Insurance Underwriting Risk Profile for Semiconductor Manufacturing Plants

Key Takeaways:

When talking about underwriting for manufacturing facilities, the main focus is often on buildings, machinery, and replacement costs.

But that view barely scratches the surface for semiconductor manufacturing plants.

These facilities operate at the edge of precision, automation, and global interdependence, where a brief outage, a single supplier failure, or a minor process disruption can trigger massive financial losses.

In this article, we break down the insurance underwriting risk profile for semiconductor manufacturing plants, covering the critical operational, supply chain, environmental, and cyber risks underwriters need to understand.

Let’s dive right in.

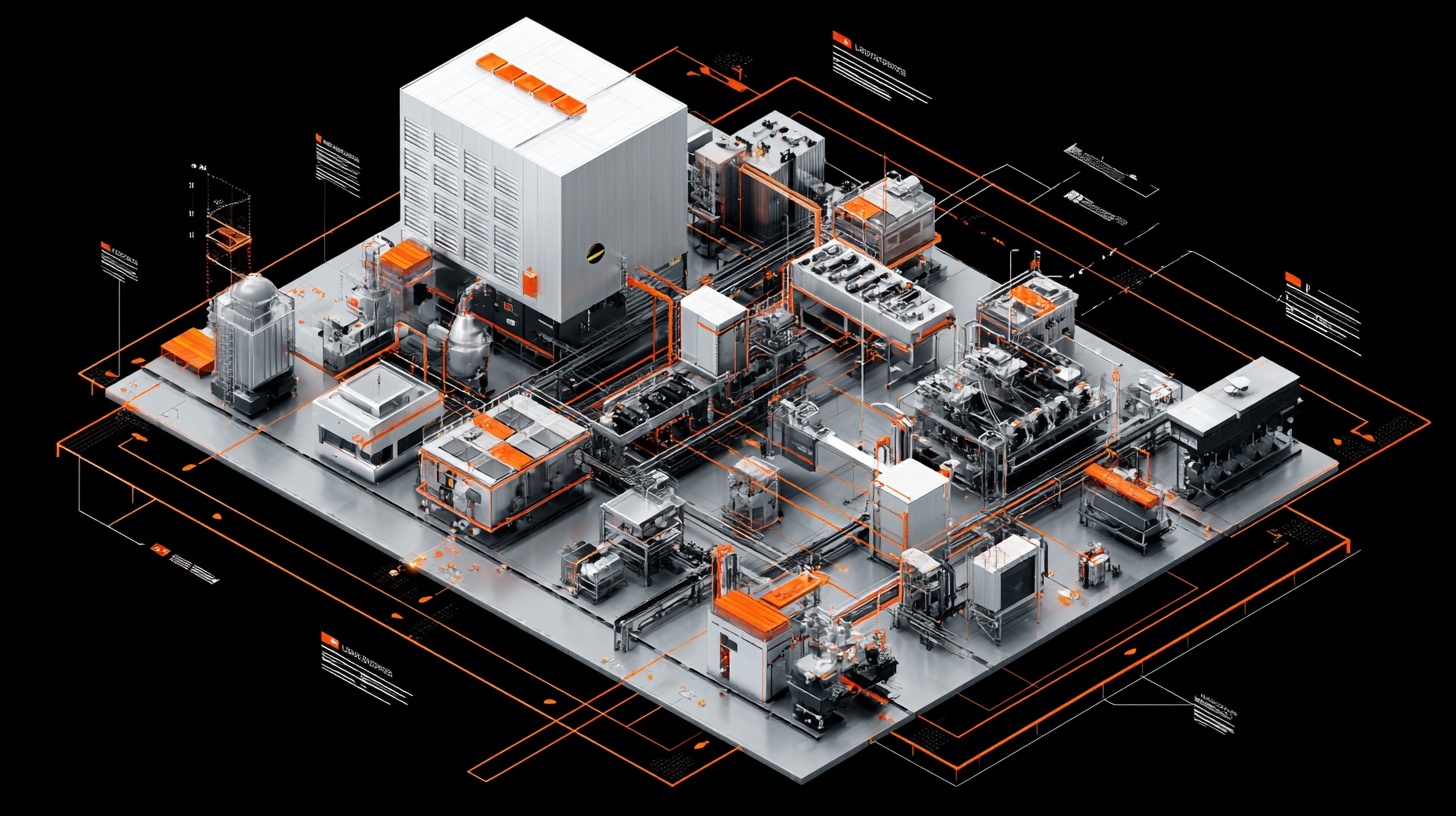

Semiconductor fabrication facilities (or fabs) are among the most valuable, complex, and capital-intensive factories in the world.

Building and outfitting a single advanced fab can cost between $10 and $12 billion.

Source: Deloitte

And it makes sense, because these aren’t your typical manufacturing plants.

Instead, they rely on ultra-precise equipment and near-perfect processes.

Even a minor error or a tiny speck of contamination can destroy entire batches of chips worth millions.

Taking this into account, the challenge lies in the fact that standard commercial insurance policies simply can’t handle these specialized needs.

Semiconductor production requires specialized coverage because of three main factors:

Most standard policies exclude cleanroom operations entirely.

Yet, a single contamination event can unravel years of planning. A cyberattack can halt production for weeks. And a supply chain failure can cascade across the entire operation.

We’re talking losses in the tens or hundreds of millions.

Insurance needs to cover more than just physical damage to billion-dollar fabs.

It also needs to cover the expensive business interruptions that follow and the liability claims that inevitably emerge.

