How to Embed ESG Without the Risk of Greenwashing Accusations

Key Takeaways:

With greenwashing posing a legal, financial, and reputational threat, ESG credibility matters more than ever.

And to do so, companies need more than good intentions.

From integrating ESG into governance to transparent reporting and supplier oversight, embedding ESG effectively takes strategy, structure, and reliable data.

In this article, we’ll break down five proven ways to strengthen your ESG approach while sidestepping greenwashing accusations.

For ESG commitments to hold weight, they need to be embedded right into governance structures, rather than added as an afterthought.

It’s not enough to set targets and report achievements.

Without clear accountability at both strategic and operational levels, even well-meaning initiatives risk being dismissed as superficial.

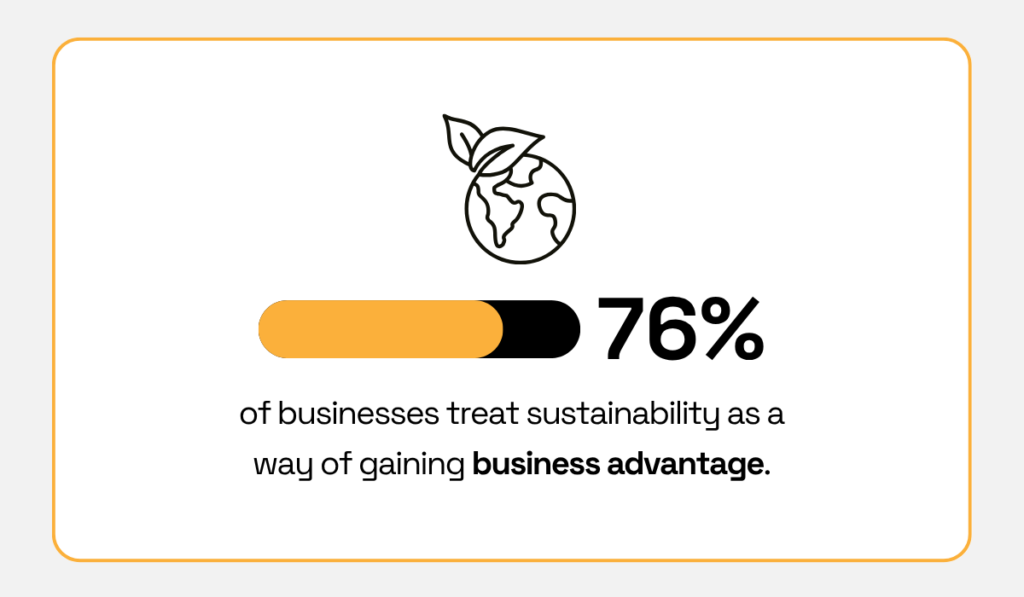

Recent research by Sweep and Capgemini Invent, surveying 500 sustainability leaders across the US, UK, Germany, and France, found that 76% of businesses view sustainability as a business advantage.

Illustration: Veridion / Data: Sweep

This optimism reflects the growing role of sustainability in attracting customers and investors and driving business growth.

But without credible internal oversight, the risk of ESG claims backfiring is real.

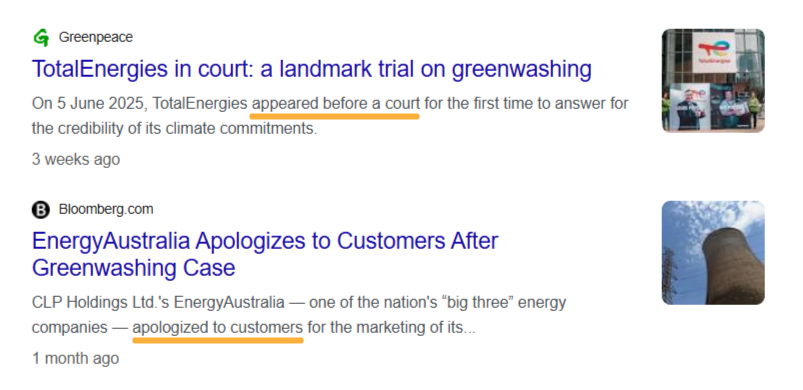

A quick glance at recent headlines shows how fragile reputation can be when green claims are called into question.

