5 Ways to Automate Strategic Spend Management

Automating strategic spend management is a surefire way to boost your operational efficiency, eliminate mistakes, and improve your financial performance.

But how do you do it?

How do you automate such a complex process?

In this article, we’ll show you exactly how.

We’ll break down the entire process, step by step, share insider tips from industry experts, and provide actionable tips to help you succeed.

By following this guide, you’ll transform the way you manage your spending and unlock impressive results in no time.

Digitizing your expense records eliminates the need for manual data entry and reporting, saving you valuable time as well as slashing the risk of costly human error.

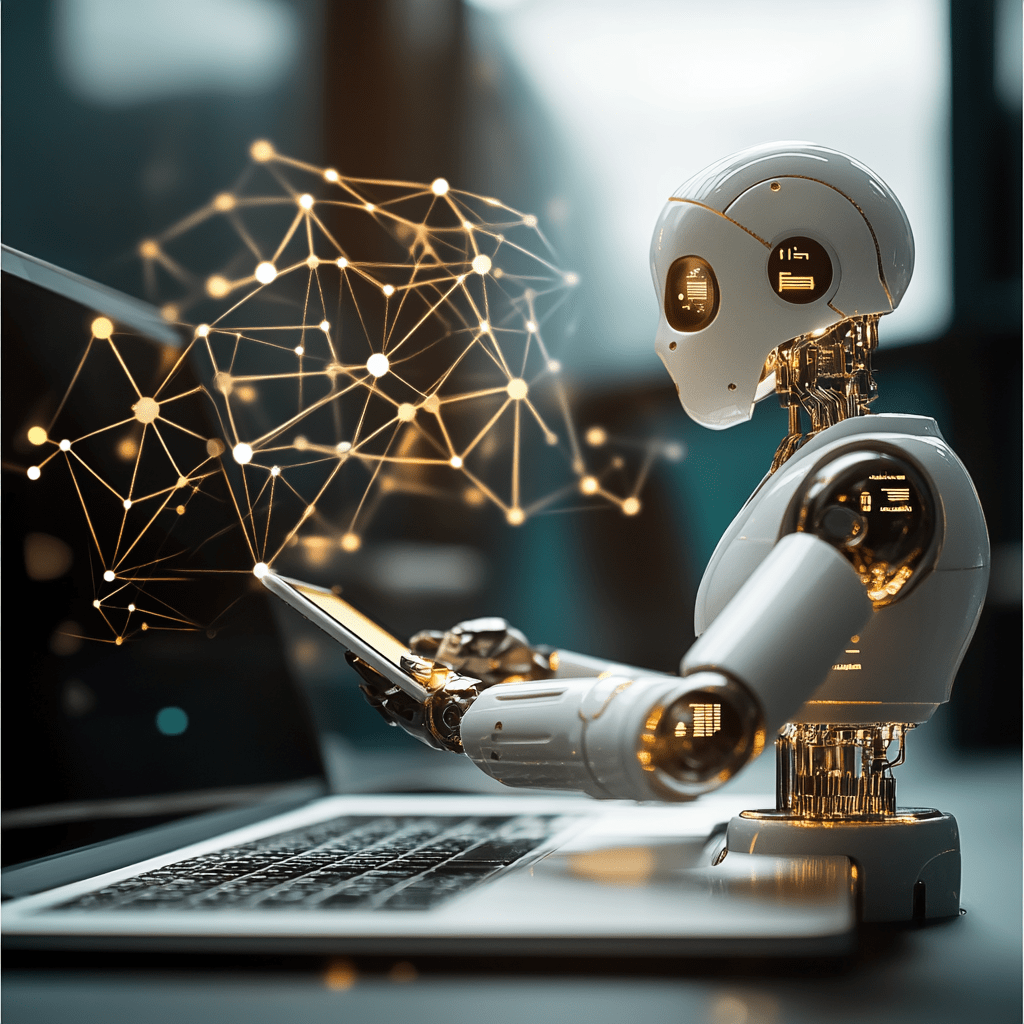

According to a 2024 Payhawk survey, some of the biggest challenges in spend management are precisely the mistakes employees make, clunky processes that waste time, and a lack of real-time visibility into spending.

Illustration: Veridion / Data: Payhawk

By going digital, you can tackle these issues head-on.

Expense reports get done in seconds and you get to access all your information from anywhere with an internet connection.

Spend management software is definitely your best option when it comes to digitizing your records.

