5 Biggest Benefits of Competitive Intelligence

Key Takeaways:

Instinct alone won’t keep you ahead, but competitive intelligence can close most of the gaps.

By turning scattered data into actionable foresight, you can anticipate competitor shifts, meet customer needs, and see where the next opportunity lies.

From pricing changes to brand positioning, CI helps you make informed, proactive decisions.

This article explores the key benefits of competitive intelligence and the ways it sharpens strategy across your operations, marketing, and more.

One of the strongest advantages of competitive intelligence (CI) lies in its ability to forecast competitor actions, be it upcoming product launches, pricing shifts, or mergers.

Even a heads-up can make a decisive difference in markets where one move can change everything.

Just think back to the 2007 iPhone launch.

With Apple tuned in to emerging consumer trends and touchscreen-based technology, the new product created a historic market disruption.

Internal documents of competitors like Nokia would later reveal that the company understood what they were up against, but couldn’t match the pace and boldness of innovation.

Source: Android Authority

It’s difficult to say whether things would have been different had Nokia, Blackberry, and other Apple’s competitors caught wind of this shift sooner.

But CI would have been the ideal tool for identifying, interpreting, and acting on early signs of change.

Today, the competitive landscape evolves faster than ever, but anticipation is far more achievable.

Modern competitive intelligence platforms powered by artificial intelligence enable real-time monitoring, allowing organizations to spot competitor initiatives long before they surface publicly.

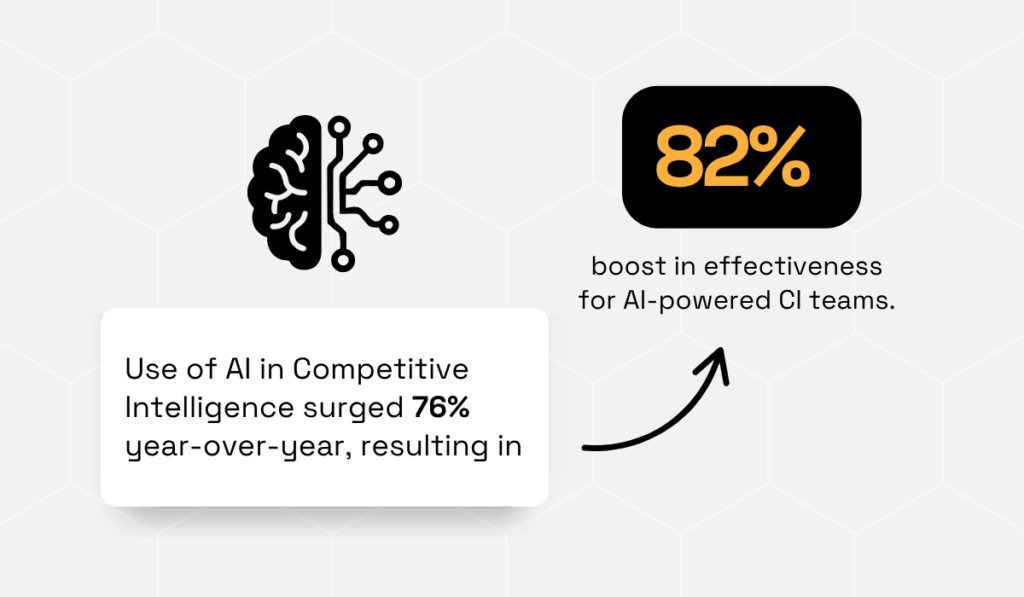

According to Crayon, CI teams saw a 76% year-over-year increase in AI adoption, leading to a substantial boost in effectiveness.

Illustration: Veridion / Data: Crayon

This transformation is fueled by the sheer scale and speed of AI data collection.