From TotalEnergies’ high-profile court case to EnergyAustralia’s public apology over misleading environmental statements, the consequences for businesses are significant.

Source: Google

And while these examples involve major corporations, it’s an even tougher challenge for smaller businesses.

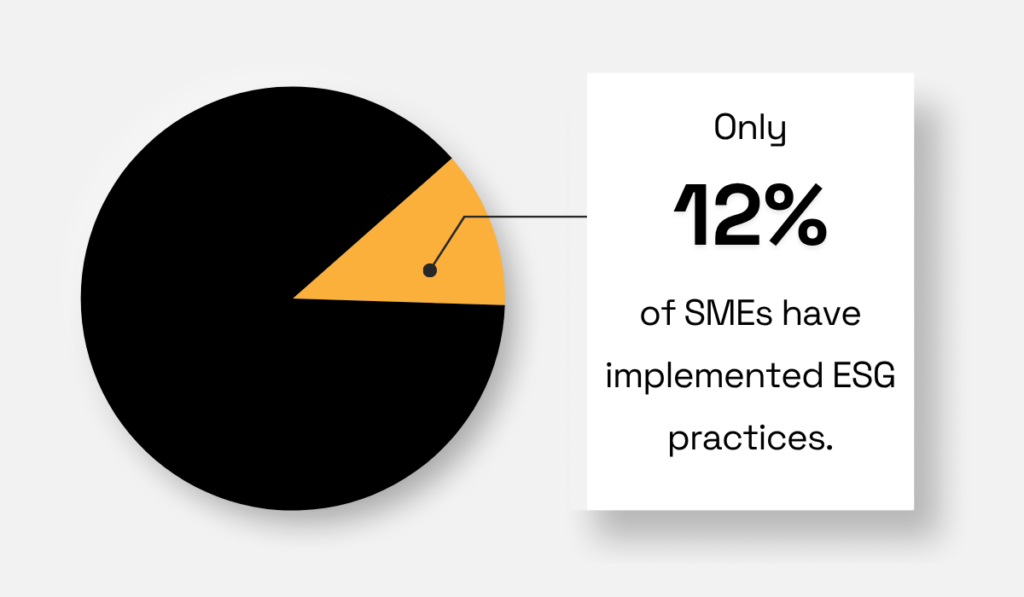

Despite escalating stakeholder expectations, a recent study revealed that only 12% of UK SMEs have formally implemented ESG practices.

Illustration: Veridion / Data: ID Crypt Global

This gap points to practical barriers but also highlights the urgency of embedding ESG at the leadership level, so that it can become a part of your core strategy and operational fabric.

Consider the case of Etex, a Belgium-based global building materials manufacturer.

Recognizing the importance of clear structure and accountability, Etex established a CSR Committee which meets quarterly to oversee all key sustainability issues, from carbon reduction to responsible sourcing.

More importantly, ESG priorities directly influence business decisions, supplier codes, employee training, and performance KPIs.

And as Board Member Caroline Thijssen explains, Etex also decided to link ESG performance to executive remuneration, ensuring leadership stays aligned with stakeholder expectations.

Illustration: Veridion / Quote: KPMG

The benefits of this approach?

More holistic decisions, stronger risk management, and long-term value creation. By formally embedding ESG into governance, your organization will move beyond promises to deliver measurable, lasting impact.

Setting measurable ESG goals is a best practice that promises credibility.

Without clear, evidence-based targets, even well-intentioned ESG initiatives risk being dismissed as vague marketing.

