Calculating Total Insurable Value for a Business Location

Key Takeaways:

Calculating the TIV of a business location can sometimes feel like walking a tightrope.

Even the tiniest mistake or oversight can spell issues for both the insurer and client.

That’s why it’s crucial to be as precise as possible in the process so you can strike a balance between setting a fair and rational rate for the client and ensuring profitability for the insurer.

In this article, we’ll show you how to do it step-by-step and how the right tools can help you streamline the underwriting process.

Let’s start with the basics.

Total Insurable Value (TIV) is the maximum value of a business location an insurer may be liable for in case of a financial or material loss involving that location.

The value is comprised of not only the location but also inventory, equipment, software, and business income.

That’s why when calculating TIV, take into account these four elements:

The total sum is then added to the total number from the business income (BI) worksheet.

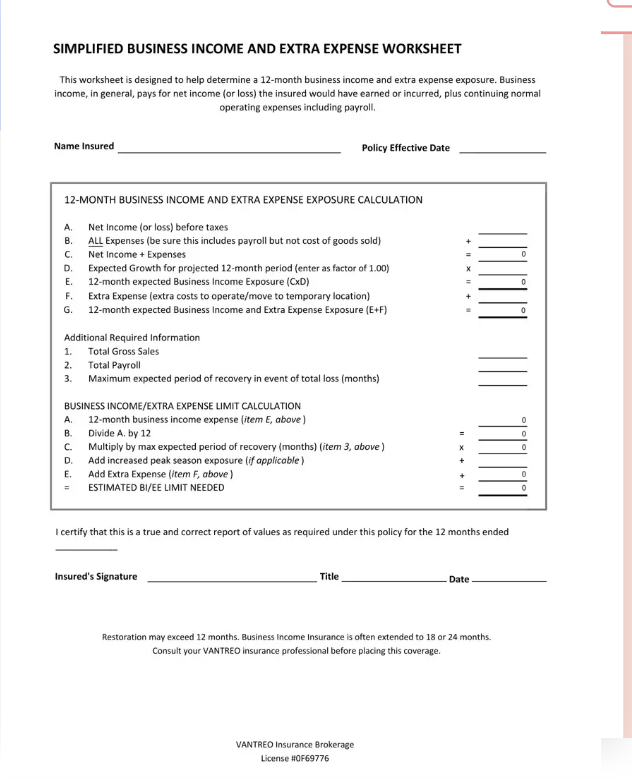

Business income refers to the expected income for the upcoming 12-month period and potential extra expenses.

This number helps select a business income limit for insurance.

Source: FormsPal

The result is then used to calculate the commercial property insurance rate.

TIV is also foundational in assessing reinsurance placement and capital allocation so the insurance company can protect its own assets and operations.

What makes calculating TIV tricky is not only the overall scope of things that need to be assessed.

Underwriters also may need to:

Getting TIV right will help you assess a specific risk in a balanced manner so a client can get enough coverage in case of a loss, while the insurance company remains profitable.

On top of that, in case of a loss, an accurate evaluation can help reduce claim settlements and ensure faster and fairer compensation.

Each of the elements that go into calculating TIV comes with its own set of nuances, so it’s very important not to miss any during your assessment.

Let’s elaborate on each of them, step-by-step.

Just about anything located on a business site needs to be included in an asset list and valued correctly.

This includes both material things like furniture, equipment, properties, data, and intangible assets like intellectual property or policies.

It’s important to accurately assess the monetary value of the inventory and the level of risk in order to calculate a premium that ensures sufficient coverage.

In order to assemble the inventory list, categorize the assets according to the three categories outlined in the image below:

Source: Veridion

Having a well-documented, categorized list will make it easier for you to come up with accurate rates and to allocate resources efficiently down the line.

Document the assets not only by putting them on a list but also by photographing them.

Along with a description, include receipts. The more documentation, the better, because it’ll be easier to calculate an accurate TIV.

However, keep in mind that some assets are different than others.

For example, properties like refineries, labs, or data centers contain assets that require specialized valuation methods.

Failure to correctly value niche assets can significantly distort the site’s true TIV.

This is why it’s important to research and choose an appropriate valuation method for these specific assets.

