Key Benefits of Automating Insurance Underwriting

Key Takeaways:

Underwriting shouldn’t be a bottleneck.

Yet too often, it remains stuck in an outdated era of long forms, repeated questions, slow turnaround times, and unclear decisions.

Behind the scenes, underwriters juggle fragmented data, manual reviews, and outdated systems, all while managing rising submission volumes and increasingly complex risk.

Automation changes this dynamic by bringing intelligence, real-time validation, and workflow orchestration into the heart of underwriting.

This article explores the key benefits of automating insurance underwriting and why the insurers that modernize now will define the future of the market.

Let’s start with the first key advantage: speeding up decisions without sacrificing accuracy.

Underwriters today are under pressure to deliver high quote volumes while remaining focused on quality risk selection.

More than 400,000 new businesses are registered each month in the US, reinforcing the urgency for insurers to accelerate underwriting and quote turnaround times.

If your business still depends on manual processes and legacy systems, it’s unfair to expect your underwriters to manage heavy insurance data workloads and still deliver fast, accurate quotes.

Manual underwriting processes, such as data gathering, document review, and repetitive risk calculations, often stretch decision timelines from days into weeks.

Let’s imagine you’re a regional commercial insurer underwriting a multi-location manufacturing business.

Under a traditional manual workflow, the submission arrives with dozens of attachments, including:

You must manually extract company details, verify legal entities, confirm operating locations, review business activities, and cross-check everything against third-party sources.

In practice, this means jumping between emails, PDFs, spreadsheets, internal systems, and external databases.

Even for a straightforward risk, the process can take several days, whereas complex accounts could easily take up to two weeks.

Such slow response times lead to missed opportunities, disgruntled customers, and lost revenue. These are bottlenecks your business can’t afford to handle.

Automation dramatically shortens underwriting cycles.

The result?

Faster decision-making for your business.

Tony Tarquini, an insurance industry veteran and Director of Strategy at Synapse Ecosystems, rubberstamps this:

Illustration: Veridion / Quote: Insurance Thought Leaders

Therefore, he goes on to explain, there is a clear need for data-driven insights and greater efficiency through automation across the entire risk lifecycle.

Modern automated underwriting systems can ingest and analyze both structured and unstructured data, including financial statements, business profiles, operational records, and third-party datasets, in minutes.

This allows underwriters to assess risk, validate exposures, and generate accurate quotes far more quickly, without sacrificing underwriting quality or control.

This is where Veridion comes in as an ideal automation partner for commercial insurers.

It fits in as a data intelligence layer for pre-verified firmographic, operational, financial, and corporate structure data at scale.

Source: Veridion on YouTube

Veridion structures its data across five levels to provide critical insights that empower underwriters to make accurate and timely decisions:

| Business Firmographics | Legal names, addresses, and official identifiers |

| Location Data | Number and distribution of operational sites |

| Business Activities | Detailed descriptions and operational tags |

| Risk Exposure Flags | Indicators to identify and assess potential risk factors |

| Industry Classifications | NAICS, SIC, ISIC, and insurance-specific codes |

Once underwriters receive customer submissions, Veridion validates legal entities, confirms locations, maps subsidiaries, and standardizes business activities, all in a matter of minutes.

Source: Veridion

In other words, instead of spending hours validating business identities, locations, ownership structures, and activities, your underwriting team can move directly from submission to risk evaluation without compromising risk accuracy.

By removing friction from data validation and enrichment, Veridion helps you issue quotes faster, respond to brokers in real time, and compete more effectively in markets where speed is now a critical differentiator.

Underwriter productivity is one of the biggest casualties in a traditional manual underwriting workflow.

Low-value, repetitive activities absorb up to half of an underwriter’s working day.

Instead of utilizing their skills on high-impact risk analysis, they spend their most productive hours manually reviewing PDFs, chasing missing information, and reconciling data across multiple systems.

According to Hyperexponential’s State of Pricing report, underwriters spend an average of 3 hours per day on manual processes and up to 10 days on peer review.

