Competitive Intelligence: Importance, Components, and Collection Methods

Key Takeaways:

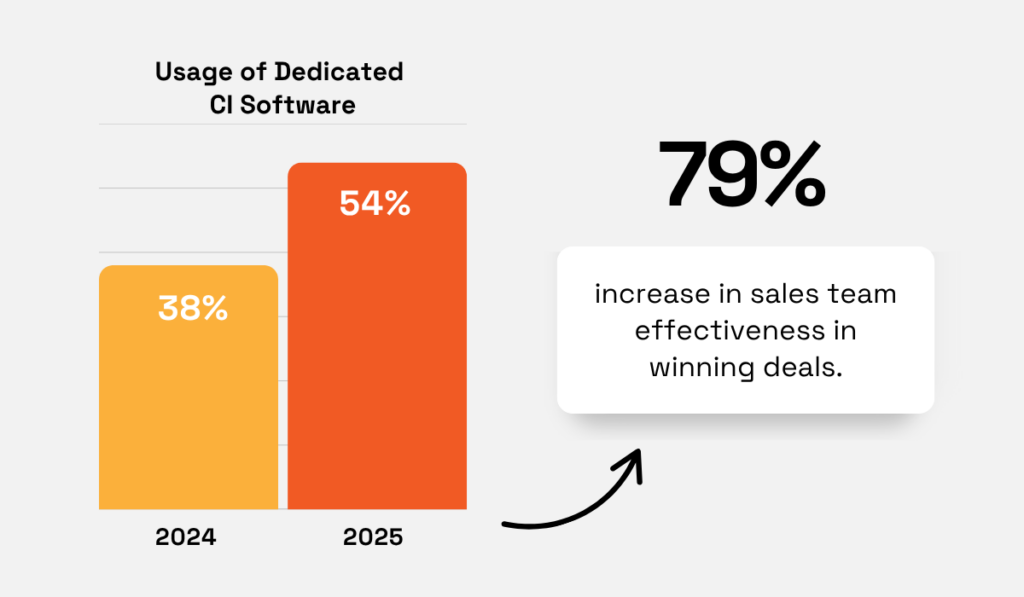

Research shows that 79% of CI-powered sales teams get better at winning deals, but competitive intelligence is much more potent and far-reaching than that.

It empowers enterprises to sharpen their market position and confidently make strategic decisions on the highest level.

While many still treat competitive intelligence as a side function, this guide centers it as a core capability.

We’ll explore why CI matters while zooming in on practical ways to make it an indispensable business advantage.

Navigating fast-moving, data-saturated markets requires competitive intelligence (CI).

It’s what allows organizations to interpret change before it becomes disruption.

Instead of relying on intuition or outdated assumptions, CI enables you to anticipate competitors’ moves, uncover emerging opportunities, and make decisions supported by data.

CI intelligence has several major benefits, which help explain why investments in CI are steadily rising.

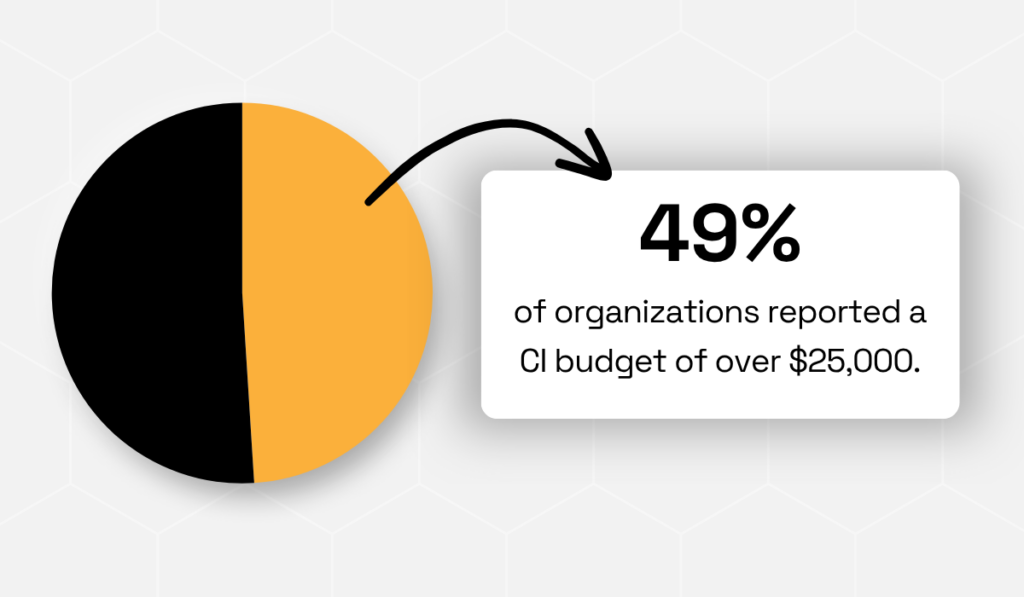

According to Crayon’s State of Competitive Intelligence Report, nearly half of organizations now allocate more than $25,000 annually to CI, up from 36% just a year earlier.

