7 Best Competitive Intelligence Tools

Competitive intelligence (CI) tools automate the collection and analysis of raw market and competitor data, turning it into structured, timely intelligence.

But not all CI platforms are built the same.

This article explores seven leading tools to help you choose the best fit for your organization’s objectives and overall strategy.

Let’s take a closer look at their key strengths, features, and use cases.

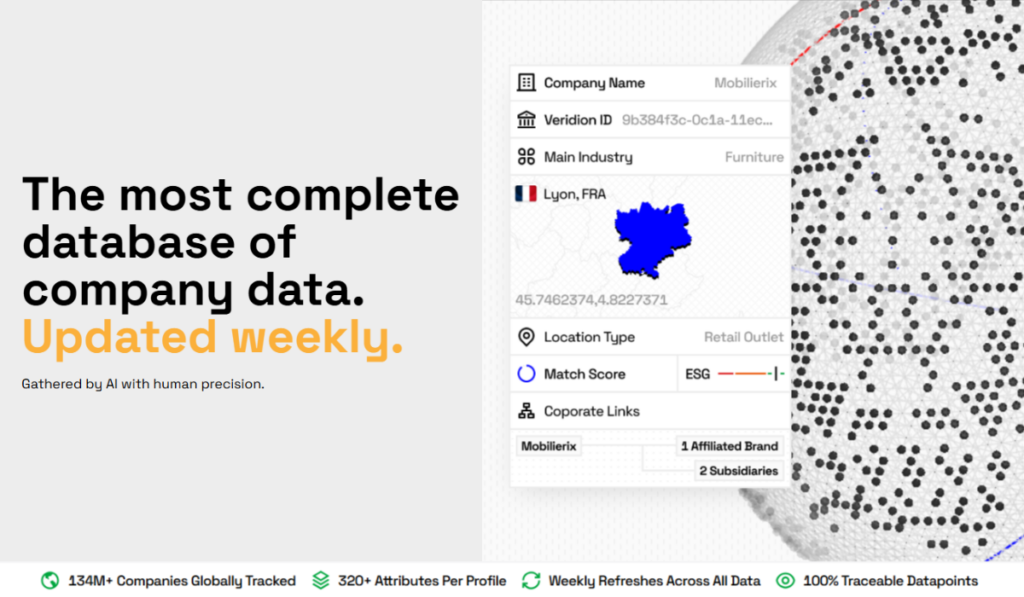

Veridion’s AI-powered platform bolsters CI efforts by gathering, cleaning, and organizing business data on more than 130 million companies worldwide, from private enterprises to the most elusive SMBs.

It continuously extracts information from company websites, media outlets, socials, and more to deliver highly accurate, real-time company profiles enriched with over 320 attributes per entity.

Source: Veridion

Leveraging a dataset that’s updated weekly ensures all market research, sourcing, or investment decisions are grounded in current activity rather than stale records.

In other words, Veridion provides a data backbone that enables you to:

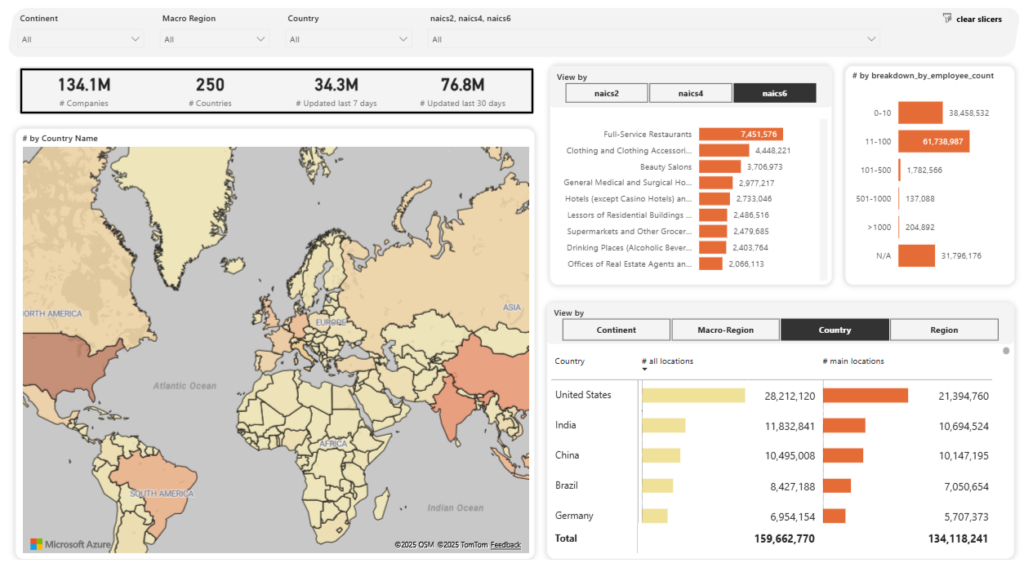

An intuitive interface with advanced filtering options allows your team to segment companies by country, region, size, or sector, offering clarity across billions of data points.