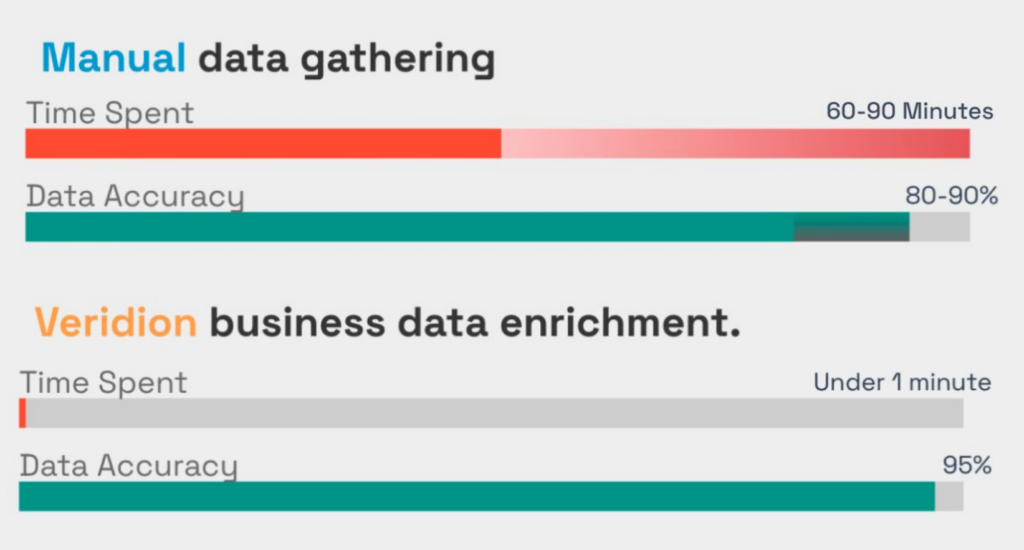

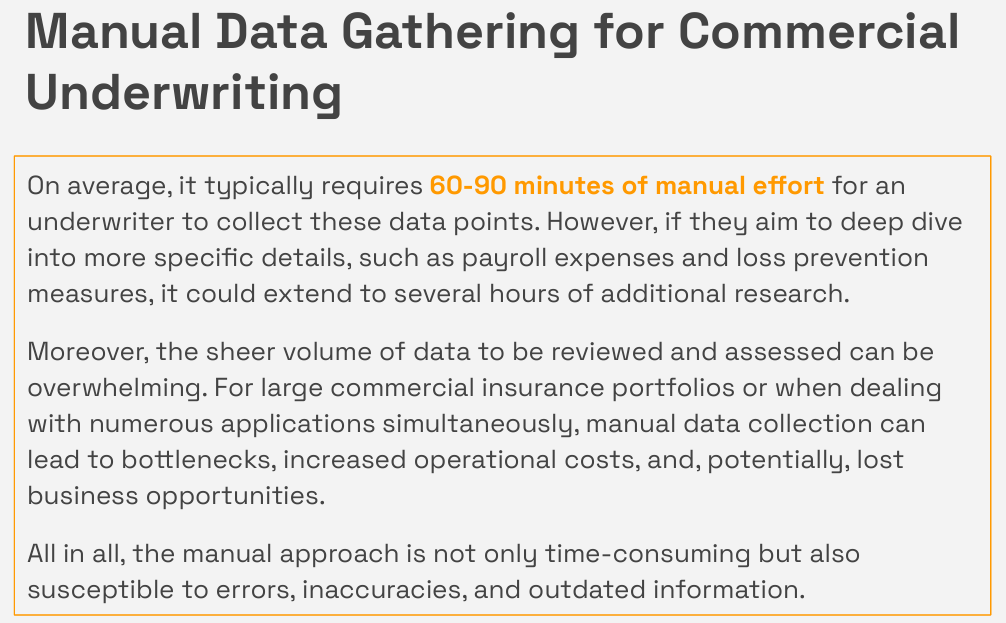

Our own findings reflect the time-consuming nature of manual data gathering, too:

Source: Veridion

This means that a senior underwriter might only have the capacity to properly review a handful of submissions per day.

The rest of their time is consumed by administrative work, such as downloading files, rekeying data, and reconciling discrepancies.

These tasks detract from productivity and insight work.

Ludovic Proust, Chief Underwriting Officer at Foyer Global Health, reflects on the reality of traditional underwriting:

Illustration: Veridion / Quote: ITIJ

As submission volumes rise and experienced talent becomes harder to hire, backlogs grow and response times slow.

