How AI Can Be Leveraged to Advance Sustainability Data Analytics

Key Takeaways:

Are you confident in the sustainability data behind your business decisions?

As ESG expectations rise, many organizations are struggling to turn fragmented, inconsistent data into insights they can trust.

Sustainability is no longer just about reporting. It’s about strategy, risk, and long-term value.

This article explores how AI can help you build stronger sustainability data analytics, from collection to reporting.

If sustainability data feels overwhelming, that’s because it is.

ESG touches nearly every part of an organization, from emissions and energy use to labor practices, governance policies, and supplier behavior.

The data behind it lives across corporate disclosures, regulatory filings, company websites, news coverage, and third-party sources.

And it often does so in different formats, languages, and under different reporting standards.

If you’re responsible for pulling this information together, you’ve likely felt how quickly it becomes unmanageable.

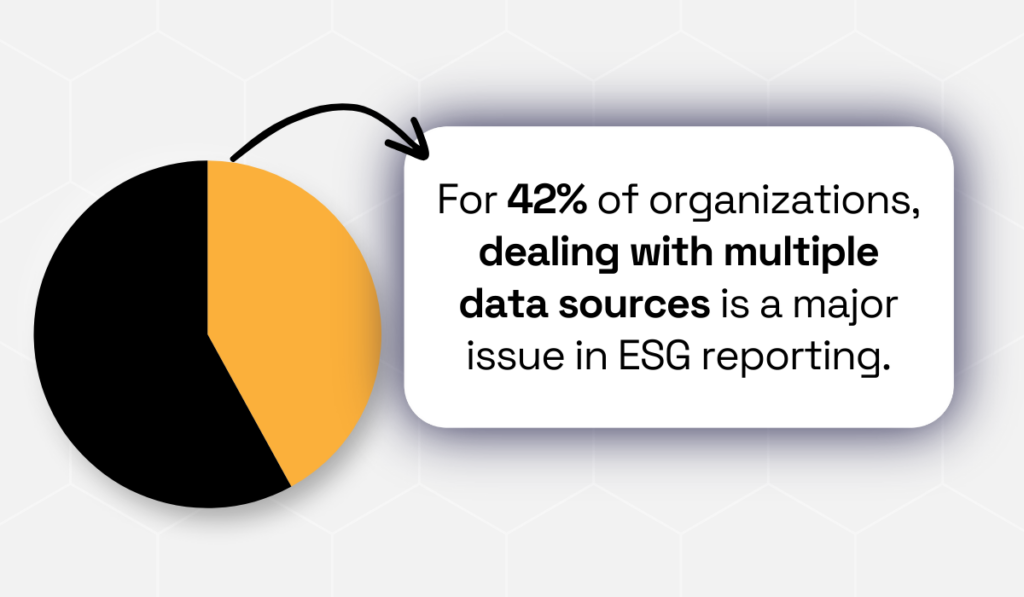

In fact, a 2025 BARC survey found that one of the biggest challenges organizations face in ESG reporting is dealing with too many unreliable and fragmented data sources.

Illustration: Veridion / Data: BARC

The problem isn’t a lack of sustainability commitment. It’s that the volume and complexity of ESG data have outgrown manual collection methods.

This is where AI fundamentally changes the process.

Instead of relying on periodic data pulls and spreadsheet-based workflows, AI-powered systems continuously collect sustainability data from both internal systems and external sources.

Natural language processing (NLP) models can read unstructured content, such as reports, websites, and news articles, and extract relevant ESG information automatically.

Machine learning models then standardize that data, translating inconsistent terminology, units of measurement, and reporting formats into structured datasets.

For example, AI can recognize that “Scope 2 emissions,” “indirect emissions from purchased energy,” and region-specific labels all refer to the same underlying concept.

This makes the data comparable across business units and geographies.

And the shift from manual gathering to automated, continuous collection is already underway.