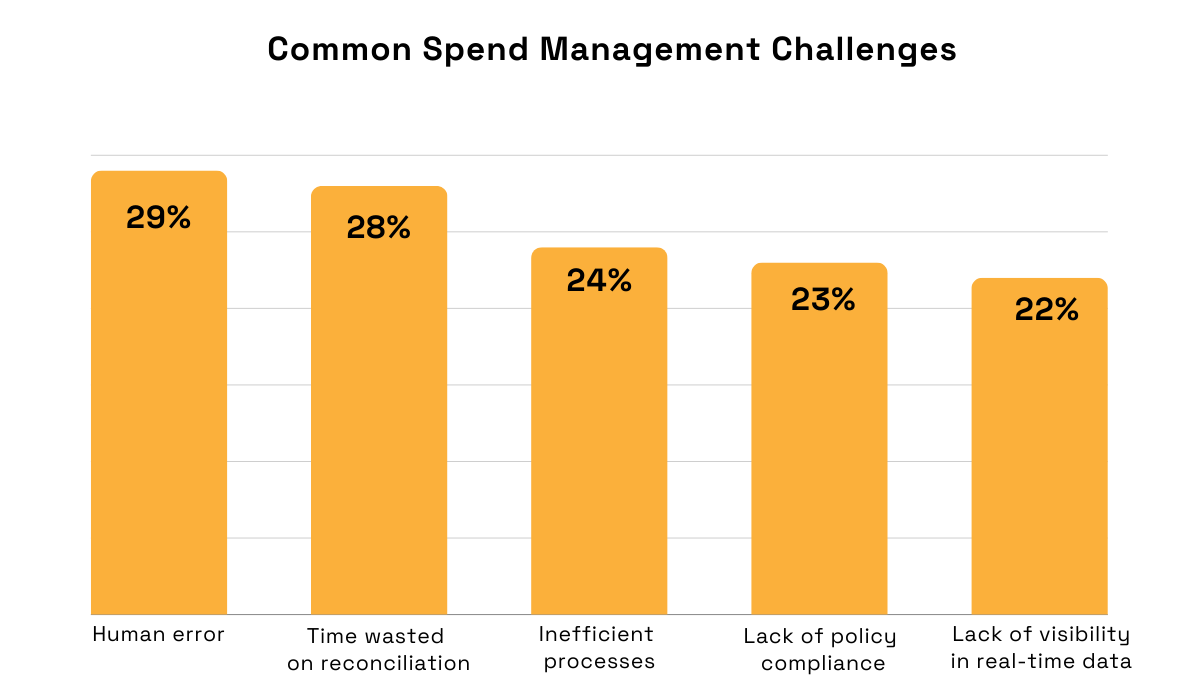

These solutions come with a wide range of features specifically designed to help you input and track expense data with ease.

For example, they consolidate all company credit cards and costs in one place and then match them with corresponding invoices.

Source: Spendesk

Not only that, but they also allow you to oversee the entire invoice management process, from the moment a purchase order request is made to the final payment.

As invoices get approved, your budget updates automatically, giving you real-time insights into exactly how much is being spent and where.

Plus, the software ensures the information is securely stored in the cloud, minimizing the risk of loss or damage to physical files.

But now, the question is: with so many options out there, how do you choose the perfect spend management solution for you?

Here are a few things to keep in mind:

| Features | Make sure the system has everything you need, like automated expense capture or customizable approval workflows |

| Ease of Use | Check if the interface is intuitive enough for your team and what kind of customer support is available |

| Cost | While these tools can save you a ton of time and money in the long run, they should still fit within your budget |

| Reviews | What are other users saying? Don’t just take the vendor’s word for it |

| Free Trial | If there’s a free trial available, take full advantage of it to see if the system is a good match for you |

With a bit of careful research, you’ll find the ideal solution in no time.

And your records?

They’ll be accurate, complete, and always up-to-date, establishing the foundation for fully automated and efficient strategic spend management.

Another big aspect of spend management automation is implementing a system that tracks what your staff spends or procures and then ensures it complies with your spending policies.

Put simply, spending policies are rules and guidelines an organization sets to manage employee expenses incurred during their work.

But what happens if you can’t enforce these rules?

You risk various operational inefficiencies and, in some cases, fraudulent expense reports or company credit card abuse.

Take, for example, the case of Bank of America (BofA) back in 2019.

Their tech stock analyst allegedly charged personal expenses at an adult entertainment venue to his BofA corporate credit card, costing the company approximately $21,000.

That’s quite an expense.

Anant Kale, CEO of AppZen, an AI-powered expense management solution, warns how costly corporate expense abuses can be:

“Expense reimbursement fraud comprises 17% of all business fraud in this country, costing U.S. businesses billions of dollars per year. That’s real money and, for large corporations, could translate to millions in losses each year.”

