Pricing Business Interruption Coverage for Data Centers

Key Takeaways:

Amazon Web Services, Google Cloud, Microsoft Azure.

These names sit behind everything from mobile banking and e-commerce to healthcare systems and public services. And behind all of them are data centers designed to operate without interruption.

But outages do happen, and when they do, the financial impact can escalate in minutes.

So, how do you price business interruption coverage for facilities where downtime is measured in seconds, but losses in millions?

This guide walks through how underwriters approach that challenge, and the key factors that shape BI pricing for data centers.

Data centers are not typical commercial properties.

They are always on, always connected, and expected to deliver uninterrupted service 24/7.

This alone makes business interruption risk fundamentally different from what insurers see in offices, retail sites, or even many industrial facilities.

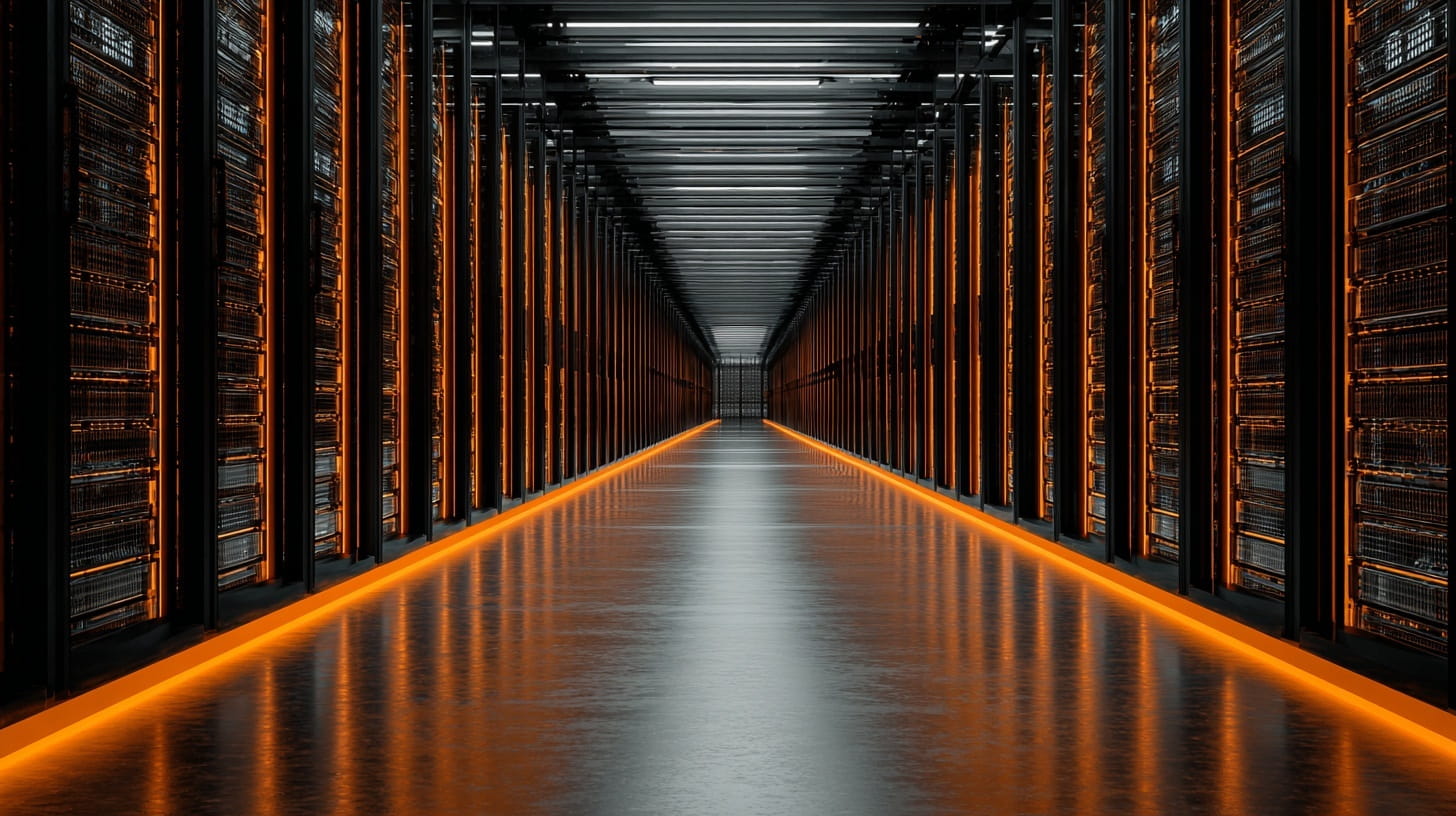

Data centers concentrate large volumes of high-value, mission-critical equipment in a single location, all operating under extremely high and continuous electrical loads.