The tasks might seem small at first glance. But they add up quickly and limit how much your team can accomplish in a day.

Automating routine tasks like data validation, risk scoring, document processing, and submission enrichment transforms underwriting from a process dominated by administrative work into one focused on expert risk judgment.

Dina Tarantola-Froner, Chief Underwriting Officer at IMG, explains:

Illustration: Veridion / Quote: ITIJ

This shows how eliminating repetitive work allows underwriters to invest time where their expertise matters most: strategic risk evaluation and decision-making.

In other words, automation transforms underwriters from data processors into strategic decision-makers.

Instead of manually reviewing documents, the underwriter starts each submission with a complete, decision-ready risk profile.

Your team increases throughput without adding headcount, reduces burnout, and delivers faster decisions, even as submission volumes climb.

Let’s say you’re a mid-sized commercial insurer handling thousands of SME policies every month across property, liability, and professional lines.

Under the traditional underwriting model, every submission requires multiple handoffs. Each policy passes through three or four different teams before issuance.

Still, errors are common, rework is frequent, and policy issuance often takes multiple days.

And what if your volumes grow?

You can only keep up by hiring more staff, which drives expense ratios higher and puts pressure on margins.

Manual effort, task rework, and processing errors caused by traditional, paper-intensive workflows increase operational costs.

According to Peter Zaffino, Chairman and CEO of AIG, the company lost over $30 billion in underwriting before embarking on a company-wide operational transformation built on technology and process modernization:

Illustration: Veridion / Quote: Time

Zaffino’s transformation of AIG underscores a broader industry reality: insurers can no longer afford cost structures built on fragmented, manual underwriting workflows.

Straight-through processing amplifies savings by cutting the reliance on large underwriting support teams.

You issue policies faster, catch errors earlier, and your underwriters spend more time on high-value tasks instead of administrative oversight.

This reduction in manual intervention speeds up issuance cycles and also allows you to optimize staffing and resources.

The results?

Measurable expense reductions and improved profitability.

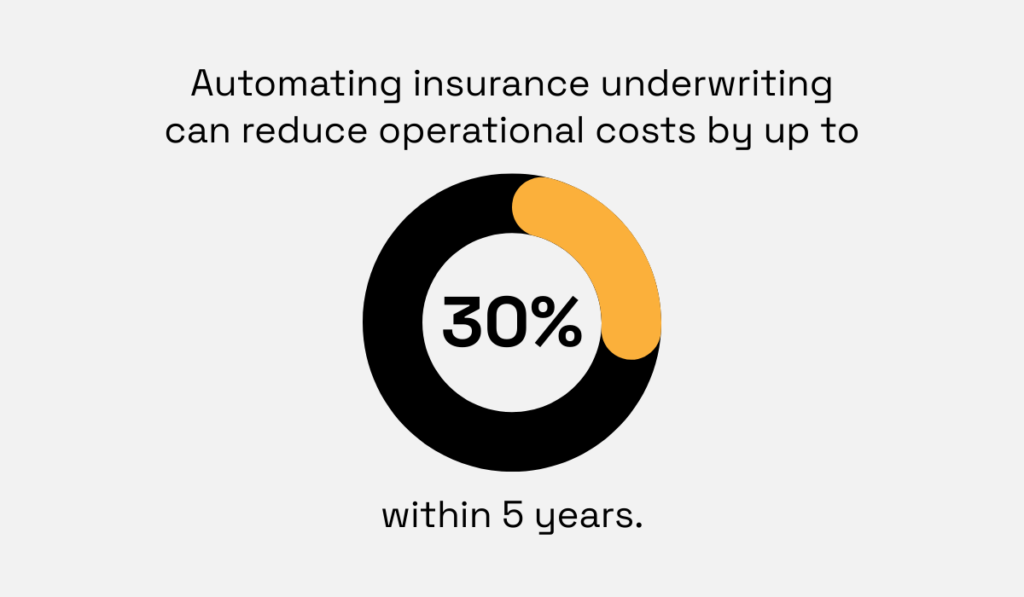

According to McKinsey, automating insurance underwriting can reduce operational costs by up to 30% within 5 years.

Illustration: Veridion / Data: McKinsey

In competitive, low-margin segments of the insurance market, even small improvements in processing efficiency can make a meaningful difference.