These abuses don’t cost you just money, but sometimes your reputation too, as we’ve seen with the BofA situation.

Even in less extreme cases, the violation of spending policies can still be problematic, forcing the accounting to validate every expense and potentially causing bottlenecks in your operations.

So, how do you enforce them?

The answer, yet again, lies in spend management software.

These systems do more than simply organize and update expense records. They also help implement controls to keep your team’s spending in check.

They usually include features that automatically verify transactions, flag non-compliant expenses, and sometimes even auto-lock credit cards for non-compliant employees.

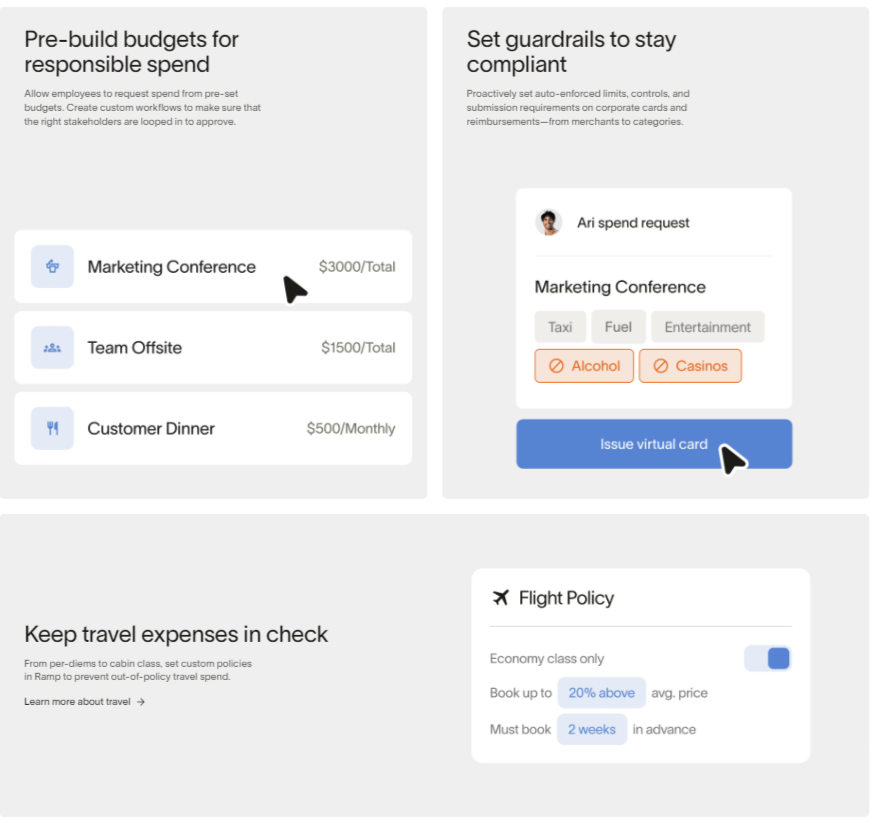

One example can be seen below.

Source: Ramp

Besides, they offer customizable approval workflows and allow users to set automatic limits or submission requirements on corporate cards and reimbursements.

So yeah, they do require a bit of manual setup, but after that, the rest is automated and you have more control over corporate spending.

Essentially, these solutions ensure nothing slips through the cracks so you can be confident that all the activities align with the company spending guidelines.

Next, integrate the tools used by your financial and procurement departments to ensure full visibility over data and prevent information silos.

Doing so improves communication between these two functions, ensuring that important data and documents—like invoices, pending approvals, and more—are automatically shared.

The result?

A single source of truth that brings significant benefits.