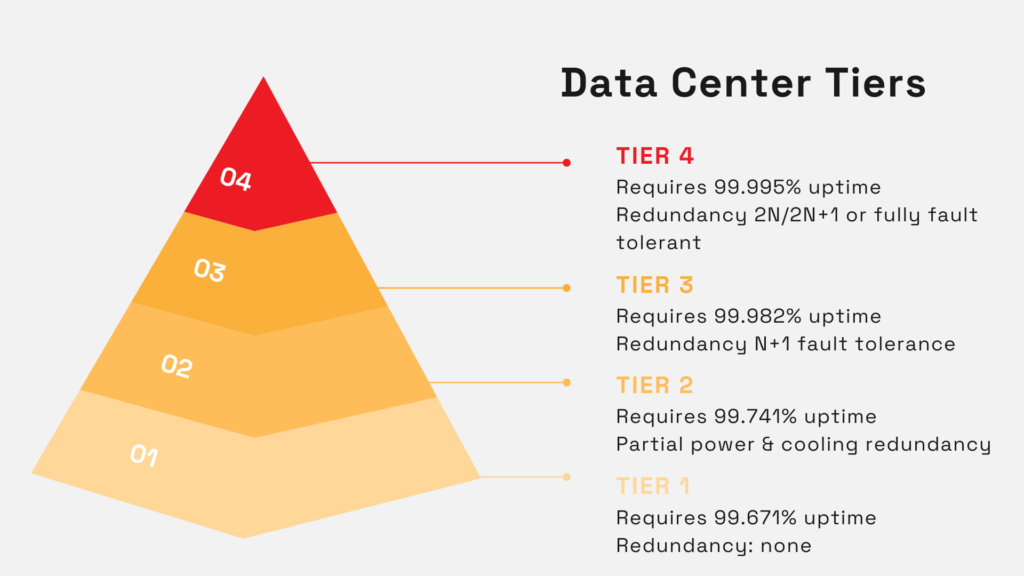

For example, data centers are relatively new and fast-growing infrastructures.

Because of their size and the growing amount of energy needed to run them, the Uptime Institute’s tier classification system is an apt valuation framework that can be used along with modeled catastrophe exposure.

Source: Veridion

Along with specific methods, doing asset inventory evaluations annually or biannually makes it easier to adapt to changes, whether it’s inflation, labor, technology, or legal costs.

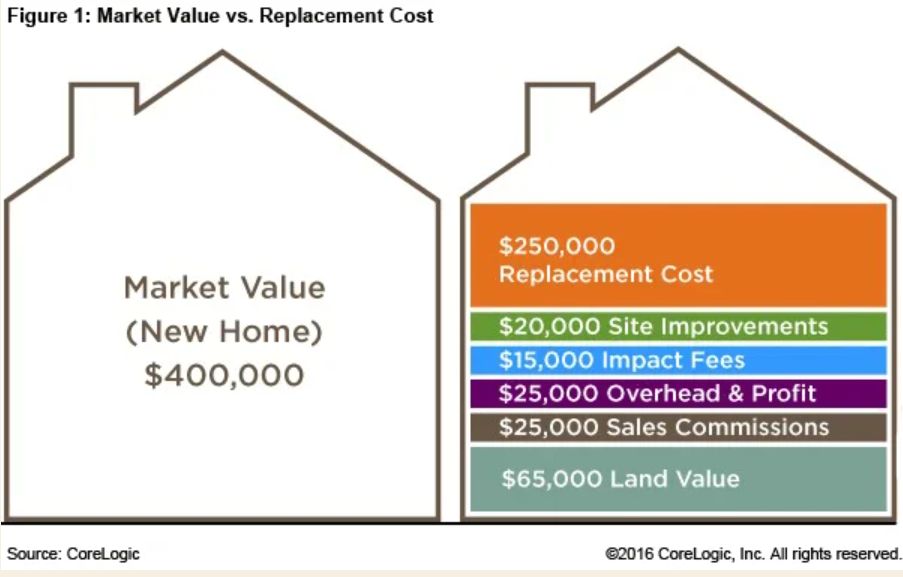

When it comes to evaluating the cost of a potential replacement of a business’s asset, it’s important to use replacement cost value (RCV), rather than market value.

