ESG Benchmarking: Why It Matters & How to Implement It

Key Takeaways:

What do you see as the biggest external risk for your organization? For 70% of executives, it’s legal and regulatory non-compliance.

One effective way to manage that risk—while driving improvements and building stakeholder trust—is through ESG benchmarking.

This guide explores the benefits and offers practical advice on comparing your sustainability performance to peers, regulations, and industry frameworks.

Let’s dive right in.

First, the essentials.

ESG benchmarking is the practice of positioning your organization’s ESG efforts within the broader context of industry standards, regulations, and peer performance.

It’s how your business evaluates where it stands today and identifies what it needs to improve to stay competitive, compliant, and credible.

Source: Veridion

The importance of gaining a clear, external perspective on how your ESG programs truly perform lies in being able to demonstrate those results to stakeholders such as investors, regulators, clients, and employees.

To support this, ESG frameworks offer more than reporting templates.

They provide structured methodologies, topic-specific KPIs, and consistent metrics for disclosures across industries and markets, helping you translate complex ESG data into comparable, decision-useful insights.

For example, Nareit’s ESG reporting guide distinguishes between voluntary disclosure frameworks and guidance frameworks, as well as third-party scoring services.

Which you use and how will depend on your benchmarking approach:

In practice, ESG performance is typically assessed using publicly disclosed data or verified third-party reports.

This ensures credibility while allowing your business to identify gaps and opportunities based on reliable, comparable metrics.