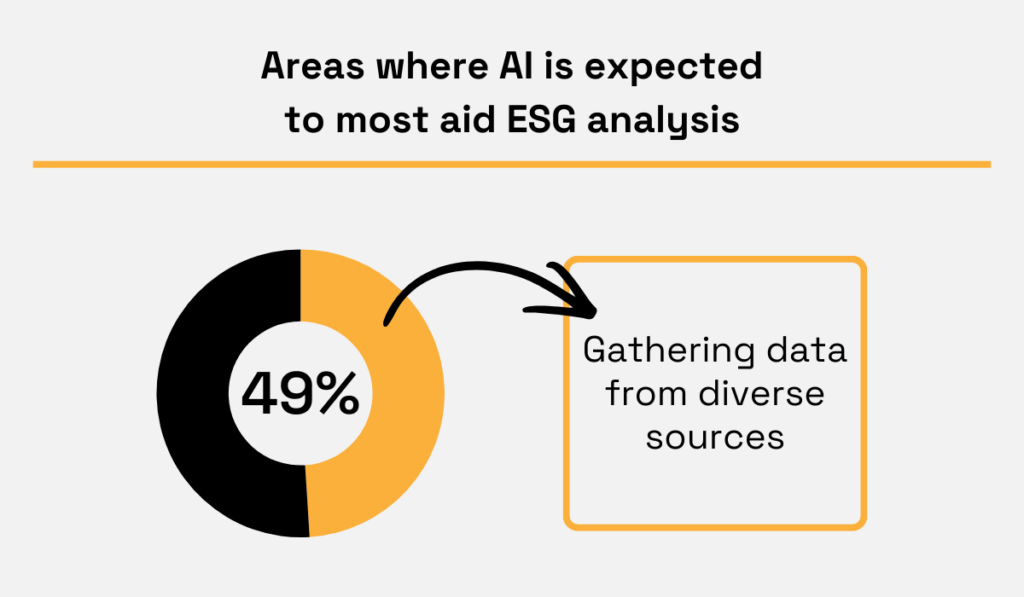

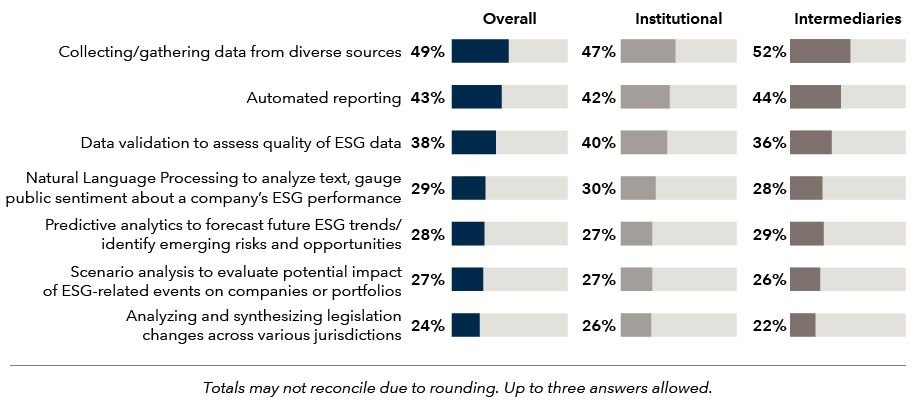

Research from Capital Group shows that nearly half of organizations expect AI to deliver the most value in ESG analysis by helping them collect and aggregate data from diverse sources.

Illustration: Veridion / Data: Capital Group

Without this kind of automation, it becomes increasingly difficult to keep sustainability data current, complete, and ready for analysis.

Collecting ESG data is only valuable if you can trust it, and many organizations can’t.

Data arrives late, key fields are missing, different sources contradict each other, and by the time issues are spotted, reporting deadlines are already close.

This is where AI makes a practical difference.

Instead of treating data quality as a manual clean-up step at the end of the process, AI checks data as it comes in.

In other words, as ESG data is ingested, machine learning models automatically assess it for common quality issues.

They can:

Because these issues are surfaced early, teams have time to investigate and correct them before they impact analysis or reporting.

AI also helps when data simply doesn’t exist.

In global supply chains, many private companies and suppliers do not publish detailed ESG disclosures.

Rather than leaving large gaps, advanced models can estimate key metrics using available information, historical data, and comparable companies.

These estimates don’t replace reporting, but they give you far better visibility than having no data at all.

This focus on data quality is one of the reasons organizations expect AI to play a bigger role in sustainability analytics.

Capital Group research cited earlier shows that data validation and quality assessment are among the top areas where AI is expected to support sustainability analysis.

Source: Capital Group

A real-world example shows how this works in practice.

EnerSys, a global industrial battery manufacturer, uses AI to improve the accuracy and auditability of its emissions data across 180 sites.