Source: Veridion

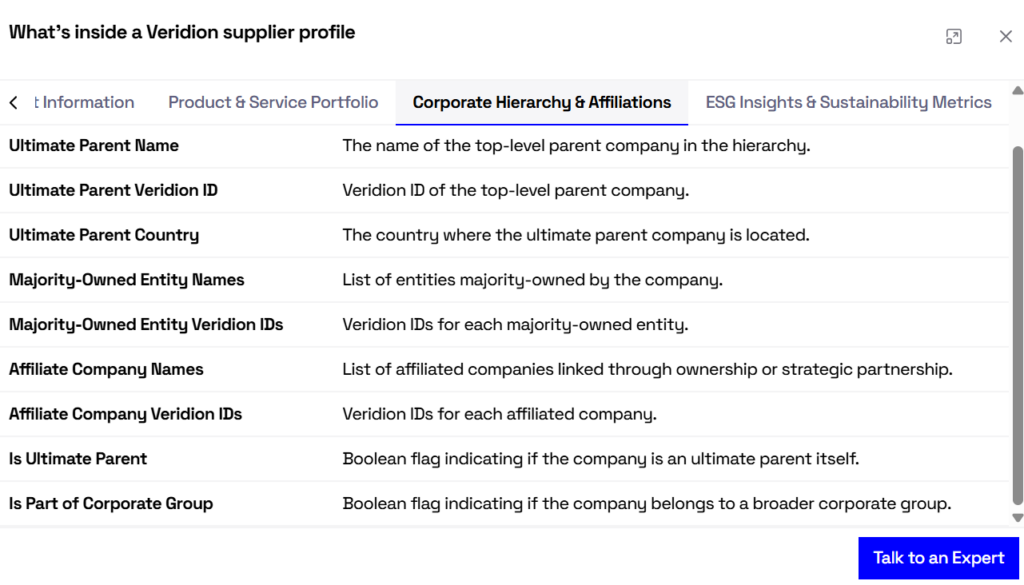

Beyond its unmatched coverage, Veridion delivers exceptional data depth.

Proprietary models can detect subsidiaries, aliases, and brand families, preventing duplication chaos to map clean corporate hierarchies.

Source: Veridion

Curious about digital maturity instead?

Veridion also enriches profiles with technographic data by analyzing indicators like web infrastructure, hosting data, and technology adoption patterns.

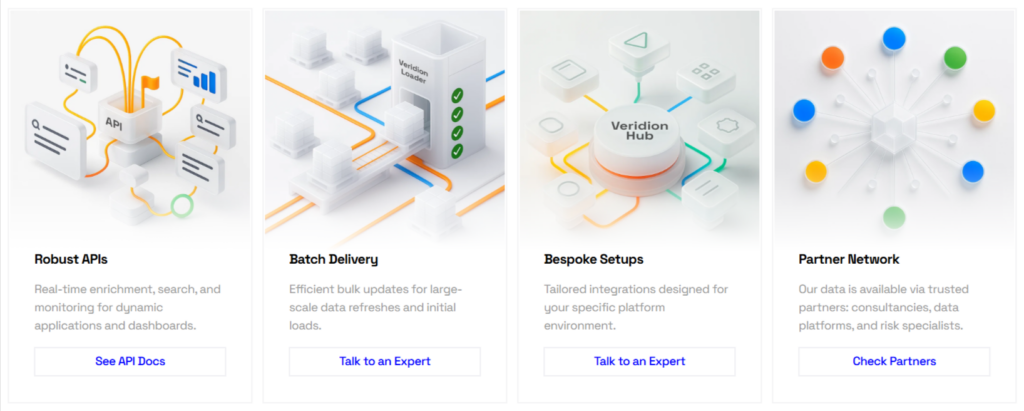

And thanks to robust APIs for real-time enrichment, batch delivery, and bespoke setups, all the data flows directly into your existing analytics systems.

Source: Veridion

This integration flexibility is key to Veridion’s role.

Unlike Krayon or Clue, which package competitor insights into dashboards and battlecards, Veridion delivers clean, verified company data that serves as the foundation for those tools.

Ultimately, this enables more accurate and comprehensive intelligence.

Pricing is adjusted based on data scope and usage, with tailored samples available on request.

All in all, if your organization depends on accurate, scalable, and continuously refreshed business intelligence, Veridion has the right foundation to build every other insight on.

Crayon is an established competitive intelligence platform built to help you monitor, interpret, and act on competitors’ digital activity in real-time.

Crayon’s AI analysis tool Sparks continuously surfaces 100+ insight types across your competitive landscape, from product updates and pricing changes to ad campaigns, and more.

The system compiles every detected change into a comprehensive feed, while features like AI summaries and importance scoring provide the necessary context and analyze business impact.

One of Crayon’s biggest advantages is how seamlessly it transforms raw intel into actionable insights for sales, product, or marketing stakeholders.

Source: Crayon

Users can turn curated insights into customizable battlecards, automated newsletters, and Slack or CRM alerts.

Moreover, you can use an AI compete assistant to get immediate, conversational answers to the most pressing questions on competitor strengths and weaknesses.

Source: Crayon

With the feature integrated into Salesforce and Microsoft Teams, though apparently not Google Workspace and Zoom, sales can efficiently separate noise from arguments that ultimately secure conversions.