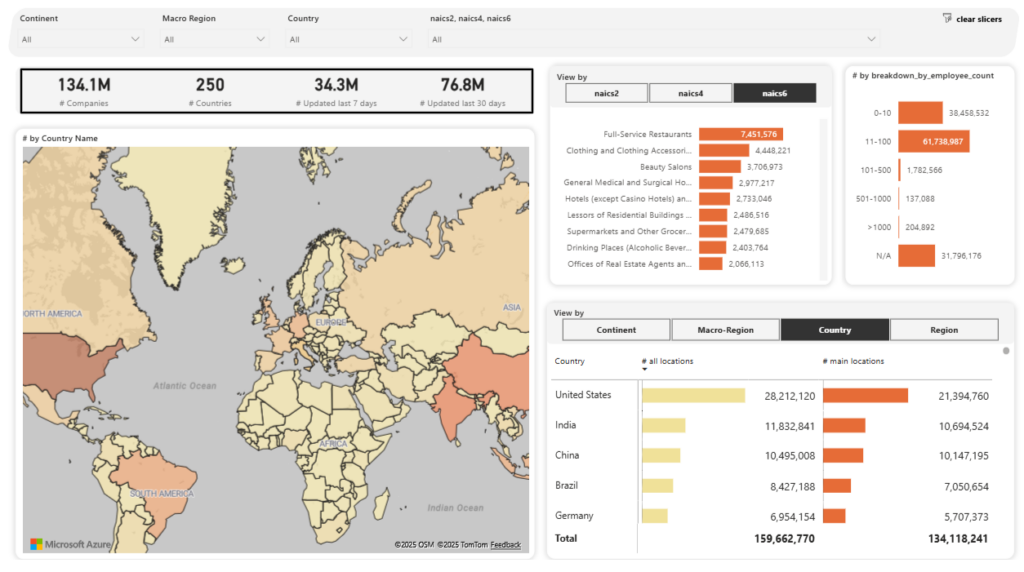

Business intelligence platforms like Veridion exemplify this shift.

By utilizing AI-powered bots to continuously scan and verify data from various sources, our expansive database of 134 million companies is able to deliver fresh, structured insights across industries and geographies.

Need a clear snapshot of potential market moves?

The intuitive dashboard lets teams filter by country, sector, or custom criteria.

Source: Veridion

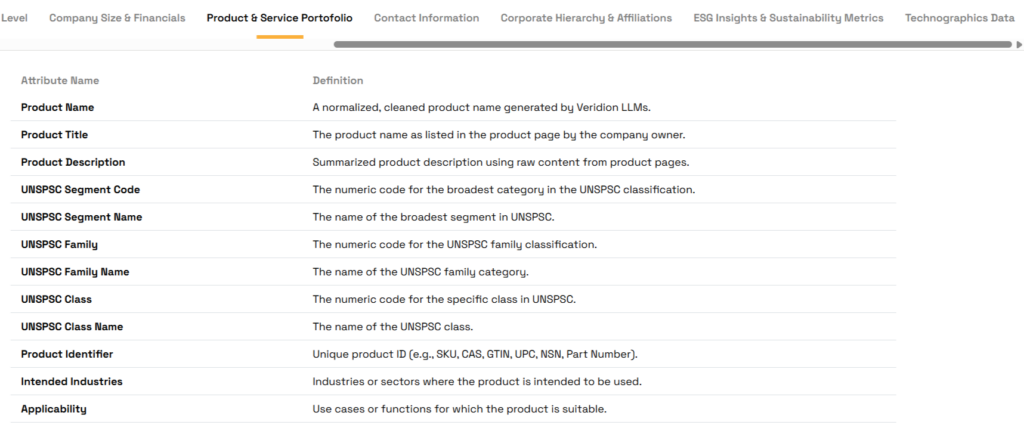

And speed doesn’t sacrifice depth.

Veridion’s 220+ data points on each company make it easier to track subtle but significant indicators of upcoming strategic shifts, whether it’s leadership changes, product lines, ESG commitments, or financial performance.

Source: Veridion

Yet even the most advanced tools work best when combined with traditional observation.

Leadership expert Robert M. Donaldson, CEO of Collaborative Strategies Consulting Inc., recommends going hands-on.

Buy a competing product, test the customer service, and make note of any advantages and disadvantages it has.

Illustration: Veridion / Quote: Forbes

Blending digital intelligence with human curiosity is essential.

When those two things align, you’ll be doing more than just responding to competitors’ moves.