In practice, the two are often interchangeable.

But, unlike market value, which is based on the perception of value and depreciation, replacement costs are much more realistic.

They take into account inflation, the current condition of the asset, its location, code requirements, and other factors that make its restoration or rebuilding more costly.

Let’s say a business property is estimated at $300.000,00 on the current market (market value).

However, its replacement cost value is $1.000.000,00 because of inflation, repair costs, higher cost of labor, and other factors.

All of these factors add up and reflect a more comprehensive value of an asset.

So, in case of a payout, the client won’t have to finance the restoration or replacement out of their own pocket.

Source: Cotality

Therefore, replacement cost is calculated as the cost of the materials and labor to replace or restore damaged property to the quality and condition before it was damaged.

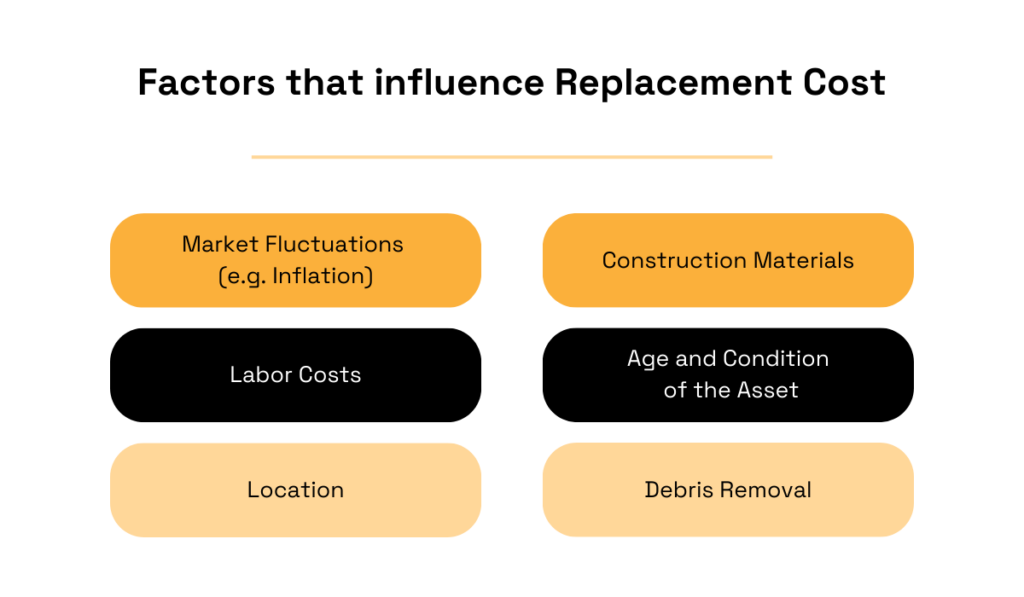

Several factors influence what the replacement cost value will be, as outlined below:

Source: Veridion

For example, when assessing how technology will impact replacement cost, it’s important to research whether any changes in technology since the construction of a property took place.

Maybe a piece of old machinery can be replaced by an improved one that’s also more cost-effective.

Alternatively, a piece of new equipment could be more expensive because it’s produced by only a few manufacturers in the world.

By making appropriate adjustments according to these factors, it’ll be easier to make an accurate estimate of the replacement cost of an asset.

Inventory and stock are tricky to assess because of their volatility.

This is especially true in industries that deal with time or season-sensitive stock.

For example, the stock on hand might include raw materials, work-in-progress goods, finished products, or goods waiting for shipment.

