B2B Data Enrichment: What You Need to Know

Key Takeaways:

Have you felt quiet dread creeping in when you’re about to make a strategic decision with incomplete information?

In large enterprise teams, decisions often need to be made quickly, but their consequences are huge.

And when the underlying business data isn’t fresh or accurate, small gaps can snowball into financial, operational, or compliance risks that threaten the entire company.

That’s why having fresh, well-contextualized company data matters just as much as having enough of it.

You need data that’s enriched with the right context to support confident decision-making.

Read on to find out what B2B data enrichment really means and why it matters so much across sales, risk, and procurement.

B2B data enrichment is the process of enhancing existing business records with additional, high-value attributes that make the data more useful.

So, it’s not about replacing your current datasets. Instead, enrichment builds on them by adding missing context and correcting inaccuracies.

The result is a deeper dive and a much more reliable view of companies you sell to, partner with, or depend on operationally.

Mathematician Clive Humby summed it up perfectly:

Illustration: Veridion / Quote: Forbes

So, how is data “refined”?

Data enrichment attributes typically include firmographics.

Think company size, revenue range, and industry classification. These let you gauge purchasing power or risk exposure, just to name a few vital factors.

But many enrichment strategies go beyond that.

They also layer in financial signals, ownership structures, product and service offerings, geographic footprint, and verified decision-maker information.

Done right, enrichment turns static records into living profiles that reflect how a business actually operates today.

Done wrong, Flik CEO Donato Diorio explains what happens:

Illustration: Veridion / Quote: SessionAI

And bad data can have catastrophic consequences, as we’ll explain later on.

Now, the goal of B2B data enrichment goes well beyond cleaning data.

Clean data is table stakes: it keeps your CRM from actively misleading you, but it doesn’t tell you who to prioritize, or where urgent risk is building.

B2B data enrichment really shines in making data actionable across workflows, from sales outreach and marketing segmentation to underwriting and vendor risk assessment.

And when your records carry that precious context, teams can move faster and in sync. Ultimately, everyone can make decisions grounded in reality.

Now let’s take a closer look at those benefits.

Data enrichment should be treated as a strategic capability, not a one-off cleanup.

Only when B2B data enrichment becomes an ongoing practice does it start delivering measurable value across the whole enterprise.

Good data enrichment affects everything from revenue predictability to risk exposure and operational resilience.

It saves vital resources and sometimes entire companies.

So here are three of the most impactful outcomes organizations get.

Enriched firmographic and technographic data lets you segment your targets with precision.

So, instead of broad filters like “manufacturing companies in Europe,” you can target businesses by revenue bands, growth stage, technology stack, operational footprint, or whatever niche industry classifications you need.

The more specific, the better odds your teams are speaking to the right company for the right reason.

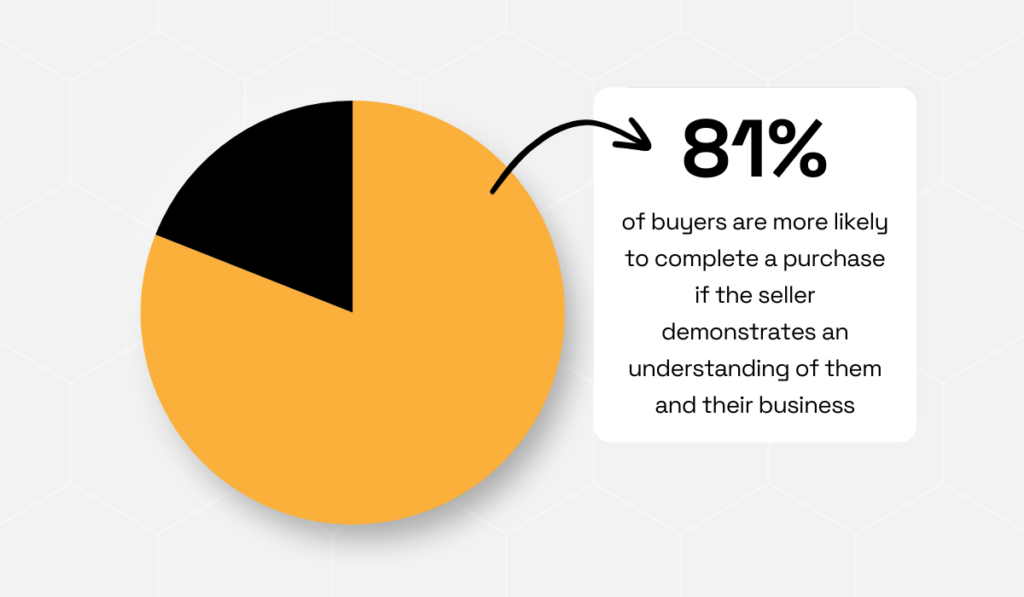

All this directly affects buying decisions.