Site teams upload utility bills as PDFs, and AI extracts the relevant data, checks for inconsistencies, and flags anomalies.

As EnerSys sustainability leader Christina Sivulka explains, this approach has made data collection more traceable and auditable, while significantly reducing manual effort:

“[Once contracts are uploaded] the AI then extracts data such as date range, usage amount, cost, and units of measurement. The AI also flags anomalies and variabilities, which has been instrumental in helping us collect our data in a traceable and auditable way.”

When data quality improves, everything built on top of it becomes more reliable, from analytics and reporting to the decisions leaders make based on those insights.

ESG risks don’t wait for quarterly reporting cycles.

Controversies, compliance breaches, environmental incidents, or social concerns can appear overnight and escalate fast.

If you’re only checking reports once a quarter, you’re already behind, and that lag can cost reputation, revenue, or regulatory compliance.

AI changes the game by letting organizations monitor ESG risks almost as they happen.

AI-powered systems can continuously scan news outlets, social media, regulatory updates, and NGO reports for relevant signals.

Advanced models flag unusual patterns, emerging controversies, or deviations from expected ESG behavior, giving teams early warnings so they can investigate and respond before issues spiral out of control.

This is exactly what Veridion does at scale.

Source: Veridion

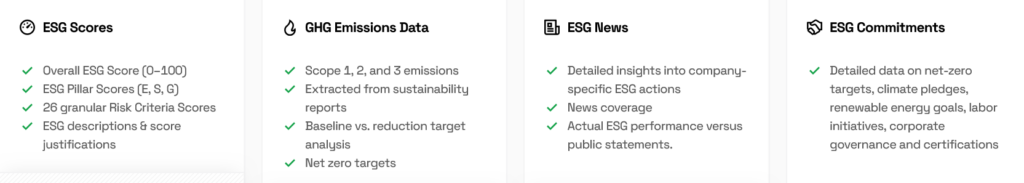

Veridion is a big data platform covering over 120 million companies across more than 250 locations, providing exceptionally rich company profiles that include:

Its AI and ML continuously update these profiles, ensuring that every change in a company’s operations, commitments, or public perception is captured.

That means your ESG data is always fresh, reliable, and actionable.

Here’s how it works in practice.

Veridion extracts and analyzes data from company websites, news sources, and public filings to make sure profiles reflect both what companies say and how they are perceived externally.

The platform classifies information using a rigorous ESG taxonomy organized into pillars, themes, and risks, and applies sentiment analysis to evaluate the tone and intent behind ESG actions.

Source: Veridion

This lets you see where commitments align with actual performance, not just where companies say the right things.

Profiles are further enriched with key context: company location, products, NAICS classifications, employee counts, and revenue.

The result is a dataset that is broad, deep, and accurate, capturing everything from overall ESG scores and granular risk criteria to Scope 1, 2, and 3 emissions, net-zero commitments, and evidence of real-world sustainability actions.

By combining structured ESG data with continuous updates, Veridion allows executives to monitor controversies, reputational risks, and operational changes in near real time.

For you as a decision-maker, this means faster, more confident responses to emerging ESG issues, better risk mitigation across your portfolio and supply chain, and a stronger foundation for strategy and investment decisions.

So, now you’ve collected your ESG data, and you’re monitoring risks in near real time.

Then what?

For most organizations, this is where things start to get messy.

You’re sitting on millions of data points across suppliers, facilities, products, and regions.

Dashboards look impressive, but actually figuring out what matters and what to do next is a lot harder.

This is where AI really starts to earn its keep.

Instead of just summarizing what already happened, AI looks for patterns across the data.

It connects ESG signals with factors like:

The kind of connections that are almost impossible to spot manually, especially at scale. In other words, it moves you from “here’s the data” to “here’s what this means.”

