7 Types of Competitive Intelligence You Need to Know About

Key Takeaways:

Competitive advantage hinges on knowledge that’s deep, timely, and actionable.

Competitive intelligence spans market dynamics, brand perception, supplier ecosystems, customer behavior, technology trends, product positioning, and environmental change.

This guide outlines seven distinct types of competitive intelligence you need to harness to stay ahead, as well as ways to do it.

Let’s jump right in.

Market intelligence focuses on analyzing industry trends, demand shifts, and competitive landscapes.

Unlike traditional market research, which gathers insights directly from customers, market intelligence examines external data to uncover broader market dynamics, emerging threats, and new areas of opportunity.

For instance, Valona’s 2024 report found that 67% of industry leaders rely on market intelligence to deepen competitor understanding and strengthen strategic decisions.

Illustration: Veridion / Data: Valona

This type of intelligence has become critical for organizations that operate in complex, fast-changing markets.

For large enterprises, effective market intelligence blends internal feedback from sales, marketing, and customer service teams with diverse external inputs.

These typically include industry reports, press releases, executive interviews, hiring patterns, and regulatory updates.

But some of the most telling insights come from unconventional sources that show what competitors are actually doing, and not just what they claim in public statements.

Consider a rival company that issues sustainability-focused press releases, but its recent patent filings suggest heavy investment in automation.

What does that tell you?

Here are a few more examples that reveal gaps between messaging and strategy:

| Source | What it indicates |

|---|---|

| Job Boards | Emerging functions, skills, or technologies a competitor is investing in. |

| Export-Import Filings | Supply chain dependencies, new market entries, or changes in product demand. |

| Patent Filings | Innovation focus areas and long-term technology strategy. |

| Legal Disputes | Operational risks, compliance weaknesses, or pressure points in expansion. |

By systematically monitoring these alternative sources, enterprises can detect early signals of competitor pivots or market shifts that mainstream channels often overlook.

And that foresight? It’s what transforms data into a real strategic advantage.

To sum up, market intelligence provides a holistic view of the competitive landscape, helping you spot growth opportunities while anticipating risks.

Brand intelligence examines how customers, partners, and the broader industry perceive competitors’ brands.

Tracking logos or taglines isn’t the point here.

It’s about decoding what people actually feel when they encounter a competitor’s brand, thereby also identifying reputational strengths and weaknesses that can later inform your brand strategy.

As Michael Durant, founder of Creating Genius, puts it, brand intelligence translates to understanding the emotional triggers behind how people connect with brands.

Illustration: Veridion / Quote: 2822 News

The result? Less trend-chasing and overspending on hit-or-miss marketing.

In other words, true brand strength comes from knowing why people trust a competitor. Or why they don’t.