Illustration: Veridion / Data: Crayon

That 13% jump reflects both the proven value of market insight and the growing recognition that falling behind carries tangible risks.

The story of Barnes & Noble and Borders vividly captures this dangerous dynamic.

The two companies were at their peak when Amazon emerged as an online bookstore that would soon completely transform the retail model.

Although expected to overtake B&N at one point, Borders was slower to adapt and less decisive in embracing the online sales model, ultimately declaring bankruptcy in 2011.

Meanwhile, Barnes & Noble survived, but this was only possible through continuous adaptation.

Source: Forbes

Barnes & Noble had felt pressure much before the pandemic, but a unique set of circumstances surrounding the pandemic, and new leadership, helped rekindle the spark and drive profit.

Under its new CEO, James Daunt, B&N started to reexamine the ways physical retail could compete with algorithms, leaning into its key strengths: curated selections, personalized recommendations, and community-based appeal.

As noted by Neil Saunders, Managing Director at GlobalData Retail, an algorithm could give near-perfect reading recommendations, but people still craved in-person interaction.

Illustration: Veridion / Quote: RetailWire

But how does all that connect to CI?

Simply put, Borders reacted too late despite the incoming signals, while Barnes & Noble proved it could interpret them in real time and translate insights into strategy.

And that’s the importance and value of competitive intelligence.

CI empowers businesses to:

Ultimately, CI strengthens both short-term competitiveness and long-term resilience, helping companies to both endure change and seize new opportunities.

But let’s take a closer look at two distinct types of competitive intelligence.

Competitive intelligence typically operates on two interconnected levels: tactical and strategic.

The difference lies not in the tools used, but in why and how insights are applied and the scale of their impact.

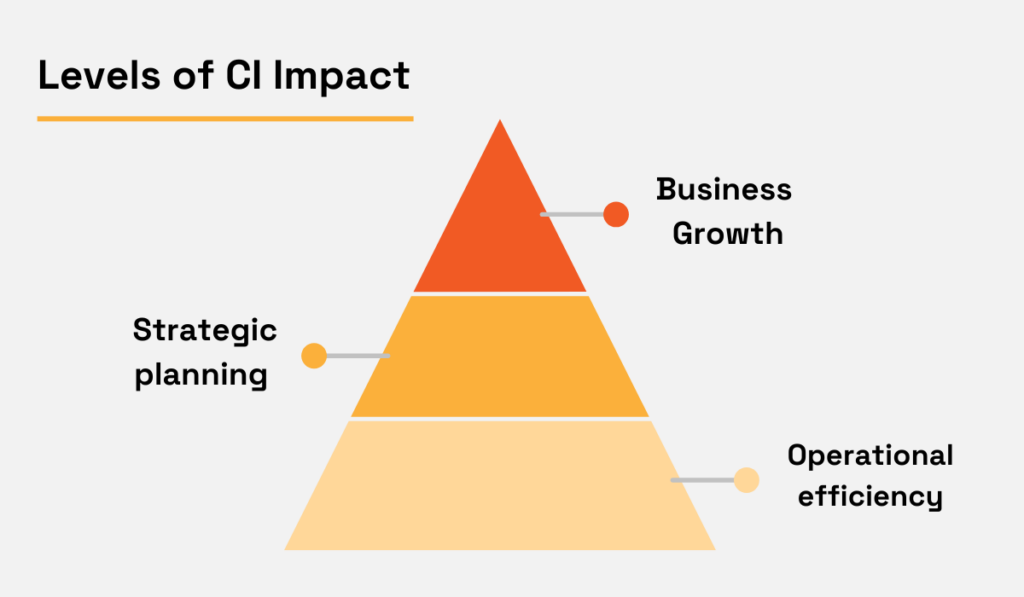

At its core, organizations pursue CI for two overarching outcomes: operational efficiency and long-term strategic clarity.

