs

Key Takeaways:

Pharmaceutical R&D labs are not your typical properties.

They combine high-value intellectual property, complex experiments, and strict regulatory oversight, which means that even small disruptions can ripple into massive financial exposure.

For underwriters, understanding these facilities and creating precise risk profiles requires more than site visits or spreadsheets.

This guide walks you through the unique risks tied to R&D facilities, while positing data as the best way to transform underwriting decisions.

Pharmaceutical R&D labs sit at the intersection of high-value intellectual property, specialized physical infrastructure, and tightly regulated scientific processes.

From an underwriting perspective, research and development facilities behave very differently from standard office or light industrial risks.

To understand why, it helps to step back.

As pricing pressure, patent cliffs, and regulatory scrutiny intensify, the ability to develop drugs more efficiently has become one of the few levers left to protect margins.

In other words, R&D is a competitive differentiator in the pharmaceutical sector, but also a cost-control mechanism.

Alexander Mirow, Partner and Life Sciences & Healthcare Industry Lead at Deloitte, summarizes this dynamic succinctly:

Illustration: Veridion / Quote: Deloitte

With efficient R&D as one of the key strategic goals, pharmaceutical labs carry enormous enterprise value.

This makes them focal points for digitalization and modernization efforts, rather than passive research environments.

That shift is reflected in executive sentiment.

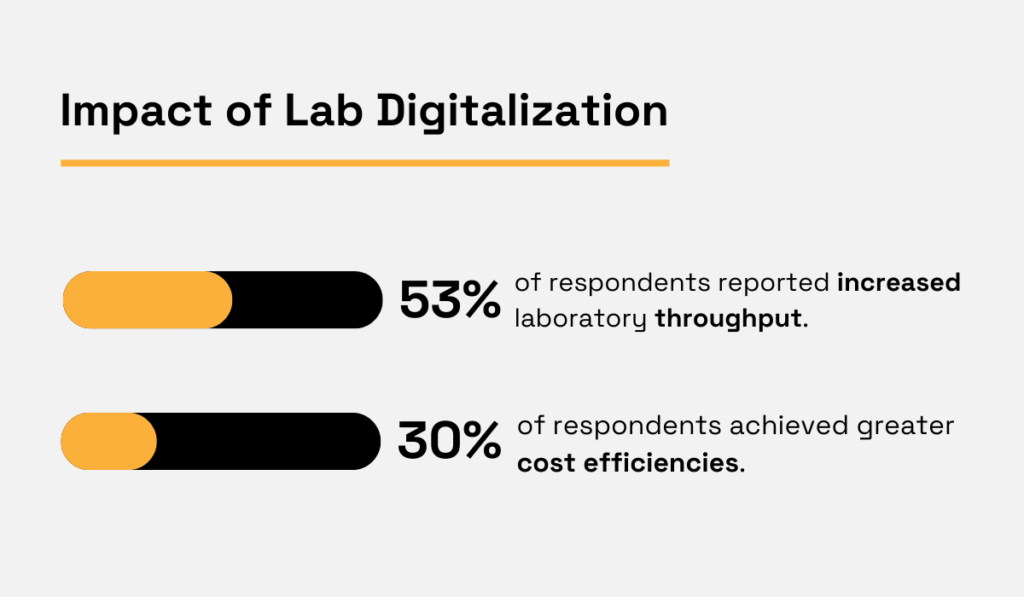

A Deloitte survey of 104 biopharma R&D leaders found that future-proofing laboratory operations ranked among the top strategic priorities.

The emphasis on measurable operational performance, including throughput, cycle time, and cost control, was reflected in the findings.

Specifically, 53% of respondents reported increased laboratory throughput, while 30% achieved greater cost efficiencies.

Illustration: Veridion / Data: Deloitte

This is where risk assessment becomes more complex from an underwriting lens.

Pharmaceutical R&D labs routinely run pilot-scale experiments, handle hazardous biological and chemical materials, and depend on uninterrupted timelines.

So when something goes wrong at the lab, the impact rarely stops at physical damage.

Equipment failure, power interruption, temperature deviation, or data loss can invalidate experiments, destroy proprietary cell lines, or invite public and governmental scrutiny.