Research from AMPLYFI shows that 81% of B2B buyers are more likely to make that purchase when sellers show a strong understanding of their needs and their business.

Illustration: Veridion / Data: AMPLYFI

Confidence works even when selling socks online, so it goes without saying how relevant this is in high-stakes B2B purchases.

When sales and marketing teams know what a company does, how large it is, and how it operates today, outreach stops sounding generic. Conversations thus become more focused, more credible, and far more useful for both sides.

This ultimately means higher conversion rates and shorter sales cycles.

Source: Veridion

A practical example can be seen in enterprise SaaS firms. These companies often segment their outreach based on installed technologies.

By enriching CRM records with technographic data, their teams avoid pitching redundant solutions and instead position their products as complementary or integrative.

The result: a more qualified, higher-intent pipeline, and fewer wasted conversations.

Sales forecasting lives or dies by data quality.

It’s easy to imagine what happens to CRM records when they rely on outdated headcount figures or estimated revenue.

First off, you can’t make accurate forecasts.

Secondly, just as President of Navesink Consulting Group Thomas C. Redman notes, you’ll waste resources, and your decision-making will be slowed down.

Illustration: Veridion / Quote: EW Solutions

Conversely, sales leaders equipped with accurate revenue ranges, employee counts, and ownership data can better assess purchasing power and deal viability.

Companies that enrich prospect data are more likely to deliver reliable pipeline forecasts and improved alignment between sales and finance teams.

This means you can then plan resources, set realistic targets, and most importantly, avoid costly surprises at the end of the quarter.

Consider a global enterprise selling into mid-market manufacturers. Without enrichment, two similarly named companies might appear equal in CRM, even if one is a local subsidiary and the other a global parent entity.

Enrichment resolves these sorts of ambiguities and makes sure forecasts reflect true deal size, not hopeful estimates.

Few areas feel the cost of poor data more sharply than risk management.

This is where B2B decisions involve suppliers, partners, or large financial commitments. Incomplete or outdated information thus increases exposure in a threatening way.

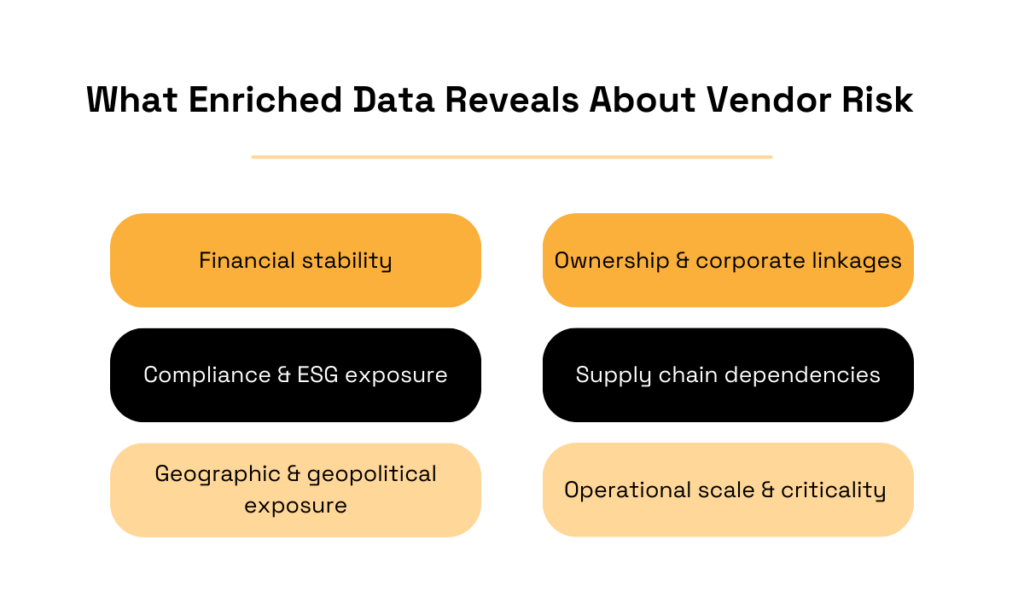

So, why aren’t clean raw records enough here?