Think about what makes these facilities so complex: ultra-precise processes, specialized materials, global supply chains, and high-value end products.

Source: Veridion

As an underwriter, you need to recognize that covering these capital-intensive plants requires customized insurance processes and data-driven risk analysis.

One-size-fits-all policies won’t cut it.

As we explained above, when you’re underwriting a semiconductor fab, you’re dealing with specialized hazards that go far beyond ordinary property risks.

Let’s walk through the main risk categories you need to evaluate.

Semiconductor manufacturing demands the cleanest environment imaginable.

Chip fabrication happens in ISO-class cleanrooms where even a single microscopic particle can destroy circuits.

We’re not exaggerating here: one speck of dust that’s invisible to the naked eye can ruin an entire wafer, affect circuit formation, or tank the yield across thousands of chips.

The video below illustrates just how rigorous cleanroom design requirements are:

Source: Air Innovations, Inc. on YouTube

But what makes contamination such a critical risk?

It’s the fact that it’s both high-severity and high-frequency.

Equipment malfunctions, filter failures, and human errors can instantly contaminate batches.

For example, in one case, a HEPA filter failure went undetected for just 24 hours.

That single day released microscopic contaminants that rendered an entire batch unusable.

The loss? Over $10 million.

Steve Rau, Technical Director at the fabrication company Edlon Inc., explains why the cost is so high:

Illustration: Veridion / Quote: Chemical Engineering

This is also why contamination is often cited as the worst-case hazard in chip fabs.

The bottom line?

Treat cleanroom integrity as your top priority when underwriting.

You should require strict maintenance records, real-time sensor systems, documented employee protocols, and detailed contingency plans.

This threat is ever-present, and managing it properly is non-negotiable.