Both contribute to sustainable growth, but they do so through different lenses.

Source: Veridion

Tactical CI serves the short-term and the immediate.

It’s about detecting shifts that demand quick responses, like monitoring competitor pricing, tracking new campaigns, or spotting product launches that could affect sales this quarter.

The insights are granular and highly actionable, feeding directly into daily operations or front-line decisions.

By contrast, strategic CI helps you zoom out.

These insights are all about identifying patterns and market trajectories in the months or years to come, ensuring you’re ready for any technology disruption, regulatory changes, or emerging business models.

It boils down to directional advantage.

You want to know where the market is heading before others do.

These differences between the two naturally extend to data sources and methods.

Tactical CI often leans on real-time feeds for social media monitoring, sales feedback, and pricing trackers.

By contrast, strategic CI combines market forecasts, patent data, policy analysis, and expert interviews to paint a longer-range picture.

Here’s a quick overview:

| Aspect | Tactical CI | Strategic CI |

|---|---|---|

| Time frame | Short-term (days to months) | Long-term (months to years) |

| Focus | Day-to-day operations, quick responses | Market direction, future positioning |

| Primary data sources | Real-time signals for pricing, ongoing campaigns, sentiment | Reports and forecasts on regulations, technology shifts, etc. |

| Primary users | Sales, marketing, procurement | Executives, strategy, R&D |

Think of a multinational manufacturer noticing a rival quietly expanding its supplier base in Southeast Asia.

Tactical CI would flag potential short-term risks, such as supply shortages or pricing volatility, to enable procurement to negotiate better terms.

Strategic CI, however, would dig deeper to determine if this could mean a regional shift in production costs or suggest a pivot from some larger geopolitical hassle.

Both interpretations matter, just for different timelines and audiences.

Remember that one isn’t superior to the other.

Tactical CI delivers agility, and strategic CI ensures foresight.

The problems start when insights from one stream don’t reach the other.

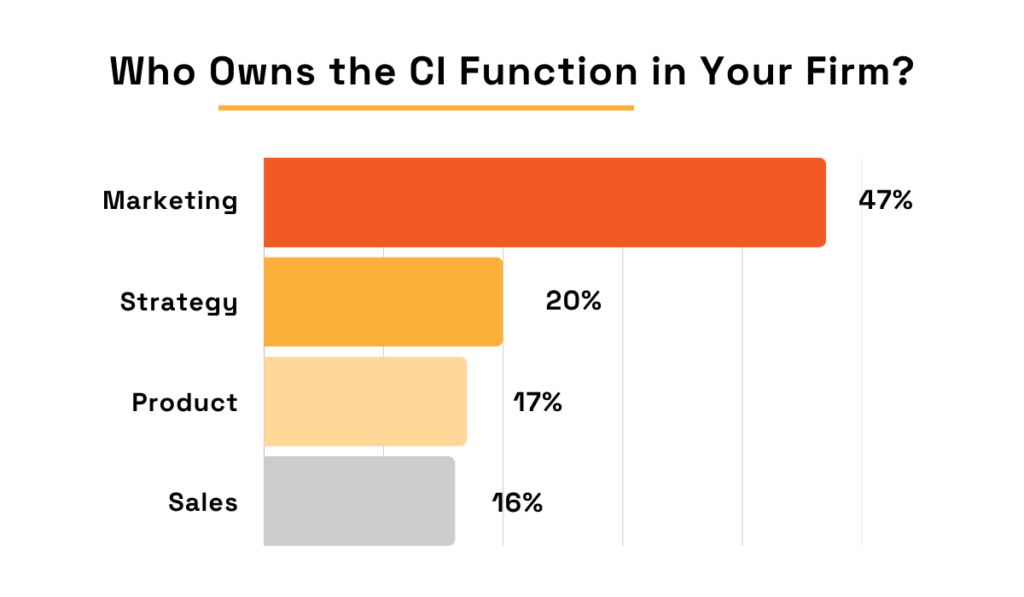

According to Crayon’s findings, CI is usually owned by marketing, with the rest spread among strategy, product, and sales.

Illustration: Veridion / Data: Crayon

While someone needs to have ownership, your organization can easily lose the full context the moment insights become siloed.

This is why you need a holistic approach that incorporates a shared CI function and enables seamless circulation of insights.

Not sure how to leverage both types of CI and ensure that different teams have access to pertinent data?

Exploring the practical side of things, namely, gathering competitive intelligence, can help explain things.