You’ll be bringing the fight to them.

Competitive intelligence empowers organizations to uncover unmet customer needs, underserved markets, and weaknesses competitors overlook.

These insights don’t just lead to new ideas.

They lead to new opportunities that can redefine entire categories.

A striking example of this is Goodles, a brand that spotted a blind spot in the $1.8–$2 billion shelf-stable mac and cheese market dominated by Kraft Heinz.

They didn’t have to invent something entirely new.

Goodles simply reimagined a staple comfort food as nutrient-rich, flavorful, and entirely suited to adults.

Source: The Wall Street Journal

Ironically, Kraft’s own 2020 “Send Noods” campaign was created to appeal to grown-up audiences, but they didn’t have the product to match the message.

In the end, it was Goodles that seized that opening, blending design, health, and attitude to capture a market Kraft had inadvertently illuminated.

As explained by their Co-Founder, Paul Earle, the brand identified and traced the formula many successful challengers share:

“Beautiful design in an ugly space, appeal to younger consumers, improved products, new energy, new language, and breaking conventions.”

That mix of insight and timing helped set Goodles apart.

Keep in mind that identifying market gaps isn’t limited to startups with bold ideas. It begins with sharing intelligence internally.

Sales teams, for example, often hear why a prospect did or did not choose a competitor.

Those snippets of feedback can reveal whether buyers feel neglected, overpriced, or underserved.

And when that kind of information stays siloed, opportunities dissolve before your eyes.

Another practical step is improving how data is presented.

Even the best insights fall flat if teams can’t interpret them quickly.

That’s why Dan Banas, Analytics, AI, and Strategy Consultant at SEI, advocates for visual analytics that can make CI findings accessible and compelling across functions.

Illustration: Veridion / Quote: LinkedIn

Investing in CI pays off because it builds a systematic advantage.

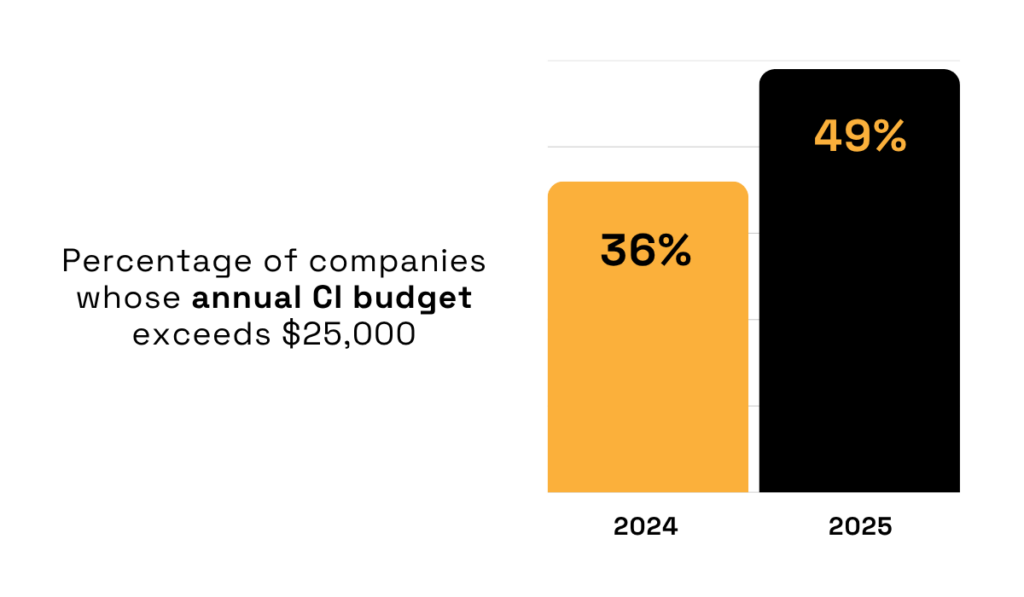

Crayon’s 2025 report shows that 49% of businesses now allocate over $25,000 annually for CI.

That is a 13% jump in just one year.

Illustration: Veridion / Data: Crayon

These figures underscore how organizations increasingly view intelligence as essential growth infrastructure, not a nice-to-have.