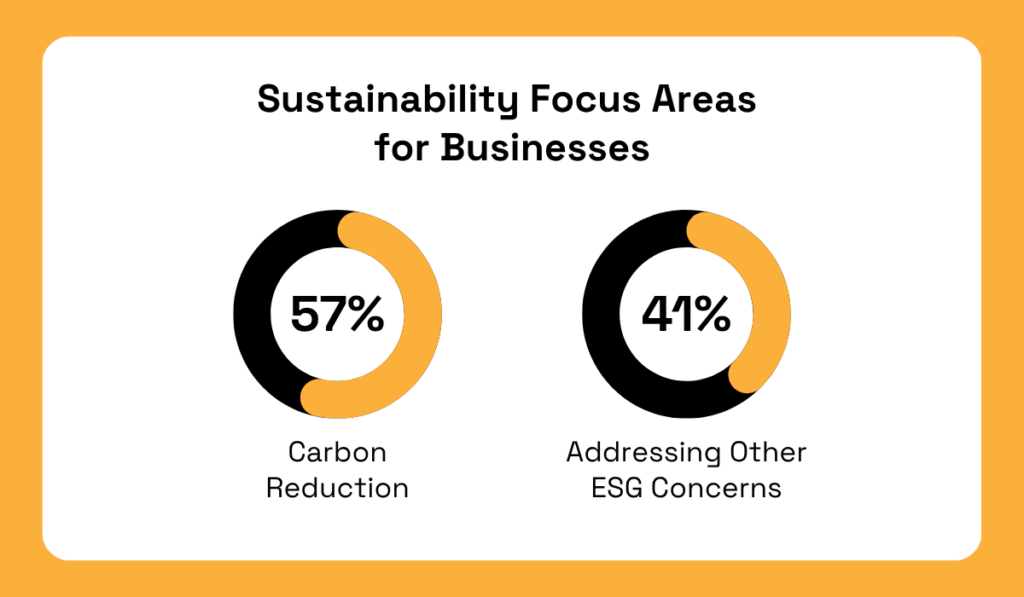

The aforementioned Sweep report also found that while 57% of businesses prioritize carbon reduction, attention to other ESG areas drops to 41%.

Illustration: Veridion / Data: Sweep

And this is where problems start.

Declaring a commitment to carbon reduction or neutrality without breaking it down into specific, trackable objectives will leave any company open to scrutiny.

Take FIFA’s 2022 World Cup.

The major sports event was billed as carbon-neutral, with the organization later facing public backlash and a formal ruling for making misleading claims.

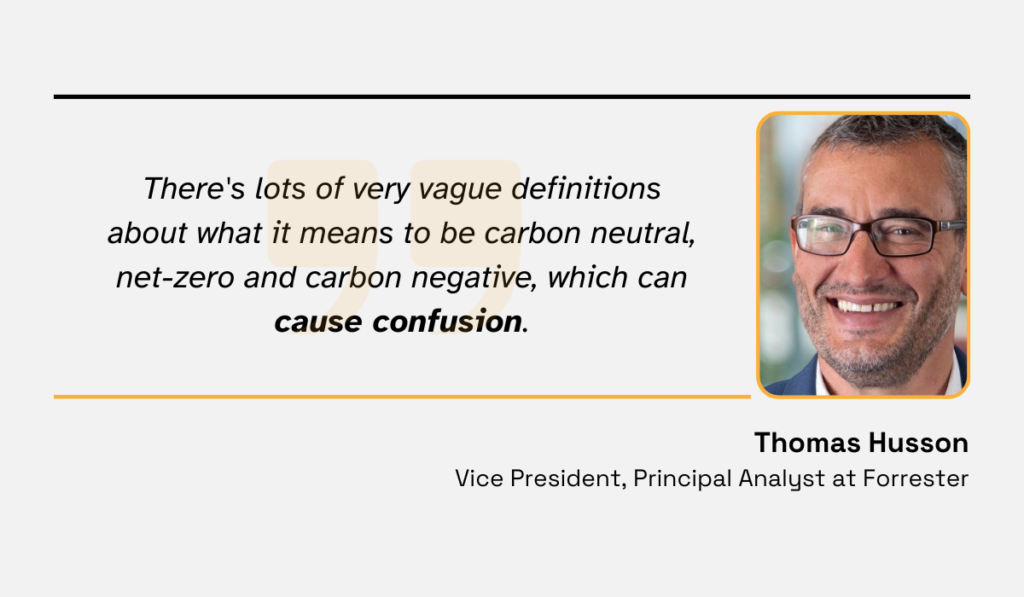

As Forrester’s Thomas Husson explains, much of this negative reception stems from poorly defined terms and vague promises that confuse stakeholders and erode trust.

Illustration: Veridion / Quote: LinkedIn

The key lesson here?

If you want to make bold ESG statements, you need hard data and measurable goals to back them up.