Organizations collect competitive intelligence through a combination of automated tools and human expertise.

First, you need to identify reliable sources of information, followed by data collection, interpretation, and connection to strategic objectives.

Here, the distinction between primary and secondary sources is key.

The former refers to intelligence gathered directly from interactions and operations, while the latter is public or third-party information.

As far as research shows, the top sources of CI today come from internal intelligence, namely feedback from buyers, sellers, and deal outcomes, which is followed closely by competitor websites and win/loss analyses.

Illustration: Veridion / Data: Crayon

Beyond these, organizations also mine analyst reports, social media updates, online reviews, and support forums, since each offers a valuable vantage point on competitor behavior and market dynamics.

In the past, research relied heavily on manual work. Teams monitored press releases, tracked patents, or gathered insights at trade shows.

While valuable, these methods are slow, inconsistent, and nearly impossible to scale.

Today, gathering intelligence is a data-driven discipline, with automation drastically accelerating discovery and data verification.

This is also reflected in the numbers.

Compared to 38% last year, over half of organizations surveyed in 2025 use dedicated CI tools, which signals a clear move away from spreadsheets and toward automation.

Illustration: Veridion / Data: Crayon

And the results speak for themselves: Companies using dedicated competitive intelligence platforms report a 79% increase in sales team effectiveness when competing for deals.

Why?

Because automated tools help you collect and store information while making it instantly actionable.

Traditional reports often become static, losing value the moment conditions shift.

But modern CI systems focus on contextual delivery, feeding relevant insights to the people who need them, at precisely the right moment.

The necessity of providing better access to data is also one of Crayon’s key takeaways in their most recent report.