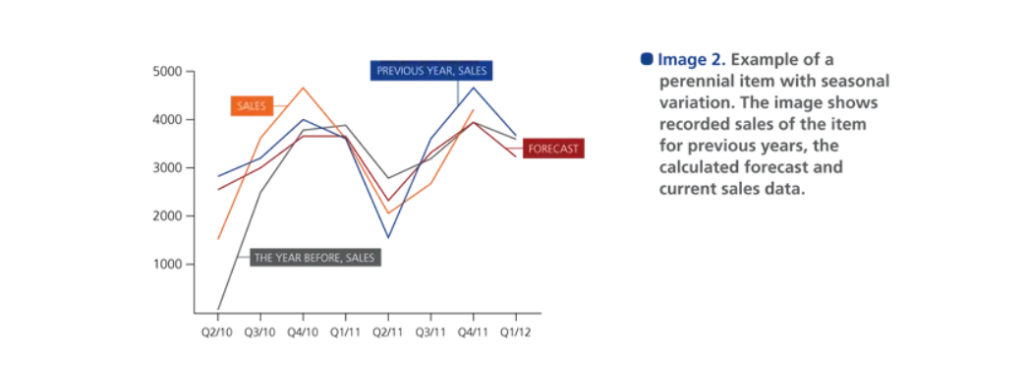

Additionally, in many industries, inventory levels are tied to seasonality.

For instance, a food distributor might build up stock in the weeks before a holiday season to meet increased customer demand, only to see inventory drop sharply once that season ends.

Source: Relex Solutions

So, if TIV is calculated based on a snapshot of inventory at a low point, the business could be underinsured during peak season.

On the other hand, if it’s based on peak inventory levels, the policy could cost much more than necessary during the rest of the year.

Underwriters, therefore, need to find a way to reflect typical operations while accounting for maximum reasonable exposure.

Another complication comes in the form of disruptions in the supply chain.

Modern global supply chains are more fragile and variable than ever, subject to transportation problems, supplier issues, or political events.

One of the most widely reported incidents was the disruption caused when a large container ship blocked the Suez Canal.

According to Lloyd’s List Intelligence, the six-day blockage resulted in supply chain disruptions estimated at around $9 billion per day.

Source: BBC

Disruptions like these can lead to sudden increases or decreases in inventory levels.

For instance, if faced with unreliable deliveries, a manufacturer might stock up on its critical components to avoid production stoppages.

Underwriters must account for this unpredictability when estimating TIV.

To make the process easier, it’s important to do regular inventory reporting, prepare for known seasonal peaks, and understand how external forces affect stock levels throughout the insurance period.

Sometimes, a business may need to halt operations at its location due to, say, a natural disaster, theft, or a system outage.

This may lead to loss of income, so it’s important that the business insures itself against this type of risk.

In that case, an underwriter will also have to evaluate how much a business is exposed to this risk and how best avoid it.

First, underwriters should identify how the income is generated.

Is it tied to continuous operations, seasonal demand, or a specific production cycle?

This helps determine how sensitive the business is to downtime and at what point revenue loss would happen.

For example, if we’re talking about a restaurant with high traffic, its BI exposure is pretty high, because revenue drops immediately if operations stop.

Another thing to assess is any element of a business that, if damaged or stolen, may bring operations to a halt.

This includes equipment, production lines, building sections, and IT systems.

That is exactly what happened to Jaguar Land Rover in September 2025: global production was halted after a cyberattack disrupted its IT networks.

Source: Industrial Cyber

The company was forced to shut down manufacturing and extend production pauses while it investigated and recovered systems.

This goes to show how damage to IT systems can directly stop operations.

When the insurer can pinpoint the bottleneck, it’s easier to estimate how long and severe the interruption will be.

You should also consider what steps are required for the business to recover and how long they would take to implement.

In other words, consider questions such as:

These factors often extend recovery well beyond initial expectations and can materially increase BI exposure.

Therefore, making conservative, experience-based assumptions rather than best-case scenarios helps ensure TIV is adequate.

Finally, underwriters should assess risk mitigation measures, such as business continuity plans or extra expense capabilities.

All of this helps to shorten recovery time and reduce BI losses.

Location validation includes not only confirming basic information like the precise location a business operates in or its legal status, but also assessing the surrounding area.

All the collected information will give you pointers to arrive at a precise TIV calculation.

Of course, you must also consider potential risks that arise out of the location itself.

These include:

| Environmental risks | Flood-prone areas, earthquake zones, hurricanes, extreme temperatures |

| Type and construction of buildings | Older wooden structures, steel-framed buildings, high-rises with limited evacuation routes |

| Population demographics | High foot traffic or tourism, older populations, transient communities |

| Other major insurance perils | Fire and lightning, windstorm or hail damage, theft or burglary |

All of these elements influence not only TIV, but also rates and premiums.