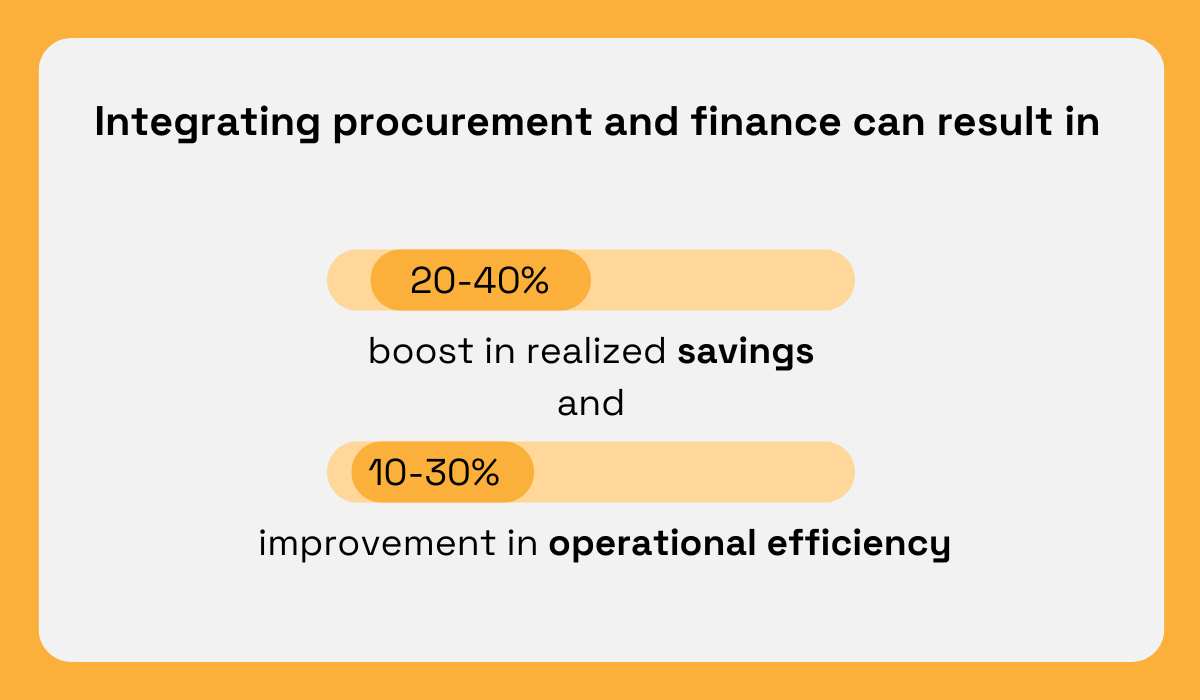

For instance, according to Deloitte, aligning procurement and finance can lead to a 20% to 40% increase in realized savings, a 10% to 30% boost in operational efficiency, and a better end-user experience.

Illustration: Veridion / Data: Deloitte

But, on the other hand, failing to integrate the two systems doesn’t just mean missing out on these benefits.

It can also result in serious operational issues, like, for instance, late payments to suppliers.

This, in turn, causes significant damage to supplier relationships, with vendors potentially refusing to deliver products until they’re paid or even choosing not to work with your company at all.

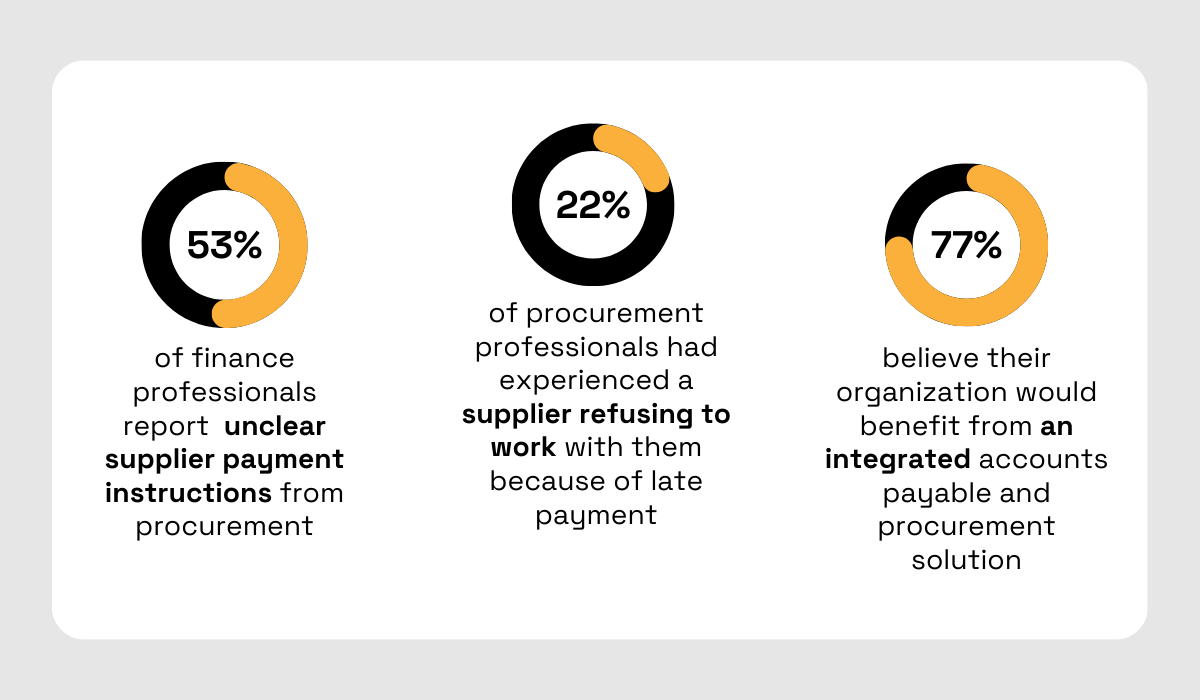

A survey by Medius sheds more light on this problem.

