How Is AI Revolutionizing Vendor Fraud Prevention?

Key Takeaways:

With AI on the rise, vendor fraud is evolving faster than ever.

Companies now face increasingly sophisticated fraud attempts that can easily slip through manual checks. Traditional controls are simply not able to keep up.

The solution? Leveraging the same AI that creates risks.

While AI may drive new forms of vendor fraud, it can also serve as a powerful shield against it, helping teams mitigate fraudulent activity before it affects the bottom line.

In this article, we’ll explore five ways it can revolutionize vendor fraud prevention in your company.

Unlike humans, AI can scan transactions, vendor updates, invoices, and payment behaviors 24/7, without taking breaks or getting fatigued.

This enables it to spot anomalies the moment they appear, reducing the risk of fraud slipping through just because it was caught too late.

And speed matters more than ever, as slower payment rails, such as bank transfers, give way to methods that settle within seconds.

When money moves that quickly, anomaly detection has to move just as fast.

Soups Ranjan, co-founder and CEO of AI-risk firm Sardine, explains the difference perfectly.

He highlights that traditional payment methods provide a few hours to catch anomalies, allowing for a more relaxed approach to fraud prevention.

Real-time payments, however, remove that cushion entirely.

The only safe way to handle them is to adopt anomaly detection that operates in real time, too.

Illustration: Veridion / Quote: McKinsey

That’s exactly where traditional, non-AI fraud detection methods fall short.

They simply weren’t made for that kind of speed. Their pace matches slower, legacy payment methods, rather than the instant payments moving today.

In fact, a research paper published in the International Journal for Multidisciplinary Research found that traditional fraud detection methods face average delays of 12 to 24 hours.

Illustration: Veridion / Data: IJFMR

This is, without question, inadequate for real-time payments.

AI can address this issue by closing that gap almost entirely.

Unlike periodic audits or manual reviews, AI-powered systems can flag anomalies like unusual pricing, duplicate invoices, and altered bank details instantly.

