6 Best Alternatives to Crunchbase for Market Intelligence

Powered by technological advances and fast changes in today’s business environment, having reliable market intelligence has become a must for forward-looking companies.

While Crunchbase is a popular tool for accessing company data and gaining market insights, there are several alternatives that might be more suitable for your intelligence-gathering needs.

In this article, we’ll explore six top alternatives to Crunchbase, highlighting how they can enhance your business strategies with accurate and actionable insights.

Let’s get started.

Our market intelligence platform, Veridion, uses AI-powered algorithms and search functions to provide businesses access to a comprehensive, regularly updated database covering over 125 million companies.

With a strong focus on private companies, Veridion’s data acquisition bots constantly scour the internet to collect the freshest data on businesses around the world.

This data is then cleansed and structured by AI to transform it into clear and understandable data points for analysis and insights.

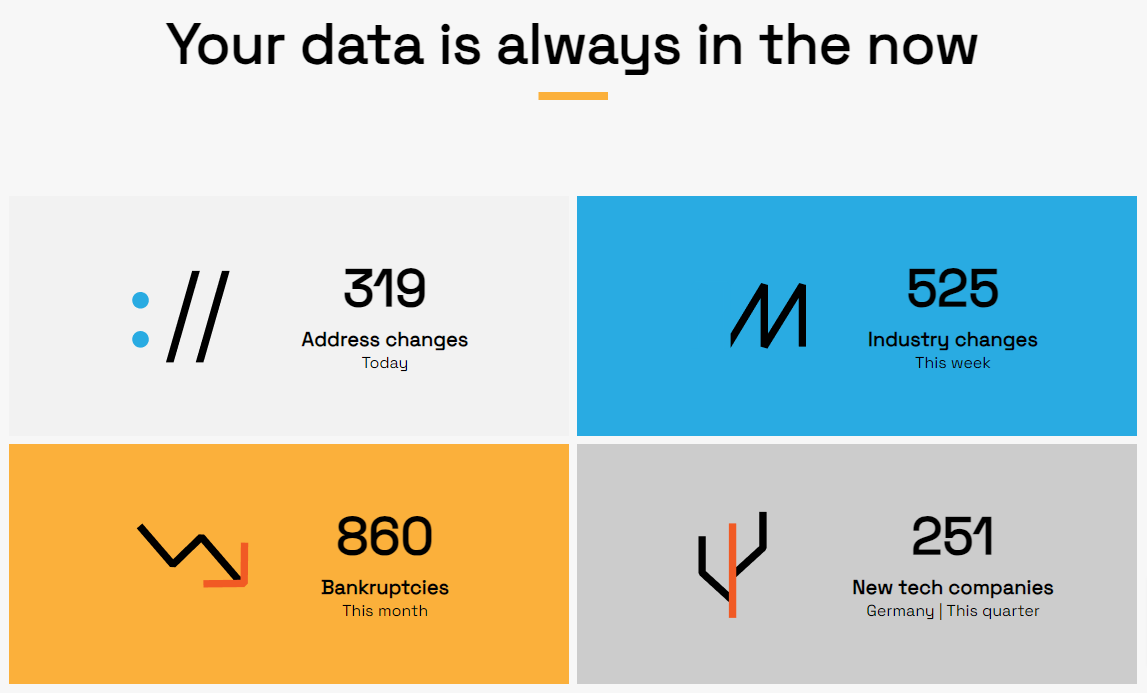

What’s more, our database is updated on a weekly basis, ensuring your market intelligence is always up to date.

Source: Veridion

In terms of general market intelligence, access to Veridion’s database allows you to:

As such, Veridion’s unparalleled data accuracy and freshness make it an invaluable resource across different industries—from insurance and consulting firms to big data startups—and particularly for procurement departments.