Illustration: Veridion / Quote: Crayon

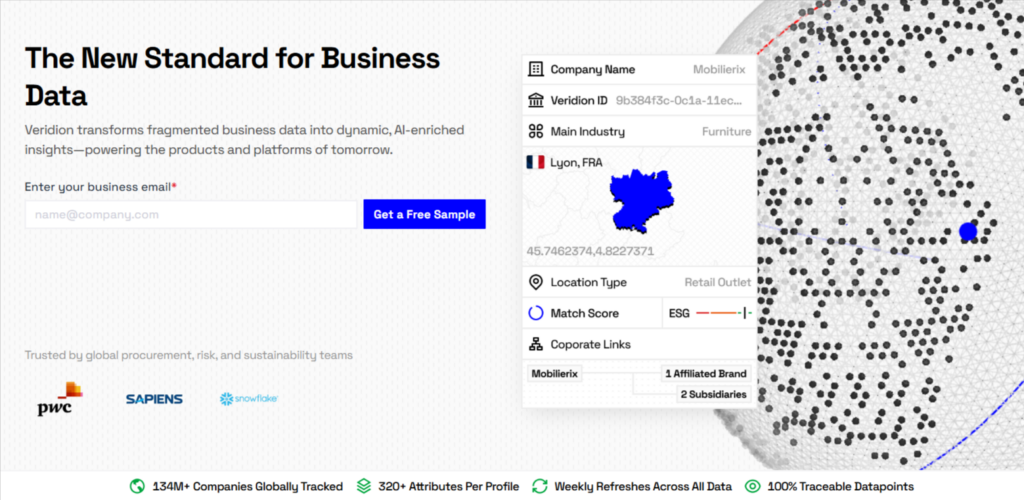

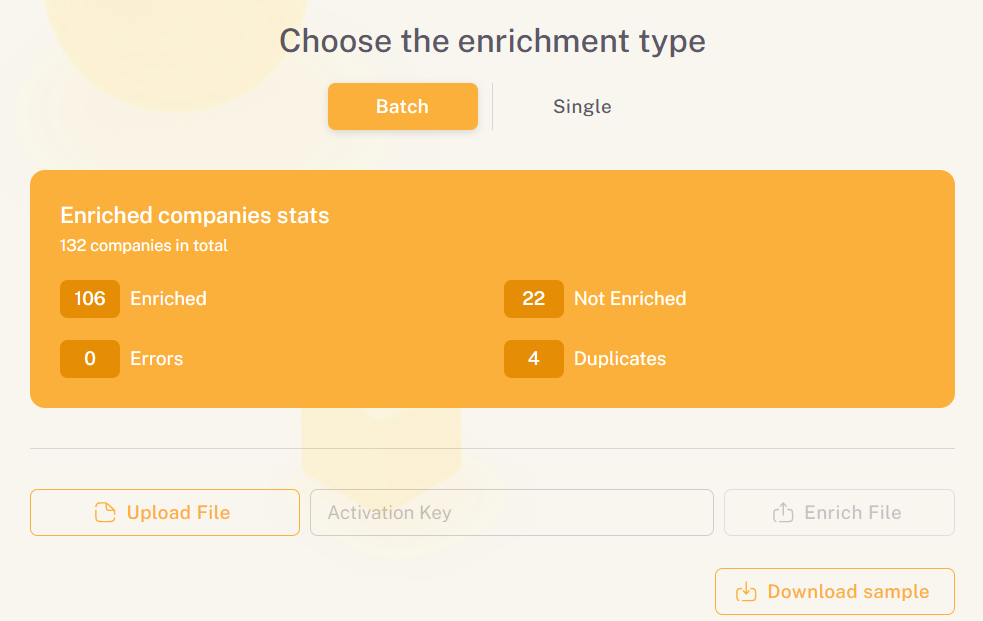

That’s where tools like Veridion come in.

While its application extends far beyond CI, Veridion demonstrates what next-generation intelligence looks like in practice.

Our global, expansive database of over 130 million company profiles combines scale with depth, offering granular insight into markets and competitors alike.

AI agents continuously scrape and validate data from company websites, media outlets, and social platforms, enriching each profile with more than 320 attributes per entity, from leadership and ESG commitments to product updates and partnerships.

Source: Veridion

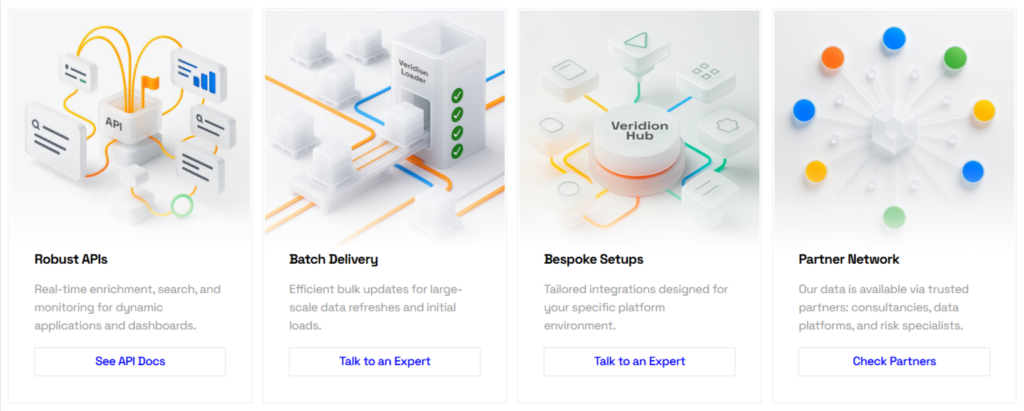

With rich datasets and weekly updates, Veridion enables teams to track even subtle signals of strategic change without waiting on quarterly reports.

Through automated enrichment and flexible delivery methods, intelligence flows directly into CRM, analytics, or ERP systems, preventing valuable data from being siloed.

Source: Veridion

Ultimately, to effectively gather competitive intelligence, you need to connect breadth with immediacy.

While automation broadens your reach and saves time, human input interprets each insight to make the most of it.

That’s how scattered signals turn into foresight that makes organizations faster, sharper, and far better prepared for what comes next.

So, what exactly makes up competitive intelligence?

At its core, CI is a coordinated system of activities that helps you analyze and reframe scattered market data, turning it into actionable insight.

While many of these steps can be done manually through spreadsheets, battlecards, and team debriefs, modern CI platforms now automate much of the process.

But let’s start with the foundation: competitive analysis.