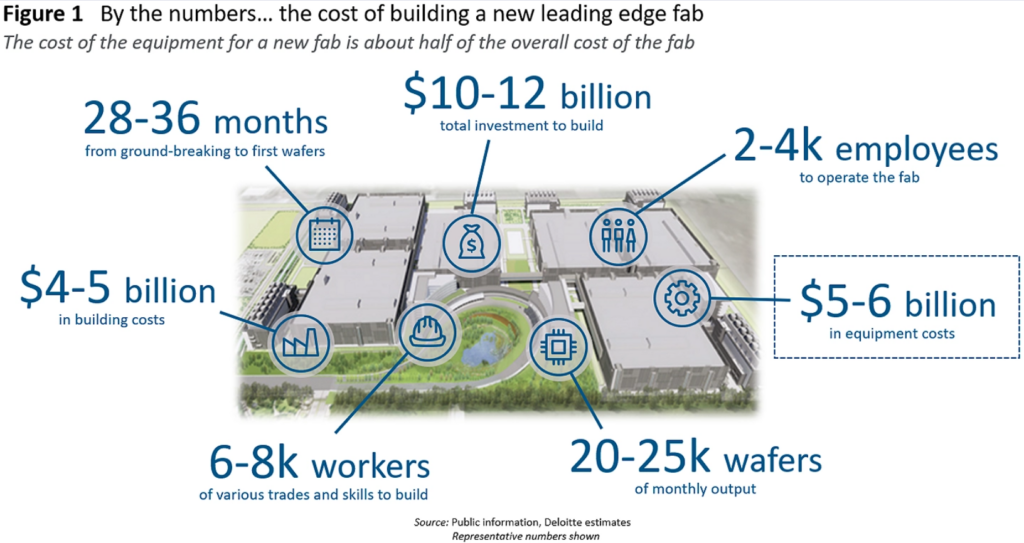

Semiconductor fabs are highly vulnerable when it comes to natural disasters.

Why?

Because many fabs are located in high-risk zones, such as Taiwan, Japan, the U.S. West Coast, and parts of Southeast Asia.

These are earthquake- and typhoon-prone regions.

Source: Technology in Global Affairs

Even a moderate earthquake can wreak havoc. It can shake precision equipment out of alignment, crack cleanroom structures, or break critical utilities.

Let’s look at a recent example.

In early 2025, a magnitude-6.4 earthquake struck southern Taiwan near Chiayi.

This event triggered precautionary evacuations across major semiconductor facilities, including TSMC fabs in central and southern Taiwan.

Source: Reuters

Structural damage was limited, and there were no major casualties. That’s the good news.

But factories were temporarily evacuated, and power interruptions hit nearby areas.

Cleanroom operations were paused for safety checks and equipment recalibration.

The major underwriting concern?

Even without catastrophic structural damage, seismic activity forces production stoppages.

It disrupts utilities, introduces contamination risks, and causes tool misalignment that leads to wafer loss and costly downtime.

These “near-miss” events reinforce why your seismic exposure assessments can’t just look at structural resilience alone.

You also need to account for operational fragility and business interruption risk, especially in earthquake-prone fab clusters like Taiwan.

Weather hazards present another major threat.

Coastal and riverine fabs face floods and typhoons—think Taiwan’s seasonal storms or Gulf Coast hurricanes.

A power outage, even a brief one, can shut off cleanrooms and stop processes that take days to complete.

The financial stakes are staggering. Building a fab costs billions, and downtime costs millions per day.

That’s why you need to scrutinize natural hazard mitigation carefully.

Your underwriting surveys should focus on several key areas, including:

Here’s the bottom line: business interruption losses from a natural disaster often exceed the equipment damage itself.

So, enforcing strong disaster protections is critical when you’re underwriting these high-value plants.

The semiconductor supply chain is deeply global and tightly interdependent.

That makes business interruption one of your foremost concerns as an underwriter.

Fabs depend on many single-source or rare inputs, as exotic substrates have limited sources.

For instance, only one company supplies extreme ultraviolet photolithography machines, and special gases like neon or silane come from a handful of specific producers.

So, even the slightest delay at any key supplier can idle an entire fab.

A recent example illustrates just how fragile this system is.

In late 2025, the Dutch government took control of Nexperia over national security concerns linked to its Chinese parent company.

Beijing responded by restricting exports of Nexperia chips from China.

Source: Reuters

This resulted in immediate shortages across the automotive sector, where those chips are widely used.