Power distribution units, backup batteries, cooling systems, and extensive cabling run around the clock.

Source: Flex

Defects, overloads, or component failures can lead to fires or equipment damage and may require full shutdowns to protect critical systems.

Leo Ronken, former Senior Underwriting Consultant for Gen Re’s Global Underwriting department in Cologne, explains:

“Fire is still one of the main causes of data centre failures. The high density of electrical power, sometimes several megawatts, increases the potential fire hazard caused by arcing, short circuits, smouldering fires or defective components, among other things.”

Even when physical damage is limited, operations often stop immediately.

And when a data center goes offline, the impact escalates quickly.

Digital services can fail within seconds, customers are affected immediately, and contractual obligations are often triggered within minutes.

Unlike most commercial properties, business interruption losses are not confined to the insured site itself.

A defining feature of data center risk is concentration and dependency.

A single facility can support thousands of downstream businesses at the same time.

When it fails, business interruption losses can spread across entire digital ecosystems.

Since many customers operate under strict service-level agreements with defined uptime guarantees, even short outages can result in:

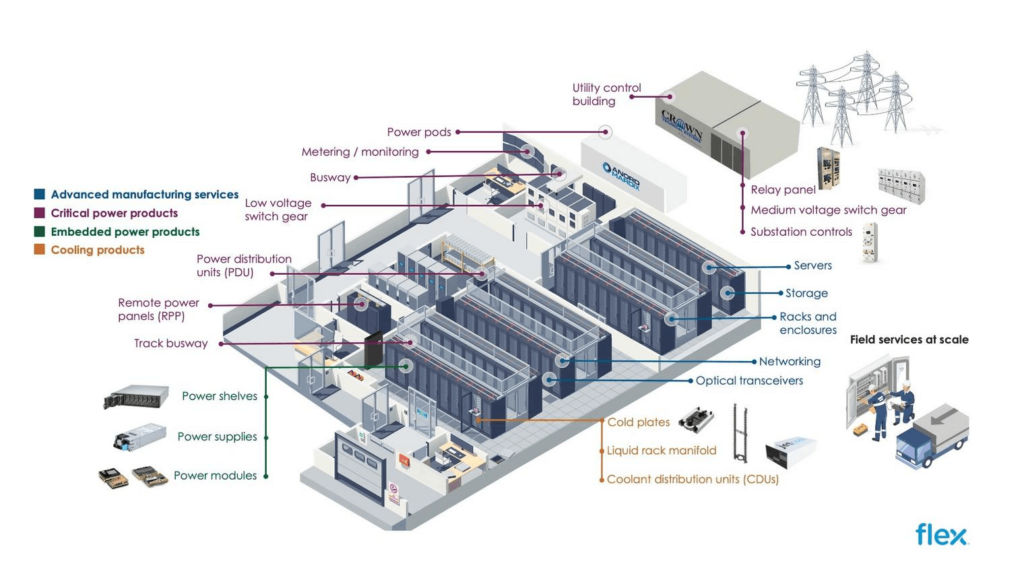

Recent hyperscale outages illustrate this dynamic.

In October 2025, a disruption affecting core infrastructure at one of AWS’s major U.S. facilities led to widespread service outages across hundreds of platforms globally.

Source: Data Centre Magazine

Banking applications, enterprise systems, and consumer services were affected simultaneously.

The incident highlighted how a single failure at a major data center can generate cascading business interruption losses far beyond the physical footprint of the facility itself.

Data center business interruption risk is further shaped by reliance on external infrastructure.

Power grids, network providers, fuel suppliers, and cooling water sources all sit outside the operator’s direct control.

Even a well-designed and well-managed facility can experience prolonged downtime if the surrounding infrastructure is disrupted by extreme weather, grid instability, or third-party failure.

Taken together, these factors make business interruption risk in data centers fast-moving, high-severity, and highly sensitive to design and operational choices.

Understanding why these facilities behave differently under stress is the first step toward pricing business interruption coverage with confidence.

The second is identifying and weighing the key risk factors that influence outage probability and duration.