Crayon’s real-time intelligence doesn’t go as deep as Veridion.

However, the platform excels at offering dedicated workflows and seamless collaboration, making it easier for large teams to align around a single source of truth.

While reviewers on G2 praise collaboration features and centralized CI, others point to analytical inaccuracies that require double-checking and manual processes.

This criticism is echoed by one Reddit user.

Source: Reddit

To get a pricing estimate based on specific competitive intelligence objectives, organizations need to reach out to Crayon directly.

To sum up, Crayon’s AI features and collaborative infrastructure are an excellent choice for companies that want to make competitive awareness a shared, ongoing process.

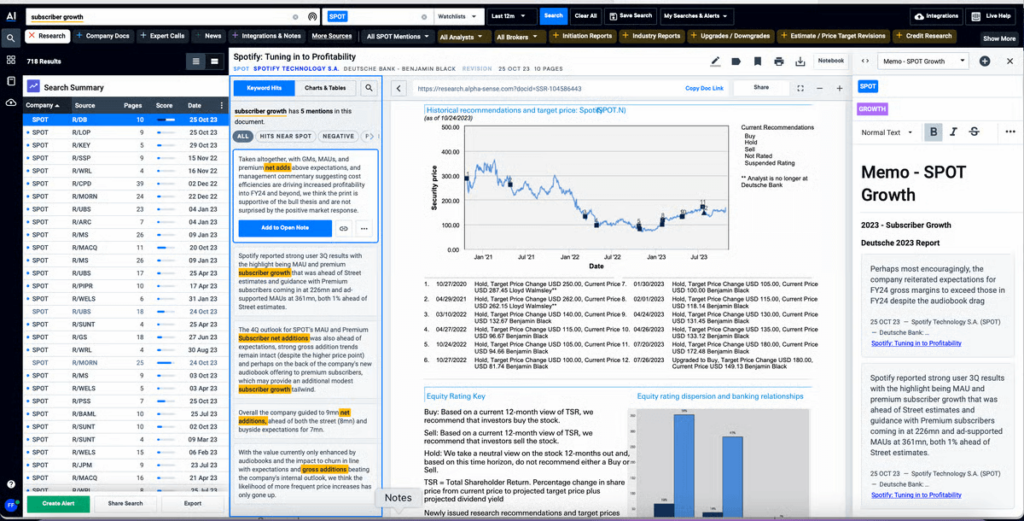

AlphaSense is a market and competitive intelligence platform that extracts insights from over 10,000 trusted content sources, including Wall Street Insights’ broker research and AlphaSense Expert Insights.

Its AI-powered search and summarization engine scans millions of documents to aggregate key topics and trends and help you monitor financial and other shifts from a single source of truth.

Users can easily narrow searches by company, sector, or theme and instantly surface key primary and secondary mentions of specific entities, as showcased in the video.

Source: AlphaSense on YouTube

AlphaSense emphasizes textual intelligence and deeper qualitative insight, which is reflected in its dashboard.

While the interface is largely clean and scores high on usability, the sheer number of feeds and complex presentation can make navigation overwhelming, especially for occasional users.

Source: G2

While this can be a drawback, their newer enterprise intelligence features like Generative Grids and Smart Summaries help condense entire earnings transcripts or research reports.

And more digestible highlights and competitor comparison charts translate to your analysts saving hours of manual reading.

Source: AlphaSense

Collaboration features also enable teams to annotate findings, share watchlists, and set up alerts for new mentions.

Just keep in mind that workflow automation isn’t as sales-oriented as in Crayon or Klue, and that there appear to be fewer customization options.

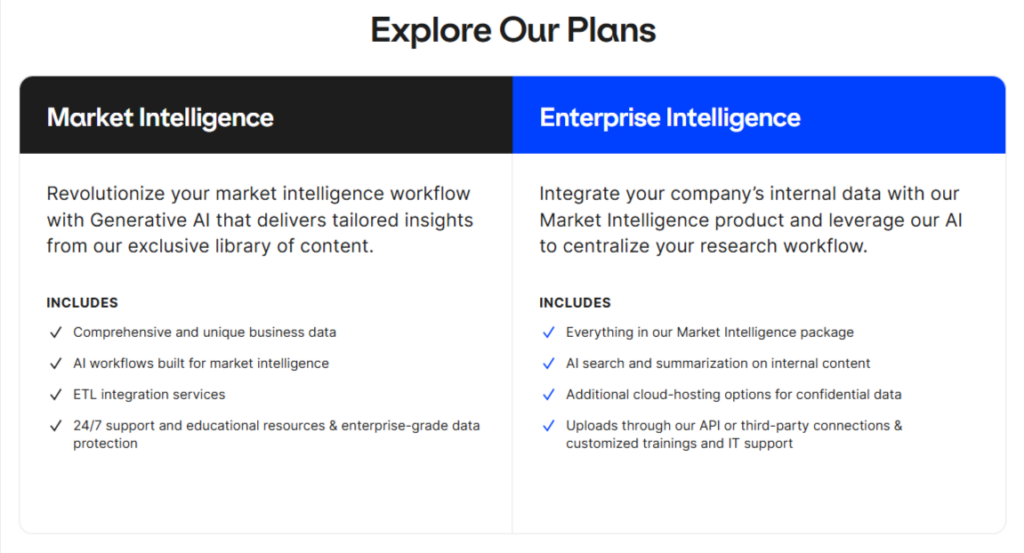

Pricing is flexible and quote-based, but the website offers a preview of key capabilities available through two dedicated plans.