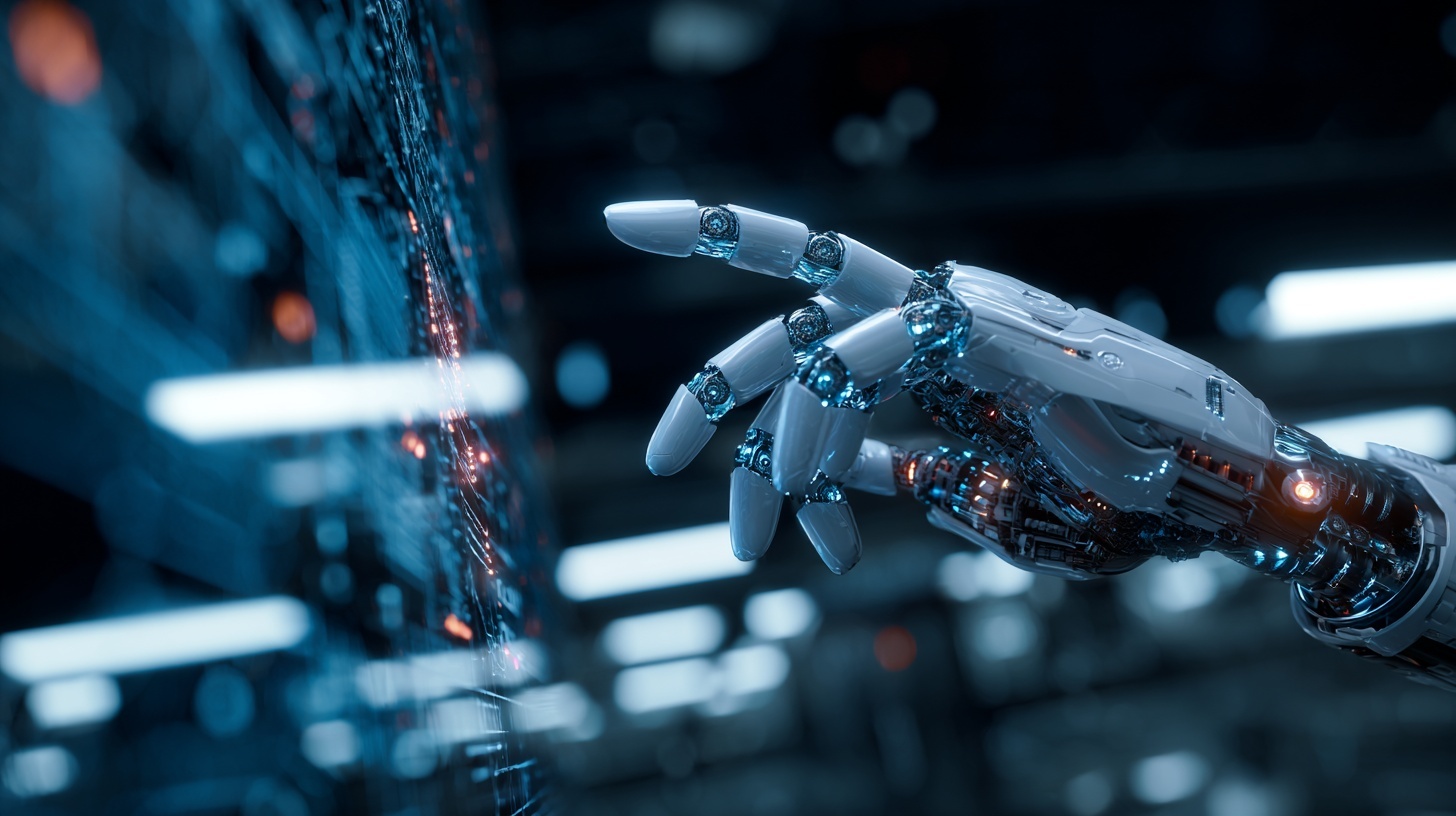

As another paper on AI-powered fraud detection explains, the process involves a series of sophisticated steps designed to detect anomalies with a high degree of accuracy.

These steps include real-time risk scoring of transactions, flagging those exceeding predefined fraud thresholds, and continuously learning from newly encountered fraudulent activities.

Additionally, AI can automatically trigger appropriate actions based on its findings, selecting the response that best matches the risk level.

Illustration: Veridion / Data: Preprints

So, AI systems don’t just detect anomalies in real time, but can also take autonomous action.

In some cases, that means human review isn’t even needed, further reducing the chances of fraud slipping through.

This is the kind of operational shift real-time payments demand.

Another way AI can protect your company is by automating vendor identity verifications (IDVs).

Unlike anomaly detection, this allows you to identify bad actors before they even attempt any fraudulent activity.

David Lomiashvili, CEO & co-founder of the IDV platform Identomat, clarifies what makes AI so good at it, especially compared to traditional, manual reviews.

First, there is speed.

AI accelerates IDVs, letting you catch fraudsters faster and take action immediately.

Second, there is accuracy.

According to Lomiashvili, AI achieves higher accuracy rates than traditional methods, making it more reliable for detecting suspicious activity.

Illustration: Veridion / Quote: Identomat

So, AI-powered IDV minimizes the risk of onboarding fraudulent suppliers while simultaneously allowing you to scale due diligence without added manual workload. It’s a win-win.

But how exactly does it work behind the scenes?