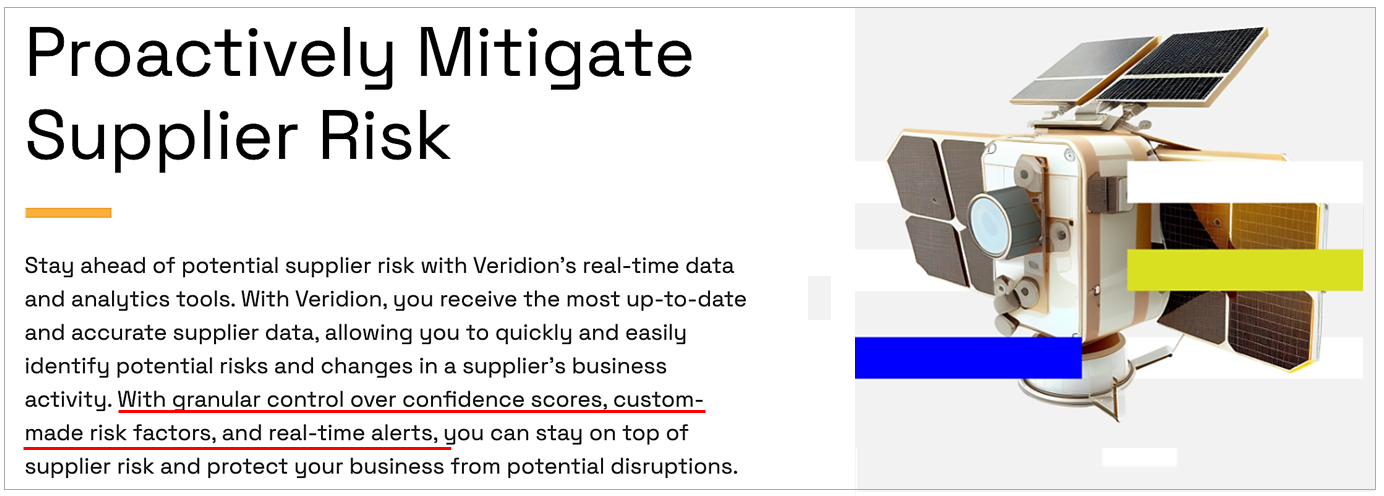

More specifically, Veridion ensures your procurement team can:

For example, you can use Veridion to set specific supplier risk factors you want to be automatically monitored and receive real-time alerts should these risks come to fruition.

Source: Veridion

Of course, this functionality refers to your existing suppliers, allowing you to timely react to potential risks and changes related to them.

As for new suppliers, your team can enter supplier search parameters using natural language input to receive a list of potential suppliers in seconds.

Then, they can further utilize Veridion’s market intelligence to:

So, what makes Veridion a great alternative to Crunchbase?

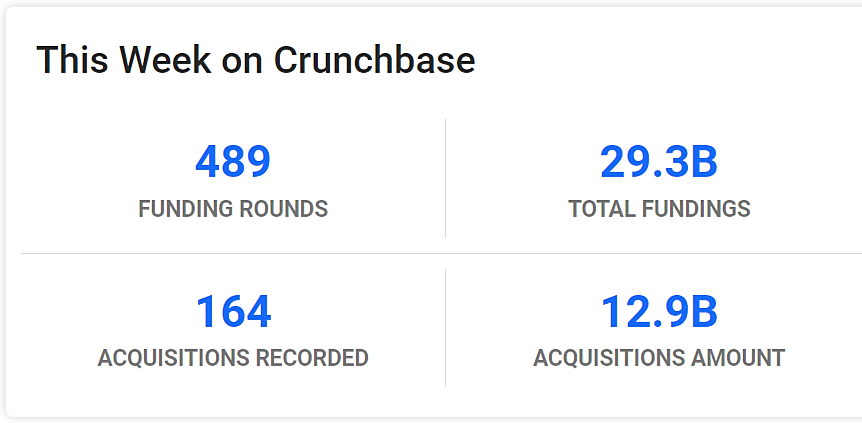

For starters, Crunchbase concentrates on providing users with funding information, company news, and investment analytics.

Source: Crunchbase

While this may be valuable for investors and market researchers looking for investment opportunities and insights, Crunchbase fails to appropriately serve some other business functions, such as procurement.

For instance, its database does not provide detailed product and service specifications, but rather a brief overview.

Naturally, this limitation hampers efficient supplier search and discovery.

Moreover, as its database largely relies on information generated by Crunchbase’s users, this can lead to issues like outdated data, duplicate entries, and missing info.

Conversely, Veridion’s data is constantly updated and cleansed, and its market intelligence can be used for both super-fast supplier discovery and effective risk management.

So, if you’re looking for a tool that offers comprehensive and reliable market intelligence, Veridion stands out as a more practical alternative to Crunchbase.