A small number of high-impact variables shape business interruption risk in data centers.

While no two facilities are identical, underwriters consistently focus on a core set of factors that determine how likely downtime is and how costly it could become.

Power supply reliability is the single biggest driver of business interruption risk in data centers.

Unlike offices or retail buildings, data centers operate at extremely high and continuous power loads.

Thousands of servers run around the clock, supported by power distribution units, UPS systems, generators, and cooling infrastructure.

So, if power fails, even briefly, operations can stop immediately and completely.

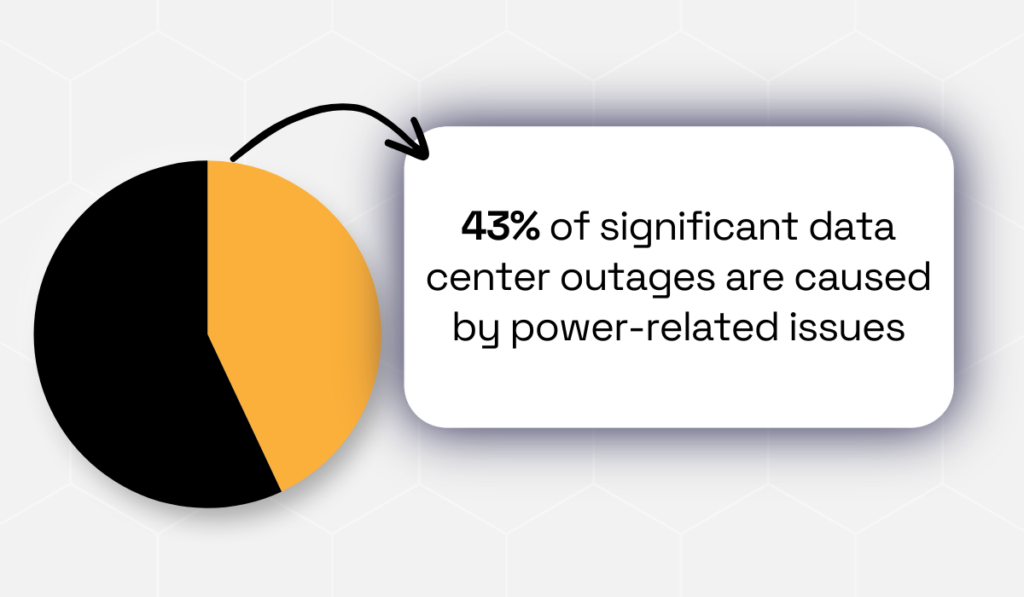

Industry data shows how often this happens.

Research by Uptime Institute, the global digital infrastructure authority, indicates that 43% of significant data center outages are caused by power-related issues, making power failure the leading cause of business interruption events in this sector.

Illustration: Veridion / Data: Loadbanks

Within this category, failures of uninterruptible power supply (UPS) systems are the most common trigger.

For underwriters, the question is not simply whether backup power exists, but how reliably it performs under real operating conditions.

Power resilience directly affects two critical drivers of business interruption loss: how often outages occur and how long they last.

When assessing power-related business interruption risk, underwriters therefore focus on:

| Redundancy levels | Are there multiple independent power paths, generators, and UPS systems, or are there single points of failure that could trigger an outage? |

| Backup generation capacity | How many generators are installed, and how long can they support full load without interruption? |

| Fuel resilience | Are fuel supply contracts secure, and can deliveries continue during regional disruptions or extreme events? |

| Testing and maintenance | Are generators, UPS systems, and transfer switches tested regularly under load, with documented results? |

These factors shape both outage probability and outage duration.

Strong power design reduces how often failures occur. Strong operational discipline limits how long an outage lasts once a failure happens.

From a pricing perspective, outage duration is especially important because business interruption losses only attach once waiting periods are exceeded.

Facilities with fast failover, proven redundancy, and regular load testing are more likely to restore power within those waiting periods, thus reducing loss severity.

Weaker power resilience increases the likelihood that outages extend beyond waiting periods, leading to higher business interruption claims.

In this context, testing deserves particular attention.

Many major data center outages occur not because systems are missing, but because they fail when needed.

As Paul Brickman, Commercial Director at Crestchic Loadbanks, notes:

“Failing to test means flirting with complete system failure. For critical infrastructure like data centers, where downtime is both extremely costly and worryingly commonplace, it is just not worth the risk.”