The resulting losses often dwarf the insured property damage, extending into:

Moreover, setbacks tied to safety incidents, compliance failures, or data integrity issues can trigger regulatory intervention, reputational damage, or pricing pressure.

All these risk factors make it challenging to categorize R&D labs within traditional underwriting categories.

Source: Veridion

While underwriting pharmaceutical R&D labs requires insuring buildings and equipment, you need to understand how operational disruption, scientific uncertainty, and regulatory consequences interact.

That complexity is exactly why insurers are rethinking how they assess risk.

As Munich Re VP Jim Craig has noted, richer data is increasingly central to improving risk selection.

Illustration: Veridion / Quote: MedCity News

This is especially true in sectors like pharma, where traditional disclosures fail to capture operational reality.

The shift toward data-driven underwriting reflects a broader realization that mitigating risk and preserving value requires facility-level insurance business intelligence.

But before moving on to solutions, underwriters need to understand key types of risks.

The risk profile of pharmaceutical R&D labs is much easier to understand by zooming in on concrete exposure categories.

Together, they explain why these facilities rarely fit standard property or casualty assumptions, though each of these five types of risks affects underwriting decisions differently.

Underwriting exposure is tightly tied to specialized laboratory infrastructure.

Clean rooms, biosafety cabinets, fume hoods, ultra-low temperature freezers, and precision instruments are all integral to keeping experiments viable.

So when these systems fail, the loss doesn’t scale linearly with repair costs.

Equipment malfunctions, power interruptions, or even brief temperature deviations can wipe out years of research in a matter of hours.

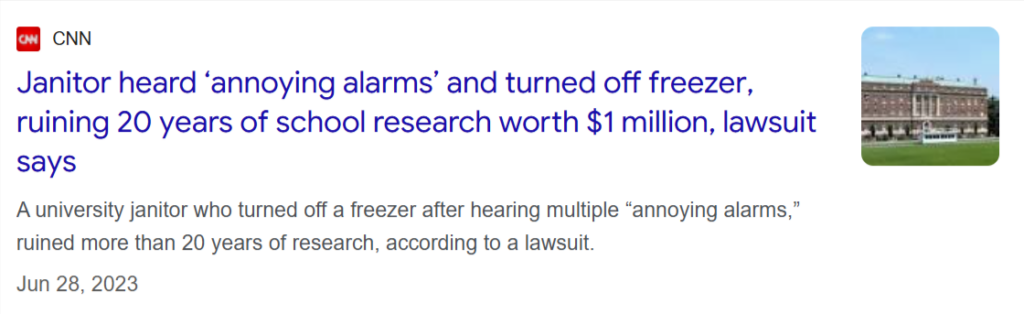

Just consider the case of one private research university in the U.S.

A simple human error, when a janitor turned off a beeping freezer, erased more than 20 years of research, including irreplaceable cell cultures and samples.

Source: CNN

A temperature fluctuation of just three degrees was enough to cause catastrophic damage.

And while the incident stemmed from a routine cleaning activity, the financial impact ran into seven figures.

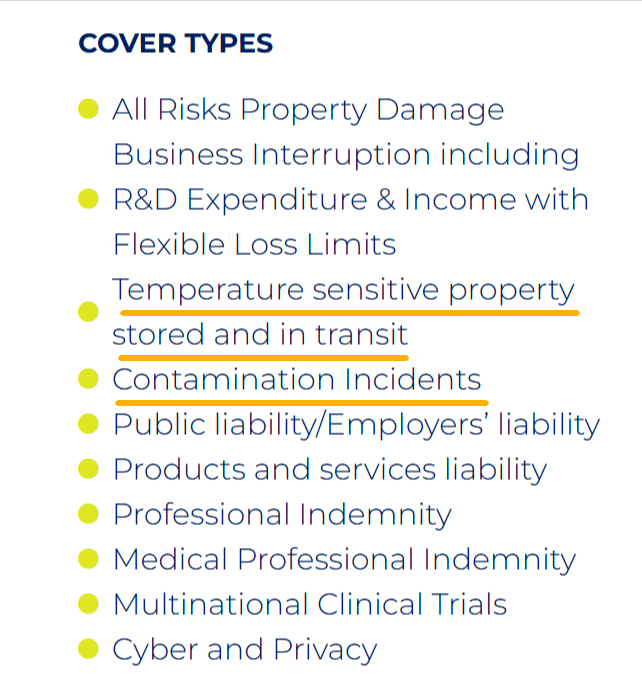

This is exactly why life sciences policies often include specific coverages for temperature-sensitive property stored and in transit.