Automakers across Europe, North America, and Asia scrambled.

They relied on dwindling reserve stock.

Some suspended production. Others warned that alternative suppliers would take months to ramp up.

This episode teaches an important lesson about a critical underwriting reality:

Geopolitical intervention at a single upstream supplier can cascade into multi-region production halts.

It triggers contingent business interruption losses and prolonged recovery timelines, often with limited visibility beyond your Tier-1 suppliers.

What makes business interruption so devastating is the fact that even a short suspension is catastrophic.

Unfinished wafers have zero value.

There’s a reason insured losses from events like the Taiwan earthquake are dominated by business interruption, rather than property damage.

If manufacturing stops, unfinished semiconductors become useless.

In fact, contingent business interruption policies are often more important than property coverage for fabs.

So, you need to evaluate supply chain concentration very carefully.

Ask questions about single-vendor dependencies and map out the geographic spread of key suppliers.

And don’t forget recent geopolitical risks: U.S.-China tech tensions, regulatory shifts, and trade restrictions all matter here.

Business interruption is often the largest potential loss in semiconductor insurance, and your underwriting models need to stress-test scenarios like supplier failure or trade embargo.

Make sure your coverage is robust, both for direct business interruption and contingent business interruption.

That includes covering second- and third-tier suppliers, not just the obvious Tier-1 partners.

Chip fabs face liability exposures that can be extreme.

Let’s start with product liability.

Semiconductors are embedded in safety-critical systems: cars, aircraft, medical devices, and more.

Imagine a faulty chip in a car’s braking system or a pacemaker.

However unlikely, the consequences could be catastrophic, leading to lawsuits and massive recalls.

Chips are becoming more complex and valuable.

As a result, individual product failures now carry significantly higher costs for manufacturers.

When you’re underwriting, consider what downstream safeguards exist.

These protections are essential.

Another major exposure is environmental liability.

Chip manufacturing uses highly toxic substances in large quantities.

Process gases like arsine (AsH₃) and phosphine (PH₃) are so poisonous that OSHA measures exposure limits in parts-per-million.

Even low doses can cause organ damage or death.

Then there are the corrosive acids: hydrofluoric, nitric, and sulfuric, used in bulk throughout the process.

Professor Long Nghiem, Director of the UTS Center for Technology in Water and Wastewater, adds:

“The two most problematic of these chemicals are hydrogen peroxide, used in surface cleaning, and triazole, for corrosion prevention. Both are very toxic and don’t break down easily.”

Add volatile organic solvents to the mix, and you’ve got a recipe for serious environmental risk.

Any accidental release or spill can trigger regulatory fines, costly cleanup operations, and health claims.

So, you need to verify that the facility has robust hazardous materials handling in place.

Look for the following:

Moreover, new regulations are emerging around chemicals like PFAS.

They’re used in plasma etching and cooling fluids, but many PFAS chemistries are now under regulatory scrutiny for persistence and toxicity.

Transene, a manufacturer of advanced materials for the electronics industry, wanted to find viable alternatives to PFAS in response to customer demand.

So, they partnered up with Toxics Use Reduction Institute and the University of Massachusetts Lowell to make it happen.

Transene’s President, Christopher Christuk, explains:

Illustration: Veridion / Quote: Remediation Technology

Fabs must track their usage and identify safer substitutes as regulations evolve, and the example above shows that it’s possible.

When you’re underwriting, always evaluate the company’s compliance history and check their waste disposal practices and emission controls.

Environmental lapses or safety violations can trigger sizable liability claims, especially given the large inventories of hazardous chemicals kept on-site.

Semiconductor plants are extremely automated.

They run on industrial control networks and proprietary software that manage everything from robotics to cleanroom systems.

This digitization makes them attractive targets for cyberattacks.

A breach could halt production, corrupt valuable IP designs, or even physically damage equipment.