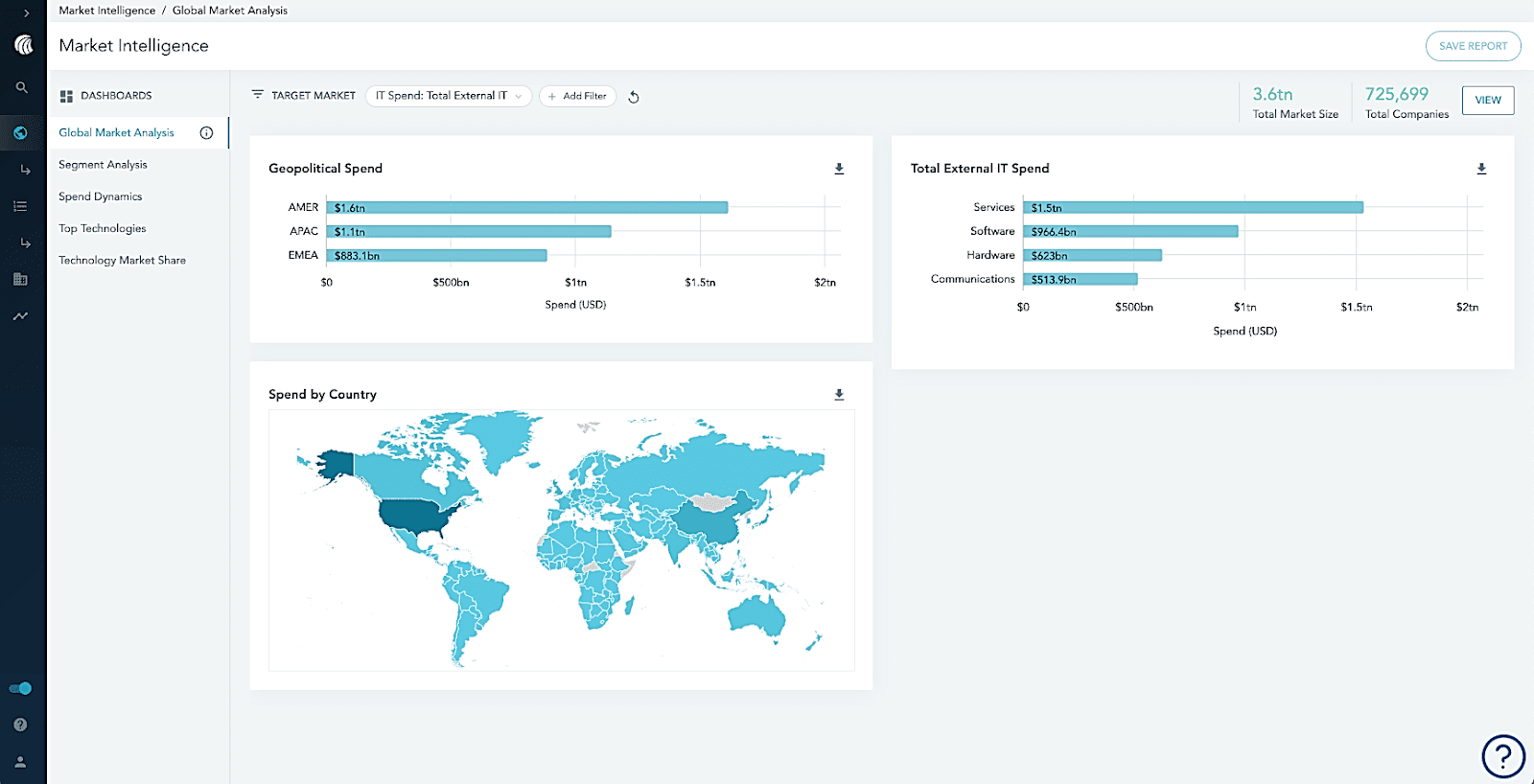

In May 2024, HG Insights, a leader in technology intelligence, launched a new market intelligence product.

This new product focuses on technographic data, i.e., information about the technologies, such as software, hardware, and IT infrastructure, used by companies across various markets.

More specifically, users can leverage HG Insights’ market intelligence to gain advanced insights into various parameters of specific companies, such as their:

HG Insights combines this company-level granularity with comprehensive market analysis.

Source: HG Insights

These insights are particularly valuable for technology vendors, IT service providers, sales teams, and market researchers who need to understand the technology landscape of their target market.

For example, HG Insights can be leveraged to:

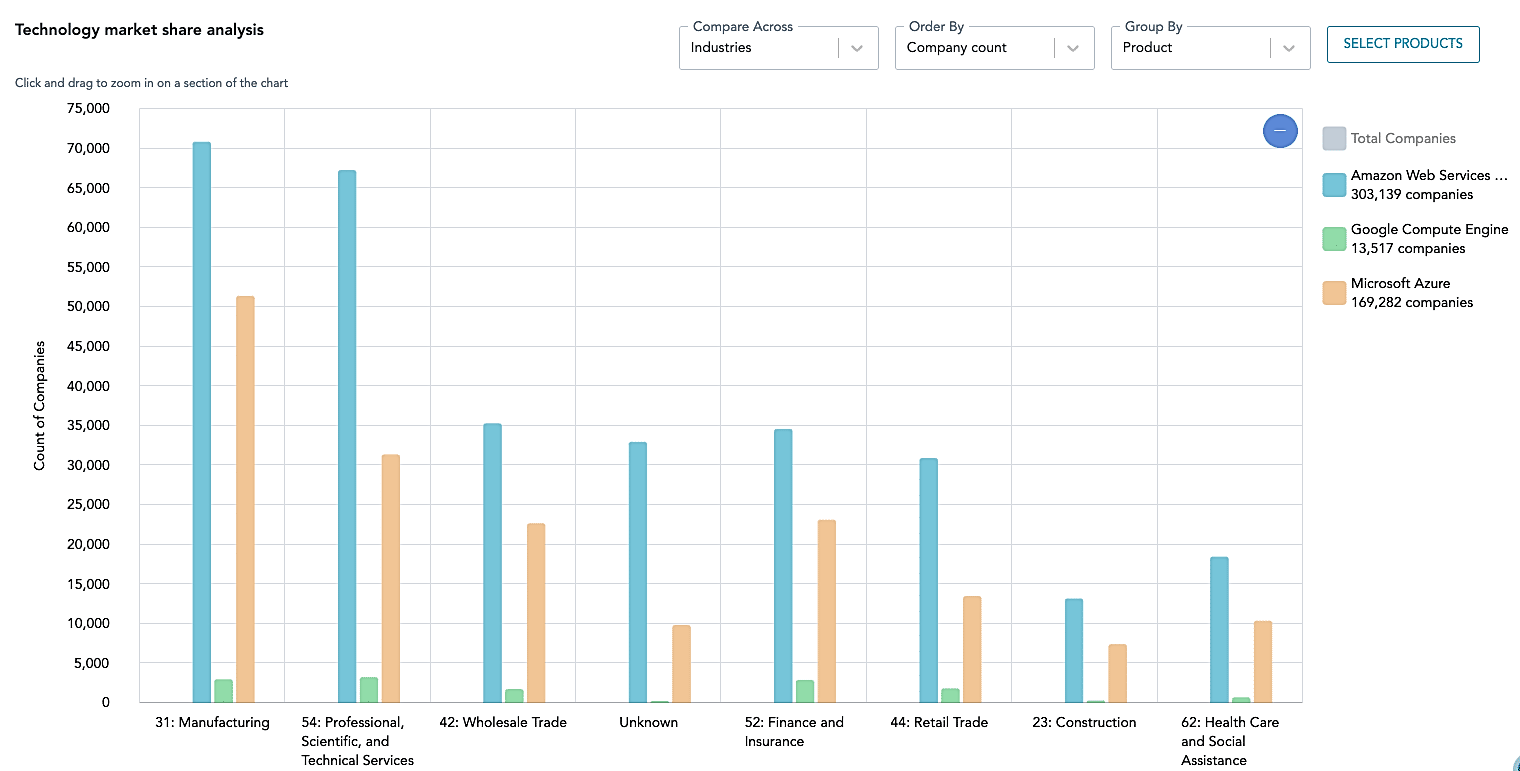

Moreover, companies can use the Technology Market Share Dashboard to compare the market penetration of specific technologies across different market segments, which is crucial for strategic planning.

Source: HG Insights

So, how does HG Insights compare as an alternative to Crunchbase?

While both of these solutions are noteworthy platforms for market intelligence, they cater to different needs and target distinct audiences.

Namely, HG Insights is particularly suited for tech-driven B2B companies that require in-depth insights into IT spending, technology installations, and competitive landscapes.

In contrast, Crunchbase is predominantly used by investors, venture capitalists, startups, and companies looking for funding information, startup maturity assessment, and market research.

D&B Hoovers is a sales intelligence platform that assists sales and marketing teams in generating new leads and contacting prospective customers.

More precisely, D&B Hoovers offers an extensive database with millions of companies worldwide, where users can access:

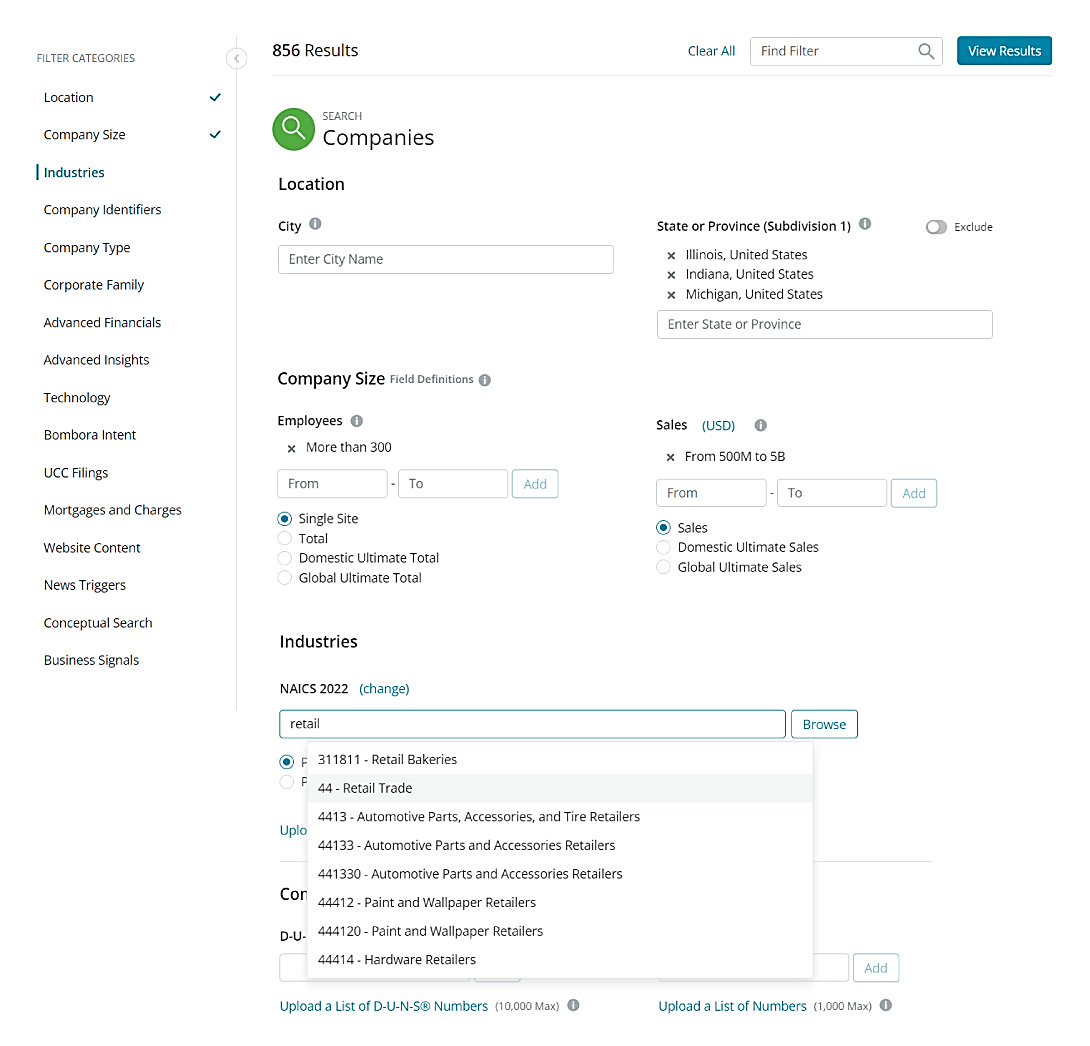

Of course, all this data can be searched and filtered according to your specific criteria.

Source: D&B Hoovers

You can also use D&B Hoovers to monitor companies for specific changes or developments by setting automated alerts and notifications.

Overall, D&B Hoovers focuses on providing sales and marketing teams, business analysts, and corporate decision-makers with in-depth data on their existing and prospective customers.

Then, it provides contact information on key executives and insights on how best to approach them.

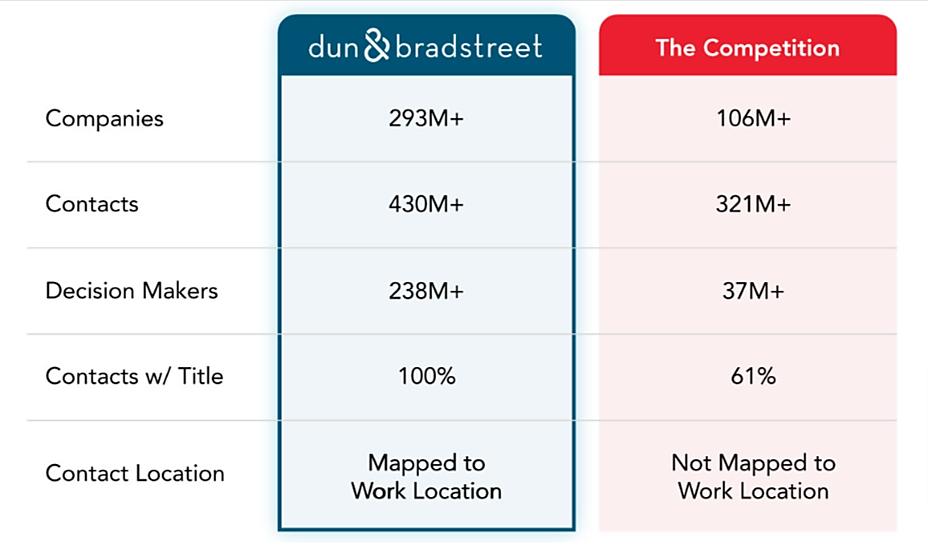

The difference between the depth and breadth of B2B data provided by D&B Hoovers and its competitors is highlighted below.

Source: D&B Hoovers

Given all the above, it’s clear that D&B Hoovers and Crunchbase serve different target audiences and use cases.

For instance, Crunchbase focuses on providing startup-specific information and funding activities.

As a result, it generally does not provide the same level of depth of company profiles, including financials, as D&B Hoovers does.