Well, you’re layering in attributes: ownership structures, compliance indicators, financial health signals, operational footprint data, and so on. Hence, organizations gain a much clearer picture of who they’re actually dealing with.

This level of visibility is especially important in underwriting, vendor risk assessment, and deal-level due diligence, where unseen connections or gaps can quickly turn into material risk.

Source: Veridion

Bottom line, you have to anticipate instead of responding reactively.

Large enterprises already operate this way.

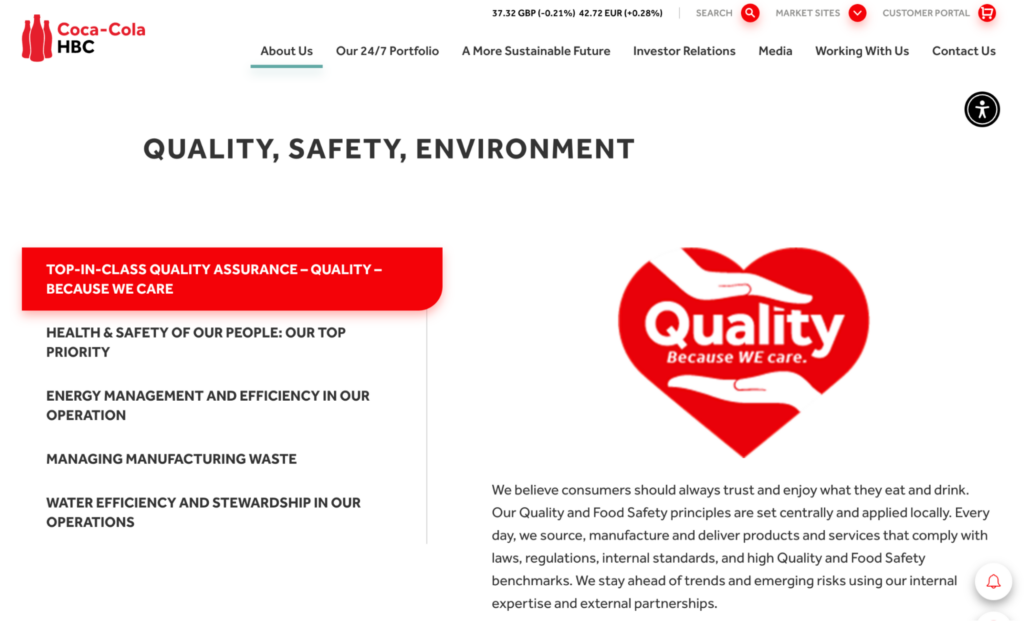

Take Coca-Cola HBC as an example.

According to their website, they closely monitor their suppliers by evaluating performance, financial stability, ESG compliance, and broader supply risk on an ongoing basis.

Rather than relying on static information gathered during the onboarding phase, the company reviews supplier risks against defined frameworks each year.

This means they always identify weaker or higher-risk partners early and act before issues escalate into disruption.

Source: Coca-Cola HBC

That discipline is reflected in the numbers, too.

96% of Coca-Cola HBC’s agricultural ingredients were certified under the Coca-Cola System’s Principles for Sustainable Agriculture in 2024.

This is a testament to their thorough supplier screening and reinforces trust with everyone, be it partners, regulators, or consumers across the value chain.

Research supports the validity of this approach.

Datamatics reports that enriched datasets significantly improve third-party risk evaluations by surfacing hidden connections and financial red flags earlier in the process.

For example, a supplier may look stable at first glance, yet be owned by a financially distressed parent company.

Without enriched ownership and financial data, this type of risk often remains unseen until operations are already affected.

In procurement, this richer context leads to more defensible decisions.

Teams can assess whether a vendor operates in high-risk regions, relies on fragile supply chains, or lacks critical certifications.

This is exactly the type of scenario where responding preventively can save an entire enterprise.

The pros of B2B data enrichment are compelling enough. But those results depend heavily on execution.