Another example comes from Danish dairy producer Arla, whose 2023 Annual Report revealed that methane accounts for 43% of its total emissions.

This wouldn’t be an issue were it not for the company’s failure to set clear methane reduction targets, which helped undermine its broader environmental claims.

Source: New Food Magazine

To avoid similar missteps, businesses need clear, balanced ESG targets.

Here’s what that might look like when it comes to environmental considerations:

Not to forget the Social and Governance dimensions, you can aim for defining diversity in leadership, supplier code compliance rates, and board-level ESG oversight metrics.

It’s important to calibrate these targets against both your organization’s capacity and a rapidly evolving regulatory landscape.

As one unnamed investment director noted in a different report, regulatory shifts last year triggered a wave of risk-aversion, with companies scaling back their public ESG ambitions.

Illustration: Veridion / Quote: Capital Group

The key thing to keep in mind is that well-defined, realistic, and measurable ESG goals matter because they keep initiatives credible, actionable, and future-proof against shifting expectations.

Any company that takes ESG seriously knows that independent verification isn’t optional.

Third-party audits, certifications, and trusted data platforms provide the objective evidence needed to back up sustainability claims and protect your brand from the risk of greenwashing accusations.

Even with strong internal processes, ESG management still involves tracking data across a web of suppliers, facilities, and operational touchpoints.

To put it differently, one weak link in that chain can quickly undermine your entire ESG narrative, resulting in fines and even costlier reputational damage.

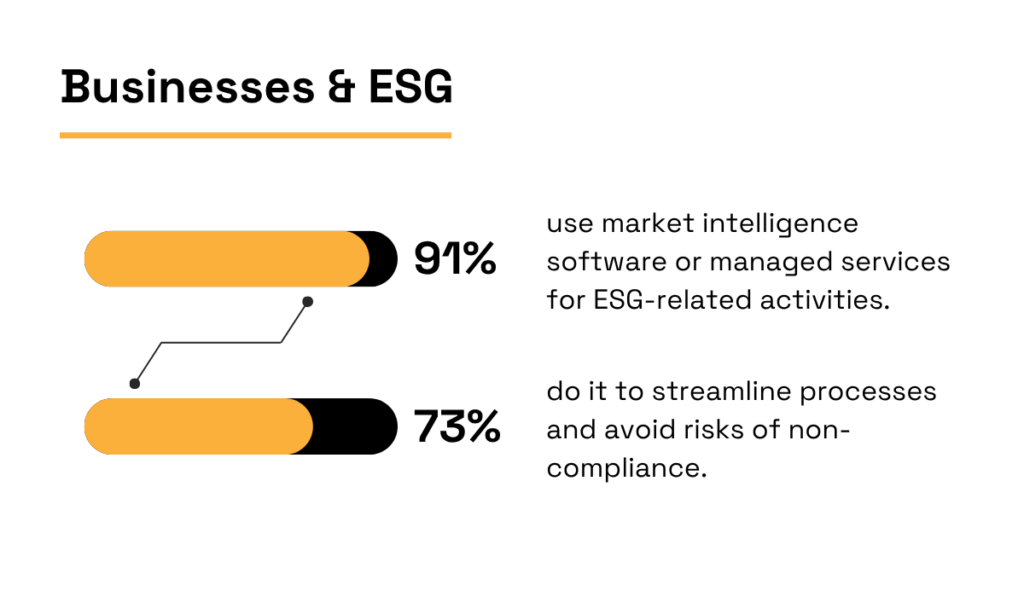

A recent Thomson Reuters report confirms how aware businesses have become of these risks.

According to the study, 91% of businesses now use market intelligence software or managed services for ESG activities.

Illustration: Veridion / Data: Thomson Reuters

Even more tellingly, 73% of businesses adopt these tools specifically to boost efficiency and avoid both non-compliance and potential reputational fallout.

The trouble is, ESG data management is anything but straightforward.

Companies have to monitor shifting regulations, verify supplier claims, and track metrics like emissions and labor practices—all while managing multiple data sources and reporting frameworks.

So, how are most companies tackling this?

A Capital Group study found that 55% of investors rely on ESG data from multiple sources, acknowledging that no single provider can cover it all.