Apparently, 53% of finance professionals report receiving unclear supplier payment instructions from procurement.

At the same time, 22% of procurement professionals say they had experienced suppliers declining to work with them due to late payments from finance, forcing them to opt for more expensive alternatives.

Illustration: Veridion / Data: Medius

However, both functions seem to agree on one thing: the solution to this problem is investing in the integration of their tools.

Therefore, be sure that your digital solutions can support efficient communication between procurement and finance.

For example, Source-to-Pay (S2P) software will provide you with connected tools for PO management, invoice submissions, and catalog and rate card management, which can all be viewed on a single platform dashboard.

This means that, as procurement generates purchase orders and contracts, finance departments are immediately notified.

Plus, suppliers can submit invoices directly through these platforms, where they are automatically matched with purchase orders and delivery receipts.

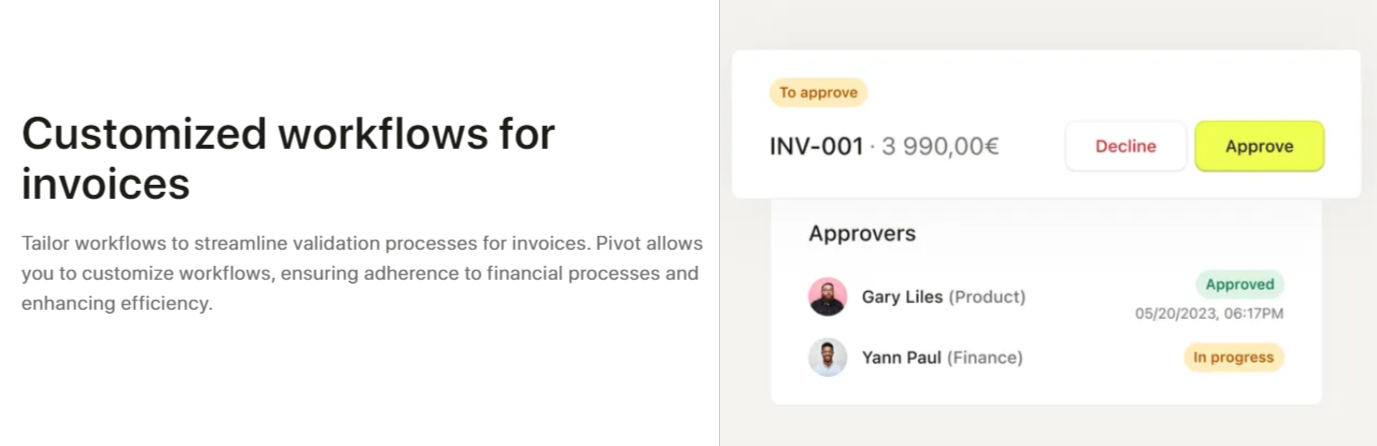

And once the invoices are approved, finance can easily process payments through the very same system.

Source: Pivot

The ultimate goal here, essentially, is to establish a single source of truth for both departments, providing everyone with access to relevant, up-to-date information and enabling them to work through a unified system.

If you manage to achieve that, you’ll see an immediate improvement in both your operational and financial performance.

Categorizing your expenses is very important for understanding your spending.

It allows you to allocate resources strategically, budget more accurately, and keep your costs under control.

Moreover, it helps you identify critical items or major cost centers, which can then inform your procurement strategies and potentially drive some of your expenses down.

Sigbjørn Nome, the CEO & Co-Founder of the sustainable procurement platform Ignite, agrees:

“Classifying, or categorizing, your spend into categories is important for several reasons. One obvious reason is the prioritization of resources. Large spend categories with a significant potential for cost reduction should naturally be prioritized, compared to smaller categories with a lower potential.”

However, creating a clear category structure and making sure everyone adheres to it can be a bit tricky.

With the wide variety of different costs coming in on a daily basis, it’s all too easy for categories to get mixed up and for expense reports to be filed incorrectly, leaving you with an inaccurate picture of where your money goes.