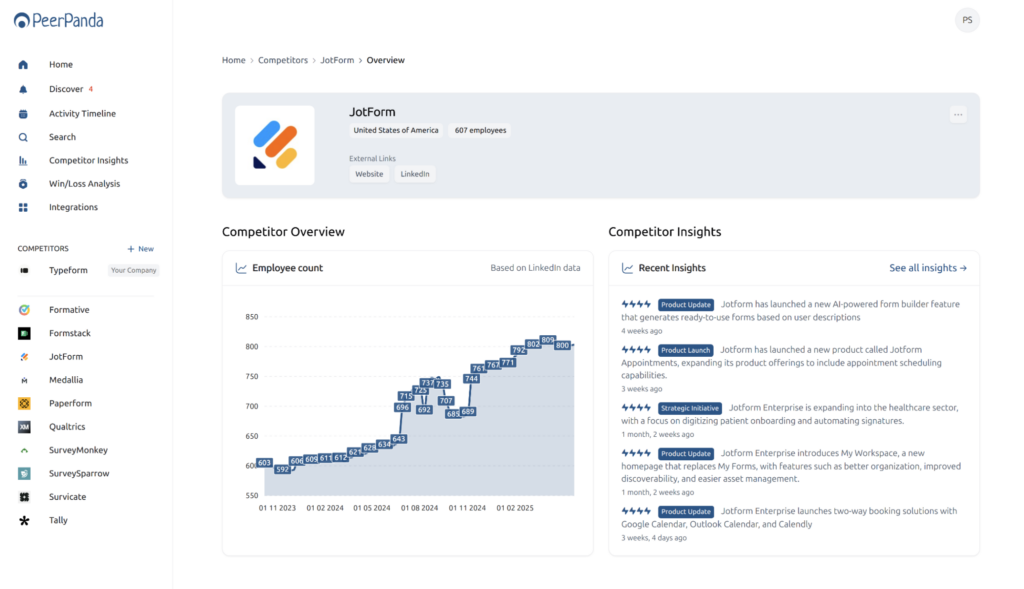

Competitive analysis involves evaluating competitors’ strengths, weaknesses, market share, and strategic moves.

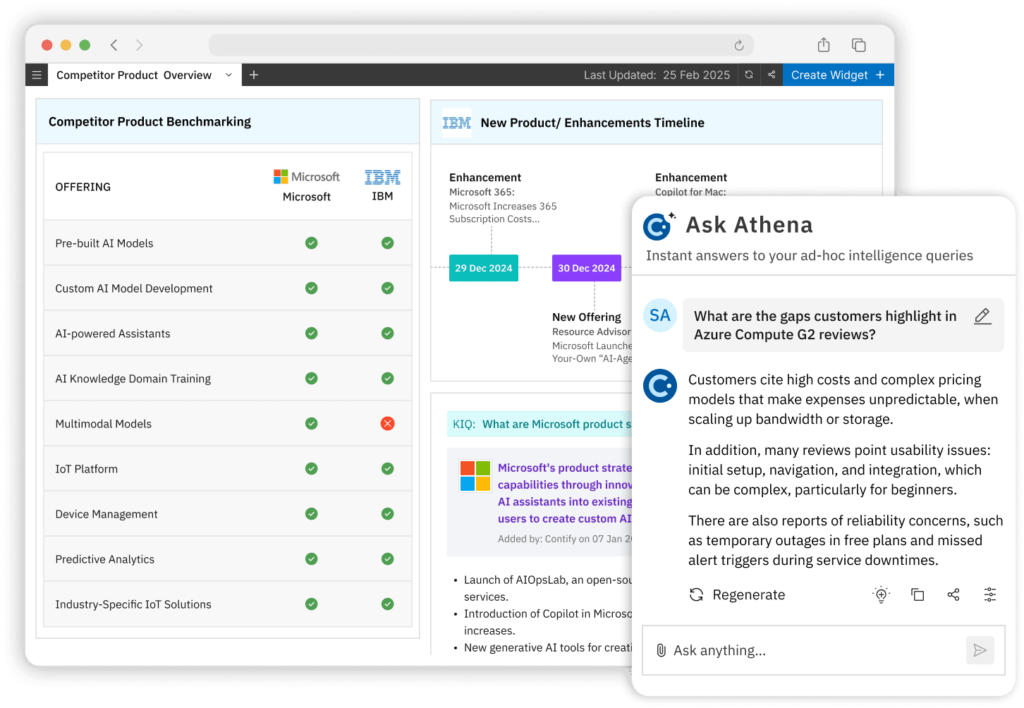

Dedicated CI tools automatically log updates and visualize trends for every identified competitor, with one example shown below.

Source: Peer Panda

Once you’ve mapped competitors, the next step is to see how you measure up.

Competitive benchmarking compares your organization’s performance, pricing, or offerings against market leaders.

And platforms like Truescope make this process visual and interactive.

With charts and timelines, you can easily track your share of voice, media sentiment, or engagement relative to peers.

Source: Truescope

While in this case the focus is on social media and things like key phrases and top hashtags, benchmarking also gives you a closer look at specific competitor offerings.

