How to Empower Suppliers to Meet ESG Compliance Goals

Key Takeaways:

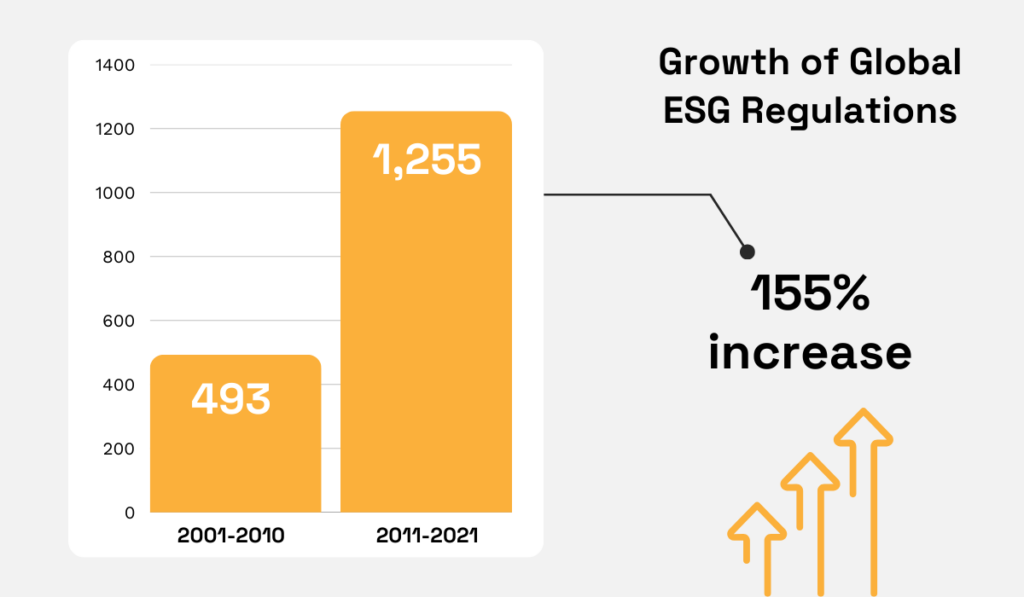

A 155% surge in ESG-related regulations over the past decade has made compliance non-negotiable.

Amid rising pressure and shifting stakeholder expectations, your suppliers hold the key to long-term ESG resilience.

But how can you actually empower them to meet those goals?

Read on as we break down practical steps to help your suppliers stay compliant, and set your supply chain up for success.

Setting clear ESG expectations ensures your suppliers understand what’s required of them, fostering alignment on compliance goals from the outset.

Being specific and transparent early on helps prevent costly misunderstandings while also strengthening supplier relationships over time.

Yet, confusion is common, especially given the complexities of a rapidly expanding regulatory environment.

The number of ESG regulations introduced globally more than doubled from 493 in the 2000s to 1,255 in the 2010s, which is a 155% increase.

Illustration: Veridion / Data: Edie

This sharp increase reflects the growing emphasis on environmental protection, ethics, and transparency, with new rules on greenwashing tightening the regulatory framework even further.

While politics are sure to impact policies and overall approach to ESG, the momentum behind sustainable financing is unlikely to slow.

Daniel Klier, ESG Book’s Former Chief Executive, agrees:

Illustration: Veridion / Quote: Edie

With this in mind, it’s critical to be upfront about your ESG priorities.

For instance, the EU’s Corporate Sustainability Reporting Directive (CSRD) requires large and listed companies to publish detailed ESG reports, with the first wave of aligned disclosures due in 2025.

It’s essential to communicate new regulations to existing and prospective suppliers on time, as well as modify your gudineliness and documentation where needed.

Your Supplier Code of Conduct doesn’t need to list every law, but it should outline clear standards around labor, environmental responsibility, and health and safety.

Another effective step is embedding the most relevant legislation in supplier pre-qualification surveys and onboarding.