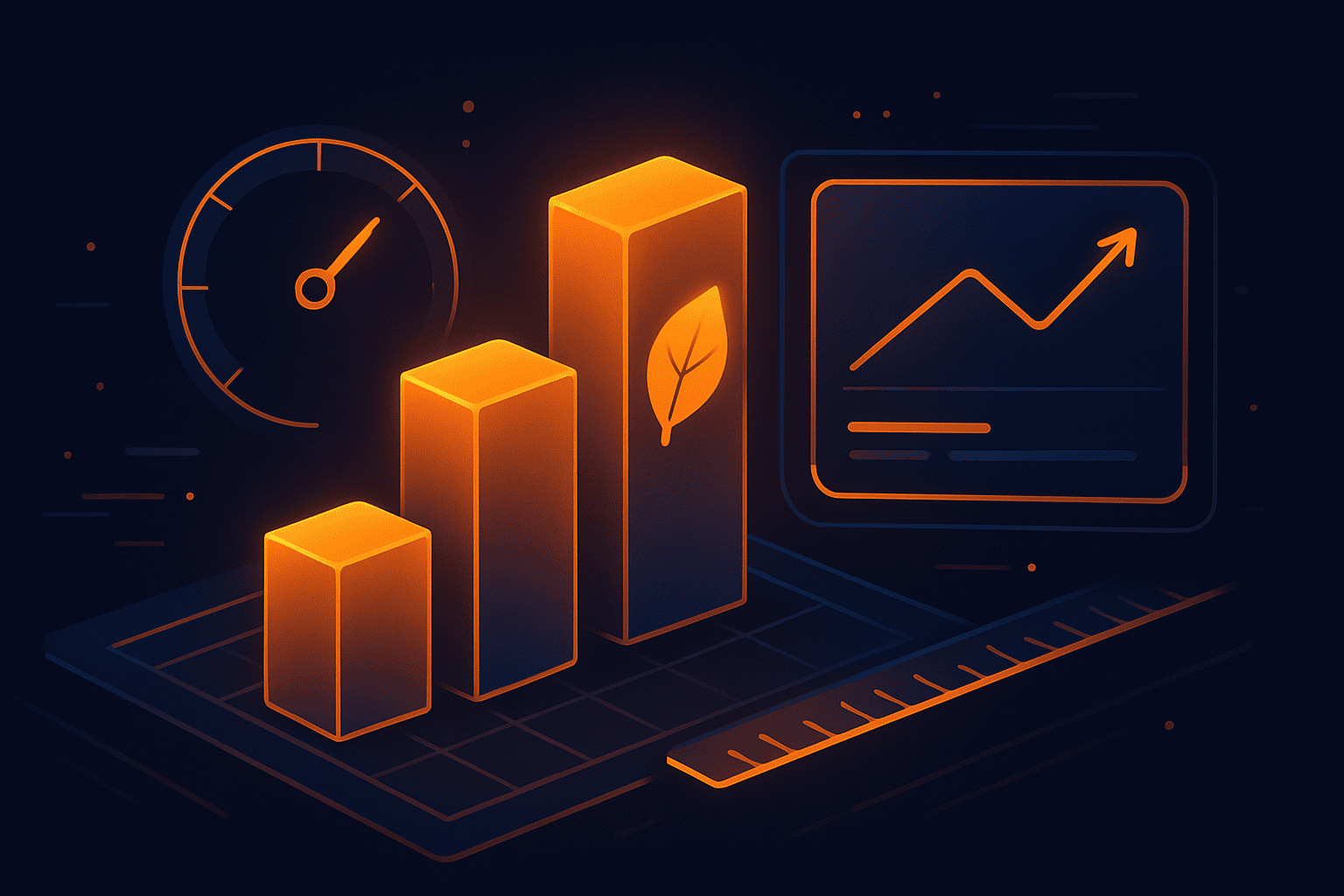

To illustrate how ESG frameworks are applied in the real world, KPMG’s data shows that GRI Standards remain the most widely used framework globally, particularly in the Americas.

Illustration: Veridion / Data: KPMG

While the world’s largest companies commonly adopt this, they, like most organizations, rely on a combination of frameworks tailored to different stakeholder demands and regulatory requirements.

To give you a clearer picture, here’s a breakdown of the most recognized ESG frameworks and what they cover:

| GRI | Broad, stakeholder-focused disclosures on economic, environmental, and social topics | General ESG reporting, sustainability teams |

| SASB | Financially material ESG issues, tailored to specific industries | Investors, CFOs, risk managers |

| TCFD | Climate-related financial risks and opportunities | Climate risk reporting, investor relations |

| CDP | Environmental risks: climate change, water security, deforestation | Operational risk teams, sustainability officers |

| IFRS | Unified, investor-focused ESG disclosure standards, combining financial and climate-related reporting | Public companies, investor reporting |

When implemented well, ESG benchmarking will allow your business to assess its standing on material ESG issues, but also:

In short, it turns ESG data into business intelligence, helping you identify where you lead, where you lag, and how to move forward.

Beyond compliance and reporting, ESG benchmarking delivers tangible business value. Let’s start with one of its most important functions—helping your business proactively detect risks.

Benchmarking helps you detect and protect against risks before they escalate into costly problems.

By comparing your ESG performance to industry standards and peer companies, it becomes easier to uncover blind spots you might otherwise miss, from supplier shortcomings to environmental vulnerabilities and compliance gaps.

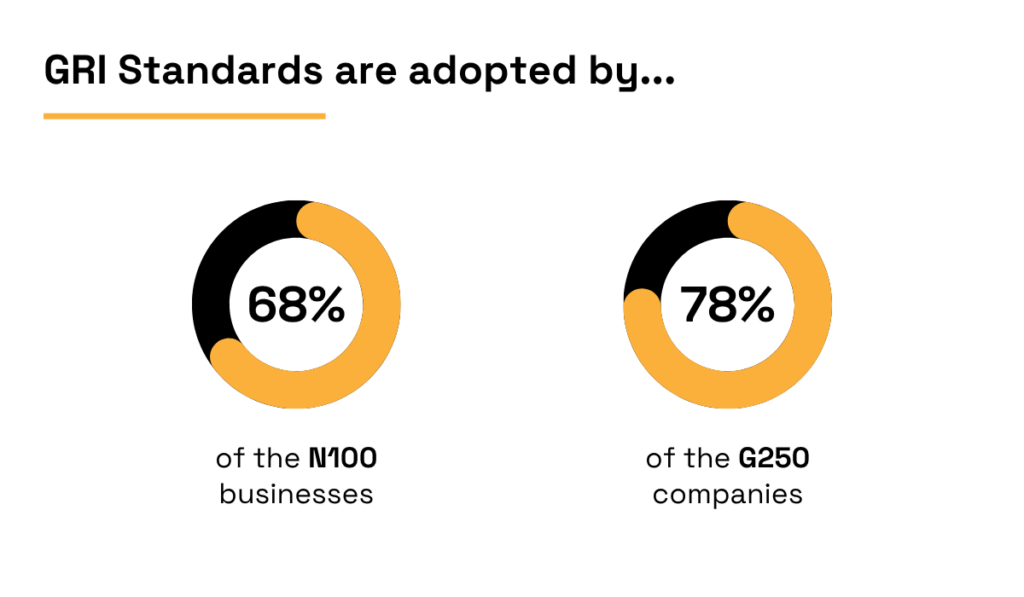

This is especially important today as ESG risks directly influence investor confidence.