Tools such as Contify provide side-by-side comparisons of competitors’ products, pricing tiers, or features.

You can trace when a rival launched an upgrade or discontinued a product line, all in a single interface.

Source: Contify

Using AI agents like Athena extends this capability by providing context on demand.

You can ask about key downsides of specific products on review sites or check how this feedback could inform a strategic shift further down the line.

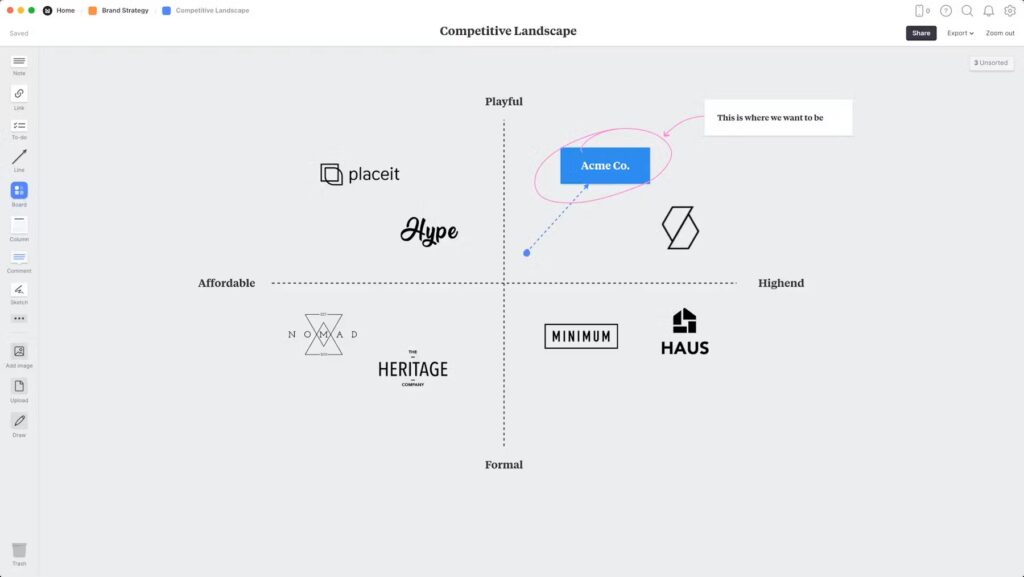

This brings us to competitive landscape analysis.

It involves mapping direct, indirect, and emerging competitors to give you a 360-degree view of the playing field.

You can group companies by features, target audience, or market share; it doesn’t matter.

Solutions like Milanote make this process as intuitive as it can get, enabling teams to collaborate live on visual boards while commenting and refining inputs together.

Source: Milanote

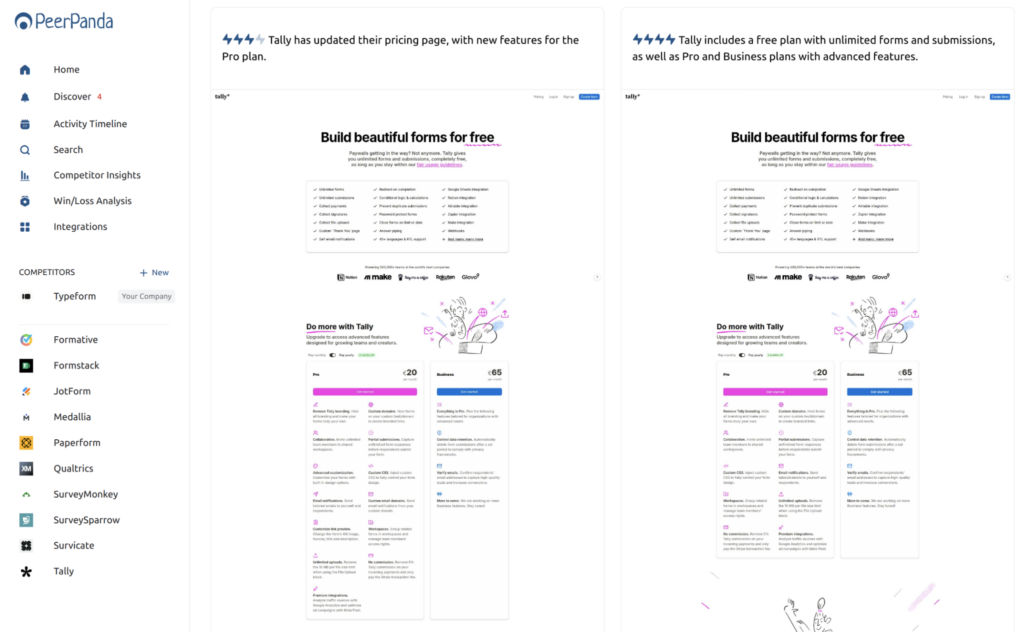

But the most powerful CI component is real-time monitoring, allowing you to track every competitor update, product launch, or leadership change.