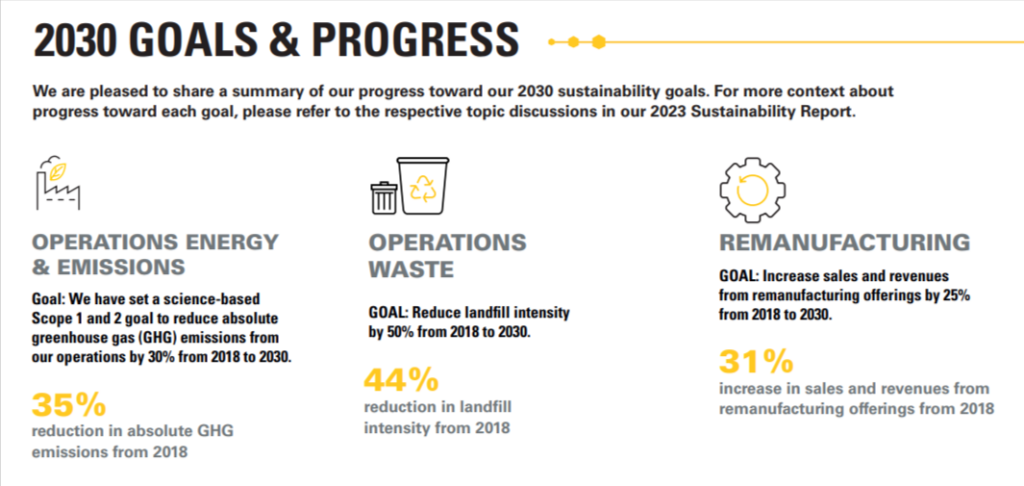

Caterpillar and many other large organizations also connect sections on supplier requirements with their core ESG goals and latest achievements.

Source: Caterpillar

Why does this matter?

Specific ESG targets can often reveal (mis)alignment more clearly than regulations alone.

But clear expectations still need to be paired with open conversations about long-term priorities.

This ensures that:

All in all, clarity now avoids costly confusion later.

So, set the tone early and revisit ESG expectations regularly as laws and goals evolve.

Many suppliers may lack the internal knowledge or tools to meet ESG requirements, especially given the sharp increase in regulations.

That’s why providing practical training resources is more important than ever.

From workshops and toolkits to access to external experts, supporting your suppliers directly contributes to stronger, more compliant partnerships.

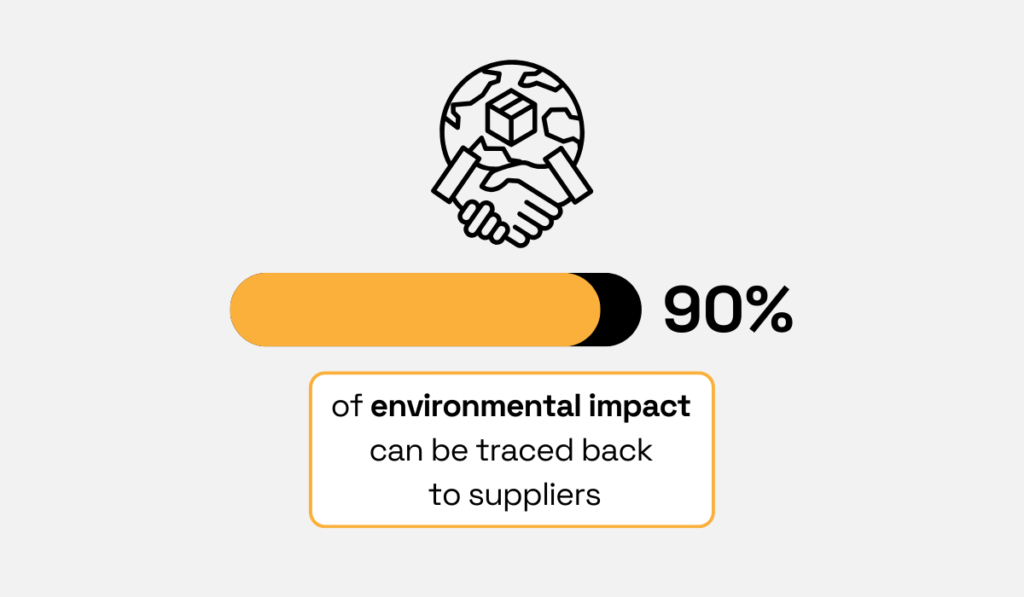

And if you need a compelling reason why, research shows that up to 90% of an organization’s environmental impact can be traced to its supply chain.

Illustration: Veridion / Data: McKinsey

In other words, your ESG performance is closely tied to your suppliers’ actions.

With this in mind, addressing knowledge gaps through training becomes essential for reducing ESG risks and strengthening overall performance.

So, what should this training look like?