Source: Alpha Sense

In short, AlphaSense is best suited for investment, strategy, and market intelligence teams that need granular, document-based insights to guide high-stakes decisions.

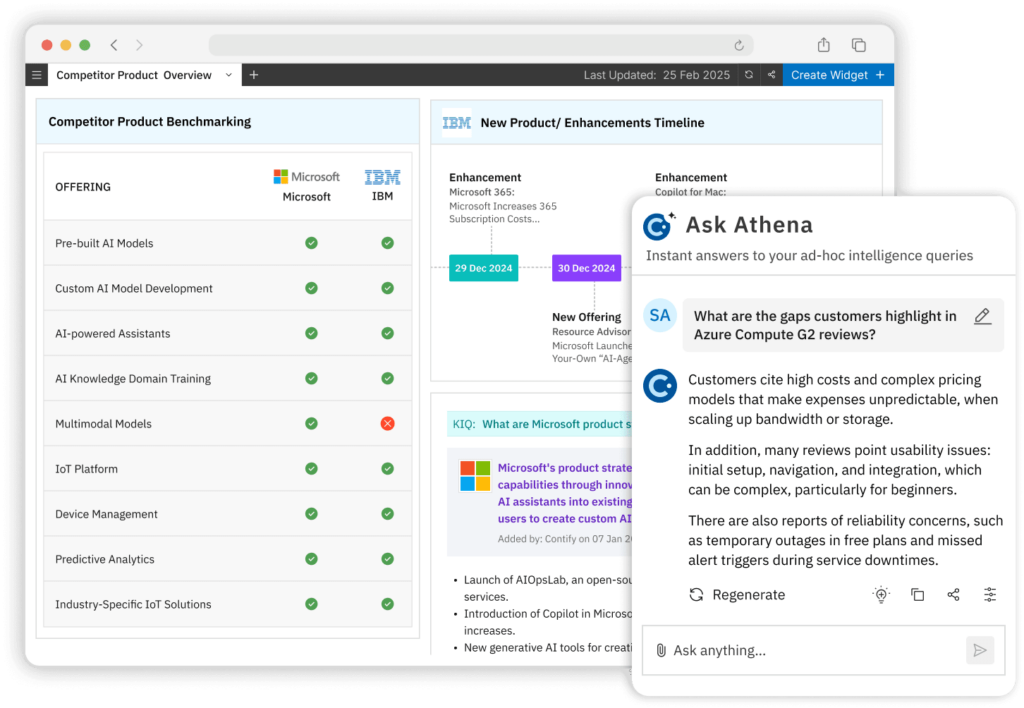

Contify positions itself as a market and competitive intelligence platform with data coverage extending to 1 million+ sources, 700,000+ companies, and 117+ languages.

The platform’s customizable dashboards and newsletters allow teams to build centralized intelligence hubs for specific focus areas, from sales and marketing to product.

For instance, if you need competitor product benchmarking, you can easily compare key offerings and view development timelines.

Source: Contify

Following other similar tools, Contify launched its Agentic AI insights engine Athena in mid-2025 to accelerate the analysis of unstructured content and deliver concise takeaways.

However, automation beyond summaries and reporting is somewhat limited, especially compared to Kompyte or Klue.

Nevertheless, users can filter insights by keywords, competitor sets, or topics, automatically route updates to specific departments, and send targeted intelligence queries.

One notable point of difference is Contify’s emphasis on data visualization.

Its One-Click Trend Analysis feature enables you to go beyond textual updates on newsfeeds and interpret key patterns by visualizing trends and timelines.

Source: Contify on YouTube

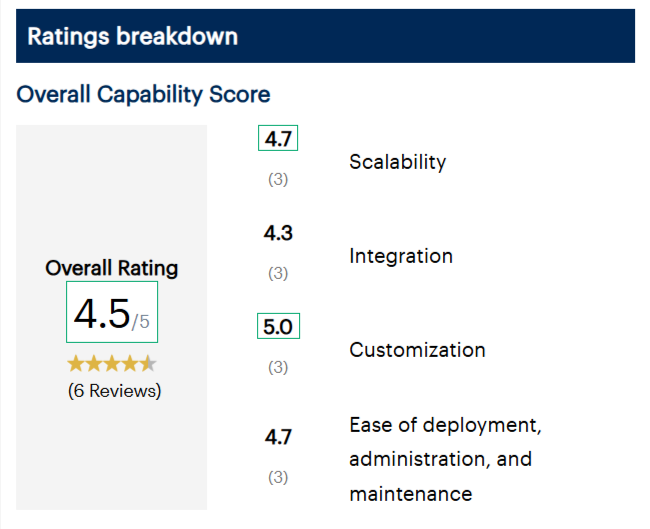

All this contributes to Contify’s high ratings in customization, scalability, and ease of deployment, as rated by Gartner.