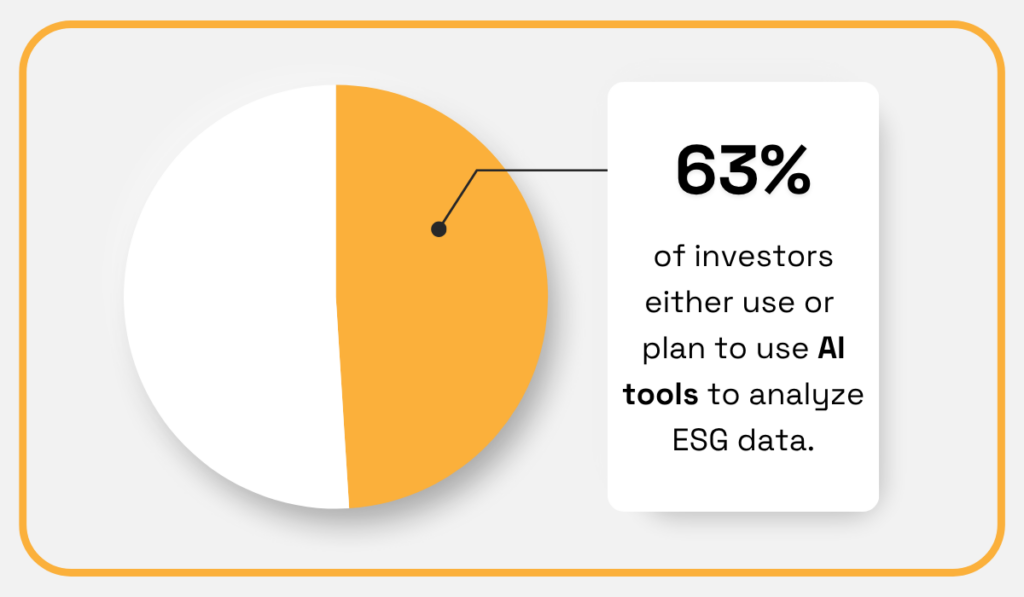

Moreover, nearly two-thirds of surveyed investors either use (10%) or plan to use (53%) AI-powered tools to enhance ESG data analysis and reporting accuracy.

Illustration: Veridion / Data: Capital Group

The main reason is that AI excels at collecting and analyzing data from a variety of sources, from corporate filings to social media presence.

That’s where solutions like Veridion step in.

Harnessing AI means that Veridion’s global database of over 120 million businesses is continuously expanding, always with fresh insights.

Source: Veridion

Veridion enables procurement teams and CSOs to access more than 80 verified data points, spanning from firmographic and product information to specific ESG data and insights, such as:

The full ESG taxonomy is available below.

Source: Veridion

The bottom line is that ESG risks evolve fast, making verified third-party data a must.

And tools like these ensure all the information is up-to-date, helping you stay compliant, earn stakeholder trust, and stay a step ahead of the competition.

Setting ESG goals internally is only half the job because ensuring your suppliers follow suit is what makes most targets achievable.

Without integrating ESG criteria into supplier selection and ongoing monitoring, companies risk falling out of compliance, damaging their reputation, or simply failing to meet their own sustainability goals.

As one Chief Supply Chain Officer at a global cosmetics manufacturer bluntly put it:

We are fumbling on the regulatory side and regularly blindsided by new regulatory changes. Suppliers are asleep, and we’re now unable to sell certain products due to non-compliance concerns.

A big part of the problem lies with lax monitoring mechanisms.

