5 Insurance Underwriting Trends to Watch For

Key Takeaways:

The commercial insurance underwriting landscape is shifting beneath your feet.

Traditional methods are straining under new pressures: interconnected global risks, climate volatility, and the sheer volume of data.

To build a resilient and profitable portfolio in 2026 and beyond, you need to understand where the practice is headed.

This article explores five transformative trends that are redefining how leading insurers assess and price risk.

Underwriting is experiencing a major technological shift.

Teams are now increasingly using artificial intelligence (AI) and machine learning (ML) to analyze massive quantities of data that were previously too difficult to handle.

This includes structured financial information and unstructured data from applications, news sources, and other digital inputs.

The primary advantage of these technologies is their ability to find patterns, connections, and anomalies that traditional rules-based models often overlook.

For instance, multimodal AI systems can analyze thousands of images, from satellite photos to social media posts, to identify property hazards and assess disaster risk better.

These algorithms can uncover factors and irregularities that human-driven methods frequently miss, boosting consistency and speed.

In its 2024 World Property and Casualty Insurance Report, the Capgemini Research Institute found that 62% of insurance executives believe that AI/ML is already elevating underwriting quality and cutting fraud.

On top of that, half of the underwriters agree that AI improves accuracy in risk evaluation.

Illustration: Veridion / Data: Capgemini

It’s clear that AI and ML systems can dramatically change underwriting from static checklists to dynamic, data-driven models.

However, successful implementation requires careful navigation.

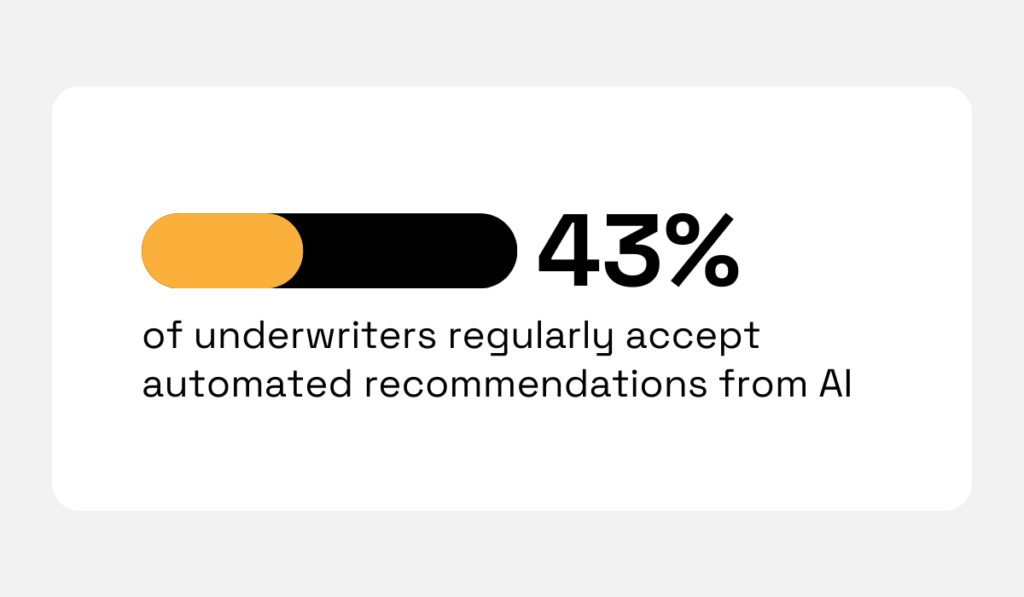

While many claims executives believe automation and AI bring high value, underwriter trust is still developing.

The same Capgemini report states that only 43% of underwriters regularly accept automated recommendations from predictive tools, citing concerns regarding the complexity of these systems and the integrity of the data used.

Illustration: Veridion / Data: Capgemini

This goes to show that leading firms view AI as a decision-support tool, not a replacement for human judgment.

In other words, AI accelerates routine analysis, allowing you to apply your judgment to complex cases.

As a result, AI-driven underwriting models enable faster decisions with fewer manual checks.

However, it’s your expertise that guides and validates the outcomes.

Despite advances in automation, your judgment remains more valuable than ever, reaffirming your vital role in underwriting decisions.

Sure, machines can crunch data, but they lack the context and creativity you provide.