Source: Risk Hub Group

In other words, property risk in R&D labs extends to research that often can’t be recreated.

Replacement costs for specialized equipment are high, lead times are long, and research continuity is fragile.

From an underwriting perspective, that combination turns otherwise ordinary property events into severe, value-dense losses.

Pharmaceutical R&D labs routinely handle toxic chemicals, volatile solvents, specialized reagents, and, in some cases, infectious biological agents.

For underwriters, this immediately introduces exposure well beyond property damage, and into employee safety, third-party liability, and environmental impact.

These materials carry inherent risks of accidental release, injury, contamination, or improper disposal.

What’s more, even isolated health events can trigger investigations, shutdowns, and reputational fallout.

For instance, the Head of the U.S. Department of Homeland Security was hospitalized immediately following her visit to a biohazard laboratory, prompting fears of a leak.

Source: Futurism

While the exact cause of the Head’s allergic reaction remained unclear, uncertainty itself is the problem.

In high-hazard environments, unexplained incidents raise immediate red flags, since the possibility of serious illness or loss of life is never theoretical.

That’s why your assessment has to go deeper.

Biosafety levels (BSL), chemical storage practices, waste handling protocols, and emergency response plans directly determine loss severity.

Equally important is the presence of a robust Quality Management System (QMS), which signals disciplined processes, staff training, and incident control.

In conclusion, if hazardous materials are involved, weak controls increase risk until the property is uninsurable.

Even when the equipment is in perfect order, any interruptions at R&D labs can wipe out months of work, taking potential revenue with it.

Paused experiments, lost cell lines, or invalidated trials can delay drug development timelines by months or even years.

A single delayed delivery of a critical reagent can halt a multi-year oncology study.

With the delay pushing back regulatory submissions and slowing potential market entry, the financial impact multiplies far beyond the cost of the materials.

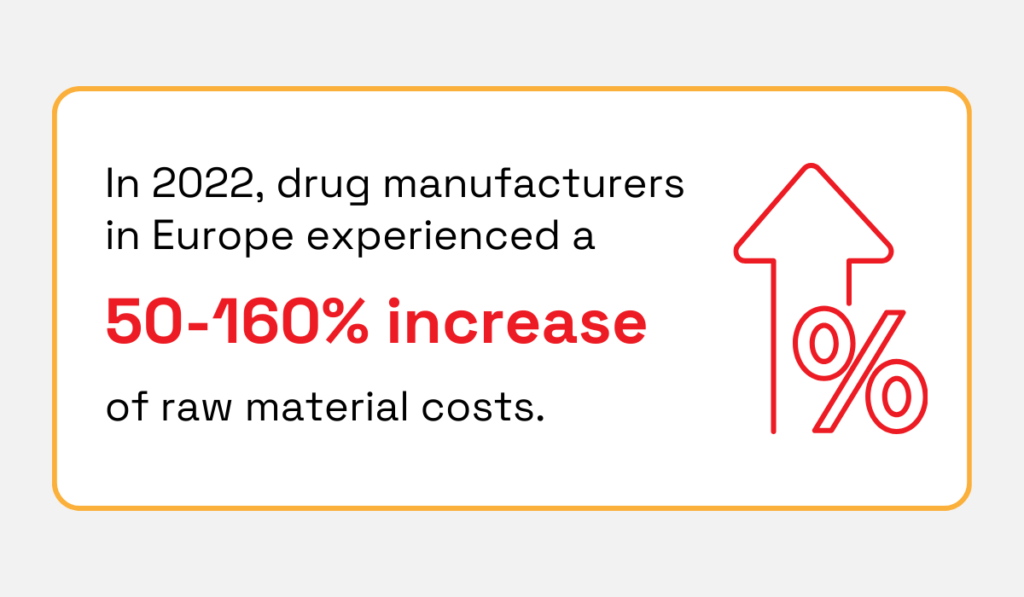

At the same time, raw material costs are rising sharply.