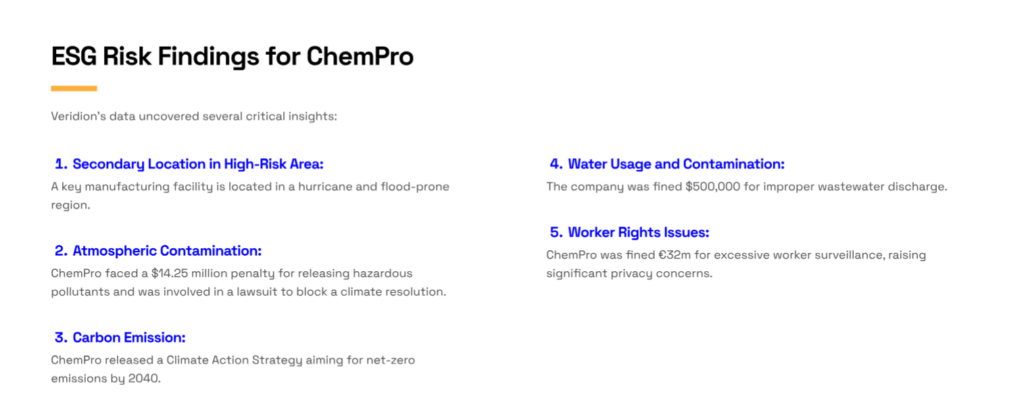

A good example comes from Veridion’s work with a commercial insurer underwriting a $50 million policy for ChemPro, a chemical manufacturer with a complex risk profile.

ChemPro’s operations included regulatory risks, prior litigation, high-risk manufacturing locations, environmental liabilities, and worker privacy concerns.

Source: Veridion

Evaluating all of that by hand would have meant pulling data from dozens of sources and trying to piece it together under time pressure.

Instead, Veridion used AI to pull together ESG data, news coverage, and operational context in one place.

First, it scanned global and local news, tracking ChemPro’s ESG initiatives and public commitments.

Then it analyzed the company’s products and services, highlighting chemicals that supported sustainability, like those used in renewable energy applications.

Next, it mapped all manufacturing locations, including a facility in a hurricane- and flood-prone region, and added financial and firmographic data to evaluate overall stability and exposure.

The insights were immediately actionable:

This is what AI-driven ESG analytics looks like in practice.

You’re not just reporting on sustainability or reacting to problems after they appear.

You use data to anticipate risk, make better decisions, and protect value, all while keeping sustainability front and center.

Collecting ESG data and analyzing it is important.

But at the end of the day, it all has to come together in clear, accurate, and timely reporting.

This is where many organizations still struggle.

Sustainability teams often end up pulling data from spreadsheets, emails, and disconnected systems, and then try to manually align everything with frameworks like GRI, SASB, or new EU regulations.

It’s slow, error-prone, and frustrating, especially when reporting should be supporting your strategy, not getting in the way.

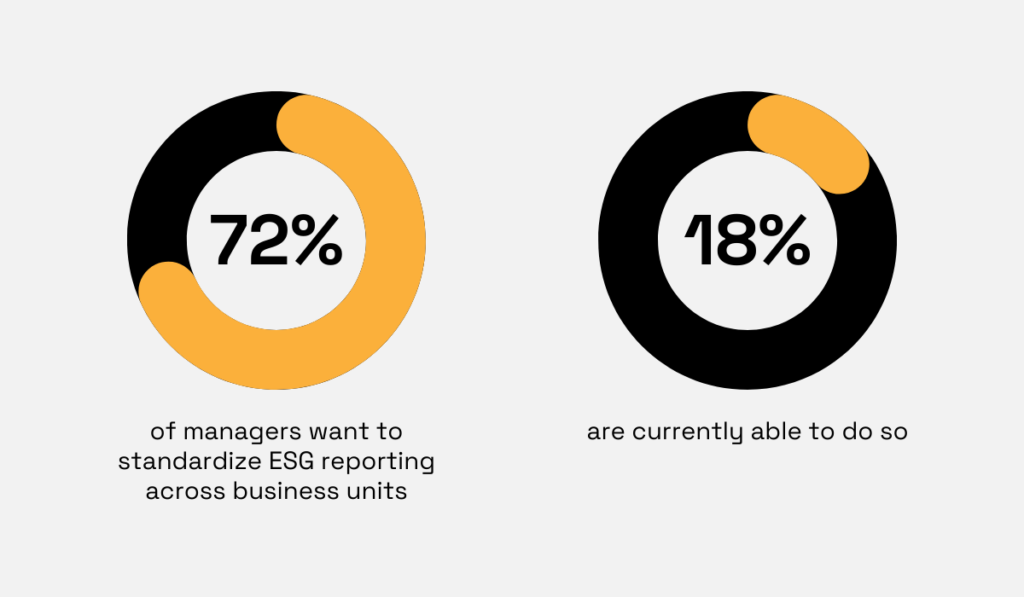

A Europe-wide study by Clearwater Analytics and Sionic found that 72% of managers want to standardize ESG reporting across business units, yet only 18% are currently able to do so.