Source: Gartner

On the other hand, frequently mentioned drawbacks concern the newsfeed itself, with some users citing limited tagging options and repeating news from multiple sources.

Pricing is tiered and based on data volume and integration scope, but you can sign up for a free 7-day trial.

All in all, Contify is an excellent fit for mid-to-large organizations that want flexibility in consolidating and organizing fragmented intelligence sources, but don’t require enablement.

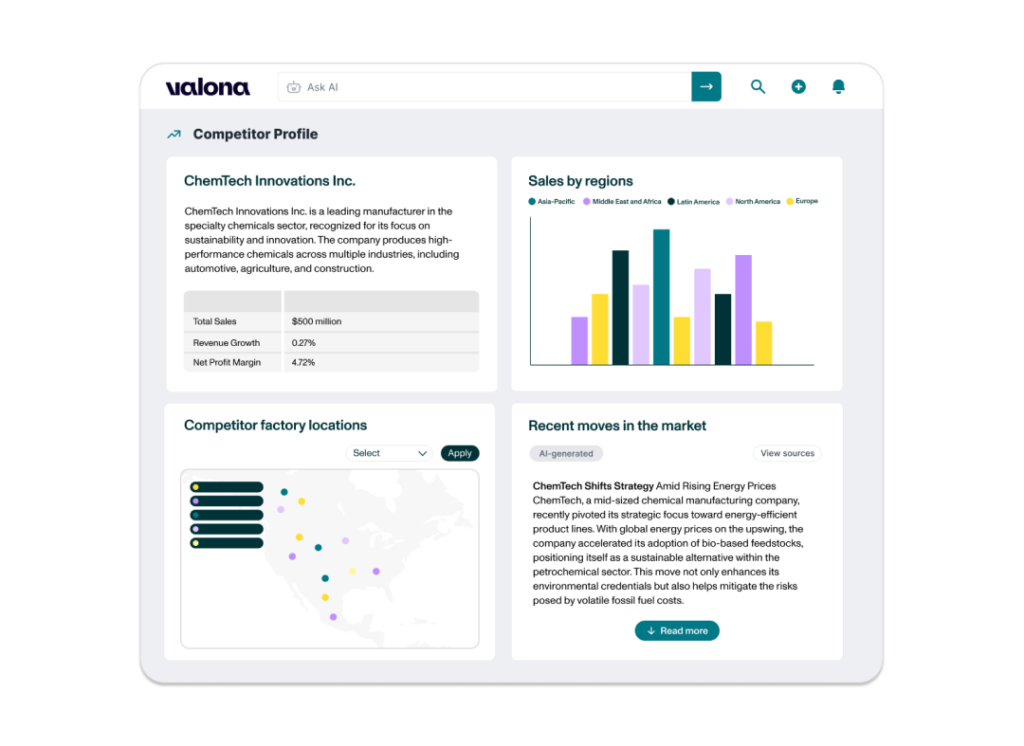

Valona (formerly M-Brain) is a market and competitive intelligence platform that blends AI automation with expert analyst curation.

Despite working with fewer data points than Veridion and Contify, the platform still covers over 200,000 sources spanning multiple geographies and languages, ensuring a global perspective.

The full Valona suite includes market trends, risk monitoring, and advisory services, but the Competitor Analysis module alone is sufficient for teams focused on CI.

The Competitor Analysis tool scours news outlets, social media, press releases, and paywalled content to provide rich competitor profiles, enable benchmarking and market positioning, and deliver automated battlecards.

Source: Valona

Dashboards and alerts are fully customizable by region, industry, or topic, ensuring that teams stay aligned.

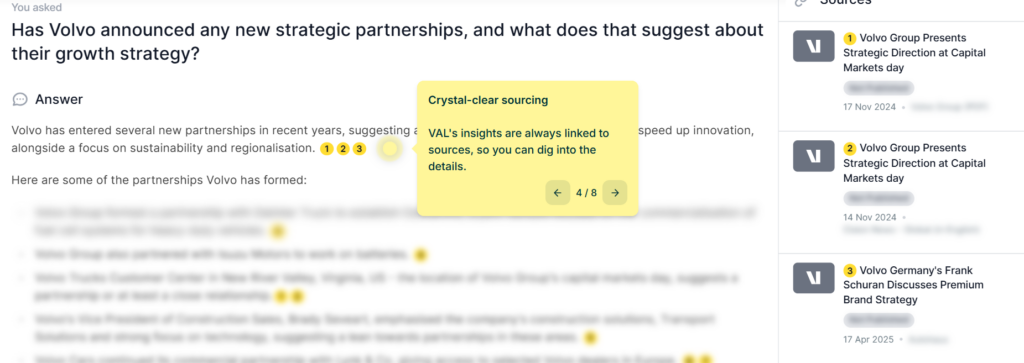

The platform’s AI assistant, VAL, which received the highest possible score in a recent Forrester report, supports natural-language queries to generate summaries and conduct analysis using SWOT or PESTEL frameworks.