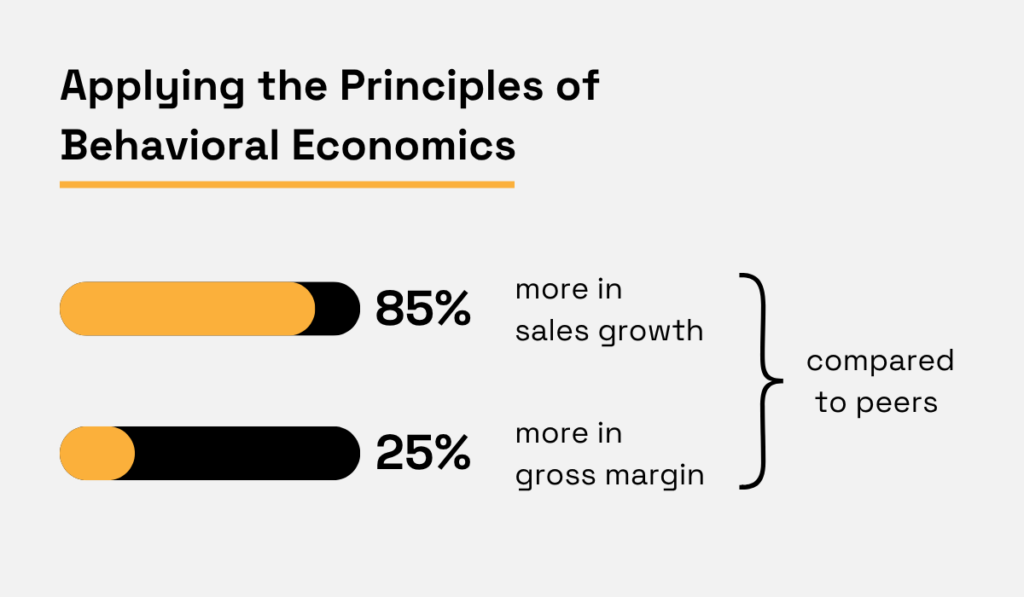

According to Gallup, companies that successfully apply behavioral economics principles—which is the understanding of how emotion and perception shape decisions—outperform peers by up to 85% in sales growth and more than 25% in gross margin.

Illustration: Veridion / Data: Gallup

That’s where competitive brand intelligence plays a vital role.

By analyzing competitors’ campaigns, sentiment data, review patterns, and even social engagement tone, organizations can spot which cues actually build credibility and loyalty.

And the best part?

You can use these insights to take up “emotional” space more strategically and address the consumer needs that are neglected by other companies.

Ultimately, brand intelligence helps you understand how competitors communicate and why the audiences respond, giving you the roadmap to make your brand the one they remember.

Supplier intelligence evaluates the strengths, weaknesses, and risks of vendors in the supply chain.

This enables organizations to ensure reliability, minimize disruptions, and uncover sourcing opportunities that competitors might overlook.

Ingmar Mester, Director of Supplier Management and Sustainability at Hapag-Lloyd AG, notes that supplier knowledge has evolved dramatically, requiring insights beyond financial ratings.

Illustration: Veridion / Quote: Craft

On top of that, new risk factors, such as climate exposure, geopolitical instability, or ESG non-compliance, make it even harder to evaluate suppliers accurately and fast.

And efficiency is the core principle here.

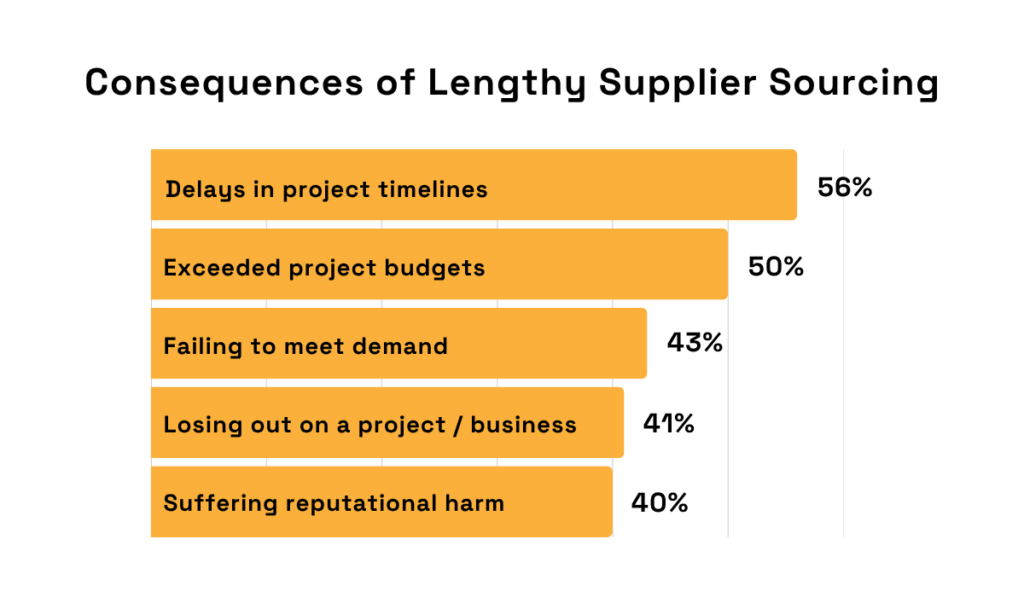

Tealbook’s 2022 report found that sourcing and procurement executives spend nearly five weeks identifying a suitable supplier, leading to delays (56%), failure to meet demand (43%), reputational harm (40%), and more.

Illustration: Veridion / Data: TealBook

That’s why speed, precision, and depth must go hand in hand.

Fortunately, new cutting-edge solutions on the market excel at automating this process.