Illustration: Veridion / Data: CWAN

That gap is exactly where AI makes a difference.

AI-powered reporting tools automatically pull ESG data from across the organization, categorize it, and map it to the right reporting frameworks.

Instead of manually checking every data point, teams can review, validate, and focus on the insights that actually matter.

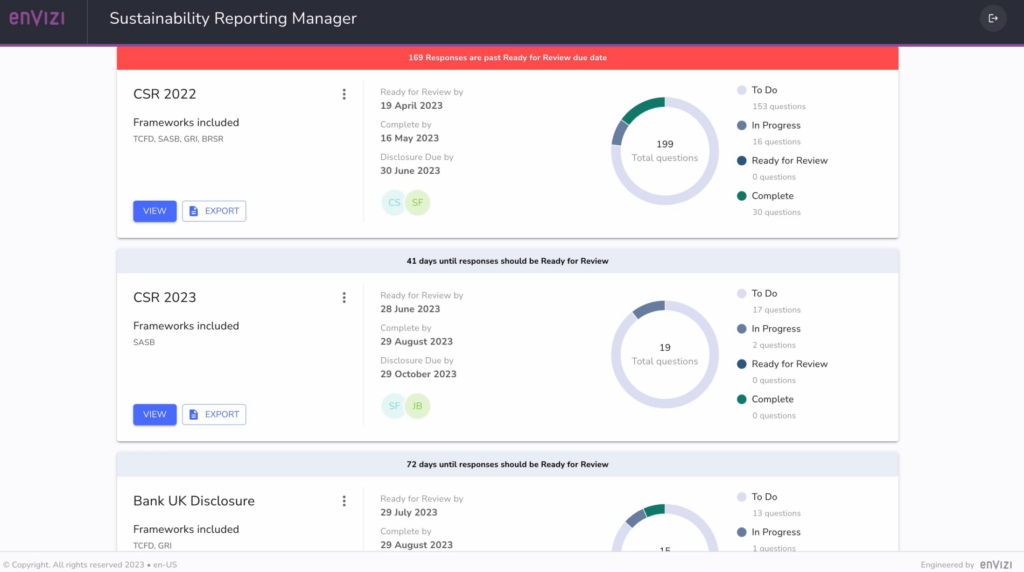

A good example is IBM’s Envizi ESG Suite.

Source: IBM

Downer Group, a global provider of transportation, utilities, and facilities management services, had been relying on massive Excel files to track greenhouse gas emissions across its decentralized operations.

Compiling the data manually took time, introduced errors, and made it hard to get a consistent view of performance.

With Envizi, Downer was able to ingest more than 20 million lines of data from 33,000 suppliers into a single, centralized system.

AI tools automatically categorized emissions data, including complex Scope 3 data, and generated reports aligned with multiple ESG frameworks.

The impact was immediate.

Data categorization errors dropped from 50% to 5%, and the time spent on monthly reporting was cut in half.

As Nathan Brogden, Group Manager of Climate and Sustainability at Downer, put it:

“With Envizi, we’re able to set a science-based target and actually track our performance against it… We can compile all the needed information into a sustainability report and clearly show the market—and any auditors—not only our output, but also the emissions accounting that supports these disclosures.”

The benefits go beyond speed and accuracy.

Automated ESG reporting makes it easier to respond to regulatory requirements, answer stakeholder questions, and track progress against sustainability goals.

Teams can quickly spot anomalies, update disclosures, and adapt reports as standards evolve.

It’s no surprise, then, that AI is becoming central to this process.

According to the aforementioned Capital Group research, 43% of organizations expect AI to automate sustainability reporting.

Illustration: Veridion / Data: Capital Group

In practice, AI turns sustainability reporting from a manual, high-stress task into a strategic advantage that supports better decisions, stronger accountability, and real progress.

AI is transforming how organizations handle sustainability data, from collection and quality control to risk monitoring, advanced analytics, and automated reporting.

By leveraging AI, you can turn mountains of ESG information into actionable insights, respond faster to risks, and make reporting more accurate and strategic.

The result is compliance, real impact, smarter decisions, and credible ESG performance.