Poorly planned enrichment initiatives often add new layers of chaos rather than clarity.

So, here are a few best practices so your enrichment efforts actually increase data value.

Great data enrichment can’t happen if the underlying dataset isn’t already structured and consistent.

Before adding new attributes, teams should standardize formats, align fields across systems, and resolve any legacy inconsistencies.

This thorough prep ensures that enriched attributes map correctly. And of course, they have to, if they’re to be used reliably later on.

For example, if one system records revenue as free-text and another uses standardized ranges, enrichment outputs may fail to align. And polluted input data leads to low-value outputs, no matter how sophisticated the enrichment source is.

Sounds like common sense, right?

Well, many organizations still underestimate this step and rush directly into enrichment.

And fragmented, inconsistently formatted data doesn’t just slow enrichment down.

It ups manual handling, error rates, and downstream risk.

Parseur’s 2025 survey reveals that American companies spend around $28,500 per employee on entering data every year.

Illustration: Veridion / Data: Parseur

When that work is repetitive and low-value, it takes a toll on the people doing it.

With over half of this survey’s employees reporting burnout and delays due to manual data tasks, it’s easy to imagine how this becomes a highly risky endeavor.

Or how teams end up mistrusting their own insights, knowing they were stitched together under pressure.

That’s why strong foundations matter.

Enterprises that invest time and resources into structuring, standardizing, and automating their data see better confidence internally.

And this is exactly where automation and high-quality external data come into play.

So you’ve got clean, thorough internal data. Here’s why using high-quality external sources is a vital add-on.

You already have valuable information in your systems.

CRM records show how you engage with a company. Procurement tools capture spend, contracts, and performance. That’s the “inside view.”

What’s missing is the outside reality check.

One that doesn’t just spot what’s wrong, but also fills in missing firmographics, realistic financial ranges, correct industry codes, and those tiny operational details that never quite make it into a form field.

This gap shows up most clearly in procurement and supplier management.

During RFx processes, suppliers are often asked to self-report key details. Despite the good intentions, data often comes back incomplete, outdated, or, let’s face it, a little too optimistic.

Over time, those inaccuracies pile up and quietly distort decisions.