In 2022, some pharmaceutical ingredients increased 50–160%, forcing companies to rethink supply chains to maintain continuity.

Illustration: Veridion / Data: Resilinc

For underwriters, these risks require looking beyond the lab walls.

You need to assess dependencies on continuous utilities, climate-controlled storage, redundant systems, and critical third-party suppliers.

In other words, identifying single points of failure in both material flow and IT infrastructure is critical.

Keep in mind that business interruption coverage often requires bespoke modeling, making risk visibility and contingency planning essential tools in your underwriting toolkit.

Pharmaceutical R&D labs exist and operate within some of the strictest regulatory frameworks in the world, such as the FDA, EMA, OSHA, EPA, and local biosafety authorities.

Since non-compliance can lead to fines, forced shutdowns, or even invalidation of research data, falling short of required standards is much more than a minor inconvenience.

Recent Mercer findings highlight the growing complexity of regulatory frameworks, with 61% of insurers citing evolving regulations as their top operational challenge in 2024.

Illustration: Veridion / Data: Mercer

Regulatory risk directly shapes insurability, pricing, and policy terms, which is why underwriters need to drill into inspection histories, audit processes, documentation practices, and training programs.

Documentation is especially critical.

Labs must maintain detailed, transparent repositories covering every operational step, from hazardous material handling to waste disposal.

Equally important is ensuring those records are regularly reviewed and updated to keep pace with evolving regulations.

To put it simply, the existence and the quality of a compliance program in an R&D lab determine whether regulatory risk translates into financial risk.

Modern pharmaceutical R&D depends on digital systems to store experimental data, genomic sequences, and proprietary formulas.

This means that cyber incidents can compromise intellectual property, research integrity, and regulatory submissions.

The awareness of the risks and the scale of this problem has grown due to the pandemic, but attacks haven’t slowed down.

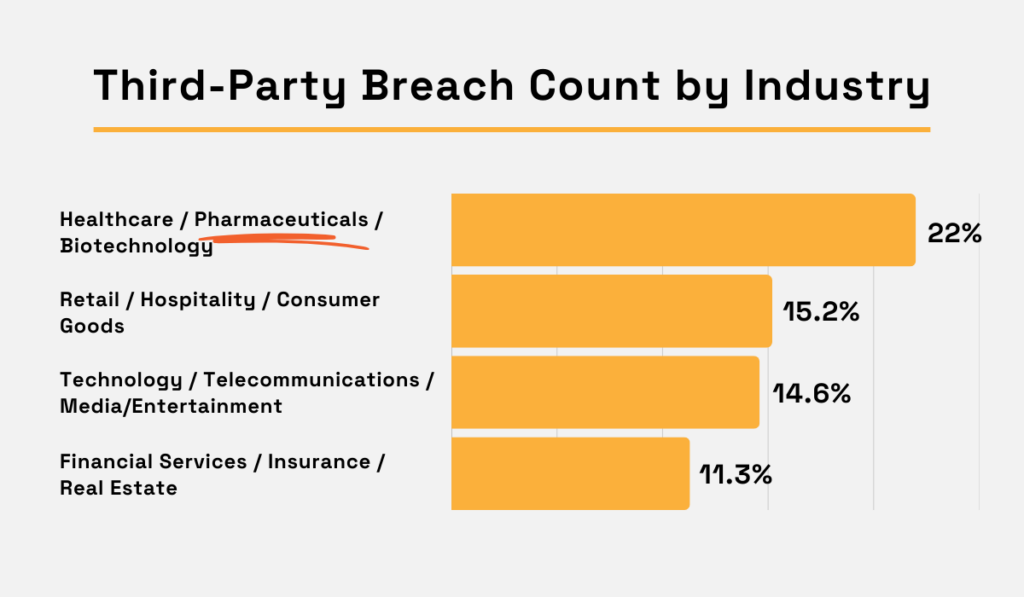

Security Scorecard reports that healthcare, pharmaceutical, and biotech companies experienced the biggest number of third-party breach incidents in 2024.