According to the 2023 PwC Global Investor Survey, 83% of institutional investors report the key role of ESG risks in investment decisions.

Illustration: Veridion / Data: PwC

So, what types of risks can benchmarking help reveal?

Think environmental compliance shortfalls or gaps in your supply chain’s ESG policies.

Benchmarking can also flag exposure to emerging risks like greenwashing, where exaggerated sustainability claims lead to legal action or reputational harm.

Felix Roscam, a lawyer at Freshfields, notes that clients are increasingly looking for guidance:

Illustration: Veridion / Quote: IBANET

While legal advice is valuable, benchmarking plays a critical supporting role.

It offers concrete, data-backed insight into where your business is underperforming relative to peers, helping you course-correct before regulators or investors raise concerns.

In short, effective ESG benchmarking turns unseen risks into actionable priorities to protect your business and its reputation.

Benchmarking also paves the way for earning stakeholder trust, which, in today’s market, directly impacts financial decisions and the bottom line.

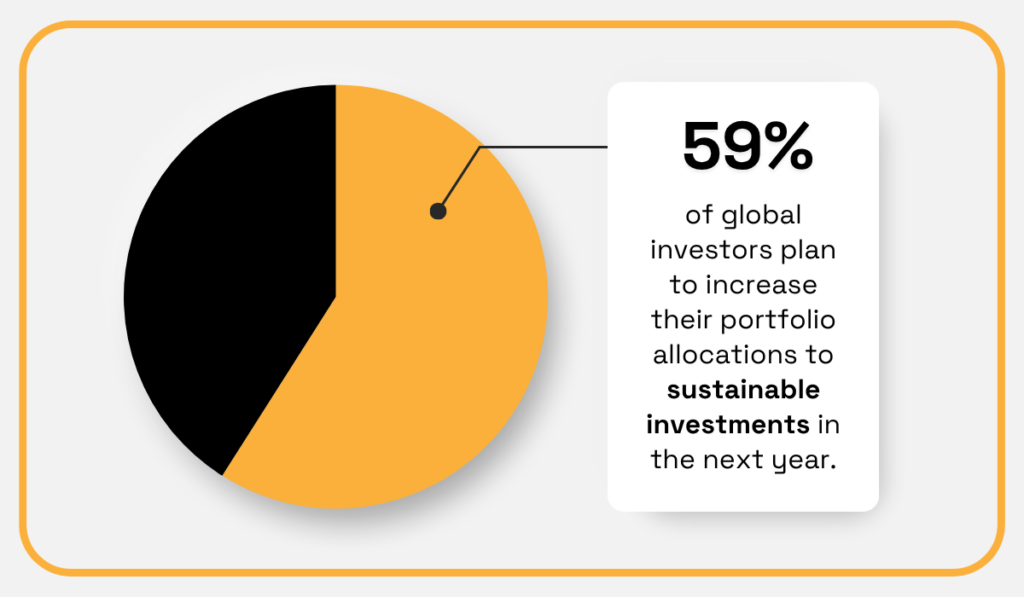

Morgan Stanley’s wide-reaching survey of 1,765 individual investors across Asia-Pacific, Europe, and North America shows that 59% plan to increase their sustainable investments over the next year.

Illustration: Veridion / Data: Morgan Stanley

The leading reason? Confidence in financial performance, driven by clear, verifiable ESG outcomes.

While general interest in ESG remains high, actual investment decisions hinge on hard numbers and credible data.

That’s where ESG benchmarking makes a measurable difference.

It validates your business’s sustainability performance against peer companies and respected frameworks, building investor confidence that your ESG efforts aren’t just symbolic.

And of course, it’s not just investors watching.

As one unnamed food and beverage sustainability consultant explains, one of their clients sees nearly half of their total profits tied to ESG performance.

Illustration: Veridion / Quote: Thomson Reuters

And that wouldn’t be possible without sustainable product lines, ethical sourcing practices, and other ESG measures.