From an insurance perspective, facilities with documented testing programs, clear maintenance schedules, and active monitoring are easier to price.

They often justify lower premiums, higher limits, or more flexible terms.

Facilities without that evidence, on the other hand, introduce uncertainty, and uncertainty almost always increases business interruption pricing.

In short, power supply reliability is a measurable, high-impact input into business interruption risk for data centers, and one of the first areas underwriters examine when pricing coverage.

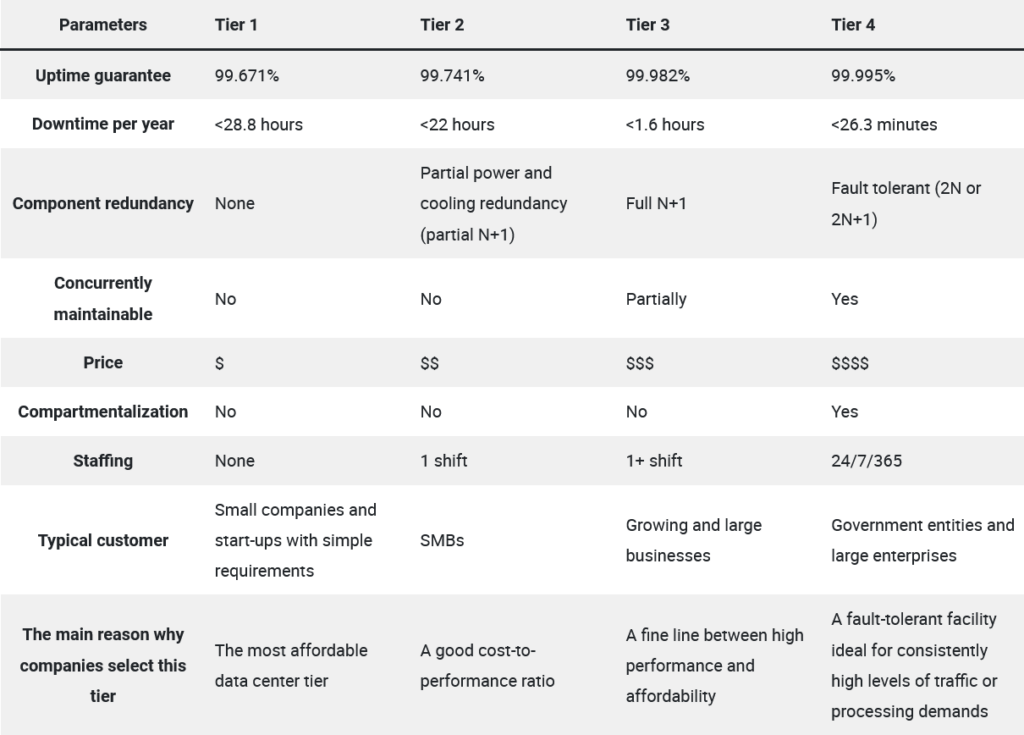

A data center’s tier classification provides underwriters with an initial benchmark for expected resilience and downtime.

The Uptime Institute defines four tiers, each reflecting how a facility is designed to handle failures, maintenance, and unexpected disruptions.

Importantly, tiers reflect design intent, not guaranteed performance, but they offer a useful starting point for assessing business interruption risk.

Here’s the breakdown:

From an underwriting perspective, tier classification matters because it influences two core drivers of business interruption loss: the likelihood of an outage and the expected duration if one occurs.

Higher-tier designs reduce reliance on single components and allow failures or maintenance activities to be absorbed without interrupting operations.

This lowers the probability that an outage will extend beyond standard business interruption waiting periods, which directly reduces expected loss severity.

As a result, higher-tier facilities generally present lower baseline business interruption risk.

This can support lower premiums, higher coverage limits, or more flexible policy terms, particularly where tier design is supported by strong operational practices.

Check the table below for a more detailed tier comparison:

Source: PhoenixNAP

However, tier alone is not determinative.

A poorly maintained Tier IV facility can still suffer extended downtime, while a well-operated Tier III facility may perform more reliably in practice.

For this reason, underwriters treat tier classification as a baseline pricing input, not a standalone rating factor.

Final pricing adjustments depend on evidence of operational discipline, redundancy testing, maintenance records, and incident history.

All in all, tier classification helps underwriters set expectations around downtime at the outset, which are then refined based on how the facility is actually run.

A data center’s geographic location is a major driver of business interruption risk.