AI handles volume and identifies patterns, but human experts are irreplaceable when interpreting ambiguous data, assessing novel or complex risks, and applying ethical reasoning to edge cases.

This is especially important when writing specialty lines or bespoke policies because each risk is unique.

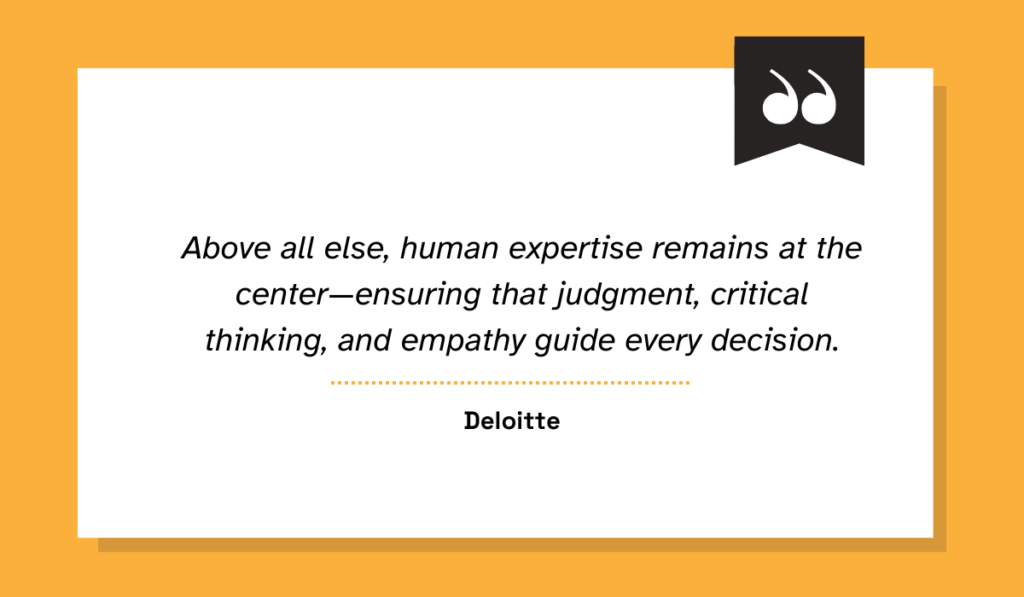

Leading voices echo this balanced view, and the industry’s leading players are consciously positioning AI as a tool in the underwriter’s kit, rather than an autonomous decision-maker.

Deloitte’s research findings back this viewpoint, emphasizing that even with AI automation, human expertise remains at the center.

Illustration: Veridion / Quote: Deloitte

On top of that, 8% of insurers who are “AI trailblazers” still keep underwriters at the heart of all decisions, using machines only as support.

This only further underscores the continued value of human review and the fact that underwriting remains a people-driven craft.

While machine tools free you from tedious tasks, they cannot substitute for your experience as an underwriter.

By using a model that incorporates a “human-in-the-loop” approach, you maintain your ability to explain your decisions, remain compliant with the law, and instill confidence in your clients.

The AI will perform the majority of the time-consuming, repetitive work (capturing and assembling the data, identifying patterns, and providing a basic score) while giving you the added opportunity to provide your judgment and interpretation on the more nuanced risks.

This human-plus-machine partnership is where true competitive advantage is built.

To fuel both AI and expert analysis, underwriters are radically expanding their data horizons.

The reliance on static application forms and historical loss ratios is giving way to a dynamic, multi-dimensional view of risk enabled by technological advances.

New alternative data sources, such as operational data, digital signals, and ESG indicators, are pouring into risk models to paint a fuller picture of each client.

These innovations are fundamentally transforming underwriting strategies by providing real-time, actionable insights.

For commercial lines, this means incorporating alternative data that reveals how a business truly operates.

This includes:

| Operational Data | Real information on business activities, supply chain relationships, and physical footprint |

| Digital Business Signals | Data harvested from company websites, news, and online presence that indicate changes in operations or risk profile |

| Ownership and Hierarchy Structures | Understanding corporate linkages to identify aggregation risks |

| ESG Indicators | Data points related to environmental management, labor practices, and governance |

By aggregating diverse signals, you build risk profiles based on real activity.

And Veridion is a great example of a platform that can help you with exactly that.

It can enrich a profile with industry classifications, corporate hierarchy, key products, and current revenue, giving context to the risk.