Automation doesn’t just improve efficiency, but turns underwriting operations into a true cost advantage.

Manual underwriting processes introduce unavoidable risk.

Underwriters must gather information from multiple sources, manually rekey data across systems, interpret policy guidelines, and reconcile incomplete or inconsistent submissions, all under time pressure.

Even the most experienced professionals are vulnerable to data entry errors, overlooked documents, version control issues, and subjective interpretations of risk factors.

Over time, these small inaccuracies compound into:

Automation fundamentally changes this equation by embedding consistency, validation, and control into every step of the underwriting workflow.

Modern automated underwriting platforms standardize risk calculations, enforce underwriting rules, and validate inputs in real time.

They automatically check required documents for completeness, verify exposure data against external sources, and immediately flag submissions that fall outside defined risk thresholds for review.

Instead of relying on fragmented spreadsheets and manual checklists, underwriters operate from a single, continuously verified source of truth.

As David Gallihawk, Chief Product Officer & General Manager for Business Information at Experian UK, explains:

Illustration: Veridion / Quote: Experian

This shift dramatically reduces variance between underwriters and ensures every submission is evaluated against the same risk framework.

It also eliminates the downstream rework that often results from manual errors, such as policy rewrites, premium adjustments, endorsements, and claim disputes stemming from inaccurate exposure data.

With fewer leakage points in the underwriting process, insurers experience more precise pricing, stronger risk selection, and better-performing portfolios.

When margins are under constant pressure, accuracy isn’t just a quality metric. It’s a competitive advantage.

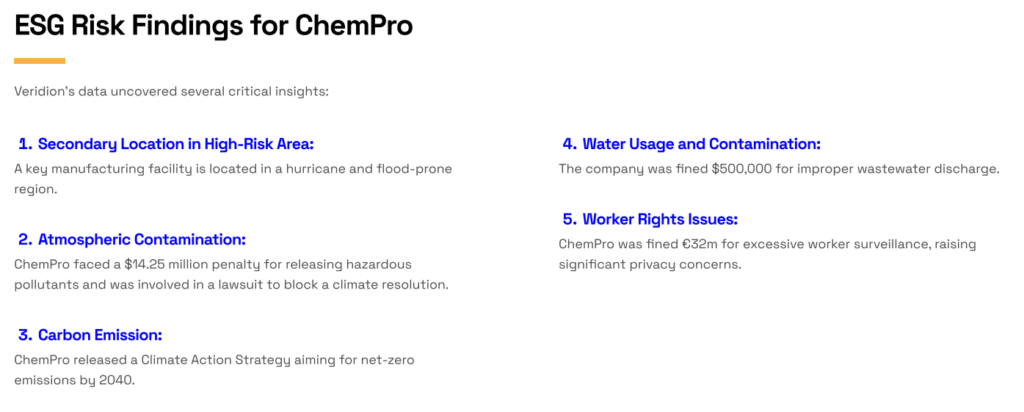

Consider our case study on automation-driven accuracy from a commercial insurer that deployed Veridion’s ESG data intelligence to strengthen its underwriting decisions for complex industrial risks.

The insurer assessed ChemPro, a global chemical manufacturer with a highly complex environmental, regulatory, and operational risk profile.

Traditional underwriting data provided only a partial view of the business.

By integrating Veridion’s verified ESG and operational data, the insurer gained a much deeper understanding of the following:

Source: Veridion

This enriched risk profile enabled the underwriting team to price the policy more precisely, tailor coverage terms to the company’s actual exposures, and design a new climate-resilient insurance product aligned to ChemPro’s risk landscape.

Without automated access to verified ESG and operational intelligence, these risk factors would have remained partially hidden or misclassified.

The result was not only better pricing accuracy, but stronger risk selection and improved portfolio resilience.

Traditional underwriting processes create friction for applicants and brokers alike.

Put yourself in your customer’s shoes for a moment.

You’re interested in a policy and ready to move forward. You request a quote, only to be met with long, repetitive questionnaires, multiple document uploads, and follow-up emails asking for information you’ve already provided.

Days pass. Then more questions arrive.

The process feels fragmented, slow, and frustrating.

Eventually, momentum is lost.

What began as a high-intent buying journey stalls somewhere between first contact and entering payment details.