For a wider comparison of the alternatives covered here, it should be noted that both Crunchbase and D&B Hoovers will provide only high-level information about each company’s products or services.

While this may be useful for market analysis and lead generation, it lacks the specifics required for effective supplier discovery.

As a market and competitive intelligence (M&CI) platform, Contify focuses on providing businesses with AI-driven analytics, insights, and updates about their competitors, clients, and industry segments.

To do so, it aggregates data from over 1 million sources, which is then curated by machine learning algorithms and humans and put into a centralized repository with a search engine.

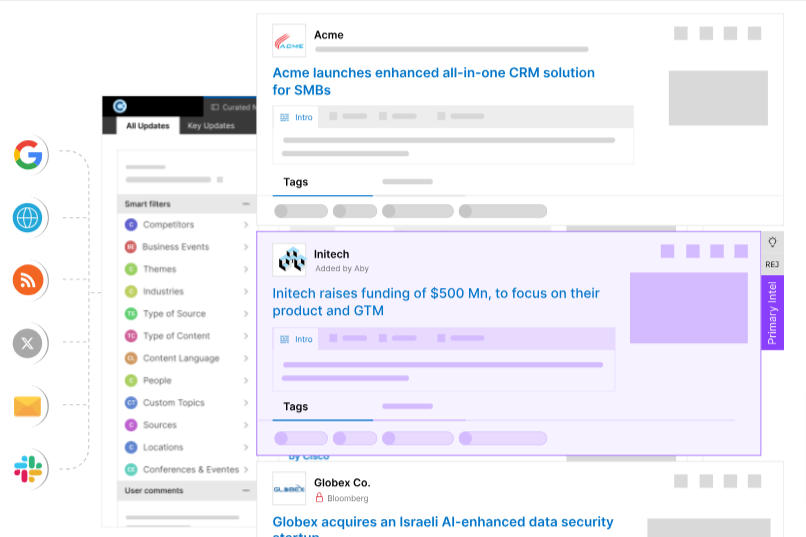

As Contify’s database is updated with fresh info, this creates a newsfeed that organizations can filter and customize to get targeted updates on competitors and industry trends.

Source: Contify

Contify’s clients get access to two news streams: one containing curated updates on their specific competitors, and one global newsfeed.

Together, these newsfeeds enable companies to expand the scope of their market and competitive research and gain insights about new competitors, trends, business signals, and technologies.

Given the above, Contify can be beneficial for:

While both Confity and Crunchbase are market intelligence platforms, they differ in their focus and target audiences.

More precisely, Contify emphasizes competitive intelligence and market trends, while Crunchbase specializes in startup data and investment insights.

So, if you need a broader scope of market intelligence focused on tracking competitors and industry dynamics, Contify is a good alternative to Crunchbase.

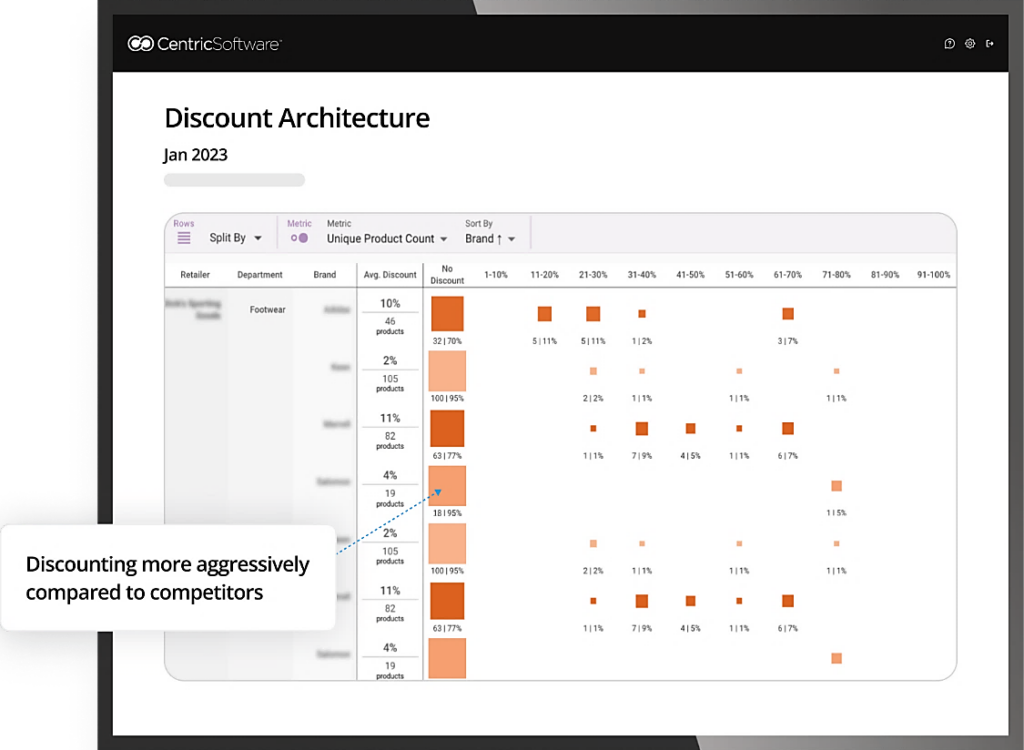

Centric Market Intelligence is a specialized platform designed to provide companies with real-time intelligence about their competitors, market trends, and consumer behavior.