For instance, if a business property is located on a territory historically affected by droughts, a higher premium is likely to be estimated, in contrast to a property based in a location not prone to catastrophe risks.

This segment of underwriting also requires collecting and analyzing a mountain of data.

Luckily, underwriters have at their disposal different tools to help them with this time-consuming, error-prone task.

For example, tools like RSmeans data are helpful in estimating and comparing factors like construction costs, labor rates, and more:

Source: RSMeans Data

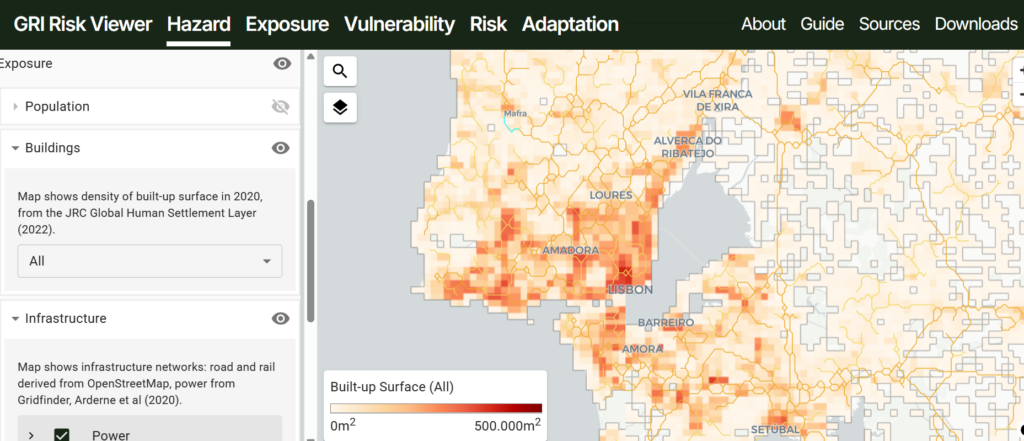

And when it comes to assessing nature-related risks, the Global Resilience Index (GRI) Risk Viewer is a great starting point.

This data and analytics portal provides open data that users can then visualize and download in order to help with assessing nature-based risks for both people and assets.

Source: GRI Risk Viewer

Using these tools appropriately in the underwriting process is a powerful way of getting ahead of mistakes and safeguarding a client’s business location.

It also provides peace of mind for both the insurance company and its customers.

Based on what we’ve covered so far, one thing is clear: underwriters have a lot to juggle.

On top of that, they often struggle with incomplete site data, inconsistent reporting from insureds, outdated third-party databases, and a lack of clarity around multi-building or co-tenanted properties.

But not all challenges come from that side of the equation.

Non-proactive companies that don’t update insurers make it hard for them to track changes like expansions, closures, renovations, or new equipment.

Furthermore, because insurance companies deal with a large amount of nuanced data and have to do lots of context-switching, underwriters may inadvertently make mistakes.

Lots of those are caused by a lack of focus on needle-moving segments of the insurer’s workflows.