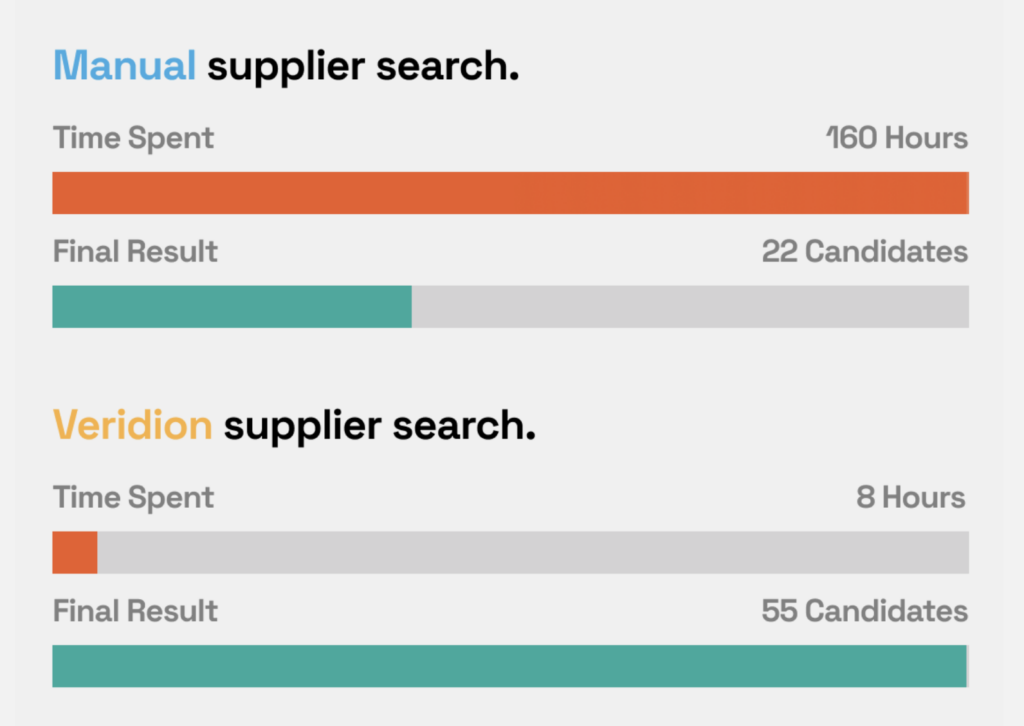

Take Veridion’s AI-powered business and supplier intelligence platform as an example.

With it, you can shorten the entire supplier discovery cycle, getting more than double the number of qualified candidates in just a fraction of the time compared to traditional sourcing.

Source: Veridion

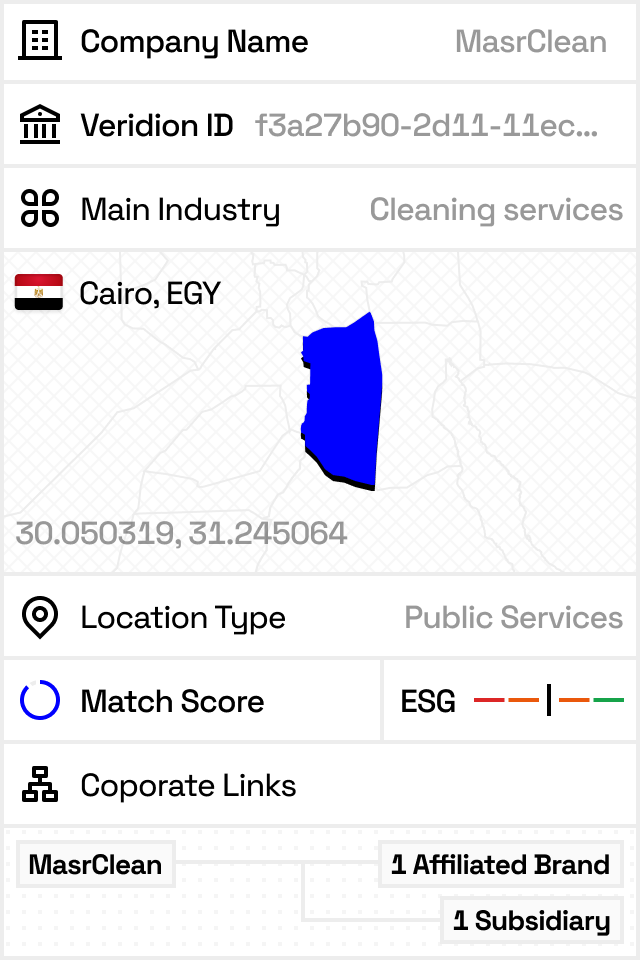

Veridion’s continuously updated database of 130+ million companies combines firmographic, ESG, and product-level data to power a rapid, criteria-based search.