Illustration: Veridion / Data: Security Scorecard

While individual incidents vary in severity, the consequences are often widespread.

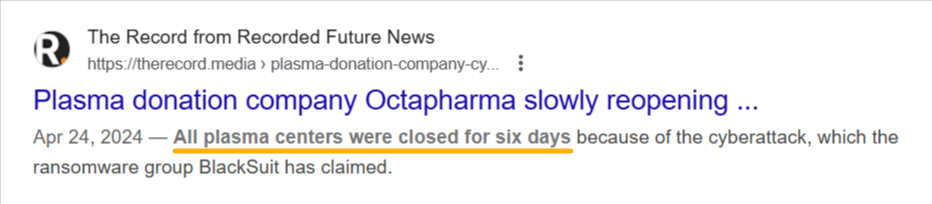

Just consider the 2024 ransomware attack on Octapharma.

The attack forced a nearly week-long shutdown across the company’s 180 plasma donation centers worldwide, all the while exposing sensitive personal and business data.

Source: The Record

The unauthorized access to the clients’ dates of birth, social security numbers, and health and financial information also prompted a lawsuit, which was later settled for $2.55 million.

This is just one example of why you must evaluate cybersecurity controls, access governance, segmentation between IT and lab systems, and incident response plans.

After all, weakness in any of these areas can convert a digital breach into a multi-million-dollar operational and reputational loss.

Luckily, this is where proactive, data-driven assessments come into play.

Now that we’ve established the complexity of underwriting risk profiles for pharmaceutical R&D labs, let’s examine the solution more closely.

Research points in the direction of implementing the right technology and securing access to verified data.

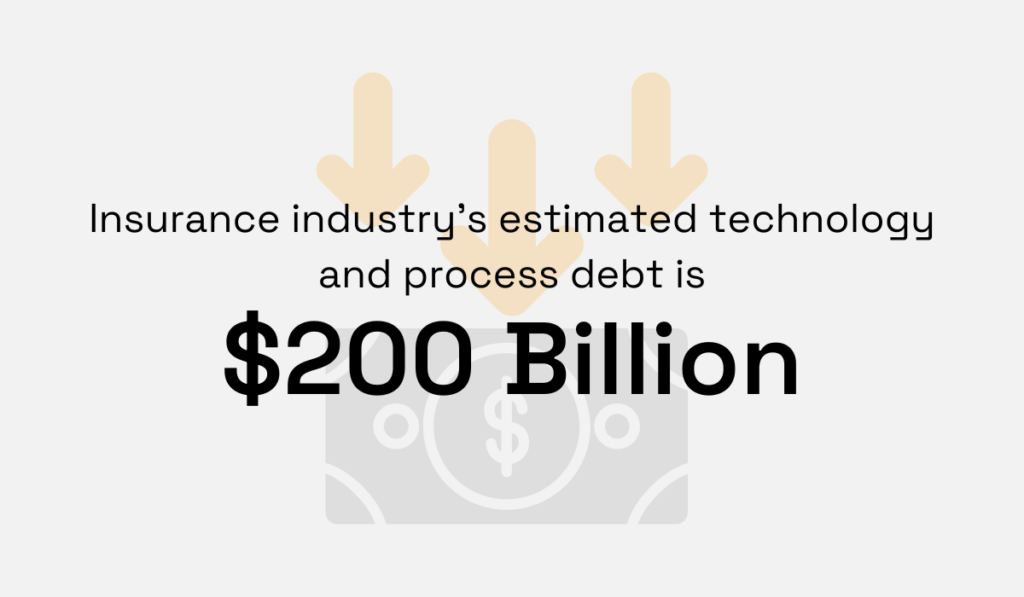

According to HFS Research, the technology and process debt in the insurance industry is estimated at $200 billion.

Illustration: Veridion / Data: HFS Research

Of that, $38.4 billion is tied directly to underwriting inefficiencies.