In short, consistent, transparent ESG benchmarking turns sustainability claims into trusted, investment-worthy evidence, helping your business attract capital, customers, and long-term loyalty.

Regulatory alignment is another essential benefit of ESG benchmarking, and it’s only becoming more important.

In fact, according to an Economist Impact report, 70% of executives consider legal and regulatory non-compliance the most significant external risk facing their companies today.

Just consider the ongoing developments around the EU’s sweeping ESG disclosure regulations.

Source: Sweep

While some planned reforms have faced criticism and delays, the overall push for streamlined but consistent ESG reporting remains, and will continue to rely heavily on established frameworks and standards.

As Professor Klaus Schwab, Founder and Executive Chairman of the World Economic Forum, puts it, ESG frameworks and standards become even more important in a rapidly shifting regulatory environment.

Illustration: Veridion / Quote: KPMG

This is where benchmarking proves invaluable.

It helps your business track evolving disclosure mandates, identify compliance gaps early, and align ESG reporting practices with both current requirements and those on the horizon.

Ultimately, effective ESG benchmarking keeps your organization audit-ready, disclosure-compliant, and agile enough to navigate an increasingly dynamic regulatory climate.

The business value of ESG benchmarking is undeniable, but it’s a whole different thing making it happen.

The next section deals with the key steps in this process.

Before you can benchmark your ESG performance, you need to know what you’re measuring and why it matters.

Yet, many companies still fall short on this front.

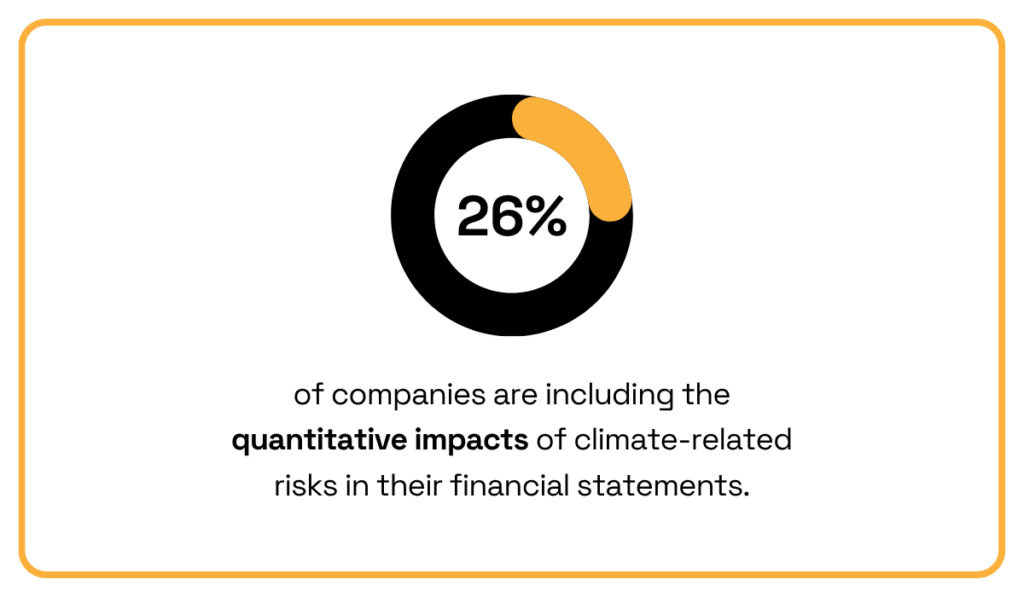

The 2023 EY Climate Risk Barometer found that only 26% of organizations include quantitative impacts of climate-related risks in their financial statements.

Illustration: Veridion / Data: EY

What enables this gap is the lack of ESG metrics, which is bound to become a regulatory and reputational liability sooner rather than later.

On the other hand, choosing indicators that reflect your business model, operational risks, and stakeholder expectations sets the stage for effective benchmarking and ongoing success.

ESG metrics should be financially material and sector-specific where possible, while staying aligned with the aforementioned reporting frameworks like GRI, SASB, or TCFD.

More importantly, these metrics need to be assessed across three categories: your operations, supply chain, and product or service impact.

Here are some foundational ESG metrics to consider:

Selecting the right metrics ensures you track what truly matters—and what your stakeholders will care about tomorrow.