You can take a quick tour yourself to see how it works.

Source: Valona

The automation complements manual analyst validation for additional accuracy, which is a differentiator compared to more automated-only platforms like Crayon or Kompyte.

While reviewers praise the platform’s accuracy and intuitiveness, keep in mind that the few reviews on G2, as well as none on Capterra, don’t offer a reliable baseline.

Source: G2

As with other solutions on the list, you’ll need to reach out to Valona’s team to get pricing that fits your exact needs.

To sum up, Valona is a strong contender among organizations looking for AI-powered competitive intelligence, as well as analyst-supported insights.

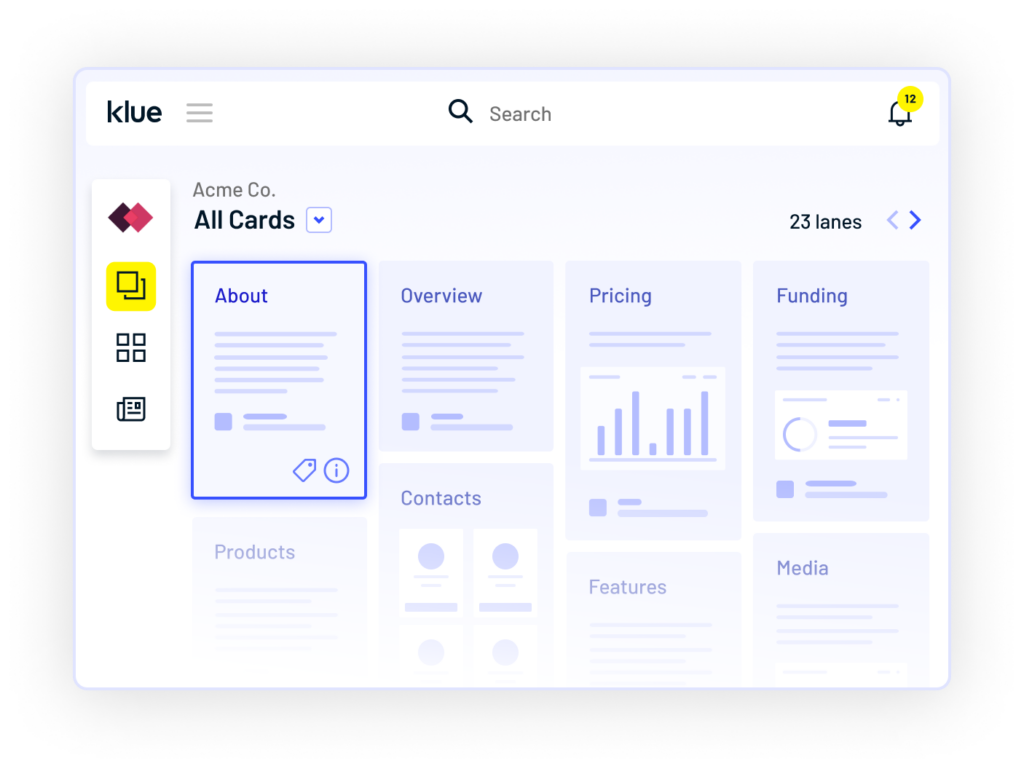

Klue is a competitive enablement platform commonly used by marketing, sales, and business development teams to turn raw intel into deal-ready insights.

The interface is designed with usability in mind, with dashboards and workflows emphasizing user-first UX.

This makes Klue more approachable than platforms built for heavy research, such as AlphaSense.

Source: Capterra

A recent enhancement, Compete Agent, acts as an AI assistant for two roles: a research analyst and a Competitive Deal Assistant.

It continuously collects and analyzes data from web sources, internal docs, and sales calls to auto-generate insights, build competitor profiles, and uncover emerging trends.

Compete Agent also surfaces deal-specific recommendations and pushes relevant intelligence into sellers’ workflows.

Source: Klue on YouTube

Given this is a recent enhancement, you might want to double-check noise filtering and insight maturity.

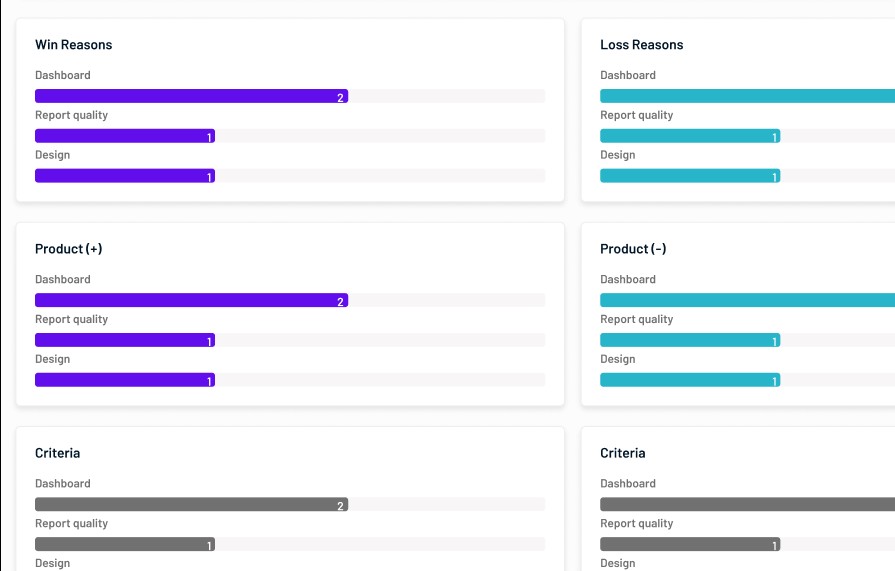

Analytics capabilities go beyond deal support.