Even the most resilient Tier III or Tier IV facility can experience extended downtime if the surrounding infrastructure fails.

Floods, earthquakes, extreme heat, severe storms, or regional power outages can all disrupt operations in ways the facility itself cannot fully control.

For underwriters, location is a foundational pricing input because it directly affects both how often outages occur and how long they last.

External hazards can:

All of this increases the likelihood that outages extend beyond business interruption waiting periods.

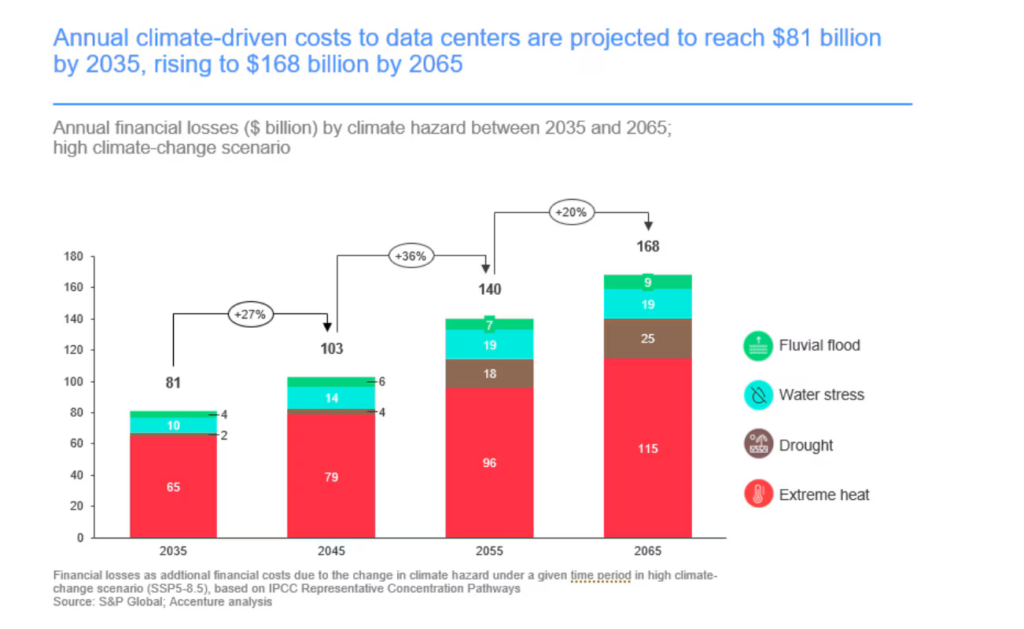

Climate-related risks are making these exposures more visible and more measurable.

Analysis by the World Economic Forum suggests that extreme heat, drought, and other climate hazards could drive $81 billion in annual data center costs globally by 2035, rising to $168 billion by 2065.

Source: WE Forum

Separate analysis of S&P data indicates that, under high-emissions scenarios, climate-driven impacts could represent a significant share of total data center asset value over time.

Source: WE Forum

These trends point to more frequent and more prolonged disruption events, which directly feed into business interruption loss expectations and pricing assumptions.

Location risk goes beyond natural hazards.

Regional grid reliability, exposure to rolling blackouts, access to multiple network providers, and the speed of emergency response all vary by location and influence recovery times after an incident.

Facilities in regions with fragile power infrastructure or slower restoration capabilities generally face higher interruption risk, even if on-site systems are well designed.

There is also an accumulation dimension.

Outages at one data center can trigger losses across thousands of dependent customers, and high concentrations of data centers in the same hazard-prone region increase the potential for correlated losses.

This can lead insurers to apply higher pricing, tighter limits, or stricter terms across an entire region, not just at individual sites.

Given all of the above, Denis Kouroussis, CEO of Volta Energy and Atom Power, rightfully notes that location strategy is one of the most influential factors in data center economics:

Illustration: Veridion / Quote: LinkedIn

When combined with tier classification, power resilience, and operational discipline, geographic location helps insurers build a realistic view of interruption risk and price coverage more accurately.

Data centers may have robust internal systems, but they rarely operate in isolation.

They rely on external power grids, network providers, cooling contractors, and other service partners to keep them running.

When a key supplier fails, it can trigger a business interruption even if nothing inside the facility is physically damaged.

This matters for pricing because third-party dependencies add failure points that the data center operator does not fully control.

They increase the likelihood of outages and can also extend outage duration, especially when recovery depends on external teams, utilities, or suppliers.