This is why automating your expense categorization is a much better solution.

For that, you’ll need a spend or expense management system.

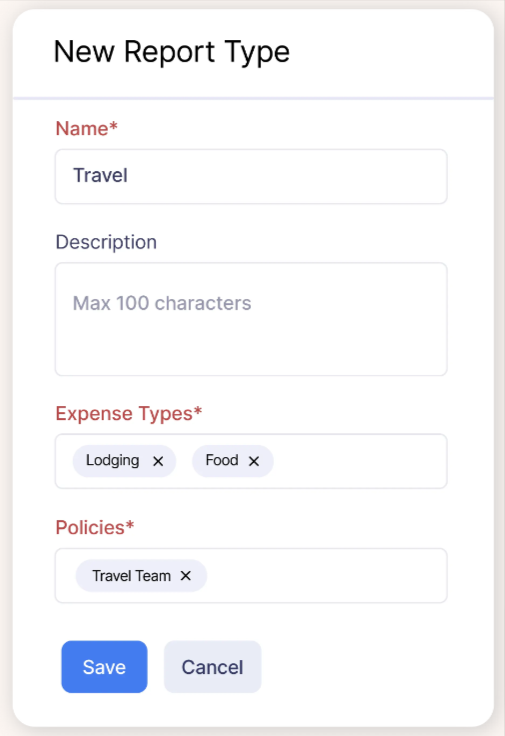

As you can see in the example below, these tools allow you to define what transactions fall under specific groups, ensuring that when employees report expenses, they can only select the appropriate categories or “types”.

Source: Zoho Expense

This contributes to more accurate reporting as well as enforces compliance with your spending policies.

Systems with AI capabilities can even gather information from your financial activities and then recognize types on their own, based on merchant or transaction data.

For instance, if you upload an invoice from a hotel, the system could immediately classify it under “travel”.

Of course, you can always set your own parameters and rules for these categories

In short, by automating this part of spend management, you remove confusion and ensure consistency in expense reporting.

As a result, you get a much clearer view of your spending, which is absolutely necessary for the next and final step we’ll cover.

Spend analysis involves examining a company’s expense data, all with the goal of better understanding how money is being spent, improving procurement strategies, and, of course, maximizing cost savings.

This process focuses on answering several key questions:

Source: Veridion

We’re talking about an extremely in-depth evaluation here, so attempting to conduct it manually may not be the best idea.

One simple mistake, like a typo, and your whole analysis could be thrown off course.

Automated spend management solutions, on the other hand, can perform spend analysis for you—and with far better accuracy.

They collect data from various sources, like invoices and credit card transactions, and then examine and interpret it.

But they don’t present you with just raw numbers.