With our Scout Supplier Discovery, users can view detailed company profiles that include location, industry, ESG match score, and corporate linkages within seconds.

Source: Veridion

That’s all the context you’d otherwise need hours to compile.

Ongoing supplier monitoring is also a breeze thanks to robust data enrichment capabilities.

In essence, by equipping teams with the clarity to act swiftly and stay ahead of risk, supplier intelligence transforms both sourcing and supplier relationship management into a strategic advantage.

Product intelligence involves gathering and analyzing data about competitors’ offerings, namely their features, performance, pricing, and customer perception.

The goal?

To understand how your product truly measures up in the market by answering questions like:

By connecting these dots, enterprises can benchmark value, uncover innovation gaps, and respond faster to evolving customer expectations.

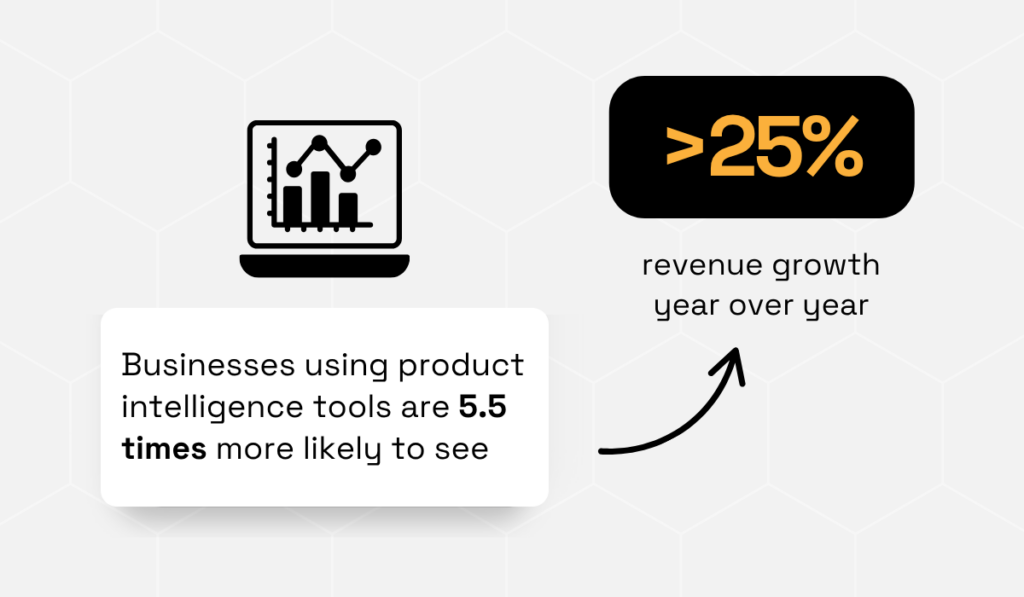

And data suggests it works.

According to Amplitude’s Product Intelligence Report, organizations using product intelligence tools are 5.5 times more likely to achieve over 25% annual revenue growth than those that don’t.

Illustration: Veridion / Data: Amplitude

Think about it: If your base package includes analytics that a competitor sells as a premium add-on, your higher sticker price might actually signal better value.

A team that’s aware of this can frame it accordingly, and that’s where competitive awareness turns into commercial strength.

But sales are only one piece of the puzzle.