In large data centers, a single third-party failure can affect multiple customers at the same time, increasing loss severity and accumulation risk.

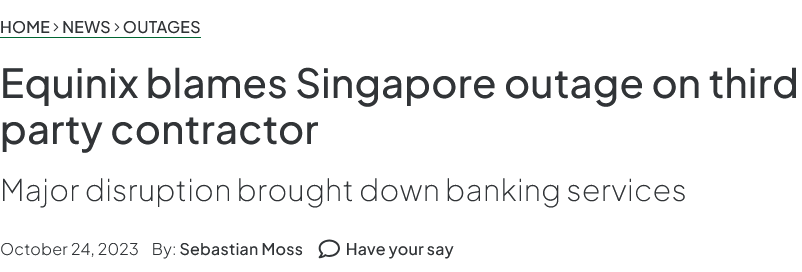

A vivid example occurred in October 2023 at a major Equinix data center in Singapore.

Source: DCD

During a planned upgrade, a third-party contractor issued an incorrect command that disrupted the chilled water cooling system.

Temperatures rose, services were taken offline, and banking and payment systems for major institutions were unavailable for hours.

There was no physical damage to the data center itself, but the interruption was immediate and widespread.

From an underwriting perspective, events like this raise two key questions.

Outages triggered by external providers may fall under direct business interruption, contingent business interruption, or utility service interruption cover, depending on the circumstances.

Greater dependency complexity increases uncertainty around coverage triggers, which often leads to higher pricing, sublimits, or tighter terms.

When assessing third-party dependency, underwriters focus on:

In practice, the more a data center depends on external suppliers without strong redundancy or contractual protection, the higher the expected business interruption risk.

Insurers reflect this in premiums, limits, and policy structure.

A data center’s operational track record is one of the clearest indicators of future business interruption risk.

Insurers do not just look at whether outages have occurred.

Instead, they analyze:

A facility with occasional short outages caused by isolated issues may present less business interruption risk than one with rare but prolonged outages linked to design weaknesses, poor maintenance, or human error.

The cause matters because it signals whether the risk is repeatable.

Outages that lead to documented fixes and procedural improvements build confidence. Repeated incidents with similar root causes reduce it.

From a pricing standpoint, operational history influences both loss expectations and uncertainty.

A strong record supports assumptions that outages will be contained within business interruption waiting periods and resolved quickly.

This can justify lower premiums, higher limits, or more flexible policy terms.

Poor or inconsistent performance increases the likelihood of extended outages and makes future losses harder to predict.

Loss history also affects pricing stability.

Facilities with uneven operations or unresolved issues are more likely to see sharp premium increases or tighter terms at renewal.

In some cases, insurers may require additional inspections, risk improvements, or sublimits for specific exposure areas.

In short, a data center’s past performance shapes underwriter confidence in how the facility will perform under stress.

That confidence, or lack of it, plays a central role in how business interruption coverage is priced.

Pricing business interruption coverage for data centers ultimately comes down to confidence.

Confidence that the information you are pricing on is complete, accurate, and reflects how the facility actually operates today.

That is where Veridion’s data adds value.