Comprehensive, intelligible CI enables you to see beyond your product line or current audience.

And in the end, the best market openings aren’t invisible. You just need to look differently.

Leveraging competitor insights accelerates innovation while reducing the risks that often derail product development.

Common risks include poor market fit, misjudged launch timing, or overestimating how much customers actually need a new feature.

Still, awareness of these pitfalls doesn’t always translate into preventive action.

McKinsey found that over one-third of companies don’t talk to end users during product development, showing just how easily feedback and competitive awareness can fall through the cracks.

If so many teams overlook their own customers, how many also underestimate what their competitors are doing or what customers are saying about them?

Competitive intelligence closes that gap.

A 2021 study of 43 Chinese high-tech enterprises found that the top three reasons for using CI in product development were reducing innovation risks, improving product quality, and driving differentiation.

Illustration: Veridion / Data: ACM Digital Library

The report also showed that organizations frequently drew on public data sources, such as online activity, digital footprints, or industry exhibitions, rather than relying on third-party consultants.

Both approaches have their advantages in helping you shape R&D priorities.

The important thing is to identify which competitor features attract the most engagement and which criticism, as well as to reveal customers’ unmet needs.

Common strategies include competitive benchmarking and SWOT analyses, but another surprisingly rich source of information is competitor product reviews.

They’re a goldmine of insight that reveals recurring complaints or missing features.

However, sorting through the noise can be exhausting.

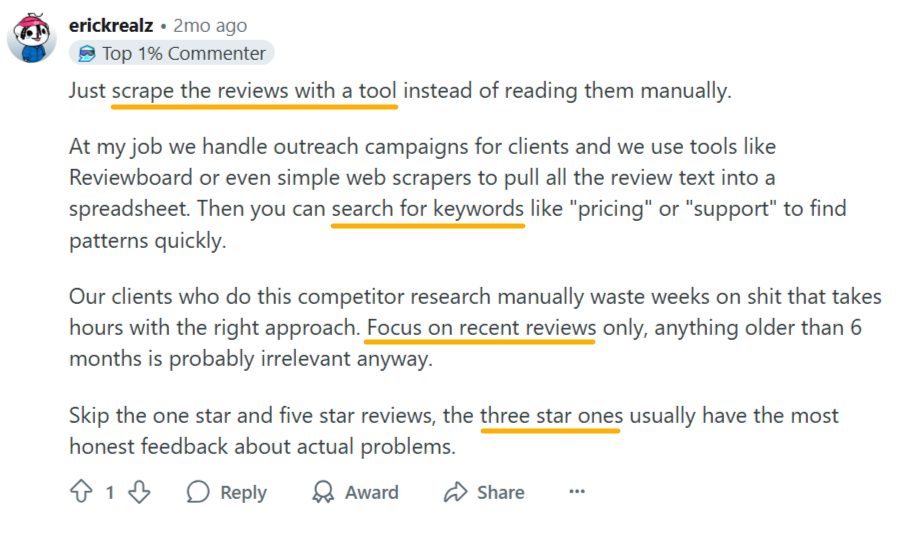

One Reddit user recommends automating the process with web scrapers or tools like Reviewboard, then zeroing in on recent three-star reviews, which tend to reveal the most actionable feedback.