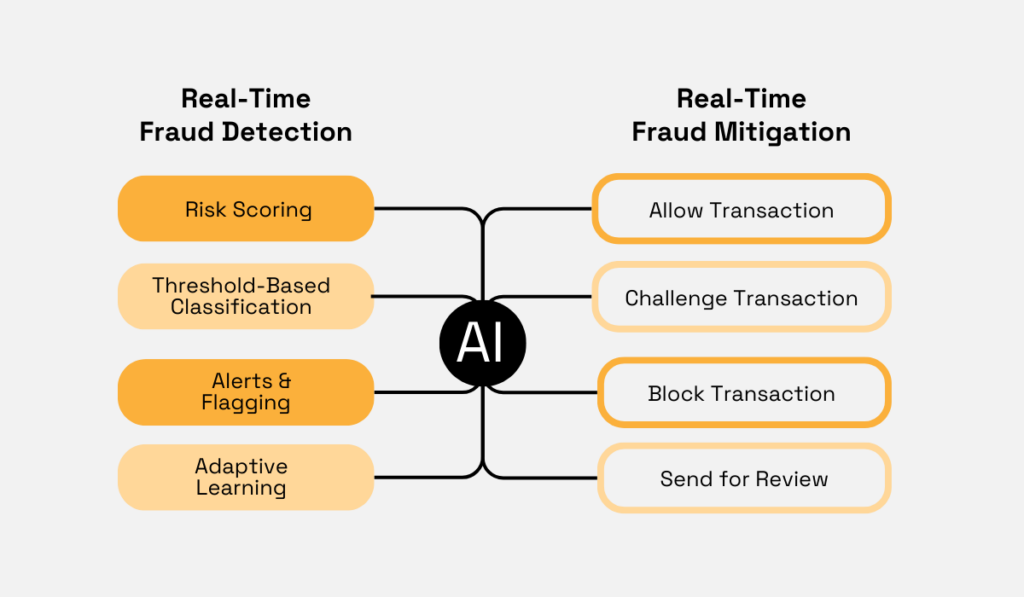

Lomiashvilli says that AI-powered IDV systems combine multiple technologies to verify identity, with the four core ones being:

The first step uses OCR to extract data from vendors’ ID documents.

Next comes biometric verification, which involves face matching and liveness detection.

This is crucial for preventing sophisticated spoofing attempts, including deepfakes.

The third step is checking document authenticity to detect tampering and forgeries, while the last layer cross-references the data with trusted sources.

Illustration: Veridion / Data: Identomat

Now, the first three steps can be done 100% internally, using nothing but vendor-submitted documents.

For OCR, systems simply extract the text from uploaded documents.

For biometric verification, they compare a live capture with the document photo.

And to check document authenticity, they analyze security features and perform AI-driven image analysis.

Data cross-referencing, however, cannot be done fully internally. You can’t “self-verify” the information from just the document alone.

To verify whether the data is real, correct, and up-to-date, the system must compare it to trusted third-party sources.

That’s where unbiased data providers like Veridion come in.

Source: Veridion

Veridion boasts a robust database covering over 134M companies and 1B products globally.

It collects more than 220+ data points on each vendor, from organizational hierarchy to technographics and ESG.

This allows you to not just verify identity, but also decide who you want to work with based on factual, objective data.

To collect this data, Veridion, too, leverages AI in its workflows.

More specifically, it uses AI to automate tasks such as de-duplication and classification to keep data accurate and usable.

Additionally, AI updates its database weekly, ensuring you work with the freshest, most complete information possible.

Source: Veridion

Integrating this data with your IDV system allows you to automate the workflow end-to-end, enhancing both accuracy and speed.

This is essential for reliable verification, not just before you partner with a new vendor, but on an ongoing basis, too.

Above, we discussed how AI can help confirm that the company or individual you’re engaging with is who they claim to be.

This step is usually performed during or just before vendor onboarding and is done only once.

Impersonation threats, however, pose continuous risks and seem to be on the rise.

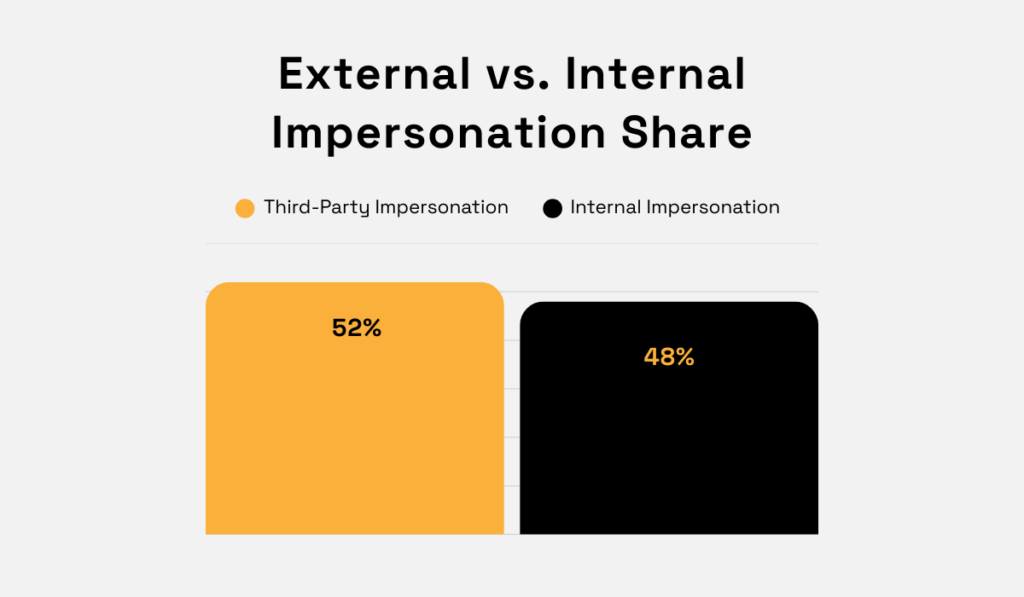

In fact, according to a 2022 study from Abnormal Security, emails impersonating external parties were more prevalent than emails impersonating internal employees.