Source: Veridion on YouTube

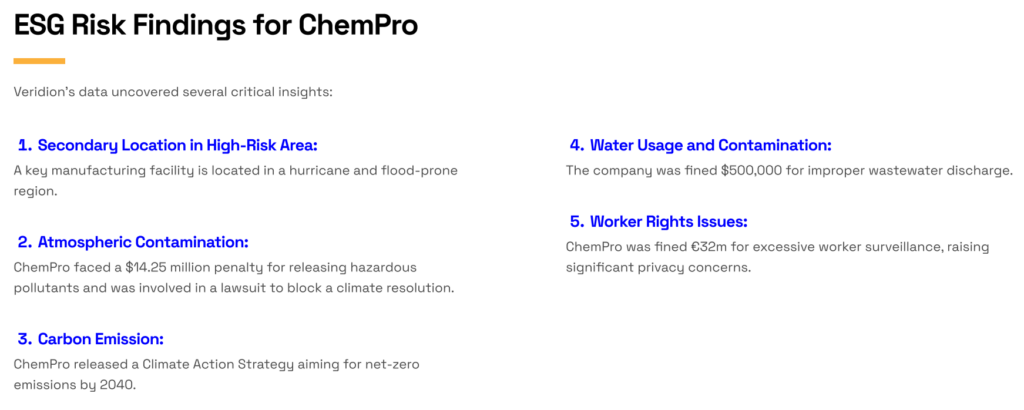

Wondering what that can look like in practice?

For instance, as reported in our case study, Veridion flagged a chemical company’s high-risk site and prior fines for pollution and privacy breaches that the application alone had not disclosed.

Source: Veridion

This insight led the insurer to raise premiums by about 30% to reflect elevated environmental risks.

Veridion continuously scans public records, news sources, corporate registries, and social channels to verify firms’ details.

These findings can confirm a business’s current operations, highlight surprise ownership links, or detect supply-chain exposures, all within seconds.

That means faster, more confident decision-making.

Instead of manually verifying a client or digging through filings, you simply query the system.

For example, Veridion’s database covers over 130 million companies worldwide.

Its Match & Enrich service can attach hundreds of attributes per company, from revenue trends to recent board appointments.

Source: Veridion

The driver for this shift is clear: to understand risk, you must understand the business itself.

Traditional industry codes (like NAICS or SIC) are often too broad or misapplied, leading to underwriting inaccuracies.

For example, classifying a company simply as a “manufacturer” overlooks whether it handles flammable chemicals or assembles electronics.

Alternative data provides the granularity needed for precise risk differentiation.

Additionally, your underwriting becomes more precise and defensible.

You can justify pricing changes or coverage terms with hard evidence, whether it’s a new warehouse in a flood zone, a digital footprint signaling aggressive marketing tactics, or weak ESG metrics in a sector.

Companies that use these external data sources report better risk differentiation and quicker turnaround.

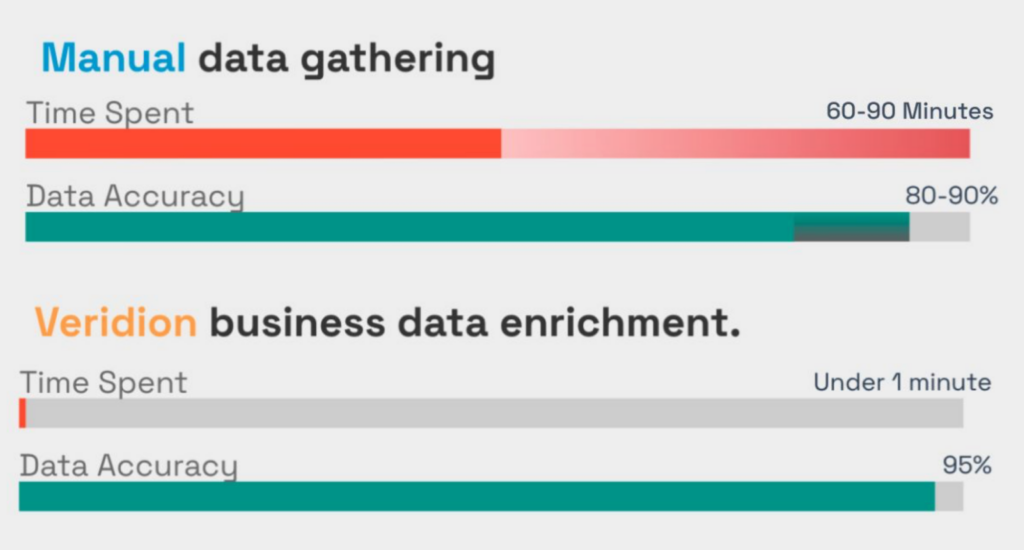

Another one of our reports also notes that enriched profiles and instant lookups can drastically reduce the hours spent on basic due diligence.