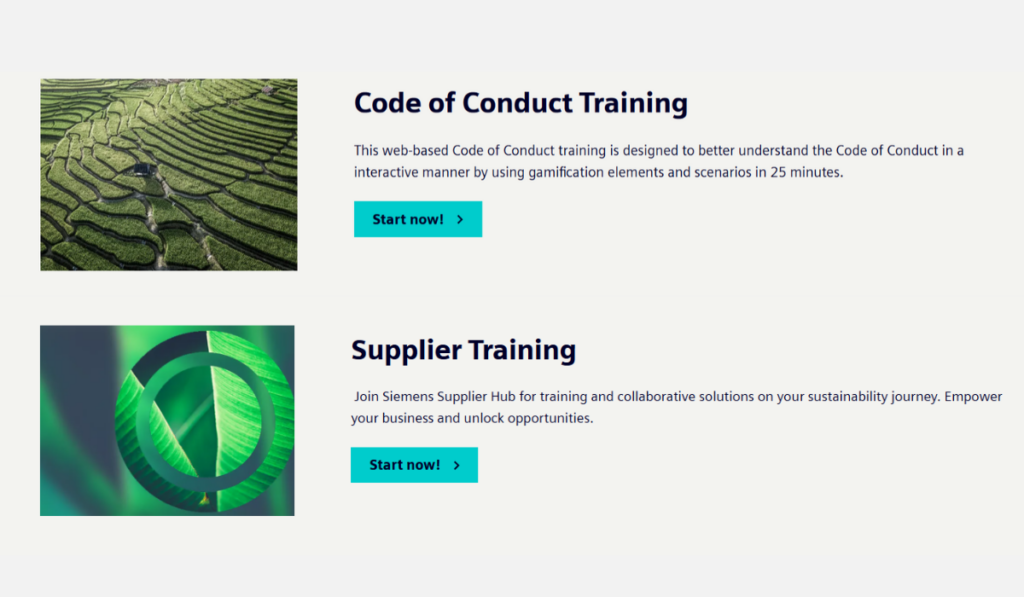

Companies like Siemens take a layered approach, offering foundational learning on topics like the Supplier Code of Conduct, followed by more specialized ESG themes like carbon tracking and sustainability audits.

Source: Siemens

Gamification elements, video tutorials, and visual aids complement written material to facilitate quicker adoption of relevant standards and policies.

Now, developing a comprehensive program requires resources, but you don’t have to do it all in-house.

For example, BBVA’s global sustainability program provides SMEs with free, multilingual access to online ESG training, complete with checklists, templates, and recorded sessions.

Source: ESG News

Directing suppliers to such resources is a cost-effective way to scale up ESG maturity across your network.

However, before rolling out any programs, it would be wise to assess suppliers’ current ESG competencies and identify knowledge gaps.

Olga Episheva, Supplier Quality Development Supervisor for Hyundai Motor Brasil, explains that conducting surveys is the quickest way to effectively design supplier sustainability training and measure its impact.

Source: Veridion / Quote: LinkedIn

To drive long-term improvement, combine quantitative assessments with qualitative supplier feedback.

This ensures not only that compliance goals are being met, but also that your ESG framework genuinely supports supplier performance and progress.

Formalizing ESG criteria within supplier contracts ensures accountability and reinforces your organization’s commitment to sustainable practices.

While communicating expectations is important, there’s no substitute for binding, contractual language that:

In short, ESG clauses turn sustainability from a set of guidelines into enforceable standards across your supply chain.

Stéphanie De Smedt, Head of Tech & Commercial Practice at Loyens & Loeff, notes that ESG clauses are not only about compliance—they’re essential for avoiding greenwashing.

Illustration: Veridion / Quote: Sustainable Views

By requiring suppliers to back up their ESG claims with verifiable data, companies can better manage risks and strengthen their position as sustainability leaders.

The big question is: What should ESG clauses actually include?

While specific benchmarks inevitably vary by industry and location, the following elements are fundamental:

| Clear Standards and Benchmarks | Define specific ESG standards that your suppliers are expected to meet, e.g. reducing carbon emissions. |

| Measurable Metrics | Establish KPIs to track progress against ESG goals, e.g. carbon footprint calculations, waste management statistics. |

| Monitoring and Reporting | Require regular ESG reporting and third-party audits to verify compliance, ensure transparency, and drive improvement. |

| Enforcement Mechanisms | Include provisions for addressing non-compliance, such as corrective action plans, penalties, or termination clauses. |

These obligations should extend beyond direct suppliers to include subcontractors and partners as well.

However, inconsistent wording or vague requirements can introduce legal and operational risks.

To address this, DocuSign recently partnered with contract standardization firm Bonterms to streamline ESG clauses across industries.

Source: ESG News

Their initiative introduces pre-vetted, standardized language to help organizations draft strong, consistent agreements faster and with fewer ambiguities.

DocuSign representatives highlight that this step paves the way for fully enforceable ESG compliance frameworks.

Illustration: Veridion / Quote: ESG News

Whether you choose to rely on standardized services or draft clauses in-house, a structured approach is essential to reduce legal uncertainty and build a resilient and ethical supply chain.

Ongoing audits and ESG assessments give companies clear visibility into supplier performance, exposing any gaps before they can become major compliance issues.