Illustration: Veridion / Data: Abnormal Security

Now, add to that the rapid evolution of AI since the report came out, and the situation looks even bleaker.

AI is making impersonation threats even more sophisticated and more difficult to detect.

Fraudsters can now use AI-generated emails, cloned voices, and synthetic documents to impersonate real vendors, and it’s tough for humans to tell them apart from the real thing.

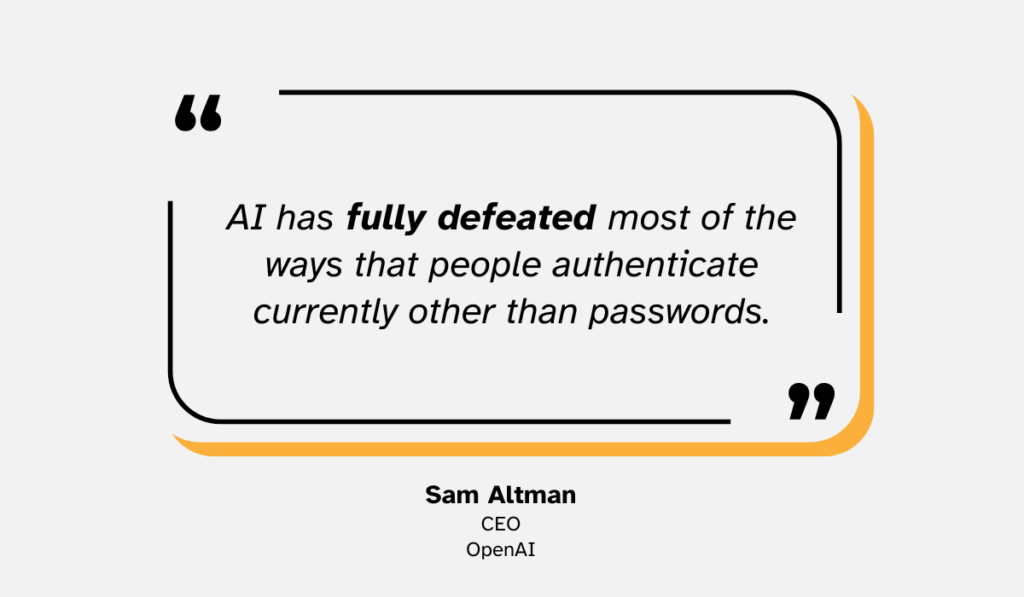

Even the CEO of the company behind ChatGPT, OpenAI, admits that AI-powered fraud is a major point of concern.

Speaking before the Federal Reserve, Altman confessed he worries that institutions are still using authentication methods that can easily be faked with AI, like voice prints and selfies.

These methods, he argues, must evolve together with AI-driven threats.

Illustration: Veridion / Quote: The Singju Post

The best way to approach this issue is to fight fire with fire.

In other words, companies should fight AI-powered fraud with AI-powered fraud detection and prevention methods.

There are several reasons why AI excels in this context, often outperforming human capabilities.

A Forrester Research analyst, Meng Liu, highlights its detection speed as being key.

As we already mentioned, contemporary fraud methods require real-time detection. AI is one of the rare technologies capable of providing it.

Others emphasize AI’s ability to predict and prevent fraud, rather than merely mitigate it, as its main advantage.

And yet, some experts are pointing to its adaptive learning capabilities and above-average accuracy in detecting AI-driven fraud.