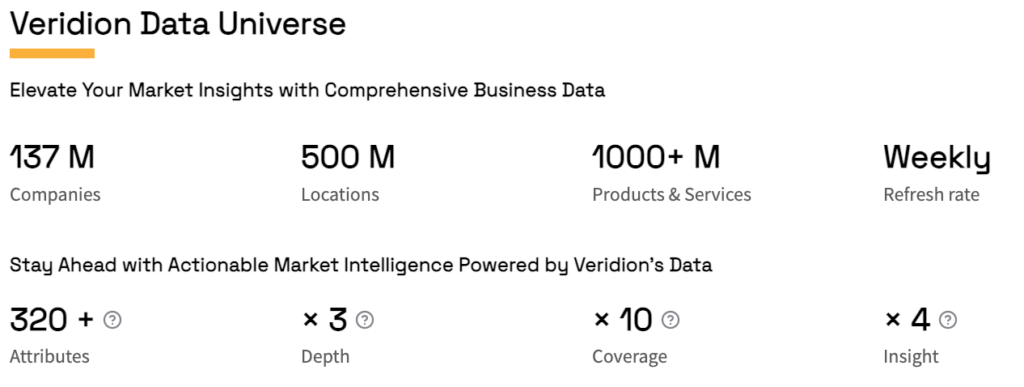

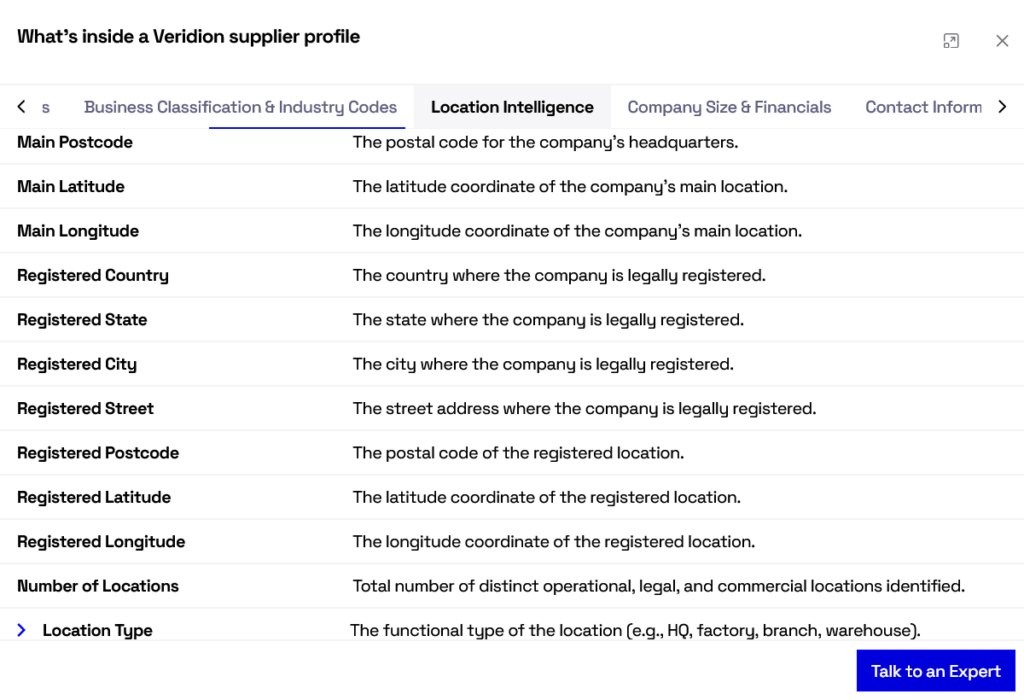

Veridion is a global business intelligence platform that aggregates and continuously updates data on millions of companies worldwide, including data center operators and the facilities they run.

Source: Veridion

It covers company locations, operational footprints, ownership structures, industry classification, and key third-party relationships, giving insurers a clearer view of how digital infrastructure is actually set up.

Underwriters can access this information through Veridion’s Match & Enrich capability, which allows them to retrieve a verified company profile from minimal inputs such as a company name, address, or website.

Source: Veridion on YouTube

In other words, underwriters can quickly enrich submissions or internal records with up-to-date external data, without waiting for lengthy follow-ups.

From a business interruption pricing perspective, this intelligence supports better decisions across the risk factors we discussed above.

Veridion’s location intelligence helps underwriters confirm how many facilities an operator truly runs, where they are located, and whether “redundant” sites are genuinely geographically independent.

Source: Veridion

This directly informs assumptions around outage duration, accumulation risk, and exposure to regional hazards.

Veridion’s data can also surface third-party dependencies that materially affect interruption risk.

Identifying reliance on specific power providers, network infrastructure, or shared facilities helps insurers assess whether potential losses sit within direct business interruption, contingent business interruption, or utility service interruption cover, shaping pricing, limits, and policy structure.

Operational signals add another layer of insight.

Changes in footprint, rapid expansion, or shifts in activity can all alter interruption risk over time.

Ongoing data refreshes make it easier to identify these changes ahead of renewal, rather than pricing based on outdated assumptions.

Source: Veridion

Simply put, Veridion helps insurers move from static, self-reported information to a more dynamic, verifiable view of data center operations:

In a sector where downtime escalates quickly and losses can multiply in minutes, better data does not remove risk.

But it does allow underwriters to price business interruption coverage with far greater precision and confidence.

Pricing business interruption cover for data centers is never simple, but it becomes far more manageable when you understand how a facility is built, where it operates, and what it depends on.

The better you understand the facility, the better you can insure it, and that starts with data you can trust.

So equip yourself with the most reliable, up-to-date intelligence available.