Klue offers dashboards that break down win/loss reasons, usage metrics, and revenue impact tied to competitive activities.

Source: Klue

The platform integrates tightly with everyday tools like Salesforce, Slack, and Teams to deliver intelligence where reps already work.

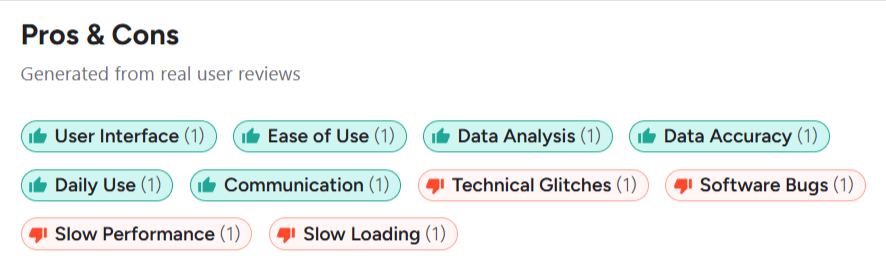

Moreover, its “Review Insights” feature processes user reviews (from sources like G2, Capterra) to extract strengths and weaknesses automatically.

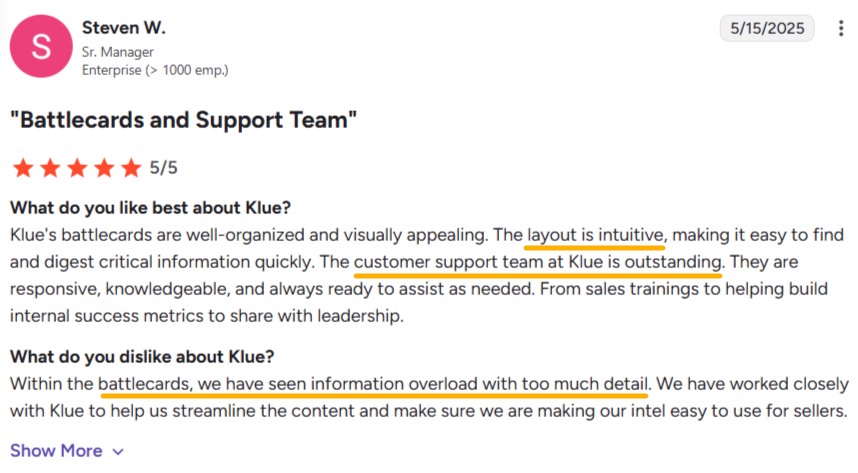

Speaking of reviews, several users praise the customer support team, with others adding general usability and visual appeal, with only minor data overload on occasion.

Source: G2

Since pricing isn’t public, you’ll need to contact Klue’s team for a tailored quote.

Klue’s AI deal support and usability make it compelling for organizations that want digestible competitive intelligence without sacrificing analytics.

Kompyte by Semrush is a fully AI-driven competitive intelligence solution designed to automate monitoring, analysis, and reporting.

In its comparison piece, Kompyte claims to track data from 500 million sources, though this figure likely refers to data points rather than unique domains.

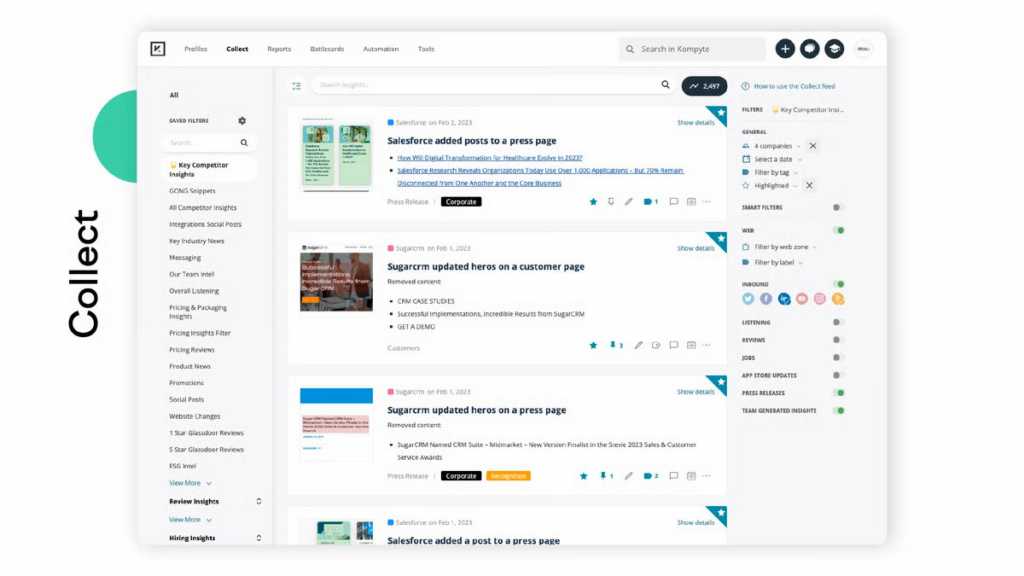

Still, its coverage is extensive enough to enable continuous updates on key competitors, as showcased below.