They foster both transparency and continuous improvement, helping companies lead rather than lag on ESG.

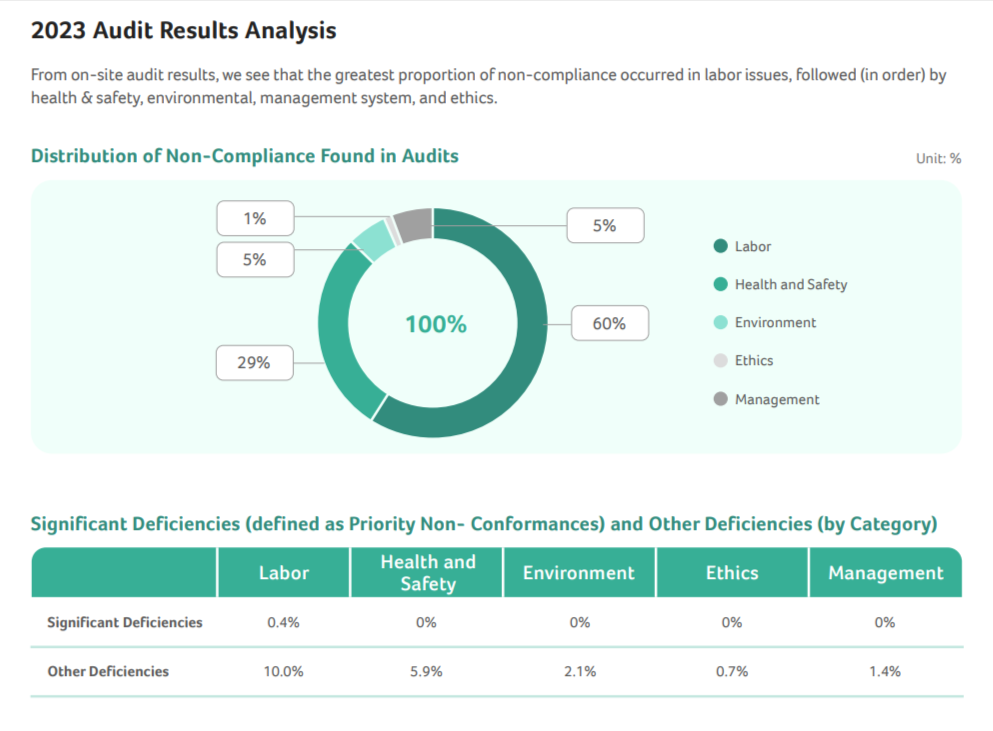

Take Acer, for example.

Their 2023 sustainability report details a wide range of ESG achievements, from maintaining top-tier CDP climate change ratings to incorporating post-consumer recycled plastics.

One particularly standout figure is that Acer audited 210,000 direct supplier employees, ensuring individual-level verification on labor practices and working conditions.

Source: Acer

This commitment to detailed assessments is the key element of Acer’s success.

When it comes to supplier performance as a whole, Acer conducted 1,228 audits across its tier-1 and tier-2 suppliers.

The most frequently flagged issues were indeed related to labor, while major non-compliance cases were extremely rare—a strong sign of ESG alignment.

Source: Acer

Acer also maintains detailed ESG scorecards for each supplier and shares results directly.

This transparency empowers suppliers to benchmark their progress against peers, motivating them to cultivate a culture of sustainability and seek improvement.