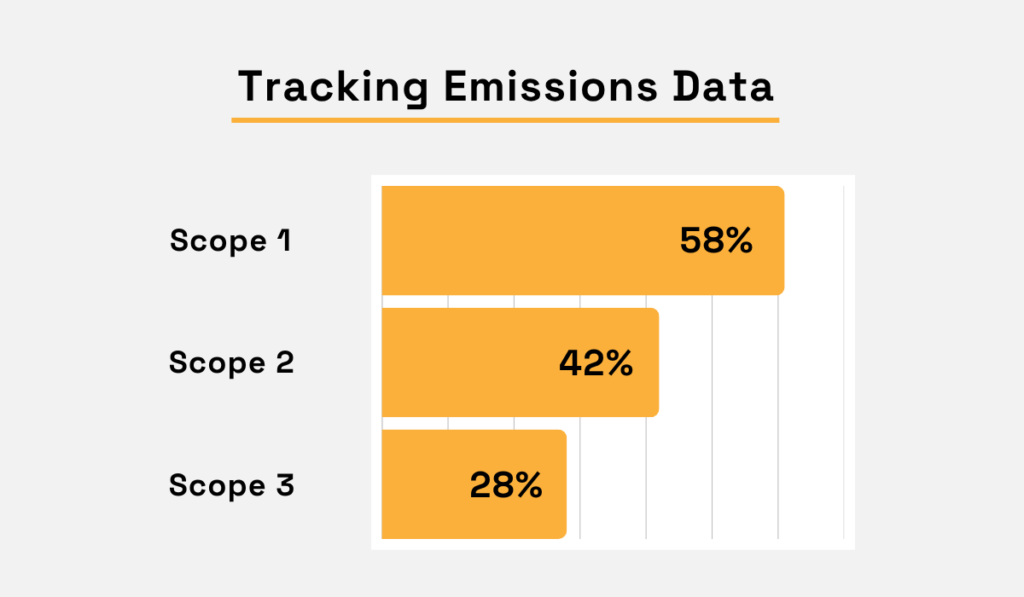

Let’s take a look at emissions data for a moment.

Despite being crucial to a company’s environmental footprint, the indirect or Scope 3 emissions that occur across your value chain remain the least monitored ESG dimension by most businesses.

Illustration: Veridion / Data: Sweep

To address this, procurement teams should define clear ESG supplier criteria—some as dealbreakers for onboarding, others for ongoing evaluation.

For example, if your company has pledged to reduce its carbon footprint by 30% within five years, suppliers’ emissions directly impact your ability to meet that target.

To make this actionable, the table below shows examples of supplier ESG criteria and how they apply during selection or ongoing performance monitoring:

| Category | Potential Criteria | Use Type |

|---|---|---|

| Environmental | Measure and report Scope 1, 2, and 3 emissions | Selection |

| Hold ISO 14001 or equivalent environmental certification | Selection | |

| Use renewable energy in production (target % or progress plan) | Performance KPI | |

| Commit to responsible waste management and recycling rates | Performance KPI | |

| Social | Adhere to international labor standards | Selection |

| Track and improve workplace diversity metrics | Performance KPI | |

| Governance | Maintain an anti-corruption policy and whistleblower process | Selection |