And the financial consequences are enormous.

Fabs risk losing millions of dollars from security events.

For reference, a single high-end 12-inch silicon wafer can be worth $20,000 and upwards.

A malware outbreak mid-process could destroy thousands of dollars of work-in-progress across hundreds of wafers.

This example explains it further.

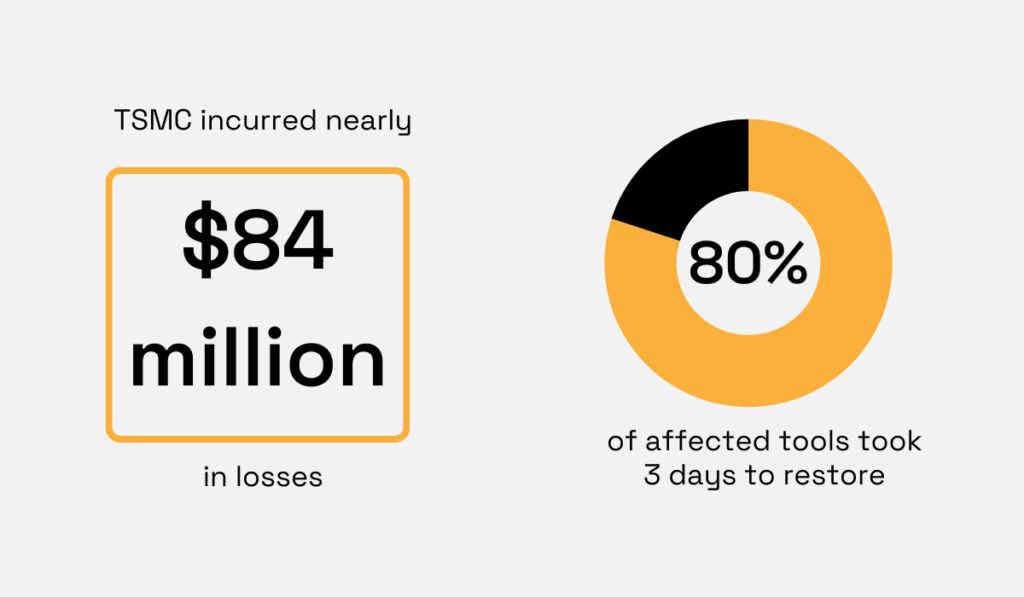

In 2018, a WannaCry variant disrupted Taiwan Semiconductor Manufacturing Company (TSMC) after infected equipment was introduced into its operational environment.

Source: Manufacturing Dive

The malware spread across both IT and manufacturing systems, forcing multiple fabs in Taiwan to halt production.

It took three days to restore about 80% of affected tools, and TSMC later disclosed nearly $84 million in losses tied to the incident.

Illustration: Veridion / Data: Manufacturing Dive

Notably, the event was attributed to lapses in security controls around inbound equipment rather than a targeted external hack.

This highlights a core underwriting risk:

Weak OT security and vendor-device hygiene can trigger large-scale production outages even without sophisticated cyber adversaries.

Because of incidents like this, insurers are now scrutinizing OT cybersecurity as closely as traditional IT.

Therefore, your underwriting questions should cover several key areas:

Industry standards are emerging to help you benchmark.

The SEMI E187 standard sets cybersecurity specifications for fab equipment, and many fabs now require equipment vendors to be certified against this standard.

In your assessment, require proof of security practices: regular audits, intrusion detection systems, and incident response plans.

Consider asking about industry collaborations, too. Many fabs participate in consortia to share threat intelligence.

The bottom line is, comprehensive cyber insurance should also be part of any policy for a fab.

Make sure it covers OT attacks, ransomware events, and data breaches, not just traditional IT systems.

All of these risks create a major challenge.

How do you accurately underwrite such complex facilities?