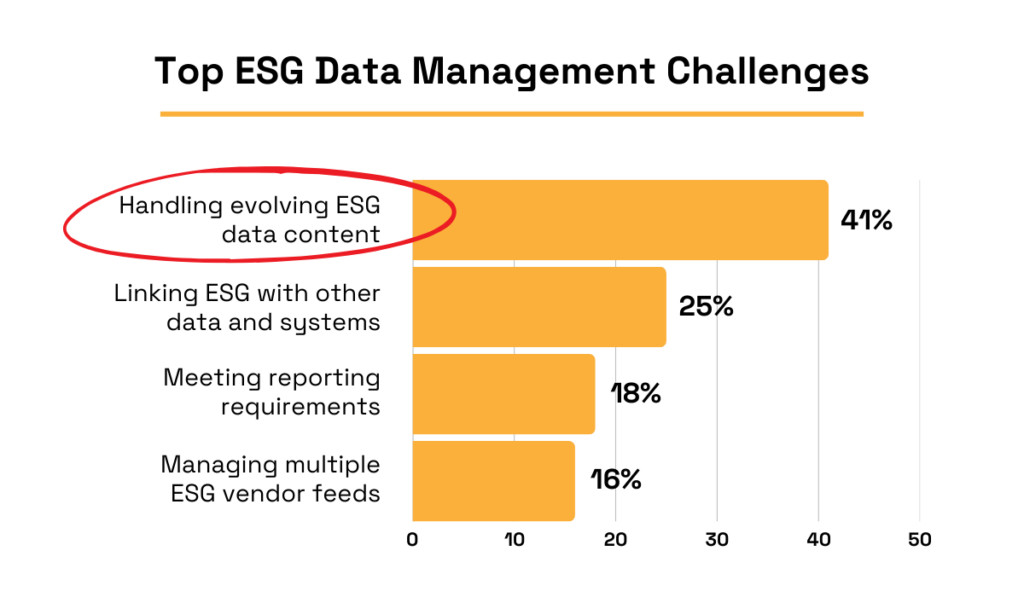

Still, on-site audits can’t catch everything, nor do they provide real-time insights.

According to a Bloomberg survey, the top ESG data management challenge is dealing with “constantly evolving and new data content.”

Illustration: Veridion / Data: Bloomberg

Integrating ESG information with other systems is another common roadblock.

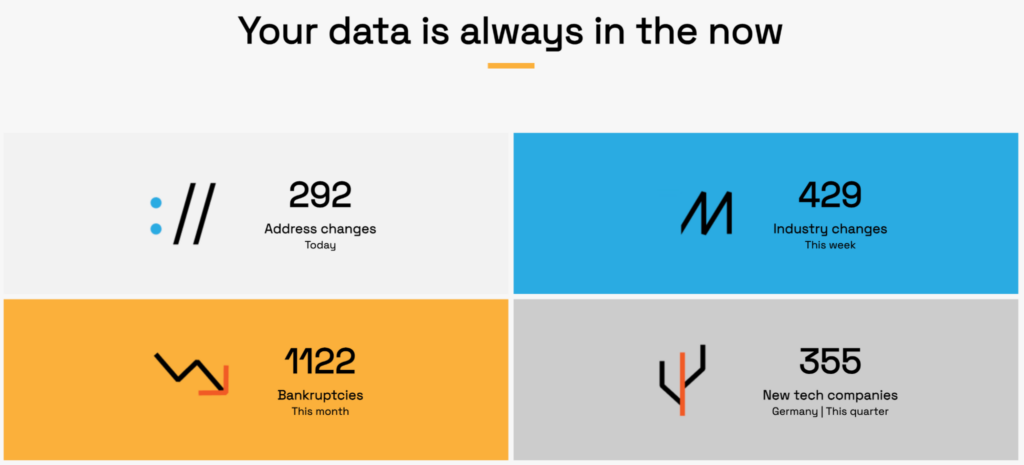

This is where data engines like Veridion step in.

Veridion leverages advanced AI technologies to deliver comprehensive, real-time ESG insights, helping procurement teams make informed decisions with total accuracy and up-to-date information.

Veridion’s AI-powered bots continuously collect relevant data on any company with a digital footprint, covering over 123 million companies across 250 geographies, with weekly updates.

Source: Veridion

The platform centralizes ESG data to give you a 360-degree view of each supplier, enabling detailed assessments against your ESG criteria.

And if you’re concerned about data depth, Veridion’s rich ESG taxonomy extends far beyond critical ESG factors like carbon footprint, water usage, or ethical labor practices.

Source: Veridion

Ultimately, services like Veridion don’t just enhance monitoring, but enable smarter, data-driven procurement.

With frequent audits and reliable data systems, you’ll be better equipped to meet ESG compliance goals while building a stronger, more resilient supply chain.

Open communication builds trust and gives suppliers space to raise concerns, clarify requirements, or seek guidance on key ESG topics.

Regular check-ins and feedback loops support long-term collaboration, making them essential for any sustainable business relationship, even beyond ESG.