It is particularly geared towards businesses in the fashion, footwear, beauty, and home products industries.

As advertised, Centric gives clients a fully accurate, regularly updated 360° view of their entire competitive environment, helping them answer questions like the ones in the screenshot below:

Source: Centric

By leveraging Centric’s market intelligence, companies can:

Additionally, they can analyze competitors’ pricing and discounting strategies to make informed business decisions.

Centric’s pricing intelligence features also allow companies to discover whether they’re discounting more aggressively than their competitors.

Source: Centric

Comparing the discounting policies of competitors allows you to see whether there’s room to optimize your discounting policy while staying competitive.

Even this brief description of Centric clearly shows how it differs from Crunchbase.

More specifically, they have distinct areas of interest.

While Centric focuses on companies in the retail and consumer goods sectors, Crunchbase is more suitable for startup investors, entrepreneurs, and analysts.

Consequently, Centric offers a range of related analytics features, such as visual dashboards and customizable reports.

Overall, this market intelligence platform can be a valuable resource for organizations looking to enhance their product strategies and market positioning through competitor and market intelligence and insights.

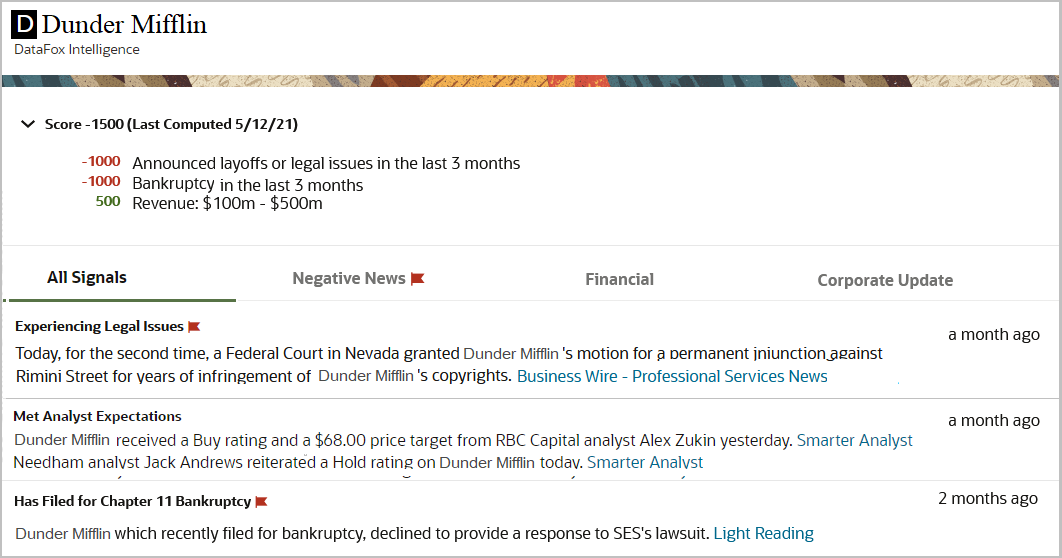

DataFox is a company intelligence platform that was acquired by Oracle in 2018 to enhance the data and intelligence capabilities of Oracle’s cloud platforms.

As such, Oracle DataFox is an integral part of Oracle Cloud Applications and can’t be purchased separately.

Its extensive database with millions of company profiles is continuously updated through AI-driven and human-in-the-loop techniques.

DataFox focuses on enabling users to enrich their business records with over 70 data points and 68 types of signals (customizable, real-time alerts).

As illustrated below, DataFox’s company intelligence can also be used to establish customized scoring models.

Source: DataFox

This allows users to, for example, prioritize accounts (potential customers) and focus their marketing efforts.

They can also run a robust ideal customer analysis to discover new prospects.