Once you’ve defined your ESG metrics, the next step is gathering reliable data to support them.

In practice, this means collecting information from a mix of sources:

One of the biggest challenges here is the dynamic regulatory environment.

While ESG legislation is tightening in many regions, paradoxically, proposals to relax certain reporting rules—like the recent EPP-backed amendments in the EU—can create similar problems.

As Andreas Rasche, associate dean at the Copenhagen Business School, explains:

Illustration: Veridion / Quote: LinkedIn

This issue is even more pronounced when it comes to publicly available peer data, a topic we’ll explore in the next section.

For now, the key is to build a process that centralizes data from multiple sources, standardizes it, and keeps it regularly updated to reflect regulatory changes and operational realities.

Once your ESG data is in place, the next step is comparing it to that of similar companies.

Peer benchmarking helps you understand whether your performance is ahead of, on par with, or behind industry norms—and where targeted improvements will make the most impact.

In theory, this means sourcing competitor reports, supplier disclosures, and third-party ESG ratings.

But in practice, many of these documents are outdated, incomplete, or simply not public, which makes meaningful benchmarking difficult, especially for private companies or suppliers in fragmented markets.

Again, this is where technology enters the picture.

According to PwC, 59% of global executives say technological change will most influence how companies create value over the next three years, including how they manage ESG.

Illustration: Veridion / Data: PwC

Furthermore, the report shows that most of the trust (61%) is placed in AI-powered tools due to their potential to quickly analyze data from multiple sources, accelerating manual search.

Think about how modern ESG benchmarking can benefit from this.

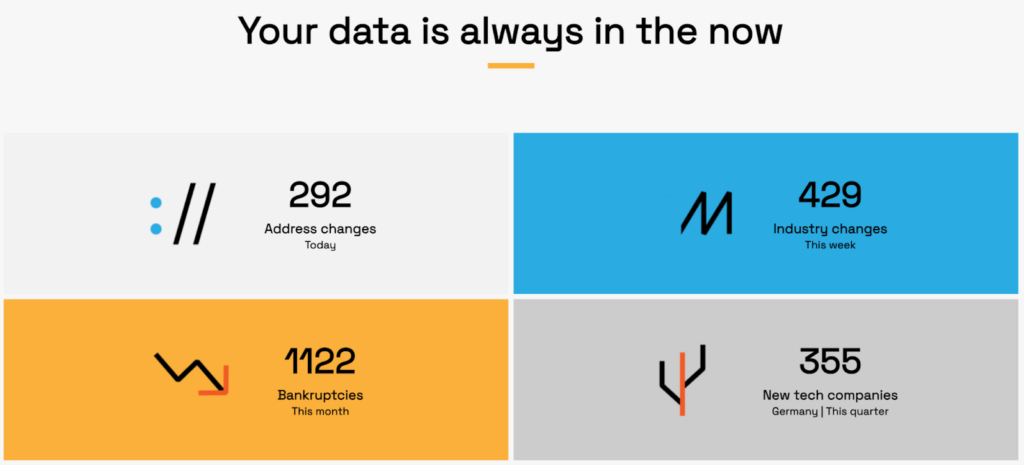

A singular AI-powered platform like Veridion offers global coverage and a continuously updated supplier database that drives decision-making.

Source: Veridion

Veridion’s AI bots crawl thousands of public sources to collect ESG-relevant data in real-time, enabling companies to:

With global reach, real-time intelligence, and automated ESG data extraction, platforms like Veridion transform what was once guesswork into informed, risk-aware decision-making.

Once your ESG benchmarks are in place, the next priority is continuous performance monitoring.

Tracking ESG metrics over time lets you spot trends, measure improvements, and quickly address emerging gaps.

It’s no surprise, then, that the Thomson Reuters report shows how 91% of businesses already use third-party ESG management tools.

Illustration: Veridion / Data: Thomson Reuters

This includes data collection, but also ongoing monitoring and analytics.

Keep in mind that the complexity of ESG reporting frameworks, combined with changing regulations and market expectations, makes manual monitoring impractical.

Modern ESG tools automatically flag deviations, track progress against targets, and generate board-ready dashboards.

A practical example worth highlighting is Workiva, a cloud-based sustainability software that has recently introduced a new carbon management tool, enabling live performance monitoring.