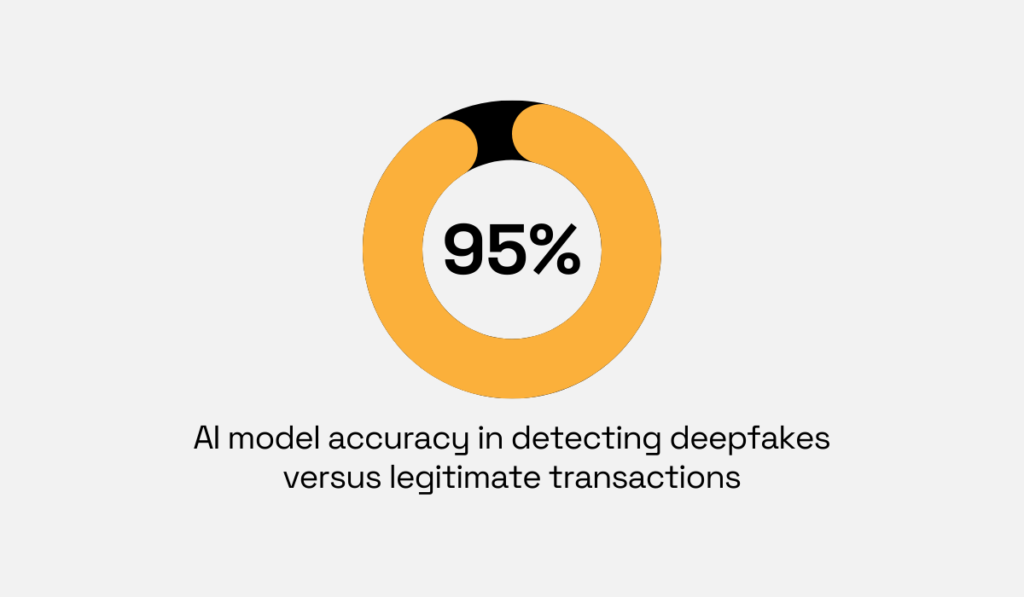

For instance, one research paper shows that AI models can detect AI deepfakes and fraud in online payments with 95% accuracy.

Illustration: Veridion / Data: ArXiv

In short, AI allows organizations to catch sophisticated impersonation attempts that human reviewers could easily miss.

This is becoming even more essential as deepfake fraud grows.

Beyond just detecting fraud risk, such as impersonation threats, AI can also actively reduce it by streamlining vendor risk scoring.

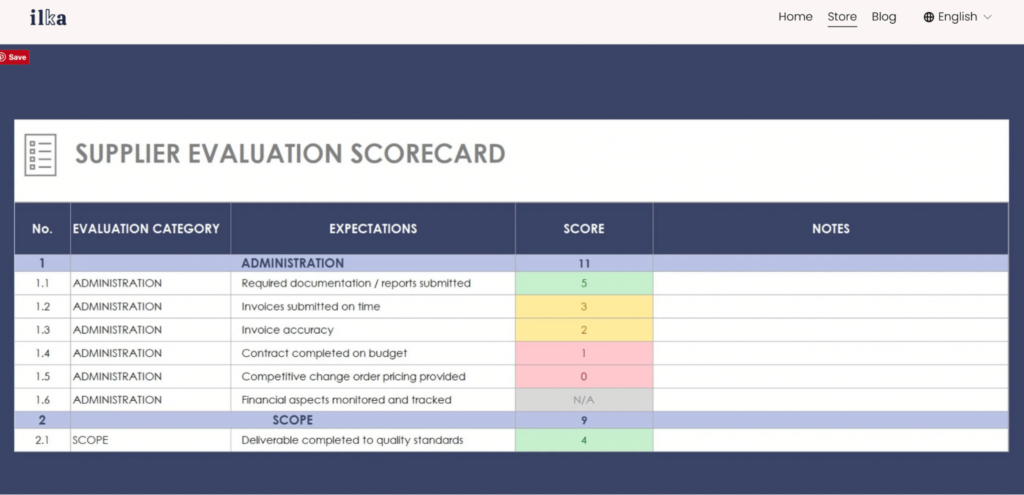

In general, vendor risk scoring is essential for identifying vendor-associated risks and helping teams prioritize risk mitigation workflows.

Source: Ilka

But AI-powered risk scoring is particularly beneficial due to its unique advantages.

Just like in previous instances, one that stands out is its ability to replace periodic assessments with continuous, real-time monitoring.

It can update scores automatically as new data appears, such as invoice changes, compliance issues, or suspicious communications, significantly reducing the time vendors remain in “blind spots.”

Secondly, AI can evaluate millions of data points to assign appropriate scores in minutes, far surpassing what human teams can process at scale.

Within that data, it can also detect patterns humans may miss, whether because they’re too subtle or because assessors are fatigued.