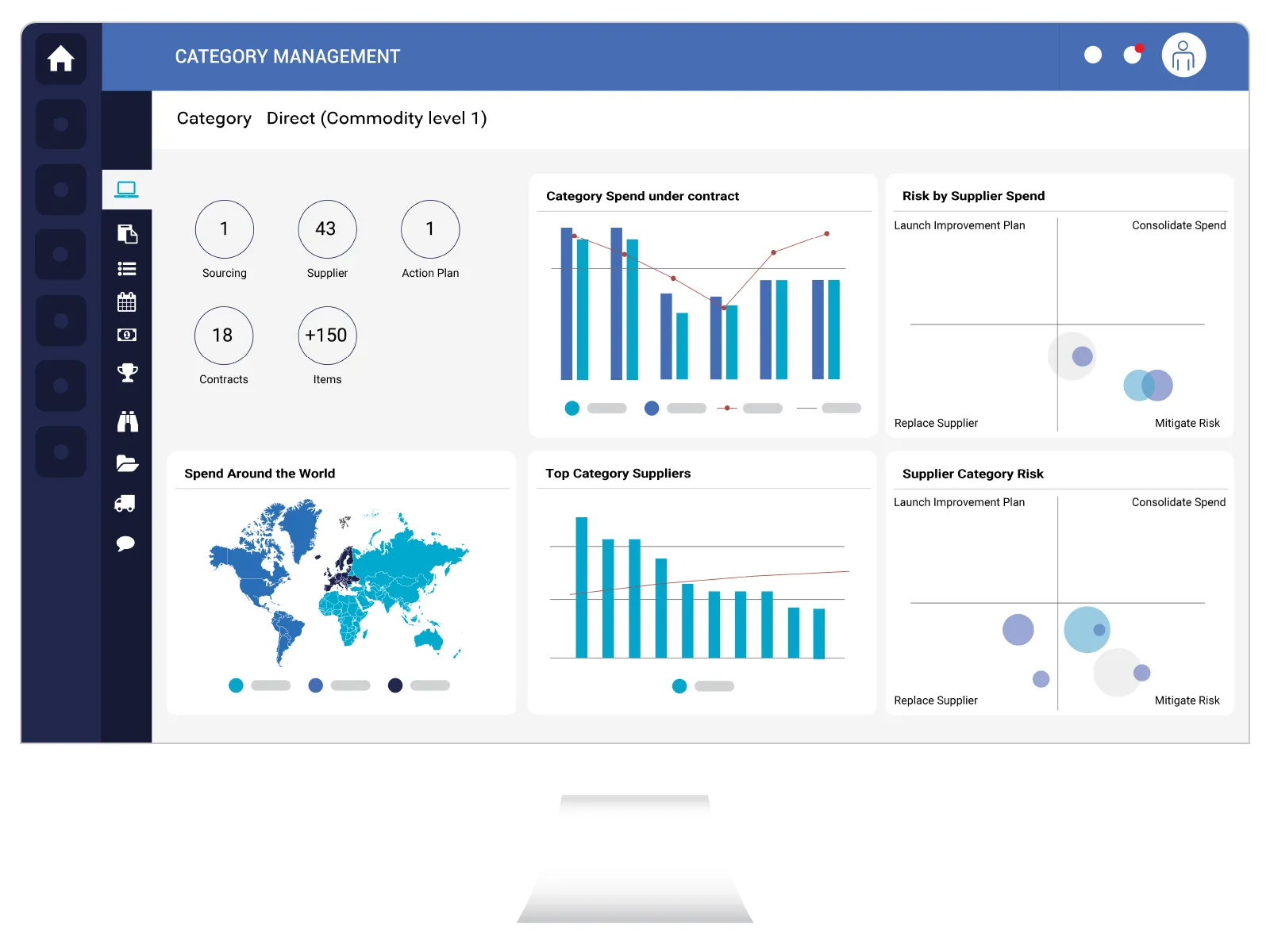

Thanks to their reporting features, you get actionable insights depicted in an easily understandable way, through colorful charts and diagrams, like in this example from Ivalua.

Source: Ivalua

Suddenly, you have a clear and complete picture of where your money is going, which is the foundation of smarter financial and procurement strategies.