Many CI platforms focus heavily on this capability, allowing users to visualize not just data shifts but the context around them.

As we’ve established previously, company websites remain a critical CI source, which is why platforms like Peer Panda prioritize features for easy web monitoring.

Every major content and layout change is flagged, while users get helpful summaries.

Source: Peer Panda

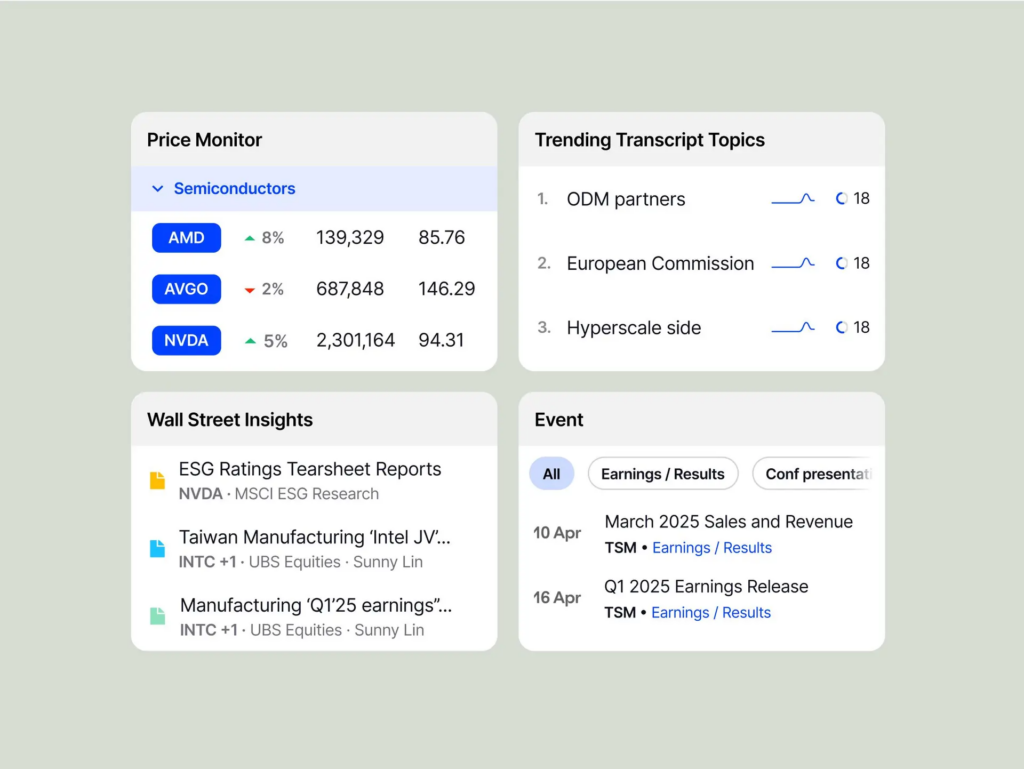

Naturally, it’s likely you won’t always prioritize the same data source or monitoring parameters, which is why platforms like AlphaSense offer extensive customization.

You can tweak dashboards to monitor what matters most, be it pricing trends, policy changes, or media sentiment.

Source: AlphaSense

And with carefully configured alerts, you’ll be instantly notified of any anomalies, such as a sudden spike in mentions of a competitor or new market entry.

But remember, even the best dashboards depend on accurate data.

To enable seamless updates and accessible insights, the best systems come equipped with powerful data enrichment workflows.

Source: Veridion

In short, each component builds upon the last.

Analysis clarifies where you are, benchmarking shows how you compare, and real-time monitoring ensures you’re always in the loop and ahead of the competition.

Monitoring rivals is the gist of competitive intelligence, but it’s hardly the full picture.

With the right tools, careful planning, and discipline, it transforms fragmented market data into strategic foresight.

That translates to timely innovation in the face of evolving customer needs and agile responses to evolving risks.

Whether your goal is faster decision-making, sharper positioning, or smarter investments, a mature CI function delivers incredible ROI that will propel you ahead of all rivals.