Source: Reddit

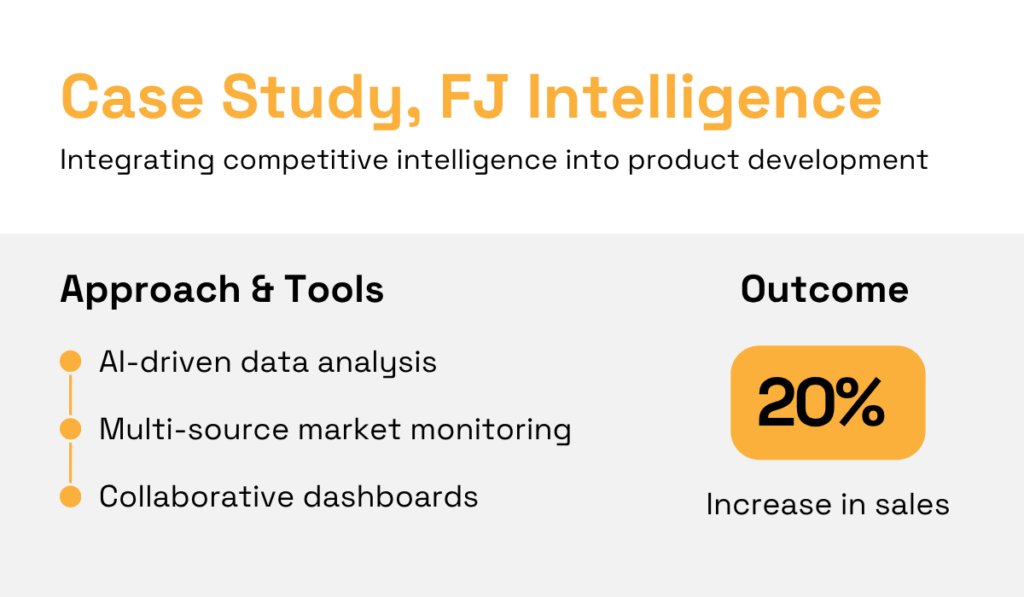

For a more advanced approach, FJ Intelligence demonstrated how a full-fledged CI system can elevate product development to a strategic level.

In their recent case study, the firm used AI-driven data analysis to extract data from multiple sources, from patents and scientific papers to social media and competitors’ websites.

They then integrated competitive insights directly into a client’s R&D process.

With a unified dashboard connecting R&D, sales, and marketing, the client, dubbed Gamma Company, identified an emerging VR trend and swiftly integrated similar features into its own products.

The result? A 20% sales increase through faster product alignment with market demand.

Illustration: Veridion / Data: FJ Intelligence

It all boils down to this:

When product teams blend structured intelligence with creative interpretation, innovation is bound to be both faster and smarter.

Sharper positioning and marketing directly influence customer acquisition and retention, but achieving both requires the right intel and agility.

Competitive intelligence gives marketing its edge, refining brand positioning and messaging so that it truly stands out in the market.

According to SurveyMonkey’s 2024 report, 61% of product marketers cite strengthening customer relationships as their company’s top priority.

This is followed closely by 58% who emphasize more personalized marketing efforts.

Illustration: Veridion / Data: Survey Monkey

Personalization and connection are two sides of the same coin.

As Michael Durant, Head of Creative Design Agency, explains, connecting with buyers requires emotional resonance, and successful brands foster it through carefully crafted systems.

Illustration: Veridion / Quote: 2822 News

So, how do you get there? You guessed it, competitive intelligence.

CI reveals how your rivals communicate and what their audiences respond to, giving you a roadmap for cultivating brand loyalty.

Moreover, by tracking competitor messaging, ad spend, partnerships, and customer engagement, marketers can pinpoint overused narratives and ample ground for emotional engagement.

In other words, you’re not copying what your competitors are doing.

“Hacking” the system means deducing what they miss.