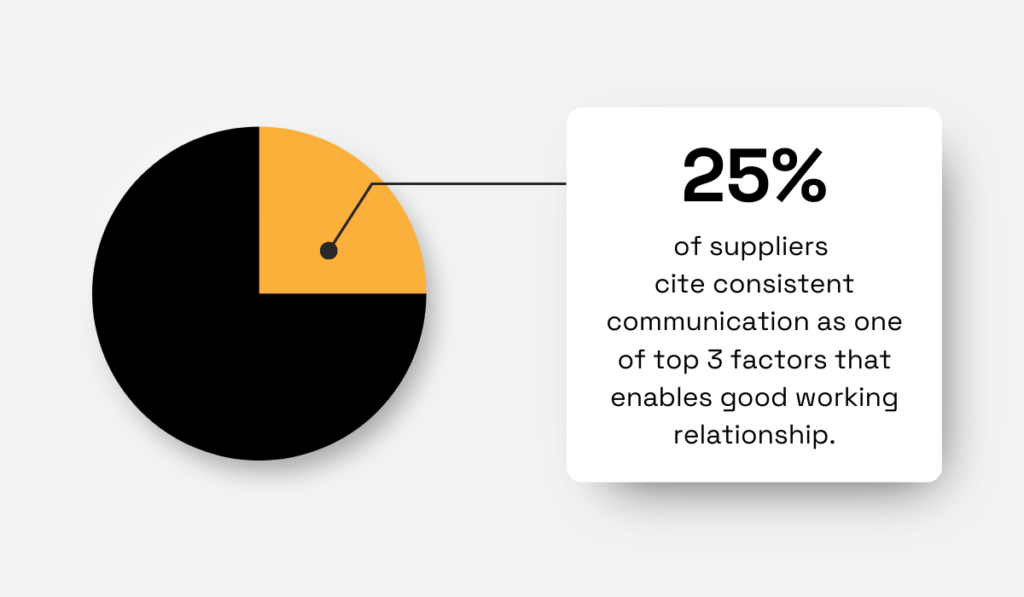

In fact, a recent HICX survey found that 25% of suppliers rank consistent communication as one of the most important enablers of a good working relationship with buyers.

Illustration: Veridion / Data: HICX

The same report shows a significant gap.

Namely, 98% of suppliers believe communication with buyers could be improved.

This disconnect isn’t surprising.

Many companies still treat supplier relationships as largely transactional, often prioritizing or even mistaking performance management for genuine partnership building.

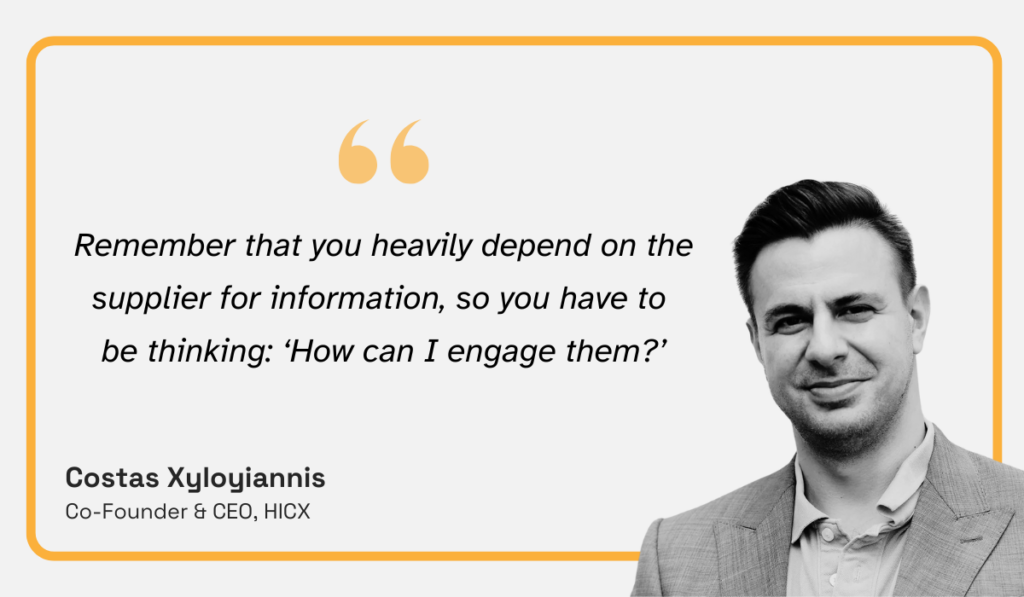

Costas Xyloyiannis, HICX’s Co-Founder & CEO, warns against this mindset, highlighting that buyers heavily rely on suppliers for data.

Illustration: Veridion / Quote: HICX

That includes the ESG metrics shaping public commitments and investor trust.

That’s why companies must foster supplier engagement and keep the communication channels open.