Here’s what it looks like in action:

Source: Workiva on YouTube

In addition to having a clear dashboard for monitoring performance shifts and relative benchmarking, the system integrates with financial reporting systems and supply chain tools.

These and similar tools enable continuous monitoring, ensuring that your ESG performance fuels real-time decision-making, rather than turning into a yearly reporting exercise.

Even with robust ESG data and benchmarks, your reporting must be transparent, credible, and aligned with stakeholder expectations.

A PwC survey revealed that 94% of investors believe current corporate ESG reporting includes unsupported claims.

Illustration: Veridion / Data: PwC

This scepticism comes from disconnected systems, a lack of ESG tech adoption, and other common ESG data management problems.

But with the danger of greenwashing accusations, regulatory action, and reputational damage looming, it’s clear that evidence-backed reporting matters more than ever.

So, what can you do to ensure transparency?

In addition to referencing trusted frameworks, your organization’s performance data has to be presented in accessible, verifiable formats.

While many still rely on static PDF reports, smarter businesses use interactive ESG dashboards and assurance-backed reporting tools.

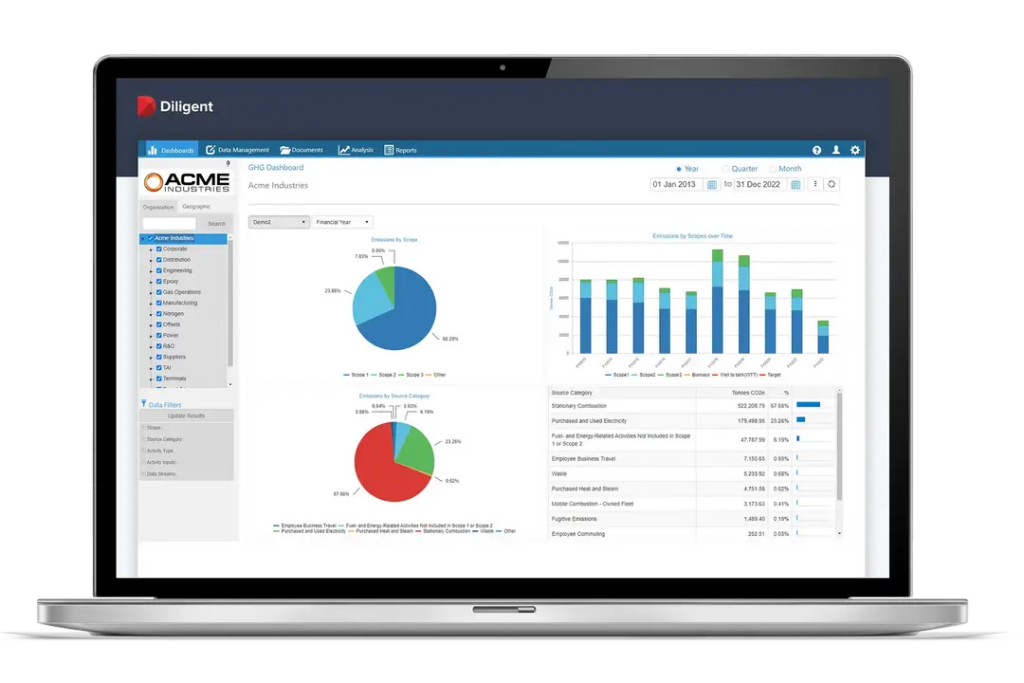

One example here is Dilligent, a platform widely used for ESG reporting that aligns disclosures with regulatory and investor requirements while integrating real-time performance data.

In this view, you get a clear, graphic overview of emission scopes by supplier tier.

Source: Dilligent

All in all, technology makes it easier to safeguard your organization’s ESG credibility, even under growing scrutiny.

And it starts with transparent reporting that’s grounded in verifiable and framework-aligned data.

Your company’s ESG performance influences everything from investment opportunities to reputation.

Now, how does benchmarking fit into this?

It makes it easier to track, compare, and improve sustainability performance, especially if paired with modern ESG management tools and AI-powered data platforms.

That way, you can turn scattered data into strategic insights that enable timely risk detection and transparent reporting, which in turn builds trust and drives long-term profitability.

In other words, the sooner you embed benchmarking into operations, the faster your ESG leadership takes shape.

So, what are you waiting for?