Not because the coverage isn’t right, but because the experience is too cumbersome.

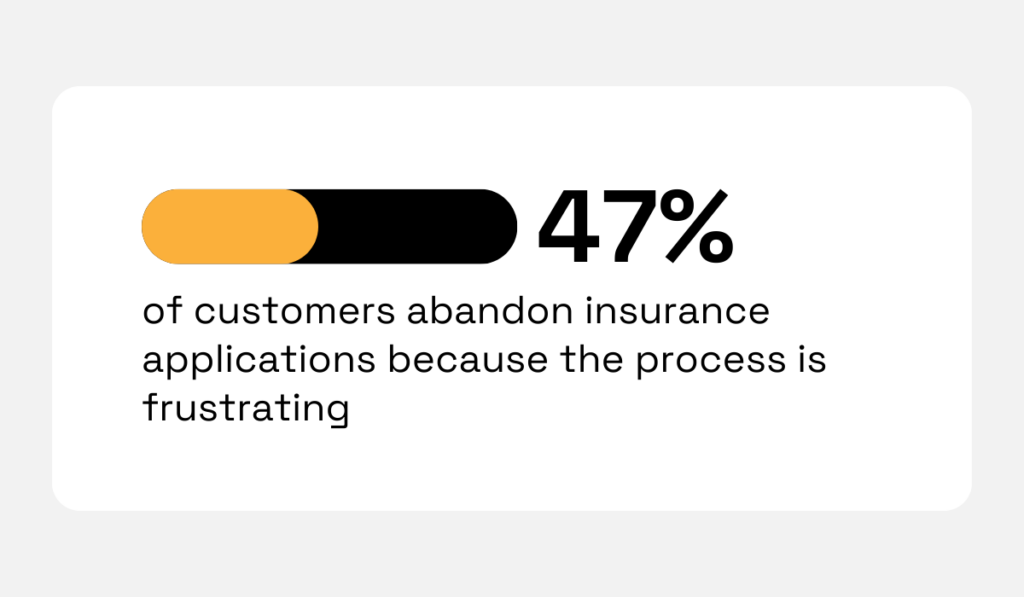

In fact, TransUnion found that 47% of customers abandon insurance applications because the process is frustrating, too long, or asks for too much information.

Illustration: Veridion / Data: TransUnion

Now put yourself in a broker’s position.

You’ve just submitted a commercial risk on behalf of a client who wants to move quickly. The submission includes financials, loss runs, property details, and operations data.

A day later, you receive an email requesting clarification on information you already provided.

Then another request for a document you uploaded. Then, a follow-up asking for data that exists in a public registry.

Days pass. Your client asks for updates. You have nothing concrete to share.

This is the reality of manual underwriting. Every unnecessary form, repeated question, and delayed response increases friction and raises the likelihood of drop-off.

Automation transforms this entire experience.

It directly addresses these pain points by streamlining submissions, validating data in real time, and automating document checks and risk scoring.

Underwriters can respond faster and with greater confidence, dramatically reducing the volume of follow-up requests for missing or inconsistent information.

At the same time, insureds benefit from faster quotes, more predictable timelines, and clearer communication.

This ultimately enhances transparency and confidence in the insurer’s processes.

Christy Traupe, Product Manager at FINEOS, explains that automation allows insurers to focus on delivering a better customer experience:

Illustration: Veridion / Quote: Insurance Thought Leaders

In short, by automating low-value manual tasks, insurers can deliver a more coherent, responsive, and customer-centric underwriting experience.

In highly competitive markets, these improvements aren’t just operational conveniences, but also differentiators.

Insurers that can offer speed, simplicity, and clarity stand out to brokers and policyholders alike, strengthening retention and building long-term loyalty.

Insurance underwriting is at a turning point.

Insurers that remain tied to manual, legacy-driven processes will continue to struggle with slow decisions, drained underwriter capacity, costly errors, and growing friction between brokers and policyholders.

On the other hand, those that embrace automation will move faster and more strategically without sacrificing accuracy.

Their underwriters regain time for expert judgment, customers receive quicker, clearer decisions, and leadership gains greater control over cost and performance.

The insurers that win will be those that treat underwriting not as a back-office function, but as a strategic growth engine.

Which side will you be on?