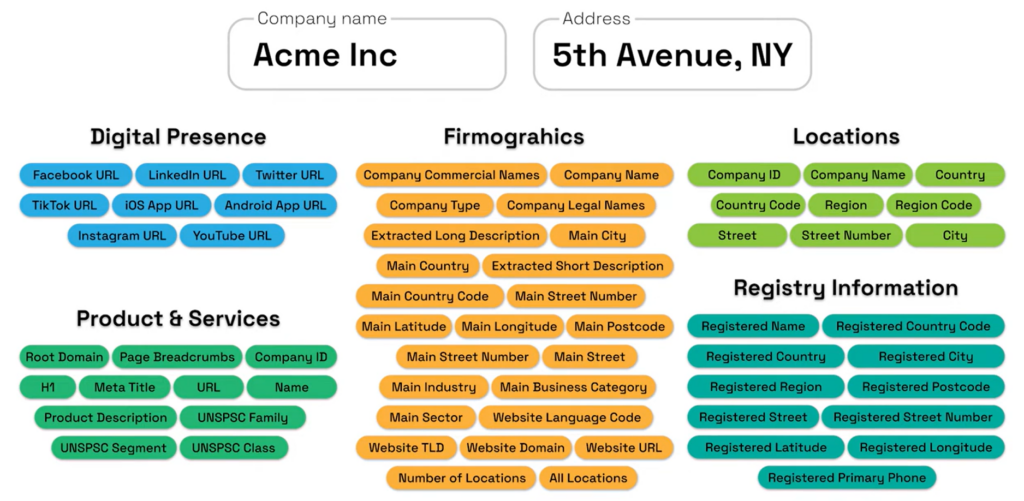

That’s where Veridion comes in.

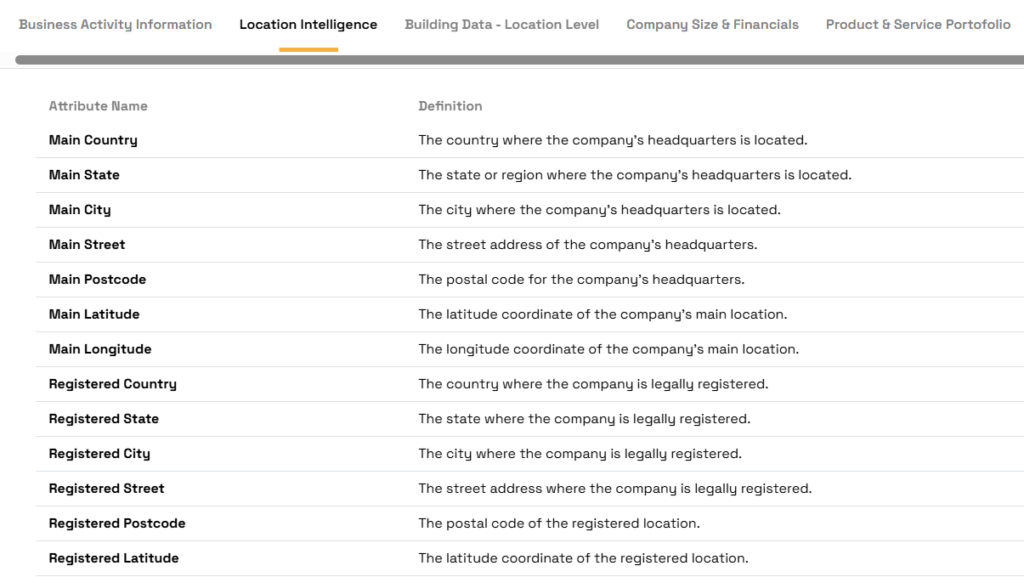

The platform provides high-fidelity, up-to-date information on semiconductor plants and their entire ecosystems.

It aggregates global firmographics and operational data, everything from exact plant coordinates to detailed supplier networks.