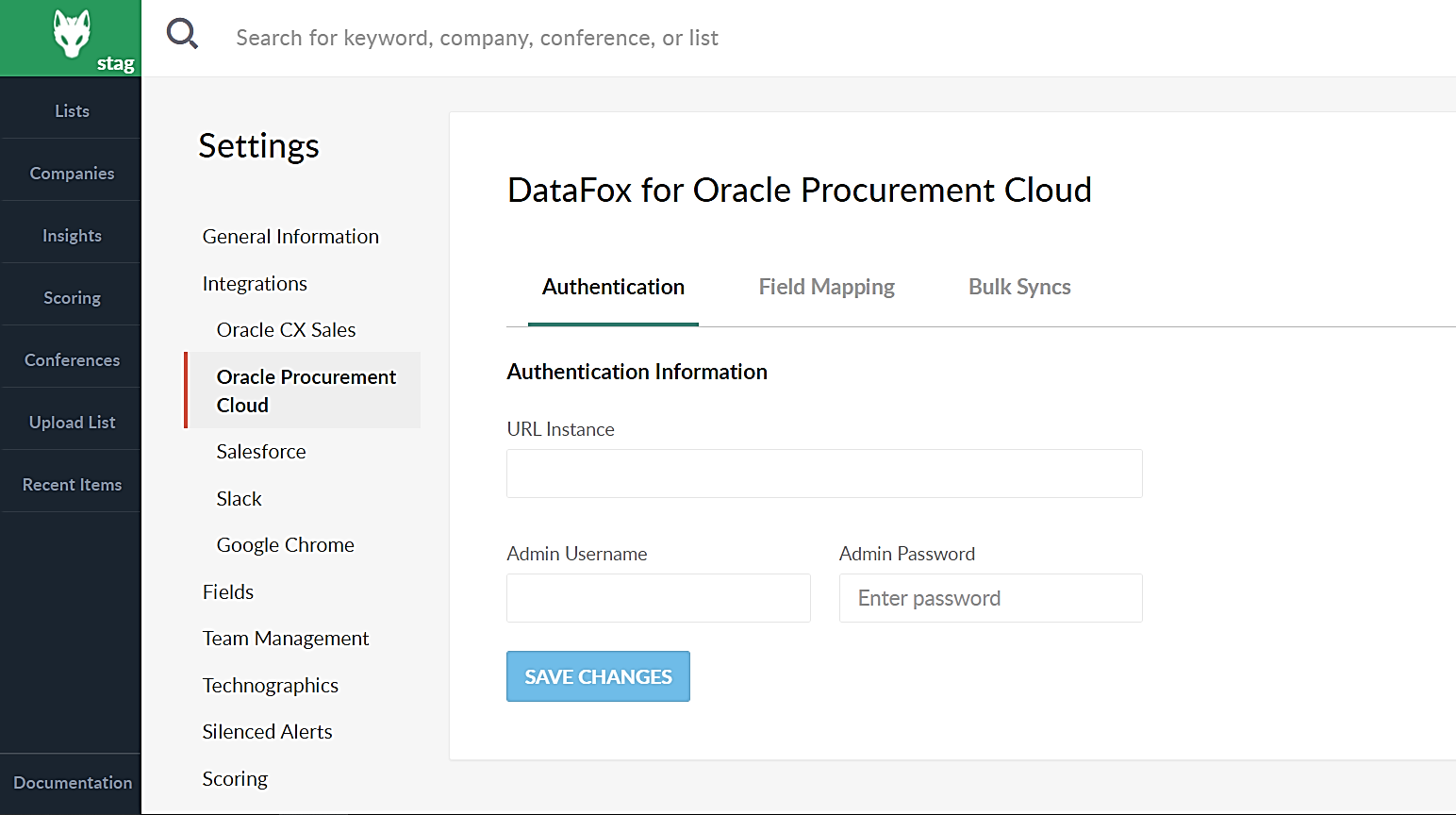

Moreover, when DataFox is integrated with Oracle Fusion Cloud Procurement, businesses can leverage it for supplier data enrichment and risk assessment.

Source: DataFox

This integration allows procurement teams to match their existing suppliers with DataFox’s company profiles, enrich their data, and set up scoring criteria.

Concurrently, they can use real-time scores and alerts to assess risks from new suppliers and continuously monitor existing supplier risks.

It’s worth noting that, out of the Crunchbase alternatives we covered, DataFox and Veridion are the only market intelligence tools with a more specific focus on procurement and supplier risk management.

However, Oracle’s procurement solutions powered by DataFox’s data focus more on managing existing supplier relationships and processes than discovering new suppliers.

As an alternative to Crunchbase, Oracle DataFox focuses on data enrichment and risk monitoring, thus casting a wider data web and providing more in-depth insights.

Having covered these six alternatives to Crunchbase, it’s clear that the presented market intelligence solutions differ significantly from one another.

Most focus on specific aspects of company data, such as investments in startups, technology stacks, sales, procurement, and risk management.

Therefore, you should look for a solution that provides comprehensive and accurate data and allows you to use it for various purposes without restrictions.

Ultimately, the right market intelligence tool should meet your specific needs, support your decision-making processes, and help you achieve your strategic objectives.