Source: Veridion

Thanks to these advantages, AI can significantly accelerate the process while providing more accurate risk scores.

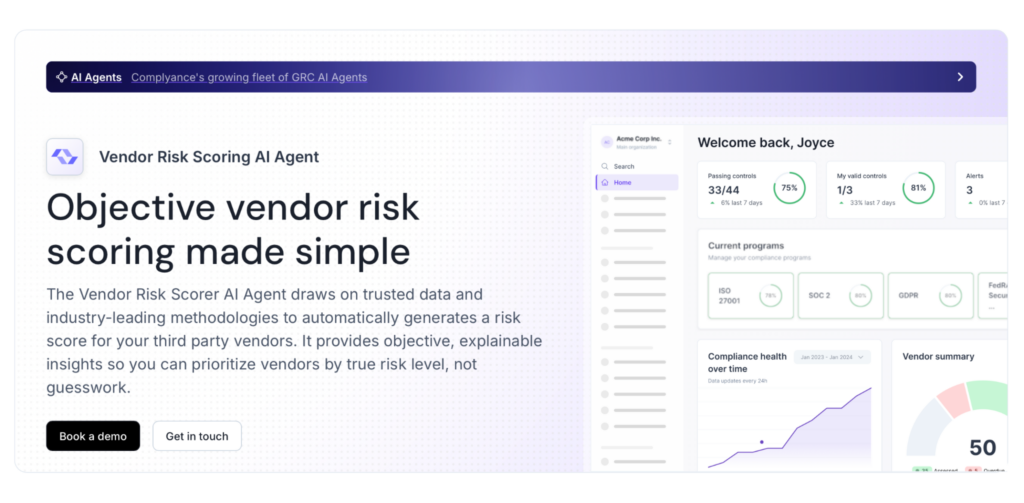

Take Complyance’s AI agent, for example.

According to the company, the agent automatically assigns risk scores to vendors based on aggregated third-party data and pre-defined methodology.

It never strays from this methodology, and it can act on updates in external data instantly.

But what makes it so reliable is that it justifies each score with clear, rational reasoning.

This allows both internal and external parties, like stakeholders and auditors, to manually review every decision and ensure transparency and accountability.

Source: Complyance

According to Complyance, this AI-driven approach has helped companies slash their vendor review cycles in half.

And this opens the door to many additional benefits.

For instance, it allows procurement, finance, and compliance teams to focus on more strategic tasks.

Since AI handles risk-based vendor segmentation, teams can go straight to addressing potential threats.

This could involve providing guidance to vendors, establishing tighter controls and audits, or something else entirely.

The bottom line is, they don’t have to waste time on admin work.

On top of that, such targeted risk management can even positively impact your profitability, as resources can be focused where potential fraud is most likely.

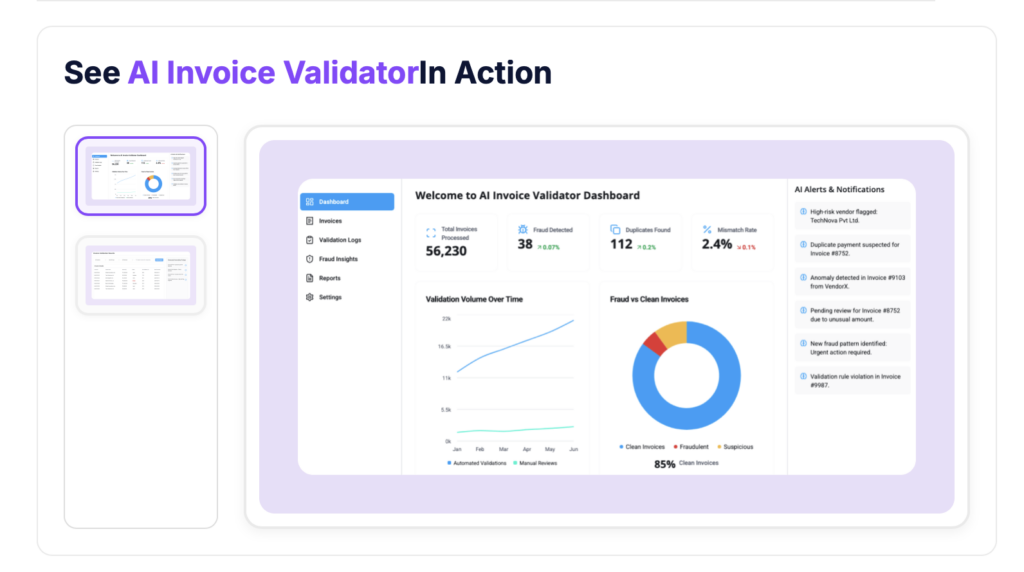

AI document analysis provides a critical safeguard against fraud and financial leakage.