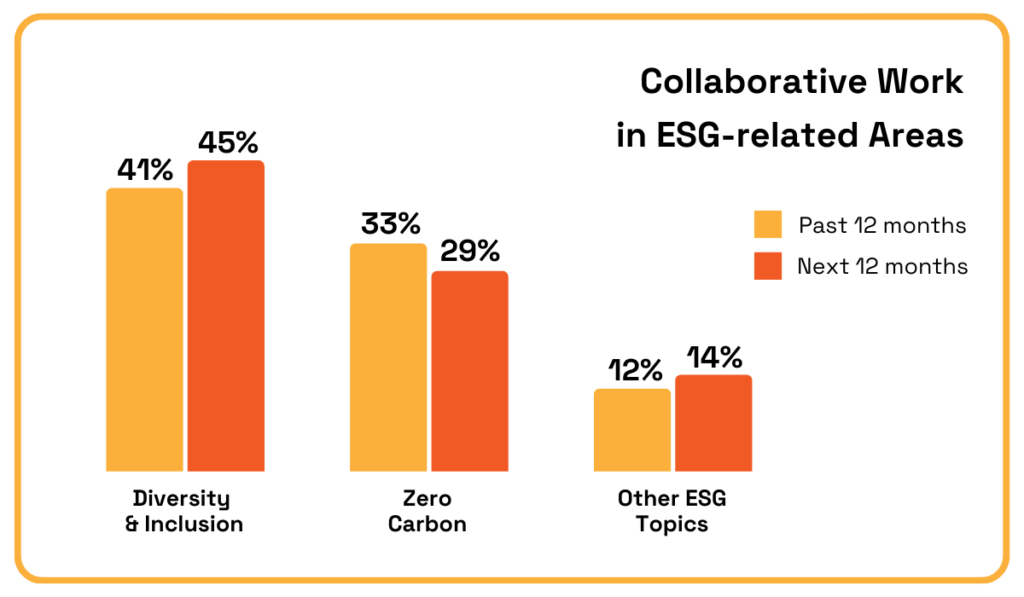

The same survey shows that the most collaborative areas often include zero-carbon programs and DEI initiatives.

Illustration: Veridion / Data: HICX

Not all ESG topics carry equal weight, which means the frequency and format of communication need to be adjusted accordingly.

To make your efforts more targeted and effective, consider the following steps:

The last step is crucial.

Companies should clearly document how and when ESG-related issues should be reported.

Define escalation paths and communication channels to eliminate ambiguity and ensure swift resolution when problems arise.

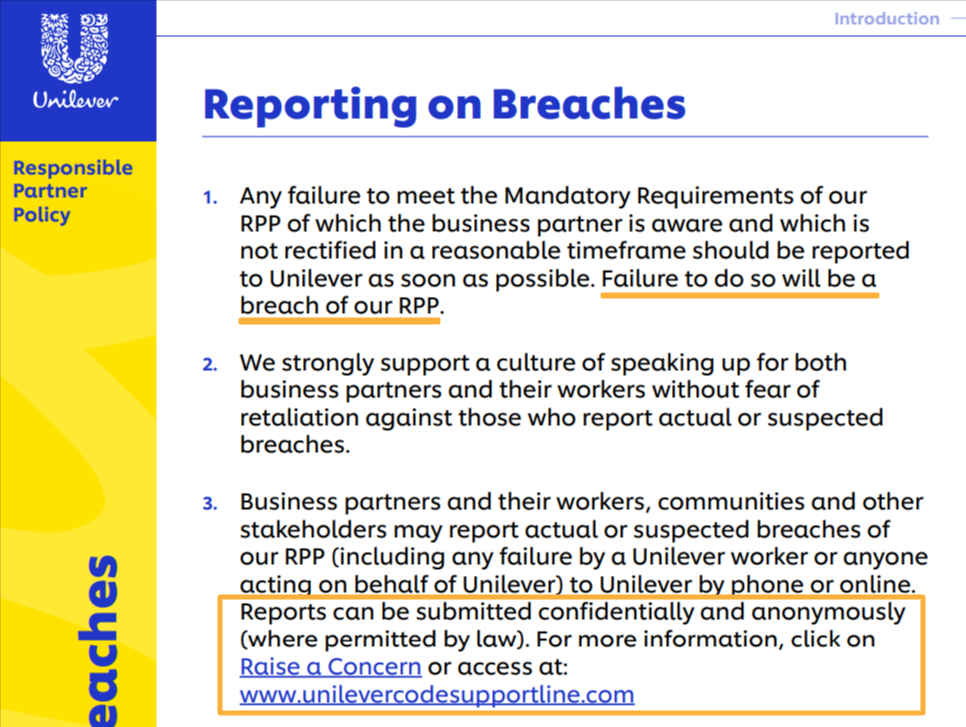

Unilever’s Responsible Partner Policy does exactly that.

It explicitly states that failing to report a breach is itself a violation, and it provides multiple, accessible channels for suppliers to raise concerns or flag misconduct, as shown here:

Source: Unilever

Whether the focus is on decarbonization or ethical labor, open, consistent communication is what strengthens both ESG outcomes and supplier relationships.

Recognizing and rewarding suppliers who meet or exceed ESG standards reinforces positive behaviors and helps build a culture of continuous improvement across your supply base.

Whether through public recognition, preferential treatment, or financial incentives, investing in supplier development is widely regarded as a key supplier management practice.