Source: G2

Kompyte’s AI Daily Summaries provide quick overviews of competitor activity, though they stop short of drawing independent conclusions.

This is in contrast to more interpretive systems such as Crayon’s Sparks or AlphaSense’s Athena.

Battlecard templates can be tailored to the way your sales team closes deals, whether you need to highlight overviews, differentiators, or talk tracks.

The platform as a whole enables you to quickly pull relevant data from existing battlecards and share it through different report templates.

In the example below, you can see a competitive pricing analysis.

Source: Kompyte on YouTube

Kompyte advertises a quick setup time where full configuration takes 1 to 2 weeks, with initial data appearing in as little as 24 hours.

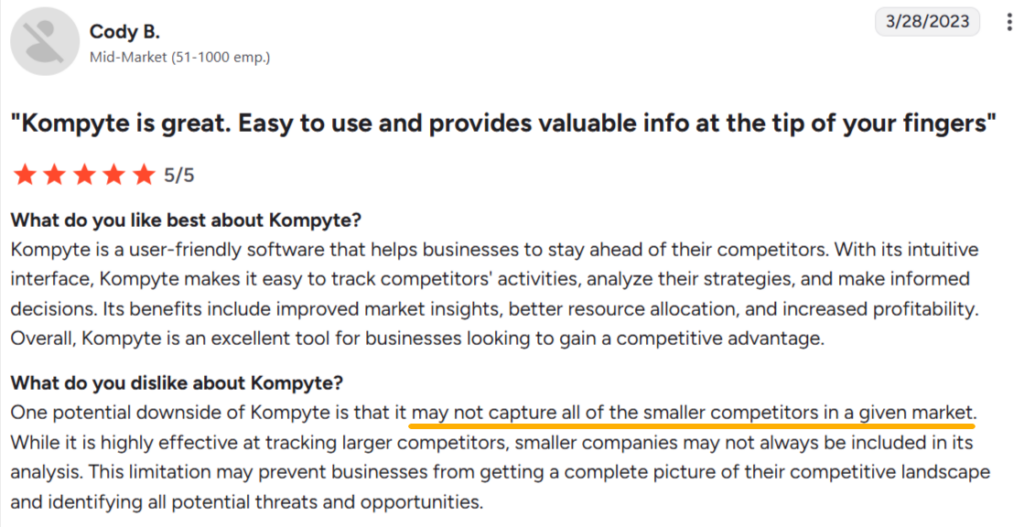

When it comes to downsides, users mention that AI occasionally surfaces less relevant results or misses smaller competitors.

Source: G2

While it’s important to note that most reviews are over 2 years old, deeper web coverage requires more specialized business intelligence tools.

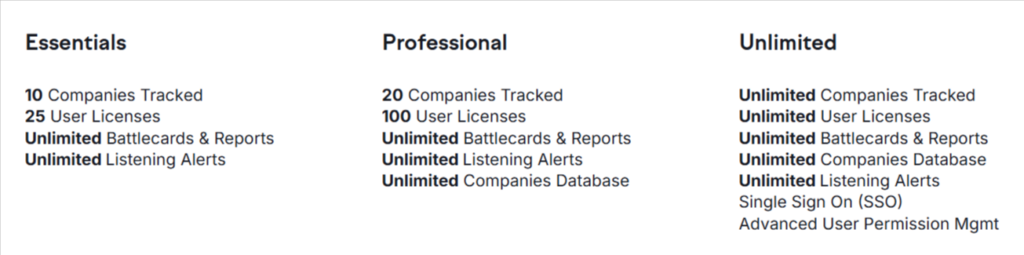

The three pricing plans aren’t fully disclosed, but they’re based on the number of companies tracked and user licenses, with the top tier offering unlimited tracking.

Source: Kompyte

In conclusion, Kompyte is a strong fit for organizations that want automated CI delivery and greater pricing flexibility, but its AI’s limited contextual analysis means you may still need manual review for finer insights.

Which of these CI tools piqued your curiosity the most?

Each solution we showcased offers a unique blend of capabilities, from comprehensive data coverage and smart dashboards to specialized workflows.

The competitive intelligence they deliver drives informed decisions and shapes strategy, enhancing your organization’s agility and resilience.

But tools alone won’t deliver value unless they align with your objectives, processes, and culture.

Keep this article as a point of reference, but take your time exploring the options.

With thorough research and some hands-on testing, you are sure to settle on a platform that will fuel your organization’s growth.