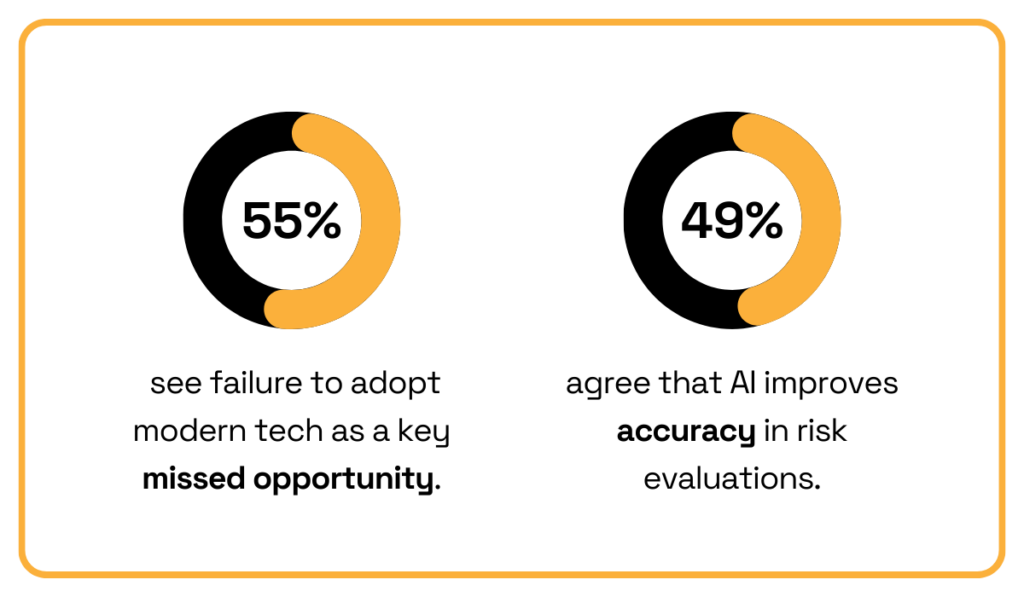

Given these numbers, it’s no surprise then that the 2025 Federato survey shows over half of underwriters (55%) see failure to adopt modern technology as a top missed opportunity.

Meanwhile, 49% highlight AI as one of the key drivers for improved risk evaluation.

Illustration: Veridion / Data: Federato

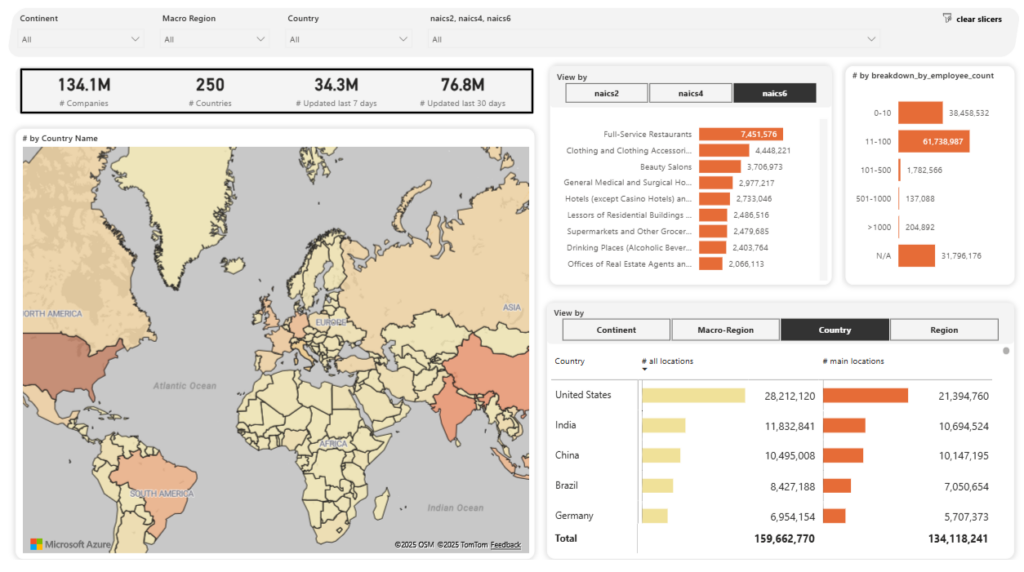

This is where our AI-powered intelligence platform, Veridion, enters the picture.