| Disclose ESG data regularly and transparently | Performance KPI |

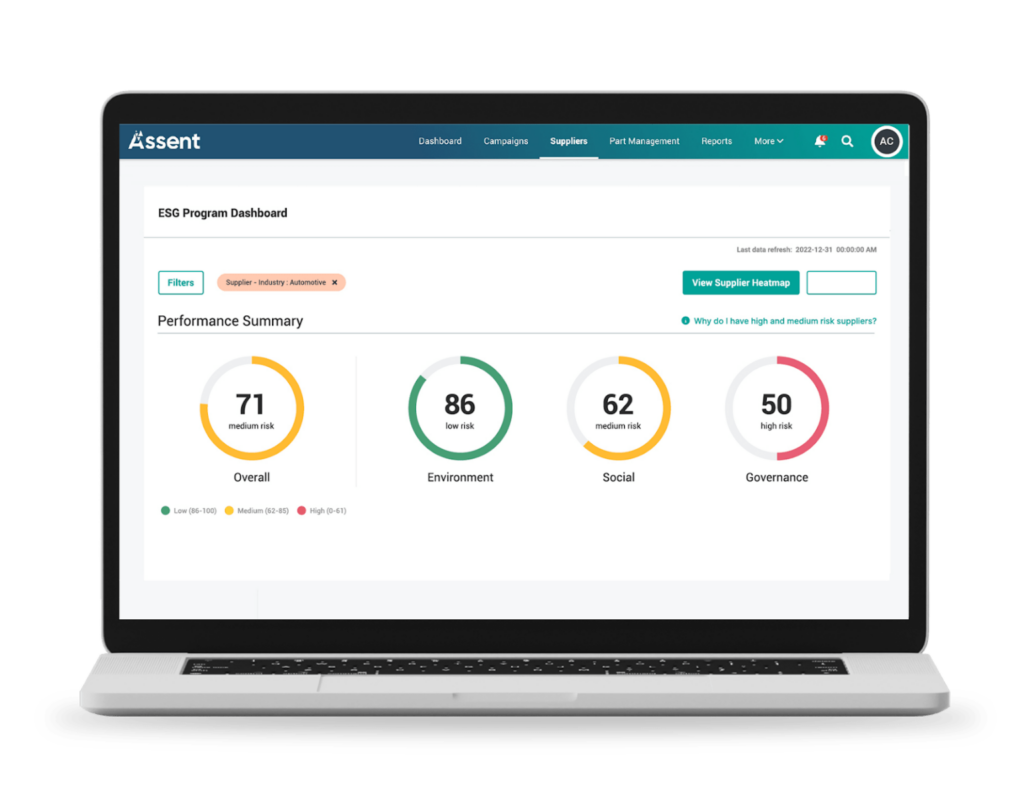

Tools like Assent help businesses track and manage these ESG metrics across their supplier base via a dedicated dashboard, flagging risks before they become compliance issues.

Source: G2

For companies looking for more tailored scorecards and automated risk mapping, platforms like EcoVadis offer advanced ESG performance tracking, benchmarking suppliers against industry peers.

In conclusion, integrating ESG criteria into supplier management transforms sustainability from an internal ambition into a practical, operational reality, minimizing the chances of greenwashing allegations.

Grounded in global frameworks like GRI, SASB, and TCFD, transparent ESG reporting is more than a checkbox.

By using standardized, audited disclosures, companies avoid selective reporting and greenwashing accusations while simultaneously building trust.

As explained by Michael Showalter, an expert in energy and environmental litigation, ESG and anti-greenwashing mechanisms are increasingly seen as a way of keeping corporations in check.

Illustration: Veridion / Quote: IBANET

So, what are different organizations doing to stay compliant?

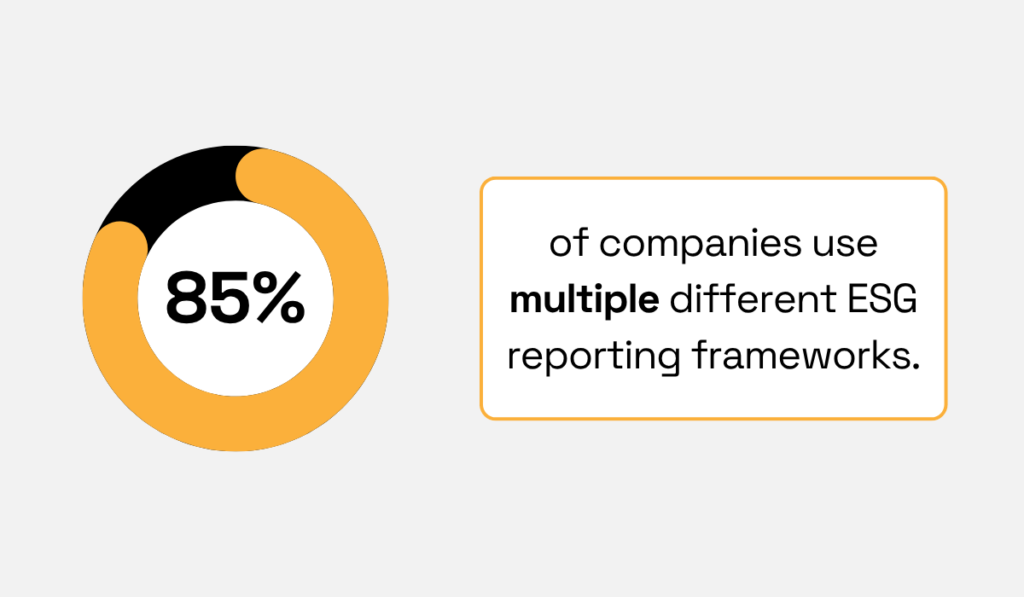

There are a number of mandatory ESG disclosures, especially surrounding greenhouse gas emissions, but a recent FEI study shows that companies currently combine multiple reporting frameworks.