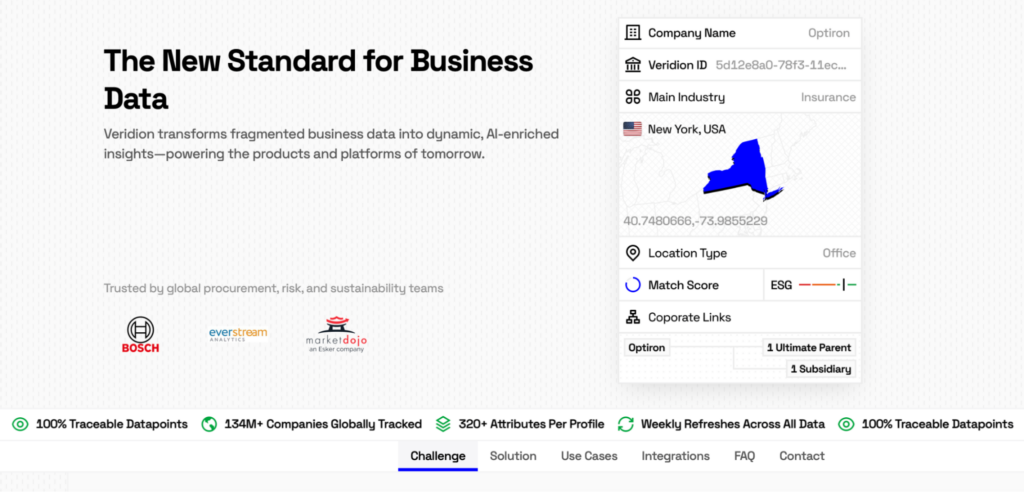

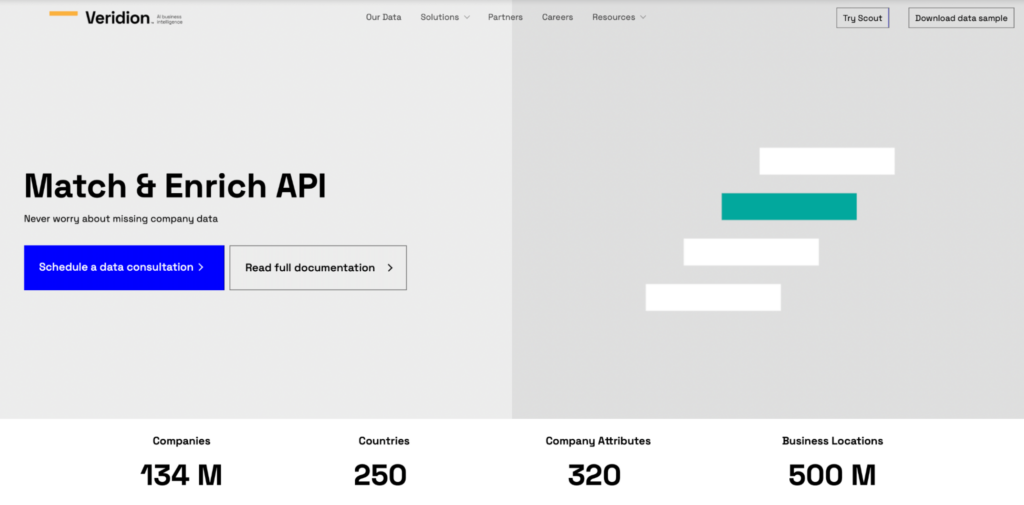

That’s where external enrichment comes in: through B2B data enrichment services like Veridion.

Source: Veridion

Veridion collects data on 134M+ global companies and offers unbiased insights across 320+ different company attributes.

Plus, the data isn’t updated or added once every quarter or year. Veridion updates it on a weekly basis.

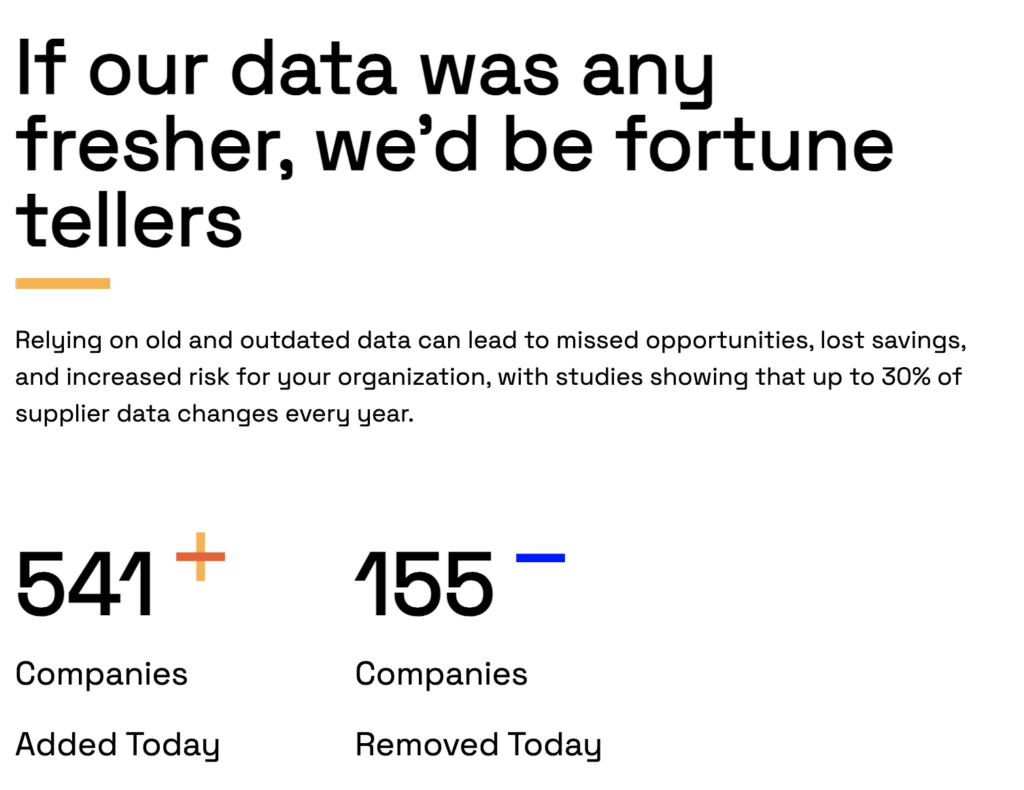

Source: Veridion

Firmographics, operational footprints, ownership structures, and financial signals: these are things that can drastically change outcomes.