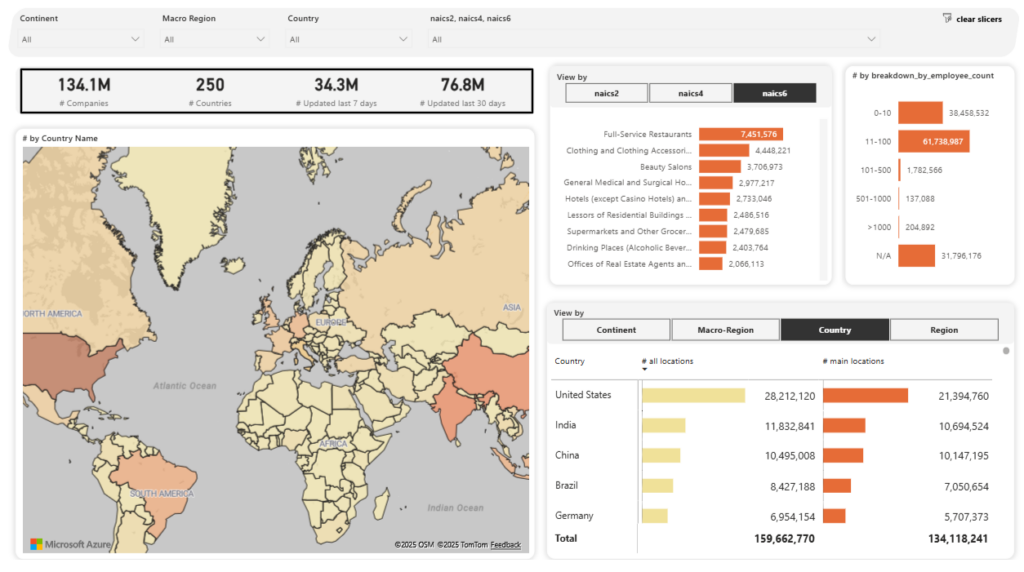

Source: Veridion

This level of data breadth and depth lets you underwrite with real precision instead of working with outdated or incomplete information.

Veridion maintains weekly-updated profiles on over 130 million businesses worldwide.

That includes detailed information on facility locations and operational attributes.

Source: Veridion

Hence, you can validate every plant’s location and role in seconds, and then immediately retrieve local hazard metrics based on those coordinates.

But it goes deeper than just location data. The platform maps multi-tier supplier and customer relationships, too.

This means you can quickly identify single points of failure in the supply chain, the kind of dependencies we talked about in the business interruption section of this article.

The platform continuously monitors corporate changes, too. New facility builds, ownership changes, and emerging third-party contracts—Veridion tracks all of it.

That keeps your risk models current instead of relying on stale information that could be months or years old.

So, how does all of this work?

Insurers integrate Veridion’s AI-powered data directly into their underwriting workflows.

It improves monitoring of underwriting risks, business activity, locations, policies, and product types in real time.

You can set up a dashboard that instantly shows a fab’s key attributes, connected businesses, and change history.

No more hunting through multiple databases or waiting for manual reports.

Source: Veridion

The result? You can assess each plant’s exposures at a granular level.

This lets you evaluate property and liability risks at individual locations and identify high-risk zones with confidence.

Whether it’s a new floodwall installed at one plant or a disruption at a key supplier halfway across the world, you’ll know about it. And you’ll know fast.

At the end of the day, underwriting semiconductor manufacturing plants is unlike underwriting almost any other industrial risk.

The exposures go far beyond physical assets. Business interruption, supply chain fragility, natural catastrophe sensitivity, and cyber risk often outweigh the cost of damaged equipment itself.

That’s why effective underwriting here requires more than standard checklists or property valuations.

Data, technical insight, and scenario-based thinking are essential, yes.

But they work best when paired with experienced judgment and a deep understanding of how fabs actually operate.

When strong risk analysis and informed underwriting are put together, insurers are better positioned to price accurately, structure the right coverage, and protect some of the most critical manufacturing assets in the global economy.