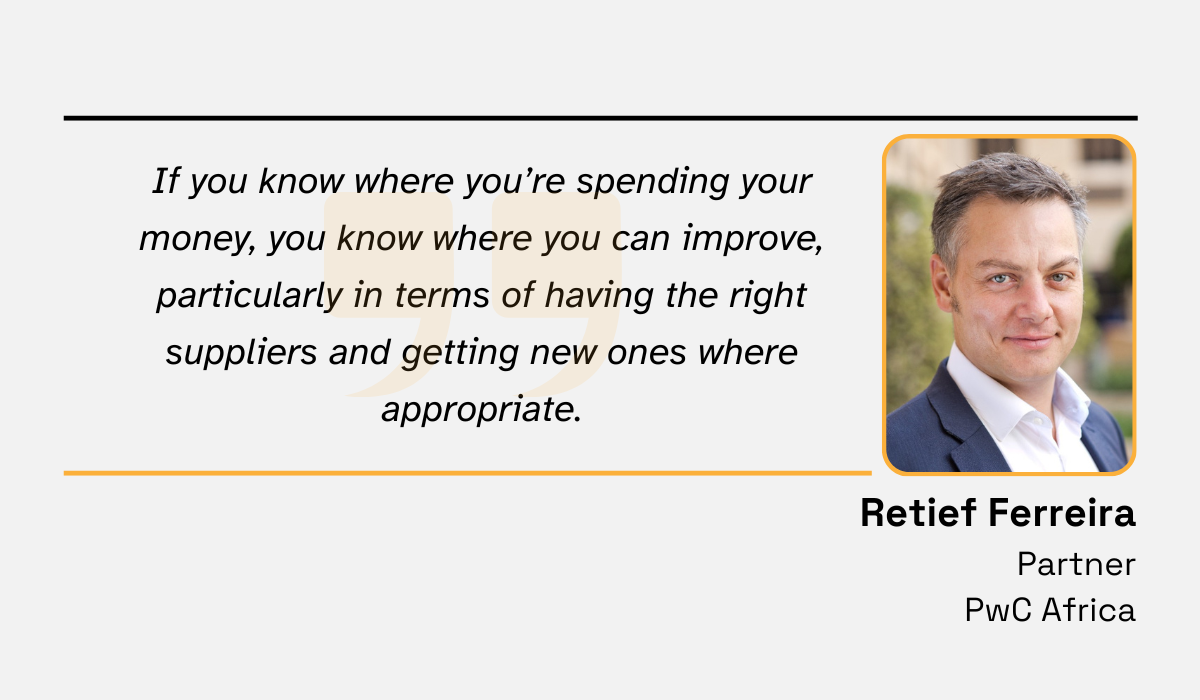

Retief Ferreira, Partner at PwC Africa, an organization providing assurance, consulting, risk, tax, and legal services, agrees with that notion.

Illustration: Veridion / Quote: SAP

That’s right, spend analysis can be a great way to uncover suppliers who are becoming significant cost centers.

And based on those insights, you may try to renegotiate contracts or even explore new, more cost-effective options.

Today, that’s easier than ever before.

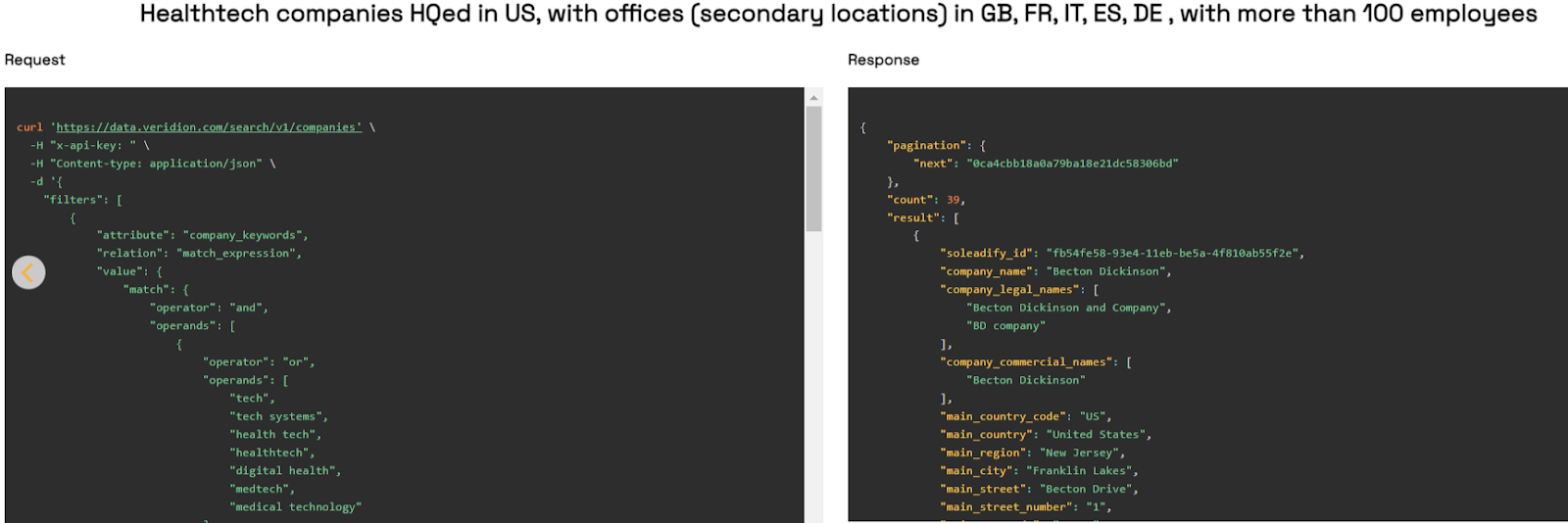

With an AI-powered supplier discovery tool like Veridion, for instance, you can find cost-effective suppliers in no time.

Leveraging Veridion’s Complex Search API, your team can specify your exact requirements and explore a global database with over 60 data points on more than 80 million companies.

Source: Veridion

Within minutes, you are presented with a variety of potential candidates that perfectly align with your product, sustainability targets, and other criteria.

But don’t forget: in order to make such improvements, you must first identify spending patterns and areas for cost savings through effective spend analysis.

Without this step, you essentially work in the dark, unaware of how you can optimize your operations to drive better financial outcomes.

Congratulations!

You know now how to automate spend management for making strategic decisions.

Isn’t it amazing how much can be achieved with a digitized process?

You can streamline various procedures, minimize errors, spot opportunities for cost savings, and so much more, all within moments.

And the benefits?

Too many to count.

But should you achieve this, expect significant cost savings, better supplier relationships, and smoother operations.