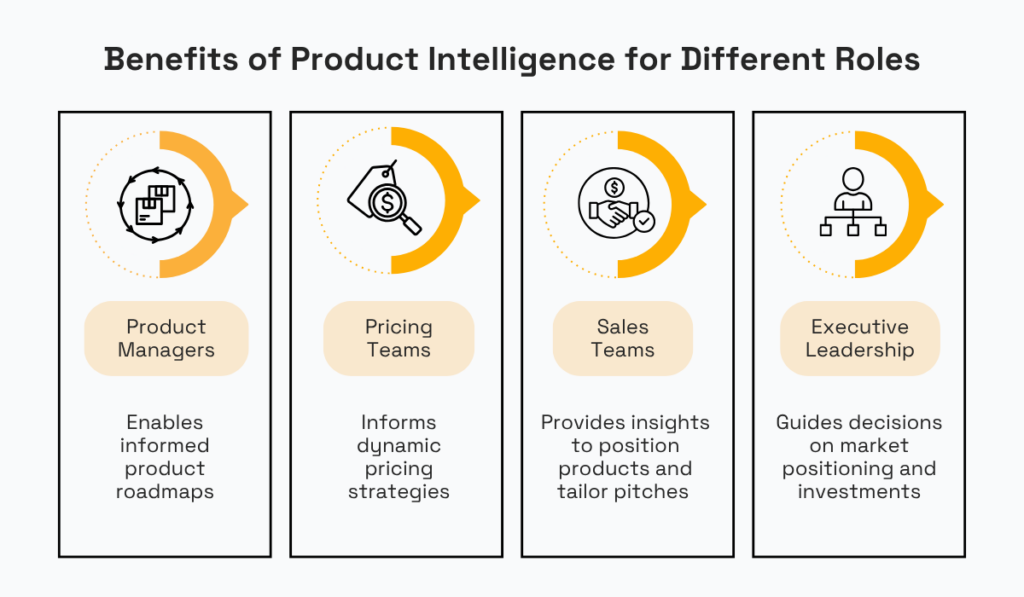

Product intelligence empowers multiple roles across the organization, from product managers and marketing teams to pricing strategists and executives.

Source: Veridion

As you can see, each function gains insights that refine decisions and enable sharper positioning.

Product intelligence isn’t just about tracking competitors.

It’s about using those insights to engineer better products, smarter strategies, and long-term market advantage.

Customer intelligence examines competitors’ customer bases, including demographics, preferences, and retention strategies.

The aim is simple: learn from competitors’ successes and gaps to strengthen your own customer engagement and retention strategies.

That’s why the popularity of customer intelligence platforms is surging.

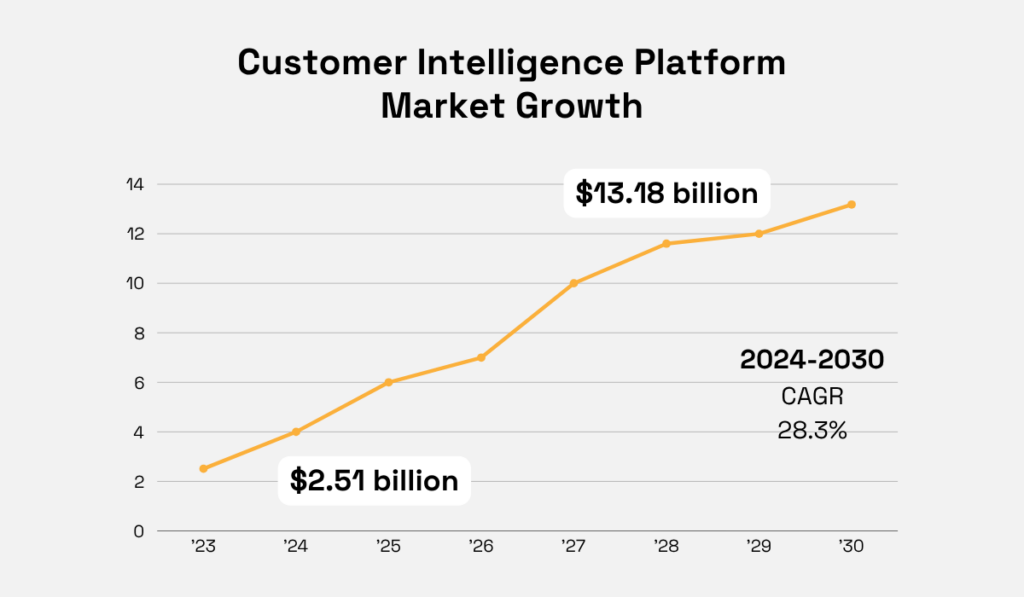

Based on the report by Grand View Research, the global customer intelligence platform market is projected to reach USD 13.18 billion by 2030, growing at a CAGR of 28.3% between 2024 and 2030.