Gary Gustafson, President of G-Force Consulting, points out that while recognition matters, top-performing suppliers need more than just praise.

Illustration: Veridion / Quote: Smartsheet

Gustafson recommends inviting high-performing suppliers to bid on new programs.

But incentives don’t have to stop at procurement opportunities.

They can take many forms, including bonuses for emissions reductions, faster payment terms, access to exclusive training, or being spotlighted at supplier summits.

Here are a few common mechanisms companies use to motivate ESG excellence:

| Remuneration Mechanisms | Achieving defined sustainability metrics, e.g., 15% emissions reduction, means suppliers receive tiered bonuses or rebates. |

| Modifier-Based Bonuses | Suppliers verified to use 100% renewable packaging qualify for extra financial incentives. |

| Scorecard-Based Incentives | Those scoring 80+ on ESG assessments get sourcing priority or long-term contract eligibility. |

| Qualification-Based Eligibility | Only suppliers who complete ESG training and pass audits can bid on high-value projects. |

Beyond these incentives, organizations can introduce gamification elements into supplier portals to rank ESG performance or open up opportunities for innovative projects.

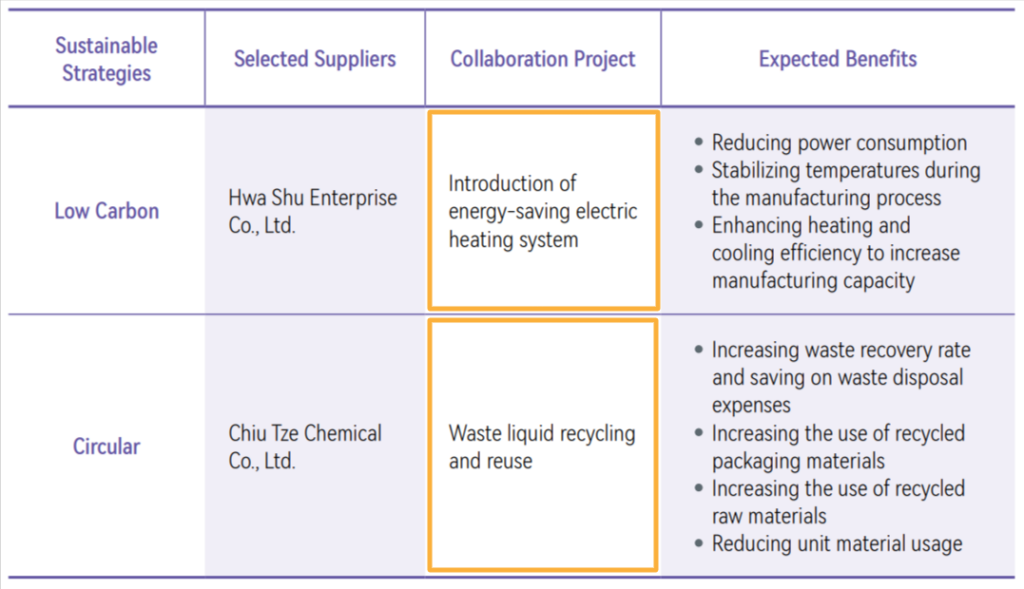

For instance, ASE Technology Holding, a global provider of semiconductor assembly and testing services, runs an ESG-focused program encouraging suppliers to submit collaborative sustainability projects.

Selected initiatives—like the two highlighted below—receive funding from the ASE Environmental Protection and Sustainability Foundation.

Source: ASE Global

ASE is currently working with 19 equipment suppliers on energy-efficient design projects and has set ambitious environmental targets, including achieving Net Zero by 2050 and cutting energy use by 20% by 2030.

The company also recently held its ‘Best Suppliers of 2024’ awards ceremony, recognizing 17 outstanding partners among 450 representatives from over 140 companies.

This event marks the first time ESG performance was factored into supplier selection.

Andrew Tang, the company’s Chief Procurement Officer, underlines that close supplier collaboration on ESG and other critical areas will remain a key priority for ASEH.

Illustration: Veridion / Quote: ASE Global

In short, meaningful incentives turn ESG from a compliance box into a shared innovation opportunity—one that builds stronger partnerships and a more resilient supply chain.

Have you noticed the pattern?

We’ve shared several examples throughout this article, but the one thing ESG leaders have in common is that they engage suppliers proactively, reward progress, and plan for the long haul.

Technology helps scale these efforts by managing ESG data and flagging risks in real time, but real impact comes from shifting the mindset.

When procurement sees ESG not as a top-down mandate, but as a shared responsibility, it creates the conditions suppliers need to thrive—and empowers them to meet compliance goals with confidence and clarity.