Its impact is most obvious when applied to invoices.

Think of this as your final checkpoint, the last line of defense before a payment is made.

Even if earlier controls or reviews missed something, AI can catch anomalies just before money leaves your accounts.

To achieve that, tools like AI invoice validators automatically review invoices in three steps:

First, AI pulls critical information from invoices using OCR and natural language processing (NLP), capturing details like vendor information, line items, totals, and tax data.

Next, it cross-checks these details against supporting documents, including purchase orders, receipts, and vendor records, flagging any discrepancies or unusual patterns.

After that, the invoice finally enters the approval workflow.

If inconsistencies or potential risks are detected, the system routes the invoice to relevant personnel for review.

And if everything checks out, the invoice is automatically cleared for payment, ensuring funds are only released after full verification.

Kriatix’s invoice validator, for example, applies this exact logic.

Source: Kriatix

According to the company, by automating invoice analysis, the tool helps companies reduce invoice verification time by up to 80%, curb financial leakage, and prevent fraudulent and duplicate payments.

However, despite all these potential benefits, many companies are still wary of automating invoice processing.

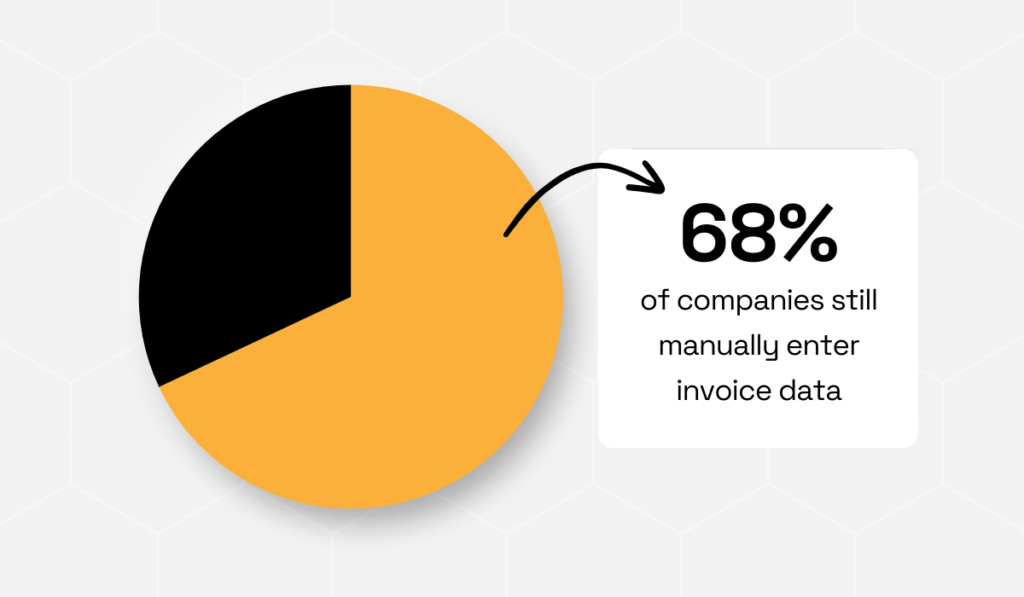

In fact, a 2025 survey from HighRadius showed that 68% of them are still manually entering invoice data.

Illustration: Veridion / Data: HighRadius

Even so, it’s obvious that AP teams are progressing toward automation.

As the same study notes, the percentage of fully automated AP teams has almost doubled in just two years, currently sitting at 20%.

So, the best course of action is to introduce automation, but perhaps to do so slowly. It might be best to start with less critical tasks and expand gradually from there.

Even a phased approach can deliver stronger fraud protection!

To echo a point we made earlier in this article, sometimes you have to fight fire with fire.

With AI-powered fraud becoming more prevalent and harder to detect, companies should adopt equally sophisticated AI fraud-prevention methods.

This article should give you a good idea of where in your company you could start implementing AI for this purpose.

Start taking action today, and put your best bet safeguard in place before fraud can strike.