Illustration: Veridion / Data: Grand View Research

While dedicated platforms can streamline and scale data collection, they still require a proper data foundation.

Effective customer intelligence blends qualitative and quantitative approaches, combining surveys, feedback forms, social listening, and direct engagement.

As Luca Rovinalti, CEO of Svet Solutions Media, explains, competitor insights also come indirectly, by consistently seeking out customer feedback:

“Maintain regular contact with clients to learn about their needs and expectations, as well as receive hints about the offers they receive from other companies. Another method is to attend trade events and leverage networking opportunities with industry peers.“

Doing so helps you gauge market trends and strengthen client relationships at the same time.

The essential advice?

Enterprise-level companies need to prioritize triangulating multiple sources of customer intelligence, including internal CRM data, competitor analysis, and direct feedback.

With platform analytics, you can aggregate and transform this data into actionable insights, helping teams identify patterns in customer behavior and competitor strategy faster.

In short, making the most of customer intelligence requires you to pull in data from multiple sources, but doing so is a strategic necessity that enables you to adapt, anticipate, and stay ahead of competitors.

Technology intelligence monitors emerging technologies, patents, and industry innovations that could reshape the competitive landscape.

This type of intelligence is critical in fast-evolving sectors such as IT, biotech, and manufacturing, enabling organizations to anticipate disruption and align investments with future trends rather than reacting too late.

Take the example of DeepSeek AI.

They caused a global stir earlier this year after debuting a highly sophisticated AI model developed at a significantly lower cost than that of competitors.

Source: Wall Street Journal

While even the biggest rivals were caught off guard, companies investing in technology intelligence remain in a much better position to anticipate such breakthroughs and pivot on time, even using them for a strategic advantage.

But how do you stay on top of all the key technology developments?

One way is by combining human insight with the speed of AI.

Amplyfi demonstrated this recently by using AI to sift through 27,000 documents in just 20 minutes, the same task that would have taken a human analyst 1.5 years.

However, the final polished report on emerging disruptive technologies was only possible with insights and reasoning from the said analyst.

Illustration: Veridion / Data: Amplyfi

That’s why automation alone isn’t enough.

Without the human input, you risk missing subtle strategic cues.

On the other hand, making full use of this synergy where AI accelerates data gathering and analysis, and humans provide contextual interpretation,

In short, technology intelligence is your radar for innovation. It’s not just about knowing what’s next, but being faster and smarter than the competition to seize your moment.

Environmental intelligence tracks external factors such as regulations, sustainability trends, and geopolitical developments.

With ESG becoming a cornerstone of corporate strategy, environmental intelligence has become essential to maintaining a competitive edge.

Companies that fail to monitor these shifts risk losing their footing—and not just in terms of compliance.

Third-party non‑compliance is an increasingly significant risk, as partners, suppliers, and contractors can expose organizations to regulatory fines, reputational damage, and operational disruption.

In fact, Bloomberg’s survey revealed ESG data as the top data management challenge among European companies, with 41% citing constantly evolving ESG data as their biggest hurdle.

Illustration: Veridion / Data: Bloomberg

This is where environmental intelligence delivers real value.

It helps organizations anticipate regulatory changes, adapt operations, and align with stakeholder expectations, turning compliance from a burden into a competitive differentiator.

Effective environmental intelligence relies on multiple approaches, including:

According to Thomson Reuters, 81% of organizations rely on third-party managed service providers to keep pace with ESG regulations and best practices.

These solutions often use comprehensive ESG taxonomies, as shown below, to ensure that no critical area is overlooked.

Source: Veridion

The takeaway?

Environmental intelligence turns regulatory awareness into strategic foresight, giving organizations the agility to ensure accountability, innovate responsibly, and strengthen their position in the market.

So, what does it take to make the most of competitive intelligence?

For starters, it’s not just about tools.

It’s a whole mindset that blends curiosity, strategy, and execution.

Across markets, products, customers, suppliers, brands, technologies, and the environment, the leaders streamline processes by pairing advanced analytics with human judgment.

That blend of technology and human intellect is what turns raw information into foresight.

Start building that capability today, and your organization won’t just keep pace, but set the tone for the whole industry.