And as they keep changing all the time, it’s crucial to use a tool that’s always on top of the game.

Veridion’s Match and Enrich API helps you verify company records and enrich incomplete profiles.

That’s how your supplier profile stops being a hopeful spreadsheet row and starts looking like a real, living business.

Source: Veridion

And this isn’t just about having prettier data. It’s about finally being able to use it.

For example, you can enrich your internal spend data with verified supplier identities and hierarchies, so you discover duplicate vendors or map concentration risk.

Now imagine doing this job manually and trusting the results.

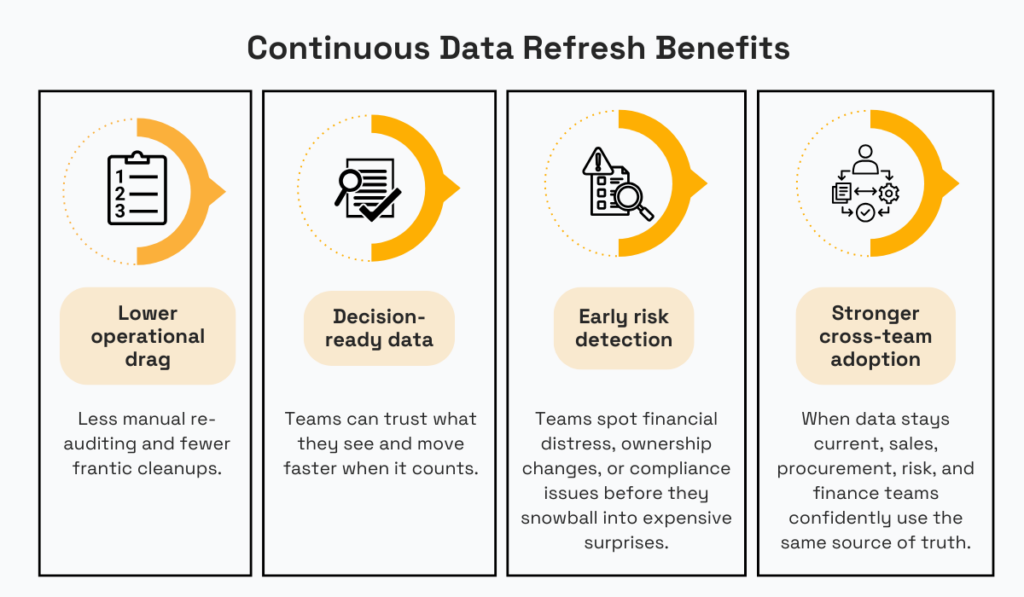

Even enriched data has an expiration date.

Companies grow, relocate, rebrand, and merge all the time. Sometimes, they disappear overnight.

Meanwhile, compliance rules are also changing, which only adds fuel to the fire.

That’s why regular refreshes have become the norm for successful enterprises.

Yesterday’s “accurate” profile can become today’s liability without them.

Therefore, enrichment should be treated as a living habit, not a one-and-done project.

President of Navesink Consulting Group Thomas C. Redman, who we mentioned earlier, explains the downside that so many companies face when they don’t take data enrichment seriously:

“People accept errors as if they’re normal. One department makes a mistake, another department spends hours fixing it, and everyone carries on as if that’s just the way things work… In many organizations, employees spend half their day, sometimes more, fixing data issues before they can even do their real work.”

Needless to say, the best teams don’t leave data freshness to chance.

They set clear update cadences and keep an eye on the changes that matter.

Think revenue shifts, new locations, ownership moves, or emerging compliance flags.

Automated validation does the heavy lifting here, so you catch meaningful updates without forcing someone to re-audit the entire database by hand.

The big wins are clear to see:

Source: Veridion

But perhaps the biggest win here is trust.

When teams believe the data reflects what’s true right now, they’ll actually use it when decisions get expensive.

Data enrichment isn’t optional at scale.

Done right, not only does it sharpen targeting or strengthen forecasts, but it reduces risk by the truckload.

So start with clean internal data, layer in high-quality external sources, and keep everything fresh.

When data reflects reality, teams trust it.

And when teams trust data, their decisions speed up, and data finally becomes an advantage rather than a frightening liability.