Illustration: Veridion / Data: FEI

Current mandates often don’t require visibility beyond tier 1, which is why this combined approach is meant to enhance transparency and ensure a strong ESG score.

Of course, the lack of standardization and vagueness leave room for public and legal scrutiny.

For instance, a major greenwashing lawsuit is currently underway in Australia, with the Australasian Centre for Corporate Responsibility suing oil producer Santos for allegedly misleading investors.

Source: ABC

Although Santos argues their roadmap is sound and subject to biases, their 2020 Annual Report and general reporting practices have cast doubt on the feasibility of the company’s “Net zero by 2040” strategy.

Now, how do you take a more balanced and mature approach to reporting?

Different firms have different needs and contexts, but here are some universal reporting best practices:

| Adopting multiple frameworks | For example, GRI for material impacts, SASB for investor relevance, and TCFD for climate risk |

| Using third-party assurance | Already covered in this article, helps verify data and enhance credibility |

| Disclosing limitations early | Identifying data gaps builds trust and signals commitment to improvement |

| Integrating visuals and storytelling elements | Helps make reports engaging, especially for non-specialist audiences |

| Automating reporting | Supports internal monitoring and external disclosure from a single platform |

Automated reporting, in particular, is quick to deliver results.

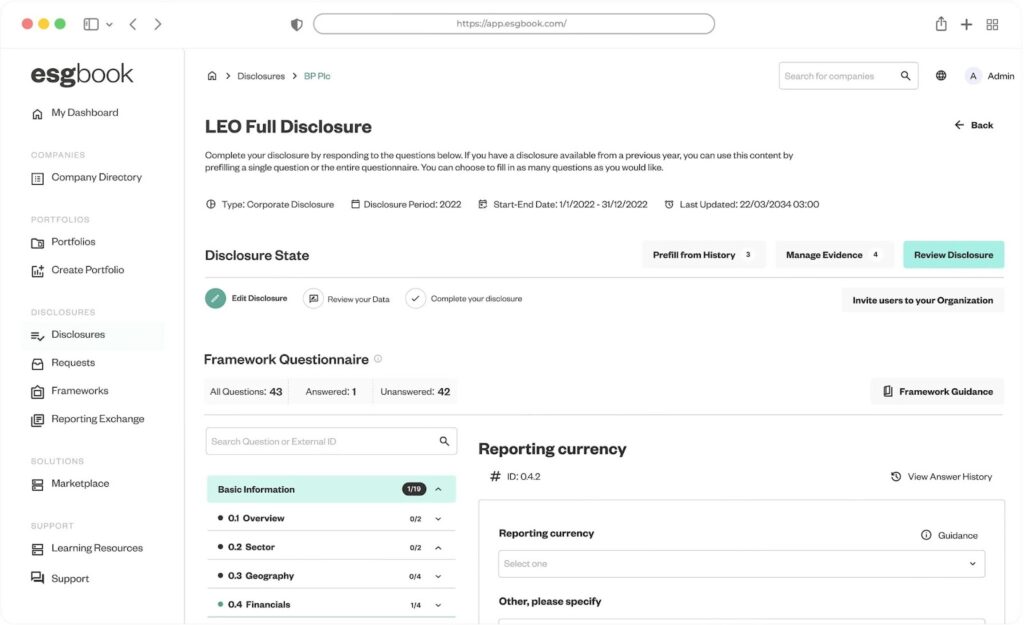

For example, solutions like ESG Book help businesses manage internal ESG metrics while providing tools for external disclosures and regulatory compliance.

Users can access core data from a single dashboard and tailor data collection based on their reporting capacity, regional regulations, company size, and sector-specific requirements.

Source: ESG Book

In the end, combining clear frameworks, honest disclosures, and the right tools ensures ESG reporting is consistent, credible, and resilient under scrutiny.

Embedding ESG on a strategic and operational level is a business imperative.

With regulators, investors, and consumers demanding proof, half-measures and vague commitments simply won’t hold up.

By setting measurable goals, integrating ESG into governance, applying clear supplier criteria, and adopting third-party data tools, you can safeguard credibility and deliver lasting value.

So, if you haven’t already, now’s the time to audit your ESG practices, upgrade your reporting, and invest in systems that make transparency possible at every level.