You can get a validated company profile in just 1.5 seconds.

Source: Veridion

This instant access to critical data accelerates risk assessment, slashes submission-to-quote times, and allows teams to evaluate a significantly higher volume of applications without adding resources.

In short, supplementing traditional data with real-world signals helps you underwrite faster and more accurately.

Environmental, social, and governance (ESG) factors are now integral to underwriting assessments, not just window dressing.

For underwriters, ESG is materially linked to loss frequency and severity.

The table below breaks down exactly how:

| Environmental | A company’s climate exposure, carbon footprint, and environmental compliance record directly influence its physical risk from natural catastrophes and its exposure to transition risks, such as regulatory fines or shifting market preferences |

| Social | Labor practices, employee safety records, and community relations can signal potential liability claims, business interruption risks, or workforce instability |

| Governance | The quality of a company’s leadership, board oversight, and cybersecurity protocols is a strong indicator of its resilience and operational risk |

For example, facilities in areas prone to flooding or wildfires carry higher property risk, and poor workplace safety records may signal future claims.

As a result, commercial and specialty lines underwriters increasingly embed ESG risk criteria into their models.

And industry data backs this shift.

A PwC survey found 85% of global insurers recognize that ESG factors will impact their operations.

Illustration: Veridion / Data: PwC

Yet many are still catching up.

Namely, Capgemini reports that fewer than half of P&C insurers have fully integrated ESG data into their underwriting processes.

That gap is narrowing because underwriters can no longer ignore ESG.

The UN’s Principles for Sustainable Insurance note that certain ESG issues—such as climate change and pollution—are increasingly recognized as potentially financially material to insurers.

In other words, ESG is not just a reputational concern. It can affect your claims cost and reserve needs.

By embedding ESG into your workflow, you align underwriting with enterprise-wide risk management and respond to evolving regulations.

In practice, you’ll incorporate ESG screens into your tools and risk appetite statements, ensuring that no significant sustainability risks slip through undetected.

The final trend on our list synthesizes the others: the move toward holistic underwriting.

Underwriting is evolving from a siloed process into a holistic enterprise exercise.

Modern business risks are interconnected: a cyber attack can trigger supply-chain disruptions, a regulatory change can spark litigation, and a reputational hit can lead to new liabilities.

To manage this, underwriters must assess policies in the context of an insurer’s entire portfolio and risk appetite.

Rather than evaluating exposures one dimension at a time, holistic underwriting considers operational, financial, technological, regulatory, and reputational factors in combination.

This shift reflects how risk works in the real world.

For example, take a coastal manufacturer.

You need to weigh its:

Treating these in isolation can miss crucial linkages.

According to McKinsey, underwriting can unlock greater value when conducted holistically, taking into account process design and behavioral factors.

The result is underwriting that aligns closely with enterprise risk management.

The holistic view also improves portfolio resilience.

By linking underwriting and investment strategies, you can smooth out volatility.

As Chris Tschida, Head of US insurance at Mercer, and Thomas Hettinger, Strategic advisory leader at Guy Carpenter, note:

Illustration: Veridion / Quote: Mecer

Adopting a holistic underwriting mindset helps you navigate complex modern risks.

It acknowledges that underwriters aren’t standalone risk assessors but key players in enterprise risk management.

By combining technical underwriting, portfolio thinking, and strategic context, you strengthen the insurance portfolio and align it more closely with your organization’s goals.

Underwriting is evolving fast.

By following these five trends, you can stay ahead.

Each trend helps you underwrite smarter, improving accuracy and speed while managing new kinds of risk.

The key takeaway is this: use technology and data to amplify your expertise, focus on what truly matters, and always consider risk in a broader business context.

Embracing these changes will boost your underwriting performance and keep you competitive as the industry moves forward.