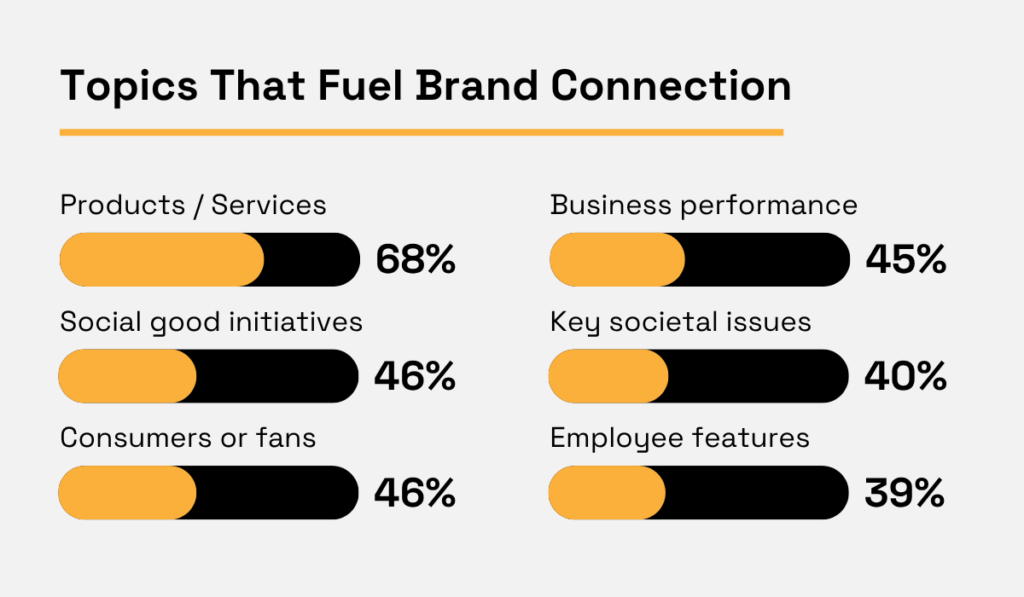

A Sprout Social survey provides a useful baseline for social media marketing efforts, with consumers themselves highlighting key topics that cultivate connection.

Illustration: Veridion / Data: Sprout Social

CI builds on this knowledge further.

A closer look at competitors’ social media behavior gives you a precise overview of themes that spark engagement among your target audience, as well as ways to deliver these to drive conversions.

Applying CI insights requires structured observation, so start by answering the following questions:

It’s also beneficial to use keyword and sentiment analysis to identify what customers associate with your competitors’ brands versus yours.

These insights help marketing teams personalize messages beyond demographics, tailoring tone, story, and value propositions to the motivations that actually drive buyer decisions.

Ultimately, competitive intelligence sharpens campaigns and builds marketing maturity.

Once you understand what resonates in your space, and what’s missing, you start to shape the market, rather than just reacting to it.

By tracking competitors’ weaknesses, strategic missteps, and external threats, competitive intelligence also acts as an early-warning system for market risks.

It’s what allows companies to avoid pitfalls affecting their competitors and have mitigation strategies at the ready.

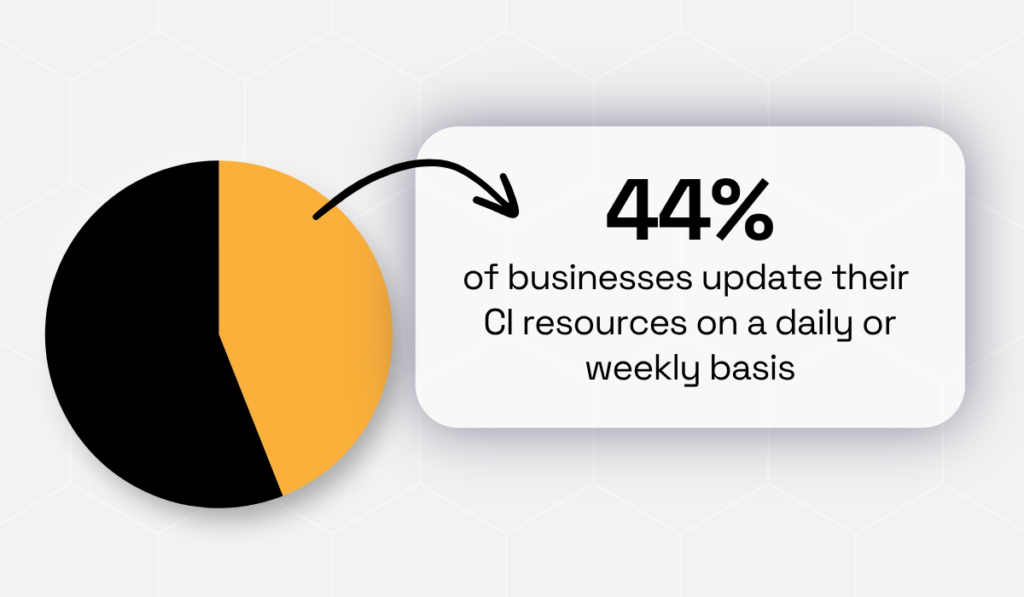

According to Crayon, 44% of businesses updated their CI resources daily or weekly in 2020.