With 134+ million companies mapped across 250 countries, 500 million business locations, and 320 attributes per profile, the platform supports several commercial insurance use cases, including underwriting.

Source: Veridion

Veridion’s weekly-updated, granular insurance data enables:

In other words, instead of guessing which sites are offices versus R&D labs or pilot facilities, you get verified, location-specific intelligence.

Key underwriting data points include:

| Underwriting Data Points | Explanation |

|---|---|

| Business Firmographics | Legal names, addresses, and Identifiers |

| Location Data | Site count and distribution |

| Business Activities | Operational tags and descriptions |

| Risk Exposure Flags | Indicators for physical, regulatory, and cyber risk |

| Industry Classifications | NAICS, SIC, ISIC, and insurance-specific codes. |

Veridion also addresses third-party, regulatory, and accumulation risk by helping you surface corporate structures and supplier relationships, and trace both ownership changes and regional exposure.

The result? A tangible reduction in blind spots.

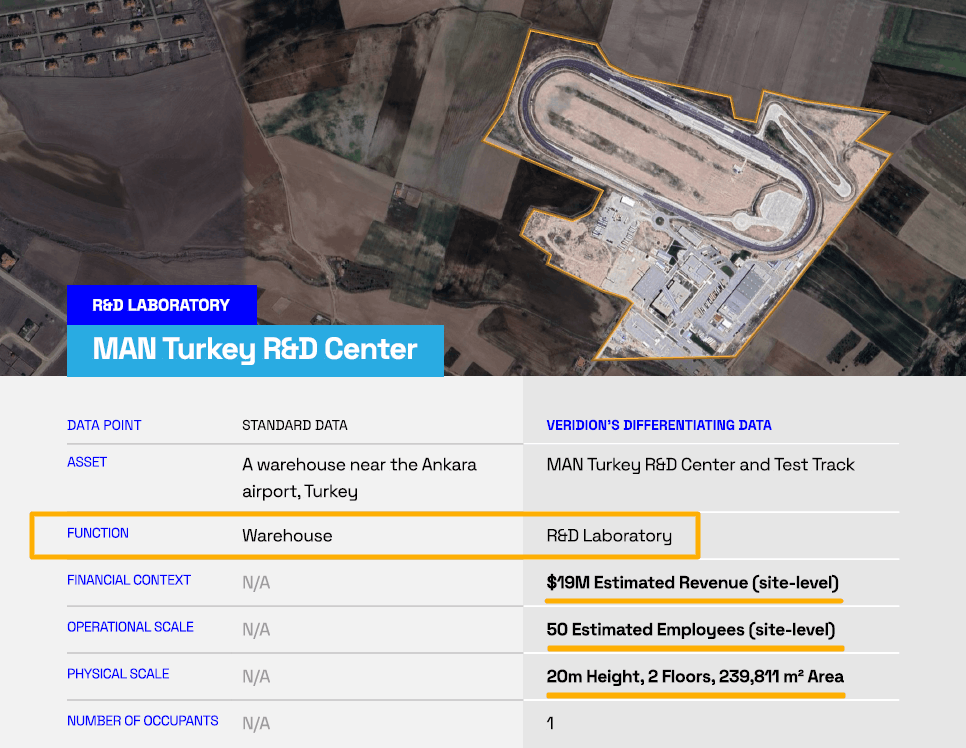

The example of the MAN Turkey R&D Center profile shows that you can map exact property functions, revenue patterns, employee distribution, and building attributes.

Source: Veridion

What makes this such a game-changer is the fact that you’re no longer working off assumptions.

With this data at your fingertips, you gain a clearer view of where high-value exposure exists, and evaluating risk becomes faster, more accurate, and defensible.

By employing the right tools, insurance professionals can make informed underwriting decisions that reflect the real operational footprint of each insured lab, rather than a generic industry profile.

Underwriting pharmaceutical R&D labs requires you to map operational complexity, regulatory exposure, and factor in multiple causes of potential disruption.

Blind spots are expensive, but you can close these gaps by leveraging verified, high-fidelity data that enables you to distinguish facility types, assess risk accurately, and price policies defensibly.

For underwriters looking to stay ahead, adopting data-driven insights is a vital step in future-proofing portfolios and making informed decisions with confidence.