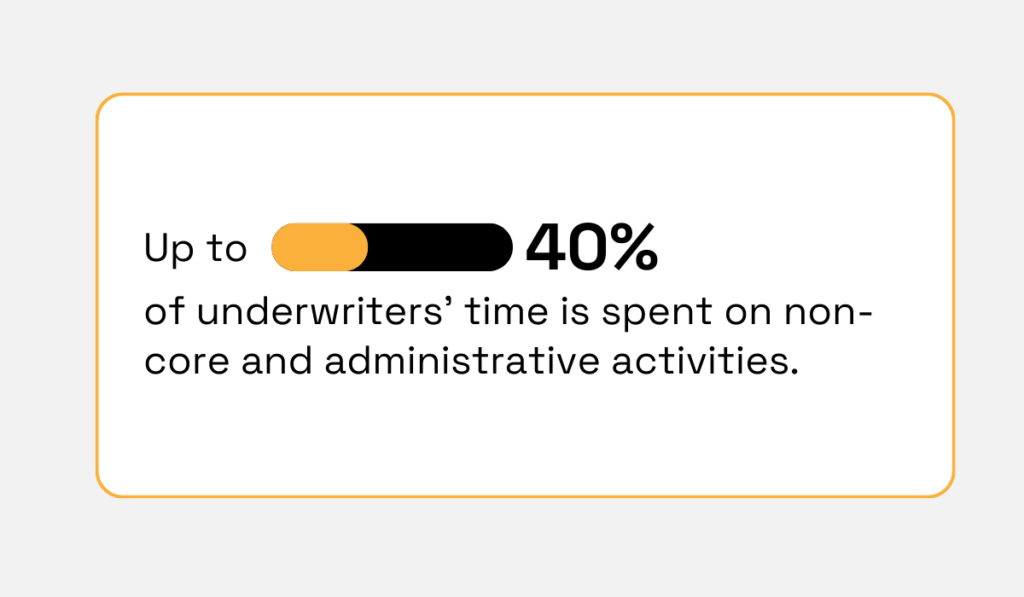

Accenture’s underwriting employee survey found that underwriters spend up to 40% of their time on non-core and administrative activities.

Illustration: Veridion / Data: Accenture

It is estimated that this represents an industry-wide efficiency loss of up to $160 billion over five years.

So, when underwriters do TIV calculations while juggling time-consuming administrative work, this may lead to pricing inaccuracies, underinsurance, loss of profitabilty and even the rise of insurance claims.

To shoo away these scary scenarios, a little help from technology goes a long way.

This is where Veridion comes in.

With Veridion’s AI-powered solutions tailored for the insurance industry, underwriters can save both time and energy, which they can redirect into relevant decision-making.

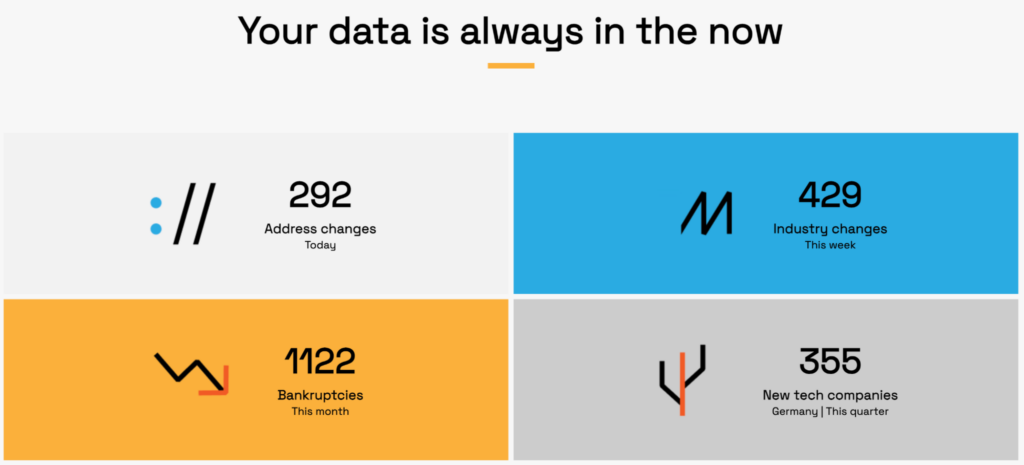

For example, our Match & Enrich API gives you access to a global database with 320 data points from more than 130 million companies and 500 million business locations.

Source: Veridion on YouTube

Veridion captures, indexes, and refreshes first-party data from 250 countries around the world.

As a result, this creates a far more accurate and timely view of a company’s operational footprint, as many businesses operate across multiple countries and jurisdictions.

Source: Veridion

This helps underwriters confirm the exact coordinates and function of each business site, ultimately reducing misclassification errors.

And to top it off, our weekly updates alert insurers to facility expansions, closures, or operational changes that impact TIV.

So not only do you have more quality data, but you also get free rein to focus on more core tasks in your daily workflow.

At first, TIV may seem daunting with all the factors that go into it.

But with access to accurate data and tools that give you a bird’s eye view of each business and all its locations, you don’t have to second-guess your estimates or waste time on manual collection of data for a TIV calculation.

That’s why staying updated about more efficient and comprehensive methods of underwriting is your ticket to a flexible and profitable insurance business.