Illustration: Veridion / Data: SCIP & Crayon

The same report showed that 98% still relied primarily on competitor websites as their main data source.

In a world where risk signals appear across multiple channels, that’s a pretty narrow focus.

When used to its full potential, CI functions as a defensive tool as much as a growth enabler.

It helps organizations detect danger early, whether it’s a disruptive innovation, regulatory shift, or supply chain vulnerability, and pivot before those risks escalate and do serious damage.

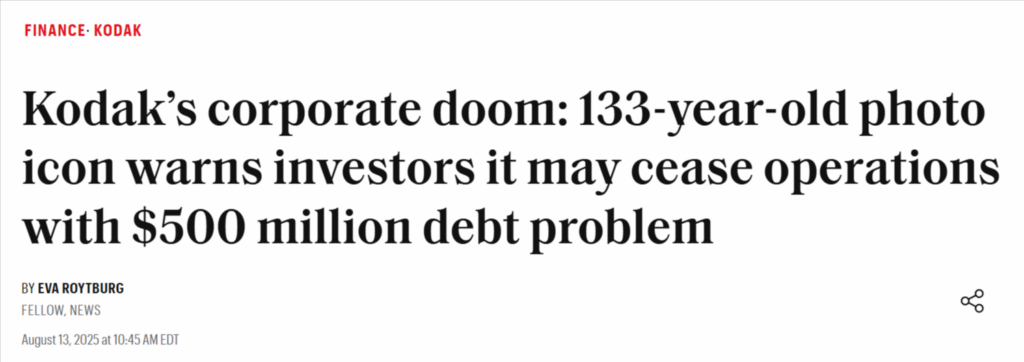

Consider the example of two industry giants, Kodak and Fujifilm.

Kodak held most of the market share for years until the two faced the same technological threat: the rise of digital photography.

Authors of one comparative study on managing digital disruption explain that recognizing the early signs of disruption gave Fujifilm the necessary edge to counter it:

“Fujifilm recognized the digital disruption early and launched its information and imaging (I&I) strategy in 1997. The company continued cultivating its I&I culture and organized resources to enhance its document solution business.“

By the end of 2016, Fujifilm’s total revenue was almost 13 times higher than Kodak’s, and the company employed 13 times more workers, as cited by the authors.

Kodak, by contrast, filed for Chapter 11 bankruptcy in 2012 and never fully recovered.

Source: Fortune

The lesson is clear: one was more successful than the other in navigating the disruption, but also in collecting intelligence.

Fujifilm’s proactive intelligence culture continues today, as indicated by its current partnership with Informatica.

In unifying data management, the company will be even more vigilant in leveraging insights and recognizing emerging risks long before they become structural problems.

But technology disruption isn’t the only danger.

Companies today face volatile input costs, geopolitical tensions, shifting regulations, and reputational risks from social media blowback.

One of the fastest-evolving threats is cybersecurity.

Embedding CI into your cyber strategy gives you a multipoint layer of protection, strengthening detection, prevention, and response.

| Threat Landscape Monitoring | Track attack patterns and exploited vulnerabilities affecting similar industries. |

| Benchmarking and Best Practices | Compare internal safeguards to leaders in the sector and close identified defense gaps. |

| Conducting Vendor and Partner Risk Assessment | Assess partners’ breach history, compliance maturity, and investments in system security. |

At its core, competitive intelligence gives you visibility and foresight.

Expanding your CI efforts gives you the means to outrun both competition and risk itself, and helps your business thrive.

If you’re still making decisions without competitive intelligence, you’re competing half‑blind.

Whether your goal is to spot market gaps, enhance product development, or sharpen your marketing campaigns, CI is often the difference between merely surviving and truly succeeding.

And with modern CI tools that blend automation, analytics, and human insight, you can easily cut through data overload and focus on what matters most.

Leverage the technology available today, and you won’t just anticipate market moves.

You’ll gain a clear, adaptable strategy for success.